In this blog, we will share our spotlight on Globus Spirits Ltd.

Globus Spirits Ltd. – Highlights

- The shares of Globus Spirits Ltd. was trading at Rs.584.40, up by 10% hitting a 52-week high in today’s trading session.

- The stock has increased by 49.9% in last one week, while the benchmark index S&P BSE Sensex has decreased by 0.25%.

- This massive rally in stock price within a week was after the company reported a more-than-doubled net profit in the March quarter (Q4FY21).

- The company reported a net profit of Rs.50.63 crores for the period ended March 31, 2021, compared to a net profit of Rs.19.35 crores for the period ended March 31, 2020.

- On a QoQ basis, the company reported total income of Rs.492.22 crores for the period ended March 31, 2021, compared to Rs.433.46 crores for the period ended December 31, 2020. The company reported a net profit of Rs.50.63 crores for the period ended March 31, 2021, compared to a net profit of Rs.38.30 crores for the period ended December 31, 2020.

- In Q4FY21, the company’s total income increased by 65% year on year (YoY) at Rs.492.22 crore, backed by increase in both volume and value, mainly in the consumer business segment. The share of consumer business (value segment) increased by around 900 basis points (bps) YoY from 35% in Q4FY20 to 44% in Q4FY21.

- Ebitda margin increased by over 1140 bps YoY to 24.9% in Q4FY21 from 13.5% in Q4FY20, on account of higher share of consumer business, and better ENA (Extra Neutral Alcohol) and ethanol realizations. According to the company, higher EBITDA margins combined with lower finance costs drove profitability at the PBT (profit before tax) level.

- The company reported EPS of Rs.17.58 for the period year ended March 31, 2021, compared to Rs.6.74 for the period year ended March 31, 2020.

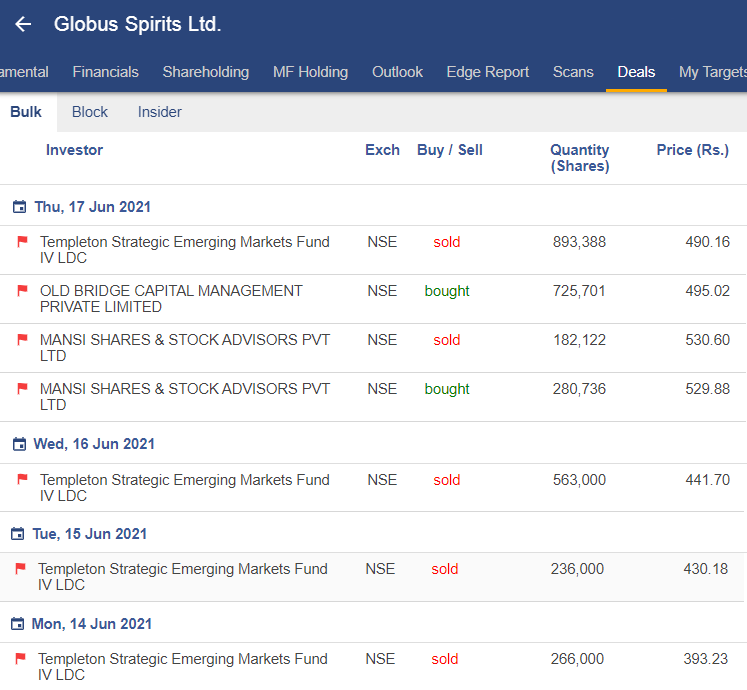

- Meanwhile, between June 14 and June 17, Franklin Strategic Emerging Markets Fund IV sold 1.96 million shares on the National Stock Exchange through bulk deals, representing a 6.8% stake in Globus Spirits (NSE). On Thursday, Old Bridge Capital Management Private Limited purchased 725,701 shares through a block deal at Rs.495.02.

- For FY21, the Board has recommended a 20% dividend, or Rs 2.00 per share (FV of Rs 10 per share).

- Globus Spirits Limited is an alcoholic beverage company based in India. The Company produces, markets, and sells Indian Made Indian Liquor (IMIL), Indian Made Foreign Liquor (IMFL), Bulk Alcohol, and contract bottling for established IMFL brands. The Industrial and Potable Alcohol business segment is where the company operates. The Company’s grain-based distillery capacity exceeds 90 million bulk litres. The company’s products are exported to Europe, Africa, the Middle East, Asia, and the Far East.

For more fundamental data and analysis, click on Globus Spirits Ltd.

Read our latest article on Divi’s Laboratories Ltd – Striving for leadership through chemistry

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company has been produced for only learning purpose. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector.