Key Takeaways

- Nifty Pharma tracks India’s pharma leaders: It represents 20 major pharmaceutical companies listed on NSE using the free-float market cap method.

- High weightage stocks drive movement: Sun Pharma, with the highest weight, has a strong influence on the index’s daily performance.

- Sector responds to global and regulatory triggers: FDA approvals, currency fluctuations, and global drug demand significantly impact index direction.

- Risks include pricing pressure and compliance issues: Regulatory scrutiny, US market pricing pressure, and high R&D costs can create volatility.

- ETFs provide easy sector diversification: Nifty Pharma ETFs and index funds offer simple, diversified exposure without picking individual stocks.

The Nifty Pharma Index is the pulse check of India’s pharmaceutical industry, an industry that supplies medicines to the world and plays a crucial role in global healthcare. Tracking 20 of the biggest and most influential pharma companies listed on the NSE, this index captures every major shift in the sector, from regulatory approvals to blockbuster drug launches. Whether you’re an investor looking for stability, a trader tracking sector momentum, or simply curious about how pharma stocks move, Nifty Pharma offers a clear window into the industry’s performance. Understanding how it works can help you decode trends, spot opportunities, and make smarter investment decisions in one of India’s most resilient sectors.

What is the Nifty Pharma Index?

The Nifty Pharma Index is a sectoral index that tracks the performance of companies in the pharmaceutical and healthcare sectors listed on the NSE.

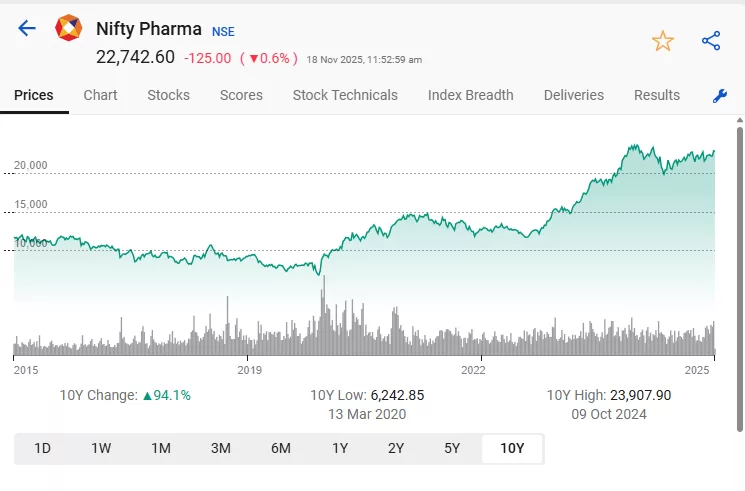

See the current chart here: Nifty Pharma

The Index consists of 20 companies listed on the National Stock Exchange of India (NSE). Nifty Pharma Index is calculated using the free float market capitalization method, where the index level indicates the total free float market value of all stocks relative to a specific base market capitalization. This index can serve multiple purposes, such as benchmarking fund portfolios, launching index funds, ETFs, and structured products.

Composition of Nifty Pharma

Below is the list of Components of NIFTY Pharma as on November 2025:

| Company Name | Symbol | Weight (%) |

| Sun Pharmaceutical Industries Ltd. | SUNPHARMA | 22.19 |

| Divi’s Laboratories Ltd. | DIVISLAB | 10.66 |

| Cipla Ltd. | CIPLA | 10.51 |

| Dr. Reddy’s Laboratories Ltd. | DRREDDY | 9.09 |

| Lupin Ltd. | LUPIN | 5.91 |

| Torrent Pharmaceuticals Ltd. | TORNTPHARM | 4.64 |

| Laurus Labs Ltd. | LAURUSLABS | 4.61 |

| Aurobindo Pharma Ltd. | AUROPHARMA | 3.97 |

| Alkem Laboratories Ltd. | ALKEM | 3.86 |

| Glenmark Pharmaceuticals Ltd. | GLENMARK | 3.55 |

| Mankind Pharma Ltd. | MANKIND | 3.11 |

| Biocon Ltd. | BIOCON | 3.05 |

| Zydus Lifesciences Ltd. | ZYDUSLIFE | 2.87 |

| Ipca Laboratories Ltd. | IPCALAB | 2.2 |

| Abbott India Ltd. | ABBOTINDIA | 1.88 |

| J.B. Chemicals & Pharmaceuticals Ltd. | JBCHEPHARM | 1.8 |

| Gland Pharma Ltd. | GLAND | 1.77 |

| Piramal Pharma Ltd. | PPLPHARMA | 1.46 |

| Wockhardt Ltd. | WOCKPHARMA | 1.35 |

| Ajanta Pharmaceuticals Ltd. | AJANTPHARM | 1.31 |

View the list of Nifty Pharma and their latest price

How Does Nifty Pharma Work?

Nifty Pharma is calculated using the free-float market capitalization method, focusing exclusively on India’s leading pharmaceutical companies. Its value represents how the listed pharma sector is performing, providing investors with a benchmark for this industry’s movement.

Calculation Method

Nifty Pharma comprises 20 pharma stocks, selected primarily from companies listed on the NSE and belonging to the Nifty 500 universe. The calculation is as follows:

- Each stock’s current market price is multiplied by its number of free-float shares. Shares available to the public, excluding promoter, government, trust holdings, etc. to get its individual free-float market cap.

- These market caps are summed across all 20 stocks, then adjusted so no single stock exceeds 33%, and the top three stocks together do not exceed 62% of the index at the time of rebalancing.

- The total is divided by the base market capitalization from the index’s starting date (with a base value of 1000) and multiplied by 1000 for the final index value.

- Formula: Index Value = (Total Free-Float Market Capitalization / Base Market Capitalization) * Base Index Value.

- The index is rebalanced twice a year to ensure it accurately reflects current market conditions.

Working of Nifty Pharma

The index tracks real-time price changes, so when the prices of large weighted stocks (like Sun Pharma, which currently has the highest weight at around 22%) move, they significantly affect the index’s movement.

It serves as a benchmark for investors and funds tracking the pharma sector, and ETFs like Nifty Pharma ETF mirror its performance by holding underlying stocks in a similar proportion.

Periodic rebalancing and capping ensure it stays representative and prevents any single stock from dominating the sector’s movement

What Moves Nifty Pharma?

The Nifty Pharma Index is influenced by a combination of domestic developments, global industry trends, and company-specific triggers. Since the sector is heavily export-oriented and highly regulated, even small events can lead to meaningful movements in the index. Below are the key factors that drive Nifty Pharma:

1. Regulatory Approvals and Compliance Events

Regulatory news is one of the most significant catalysts for the pharma sector. Positive developments like US FDA approvals, clean audit reports, and facility clearances tend to lift the index. On the other hand, warning letters, import alerts, or inspection observations can lead to sharp corrections.

2. Global Demand for Generic Medicines

India is a dominant supplier of generics to regulated markets such as the US and Europe.

Higher demand, favorable pricing, or expansion into new therapy areas boosts sector performance. However, pricing pressure in the US generics market remains a structural challenge that impacts earnings.

3. Currency Movements (INR vs USD)

Pharma is one of the most export-heavy sectors in India.

A weaker rupee increases revenue for companies earning in dollars, supporting the overall index. A stronger rupee, however, may hurt export competitiveness and profit margins.

4. R&D Pipeline and New Product Launches

Progress in clinical trials, launches of specialty drugs and biosimilars, and strong domestic formulations performance contribute positively to stock sentiment.

5. Government Policies and Healthcare Spending

Policy announcements related to drug pricing, export incentives, PLI schemes, and healthcare budget allocations directly impact sentiment in the pharma sector.

Supportive government measures usually lead to sector-wide rallies.

6. Mergers, Acquisitions, and Global Partnerships

Strategic acquisitions, partnerships for specialty products, technology collaborations, or global licensing deals often result in strong movements in individual stocks and, in turn, the index.

Risks to Know Before Investing in Nifty Pharma

While pharma offers stability and long-term growth opportunities, the sector also carries unique risks. Understanding these risks is essential before investing directly in pharma stocks or indirectly through Nifty Pharma–linked funds or ETFs.

1. Regulatory and Compliance Risk

The sector operates under strict scrutiny from regulators such as the US FDA, EMA, and CDSCO.

Any deviation from compliance norms can lead to warnings, import alerts, product bans, or even shutdown of manufacturing facilities.

Such events have historically triggered sharp corrections in pharma stocks.

2. Pricing Pressure in Key Export Markets

The US, one of the biggest markets for Indian pharma, continues to face intense pricing pressure due to heightened competition and consolidation among buyers.

This affects profitability and can drag the sector’s performance.

3. Currency Volatility

Fluctuations in the rupee-dollar exchange rate significantly impact revenue visibility.

A sharp appreciation in the rupee can compress margins for export-focused companies.

4. High R&D Costs and Product Failures

Drug development is expensive and time-consuming.

Failures in clinical trials, regulatory rejections, or delays in product launches lead to high write-offs and lost opportunities, affecting stock performance.

5. Litigation and Patent-Related Risks

Pharma companies frequently face legal challenges related to patent disputes, delayed launches, and product liability claims. Unfavourable court rulings can materially impact earnings.

6. Overdependence on the US Market

For many companies, a large share of revenue comes from the US. This concentrated exposure makes the sector vulnerable to US healthcare policy changes, regulatory tightening, and market slowdowns.

Conclusion

While the sector provides stability, it is also shaped by global regulatory environments, currency fluctuations, R&D outcomes, and pricing pressures in key markets such as the US. Investors should be mindful of these risks and avoid treating pharma as a one-way bet.

For long-term portfolios, Nifty Pharma–linked ETFs or index funds can serve as effective diversification tools. They provide exposure to industry leaders without the need to pick individual stocks.

Also Read: NIFTY 500 – What It Is, Why It Matters & How to Invest

Frequently Asked Questions (FAQs)

1. Which Pharma stocks have the highest weightage in the Nifty Pharma Index?

Sun Pharmaceutical Industries has the highest weightage at 22.19%, followed by Dr Reddy’s Laboratories at 10.66% and Cipla at 10.51%.

2. How often is the NIFTY Pharma index rebalanced?

The Nifty Pharma index is reviewed and rebalanced semi-annually.

3. What influences Nifty Pharma the most?

The major influences of Nifty Pharma include – USFDA actions and regulatory updates, currency movements (especially USD/INR), Government healthcare policies, global pharma trends, sector rotation during market volatility.