Key Takeaways

- Industry Outlook: India is the second-largest cement producer globally, driven by housing, infrastructure, and industrial demand.

- Growth Drivers: Government projects like Bharatmala, PMAY, and rising urbanisation are major contributors to cement consumption.

- Investment Factors: Key aspects include sales growth, debt levels, operating margins, capacity utilisation, and brand reputation.

- Risks: Cement stocks face challenges from input cost volatility, competition, regulatory norms, and economic cyclicality.

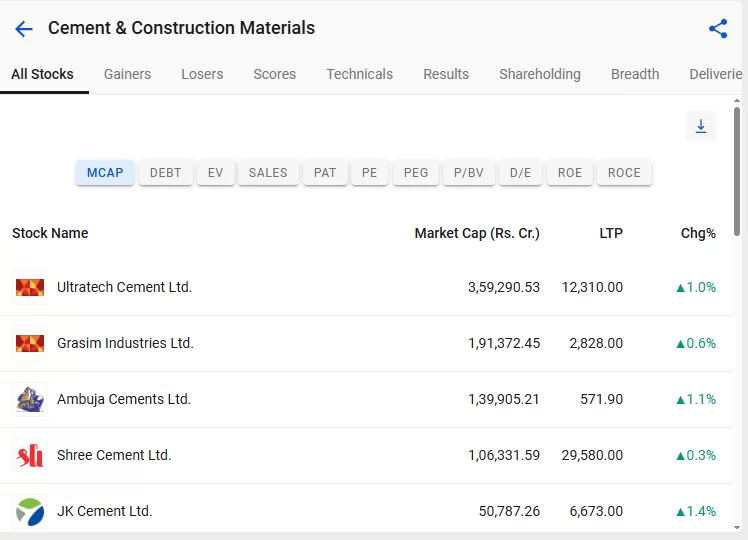

- Top Cement Stocks:

- UltraTech Cement

- Ambuja Cements

- Shree Cement

When you drive past a flyover or see new buildings being constructed in your city, behind the scenes are tonnes of cement being used. Cement is the literal foundation of infrastructure, and in the context of a country like India, which has such ambitious infrastructural goals, cement is a barometer of economic progress and a potential wealth generator for investors.

But investing in cement stocks is not as simple as taking a bet on India’s growth potential. It involves proper understanding of costs (both environmental and economic), government policies and structural risks.

This blog will take you through what cement stocks are, why they may be a compelling investment, especially in India and what the future holds for this industry. Based on factors discussed later, we will disclose what we feel are the cement stocks an investor must be looking at.

What are Cement Stocks?

Cement stocks refer to companies engaged in the manufacturing, production, and sale of cement and related construction materials.

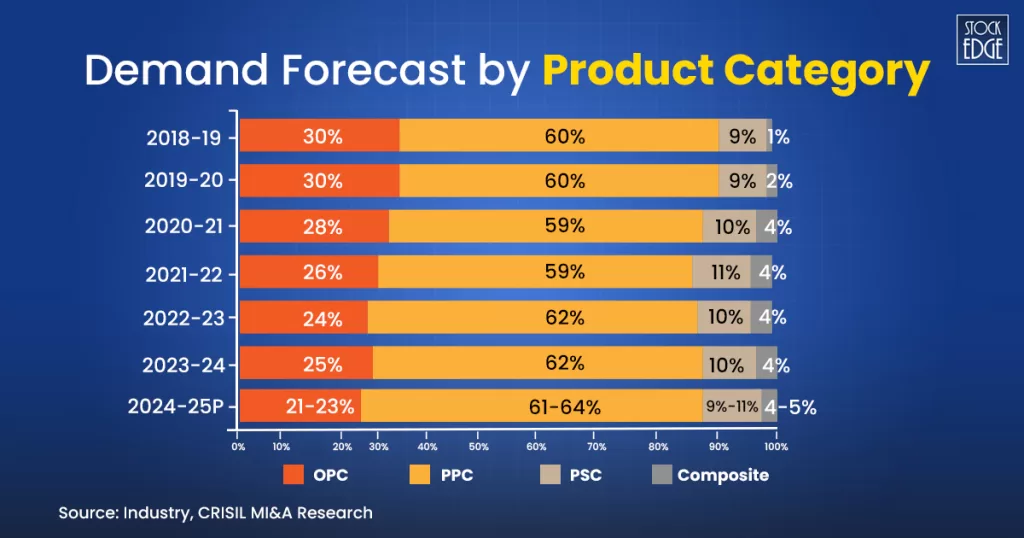

Cement is of different types, with OPC (ordinary Portland cement) being the most popular one globally, due to its strength and durability. However, the use of blended cements, such as PPC (Portland Pozzolana Cement), PSC (Portland Slag Cement), and Composite Cements, has been on the rise, as they are sustainable, durable, and less costly.

In India, the majority of the cement sold is PPC. OPC usage is generally concentrated in the western regions, while PSC is more popular in the east.

Demand Driver of the Cement Industry

India is the second largest producer of cement in the world, accounting for roughly 8-10% of the world’s cement production.

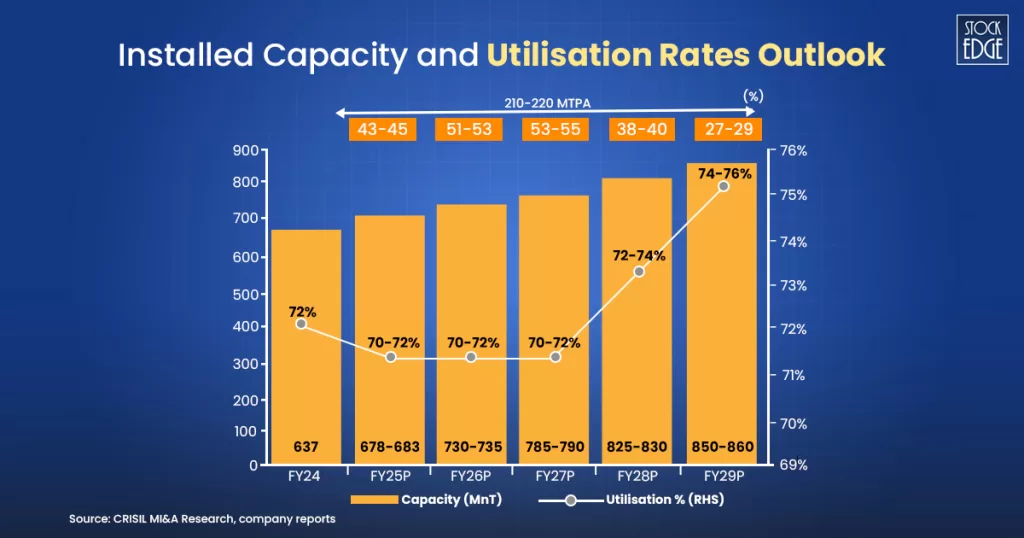

According to the Cement Manufacturers’ Association, India’s installed cement capacity is currently at 690 million tonnes in FY25. This capacity is expected to increase at a rate of approximately 6-7% per annum.

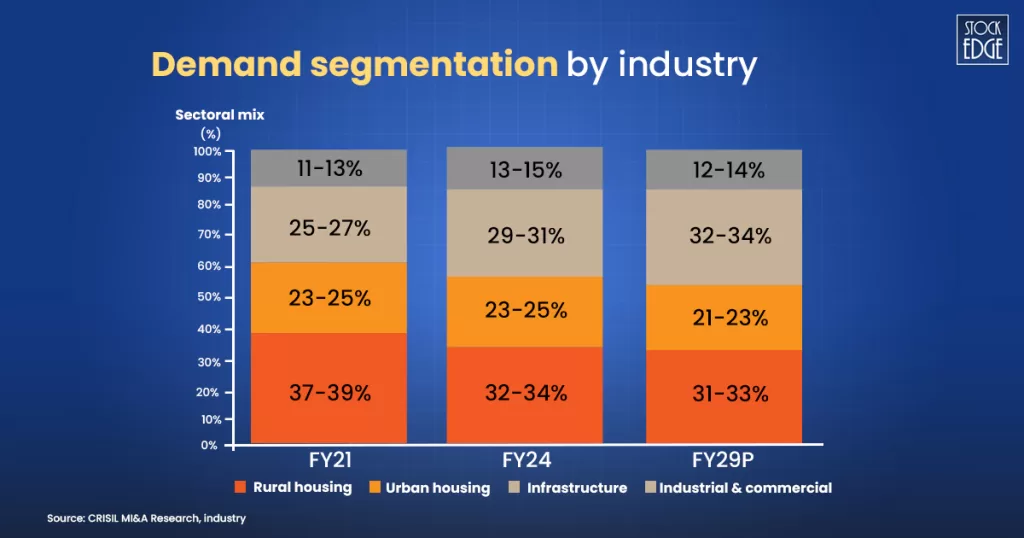

As of FY 2024, housing contributed around 56-58% of total cement demanded, followed by infrastructure at around 29-31% and industrial/commercial at around 13-15%. Here are the key drivers of the cement industry.

Now let’s look at the key demand drivers of the cement industry:

1. Infrastructure Development: Construction of roads, bridges, airports, ports, and railways drives large-scale demand for cement. Government initiatives like Bharatmala, Sagarmala, and urban infrastructure projects boost consumption.

2. Real Estate & Housing: Residential and commercial construction are major contributors. Affordable housing schemes like Pradhan Mantri Awas Yojana (PMAY) increase cement demand. Rising urbanization and population growth fuel housing needs.

3. Government Policies & Public Spending: Fiscal stimulus, budget for construction, and public-private partnerships boost demand. Tax incentives and subsidies for housing and infrastructure indirectly increase cement consumption.

4. Merger and Acquisition: Many large cement companies expand their business inorganically, that is, by acquiring or taking a stake in smaller players. This helps them quickly increase production capacity, enter new regional markets, and achieve economies of scale.

Factors to Consider While Buying Cement Stocks

Investors should base their investment on two factors:

- Quantitative- These focus on the company’s financial statements

- Qualitative- These focus on the company’s value and potential based on non-numerical factors.

We will first look at the quantitative aspect and then move on to the qualitative side

Quantitative Factors Affecting Cement Stocks

We begin by highlighting the key ratios to consider when investing in cement stocks.

Rs Realization/MTA

This ratio basically tells us the revenue earned per ton of cement sold. This metric indicates profitability per unit, with higher realization suggesting better income per ton.

| Company | FY25 Blended Realisation (₹/t) |

| UltraTech Cement | ₹5,777 |

| Ambuja Cements | ₹5,288 |

| Shree Cement | ₹5,031 |

| JK Cement | ₹5,744 |

| Dalmia Bharat | ₹4,757 |

| ACC Limited | ₹5,098 |

Source: Annual Reports

Capacity Utilization(%)

It tells us about the % of total production capacity that is utilised. With cement being such a capital-intensive industry, fixed costs form a large part of total costs. Thus, higher utilization rates may reduce company costs per unit and increase margins.

| Company | Capacity Utilisation(%) |

| UltraTech Cement | 78 |

| Ambuja Cements | 84 |

| Shree Cement | 68 |

| JK Cement | 76 |

| Dalmia Bharat | 63 |

| ACC Limited | 78 |

Source: Annual reports and StockEdge

Financial Strength of the Business

The financial strength of a cement company can be assessed through key metrics. Strong sales growth, low debt-to-equity ratio and high operating profit margin show efficient operations and resilience.

| Company | Sales growth(%) | Debt to Equity | Operating Profit Margin |

| UltraTech Cement | 8 | 0.34 | 17.91 |

| Ambuja Cements | 13.02 | 0.01 | 17.92 |

| Shree Cement | -5.14 | 0.05 | 22.32 |

| JK Cement | 7.10 | 0.99 | 17.94 |

| Dalmia Bharat | -4.70 | 0.33 | 18.73 |

| ACC Limited | 13.96 | 0.02 | 13.89 |

Source: StockEdge

Qualitative Factors Affecting Cement Stocks:

- Raw material Security- Companies with their own mines avoid third-party sources, gaining cost benefits and a more reliable supply chain.

- Distribution Network- A strong distribution network insulates cement companies from regional risks. Due to cement’s high-volume, low-value, perishable nature, logistics efficiency is essential.

- Product Range- Premiumization and product segmentation allows companies to have a more independent pricing strategy in a market where firms are price takers.

- Brand Reputation- Since cement from different companies is nearly identical, public perception of the brand becomes the key differentiator.

Risks of Investing in Cement Stocks

- Cyclicality – Cement demand is highly correlated with the overall economy and construction activity. It is also seasonal, with monsoons and adverse weather conditions often disrupting sales.

- Input Price Volatility – The industry is exposed to fluctuations in the prices of key inputs such as limestone, clay, coal, pet coke, and fuel, which can significantly impact margins.

- Environmental and Regulatory Risks – As one of the most polluting industries, cement faces growing regulatory scrutiny. Stricter carbon emission norms or operating restrictions could increase costs and limit production flexibility.

- Intense Competition – Cement is largely a commoditised product with little differentiation. Companies rely heavily on pricing, brand promotion, and distribution reach to maintain or grow market share, driving competitive pressures.

- Policy Dependence – Government fiscal and monetary policies, including infrastructure spending and interest rate changes, directly influence demand and profitability.

3 Cement Stocks to Watch Out for

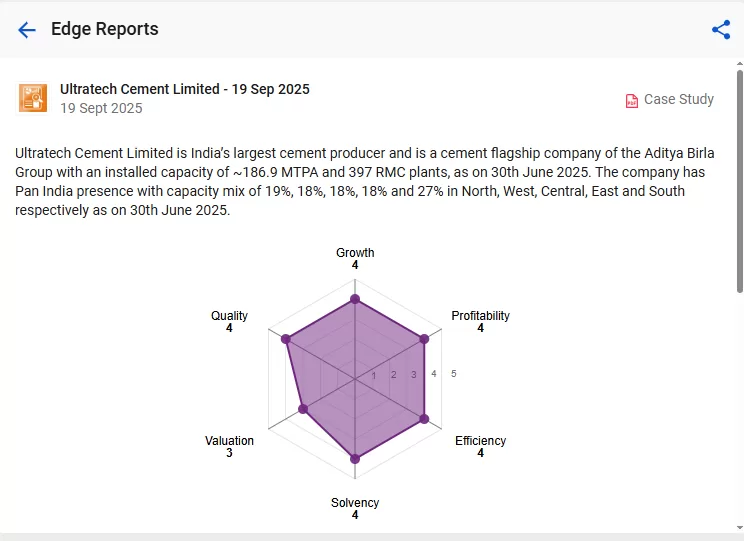

Ultratech Cement

Ultratech Cement is the largest cement manufacturer in India with a market capitalization of 3,56,784 crore. It is a true Pan-India player, serving more than 30,000 destinations across the country. It has an installed cement capacity of around ~186.9 million tonne per annum (MTPA) and 397 RMC plants in 158 cities, as on 30th June 2025

Financials

In FY25, their net revenue from operations increased by 7% YoY to ₹75,955 cr. They delivered a strong operating performance in Q1FY26, with EBITDA growing 44% YoY to 4591cr while PAT increased to 2,226 crores, rising nearly 49% YoY.

Future outlook

Ultratech significantly increased its renewable energy capacity by 64% and WHRS capacity by 26% in FY2025 and it plans to generate 100% of its energy requirements from renewable sources by 2050. The company has also announced its plans to enter the wires and cables segment with a ₹ 1,800 crore capex spread over two years. To learn more about the company’s future outlook, read the Edge report.

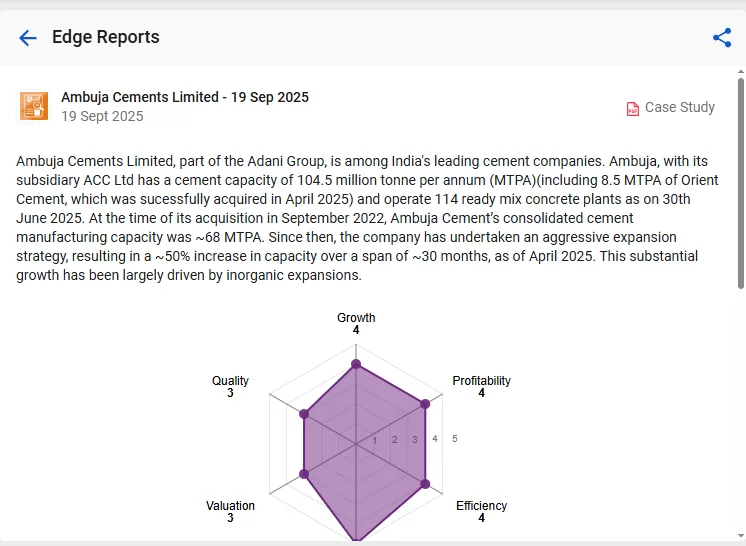

Ambuja Cement

Ambuja Cements is part of the Adani Group and is one of the leading cement companies in India. It has an installed capacity around 31 MTA, which it plans to double by 2028. It commands a 15.5% market share as of September 2025 and has a market cap of 1,41,191 crore.

Financials

In FY 2025, revenue increased 6% YoY to 35,040 cr with EBITDA falling 7 % YoY to 5,971 cr. PAT decreased by 9% YoY to 5,145 cr, mainly due to increase in depreciation. EBIDTA margins stood at 17.04%, down from 19.3% in the previous year. ROE fell from 14.49% to 11.2% while cash flow from operations fell from 5,646 cr to 2,237 cr.

Future Outlook

One of the major advantages of Ambuja Cement is that it has zero debt and has large cash reserves, which enable it to quickly expand both organically and through acquisitions. Ambuja recently acquired a 100% stake in Penna Cement Industries and controlling stakes in Sanghi Cement and Orient. To understand its impact on the business, read our Edge Report.

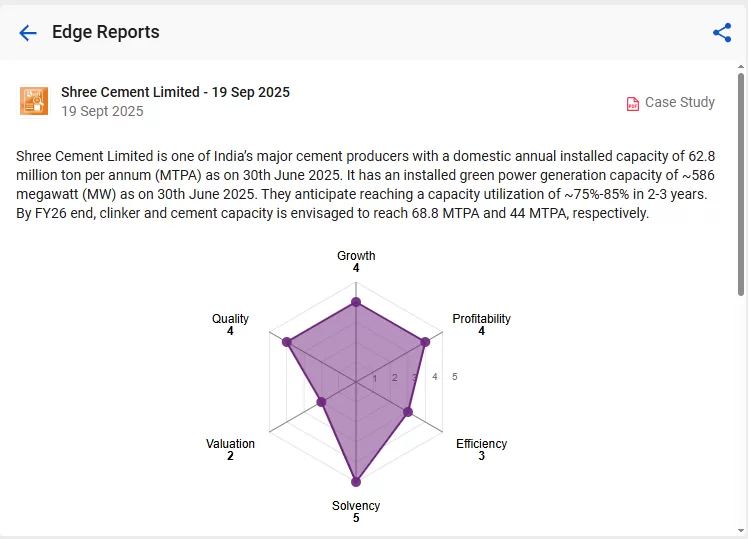

Shree Cement

Shree Cement is the third largest cement producer in India having an installed production capacity of 56.4 MTA, with plans to increase it to 80 MTA by 2028. As of September 2025, they have a market cap of 1,07,509 crore and command around 8% of the market share.

Financials

The company reported standalone sales of 18,037 cr, a 8% YoY fall, while the EBITDA fell 12% YoY to 3,837 cr. This can be due to the fact that Shree Cement is prioritising margin expansion over pure volume growth. While the company’s current-year performance has been muted, they have strong cash flows, near-zero debt levels, an aggressive renewable energy roadmap, and consistently high margins, which reinforce its position as a resilient and attractive long-term investment opportunity in the cement sector.

Future Outlook

Shree Cement is recognised as the lowest cost producer and has very high operating margins. It heavily prioritises sustainability and generates around 65% of its total energy from renewable sources. Its green power capacity stands at 582 MW with planned additions of 128 MW in the coming years. To know more about the company’s future outlook, read the Edge report.

Final Thoughts

The cement sector appears promising. However, the increasing use of alternatives, such as green building materials and new construction technologies, presents a long-term challenge to the growth of cement demand.

The cement industry is also quite influenced by overall economic growth. India’s economy looks promising, boosted by strong domestic demand, steady inflation, and smart policy choices. Still, we should keep an eye on external challenges like global trade issues and geopolitical concerns to maintain this positive growth path.

To get a practical insight into the cement sector India, watch this Stocks2Watch by Vivek Bajaj

Frequently Asked Questions (FAQs)

1. Which is the largest cement company in India?

Ultratech is the largest cement company in India.

2. Which Cement company in India is most Eco-friendly?

Dalmia Cement with its aggressive carbon negative goals, focus on renewable energy, low clinker use and water positivity is a worthy candidate for the above tag.

3. Who should invest in cement stocks

If you are bullish on India’s growth potential and have a longer term investment outlook.

4. How should I choose the right cement stock?

Perform quantitative and qualitative analysis and stay up to date with recent developments.

5. Why Should You Invest in Cement?

Several tailwinds make cement stocks attractive for medium- to long-term investors in India. Increased government spending on infrastructure and housing, along with a positive outlook for the Indian economy, benefits the cement industry.