Table of Contents

India’s most awaited festival, Diwali, is just around the corner! Wishing a prosperous Diwali to all our readers. The celebrations kick off with Dhanteras, also known as Dhanatrayodashi, a day when many of us traditionally buy gold – a cherished asset across generations. But as times change, so do investment trends, with gold stocks in India gaining popularity among investors. So, what’s your pick for Diwali 2024 – shinny gold or golden stocks?

What are Gold Stocks?

Gold stocks in India are shares of publicly listed companies whose business has a direct or indirect relationship with the precious metal Gold. The movement in the price of gold somehow affects the business of these companies, and they are generally preferred as Gold stocks in India. For instance, companies that are involved in the mining, exploration, production or sale of gold. Example: Kalyan Jewellers India Ltd, Senco Gold Ltd. both are major players in the gold jewelry industry and are considered as Gold stocks in India.

Gold Industry in India – A Brief Overview

Earlier, our country, Bharat, was known as “Sone ki Chidiya” – The golden bird mostly known for its prosperity, culture and religion where the precious metal gold is deeply rooted in our culture and tradition. India is one of the largest consumers of gold globally, with gold playing a key role in celebrations, weddings, and festivals, where it is seen as a symbol of wealth, prosperity, and status.

Moreover, the gold jewellery market in India is vast and highly fragmented, consisting of both organized players (large brands and retailers like Tanishq by Tata, Kalyan Jewellers, etc.) and unorganized ones (small, independent jewellers and artisans). However, in recent times, the gold industry has seen a shift toward formalization, with increasing consumer awareness of hallmarking and quality standards of gold. Online gold sales and gold as an investment product are also gaining popularity, making gold accessible to a new generation of buyers. All such factors have added to an increase in gold consumption, which eventually leads to a rise in gold prices both domestically and internationally.

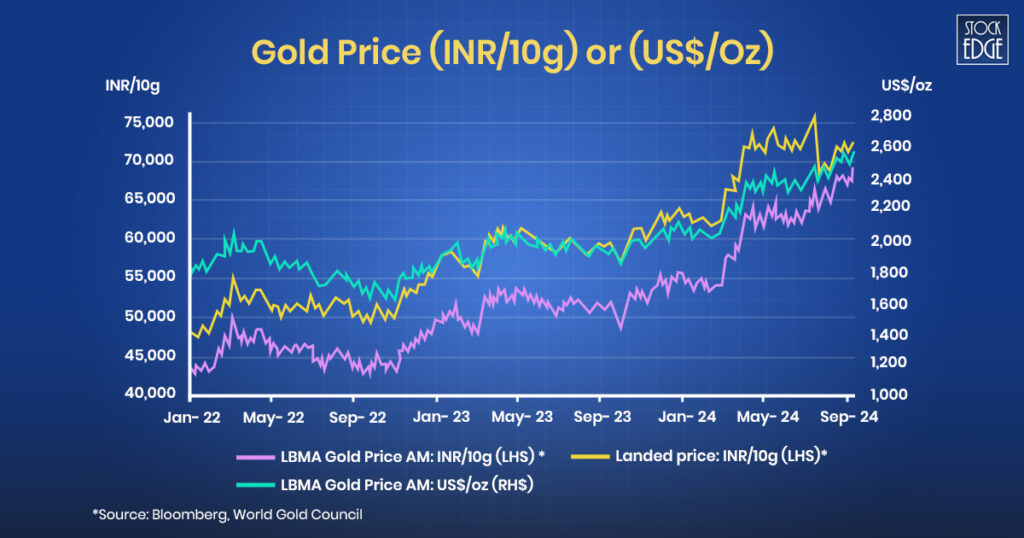

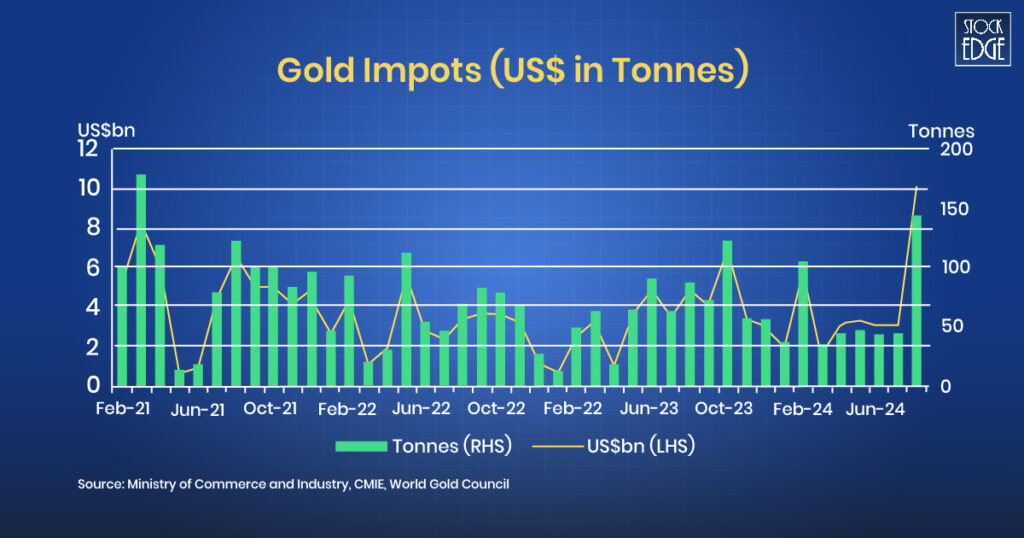

As you can see, the price of gold globally has surged but the price difference between gold prices in India generally differs as India heavily imports gold which leads to premium gold prices here in the country. But since the announcement of import duty cut on 23 July 2024 by the government, the spread between domestic gold prices and international prices have reduced. Additionally there has been a surge in import of gold.

So, by this time it is clear that gold is in high demand right now. Therefore, apart from investing directly in gold; Is there an investing opportunity for gold stocks in India? But before that let’s find out some of the key growth drivers of Gold stocks in India.

Key Growth Drivers of Gold Stocks in India

Here are major three growth drivers for gold stocks in India, due to the rise in gold prices:

- When gold prices rise, consumers often see it as a safe haven investment, especially in India where gold is traditionally viewed as an asset which maintains its value and appreciates over time. This increase in the demand for gold as a financial asset is driving massive sales for gold jewelers in India, leading to rise in share prices of gold stocks in India.

- Gold jewels in India are popular all over the world because of their craftsmanship skills in making jewelry at a competitive price. This gives rise to export demand, particularly from markets like the Middle East, the U.S., and Europe, where consumers seek high-quality, intricately designed Indian gold jewellery.

- With rising gold prices, jewellers have the opportunity to introduce more value-added services, such as custom designs, exclusive collections, and high-end craftsmanship. This allows them to charge premium prices for unique, high-quality pieces, leading to better profit margins. Additionally, jewellers who have stockpiled raw gold at lower prices can capitalize on selling their inventory at a higher market value, boosting profitability which is driving the growth of gold stocks in India.

Factors to Consider Before Investing in Gold Stocks in India

There are several factors to consider when investing in Gold stocks especially which are directly impacted by the movement of gold prices.

Consumer Demand and Sentiment

The demand for gold in India is deeply influenced by cultural factors, seasonal trends, and consumer sentiment. Festivals, weddings, and investment preferences impact sales for gold stocks in India. You should assess how demand trends for gold jewellery are evolving, especially as rising prices can make gold less affordable for the average consumer. However, companies targeting premium or investment-oriented customers might be better positioned during price increases.

Gold Inventory Management

Many companies that deal with gold, especially jewllers with large gold reserves or efficient inventory management can benefit from price fluctuations in gold. If a company has purchased raw gold when prices were lower, it can sell its jewelry at higher prices when the market rises, improving profitability. It’s necessary to assess how well a company manages its gold inventory and its purchasing strategies to hedge against volatile price swings.

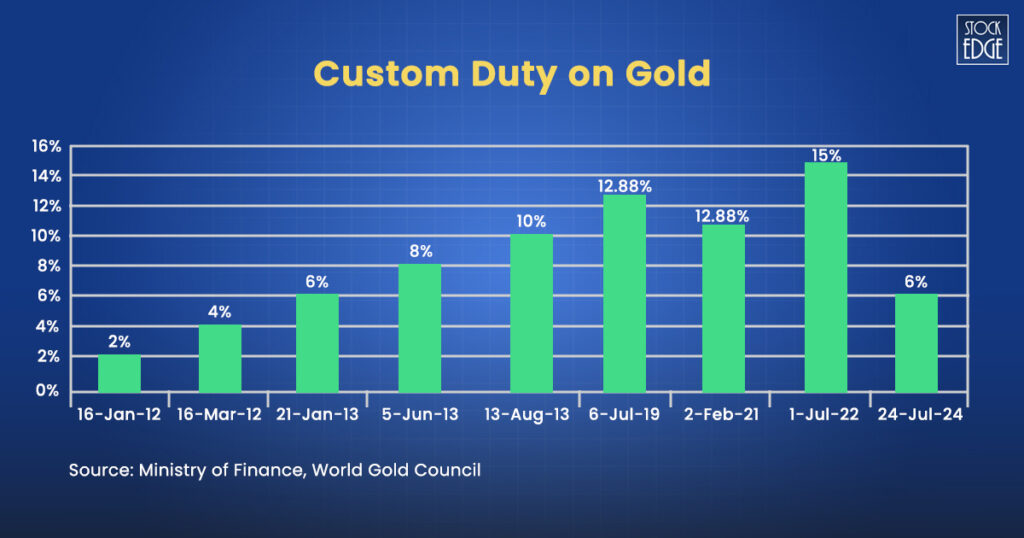

Government Regulations and Duties

The Indian government imposes customs duties and taxes that directly impact the cost structure of gold jewellery companies in the country. Changes in policies like import duty hikes, hallmarking mandates, or restrictions on gold imports can impact profitability. Recently, on 23 July 2024 the Government of India has announced a rate cut on custom duty in importing gold which has triggered high demand for gold.

Here is a chart showing the custom duty on gold over the years:

Operational Efficiency

Investing in Gold stocks in India can sometimes be daunting due to the high price volatility in gold, which directly affects the profitability of the companies. So, you should always look for companies that have efficient business operations. The daily operations of sourcing gold, manufacturing jewelry and efficiently retailing them to consumers is the key to avoid high price fluctuations of gold and smoothing the streamline of revenue for the company.

Financial Performance

Tracking the financial performance of a stock is essential before making an investment decision. The sincerity increases especially for gold stocks in India as their profitability is highly impacted due to price fluctuation in gold. Additionally, you must monitor the debt on their balance sheet as highly leveraged companies struggle during periods of price volatility or when consumer demand declines.

Benefits of Investing in Gold Stocks in India

Investing in gold stocks in India has its own unique advantages, which are discussed below:

Diversification: Beyond Physical Gold

Investing in gold stocks in India provides broad exposure to the growth of the Indian gold industry without holding physical gold. It offers investors to diversify within the gold sector by taking ownership in publicly listed stocks that are involved in gold mining, refining, or jewelry manufacturing and retailing. But unlike physical gold or Gold ETFs, gold stocks in India offer a broader exposure to different aspects of the industry, including profitability from rising prices, operational efficiency, and market expansion.

Dividend Income

Some gold stocks in India offer dividends, providing regular income streams to investors, which physical gold or Gold ETFs do not. This feature allows investors to benefit from both capital appreciation and income.

Potential for Higher Returns

Gold stocks in India have the potential to deliver higher returns compared to owning physical gold. This precious metal will only appreciate when the value of the commodity rises. But, gold stocks in India might benefit from factors besides the rising commodity prices, like demand from exports, new product launches, cost management, market growth, development economics, and mergers and acquisitions.

Now, we have arrived at the best part of the blog, where you get the list of best gold stocks in India that you may invest in for the long term.

Best Gold Stocks in India

Titan Company Ltd.

The company is one of the leading manufacturers of luxury fashion accessories in India. But when did Titan enter the gold industry? They sell watches, eyeglasses etc. Right? You will be astonished to know that ~90% of the company’s revenue comes from its jewelry segment: Tanishq by TATA. Therefore an increase in the price of gold might subsequently translate to an increase in the revenue of the company on higher realizations.

Financial Performance

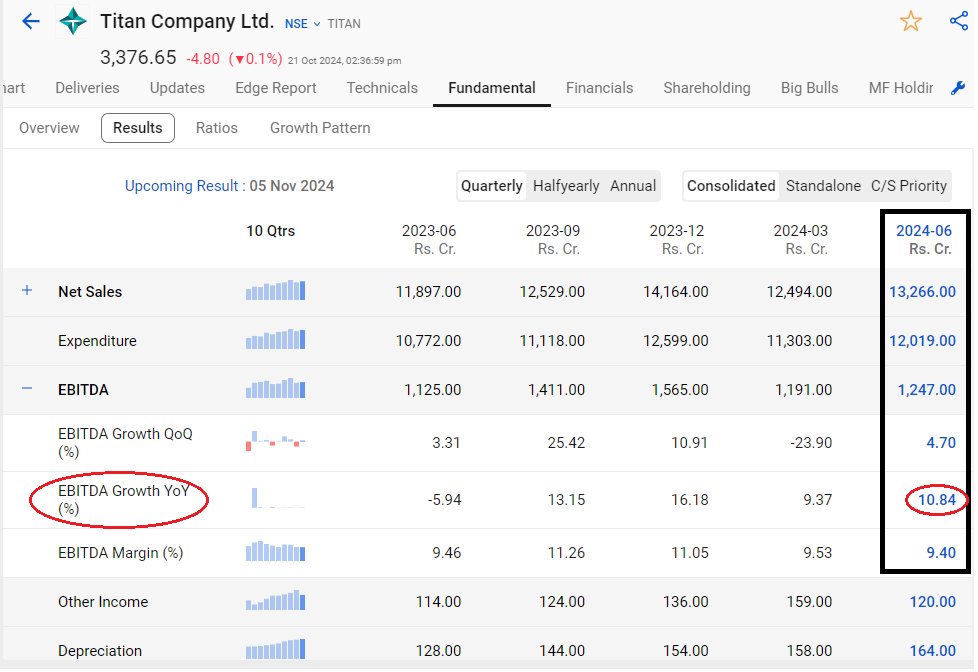

In FY24, revenue grew by 26% YoY driven by jewelry and other business. In the latest quarter of Q1 FY25 , the revenue stood at ₹13,266 cr, up by 12% YoY. It was impacted by the rising gold price, lower number of wedding dates in the country across India and elections. In FY24, EBITDA was increased by 8% whereas in the latest quarter of Q1 FY25, EBITDA was increased by ~11% to ₹1,247 cr driven by higher sales.

You can track the revenue and EBITDA growth of Titan Company Ltd. from the StockEdge for your ease:

For a further analysis on Titan Company Ltd. you can refer to our case study.

Muthoot Finance Ltd.

It is a financial services company in India. Yes, you might be wondering why this finance stock is considered one of the gold stocks in India. This is due to the fact that the company is one of the largest providers of gold loans in India. Muthoot Finance provides gold loans at low interest rates. A gold loan or a loan against gold is a secured loan that customers can avail of from Muthoot Finance in lieu of gold ornaments like gold jewellery.

Therefore, with an increase in the price of gold, people will be able to avail of more loans against the same quantity of gold held, which might lead to an increase in the gold loan AUM (asset under management) of the company.

Financial Performance

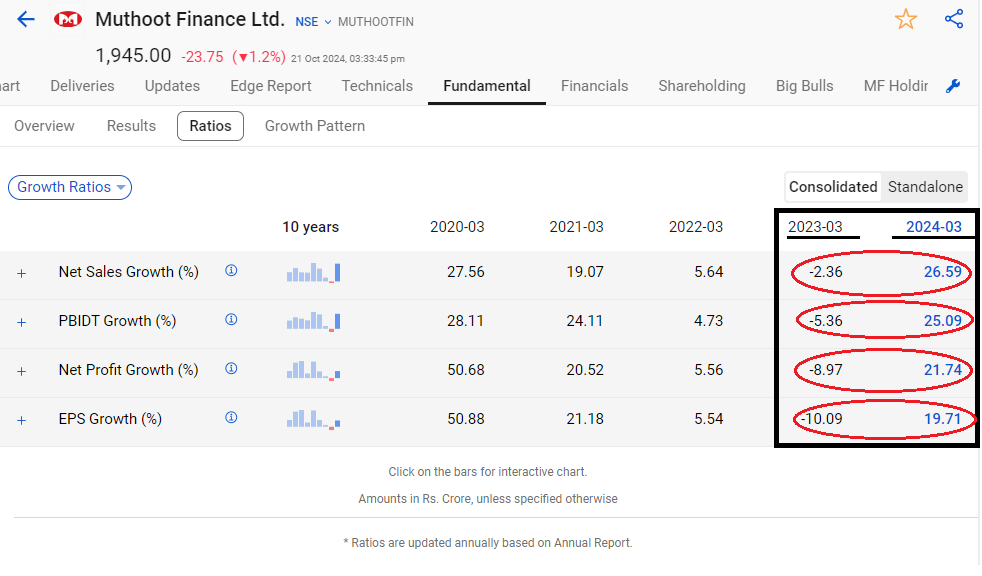

The company has managed to significantly improve its financial performance in the past year. The net sales, net profit and EPS of the company has remarkably increased from FY 23 to FY 24. Using StockEdge, ratio analysis it is easy to analyze growth of a company.

Additionally, with increase in prices of gold, the company is expected to continue its growth trajectory. An increase in gold prices benefit gold financiers by increasing the value of gold collateral, thereby attracting more customers seeking loans against their now more valuable assets.

Kalyan Jewellers India Ltd.

This company is a pure-play gold stock in India. It is one of the leading gold jewellers in India, with a strong brand presence across major Indian cities. Additionally, the company had expanded its footprint to the Middle East market with six showrooms. Kalyan Jewellers designs and markets a diverse selection of gold, studded, and other unique jewellery products across price points. Therefore, an increase in the price of gold will subsequently translate to an increase in the revenue of the company on higher realizations.

Financial Performance

In the last 3 years the company has delivered a compounded sales growth of 29.34% and profit growth of 359%. As of Oct 24, the stock price too has surged nearly 130% in the past year. The return ratios like the ROE, ROCE of the company have been steadily increasing over the years as you can monitor using StockEdge.

In contrast, the company has significantly reduced its Debt on the balance sheet. The Debt-equity ratio of Kalyan Jewellers has declined from 1.68 in 2020 to 0.79 as of 2024. The company has stable operating margins of 7-8%, and with solid growth plans in place, is expected to perform well in the coming quarters and years, driven by the growth opportunities in the Indian jewelry industry.

Further, if you wish to diversify your portfolio into more gold stocks, then you can check out one of our investment themes: The Shining Metal – Gold.

In this investment theme, we have provided an elongated list of gold stocks in India where you can invest. This is a thematic investment on gold and stocks listed in the theme mostly has a direct or indirect impact based on the overall trend of the precious metal gold. Investing in gold stocks can be beneficial for investors who want to diversify their asset class beyond physical or digital gold. Additionally, if you wish to directly invest in gold, then identifying the right investment product based on your risk appetite is necessary. You can read this blog: Investment in Gold: Discover ways to shine your portfolio brighter!

The Bottom Line

Investing in gold stocks in India becomes particularly more fruitful when gold is priced high as these firms stand to gain in terms of profits and stock price as well. Unlike physical gold, gold stocks in India provide exposure to profitability of firms, allowing investors to benefit from the increase in prices, operational efficiencies, global demand, and possible dividends. By analyzing top investors’ portfolios, you can identify which gold stocks are favored by successful investors, enhancing your investment strategy and potential returns in this lucrative sector.

Happy Investing!