Table of Contents

Shriram Finance share has replaced UPL stock to become one of the constituents of Nifty 50 from 28th March 2024. So, post the inclusion of Shriram Finance share, can it unlock value for its shareholders? In this blog, a complete analysis of the company’s fundamentals may give you the answer to it.

A fun fact about the company: Earlier, Shriram Finance was known as Shriram Transport Finance Company (STFC), one of the flagship companies of the Shriram group, which has a strong presence in financial services. Recently, Shriram Group has merged its two lending subsidiaries, i.e., Shriram City Union Finance Ltd and Shriram Transport Finance Company Ltd. Post the amalgamation, Shriram Finance Ltd. with assets under management of ₹ 1.9 lakh crore, is the country’s largest retail non-banking finance company.

Company Overview

Shriram Finance Ltd., incorporated in 1979, is the flagship company of the Shriram group. It is registered with RBI as a deposit-taking, asset-financing non-banking financial company. STFCL provides financing for vehicles such as CVs (both pre-owned and new), tractors, and passenger vehicles. The company stands as one of the largest asset financing Non-Banking Financial Companies (NBFCs) in the country. It serves as a comprehensive finance provider for the commercial vehicle industry, focusing on partnering with small truck owners to fulfill all their asset-related needs.

Shriram Finance has diversified business. Its products include:

- Commercial vehicle loans

- Business loans

- Deposits

- Working Capital loans

- Life insurance

- Emergency credit line guarantee scheme (ECLGS)

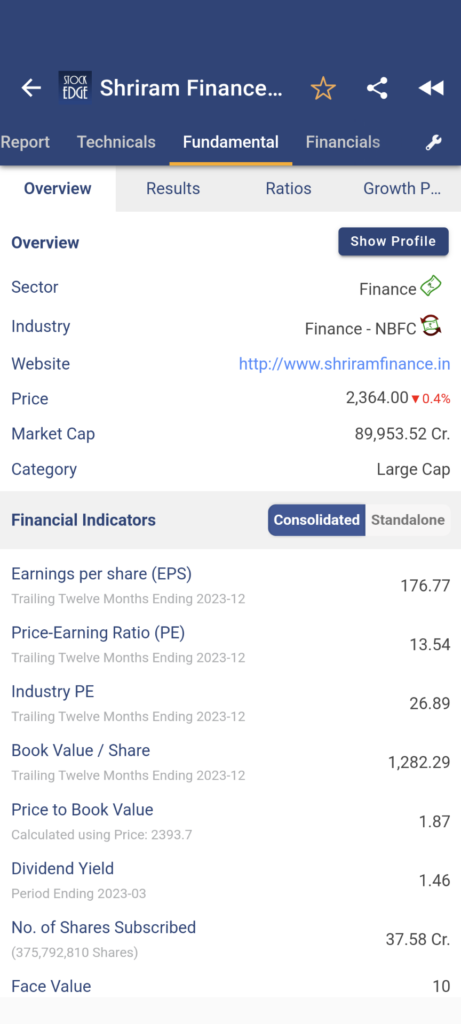

You can get a complete overview of the fundamentals of Shriram Finance share from StockEdge.

Financial highlights

Shriram Finance net interest income (NII) was up by 15.04% YoY and 5.7% QoQ to ₹5,093.9 core. Net interest margin (NIM) expanded by 6 bps on a sequential basis to 8.99% and against 8.52% YoY. Incremental cost of borrowings was up 25 bps sequentially to 8.95%. Net profit, standalone basis, increased by 2.3% YoY and 3.8% QoQ to ₹1,818.3 crore.

Overall, AUM growth for the quarter came in at 20.7% YoY to ₹2.14 lakh crore, in which on-book Aum stood at ₹2.11 lakh crore while off book AUM came in at ₹3,177 crore.

Growth in the commercial vehicle (CV) segment, which forms 47.8% of total AUM, stood at 13.1% on YoY and 4.1% QoQ to ₹1,02,465 crore.

The company has a co-lending segment with one PSU and one Private bank and has volume of around 20% of total AUM.

Personal loan segment saw a robust growth of 65.4% YoY while gold loans reported a rise of 32.8% YoY and 8.9% QoQ and forms around 2.75% of total AUM.

MSME and Two wheelers portfolio reported a growth of 30.3% and 21.3% on a YoY basis, respectively.

Housing finance AUM reported a growth of 67.5% YoY and 11.2% QoQ to ₹12,025 crore.Home loans were up 56.5% YoY while LAP increased 113.6% YoY.Top-up loans jumped sharply by 70.8% YoY to ₹593.7 crore.

In Q3 FY24, the asset quality improved on an overall basis as gross stage-3 and net stage-3 assets stood at 5.66% and 2.72% as against 5.79% and 2.8% on a sequential basis.

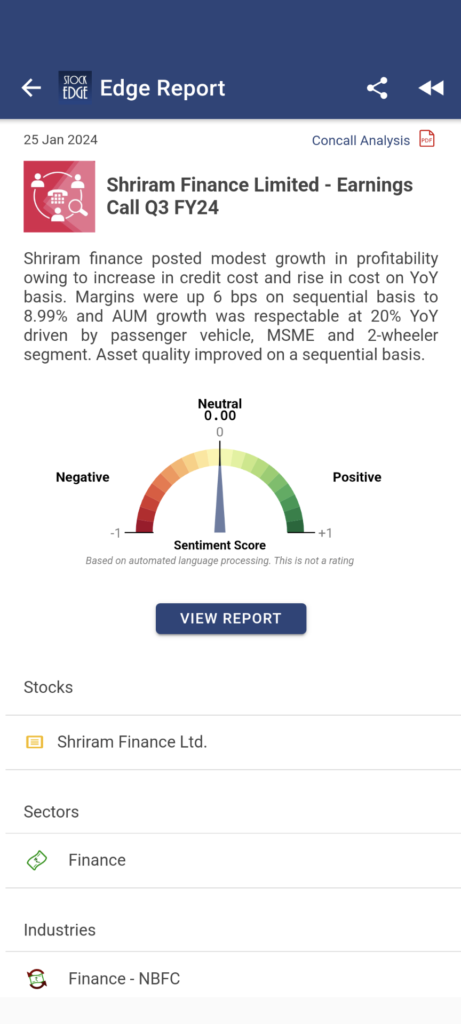

Please note, every quarter companies publish their financial statements. Additionally the management shares insightful data about the upcoming ventures of the company through a Con-Call.

At StockEdge, we prepare a brief report for your ease of understanding in the form of a Con-Call report which you will find under the tab Edge Reports.

Here is the concall analysis of Shriram Finance share for Q3 FY24.

SWOT analysis of Shriram Finance share

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strengths

Mr. Y.S. Chakravarti has been appointed the Managing Director & CEO of SFL. He started his career with Shriram Chits Pvt Ltd, Andhra Pradesh, in June 1991 as an executive trainee and rose to the position of chief executive by 1998. He also served as the managing director and CEO of SCUF prior to the merger with STFCL. The operations of SFL are led by Mr. Umesh Revankar, Executive Vice Chairman, who has been with the Shriram group for more than 35 years. He was previously the Vice Chairman and Managing Director for STFCL before the merger.

The management team, including Mr Parag Sharma (Whole-time Director, Joint Managing Director, and Chief Financial Officer of SFL) and several others, have been previously associated with STFCL pre-merger for several years. The company’s housing subsidiary is headed by Mr Subramanian Jambunathan, managing director and CEO of SHFL, who has more than two decades of experience in the lending business.

Weakness

The underlying borrowers in this segment are viewed as an economically

weaker class, which is susceptible to economic downturns. SFL’s asset quality comes under pressure since it has high exposure to small fleet operators and first-time buyers who are more vulnerable to the negative effects of an economic downturn.

Opportunities

• AUM growth for FY24 to be at 20% while in FY25 it is expected to be around 15%.

• Credit cost guidance is at the 2% mark for FY24.

• The bank plans to add 100 to 150 branches in the coming quarters.

• Margins are expected to stay around 8.9% going forward.

Also, Shriram Finance has launched the super app Shriram One. The Super App offers a range of services including loan repayment, investment, insurance, and utility. This will add inclination towards digitization in the company.

Threat

Major borrowers of Shriram Finance operate mainly in the transport of agricultural and agriculture-related goods, mining, e-commerce segments, etc., which, although facing disruption during the lockdown period, have bounced back after the restart of economic activities. This is evidenced by the increased capacity utilization and the ability to pass on the rise in freight rates on the back of improved demand and a rise in fuel prices. This risk continues to remain industry-wide for all the players in this segment.

Conclusion

Shriram Finance’s has a strong management team which is expected to lead to an improvement in asset quality, AUM and positive guidance on NIM in the near future. Also, with addition of Shriram Finance share in Nifty 50 will lead to large sum of inflows. Combining these factors along with strong financials, the outlook is positive.

Yes, from 28th March 2024 Shriram Finance Share is a Nifty 50 Stock. If you would like to know the constituents of Nifty 50, can read this blog; All About NIFTY50, Components of NIFTY50, and How to Invest in it

Happy Investing!