Key Takeaways

- Cyclical Stocks: These are companies whose share prices and profits fluctuate with economic cycles doing well in expansions and suffering during downturns.

- Benefits: Cyclical stocks offer high growth potential when the economy improves, and let investors ride sector-specific and macroeconomic rebound early.

- Risks: They can be volatile due to GDP swings, interest rates, inflation, policy changes, and sentiment shifts. Performance drops sharply in recession.

- Identification Process: Look for high‑beta stocks, monitor sector rotation, track macro indicators like GDP, inflation, consumer confidence, and use valuation metrics like PE and EV/EBITDA relative to cycles.

- Top Picks:

- Tata Steel Ltd.

- Pidilite Industries Ltd.

- JSW Steel Ltd.

Table of Contents

Imagine when your salary rises, or you get a big bonus; what’s the first thing you do?

A vacation, upgrading your phone, or maybe buying gold jewellery. These desires often rise when things are going well for you financially. Cyclical stocks are exactly the same. These stocks shine the brightest when the economy is doing well and fade when things get slowed down.

Let’s understand with an example. In the Union Budget 2024, the government reduced the customs duty on gold and silver to 6% and on platinum to 6.4%. This is like an external push that makes gold more affordable, increasing demand and boosting jewellery stocks.

What happens next?

As you saw, Titan Ltd.‘s EBITDA shows an upward trend, reflecting the impact of increased demand.

This shows how cyclical stocks are highly influenced by economic conditions and government policies. They typically rise or fall based on industry-specific changes or broader economic shifts.

In this article, we’ll explore what cyclical stocks are, the benefits and risks associated with them, how to analyze these stocks, and some top cyclical stocks to watch.

What Are Cyclical Stocks?

Cyclical stocks are shares in companies whose performance and stock prices are closely related to the economic cycles of expansion and contraction. When the economy is growing, such as with rising GDP, consumer confidence, and spending, it performs well.

However, during recessions or economic slowdowns, these stocks often underperform as consumer and business spending contracts, affecting the revenue of companies in sectors like automotive, luxury goods, travel, and construction.

Benefits of Investing in Cyclical Stocks

Investing in these stocks can be highly rewarding if you understand the economic cycles and market trends. Here are the key benefits of investing in these stocks.

Potential for Growth

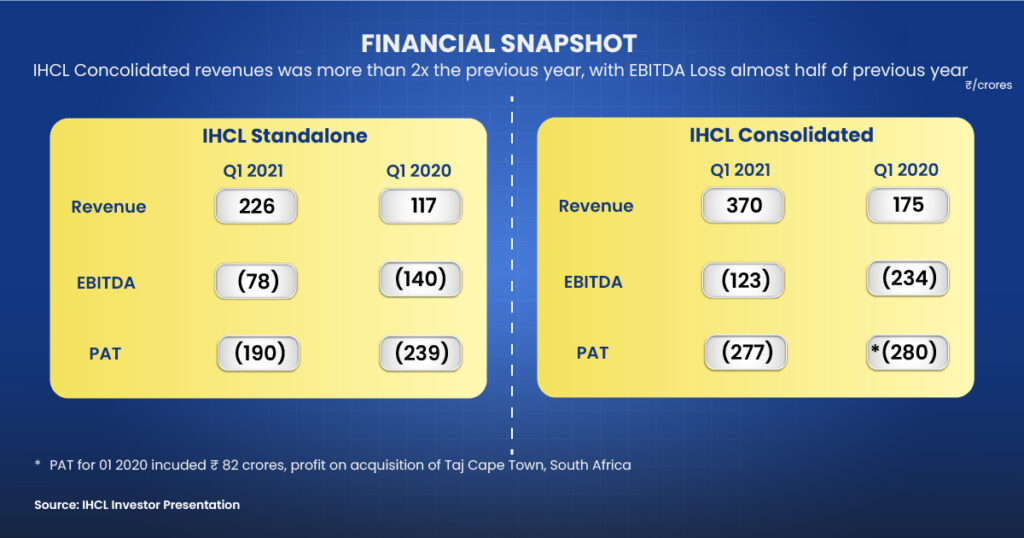

When the economy performs well, consumer spending increases and businesses also earn higher revenues. For example, after COVID-19, The Indian Hotels Company Ltd.’s financials improved significantly. In Q1 2021, its consolidated revenue more than doubled to ₹370 crores from ₹175 crores a year ago, while EBITDA loss reduced to ₹123 crores from ₹234 crores.

Sector-Specific Investment

Cyclical stocks offer the opportunity to invest specifically in those sectors that are highly sensitive to economic cycles, such as materials, industrials, or consumer discretionary. As a result, you can adjust your portfolio’s exposure to expected economic factors.

Market Recovery Participation

As the economy begins to rebound, these companies tend to see increased demand and profitability earlier than companies in other sectors. By investing in cyclical stocks, investors can participate directly in the early stages of a market upturn.

Risks Associated With Cyclical Stocks

Cyclical stocks act as a double-edged sword. If these companies generate high returns during expansion. Then, they also carry risks during the recession. Let’s explore the challenges of investing in cyclical stocks through the lens of real-life case studies from Indian companies.

High Volatility

Cyclical stocks are heavily influenced by macroeconomic factors such as GDP growth, interest rates, inflation and many more. During a recession, there is less demand for discretionary goods, and companies’ stock prices fall.

Let’s explore a real example of how COVID-19 has influenced the Nifty Auto. Due to the lockdown, the Nifty Auto plunged approximately 37% in March 2020. However, it made a strong recovery, increasing by roughly 67% within six months.

Unpredictable Performance

Cyclical stocks rely on multiple factors, such as government policies, global demand and many more. And any unfavorable event can trigger panic and uncertainty in the market. On the day of the Union budget 2025, the textile stocks zoomed up to 9% after Finance Minister Nirmala Sitharaman announced a 5-year mission for cotton farmers in order to improve productivity.

Overexposure to Market Sentiment

Cyclical stocks are very sensitive to market news and investor sentiment, frequently experiencing significant price swings in both directions. On May 21, 2022, the Indian government imposed export taxes on steel and iron ore to cool down the steel prices in India and to tackle inflation. After that news, Tata Steel fell ~10%.

How to Identify Cyclical Stock?

After understanding the pros and cons of cyclical stocks, the main question now is how to identify these stocks. Here are some key characteristics to look for:

Understand the Business Cycle

First, it is important to understand the stages of the business cycle to analyze cyclical stocks effectively. Cyclical sectors usually perform well when consumer spending and business investment rise. They suffer when consumer and business demand decline during an economic downturn.

Identify the Cyclical Sectors

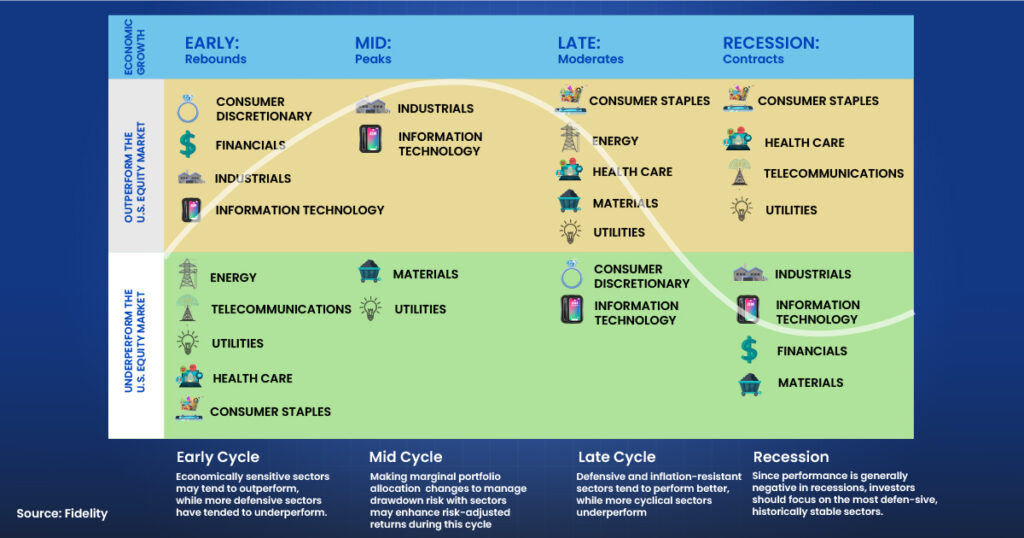

Cyclical companies typically produce goods or services that are considered “discretionary” or non-essential. These are the things people tend to spend more on when the economy is good and cut back on when times are tough. Here are the sectors that performed well during the different business cycles. It’s interesting to note that during recession periods, only essential goods and services tend to do well.

Monitor Macroeconomic Indicators

Keeping an eye on macroeconomic indicators is important for cyclical stocks because they react strongly to economic changes. To stay informed, it’s helpful to track various factors like GDP growth rates, interest rates, inflation (both CPI & WPI), the consumer confidence index (CCI), industrial production (IIP) & manufacturing PMI and many more.

Focus on Key Financial Metrics

To analyze cyclical stocks, you have to evaluate how sensitive a company’s earnings are to the economic cycle. You have to analyze the P/E ratio during a downturn, which could signal a good buying opportunity, while a high P/E ratio at the peak might indicate overvaluation. You also have to assess how well a company can maintain growth and margins during different phases of the business cycle.

Look for High Volatility (Beta)

Cyclical stocks often have a higher beta (greater than 1), which means they are more volatile than the broader market. A higher beta suggests that these stocks move more dramatically in response to market changes. You can check out the high-beta stocks using StockEdge.

Sector Rotation

Sector rotation is the strategy of moving investments between sectors based on the stage of the economic cycle. Understanding sector rotation is crucial when analyzing cyclical stocks because specific sectors outperform during different stages of the business cycle. To simplify this process, StockEdge has introduced Sector Rotation features that allow you to identify not only strong sectors but also strong industries that fall under an overall sector through sector rotation.

To learn how to beat the street with a sector rotation strategy, read our blog!

5 Best Cyclical Stocks to Invest In

Let’s look at the 5 best cyclical stocks and understand why they are considered to be cyclical stocks, as well as their financials.

Tata Steel Ltd.

Tata Steel Company, founded in 1907 in India, is recognized as Asia’s first integrated private steel producer. It has an overall installed capacity of around 35 million tonnes per annum (MTPA). India’s capacity is 21.6 MTPA, Europe accounts for 12 MTPA, and South-East Asia contributes 1.7 MTPA. The company specializes in producing both long and flat steel products.

In Q3 FY25, consolidated revenue declined by 3.01% year over year to ₹53,648.30 crore. Why did this happen?

Due to geopolitical tension and cheaper imports, which put pressure on domestic steel prices. This affected steel producers across the board, from large corporations to smaller players. This shows steel stocks are cyclical in nature. As they are highly dependent on external factors like global demand or geopolitical events.

However, the company produced ~5.69 million tons (MT) of crude steel, up 6% year over year, and delivered ~5.29 MT in Q3 FY25.

To know more about the company’s financial performance, read our edge reports!

Pidilite Industries Ltd.

Pidilite Industries holds over 65% of the adhesives market, making it the leader in this sector. The company boasts well-known brands such as Fevicol, Fevikwik, M-Seal, Dr Fixit, Fevicryl, and Araldite.

During the quarter, standalone revenue from operations growth was aided by underlying volume growth (UVG) of 9.7% year over year across categories and geographies. The company remains cautiously optimistic about improved demand conditions, which are due to the good monsoon season and increased construction activities.

Pidilite depends on vinyl acetate monomer (VAM), a key raw material that is a derivative of crude oil. By falling crude oil prices, the cost of vinyl acetate monomer (VAM) decreases, leading to lower raw material costs which improve its profit margins.

To know more about the future outlook, you can read our concall analysis!

JSW Steel Ltd.

JSW Steel is one of the leading steel manufacturers in India. It has manufacturing units in India, the USA, and Italy. It has diversified manufacturing facilities across various regions in India. As of September 30, 2024, it had an installed crude steel capacity (consolidated) of ~34.2 MTPA. The company’s product portfolio includes semi-finished, flat, and long products.

During the quarter, the consolidated crude steel production in Q3 FY25 stood at 7.03 MT (million tons), up by 2% YoY and 4% QoQ. The consolidated steel sales were 6.71 MT, up by 12% YoY. The domestic volume sales were up by 14% YoY.

Steel consumption increased by 6.8% year-on-year, reaching 38.46 million tonnes, driven by extensive government infrastructure initiatives, rising urbanization, and a booming construction sector, especially in residential buildings and the automotive industry.

To know more about this company, read our edge Report!

The Phoenix Mills Ltd.

Phoenix Mills Ltd, established in 1905 in Lower Parel, Mumbai, is now a leading retail-focused mixed-use developer in India. The PML Group has developed over 19 million sq. ft. across retail, hospitality, commercial, and residential segments.

For Q2 FY25, they reported standalone income from operations amounting to ₹116 crore from Phoenix Palladium Mumbai and a small segment of offices, representing a 3% year-over-year growth.

Let us now explore the reasons behind that result. The Indian real estate industry is expanding rapidly, owing to rapid urbanization, rising disposable incomes, increased demand for residential and commercial spaces across various segments, government initiatives promoting infrastructure development, and a growing middle class, all of which contribute to strong demand for housing and commercial properties across the country.

To know more about the company’s fundamentals, read our edge report!

The Indian Hotels Company Ltd

The Indian Hotels Company Limited (IHCL) businesses range from iconic luxury to upscale and budget stopovers and in-flight catering. As of 31 October 2024, IHCL had a portfolio of 350 hotels, including 232 operational hotels and 118 in the pipeline. It achieved a 60:40 mix of capital-light and capital-heavy operational inventory.

The company continued its strong performance for the 11th consecutive quarter, backed by strong growth momentum and key strategic initiatives. During the quarter, the hotel segment showcased 16% year-over-year growth, and the EBITDA margin expanded by 230 bps year-over-year to 40.9%. Do you know the exact reason for this result?

In the interim Budget 2024, the Indian government has allocated INR 2,449.62 crore to support tourism initiatives, a 44.7% increase over the previous fiscal year. They also promote domestic tourism by cutting GST rates and imposing high ones on visitors from overseas.

You can explore the company’s financial performance more using our Concall Analysis!

Final Thoughts

Cyclical stocks are highly volatile as they offer unique opportunities, but they come with inherent risks due to their sensitivity to the economic cycle.

Before investing in these stocks, it is important to assess the trends in specific industries and sectors. You must also analyze the company’s fundamentals, including profitability and debt, to ensure it can withstand economic fluctuations.

You also need to monitor macroeconomic indicators, as these aspects may impact the performance of cyclical stocks, especially in sectors reliant on consumer spending or high capital expenditures.

FAQS

Can Cyclical Stocks Be Part of a Long-Term Strategy?

Cyclical stocks can be part of a long-term investment strategy, but they require a clear understanding of economic cycles. So, it’s important to understand the macroeconomic indicators, the financial health of the company, and market trends before investing in these stocks.

How to Value Cyclical Stocks?

Cyclical companies depend heavily on economic ups and downs. However, some approaches are particularly helpful for assessing companies with cyclical revenue streams. Here are some key valuation techniques for cyclical stocks:

- Price-to-Book (P/B) Ratio – Since earnings can be volatile, analyzing a company’s book value provides a more stable valuation metric, especially for industries like banks and utilities.

- EV/EBITDA (Enterprise Value to EBITDA) – This metric helps assess the operating performance of companies in sectors like auto, insurance, pharma, and cement, where earnings fluctuate with economic cycles.

- Price-to-Sales (P/S) Ratio – For companies with fluctuating profits, the P/S ratio helps evaluate their valuation based on revenue rather than earnings.

When to invest in cyclical stocks?

Investing in cyclical stocks is best when the economy is on an upswing or is expected to recover. During economic expansion, these stocks tend to perform well, as consumer spending, business investment, and demand for goods and services are high.

How Do Cyclical Stocks Perform in a Recession?

Cyclical stocks generally underperform during a recession because their performance depends on the economic cycle. Usually, during the recession, people focus on necessities rather than discretionary items. Due to this, these companies generate low revenue. It may also create pressure on profitability, cash flow, and their ability to pay debt.

Are cyclical stocks high risk?

Yes, cyclical stocks are generally considered high risk due to their sensitivity to the economic cycle. They perform well in strong economic conditions but can experience significant declines during downturns. They are more volatile than defensive stocks.

Read Also: Nifty 50 Top Picks: 10 Stocks That Can Drive India’s Growth and Your Portfolio