Key Takeaways

- India’s Consumption Boom: India is poised to become the world’s third-largest consumer market by 2030, driven by a growing middle class, increasing disposable incomes, rapid urbanization, and a digital-first mindset.

- Defensive Nature of Consumption Stocks: Consumption stocks, encompassing companies that produce or sell goods and services regularly used by households, are considered defensive. They tend to perform steadily even during economic downturns due to consistent demand.

- Top Picks:

- Hindustan Unilever Ltd.: A leading FMCG company with a diverse product portfolio and strong brand equity.

- Maruti Suzuki India Ltd.: India’s largest automobile manufacturer, benefiting from rising vehicle demand.

- Titan Company Ltd.: A prominent player in the jewelry and watch segments, capitalizing on increasing consumer spending.

Imagine walking into a mall in Mumbai on a weekend — it’s packed. Young families are shopping for groceries at DMart, sipping coffee from Starbucks, trying on clothes at Zudio, ShopperStop, etc. Now, scale that scene across 1.4 billion people, and you get a glimpse of what’s happening in India.

India is witnessing a massive wave of consumption, driven by a growing middle class, increasing disposable incomes, rapid urbanization, and a digital-first mindset. With the country expected to become the world’s third-largest consumer market by 2030, investors are closely watching this trend.

But not all companies will ride this wave equally. Some have the brands, distribution, pricing power, and innovation edge to dominate for years to come.

In this blog, we’ll break down the Top 5 Consumption Stocks in India that are perfectly positioned to benefit from this structural trend — and why they deserve a spot on your radar.

Table of Contents

What are Consumption Stocks in India?

Consumption stocks in India refers to companies that produce or sell goods and services consumed by individuals and households on a regular basis. These companies benefit from rising consumer income, urbanisation, and the expansion of the middle class. They are often considered defensive stocks, meaning they tend to perform steadily even during economic downturns due to consistent demand.

To track the performance of the consumption stocks in India, the NSE (National Stock Exchange) created the Nifty India Consumption Index. It typically includes 30 companies across various sectors. This image presents the data as of April 25, 2025.

What’s Fueling the Surge in Consumption Stocks in India?

India’s consumer market is expected to grow by 46% by 2030, driven by rising incomes, a young workforce, and rapid urbanization.

Source: Mirae Asset Mutual Fund

According to IBEF, consumer expenditure is expected to increase to Rs. 3,72,33,700 crore (approximately US$ 4.3 trillion) by 2030, up from Rs. 2,07,81,600 crore (approximately US$ 2.4 trillion) in 2024. Let’s look at what’s driving this growth:

Rising Disposable Income

In recent years, the country’s disposable per capita income has increased steadily and is expected to continue doing so. According to Statista, India’s per capita disposable income grew from $2,110 in 2019 to $2,540 in 2023 and is projected to reach $4,340 by 2029. This increase in disposable income is changing consumer spending and enhancing purchasing power.

Urbanization

While urban India continues to lead in discretionary spending, rural areas are catching up fast. Narrowing rural-urban consumption gaps and rising aspirations in tier II and III towns are unlocking new demand pockets.

Source: Edelweiss Mutual Fund

Digital Commerce Explosion

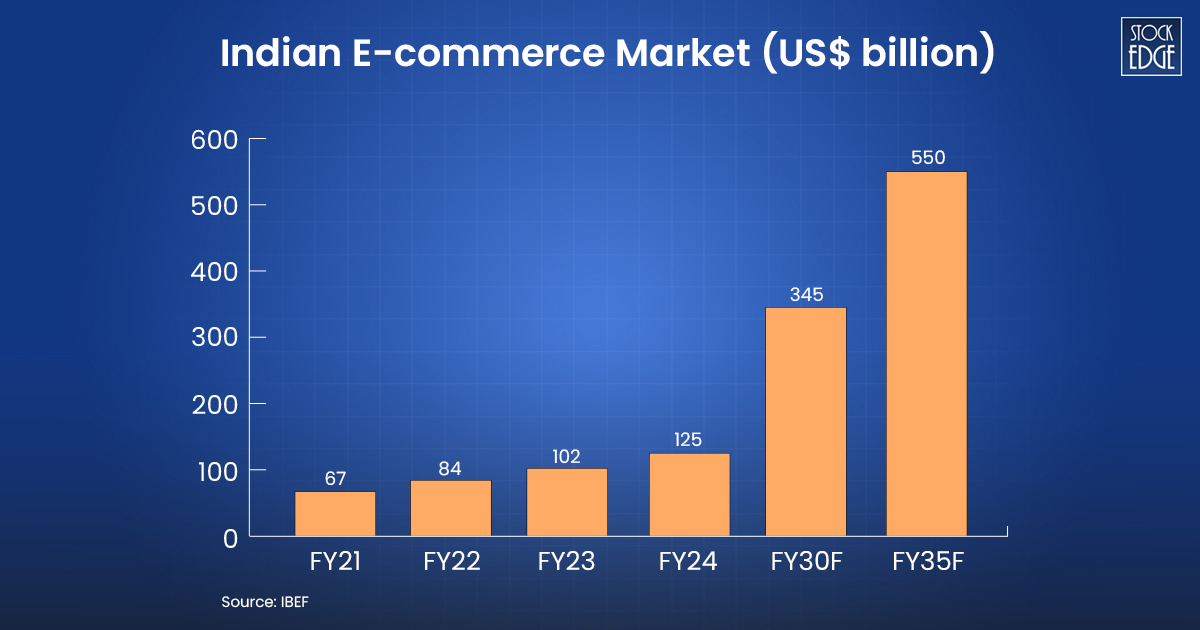

From online retail (21% CAGR) to quick commerce and social commerce (47% CAGR), the shift to digital is transforming how Indians discover and buy products. Direct-to-consumer (D2C) brands are booming, reaching beyond metros into tier II and III towns with focused storytelling, influencer marketing, and convenience.

Source: IBEF

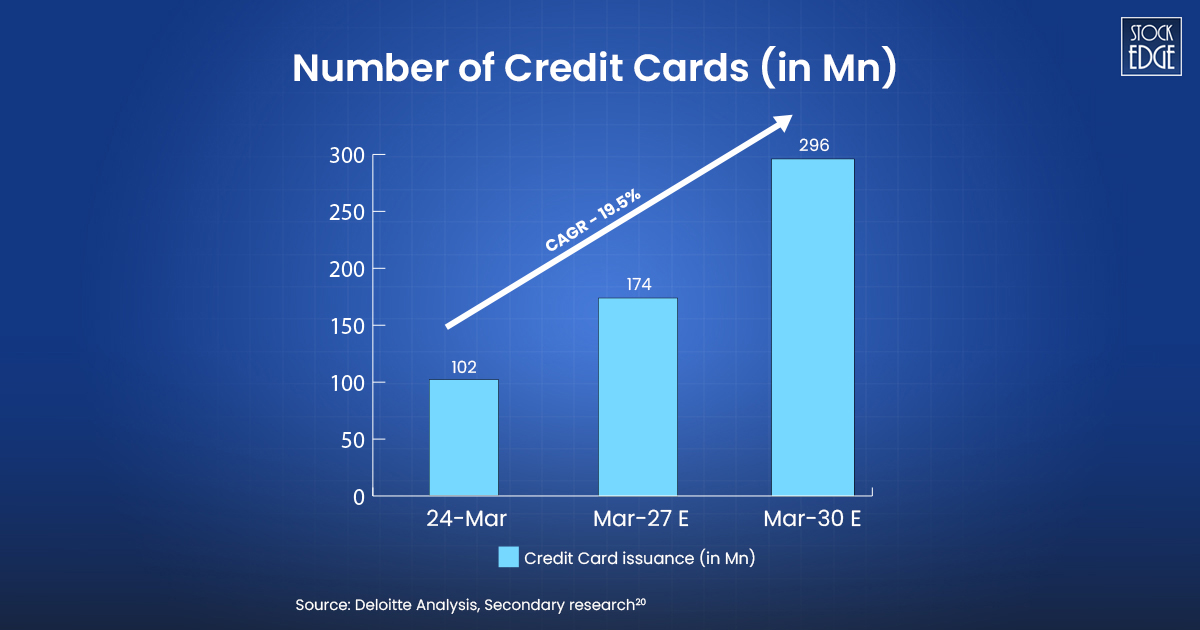

Credit Access & Digital Payments

India’s credit card market is expected to triple from 102 million in 2024 to 296 million by 2030, driven by digital adoption and financial inclusion. India is expected to see a threefold increase in credit card spending by the end of FY 2030. With increasing access to consumer credit and the integration of UPI, people are becoming more comfortable spending on non-essentials.

Premiumisation & Brand Consciousness

India’s luxury market, the fastest-growing in Asia, is projected to reach approximately US$30 billion by 2030, driven by a 20% compound annual growth rate (CAGR). Luxury and premium products are now accessible beyond major cities through online shopping platforms.

Factors to Consider Before Investing in Consumption Stocks in India

India’s consumption story remains one of the strongest long-term growth themes in the global market. With rising disposable incomes, an aspirational middle class, and a youthful population, the opportunities in the consumption sector are abundant. However, not every consumption stock will deliver the same level of returns. To make informed investment decisions, it is crucial to evaluate a mix of financial and non-financial indicators that highlight a company’s potential in the consumer sector.

Sector Tailwinds and Demand Drivers

Before selecting a company, it is crucial to assess the macroeconomic and demographic factors fueling demand. India’s rising middle class, increasing rural consumption, urbanization, and the digitization of consumer habits are creating long-term demand for branded goods and services. Structural shifts, including the transition from unorganized to organized retail, along with rising per capita consumption, provide a strong runway for growth. Investors should favour sub-segments where these tailwinds are most visible, such as personal care, health & wellness, digital-first consumer brands, and quick-service restaurants.

Revenue Growth and Volume Trends

A healthy consumption stock typically demonstrates consistent revenue growth, led by underlying volume expansion rather than just pricing power. Volume-led growth is more sustainable and reflects genuine consumer adoption. Companies with a 5-year revenue CAGR of 10-15% or more, and a steady improvement in volumes, are generally better positioned. Additionally, analysing segmental performance and new product contributions can provide insights into the company’s growth drivers.

Profitability and Operating Leverage

Operating leverage plays a vital role in the scalability of a consumption business. As sales grow, fixed costs get spread over a larger base, expanding margins. Investors should study gross margin and EBITDA margin trends — high and stable margins indicate pricing power and cost efficiency. For example, FMCG companies with high asset turnover and lean cost structures tend to scale profitably and better withstand inflationary pressures.

Working Capital and Inventory Efficiency

Strong consumption businesses manage their supply chains and inventory cycles efficiently. Metrics such as inventory turnover ratio, receivable days, and cash conversion cycle provide a peek into operational agility. Companies that maintain low working capital needs and quickly turn over inventory tend to generate better free cash flows and higher returns on capital employed (ROCE), making them more resilient during economic downturns.

Brand Equity and Distribution Strength

In the consumption space, brand trust and visibility are critical moats. Companies with substantial brand equity enjoy better consumer loyalty, pricing power, and shelf presence. Equally important is their distribution network — deeper rural penetration, modern trade presence, and an evolving omnichannel model are significant competitive advantages. Investors should consider those companies that continuously invest in brand building and are adaptive to changes in consumer touchpoints.

Management Quality and Strategic Execution

The management’s vision, governance standards, and execution ability have a direct impact on long-term value. Investors should evaluate the consistency of strategic execution, capital allocation discipline, and response to market shifts. Transparent disclosures, low promoter pledging, and a track record of innovation and expansion are key indicators of high-quality leadership in the consumption sector.

Valuation vs. Growth Potential

Consumption stocks frequently trade at a premium because of their predictable cash flows and potential for growth. However, overspending can reduce returns. It is critical to determine whether profits and cash flow projections justify valuations. The PEG ratio (Price-to-Earnings-to-Growth), EV/EBITDA multiples, and free cash flow return help align growth expectations with the price paid.

ESG and Sustainability Factors

Today’s consumers are more concerned with sustainability, and companies that share these principles frequently enjoy long-term trust and loyalty. ESG (Environmental, Social, and Governance) initiatives are becoming increasingly important. Companies that are ahead on the ESG curve may also benefit from cost efficiencies, regulatory ease, and improved stakeholder relationships.

In simple word, identifying the right consumption stocks in India is not just about tracking sales growth. It’s about understanding the broader ecosystem from economic trends to consumer behaviour, operational efficiency to brand positioning, and valuation discipline to governance.

Best Consumption Stocks in India

After understanding the factors considered before investing in consumption stocks in India, let’s move ahead and explore the top gainers consumption stocks in India.

Hindustan Unilever Ltd.

Hindustan Unilever Ltd. is the largest fast-moving consumer goods (FMCG) company in India. The company has a diverse product portfolio with over 50 brands across 16 distinct categories including fabric solutions, home & hygiene, life essentials, skin cleansing, skincare, hair care, colour cosmetics, oral care, deodorants, tea, coffee, ice-cream & frozen desserts, foods, health food drinks (HFD).

It has 19 brands reporting over ₹1,000 crore each annually. These 19 brands account for over 80% of the company’s turnover in FY24. Some of its prominent brands are: LUX, Surf Excel, Vim, Lifebuoy, Dove, Glow & Lovely, Pond’s, Vaseline, Clinic Plus, Sunsilk, Horlicks, Viva, and others.

Source: StockEdge

The overall FMCG (fast-moving consumer goods) industry experienced subdued demand in FY25. Rural demand improved gradually, while urban demand moderated. However, in the mid- to long term, the company aims to achieve about 80% of its growth from the future core and market maker portfolio. They expect growth to gradually improve, driven by portfolio transformation and strengthening underlying macro conditions. Macro-economic improvement is anticipated to benefit from monetary stimulus, tax relief, lower food and crude inflation, and improved agricultural output. H1 FY26 is expected to outperform H2 FY25.

To know more about their financial performance, read our Edge Reports.

Maruti Suzuki India Ltd.

Maruti Suzuki India Limited, initially a joint venture between the Government of India and Suzuki Motor Corporation (SMC), became an SMC subsidiary in 2002, with SMC owning 58.19%. The company leads India’s passenger vehicle segment with over 45% market share and is the largest exporter of passenger cars, accounting for ~42% of exports to 100+ countries, including South Africa, Saudi Arabia, Chile, Mexico, and the Philippines.

Its annual production capacity stands at 23.5 million units (FY24) across Gurugram, Manesar, and Gujarat. Key export models include Dzire, Swift, Baleno, S-Presso, and Grand Vitara. It operates through two major sales channels — Arena (mass-market models, such as Swift, Brezza, Alto, etc.) and Nexa (premium offerings, like Baleno, Grand Vitara, Jimny, etc.). It also offers commercial vehicles such as Super Carry and Eeco Cargo.

Source: StockEdge

The company is expanding its CODO (Company-Owned Dealer-Operated) network, with nine outlets already operational and thirteen more planned. It aims to achieve sales of approximately 7,50,000 units from exports by FY30. This year’s export target is 300,000 units. As the use of electric vehicles increases, encouraging the adoption of strong hybrid technology, CNG, ethanol, and biogas-powered cars becomes essential for a more efficient transition. Hybrid cars significantly improve fuel efficiency by 35-45% and reduce carbon and greenhouse gas emissions by 25-35%, making them a highly efficient alternative to conventional vehicles.

To know more about their financial performance, read our Edge Reports.

Titan Company Ltd.

Titan Company Limited is an Indian lifestyle company that primarily manufactures fashion accessories such as jewellery, watches, and eyewear. It is the largest branded jewellery maker in India, with over 80% of its total revenues generated from the jewellery segment.

Titan produces watches under the brand names Titan, Fastrack, Sonata, Nebula, RAGA, SF, Favre Leuba, and Xylys, holding the position of the fifth-largest integrated watch manufacturer in the world. It has also ventured into the fields of Indian dress wear and fragrances under the brands Taneira and Skinn. As of September 30, 2024, the company operated 3,171 stores across approximately 4.44 million square feet in 429 towns.

Source: StockEdge

The management stated that the international jewellery business is expected to be around ₹2,500 cr by FY25-FY26, with strong store expansion in key geographies. Each store would consume $6-8 million in inventory. The company targets adding approximately 40-50 stores in Tanishq and around 70-80 stores in Mia, as well as in CaratLane, each in the next 12-24 months. They plan to add about 14 Tanishq stores internationally in the coming periods. The EBIT margin overall is expected to be 11%-11.5% in FY25, while the same will be in the range of 13%-14% for the watches and wearables segment. To know more about jewellery stocks, read our blog, Top 3 Jewellery Stocks in India.

You can also check out our edge reports to learn more about the financials.

Final Thoughts

India is not just growing – it’s changing fast into one of the world’s biggest consumption-driven economies. With a young population (over 65% under the age of 35) and a median age of just 28.4 years, more people are spending on better lifestyles, brands, and experiences. Over 850 million Indians are now online, and the e-commerce market is projected to grow, reaching an expected $350 billion by 2030. Income levels are also rising, with upper-middle and high-income households set to increase from 24 million in 2020 to over 80 million by 2030. Even rural areas are joining the consumption story, contributing 30–45% of revenue for many FMCG companies. This creates a powerful opportunity for long-term investors.

Frequent Asked Questions (FAQ)

Which stock comes under Nifty Consumption?

Nifty Consumption includes stocks of companies involved in consumer-oriented businesses like FMCG, auto, and retail. Hindustan Unilever, ITC, Nestlé India, Titan, Asian Paints, and Marico are some among them. The index helps track the performance of this sector.

What are consumption sector stocks?

Consumption sector stocks are shares of companies that make goods for everyday use, like food, clothing, and personal care. Consumption stocks are among the safest stocks in the market due to its strong cash flows, low debt, and stable returns.