Key Takeaways

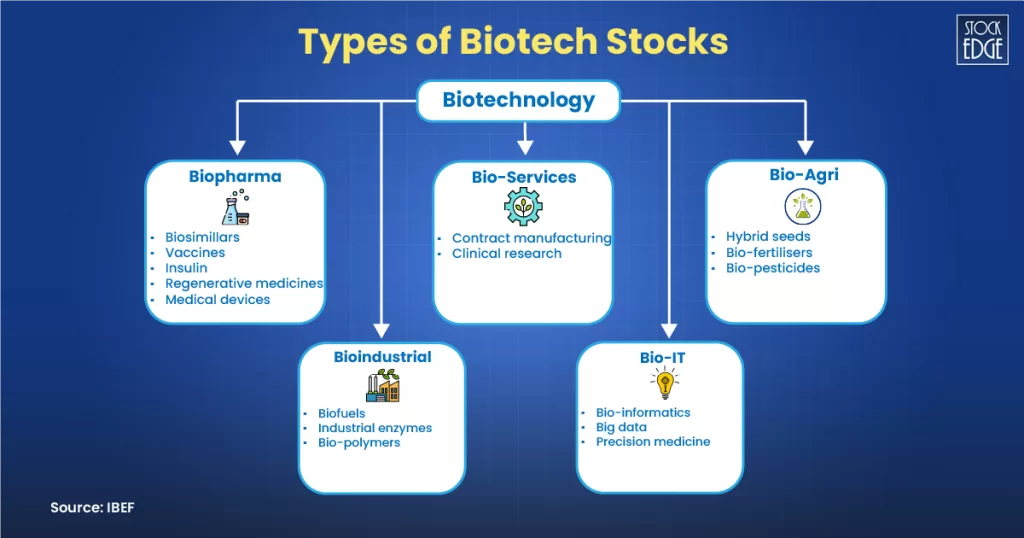

- Biotechnology: India’s biotech sector is growing rapidly, covering Biopharma, Bio-Services, Bio-Agri, Bioindustrial, and Bio-IT, and is expected to contribute ~19% to the global biotech market by 2025.

- Why Biotech Stocks: Key factors include strong R&D pipelines, regulatory approvals, financial health, market size, commercialization potential, and fair valuations.

- Growth Drivers: Rising healthcare demand, innovation in biologics, gene therapy, vaccines, precision medicine, and government initiatives like BIRAC and Bio-RIDE are fueling sector growth.

- Risks: Biotech investments face clinical trial failures, regulatory delays, high capital intensity, competition, pricing pressure, patent issues, and supply chain challenges.

- Top Picks:

- Biocon Ltd.

- Zydus Lifesciences Ltd.

- Dr. Reddy’s Laboratories Ltd.

India’s biotechnology sector has been on an upward trajectory, driven by global demand for innovative healthcare, agricultural solutions, industrial bio-products, and advances in information technologies. According to the IBEF, the contribution of the Indian biotechnology industry in the global biotechnology market is expected to increase to ~19% by 2025.

With growing investments in R&D, regulatory push, increasing public and private biotech infrastructure, India is becoming a major hub not only for generic medicines but also for novel biologics, vaccines, cell and gene therapy, precision medicine, agricultural biotech, and bioindustrial innovations.

In this blog, we will explore what biotech stocks are, why they appear promising, the factors and risks involved, and highlight top biotech stocks.

What Are Biotech Stocks?

Biotech stocks are shares of companies engaged in biotechnology: using living organisms or systems (cells, microbes, genetic engineering, etc.) to develop products or processes. These products could be used in human health (vaccines, biologic drugs, diagnostics), agriculture (hybrid seeds, biofertilizers), industrial processes (enzymes, biofuels), or in bioinformatics/computational biology. Compared to “pharmaceutical” companies that often focus on small-molecule drugs or generics, biotech firms usually have:

- Higher R&D intensity

- Long product development cycles (clinical trials, regulatory approvals)

- Potential for breakthrough innovations (e.g. biologics, gene therapy)

- Higher volatility (both upside and downside)

Biotech overlaps with pharma but leans more toward innovation, biology, and emerging science. The Indian biotech sector can broadly be divided into five segments:

1. Biopharma

The Biopharma segment is the most significant contributor to India’s biotechnology sector. It covers areas such as biosimilars, vaccines, insulin, regenerative medicines, and medical devices. Companies in this space are Biocon Ltd., Dr. Reddy’s Laboratories, Zydus Lifesciences, Panacea Biotec Ltd., and many more.

2. Bio-Services

The Bio-Services segment is driven by India’s strength in contract manufacturing and clinical research, which makes the country a preferred outsourcing hub for global pharma and biotech companies. Companies include Syngene International Ltd., Neuland Laboratories Ltd., Dr. Reddy’s Laboratories, and many more.

3. Bio-Agri

Bio-Agri applies biotechnology to improve agricultural productivity and sustainability through innovations in hybrid seeds, bio-fertilisers, and bio-pesticides. This segment is crucial for ensuring food security and promoting eco-friendly farming practices in India. Companies include UPL Ltd., Rallis India Ltd., Advanced Enzyme Technologies Ltd., and many others

4. Bioindustrial

The Bioindustrial segment focuses on using biotechnology in industrial applications, thereby reducing dependence on fossil fuels and enabling sustainable manufacturing. It includes biofuels, industrial enzymes, and biopolymers. Companies in this space are Praj Industries Ltd., Advanced Enzyme Technologies Ltd., Biocon Ltd., and many more.

5. Bio-IT

The Bio-IT segment merges biotechnology with data science and computational tools, concentrating on bioinformatics, big data analytics, and precision medicine. This field is still developing in India, but shows strong potential with the growth of genomics and personalized healthcare. Companies include Thyrocare Technologies Ltd., Metropolis Healthcare Ltd., Laurus Labs Ltd., and many others.

Why Should You Invest in Biotech Stocks?

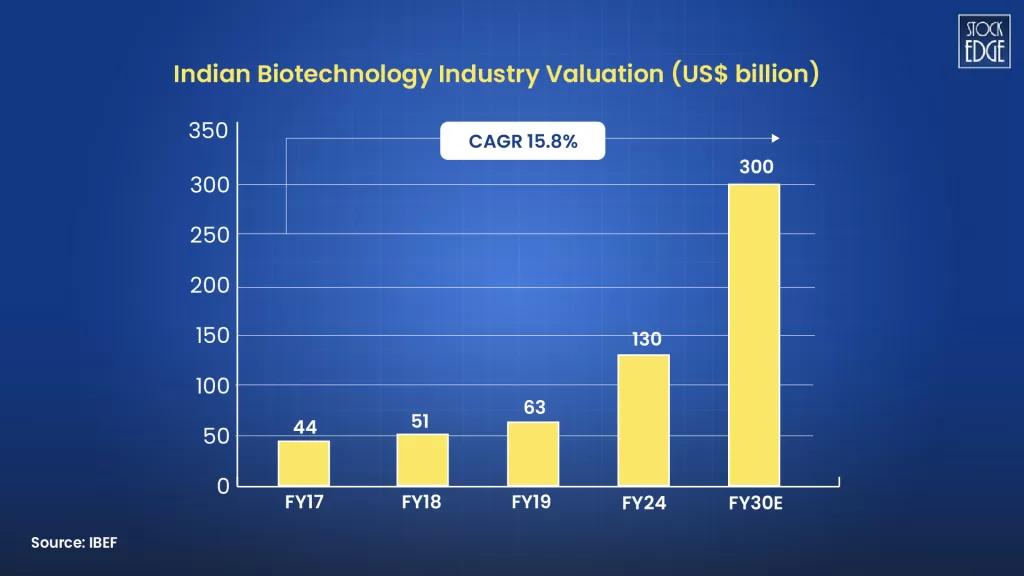

India’s biotech industry has seen remarkable growth, expanding from a Rs. 86,880 crore (US$10 billion) sector in 2014 to over Rs. 11,29,440 crore (US$130 billion) in 2024, with forecasts to reach Rs. 26,06,400 crore (US$300 billion) by 2030. The country now produces 60% of the world’s vaccines and hosts the second-largest number of USFDA-approved manufacturing facilities outside the U.S. As investments increase in areas like Bio-Pharma, Bio-Agri, Bio-Industrial, Bio-Energy, Bio-Services, and Med-Tech, India is establishing itself as a global leader in biotechnology.

The Indian biotechnology industry is projected to reach Rs. 13,03,200 crore (US$ 150 billion) by 2025 and has the potential to grow to Rs. 23,45,760 – Rs. 26,06,400 crore (US$ 270-300 billion) by 2030. By 2025, its share in the global biotechnology market is expected to increase to approximately 19%.

The government also supports the biotechnology sector by launching schemes like the Biotechnology Research Innovation and Entrepreneurship Development (Bio-RIDE), which aims to foster innovation and biomanufacturing, and the Biotechnology Ignition Grant (BIG) scheme, which provides seed funding for startups. Other initiatives include the National Biopharma Mission (i3) for biopharmaceutical development and the Biotechnology for Economy, Environment, and Employment (BioE3) Policy, which aims to drive high-performance biomanufacturing.

Factors to Consider When Investing in Biotech Stocks

Investing in biotech companies can be highly rewarding, but it also comes with unique risks. Before adding biotech stocks to your portfolio, it’s important to carefully evaluate the following factors:

1. R&D Pipeline Strength

A company’s future depends on its R&D pipeline. Check how many products are in pre-clinical or clinical stages and whether they target large therapeutic areas like oncology, diabetes, or infectious diseases. A diversified pipeline reduces dependency on a single product.

2. Regulatory Approvals and Success Rate

Biotech products face strict regulatory scrutiny from agencies like US FDA, EMA, or DCGI. Track record of approvals is crucial, as failed or delayed trials can sharply affect stock prices.

3. Financial Health

Examine a company’s cash reserves, burn rate, debt, and profitability trends. Firms with strong balance sheets can sustain long R&D cycles, while highly leveraged companies may struggle if trials are delayed.

4. Market Size and Commercialization Risk

Assess market demand, competition, pricing power, and IP protection. Products targeting widespread diseases offer larger revenue potential, while niche therapies may generate limited returns.

5. Valuation

Biotech valuations often reflect future expectations rather than current earnings. High valuations can be risky if trial outcomes are adverse, so compare valuations with pipeline quality, revenue visibility, and peers before investing.

Risks of Investing in Biotech Stocks

Let’s now understand the risk of investing in biotech stocks

- Clinical / Trial Failures: Even late-stage candidates can fail, causing steep losses.

- Regulatory Delays or Rejections: Regulatory bodies may delay or reject applications; post-approval inspections matter.

- High Cost & Capital Intensity: Manufacturing biologics, vaccines, gene therapy, etc., requires high upfront investment.

- Competition: Both domestic and international. Biosimilars face competition from new originator biologics, generics etc.

- Pricing Pressure, IP/Patent Disputes: Biosimilars must navigate patent cliffs; pricing controls or reimbursement limits can reduce margins.

- Supply Chain Risks: Raw materials, specialized equipment, and reagents may be imported; disruptions can affect cost or production.

- Valuation Corrections: Many biotech stocks are priced on future expectations; if growth or approvals fall short, valuations may drop sharply.

- Policy & Tax/Regulatory Changes: Incentives, import duties, and biotech policies can change with the government, affecting profitability or competitiveness.

Top Biotech Stocks to Watch in 2025

Biocon

Biocon is a global, innovation-led Indian biopharmaceutical company founded in 1978 by Kiran Mazumdar-Shaw, with headquarters in Bangalore. The company develops and manufactures a range of affordable, high-quality biopharmaceutical products and services, including biosimilars, generics, and novel biologics, with a focus on diseases such as diabetes, cancer, and autoimmune disorders.

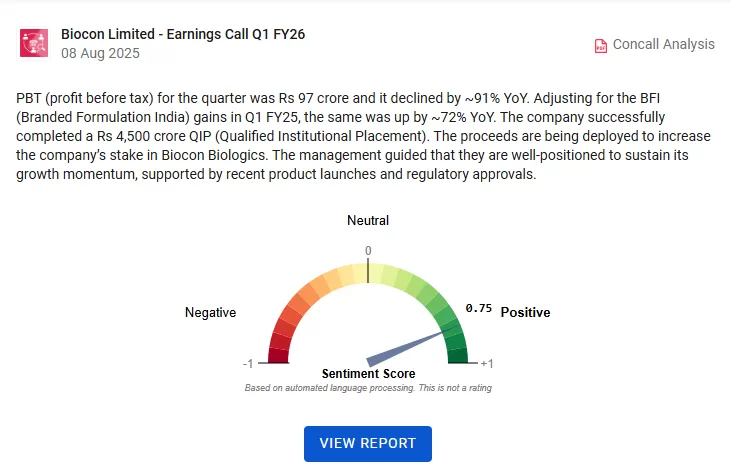

In Q1 FY26 (Apr–Jun 2025), Biocon Limited reported revenue of ₹3,942 crore, up 14.8% YoY, while net profit fell sharply to ₹89 crore, declining 89.6% YoY, mainly due to the absence of one-time gains recorded in Q1 FY25. Core EBITDA grew ~11% YoY to ₹1,003 crore, and PBT, after adjusting for prior year one-offs, increased ~72% YoY, reflecting strong operational performance. Its revenue mix demonstrates its diversified business model, with 61% from biosimilars, 22% from Syngene’s CRDMO services, and 17% from generics.

Why it Stands Out?

Biocon stands out due to its diversified business model across biosimilars, CRDMO, and generics, strong global presence with US and European approvals, and a robust R&D pipeline. Strategic vertical integration, new manufacturing facilities, and partnerships enhance efficiency and growth. Combined with leadership in emerging markets, Biocon is well-positioned for sustainable, innovation-driven growth.

To know more about the future prospects of the company, read our Edge Report!

Zydus Lifesciences Ltd.

Zydus Lifesciences Limited, formerly Cadila Healthcare Limited, was incorporated in May 1995 and renamed on February 24, 2022. It is a leading Indian pharmaceutical company involved in R&D, manufacturing, marketing, and selling of human formulations (generics, branded generics, specialty formulations, biosimilars, vaccines), APIs, animal healthcare, and consumer wellness products.

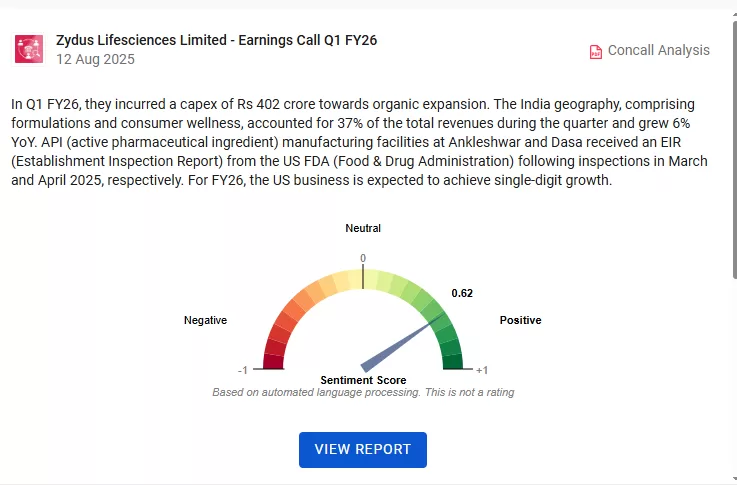

In Q1 FY26, Zydus Lifesciences reported consolidated revenue of ₹6,574 crore, up 5.9% YoY, and net profit of ₹1,487 crore, a 1.6% increase YoY. EBITDA stood at ₹2,089 crore with a margin of 31.8%, while R&D expenditure was ₹486 crore, reflecting continued investment in innovation. The company also incurred ₹402 crore in capex for organic expansion, and net cash increased to ₹5,631 crore, enhancing financial flexibility.

Why it Stand Out?

Zydus Lifesciences stands out due to its diversified business across India, the US, and international markets, spanning formulations, consumer wellness, biologics, and med devices. Its strong R&D capabilities, huge ANDA approvals, and pipeline of innovative products, including the 55B2 program, position it for sustained growth. Strategic expansions, such as the global biologics CDMO entry, Med Tech acquisitions, and partnerships in interventional cardiology, further enhance its global footprint and long-term competitiveness.

Check out the Edge Report to analyze the business financials in more detail!

Dr. Reddy’s Laboratories Ltd.

Dr Reddy’s Laboratories Ltd. is a prominent pharmaceutical firm based in Hyderabad, Telangana, India, where its registered office is also situated. The company operates through three divisions: Pharmaceutical Services and Active Ingredients, Global Generics, and Proprietary Products, providing a range of products and services such as Active Pharmaceutical Ingredients (APIs), Custom Pharmaceutical Services (CPS), generics, biosimilars, and specialized formulations.

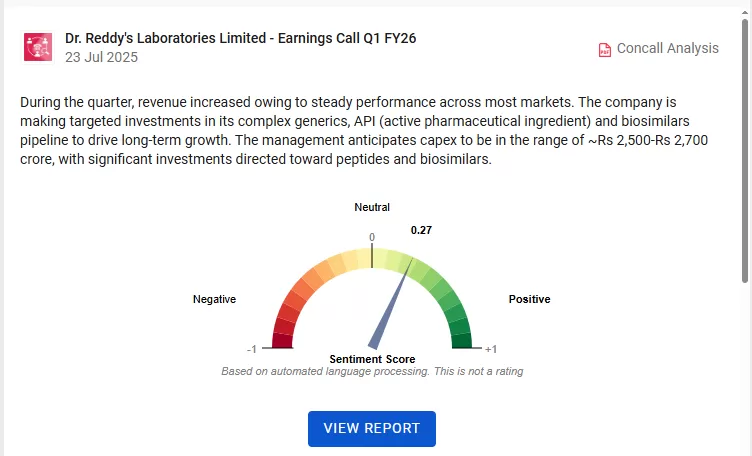

During the quarter, revenue increased owing to steady performance across most markets. The company is making targeted investments in its complex generics, API (active pharmaceutical ingredient) and biosimilars pipeline to drive long-term growth. The management anticipates capex to be in the range of ~Rs 2,500-Rs 2,700 crore, with significant investments directed toward peptides and biosimilars.

Why it Stand out?

Dr. Reddy’s Laboratories has a diverse global presence in North America, Europe, India, emerging markets, and its PSAI segment. It combines strong R&D with a pipeline of complex generics, biosimilars, and innovative products like semaglutide, backed by approvals and upcoming launches. Strategic expansions through acquisitions, partnerships, and CDMO growth (Aurigene) boost its competitiveness and growth potential.

To know more about the future prospects of the company, read our Edge Report!

Conclusion

India’s biotech sector in 2025 is at an inflexion point. With strong government backing, rising global demand, and growing R&D and manufacturing capabilities, the industry is likely to deliver strong growth. However, it is not without risk, and success depends heavily on execution, regulatory milestones, and managing capital intensity.

Frequently Asked Questions (FAQs)

How do biotech companies make money?

Biotech companies earn revenue by developing and selling drugs, vaccines, biosimilars, and diagnostics, as well as providing contract research and manufacturing services. Some also generate income from bio-agri products, industrial enzymes, or biofuels, depending on their segment.

Which are the top biotech companies in India?

Leading Indian biotech firms include Biocon Ltd. (biosimilars, insulin), Dr. Reddy’s Laboratories and Zydus Lifesciences (biologics, vaccines), Syngene International Ltd. (CRO/CDMO), Panacea Biotec Ltd. (vaccines), and Advanced Enzyme Technologies Ltd. (industrial enzymes).

What is the future of the Biotech Sector?

India’s biotech sector is set for strong growth, targeting a $150 billion bioeconomy by 2025, driven by rising healthcare demand, innovation in precision medicine, genomics, and bioinformatics, and government support like BIRAC. While risks from R&D failure and regulations exist, long-term potential remains high.

Who should invest in biotech stocks?

Biotech stocks suit long-term investors with higher risk tolerance who seek exposure to innovation-driven sectors. Companies with strong pipelines, partnerships, and financial stability are best positioned to offer growth opportunities.