Table of Contents

Introduction

Imagine this: you work hard every single day, putting in countless hours to earn a living and secure your future. But when the paycheck arrives, a significant chunk—almost a third—disappears in taxes. It’s a reality that many of us face, and it often feels like no matter how hard we work, a large part of our earnings slips through our fingers.

This is why planning your taxes smartly is just as important as growing your savings. The right strategy can help you retain more of your hard-earned money while building wealth for the future. Enter Equity Linked Savings Schemes (ELSS)—a powerful tax-saving tool that offers you the dual advantage of reducing your tax liability and creating long-term wealth.

ELSS funds are not your typical tax-saving instrument. They stand out because of their potential for high returns, thanks to their market-linked nature, and a relatively short lock-in period of three years. Additionally, the capital gains from ELSS investments are taxed more favorably, helping you maximize your returns while minimizing tax outflows.

In this blog, we’ll introduce you to the Top 5 ELSS mutual funds that are designed to make your money work smarter. Whether you’re an experienced investor or someone just starting their financial journey, these funds offer a reliable way to grow your savings and achieve your financial goals. Ready to keep more of your earnings while creating a brighter financial future? Let’s dive in!

How to Choose the Best ELSS Mutual Funds?

With more than 30 ELSS mutual funds, it becomes a serious challenge to investors which fund to consider. There are many parameters within the fund selection criteria to identify which is an optimum fund that suits your risk appetite, investment horizon and investment style.

ELSS mutual funds have attracted a lot of new investors with Assets Under Management (AUM) increasing significantly from ₹1,88,033 crore in Nov ’23 to ₹2,48,165 crore in Nov ’24. Recording an increase of 30% on a yearly basis.

As of March 2020, the total AUM under the ELSS category was nearly 75,000 crore, a significant growth of 225% in less than 5 years.

Historical Performance

Before you shortlist an ELSS mutual fund, it is wise to check how the fund has performed in the past. Compare the performance with its peers and the benchmarks index it follows. Analysing such data will showcase the fund’s ability to perform in various market cycles.

| Return Statistics (%) | Return distribution (% of times) | |||||||||||

| Scheme / Category Name | Launch Date | Average | Median | Maximum | Minimum | Negative | 0 – 8% | 8 – 10% | 10 – 12% | 12 – 15% | 15 – 20% | Greater than 20% |

| Quant ELSS Tax Saver | 01-01-2013 | 25.58 | 29.24 | 55.83 | -6.59 | 2.73 | 9.42 | 5.53 | 7.03 | 5.05 | 7.44 | 62.8 |

| HDFC ELSS Tax saver | 01-01-2013 | 14.01 | 14.39 | 36.34 | -10.96 | 13.38 | 14.61 | 7.71 | 5.53 | 11.13 | 17.54 | 30.1 |

| Mirae Asset ELSS Tax Saver | 01-12-2015 | 19.07 | 19.78 | 36.71 | -1.4 | 0.34 | 7.1 | 3.41 | 1.84 | 7.3 | 31.74 | 48.26 |

| Motilal Oswal ELSS Tax Saver Fund | 21-01-2015 | 16.08 | 16.19 | 31.06 | -5.06 | 5.87 | 10.51 | 4.64 | 6.28 | 15.36 | 22.87 | 34.47 |

| SBI Long Term Equity | 01-01-2013 | 15.66 | 15.62 | 35.69 | -8.17 | 6.08 | 16.79 | 9.28 | 5.94 | 9.42 | 17.06 | 35.43 |

| Equity: ELSS | – | 12.74 | 14.7 | 32.02 | -9.32 | 10.75 | 19.07 | 7.51 | 5.21 | 8.38 | 30.29 | 18.8 |

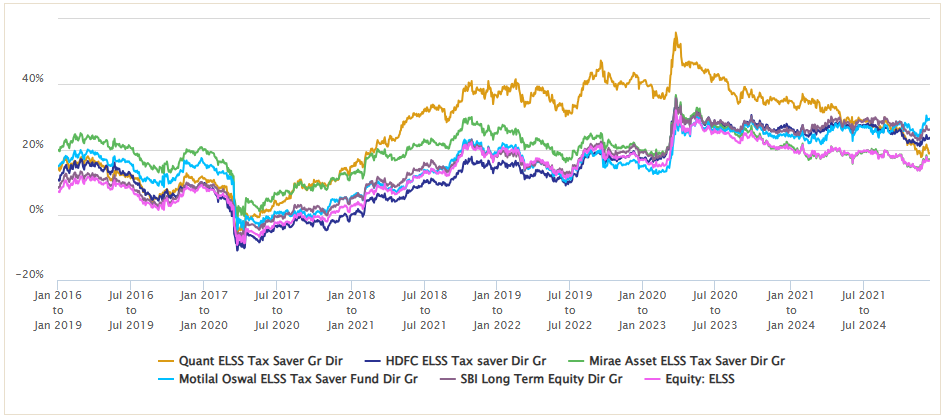

The above table shows the rolling returns for a 3-year investment horizon when rolled daily since 2016, the category average returns show that there is a 18% probability that the ELSS category will deliver returns greater than 20% per annum. There is a 49% chance that the average returns of the category will give returns greater than 15% p.a. The average returns of the category are at 12.74%.

Out of the above 5 funds, Quant Mutual fund tops the list with a 62.8% probability of delivering returns greater than 20%. However quant mutual funds carry “Very High Risk” and are suitable for risk-neutral investors looking for high risk and high return options. Followed by Mirae Asset ELSS Tax Saver Fund with a probability of 48% of delivering returns above 20%, and a 80% probability of giving returns above 15% annually.

HDFC ELSS Tax Saver Fund has the lowest probability as per rolling returns, with a 30% chance of delivering returns above 20% per annum and a 47% probability of generating returns above 15% per annum.

However Investors should be informed that these are historical returns and there is no guarantee of future returns.

Expense Ratio

The expense ratio is the fees charged by the fund manager for day to day management of the fund. Usually an expense ratio below 1% in an actively managed fund is considered good. If a fund has a low expense ratio it will earn higher returns in the long-term.

Usually Direct Plans have a lower expense ratio as compared to Regular Plans, as there are no intermediaries and no commissions charged in Direct Plans. On average, the expense ratio for direct plans of ELSS funds is below 1%, with the highest expense charged at 1.89% and the lowest expense as 0.50%. ITI ELSS Tax Saver Direct Plan and Canara Robeco ELSS Tax Saver Direct Plan charge 0.50% and 0.54% fees.

Fund Manager Expertise

ELSS mutual funds are actively managed equity funds; in order to select the best ELSS mutual fund it is crucial to check the fund manager’s background and education. Fund managers’ skills and expertise matter the most for generating superior returns as they are actively managing funds. It is better to check the fund manager’s tenure, or how long they’ve been managing a fund, when evaluating a fund.

Read our blog on Top Mutual Fund Managers in India 2024.

Portfolio Composition

ELSS mutual funds typically spread their investments in different sectors and across market-cap to well-diversify the portfolio. It also helps in mitigating the risk of portfolio concentration. ELSS funds may invest up to 20% in any asset class like debt instruments or commodities like gold and silver.

On an average, most ELSS funds invest entirely in equity-related instruments, with only a handful of funds having exposure in liquid short-term debt securities.

Risk Appetite

As a minimum of 80% allocation is made in equity and equity-related stocks, ELSS mutual funds are categorized under the Equity category. Investors with high-risk appetites who can handle market volatility should only consider investing in such a fund.

Be informed that historical returns offer no guarantee of future performance, and market-related risks may heavily influence the performance of the fund.

Top 5 ELSS Mutual Funds to Invest in 2025

Here at StockEdge, we have shortlisted 5 Top ELSS mutual funds based on selection criteria such as fund track record, AMC reputation, asset size, key financial ratios etc.

We also have a curated Investment theme for Tax-savings mutual funds, under the StockEdge app.

SBI Long Term Equity Growth:

Why Choose This Fund?

SBI Long-term Equity Fund is the oldest fund in the Equity- ELSS category.

Launched in March 1993, SBI Long Term Equity Fund has completed more than 3 decades in the Indian stock markets. Since the fund started its operations, it has delivered an astonishing 17.31% returns per annum for every year.

AUM: 27847 crore

Expense Ratio: 0.93%

Portfolio Holding: 90% in Equity, 10% as Cash Allocation (as on Nov’24)

Fund Manager: Dinesh Balachandran

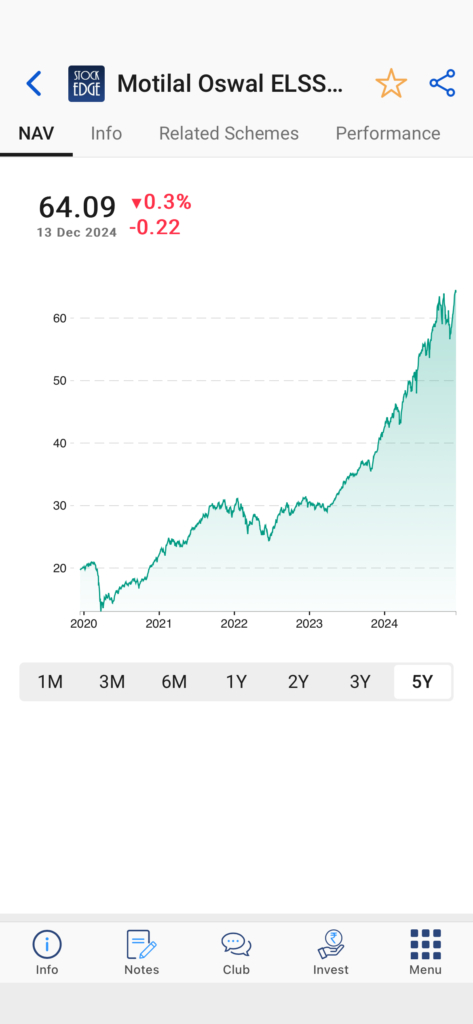

Motilal Oswal ELSS Tax saver – Direct

Why Choose This Fund?

Motilal Oswal ELSS Tax saver Fund has outperformed all its peers in terms of returns generated by the fund in both short and long-term investment horizons. This scheme has more than doubled in 3 years by delivering 29.1% per annum.

AUM: 4187 crore

Expense Ratio: 0.65%

Portfolio Holding: 98.8% in Equity, 1.2% as Cash Allocation (as on Nov’24)

Fund Manager: Roshi Jain

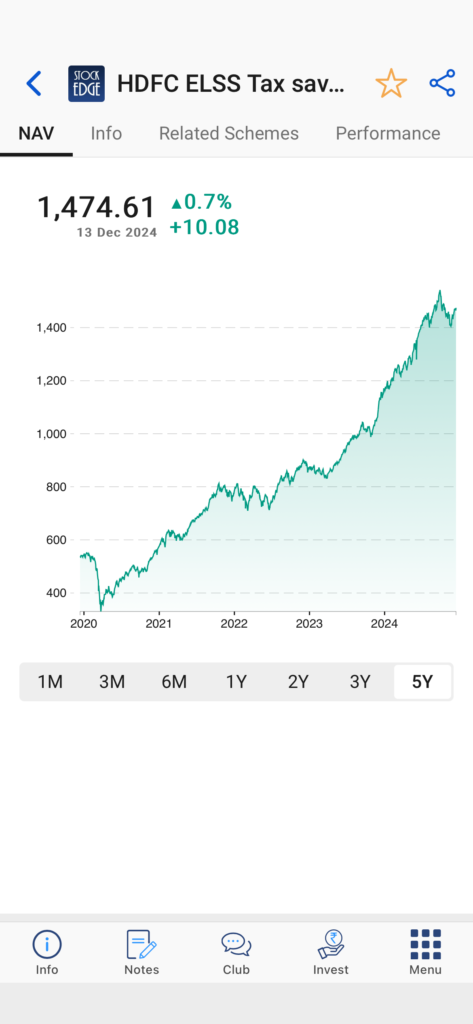

HDFC ELSS Tax Saver Fund

Why Choose This Fund?

HDFC ELSS Tax Saver Fund – Direct Plan is a pioneer in the category with a proven track record and an experienced fund management team. This scheme is managed by Roshi Jain, who is a well known personality in the fintech industry. Roshi Jain has previously worked with Franklin Templeton Investments, Goldman Sachs, & Wipro Ltd.

AUM: 15945 crore

Expense Ratio: 1.09%

Portfolio Holding: 92% in Equity, 8% as Cash Allocation (as on Nov’24)

Fund Manager: Ajay Khandelwal, Santosh Singh, Rakesh Shetty, Atul Mehra

Mirae Asset ELSS Tax Saver Fund

Why Choose This Fund?

Mirae Asset ELSS Tax Saver Fund – Direct Plan is gaining popularity due to their aggressive buys in stocks and heavy portfolio churning. With portfolio turnover (%) of 128%, this fund has seen robust inflows, with total assets increasing more than 25% in the past 12 months. It has a low NAV of 48, which makes it an attractive option for long-term disciplined investors. The fund charges no Exit Load.

AUM: 25315 crore

Expense Ratio: 0.61%

Portfolio Holding: 99.3% in Equity, 0.5% as Cash Allocation (as on Nov’24)

Fund Manager: Neelesh Surana

Quant ELSS Tax Saver Fund – Direct

Quant ELSS Tax Saver fund follows VLRT methodology for stock selection, which has helped to generate the highest returns among its peers, in the last 10 years when invested via a Systematic Investment Plan (SIP). Within Quant AMC, this is the 2nd biggest fund in terms of asset size. This is a good option, as it has a low expense ratio and charges no exit load. Minimum investment is as low as 500 for both SIP and lump sum investments.

AUM: 10799 crore

Expense Ratio: 0.59%

Portfolio Holding: 96.5% in Equity, 3.5% as Cash Allocation (as on Nov’24)

Fund Manager: Vasav Sahgal & Ankit Pande

Benefits of Investing in ELSS Mutual Funds

Wealth Creation with Tax Benefits

An ELSS fund is an equity-oriented scheme that demands a three-year lock-in period. This offers a good opportunity for long-term investors looking to create wealth in the market by getting the benefit of high-growth equity exposure with a medium-term investment mandate.

ELSS funds are also known as tax-saving schemes. It offers dual tax benefits to the investors.

You can receive a tax exemption of up to Rs. 150,000 if you invest in ELSS schemes. Additionally, long-term capital gains under this scheme at the end of the three years are taxed at 12.5% above gains of 1.25 lakh p.a.

Flexibility in Investment

Among other tax-saving investments like PPF, NPS and National Savings Certificate, ELSS funds have the lowest lock-in period, which is only 3 years. Different investment options under the 80C basket are government-backed investments and come with a lock-in of 15 years,

After the lock-in period, investors can redeem the fund anytime they wish to and they will be liable for LTCG taxation.

ELSS funds also offer the flexibility to invest via lump sum or systematic Investment Plans and at any frequency weekly, quarterly, or monthly, as stated in the fund’s objective.

Inflation-Beating Returns

ELSS funds have generated returns above 10% p.a. in the long-term horizon of 20+ years. Within 80C investment options, only ELSS mutual funds have the potential to offer inflation-beating returns. This is what makes ELSS stand out among all tax-saving investment options.

Tax Implications on ELSS Funds

Capital Gains Tax

As equity-linked savings schemes are equity-oriented schemes with a minimum mandate of 80% exposure in equity instruments, tax treatment for ELSS funds is considered the same as equity category funds.

As ELSS funds have a 3-year lock-in period, the capital gains are considered as Long-term Capital Gains (LTCG) at 12.5% for all investments withdrawn after 3 years.

The LTCG taxation is above the 1 lakh gains, which has increased to 1.25 lakhs in the Union budget 2024 taxation changes.

Dividend Taxation

Any dividends offered by these funds through the IDCW investment options are added to investors’ income and taxed as per the income tax slab rate.

Until Budget 2020, dividends were made tax-free in the hands of investors as the AMC was supposed to pay dividend distribution tax. Along with this, dividends over Rs 5,000 are subject to a TDS (tax deducted at source) of 10%.

Some Insider Tips

Start Early

By investing in ELSS mutual funds, investors not only save taxes of up to ₹46,800 in a financial year but will also help accumulate wealth over the long run. The compulsory lock-in helps you to mitigate short-term fluctuations caused within the equity category and provides a higher possibility of generating superior returns in the long term.

Opt for SIPs

Systematic Investment Plans (SIPs) allow you to invest a fixed amount at regular intervals (monthly, quarterly). Rupee-cost averaging helps you smoothen market volatility over the long term.

Though ELSS funds can be considered an ideal choice for lump sum investments due to the lower risk of negative returns in a 3 years, it is always better to go for SIPs as they average out the total investment cost.

Review Periodically

ELSS mutual funds are pure-equity funds that invest in company’s equity stocks. The equity shares of a company may fluctuate heavily depending on various factors, such as macro and microeconomic data, company earnings and corporate governance.

It is always better to review the performance and asset allocation of the fund, to check if the fund is aligned with its investment objectives.

Final Thoughts

Because ELSS primarily invests its assets in equity and equity-related instruments, it is ideal for investors with a higher risk tolerance. For individuals who fall into higher income tax brackets, ELSS is a great investment. Out of all the Section 80C investments, ELSS has the shortest lock-in time. Investors can reduce taxes and build money by investing in ELSS.

For a risk-averse investor, ELSS funds are not an ideal investment option and should consider investing in other government-backed tax-saving options.

Read Also: Nifty 50 Top Picks: 10 Stocks That Can Drive India’s Growth and Your Portfolio