Table of Contents

Understanding Solar Stocks

Go Green! For the first time, both industrialists and environmentalists share the same rhyme. Crony capitalism has been blamed for several decades for destroying the nature we inherited from our forefathers. Well, not anymore! Now, money lies in investing in a sustainable future or by investing in companies that are building capacity for the same cause. Coincidently, you as an investor must also be humming ‘Go Green’ for your portfolio (pun intended).

Well, it has been StockEdge’s endeavor to keep your portfolio green, and this time, we have come up with our blog on ‘Green Energy’, briefing you about the solar sector and listing out a few solar stocks in India that look interesting to us, worthy of your attention.

Concept of Solar Energy Stocks

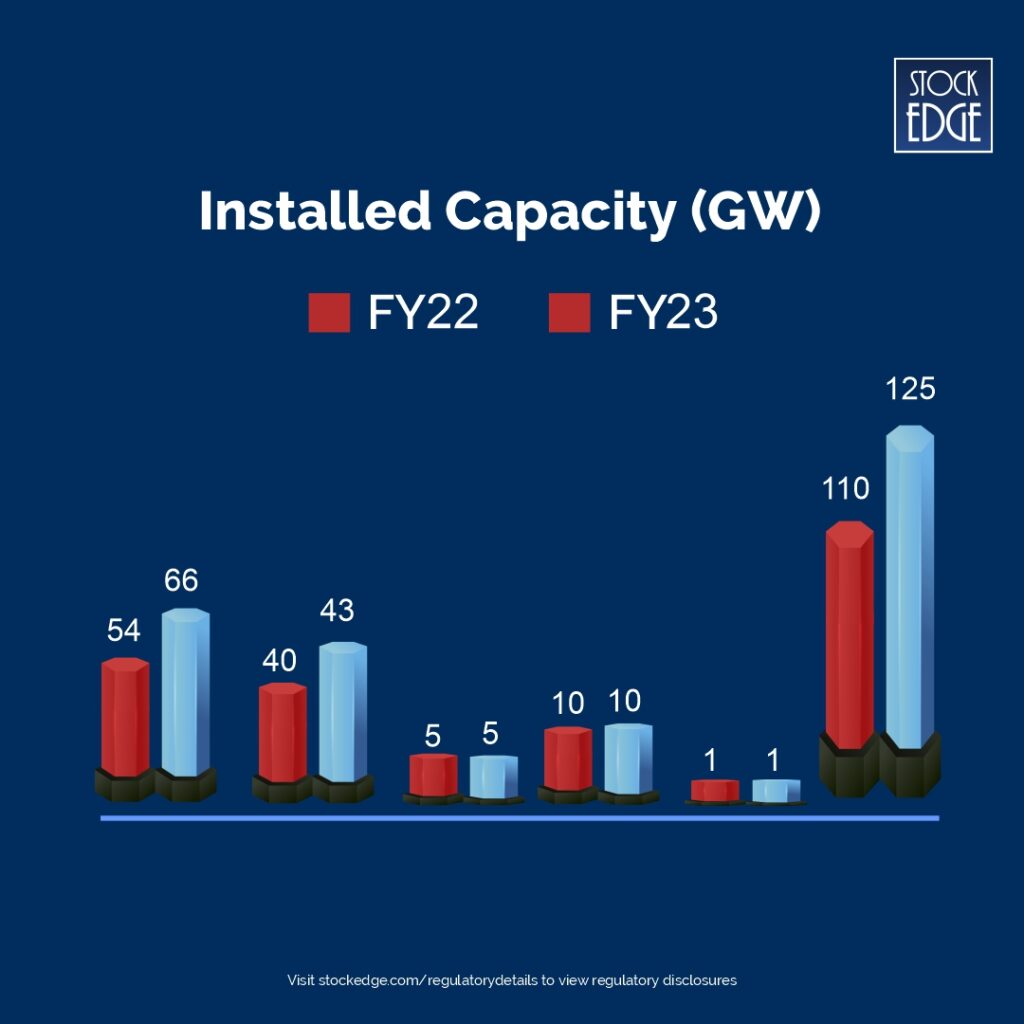

Renewable energy can be generated through the following measures: wind, solar, geothermal, hydro and biomass. In recent years, the global shift towards renewable energy has gained significant momentum as India crosses the 100 GW mark in renewable energy generation.

However, still, there is a lot of scope left. India’s ambitious target is to reach 500 GW of renewable energy generation by 2030 and increase the share of renewables from ~30% in 2024 to ~45% in 2030.

Now, within renewables, solar power is gathering the attention of investors, especially in India, due to its geographic location as a tropical country.

Solar Energy and the Indian Market

Did you know India gets about 300 days of sunshine in a year, which has the potential to generate solar energy of 748 GW? That’s almost double the current installed capacity of electricity generated via both renewable and non-renewable sources.

India’s solar energy sector has witnessed remarkable growth over the past decade, fueled by supportive government policies, declining solar panel costs, and increasing environmental consciousness.

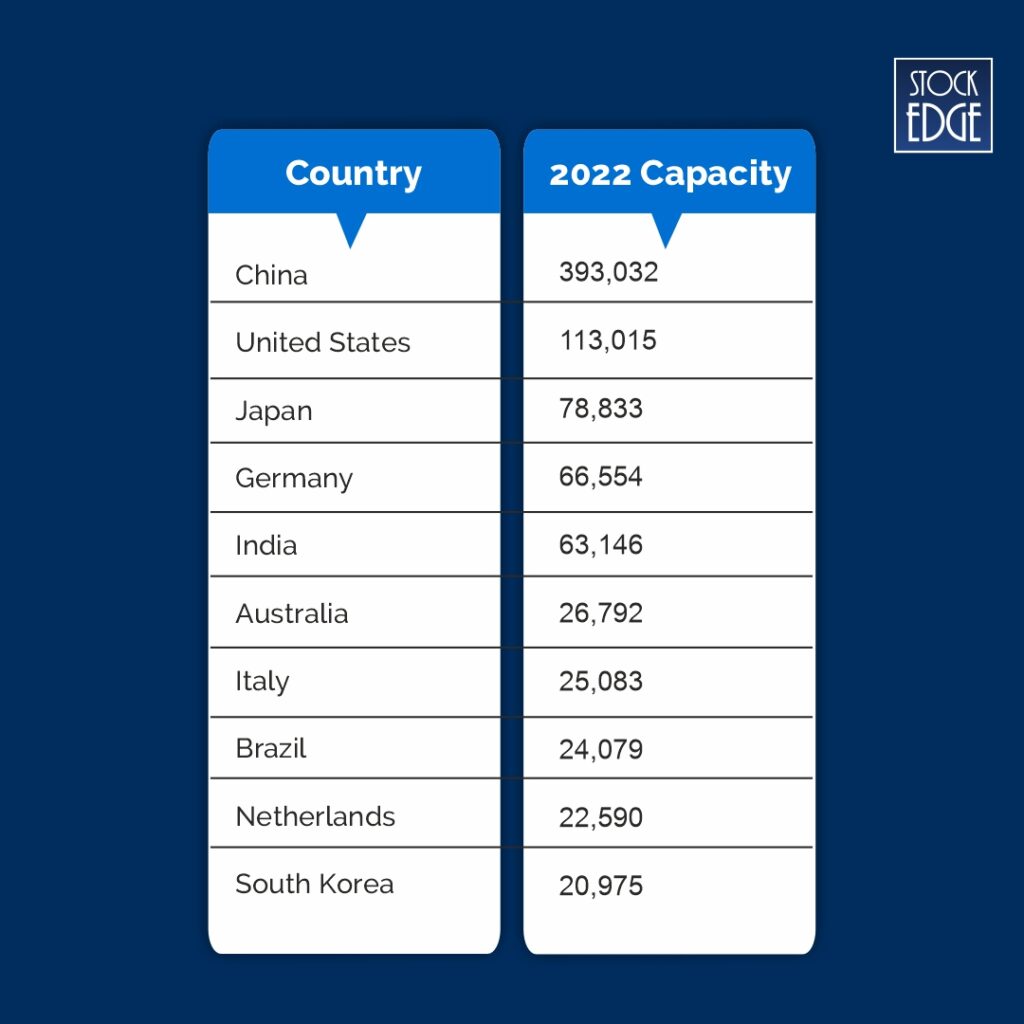

The government’s initiatives, such as the National Solar Mission and various state-level policies, have played a pivotal role in driving solar energy adoption across the country. India ranks in the top 5 in the World Solar Energy Installed Capacity list and wants to become a net exporter by 2026. The following table shows the installed capacity (MW) for the year 2022.

India’s commitment to renewable energy is exemplified by its ambitious targets, including achieving 450 GW by 2030. This shows that by 2030, solar energy will be the dominant space within renewables. In other words, our endeavor now is to look out for the top solar stocks in India that are going to benefit from the rising energy demand over the next 5-6 years.

Let us now understand the solar sector in more depth before jumping to our segment of the top solar stocks in India to invest in 2024.

Why Should You Invest in Solar Energy Stocks?

Potential for Growth in Solar Sector

It’s obvious to know that a large sum of money can be made when you invest in a sector right at the start of the trend. Imagine the time when Late Sri Rakesh Jhunjhunwala entered Titan. The Indian consumer market was at a very nascent stage then but look at his courage and conviction. Today, Titan is a leading consumer brand in India, and nothing needs to be said about the profits Titan’s stock gave him.

We look at the Indian solar sector with similar lenses.

As already seen, India has currently installed 125 GW of solar capacity against the target of 450 GW by 2030. Just for the purpose of comparison, 1 GW capacity is enough to power 20,00,000 homes in India with an average power consumption of 375 KWh per month or 4,500 KWh per year. So, India should be able to power 90 crore houses through solar by 2030. This also means that the market is estimated to rise by 3.5x. Market size-wise, India is to be number 3 after China and Europe in a few years due to the abundance of sunlight here and the export potential.

Now you see why there is so ‘gung-ho’ about the Solar sector. Additionally, there is government support to boost the sector as well. Let’s dig deep into it.

Government Policies Supporting Solar Energy

Soon after the Pran Pratishtha ceremony at Ayodhya Ram Mandir, PM Narendra Modi announced the cabinet’s initiative to power 1 crore households through solar energy. The move will not only reduce the financial burden on the middle- and lower-income class but also make India self-reliant in energy. The Budget has proposed INR 10,000 crore for this initiative.

Apart from this, the government has also been promoting solar panel installations via subsidies as high as 60% in some states.

Now that we are more or less convinced that Solar is the sector for the future, a major push for your portfolio to “Go Green”. Let’s now evaluate solar stocks in India for investment purposes.

Evaluating Solar Stocks for Investment

Factors to Consider Before Investing

When it comes to factors to consider before investing in Solar Stocks in India, the following should be kept in mind.

- Fundamentals

The basic rules of investing remain constant in the case of the solar sector as well. Invest in solar stocks in India with good fundamentals. The company should be profitable or at least should have a visibility of profitability in the near future. Solvency should also be prudently evaluated.

- Innovation

Solar energy is a relatively new sector and a newer form of technology. As seen with any of the previous tech-related innovations such as automobiles, mobiles and other consumer durables, the threat of rapid innovation and not keeping pace with the market trend is eminent. Therefore, invest in solar stocks in India that focus on innovation and well-qualified management.

- Competitive advantages

Economics teaches us that excess demand invokes more suppliers. Due to the cost advantages of solar power, we see an exploding demand for solar equipment. On the one hand, it invites a lot of competition, and on the other hand, companies that are able to create a monopoly or develop a kind of moat through patents, lowest cost, or brands can lead the pack. Invest in solar stocks in India with durable competitive advantages.

- Corporate governance

Sectors that are dependent on government policies and subsidies invite a series of entrepreneurs who lobby with government agencies for their benefit. Such activities, when it comes to the limelight, can significantly deteriorate a company’s image. Additionally, innovation-prone sectors benefit when the management understands and mends the company’s products and policies as per the market trend. Hence, qualified management is needed in such a sector. Invest in solar stocks in India with good governance.

- Government Policies

The scope of the solar energy sector in India is very much dependent on the government policy push. Hence, investors should closely study the government policies and announcements related to the solar sector.

- Valuations

“Stock Market is there To Serve You, and Not to Instruct you” – Warren Buffett.

Invest in companies that are available at reasonable valuations. Do not let FOMO override your senses. In the current market, many of the renewable energy stocks are trading at exorbitant valuations as high as 100x PE. Skillful investors wait for the right opportunity to get into fundamentally strong stocks. Invest in solar stocks in India that are available at reasonable valuations.

Now, let’s shift focus to what all types of companies are expected to benefit from the solar sector boom.

Analyzing Market Trends for Solar Stocks

Amongst the obvious beneficiaries of the solar sector boom are companies manufacturing solar panels. China dominates the global market in solar panel manufacturing; however, in India, listed companies like Borosil Renewables and Warree Renewable Technologies are also engaged in manufacturing solar glass panels – the most important component in the solar energy ecosystem. The current market size of this industry is ~ INR 3,500 crores.

Other than this, battery manufacturers are also expected to benefit as out of the two models of the solar system installation (on-grid and off-grid system), the off-grid system heavily depends on the battery. In India, Exide Industries and Amara Raja Batteries are the leading players. The market size of this industry is ~INR 26,300 crores. The market size is larger due to the early replacement cycle.

Well, the list goes on and on; look at the table below to understand the ancillary industries that can benefit from the solar energy boom, their respective market sizes and the top players in each industry.

Now, let’s move on to the most important section: we have been waiting for the top solar stocks in India for 2024.

Top Solar Energy Stocks to Watch in 2024

Tata Power Ltd.

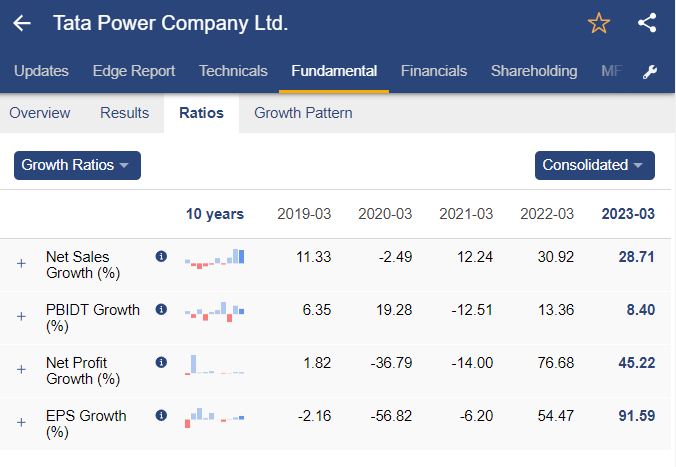

Tata Power’s subsidiary, Tata Power Solar Systems Limited, specializes in providing infrastructure for the solar ecosystem. It manufactures solar modules, cells and provides EPC services for solar projects. The total installed capacity (thermal and renewable combined) is 14 GW, while solar is 2.94 GW. Tata Power has been able to grow its sales at 28.7% y/y in FY23. The Net profit grew at 45.2% y/y in FY23. The company is showing good traction in the market.

The Debt to Equity stands comfortably at 1.7x and the interest coverage ratio stands at 2.25x. The company has a comfortable solvency ratio.

The ROE and ROCE stands at 14.87% and 13.30% respectively, which is above average when compared to the broader set of companies in the Indian stock market.

The company is trading at a reasonable PE of 18.21x and PB of 2.11x. The levels are lower than the last 10-year average.

Future of the company also looks bright as the management has indicated some margin improvements in the solar rooftop business. In addition, the reduction in prices of cells and modules are expected to be margin accretive as well.

In StockEdge, we have an entire case study report on TATA Power, which you may refer to for a detailed analysis of the company.

Adani Green Energy Ltd.

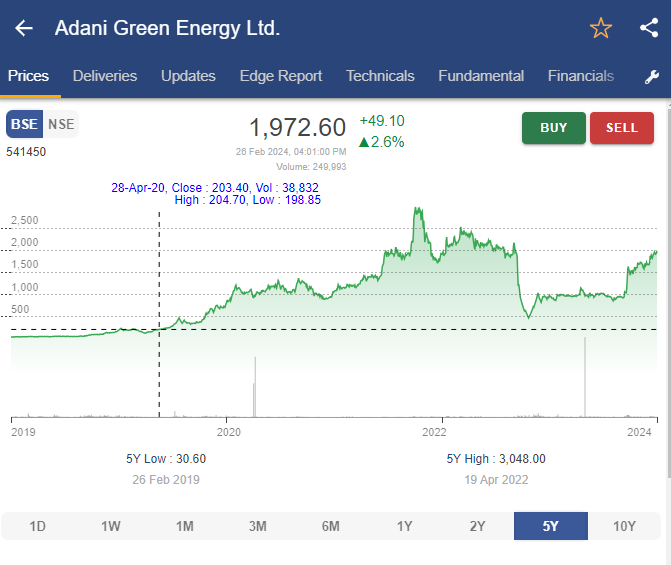

Adani Green is the flagship solar power generation company of the Adani Group and operates the Kamuthi Solar Power Project, the largest solar photovoltaic plant in the world. The share price has given a phenomenal return over the last 5 years, reflected in this chart.

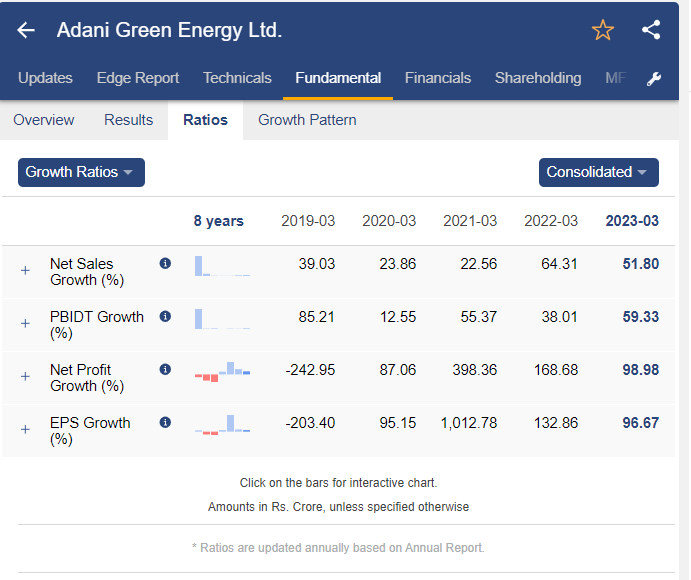

The company has grown its sales by 51.8% and 64.31% for FY23 and FY22 respectively. The net profit has also grown at an impressive 98.98% and 168.68% y/y in FY23 and 22 respectively.

The company has a high debt to equity ratio of 9.23x, however has reduced substantially over the years from a peak of 45.05x in 2022. The interest coverage ratio is also moderate at 1.41x.

The company has been able to generate a healthy return ratio of 27.52% ROE and 8.46% ROCE.

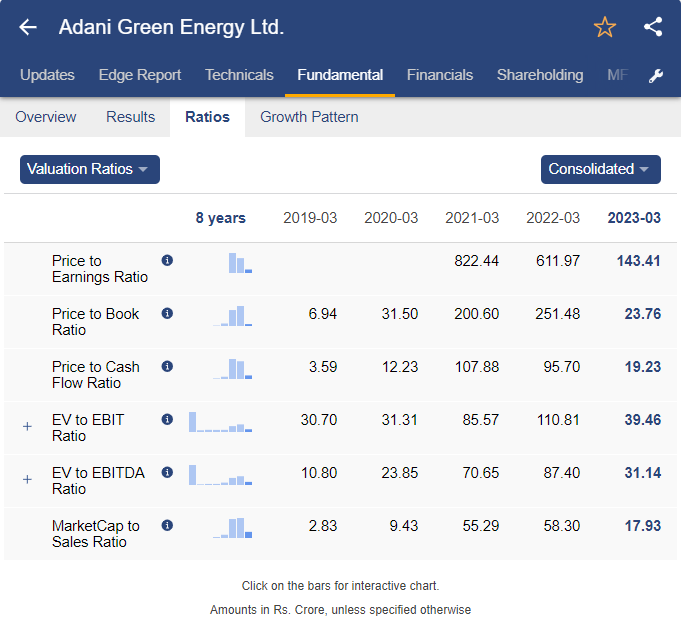

Valuations are quite stretched for this company and trading at a PE of 143.41x and a PB of 23.76x.

The future of Adani Green looks bright as it is expected to double its solar manufacturing capacity from 4 GW presently to 10 GW in the next 5-7 years. The company is also expanding through backward integration through the electric manufacturing cluster at Mundra.

Borosil Renewables Ltd.

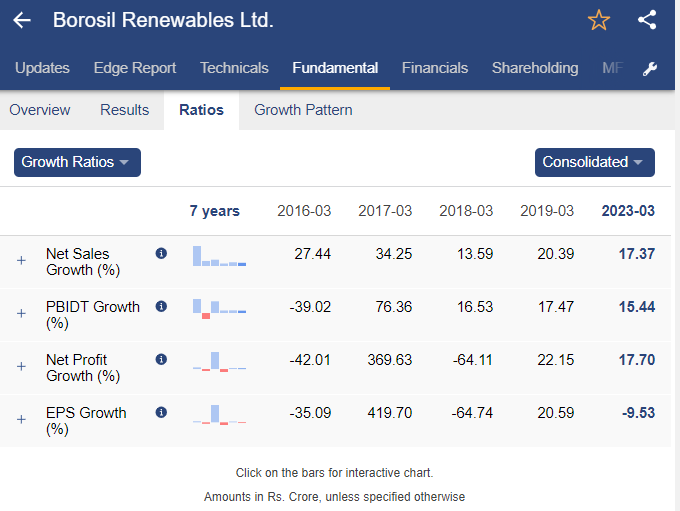

Borosil is a Gujarat-based solar panel manufacturer – which is considered the most important component in the solar power plant ecosystem. It has been able to grow its sales at 17.37% y/y in FY23, and PAT growth was at 17.70% y/y.

Solvency wise, the debt to equity is at comfortable 0.45x and the interest coverage ratio is at 13.97x.

Valuation wise, it’s trading at a hefty PE of 77.21x and PB of 5.86x.

Investors should benefit from Borosil’s expansion plans. They have recently acquired a majority stake in European solar glass manufacturer Interfloat Group, giving it access to the international markets. In India, too, the company has expanded its glass manufacturing capacity from 550 tons to 1000 tons per day.

Suzlon Energy Ltd.

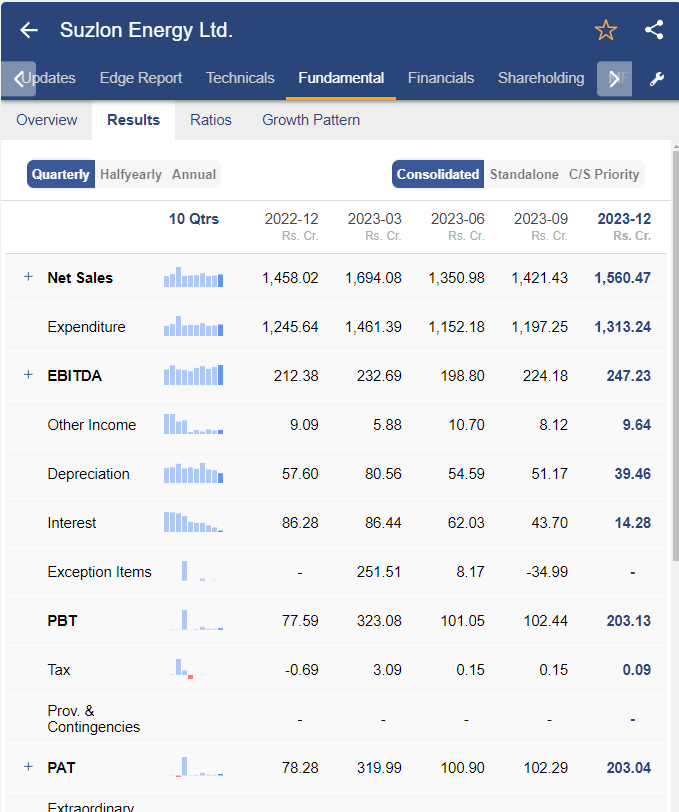

Suzlon was predominantly a wind energy player; however, in 2016, it forayed into the solar energy sector with a capacity of 340 MW. Although the company has shown lacklustre revenue growth, profit went up 2.5x in the December 2023 quarter due to lower depreciation and interest expenditure.

With various restructuring exercises with the creditors, the company has been able to improve the solvency ratios and the interest coverage has improved to 7.87x in 2023.

Suzlon investors should reap the benefit of new orders that the company is gathering both in the wind and solar energy space.

KPI Green Energy Ltd.

KPI Green Energy is a Gujarat-based renewable energy conglomerate started in 2008 to develop, build, maintain and operate solar plants. The company runs two types of businesses: independent power producers (15% of total revenue) and captive power producers (85% of total revenue). The company’s management comprises ex-bureaucrats and ISRO scientists, which gives it huge credibility.

The company has been able to grow its sales by 179.98% y/y in FY23. The net profit has also grown by 153.5% y/y.

The company has generated an ROE of 53.26% in FY23 and is running its operations very efficiently.

Solvency of the company is also stable as the Debt to Equity is at comfortable level of 2.02 and the interest coverage is of 4.03

Valuations also look stable as the company trades at a PE of 13.79x, lower than the industry average.

The future outlook of the company looks bright as its growth strategy of venturing into hybrid, strategic acquisition of land, and timely project execution + Robotic panel cleaning should help them save cost. Additionally, they possess an order book of more than 540 crores and plan to reach a capacity of 1000 MW by 2025 vs. the current capacity of 312 MW.

Emerging Solar Energy Stocks in India

The following are some of the emerging names in the list of solar stocks 2024.

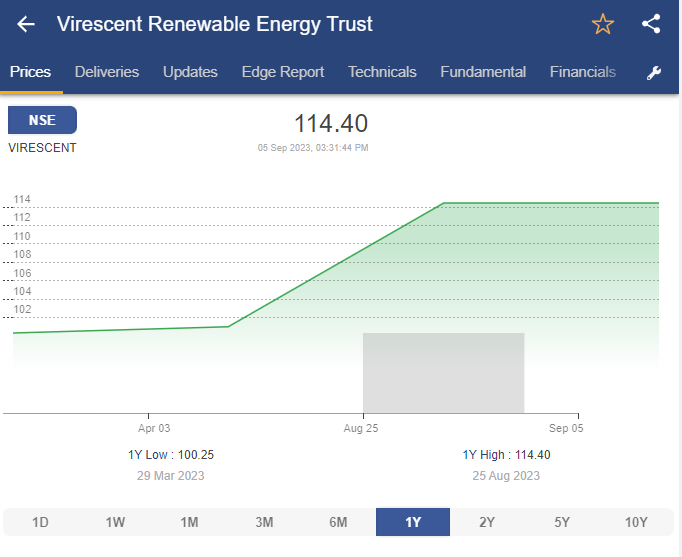

Virescent Renewables Energy Trust

The trust is India’s first private InvIT to house operating renewable energy assets. It was set up by the private equity firm KKR and later was taken over by IndiGrid. The trust has a total capacity of 563 MW.

The company has a yearly sale of 522 cr in FY23 and net profit of 71 crore. The dividend payout in the year 2013 was 78%.

WEBSOL Energy System Ltd.

The company has been a manufacturer of photovoltaic monocrystalline solar cells in India since 1994. The company has zoomed by a massive 1700% over the last 5 years.

The company currently has a capacity of 550 MW, which it wants to increase to 2.4 GW in a phased manner. Currently, the company has stopped commercial production in order to prepare its new capacity; hence, in the nine months ended 31 December 2023, the company showed a revenue of just 0.99 cr vs 17.11 crore in the same period last year.

Comparing the current financial position of the company with the past is irrelevant. The future outlook of the company can only be based upon the execution power of the management.

Other than these you can also check our investment theme on solar energy. To understand more detail on investment themes in the stock market you can read; Powerful Investment Themes for Retail Investors

Risks and Challenges in Solar Stock Investment

Competition from Traditional Energy Sources

Even though solar energy is an emerging sector for generating power, it’s going to be a challenging task to replace traditional sources of energy completely. There is about 416 GW of traditional capacity already installed, and to replace it with the growing power consumption needs is a hefty task. As we know, traditional sources of energy can be used whenever needed; however, solar energy is dependent on sunshine.

Global Economic Conditions

Transformation to solar energy is a capex-heavy deal, and in the current macro environment wherein countries are dealing with high inflation and a slowing economy, it is a challenge.

Regulatory Risks

Solar energy is a Business to Government (B2G) driven capex, and hence, there is always a risk of policy changes with changing Government. Additionally, different states also have their own subsidy schemes for promoting solar energy. A nationwide uniform solar promotion scheme is the need of the hour.

Future of Solar Energy Stocks

Expected Growth of Solar Sector in India

India’s solar market was estimated at USD58bn in the year 2023 and is expected to reach USD238bn by 2032, a CAGR of ~40%. In the past decade, there has been a monumental shift in the energy share of renewables to the total energy consumed. It is expected that with more and more countries joining the revolution and India’s dream of becoming a net exporter of solar energy, there is tremendous scope for making returns in India’s solar stocks.