Table of Contents

Key Takeaways

- The Present and Future: Artificial Intelligence (AI) is no longer a concept of the future; it’s actively transforming industries like healthcare, finance, and retail in India.

- India’s AI Growth Trajectory: The Indian AI market is projected to reach between $17 billion and $22 billion by 2027, with significant investments from both the government and private sectors.

- Investment Considerations: When evaluating AI stocks, consider factors such as the company’s technological capabilities, market presence, financial health, and alignment with India’s digital growth initiatives.

- Top 3 AI Stocks in India:

- Tata Elxsi Ltd.

- Persistent Systems Ltd.

- Affle (India) Ltd.

Amazon Alexa, Chat-GPT, Google Gemini, and Microsoft Co-Pilot are all artificial intelligence systems that make our lives easier by performing simple tasks. It makes our work efficient and more productive at the same time. Think of similar artificial intelligence models for large businesses and corporations that are making them efficient and productive, which will eventually contribute to the overall economic growth of the country. In this blog, let’s explore investment opportunities in artificial intelligence stocks, which are developing these AI models to help businesses and corporations across the world.

In 1955, an American computer scientist named John McCarthy first coined the term “Artificial Intelligence”. He is known as the father of Artificial Intelligence (AI). But what exactly is Artificial Intelligence (AI)?

Imagine supercomputers with the capabilities to think, learn and act like humans. It can make decisions and solve problems without any human assistance, whether it is predicting the climate or suggesting what to watch next on Netflix. Today, artificial intelligence (AI) is creating machines smart enough to help us with everyday tasks, and in doing so, it’s changing how industries work! Curious how this technology is reshaping industries and boosting India’s growth? Let’s dive in and find some opportunities to invest in artificial intelligence stocks in India.

What are Artificial Intelligence Stocks In India?

Artificial Intelligence stocks in India are public listed companies that are focusing on developing, integrating, or leveraging artificial intelligence technologies to create innovative solutions, improve efficiency, and drive growth across several industries like agriculture, education, healthcare, financial services and more.

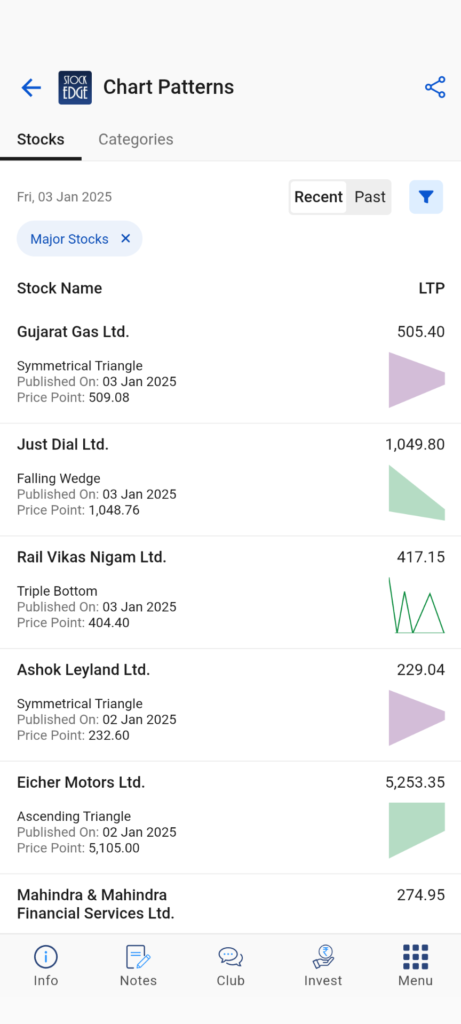

For instance, at StockEdge we are also harnessing the power of artificial intelligence to identify chart patterns in stocks. Isn’t it fascinating how AI is helping traders to spot chart patterns in stocks without the hassle of manually analyzing 6000+ stocks listed in the Indian stock market market.

So, you see Artificial Intelligence is not the future any more, it is present in numerous applications around us.

Overview of Artificial Intelligence (AI): Accelerating India’s Economic Growth

To identify investing opportunities in Artificial Intelligence stocks, the foremost important thing is to have a brief overview of the Artificial Intelligence (AI) industry and how it is boosting the economic growth of our country.

The potential of artificial intelligence to drive the economic growth of India lies in several factors, such as:

Investment in AI

According to S&P Global, the Indian market for artificial intelligence is expected to grow to between US $17 billion and US $22 billion by 2027, attracting investments of US $4 billion. Our government is committed to the industry’s development by announcing a budget of US $1.3 billion through the India AI Mission, which is a significant investment compared to some developed countries like the USA.

Digital infrastructure

Despite steady investment in AI research and development, a country requires infrastructure to perform research and development on artificial intelligence. Access to the internet, the availability of reliable data and a common goal of both public and private enterprise to support AI research and development.

Supportive Laws & Policies

There are opportunities for the Indian IT/ITES providers to create AI specific models, trained with datasets that can help Indian researchers in various sectors such as climate, environmental studies, agriculture, food supply chain, healthcare, mobility and more. But there should be support from the government to research, develop and build up such artificial intelligence models that can transform several home grown industries in the future.

AI Skill Development

The introduction of artificial intelligence has rapidly changed the job market in India. A lack of AI skills can quickly replace the existing workforce. Hence, AI skills need to be developed by a majority of the Indian workforce if they do not want to be replaced by the mighty AI. However, on the brighter side, AI is creating new job opportunities across various industries like manufacturing, healthcare, and financial services that are increasingly embracing AI and Generative AI to drive growth. Therefore, upskilling the Indian workforce is a key aspect of embracing artificial intelligence in the country.

Now that you have an understanding of the overall artificial intelligence industry and how it can benefit the economic growth of the country, let’s dig deep into identifying artificial intelligence stocks in India for your investment in the long term.

Best Artificial Intelligence stocks in India

1. TATA Elxsi Ltd.

The first artificial intelligence stock is from the renowned TATA Group. Established in 1989, Tata Elxsi is amongst the world’s leading providers of design and technology services. Tata Elxsi enables its clients to transform their products and services by harnessing cutting-edge technologies like Artificial Intelligence (AI), Generative AI (Gen-AI), Cloud Computing, Internet of Things (IoT), and Virtual Reality.

Tata Elxsi leverages AI and Generative AI (Gen-AI) to enhance workflows, regulatory work, and network operations automation. Their platforms like NEURON, iCX, and TEcare have been enriched with Gen-AI.

The company has initiated specialized programs to make 25% of its engineers AI-ready by Q3 FY25.

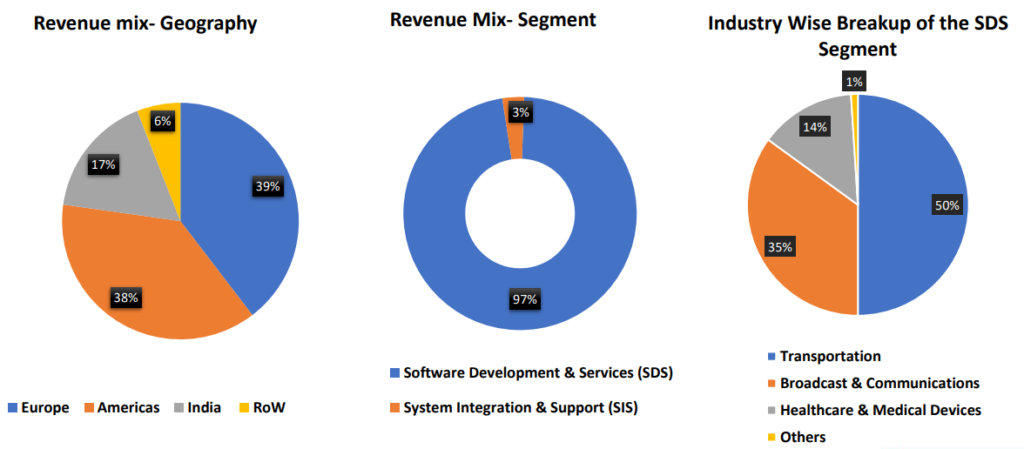

The company has two revenue streams: 1. Software Development & Services (SDS) and 2. System Integration & Support (SIS).

The Software Development and Services (SDS) division, which heavily incorporates AI, contributed 97% of the revenue in FY24. Also, geographically, the majority of revenue comes from the US and Europe. The services provided by the company are spread across several industry verticals, such as transportation, healthcare, media, and more. A complete study of the revenue mix for FY24 is given below:

Image source: StockEdge Edge reports

Financial Performance

The company’s sales growth is steadily increasing. In the last 5 years, the CAGR sales growth for the company is 17.3%. In FY24, revenue stood at ₹3,552 cr, up by 13% and in the last two quarters of FY25, revenue increased by 8.96% and 8.32% YoY, respectively. The net profit in the last quarter of Q2FY25 is at 229 cr, up by 14.7% YoY. The company also maintains a steady profit margin between 20% to 24% from FY21 to FY24.

The company remained debt-free for a very long time and the company’s working capital cycle is negative meaning it is efficient in collecting payments from customers quickly, often upfront or soon after delivering goods or services.

The cash flow from operating activities is at 701 cr for FY24 has been steadily increasing over the past few years due to increase in profits, decrease in billed trade receivables, & non-cash expense adjustments.

Future Outlook

For FY25, the company remains hopeful of double-digit revenue growth, given a stable demand environment. AI’s role in Engineering Research & Development (ER&D) is critical, with global ER&D spending projected to grow at 8-9% annually. Tata Elxsi’s focus on AI and its presence in high-growth markets like healthcare and automotive positions it as a strong player in this space and you may consider it one of the top artificial intelligence stocks in India. It has also been featured among top gainers.

We have further more detailed case study on TATA Elxsi Ltd., which you must refer for detailed analysis before making an investment decision.

2. Persistent Systems Ltd.

The next artificial intelligence stocks in the list is Persistent Systems which focuses on delivering advanced AI, machine learning, and Generative AI (GenAI) solutions. Incorporated in 1990, Persistent Systems Limited is amongst the world’s leading providers of product engineering services. The company has unified its AI capabilities under the brand Persistent.AI.

Recently the company launched SASVA™ which is an AI-powered platform enhancing software engineering with tools like automated code generation and validation. Isn’t it astonishing to see such capabilities in machines? The company has over 16,000+ employees trained in AI and GenAI tools, Persistent.AI is well-prepared to capitalize on the growing demand for AI solutions globally. Persistent Systems has been an integral part of Nifty Midcap 150 Index.

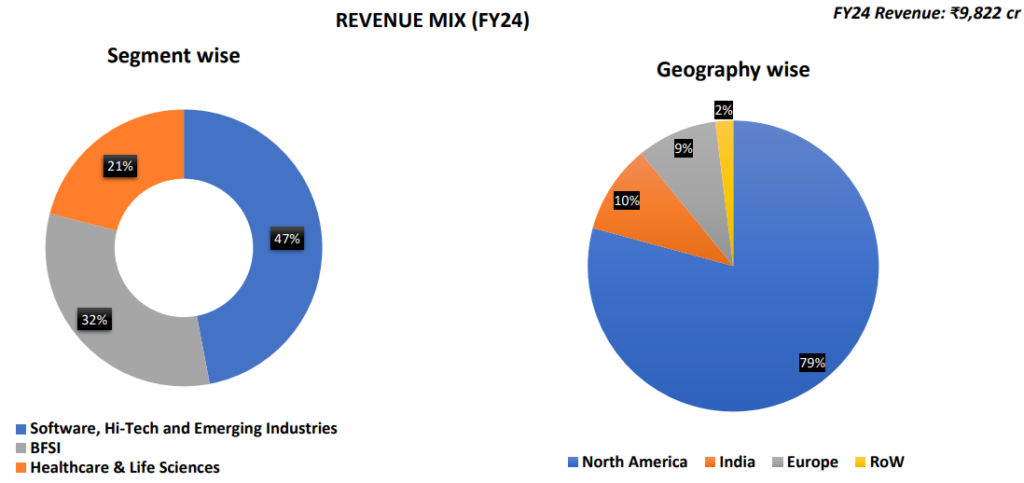

The company has various revenue streams across industries where applications of artificial intelligence are improvised to enhance the outcome. For instance, in the healthcare sector, AI for patient data management and personalized treatments are improving healthcare outcomes. Furthermore, the company generated 21% of the revenue from healthcare and life sciences in FY24. Similarly, there are other revenue segments of the company, but geographically, the major revenue comes from the North America region. A complete revenue mix FY24 is given below:

Image Source: StockEdge Edge reports

Financial Performance

The company’s sales growth is steadily increasing. In the last 5 years, the CAGR sales growth for the company is 23.9%. In FY24, revenue stood at ₹9,822 cr, up by 17.6% and in the last two quarters of FY25, revenue increased by 18% and 20% YoY, respectively. The net profit in the last quarter of Q2FY25 is at 325 cr, up by 23.5% YoY. The company also maintains a steady profit margin between 10% to 12% from FY21 to FY24.

The company has reduced its long-term debt by ₹196 cr, while the short-term debt reduced by ₹28 cr and the debt to equity ratio stands at 0.04x.

The cash flow from operating activities increased to ₹1,221 cr. The rise was majorly due to operating profit while the net working capital changes on account of increase in overall assets and in trade payables led to a positive impact of ₹24 cr.

Future Outlook

The company aims to deliver revenue of $2 billion in the next 3-4 years. Also, the company is focusing on cost optimization levers around employee costs & efficiency to drive margin expansion. The company expects to improve EBIT margins by 200-300 bps in the coming years. The focus on innovation, along with its experience in data systems and cloud technologies, makes it a leader in enabling enterprise AI adoption. The efforts in building scalable, secure, and enterprise-ready AI solutions position it as a key player in the evolving AI landscape.

We have further more detailed case study on Persistent Systems Ltd., which you must refer for detailed analysis before making an investment decision.

3. Affle (India) Ltd.

The company is leveraging artificial intelligence and generative AI to transform the advertising technology landscape, with an emphasis on increasing consumer engagement. It uses AI algorithms for predictive analytics, customized suggestions, and fraud protection.

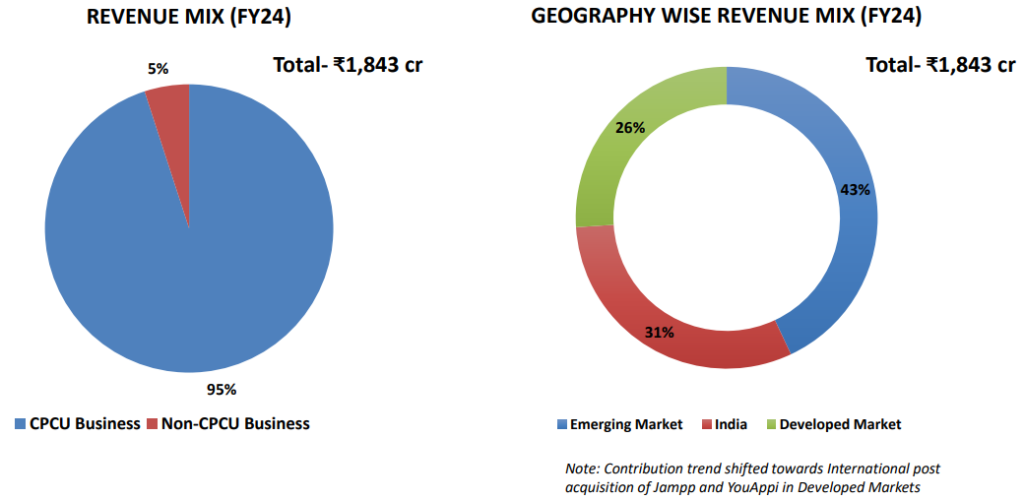

They serve a wide range of B2C companies across industries, including e-commerce, fintech, and more. Some of their clients include Apollo 24|7, Motilal Oswal, Swiggy, and Zepto. The company primarily earns revenues from its consumer platform on a Cost Per Converted User (CPCU). AI-driven solutions are a core part of Affle’s CPCU (Cost Per Converted User) revenue model, which accounts for 95.5% of its total revenue.

Additionally, it also earns revenue through awareness and engagement type advertising (Non-CPCU), which comprises cost per thousand impressions (CPM), cost per view (CPV) and cost per click (CPC) models.

Here is the revenue mix of Affle India in terms of business segment and geography.

Financial Performance

The company’s sales growth is steadily increasing. In the last 5 years, the company’s CAGR sales growth has climbed by 49.2%. In FY24, revenue stood at ₹1,843 cr, up by 28.5% and in the last two quarters of FY25, revenue increased by 27.8% and 25.8% YoY, respectively. The net profit in the last quarter of Q2FY25 is at 92 cr, up by 37.7% YoY. However, the profit margins declined from the peak of 26% in FY21 to 16% in FY24, which would be worrisome if the company failed to revive its margin.

As of 31st March 2024, the total debt of the company increased to ₹177 and the debt to equity ratio at 0.07 on a consolidated basis. However, on a standalone basis, the company remained debt-free.

In FY24, Affle generated ₹262 cr of operating cash flows aided by healthy profits and working capital adjustments.

Future Outlook

As consumer trends like smartphone usage and connected TV remain intact, the management expects the business to grow at 20% in the long term. So, the tailwind continued to be intact, anchored on the accelerated consumer adoption of the digital and an enhanced organizational shift towards digitally enabled processes. The global advertising technology market is highly competitive and is dominated by digital giants such as Google and Facebook. However, Affle India is uniquely positioned in the overall value chain, and the implementation of artificial intelligence has made it one of the top artificial intelligence stocks in India.

We have further more detailed case study on Affle (India) Ltd., which you must refer for detailed analysis before making an investment decision.

Also, we have added this particular stock as one of the top stocks for 2025

Please note that one must do their own research before investing in the markets. Our team of analysts have put in tremendous effort to publish each report, and it is done with absolute thoroughness with the sole aim of making every user financially literate. Also, the listed investment ideas get updated every quarter. So, look for the latest update on the report. In addition, we keep on adding coverage to new investment ideas or dropping old ones. So, keep following the investment ideas section of StockEdge for the latest investment ideas.

Bottom Line

Now, you have realized that artificial intelligence stocks in India are a long-term investment. AI is now transforming industries, including healthcare, manufacturing, finance, and retail, with Indian companies at the forefront of leveraging this technology to deliver efficiency, innovation, and growth. The Indian IT landscape has been strong over the years, and its growth was well supported through government initiatives that fueled digital transformation.

Moreover, AI helped build a strong ecosystem for sustainable development. The potential for growth here is tremendous as businesses turn to AI to help improve decision-making, allocate resources and drive personalized consumer experiences. Investing in artificial intelligence stocks is a smart move for the future, as you will be able to benefit from both the rapid development and widespread adoption of this revolutionary technology.

Happy Investing!