Table of Contents

Imagine how long it typically takes to deliver a parcel over a 46-kilometer distance. Most of you say it could take 1-2 days, but what if your mail arrives faster than your lunch?

This isn’t science fiction. It is a reality in India. In May 2022, a parcel jetted 46 kilometers in just 25 minutes, marking a historic first for India’s postal service.

How did this remarkable event happen?

The key to this new reality in India is drone delivery. Today, drone stocks are steadily rising as the use of drones expands across various industries. Their uses have been notably prevalent in non-commercial fields such as aerial photography, land surveys, agriculture, mining, disaster management, construction, and national highway and railroad track mapping.

In this blog, we will discuss the value chain analysis of drone stocks, explore why this sector continues to shine day by day, and determine which drone stocks in India are part of this thriving industry.

Rising Horizons: How Drone Stocks Are Soaring Globally and in India

Drones, commonly known as Unmanned Aerial Vehicles (UAVs), started off being used for defence purposes and are now increasingly used in civilian space. According to the Federation of Indian Chambers of Commerce and Industry (FICCI), this sector has the potential to transform many sectors and could contribute 4-5 % to India’s GDP due to the multiplier effect.

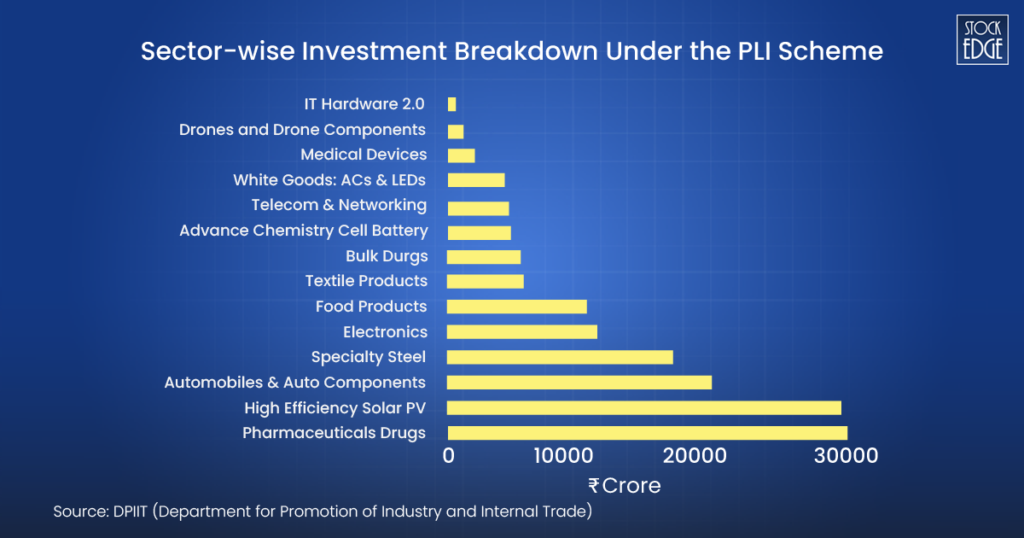

According to the Economic Survey 2023-2024, around ₹595 crore are invested in drone and drone components under the PLI (Production Linked Incentive) Scheme, reflecting the government’s commitment to fostering innovation and manufacturing in this space.

As of March 2024, over 200 drone tech startups were operating in India, indicating a thriving and innovative ecosystem. Moreover, substantial investments totalling over US$83 million from January 2016 to November 2023 have fueled the market’s expansion and innovation.

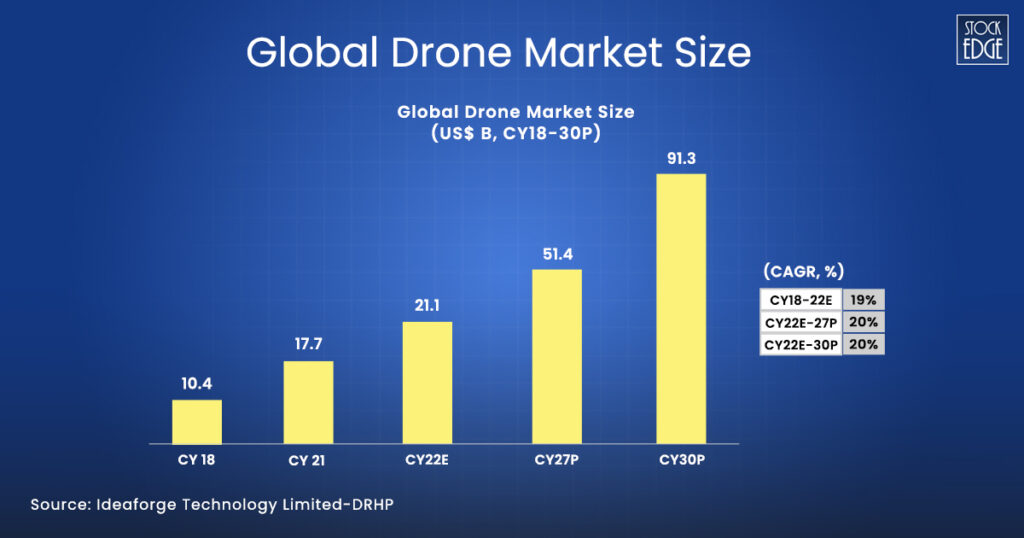

Even the global drone industry grew at a CAGR of 19% from CY18-22 and is projected to reach ~US $51.4 billion in CY27 and ~US $91.3 billion by CY30, with a CAGR of 20%.

Now, look at how this drone company works by highlighting its value chain analysis.

Value Chain Analysis of the Drone Stocks

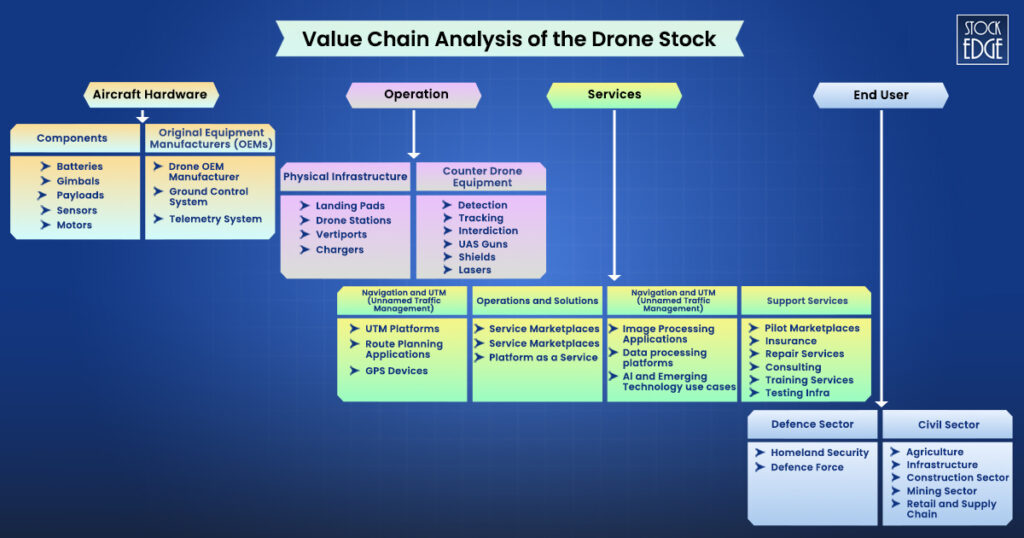

The Indian UAV market works in a systematic approach. It begins with Aircraft Hardware, which develops and manufactures critical components such as batteries, gimbals, and sensors. The next step is Operations, which entails establishing the required infrastructure and mechanisms for safe and effective drone management. Following that comes the Services segment, which provides a variety of support tasks that benefit the UAV ecosystem. Finally, the process concludes with End Users, who are the ultimate users of drones and related services in a variety of industries, including defence, agriculture, construction, and mining.

Here’s the image that depicts how this sector works.

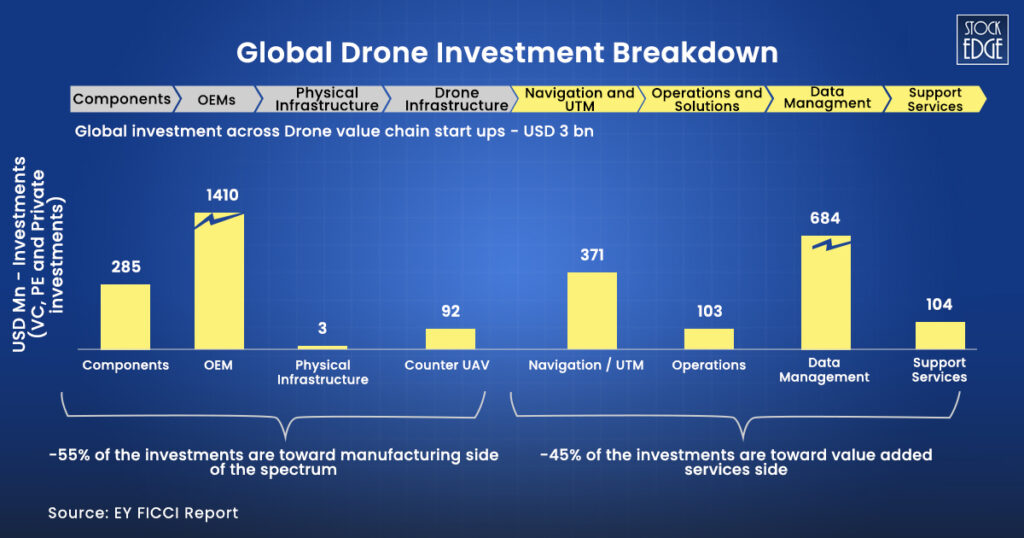

The value chain of drone stocks in India includes both manufacturing and value-added service components. According to EY FICCI data, around 55% of worldwide investments are made in the manufacturing side, with the remaining value invested in the value-added spectrum.

To comprehend the drone sector’s mechanism, it is important to look at how India will position itself to become a global drone hub and an appealing investment opportunity. By analyzing India’s strategic investments, supportive regulation, and developing ecosystem, you can observe how these elements promote innovation and provide investment prospects in drone stocks.

How will India become the Global Hub for Drones?

India is shifting its focus from ‘Make in India’ to ‘Make for the World.’ The Indian drone industry is expected to generate USD 40 billion in revenue by 2030, expanding at a 37% CAGR.

But how?

Let us look at the factors which bolster the significant growth potential and favorable environment for drone stocks in India.

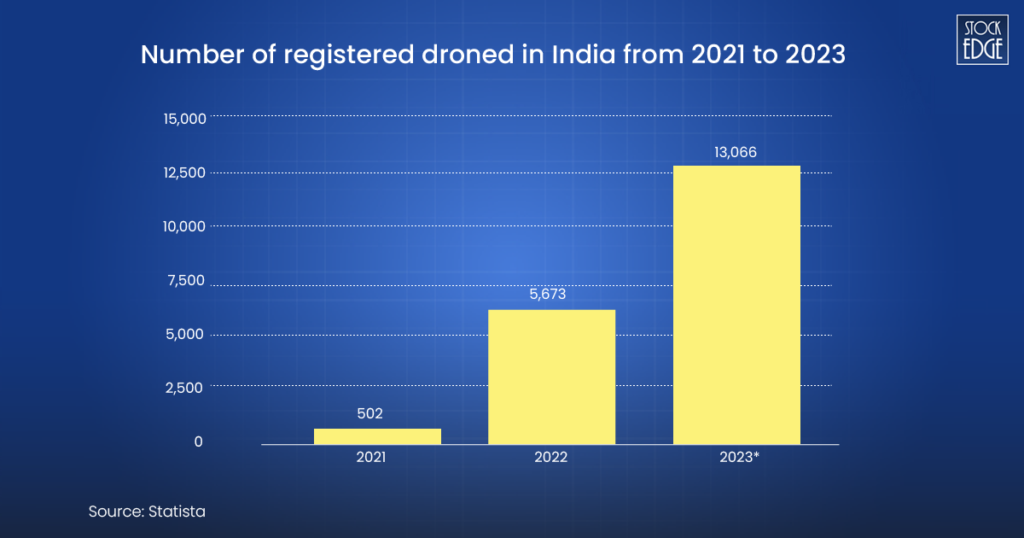

- Drone Rules 2021: In August 2021, the government introduced the ‘Drone Rules 2021’, which, after extensive consultations with stakeholders, created a more liberalized regulatory framework. As of 7th August 2024, there are 24,122 drones registered with a Unique Identification Number (UIN).

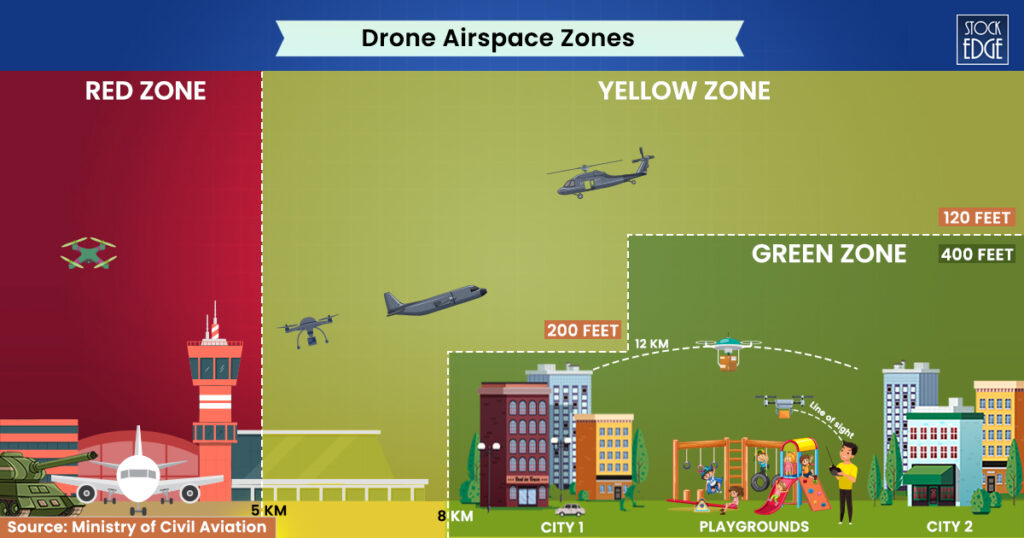

- DigitalSky Website: The government launched the DigitalSky website, which features an airspace map divided into green, yellow, and red zones. More than 90% of the Indian airspace is in the green zone, which signifies free-to-fly zones, eliminating the need for operational approval from local authorities before conducting drone operations.

- Production-Linked Incentive (PLI) Scheme: In the fiscal year 2021-2022, the government allocated ₹ 120 crores for a Production-Linked Incentive (PLI) scheme aimed at fostering growth in drone and drone component manufacturing. This commitment has continued to rise, with the interim budget for 2024 featuring an allocation of ₹ 57 crores specifically for drones and drone components under the PLI scheme. This represents a significant increase of 72% compared to the previous year’s allocation of ₹ 33 crores.

- Ban on Drone Imports for Commercial Use: A notification from the Directorate General of Foreign Trade (DGFT) has banned the import of drones for commercial applications, with exceptions for R&D, defence, and security purposes. This move aims to increase the market share of domestic drone manufacturers and tap into the potential of the domestic market.

- Various Government Schemes have been launched: A significant part of the drone companies’s exponential growth has been attributed to various government initiatives and laws that encourage local drone manufacture. List of Government Schemes:

- Drone Shakti Scheme

- Mission Raksha Gyan Shakti

- PM Kisan Drone Yojana

- Namo Drone Didi Yojana

These factors create a favorable environment for innovation and investment and also highlight promising opportunities within the drone sector. Many other sectors are also entering this space; for instance, Yamaha Motor India Pvt. Ltd., a subsidiary of the Japanese multinational, began selling multi-rotor drones for crop monitoring in 2018 to meet growing demand in Japan.

So, it’s important to focus on identifying and investing in potential drone companies in India to capitalize on the sector’s growth and diversification. Let’s look at the various drone stocks and assess their potential to invest.

Top 4 Drone Stocks in India

Zen Technologies

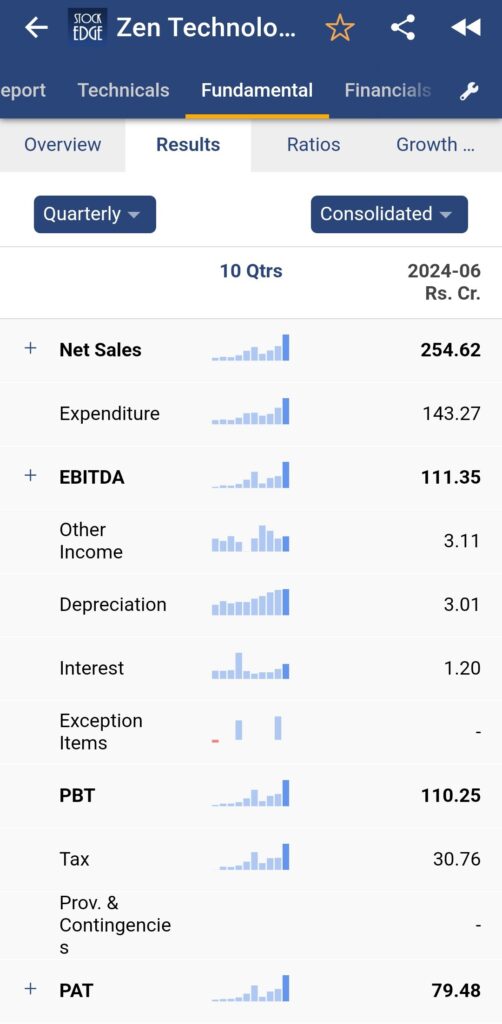

The company experienced significant revenue growth, increasing from ₹132.45 crore in Q1 FY24 to ₹254.62 crore in Q1 FY25. This represents substantial year-on-year growth. Operational EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) has shown strong growth, indicating improved operational efficiency. EBITDA margins have also expanded. The total order book stands at Rs 1158.54 crore, mainly consisting of training simulators and anti-drone systems. The company spent ₹6.69 crore on R&D. Zen Technologies is a integral part of Nifty Smallcap 250 Index

Paras Defence & Space Technology

Paras Defence and Space Technologies, with its extensive 40-year history, operates in two main sectors: Optics & Optronic Systems and Defence Engineering. The company also has a significant presence in the drone industry through its subsidiaries. Paras Anti-Drone Solutions focuses on developing radio frequency (RF) and microwave systems for countering uncrewed aerial vehicles (UAVs), while Paras Aerospace provides drone services and related technologies.

In Q1 FY25, Paras Defence and Space Technologies reported revenue of Rs 83.57 crores, marking a ~5% increase from last quarter. The order book showed a substantial increase, up 60.31% from Rs 393 crores in FY23 to Rs 630 crores in FY24, indicating a robust pipeline of future business. To know more about this company, you can read our blog, Top 5 Defence Stocks in India.

Drone Destination Ltd.

Drone Destination Ltd. went public on the NSE SME (Small and Medium Enterprises) zone on July 21, 2023. They reported impressive financial growth for the year ending March 31st, with revenues soaring from INR 12.07 crores to INR 32.62 crores (170% increase). EBITDA grew significantly, reaching INR 13.86 crores with an improved margin of 44%. PAT also saw substantial growth, climbing to INR 7.08 crores. Despite a 153% rise in expenses, the company managed efficient cost control.

Ideaforge Technology Ltd.

Ideaforge Technology Limited is a market leader in the Indian drone market and has also been ranked 5th globally in the dual-use category (civil and defence) drone manufacturers.

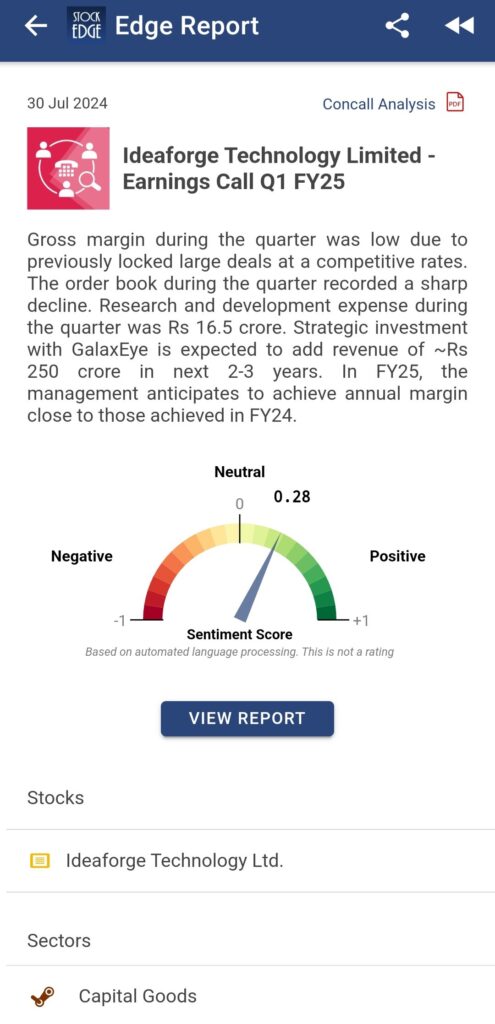

In Q1 FY25, they reported revenues of ₹86.2 crores, a decline of 11.2% YoY compared to ₹97.1 crores in Q1 FY24. The net profit also dropped sharply by 93.8%. The order book witnessed a significant decrease, ending the quarter at ₹54.2 crores, expected to be executed by Q2 and Q3 of FY25. However, the company invested ₹16.5 crores in research and development, reflecting its commitment to innovation. With an execution capacity of approximately 10,000 drones per year, they continue to maintain a strong production capability.

However, In FY24, they demonstrated strong growth in net sales, PBIDT, and net profit. They also made substantial strides in Q1 FY25, securing five new patents and successfully completing early adopter programs and demonstrations in the U.S., which have the potential to convert into orders.

To know more about these drone stocks, read our Edge Report.

The Bottom Line

The rapid growth of drone technology, combined with India’s promising regulatory environment, marks a transformative era in drone stocks. The future of aviation services in India depends on the expansion of the Maintenance, Repair, and Operations sector and the growing drone stocks in India. With liberalized regulations and incentives, India aims to become a global drone hub by 2030. Recent developments include more training organizations, remote pilot certifications, registered drones, and permitted drone models.

The Indian government has also taken various measures to expand drone stock. According to Ministry of Civil Aviation projections, the drone manufacturing business will grow from ₹ 60 crore in FY 2020–21 to ₹ 900 crore in FY 2025.

To sum up, the drone stocks in India are far more than just a technological marvel. They are a vital industry that is defining the future of various industries. Drones stocks will play an increasingly vital part in India’s economic environment as the sector continues to grow, innovate, and make strategic investments

Happy Investing!