Key Takeaways

- Jewellery Market Growth: India’s jewellery industry is expected to reach ₹9.5 lakh crore by 2025, driven by rising incomes, wedding demand, and shift towards branded products.

- Rising Brand Preference: Consumers are moving from unorganised jewellers to trusted brands that offer better designs, purity assurance, and modern shopping experience.

- Positive Outlook: Shift towards organised players, digital buying trends, and festive gold demand make jewellery stocks attractive for long-term investors.

- Top Picks:

- Titan Company

- Kalyan Jewellers

- Senco Gold

Table of Contents

India has always had a deep-rooted connection with gold and jewellery. For Indians, jewellery is not just metal and stones. It is an emotion, a legacy, and a reflection of tradition. From Diwali and Dhanteras to Akshaya Tritiya, weddings, and even harvest festivals, jewellery is an inseparable part of Indian life, woven into our culture and values.

But today, with gold and diamond prices touching new highs, buying jewellery has become more expensive. In India, 24-carat gold prices increased from around ₹48,651 per 10 grams five years ago to ₹79220 per 10 grams.

So, investing in jewellery stocks provides an opportunity to capitalize on India’s ever-growing demand for gold and ornaments, driven by cultural traditions, festive celebrations, and weddings.

In this blog, we will explore jewellery stocks, provide an overview of the sector, discuss the key factors to consider before investing and highlight the best jewellery stocks in India.

What are Jewellery Stocks?

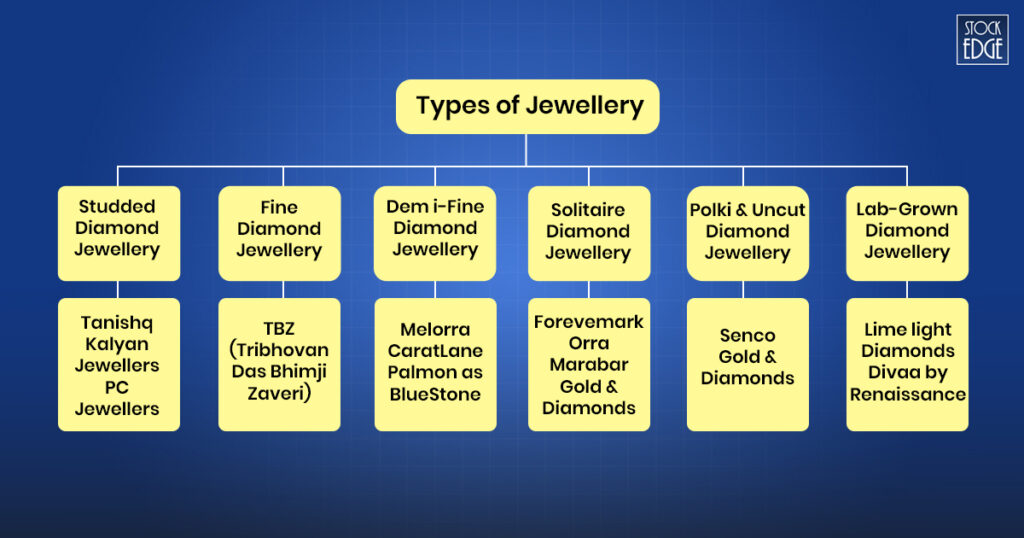

Jewellery stocks are those companies that make, sell, or export jewellery, including gold, silver, and diamond products. Here are some of the most popular types of diamond jewellery stocks.

- Studded Diamond Jewellery

Studded diamond jewellery is suitable for weddings, special occasions, and daily wear. Leading brands in India include Tanishq (Titan), Kalyan Jewellers, and PC Jeweller.

- Fine Diamond Jewellery

Fine diamond jewellery uses high-quality diamonds in 18K or 22K gold or platinum. Due to its superior quality, it is typically more expensive. Notable brands include TBZ (Tribhovandas Bhimji Zaveri).

- Demi-Fine Diamond Jewellery

Demi-fine diamond jewellery combines quality and affordability. It uses 14K or 18K gold-plated silver or alloys with real diamonds. Notable brands include Melorra, CaratLane (a Tanishq brand), Palmonas, and BlueStone.

- Solitaire Diamond Jewellery

Solitaire diamond jewellery showcases a single, valuable diamond. It is typically found in rings, pendants, and earrings and has high resale value. Brands like Forevermark, Orra, and Malabar Gold & Diamonds provide various solitaire options.

- Polki & Uncut Diamond Jewellery

Polki jewellery features uncut, raw diamonds set in traditional styles, often paired with gold or meenakari work. This type of jewellery boasts a rich heritage and is commonly worn by brides and during festive occasions. A notable brand is Senco Gold & Diamonds.

- Lab-Grown Diamond Jewellery

Lab-grown diamonds are eco-friendly, providing the same brilliance and durability as mined diamonds but at a lower cost. Demand for lab-grown diamond jewellery rises among environmentally conscious buyers, with brands like Limelight Diamonds and Divaa by Renaissance leading the global market.

Sector Overview: Best Jewellery Stocks in India

If you look at the trend, jewellery demand remains strong throughout the year. Interestingly, July is the only month when jewellery buying sees a dip. This offers promising opportunities for investors looking to benefit from this thriving industry.

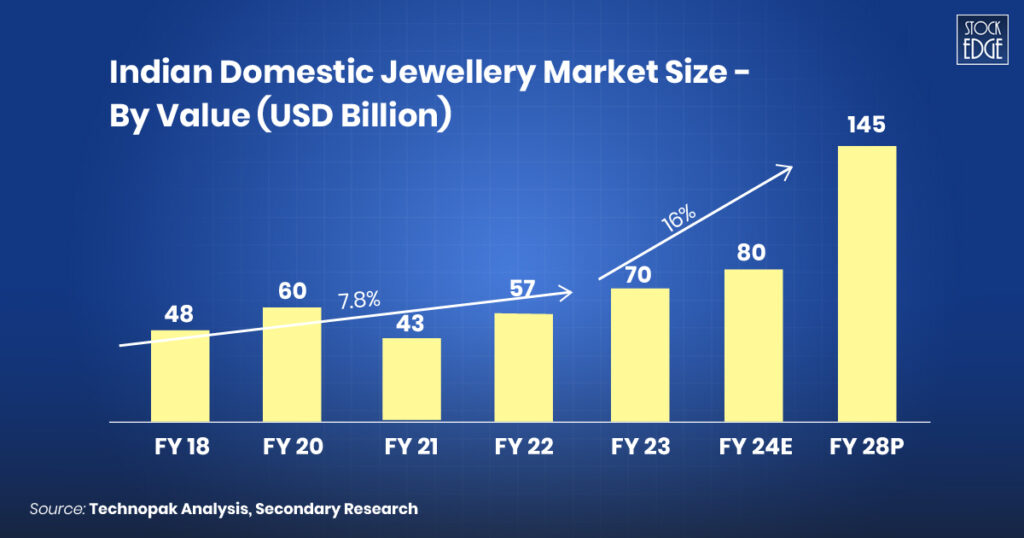

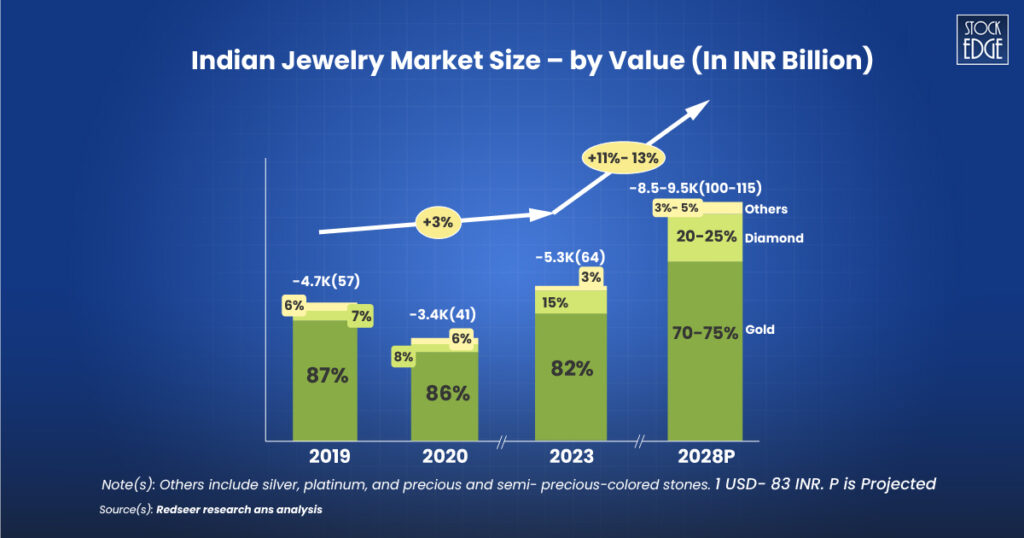

Let’s now look at how this sector is growing. The Indian jewellery retail sector was nearly USD 70 billion in FY 2023. This growth outlook arises from a strengthening economy, rising disposable incomes, increased consumer demand for gold, higher gold prices, and growing interest in diamonds, other precious stones, and costume jewellery.

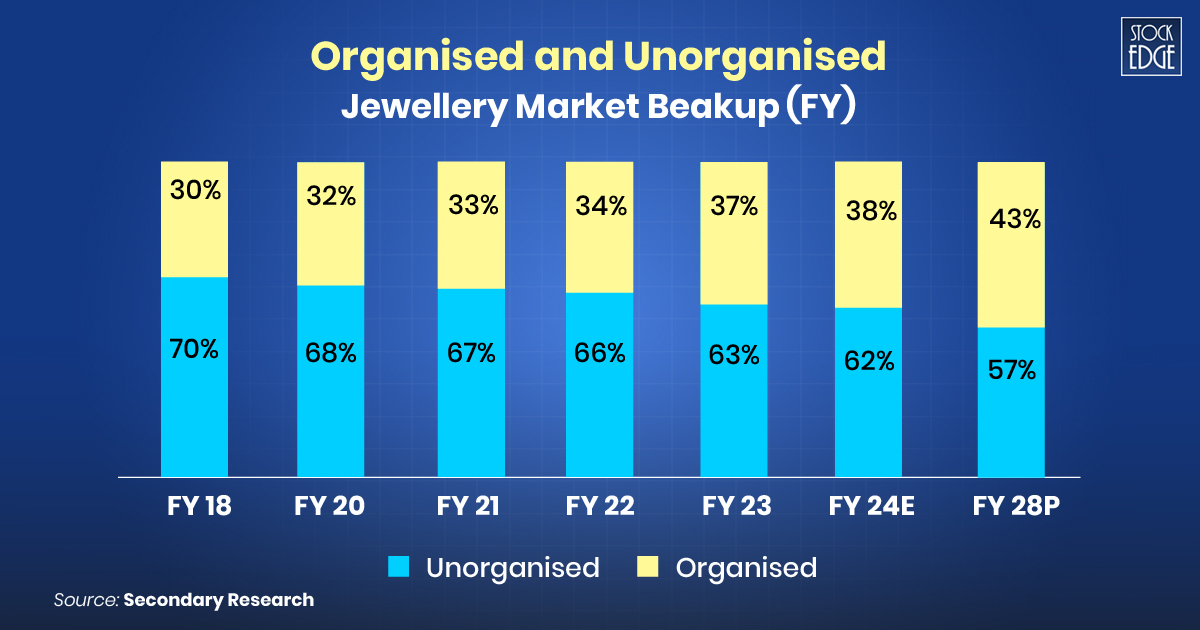

In FY18, around 70% of the market was dominated by unorganized players, while the organized sector held only about 30%. By FY28, the unorganized share is projected to drop to 57%, with organized brands growing to 43%. This transition is driven by factors such as more substantial brand awareness, tighter regulations (like hallmarking), and increasing consumer trust in established retailers. As a result, more consumers are gravitating towards well-known jewellery brands, leading to a gradual formalization of the industry. Read our blog “Best Gold Stocks In India” to get a brief overview of the gold sector.

In StockEdge, you can explore stocks that benefit from the shift from the unorganized to the organized sector. Let’s understand the key drivers of this substantial growth in jewellery stocks.

Key Drivers for Jewellery Stocks in India

Emergence of online shopping

First, assess the overall demand for luxury goods, changes in consumer preferences, and seasonal or regional buying trends. The rise of online retail and shifting demographics can also impact demand. Here’s the table that shows the e-tail penetration of key categories, including the jewellery sector:

| Category | FY 2023 Retail Size (USD Billion) | FY 2023 E-tail Size (USD Billion) | FY 2023 E-tail Penetration | FY 2028P Retail Size (USD Billion) | FY 2028P E-tail Size (USD Billion) | FY 2028P E-tail Penetration | CAGR FY 2023-28P |

| Food & Grocery | 619 | 14 | 2% | 907 | 47 | 5% | 27.4% |

| Jewellery | 70 | 4 | 6% | 145 | 14 | 10% | 28.5% |

| Apparel & Accessories | 76 | 16 | 21% | 182 | 45 | 25% | 23.0% |

| Footwear | 16 | 3 | 20% | 21 | 5 | 24% | 20.1% |

| Pharmacy & Wellness | 28 | 1.4 | 5% | 50 | 5 | 10% | 29.0% |

| Electronics | 63 | 18 | 30% | 130 | 47 | 36% | 19.9% |

Source: PN Gadgil Jewellers Ltd, DRHP

The jewellery sector is experiencing a significant shift due to the rise of online shopping. With a projected CAGR of 28.5% from FY 2023 to FY 2028, the e-tail penetration in jewellery is expected to grow from 6% to 10%. This growth is driven by increasing consumer trust in online platforms, competitive pricing, and the availability of certified jewellery with easy return policies.

Diversification into Other Jewellery Types

India ranks as the world’s second-largest gold consumer, following China. Although gold remains the preferred choice, shoppers are increasingly recognizing other jewellery options, such as diamonds and pearls. In turn, retailers are adapting by providing a variety of products, including lightweight and budget-friendly alternatives.

Growing Working-Age Population

India’s working-age population increased from 65% in 2013 to 68% in 2022. This rise, particularly among younger workers, is likely to enhance the demand for lightweight fashion jewellery, significantly affecting the overall gold demand.

Competitive Edge

India’s gems and jewellery sector enjoys a competitive advantage due to its skilled artisans and lower production costs. Coupled with expertise in handling smaller diamonds, India stands out as a key player in the global market, even outpacing renowned countries like Belgium and Israel.

Focus on Skill Development

Government-backed gems and jewellery training institutes nurture a skilled workforce in jewellery design, manufacturing, and gemology. They foster continuous innovation, aligning with global preferences. Currently, there are seven institutes in five cities (Mumbai, Delhi, Jaipur, Varanasi, Udupi) and four gemological laboratories under GJEPC (Gem & Jewellery Export Promotion Council).

Government Support Initiatives

The government’s support, through measures such as duty drawbacks and import duty waivers, acts as a catalyst for industry growth. In the 2025 Union Budget, the government reduced the import duty on jewellery from 25% to 20%. It makes luxury and unbranded imports cheaper. The budget also eases lab-grown diamond imports and cuts platinum findings duty from 25% to 5%.

Factors to Consider Before Investing in Diamond and Jewellery Stocks in India

Let’s now take a look at what factors need to be considered before investing in diamond and jewellery stocks.

1. Financial Performance & Profitability

A company’s revenue shows how well it is growing. If sales increase every year, it means the company is expanding, and demand is strong. Additionally, the net profit margin is also important to analyze the jewellery stocks as it tells us how much profit the company makes after expenses. A higher margin means the company is managing costs well and earning good profits.

| Name | Sales Rs.Cr. | Net Profit Margin Annual % |

| Titan Company | 58034 | 6.84 |

| Kalyan Jewellers | 23422.77 | 3.21 |

| PN Gadgil Jewellers Ltd. | 7554.12 | 2.56 |

| Thangamayil Jewellery Ltd | 4518.31 | 3.22 |

| Senco Gold | 6026.66 | 3.61 |

As on 31st March 2024

Source: StockEdge

2. Debt & Borrowings

Jewellery stocks need a lot of money to buy gold and diamonds, so it’s important to check how much debt they have. A low debt-to-equity ratio is better because it means the company is not heavily dependent on borrowed money. Also, if the interest coverage ratio is high, it means the company can easily pay off its interest on loans.

| Name | Debt (Rs.Cr.) | Debt to Equity | Interest Coverage Ratio |

| Titan Company | 21648 | 2.22 | 5.78 |

| Kalyan Jewellers | 4549.92 | 1.04 | 3.62 |

| PN Gadgil Jewellers Ltd. | 233.34 | 0.16 | 7.55 |

| Thangamayil Jewellery Ltd | 800.2 | 1.55 | 5.08 |

| Senco Gold | 1881.13 | 1.31 | 2.54 |

As on 31st March 2024

Source: StockEdge

3. Inventory & Stock Management

Since jewellery is expensive, companies must manage their stock well. If they hold too much unsold jewellery, it increases costs. A high inventory turnover ratio is good because it means the company is selling jewellery quickly. Also, the days inventory outstanding (DIO) should be low, meaning the company does not keep jewellery in stock for too long.

| Name | Inventory Turnover Ratio | Inventory Days |

| Titan Company | 2.22 | 176.34 |

| Kalyan Jewellers | 2.08 | 191.27 |

| PN Gadgil Jewellers Ltd. | 7.33 | 61.8 |

| Thangamayil Jewellery Ltd | 3.14 | 127.52 |

| Senco Gold | 2.06 | 200.95 |

As on 31st March 2024

Source: StockEdge

4. Store Expansion & Market Presence

More stores mean more sales, but only if they are in the right locations. Companies expanding into smaller cities (tier-2 and tier-3) may have more growth opportunities. Another important factor is average store size, which shows the typical footprint of a retail establishment, indicating how much space a shop typically occupies.

| Name | Average Store Size (Sq Ft) |

| Titan Company | 4200 |

| Kalyan Jewellers | 6500 |

| PN Gadgil Jewellers Ltd | 3500 |

| Thangamayil Jewellery Ltd | 2500 |

| Senco Gold | 1500 |

As on 31st March 2024

Source: PN Gadgil Jewellers’s DRHP

5. Brand Reputation & Customer Trust

Well-known brands like Titan (Tanishq) and Kalyan Jewellers have strong customer trust. A company with a high market share is usually more stable. Companies that invest in marketing and customer loyalty programs do better in the long run.

| Name | Marketing Expenses | % of Revenue |

| Titan Company | 829 | 1.76% |

| Kalyan Jewellers | 2705.55 | 1.46% |

| PN Gadgil Jewellers Ltd. | 419.47 | 0.69% |

| Thangamayil Jewellery Ltd | 1033.7 | 1.97% |

| Senco Gold | 203.2 | 0.53% |

As on 31st March 2024

Source: PN Gadgil Jewellers’s DRHP & Annual Reports

Best Jewellery Stocks in India

Now that you understand how to evaluate jewellery stocks, look at the best jewellery stocks in India.

Titan Company Ltd

Titan Company Limited, a top Indian lifestyle brand, specializes in jewellery, watches, and eyewear. Tanishq, its flagship brand, is India’s largest jewellery retailer, known for purity, style, and innovative designs. The company also includes Zoya, a luxury brand; Mia by Tanishq, which offers contemporary pieces; and CaratLane, an omnichannel brand for affordable modern jewellery.

In the jewellery segment, they achieved a 20% YoY revenue growth, reaching ₹38,352 crore in FY 2023-24, despite external challenges like geopolitical supply chain disruptions. EBIT stood at ₹4,726 crore, reflecting an 8.3% YoY growth, with an EBIT margin of 12.3% (excluding bullion sales and before exceptional items).

To learn more about Titan’s financial performance, check out our Edge reports!

Kalyan Jewellers India Ltd

Kalyan Jewellers India Ltd. is one of India’s largest jewellery retailers, offering a variety of gold, diamond, and jewellery products. It ranks among the top 5 gold jewellery retailers, capturing approximately 6% of the organised market share.

In Q3 FY25, the company experienced robust year-over-year revenue growth despite fluctuating gold prices, driven by customer sentiment and wedding demand. In the diamond segment, the share of solitaire is approximately 5% to 6%, so the company anticipates no significant impact from lab-grown diamonds. The company’s digital-first lifestyle jewellery brand, Candere, also plays a vital role in expanding its diamond segment. It opened 49 Kalyan showrooms and 34 Candere showrooms in India in 9MFY25.

To learn more about its financial performance, check out our Edge reports!

International Gemmological Institute (India) Limited

International Gemmological Institute (India) Limited certifies polished jewellery for diamonds and coloured stones, serving a global clientele, including diamond growers like Kira Diam and brands like Morellato. As of September 30, 2024, the company operates 19 IGI labs in India and 1 IGI in Turkey, alongside 9 educational schools.

IGI India leads the market, outpacing competitors GIA, HRD, and GSI with its extensive lab network and growing market share. The recent acquisition of IGI Belgium and IGI Netherlands increases its labs from 20 to 31 worldwide. With a 72% EBITDA margin and a 54.7% profit margin, IGI India exceeds many rivals financially.

Bottomline

Diamond-studded jewellery, the second-largest segment, accounted for around 7% of the market in CY 2019. It will grow rapidly to INR ~780 billion (USD ~9 billion) by CY 2023, contributing ~15% to the overall market. The diamond-studded jewellery market is expected to drive India’s jewellery market by growing at a projected ~20% CAGR from CY 2023 to CY 2028.

The primary reason for the diamond industry’s growth is the increased demand for laboratory-grown diamond jewellery. Another factor is the growing commitment to trustworthy brands, which has significantly raised the market size.

Frequent Asked Questions

Which jewellery stock is best in India?

Titan Company Limited is the top jewellery stock in India. It is known for its premium brands like Tanishq and CaratLane, and it has strong financials and consistent growth. Kalyan Jewellers is another strong contender, with rapid expansion and a growing market share. Other notable jewellery stocks include Thangamayil Jewellery, Goldiam International (focused on diamond exports), and PN Gadgil Jewellers Ltd. Investors should consider financial performance, growth potential, and risk factors before investing.

Is it good to invest in jewellery stocks?

Investing in jewellery stocks can be rewarding because cultural traditions drive demand, and jewellery acts as a hedge against inflation. However, there are risks, such as fluctuating gold prices, economic slowdowns affecting luxury spending, and changing consumer preferences. It’s important to research a company’s financial stability, brand reputation, and market position before investing.