Table of Contents

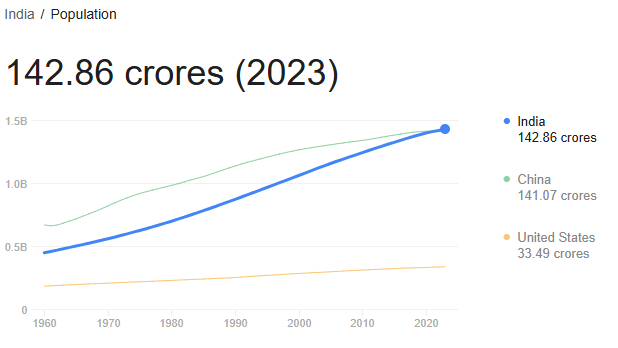

India’s population has surpassed China’s in 2023, with 142.86 crores of India’s energy demand to be provided by the Oil & gas sector, which accounts for nearly 2.17% of the total energy. The major energy source remains coal, which accounts for 71%. But oil and gas are important sources of energy that are closely tied to India’s increase in population. Imagine transportation at a large scale or your average daily commute in your car or bike will require petrol, diesel or CNG to run.

Yes, EVs are growing in numbers, but that too requires electricity that is generated by thermal power plants based on the fuel used to generate the steam, such as coal, gas, and diesel, natural gas. About 71% of electricity consumed in India is generated by thermal power plants.

So, yes! The oil and gas stocks, in the long run, can be a good investment. This blog will take you to a deep dive into the various investment opportunities in oil and gas stocks. The overall industry is huge and highly affected by price movements in various commodity prices like crude oil, natural gas, etc. Therefore, monitoring these essential commodities can provide you insights on when and why to invest in the oil and gas stocks of India.

What are oil and gas stocks?

India’s large corporations or organizations that are publicly listed in the stock market and are involved in oil exploration, distribution or refining of crude oil and natural gas are referred to as oil and gas stocks. Some examples are Oil India, BPCL, Petronet LNG, Indraprastha Gas Ltd., etc.

Sector Overview

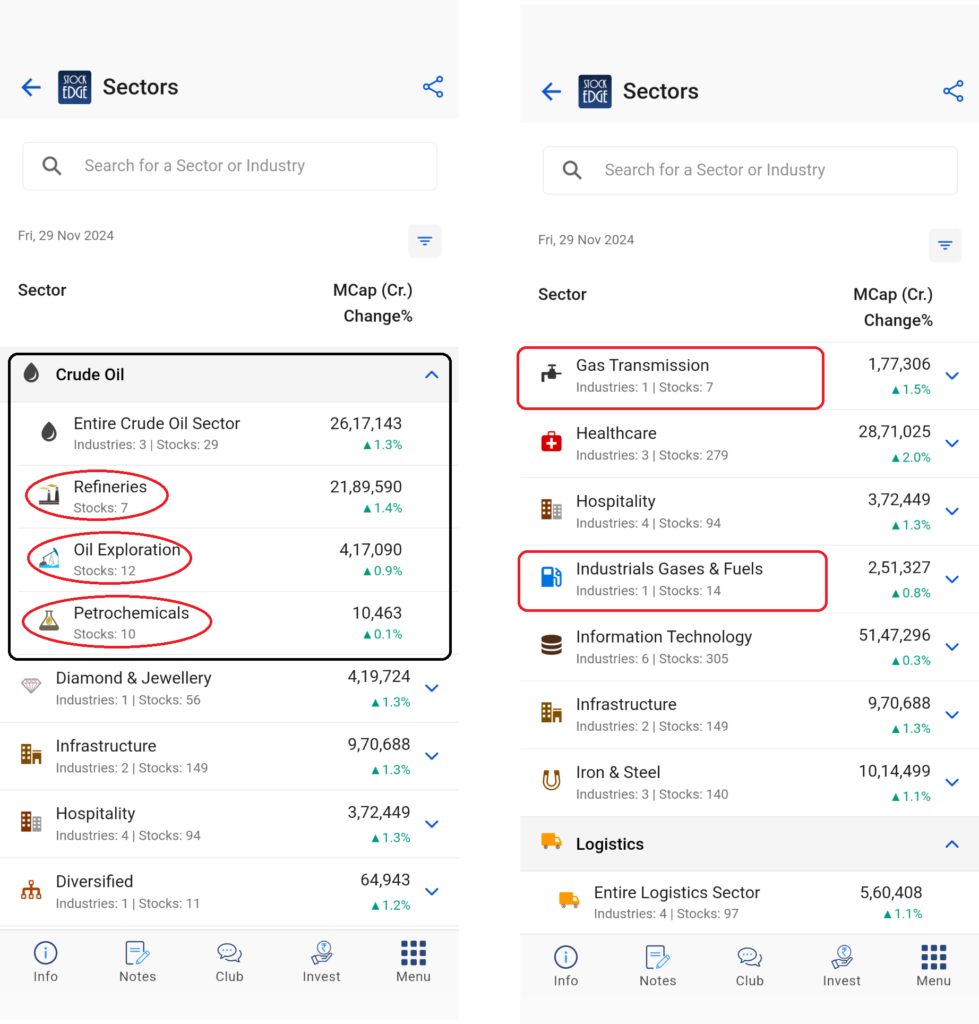

At StockEdge app, you can get the list of oil and gas stocks which we have divided into three separate sectors:

As you can see, considering the vast applications of crude oil, the sector is divided into three industries: oil refineries, oil exploration, and petrochemicals. So, as per the classification, there are 29 stocks and 3 industries. In addition to this, the gas transmission and industrial gases & fuel sector combined has 50 stocks to invest in.

The oil & gas sector of India can be divided into three major segments:

The upstream segment involves exploration and production, where state-owned PSU ONGC Ltd. dominates and accounts for nearly 70% of the country’s total oil and gas output.

The midstream segment is involved in the storage and transportation of oil and gas. Here, Indian Oil Corporation Ltd. (IOCL), which is also a PSU, operates a 14,701 km network of crude, gas and product pipelines.

The downstream segment involves refining, processing and marketing. Here as well, the Indian Oil Corporation Ltd. IOCL is the largest company, controlling 11 out of 22 Indian refineries in India. However, among the private players, Reliance launched India’s 1st privately owned refinery in 1999 and has gained considerable market share (30%) by January 2021.

Factors for Growth in Oil & Gas Sector

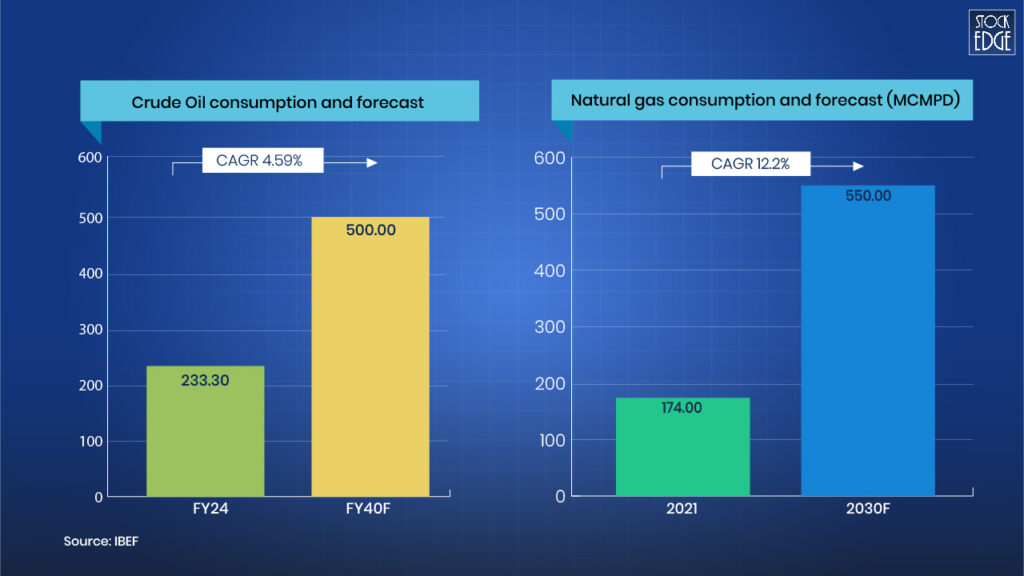

India is the third-largest energy consumer as of 2023, and energy demand in India is anticipated to grow faster than all major economies on the back of robust economic growth. Consequently, India’s energy demand as a percentage of global energy demand is expected to rise to 11% in 2040 from 6% in 2017, as per the report by IBEF.

1. Rising Demand

The demand for crude oil and natural gas is expected to increase over the next couple of years due to economic growth and is largely driven by an increase in population in the country.

2. Business Environment

India has always been a favourable destination for businesses across the world. This is mainly due to the abundance of skilled labour at a lower cost. Oil and gas companies require skilled labour to operate highly advanced machinery that is used in the oil and gas exploration, refining, processing and transportation of oil, natural gas, etc.

3. Government Policy

On 2nd Dec 2024, the GOI scrapped the windfall tax on aviation turbine fuel (ATF), crude products, diesel and petrol products. It is a big relief for Oil refineries in India. The tax was first introduced on July 1, 2022, to help the government tide over the aftereffects of COVID-19 and garner more revenue from the industry. Also, the government allowed 100% FDI in the oil and gas sector, which can not only bring foreign investment but advanced technology and know-how that can increase the efficiency of the overall sector.

How Crude Oil price movements affect oil and gas stocks?

As mentioned above, you can spot investing opportunities in oil and gas stocks if you closely track the price action movements of commodities like crude oil and natural gas. First, let’s understand how crude oil affects oil and gas stocks in India.

Our country is highly dependent on crude oil as India imports over 80% of its crude oil needs. A higher crude price increases the import bill, leading to inflation, fiscal deficit, and currency depreciation. This impacts broader markets and specific sectors.

There could be two major scenarios: one, when crude oil prices are increasing, and the other, when crude oil prices are declining.

How oil and gas stocks perform during rising crude oil prices?

There is usually a positive impact on Oil Exploration companies like ONGC, Oil India, and Cairn India as they benefit from higher crude prices and can sell at increased rates.

So, is it true that most oil and gas stocks have a positive impact if the international crude oil price rises? No! Not always; in fact, there is a negative impact on Oil Refining companies such as Indian Oil, BPCL, and HPCL as these companies face margin pressure due to higher input costs, especially if they cannot pass on the increased cost to consumers majorly due to government regulations and interventions. But these oil and gas stocks become favourable when the crude oil price declines.

How oil and gas stocks perform during falling crude oil prices?

A falling crude oil price is beneficial to the overall Indian economy, as 80% of crude oil is imported. A drop in crude oil prices reduces the current account deficit and, more importantly, improves the balance of payments. In addition to this, falling crude oil prices positively impact numerous sectors of the economy because of its vast useability.

For instance, the aviation and logistics sectors with high fuel dependency (e.g., Indigo, SpiceJet) see decreased costs and increased profitability when crude prices rise. In the automobile sector, lower fuel costs increase the demand for vehicles, especially in the two-wheeler and passenger car segments. Also, paints and chemicals companies like Asian Paints and Pidilite use crude derivatives as raw materials, so a decline in crude prices improves their margins.

At StockEdge, there is a dedicated investment theme of falling crude oil, which can provide you with a list of stocks that can have a positive impact if crude oil prices decline over time.

Top oil and gas stocks in India to Invest

Let’s see which are the top oil and gas stocks to invest in:

1. Oil & Natural Gas Corporation Ltd.

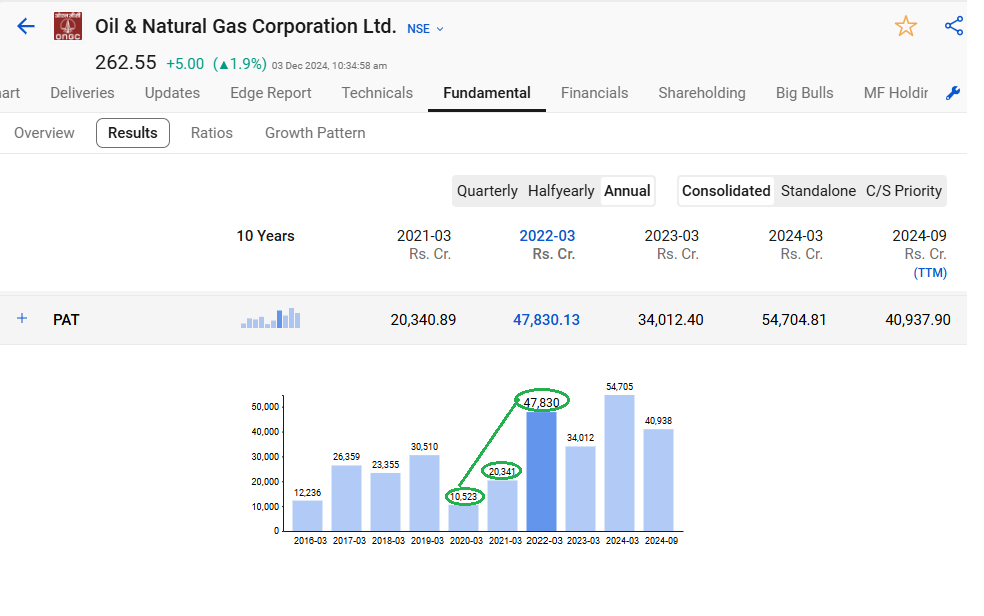

Oil & Natural Gas Corporation (ONGC) is the largest crude oil and natural gas company in India. ONGC has the unique distinction of being a company with in-house service capabilities in all areas of Exploration and Production of oil & gas and related oil-field services. The company’s profitability is highly correlated to international crude prices (WTI Crude). A rise in the crude price has a positive impact on the company’s profitability due to higher realizations from its revenues.

As you can see in the above charts, the WTI crude oil prices climbed from $20 to nearly $120 from 2020 to 2022. In the same period, you can see that the PAT or Net profit of the company has also increased from 10,000 crores to nearly 47,000 crores.

So, yes! The company’s profitability highly depends on the rise in crude oil prices. Therefore, it can be a good investment when global crude oil prices are on the rise.

But of course, there are other factors, such as the company’s operations, management, and government interventions, that can affect the share price in the long term.

2. Petronet LNG Ltd.

The next oil and gas stock that can be a good investment opportunity is Petronet LNG, which is one of the fastest-growing companies in the Indian energy sector. The company is developing LNG as a motor vehicle fuel and for other small-scale consumption. In general, the LNG prices move in line with the crude oil prices, though with a time lag. This helps the company improve its realizations and, thus, its operating profits. A rise in crude increases sales of LNG or liquefied natural gas.

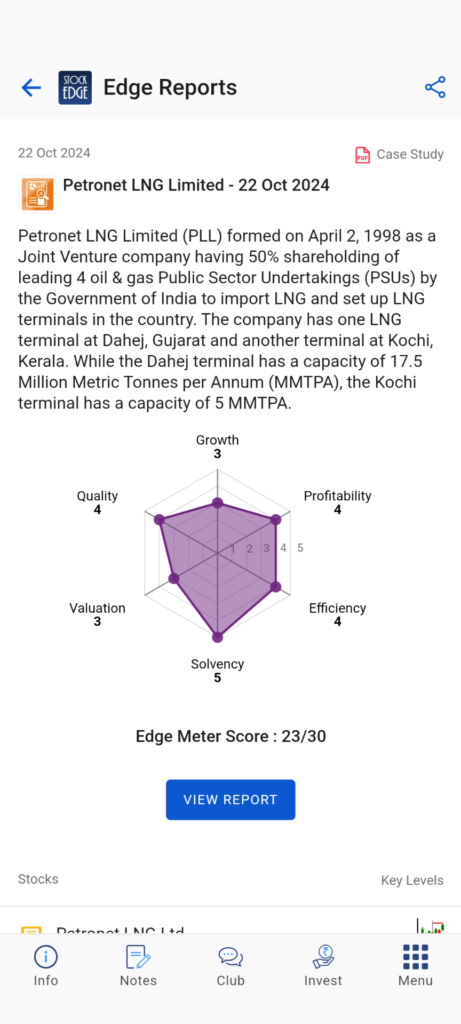

At StockEdge, we have a complete case study on the company and its financial performance, which evaluates the six major pillars: growth, profitability, solvency, efficiency, valuation and quality of the management.

Click to read the research report on Petronet LNG Ltd. before making your investment decision.

3. Indraprastha Gas Ltd.

Incorporated in 1998, Indraprastha Gas Limited is one of the leading city gas distribution (CGD) companies in India. The company is a joint venture promoted by GAIL (India) Limited and Bharat Petroleum Corporation Limited (BPCL). It has an extensive distribution network to transport (CNG), both domestic and commercial.

The company has two major products: CNG (Compressed Natural Gas) & PNG (Piped Natural Gas).

In terms of finances, the company’s net sales growth jumped by nearly 7% YoY in the latest quarter of Q2 FY25. However, the EBITDA growth declined by 18% YoY because of an increase in the input cost of the gas. Also, in Q2 FY25, the total sales volume increased by 9% YoY to 9.03 mmscmd (million metric standard cubic meters per day) as compared to 8.30 mmscmd in Q2 FY24, and the company is targeting to close FY25 with a sales volume of ~9.5 mmscmd suggesting growing business despite the challenges in input cost.

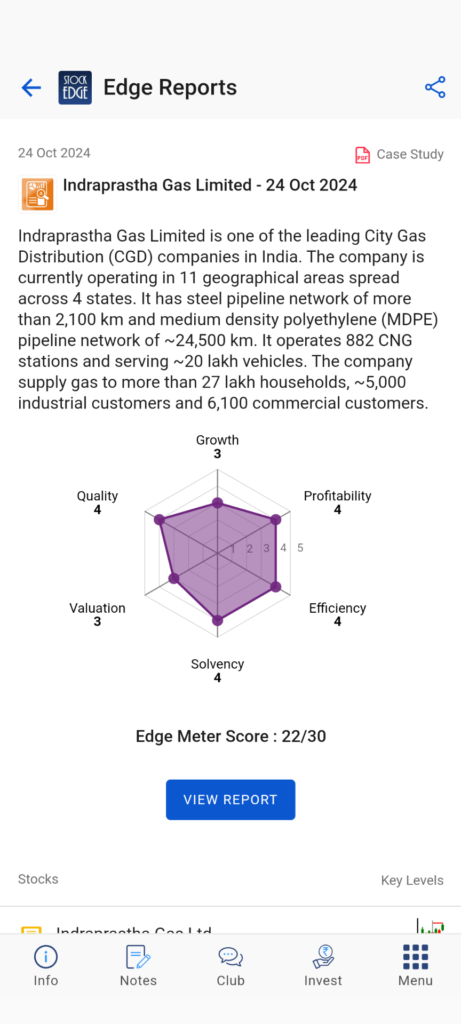

Our team of analysts at StockEdge has also made a detailed case study of the company on six broad parameters such as growth, profitability, efficiency, solvency, valuation and quality, which you can view on a spider chart below:

Click to read the research report on Indraprastha Gas Ltd. before making your investment decision.

In addition to this, the stock is currently trading near its accumulation zone as you view on the edge chart below:

Therefore, fresh investment at current price can be good long term investment if you are willing to diversify your portfolio into oil and gas stocks of India.

The Bottom Line

In conclusion, India’s oil and gas sector holds significant potential for long-term investors, driven by rising energy demand, favourable government policies, and the sector’s pivotal role in the economy. While factors such as crude oil price volatility and input costs can influence stock performance, strategic investments in companies like ONGC, Petronet LNG, and Indraprastha Gas offer opportunities to capitalize on growth in this dynamic industry. By staying informed about market trends, government policies, and commodity price movements, investors can make well-timed decisions to harness the potential of this essential sector in India’s energy ecosystem.

Want to learn how to navigate the market with confidence? Start with our Beginner’s Guide to Investing today!