Table of Contents

“The trend is your friend, except at the end where it bends” – Ed Seykota.

In the stock market, there is a common saying that a trader should never go against the trend and always follow the trend of a stock. Therefore, while trading in the stock market, it is essential to identify the trend of a stock before making a decision on its entry or exit. But what exactly is the trend of a stock, and how can technical indicators help identify it? All of it will be explained in this blog, so sit tight and enjoy reading it.

What is a Trend?

In technical analysis, a trend refers to the direction in which a stock’s price is moving. While talking about a stock’s price trend, is it unfair not to mention the concept of Dow Theory. In the 19th century, Charles H. Dow framed the guiding principle of technical analysis that is widely used to identify the overall trend of the stock market. A higher highs and high lows movement of a stock defines an uptrend whereas a lower highs and lower lows defines a downtrend of a stock.

Take a look at the chart of Blue Star Ltd., which is in an up trend, making higher highs and higher lows:

As you can see, there is a clear up trend in the stock, just by drawing a trendline on a price chart, you can easily identify the trend of a stock. However, it could be difficult to find entry and exit points while making a decision.

This is where technical indicators come in. They do a fabulous job of identifying buy or sell signals in a stock. But if you are new to technical indicators, here is a brief overview.

What are Technical Indicators?

Technical Indicators are generally used to identify the future price movements of a stock. Usually, traders use such technical indicators in conjunction with price to make a decision for buying or selling a stock.

In technical analysis, the price of a stock is supreme, and everything revolves around price, as technical indicators are generally mathematical calculations based on the stock price itself. By interpreting these technical indicators, you can generate buy signals when an indicator suggests a potential upward movement and sell signals when it indicates a possible downward trend, aiding in making informed trading decisions.

Categories of Technical Indicators

There are two broad categories of technical indicators. They are namely:

- Leading Technical Indicators– These technical indicators generate signals ahead of price action movements.

- Lagging Technical Indicators– These technical indicators provide a signal after a price action move has occurred which the technical indicator confirmed.

Both categories of technical indicators are equally important and have their own pros and cons of using it while studying technical analysis.

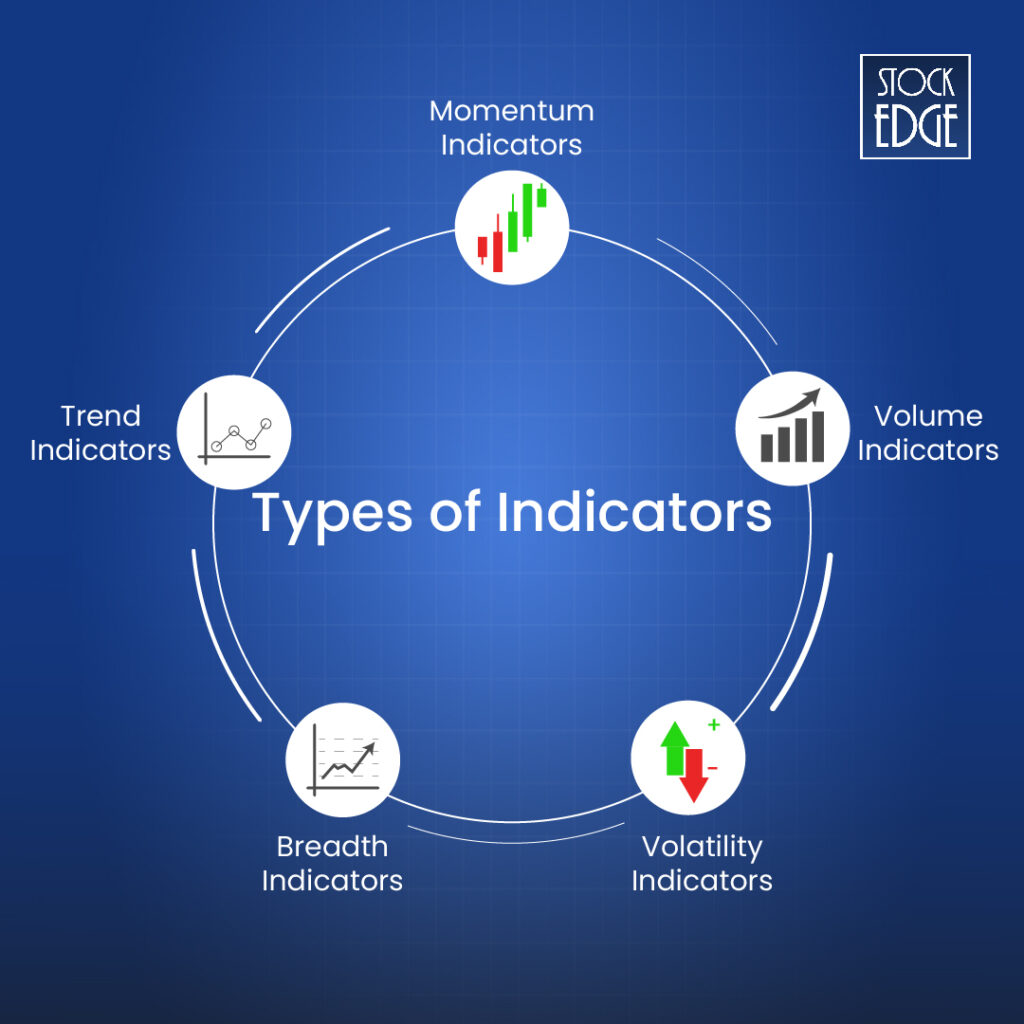

Types of Technical Indicators

In general, there are five different types of technical indicators, as shown below:

Each technical indicator has unique characteristics that generate buy-sell signals and which can help you make trading decisions. However, this particular blog will only discuss trend indicators, as Ed Seykota rightly indicates the importance of trend analysis while trading in the stock market.

Overview of Trend Indicators

Trend indicators are tools used to identify and confirm the direction of a stock’s price movement. These technical indicators can help you to determine the prevailing trend (upward, downward, or sideways) to make informed decisions. Analyzing the price trends can easily provide you with a general idea of the ongoing trend of a stock. However, in this blog, there are three technical indicators that will be explained in detail so that you can become an expert in trend analysis using the technical indicators.

Top 3 Technical Indicators

Let’s discuss the top three trend based technical indicators which can help you determine the correct entry and exit points while trading stocks.

1. Moving Averages

This trend indicator smooths out price data to create a single flowing line, making it easier to identify the direction of the trend. When price trades above the moving average it is considered to be bullish and vice versa. Although it is a lagging indicator, it helps to get a confirmation of the trend. It basically averages out the stock price for a particular time period to filter out the noise from the short-term price fluctuations.

There are two types of moving averages which are, Simple Moving Average (SMA) and Exponential Moving Average (EMA).

SMA is where you simply add up the price points and divide by the specified number of periods, whereas EMA gives more weightage to recent price points while calculating the average. Therefore EMAs for trend analysis are comparatively better as recent price action drives the future price movements of a stock.

Some popular moving average time frames are 20, 50, 100 and 200.

Moving Average Strategy

A crossover between short and long-term EMAs generates some of the best buy and sell signals on the daily price chart. These crossover signals can provide swing traders with the right opportunity at the right time.

So, how exactly does the EMA crossover work?

When a short term EMA crosses above the long term EMA form below is considered as a bullish signal. Also known as the Golden Crossover.

When a short term EMA crosses the long term EMA from above is considered as a bearish signal. Also known as Dead Crossover.

Here is an example of Britannia Industries Ltd.

Take a look at the above price chart, which shows EMA crossover generated buy and sell signals.

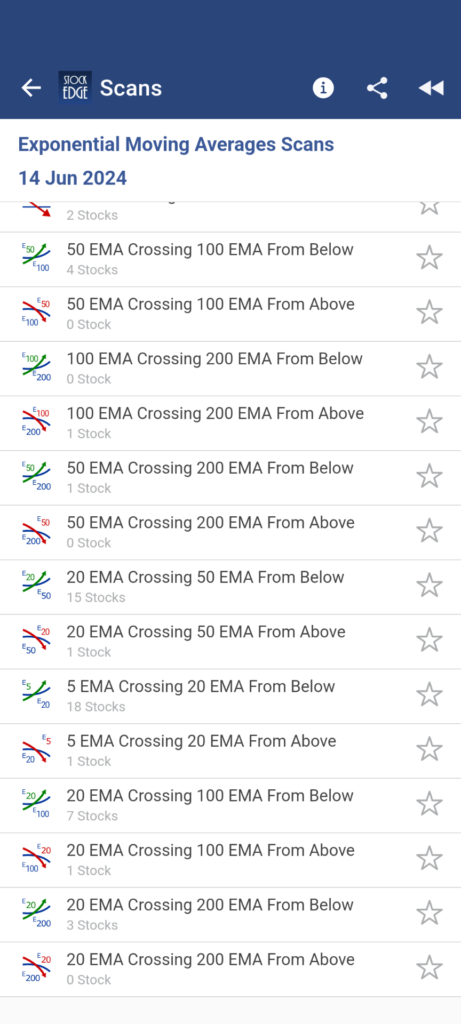

Yes, the moving average crossover strategy looks promising but how to identify such crossovers. That’s where StockEdge comes in to help you become a smart trader. The technical scans in StockEdge, can definitely help you identify EMA crossovers in stocks.

There are a plethora of EMA scans available in the StockEdge app. Use it to identify crossovers and make informed trading decisions in the market.

2. SuperTrend Indicator

This is an extremely popular technical indicator because of its simplicity. It determines whether you should be in a long (buy) or short (sell) position. However, this technical indicator is derived from a volatility based technical indicator which is average true range (ATR) values. Thus, a supertrend indicator considered as a dynamic technical indicator because of its use of ATR in its calculation makes it adaptive to market volatility, providing timely signals in different market conditions.

How do you interpret the Supertrend Indicator?

When the price is above the Supertrend line, the stock is considered to be in an uptrend, and the indicator line turns green. This suggests that traders might consider long positions. On the other hand, when the price is below the supertrend line, the stock is in a downtrend, and the indicator line turns red. This indicates that traders might consider short positions.

In the above example, look at the daily chart of National Aluminium Ltd. The stock is upturned as per the price chart. However, with the use of supertrend indicators, you can easily identify entry and exit points. For instance, when price is trading above supertrend indicator it indicates a buy signal where the supertrend line acted as support at some points and when supertrend indicator changes to red it means price went below supertrend line which suggest an exit of long position in the stock.

However, please note there are few limitations to this technical indicator which is when stock is in whipsaw or sideways movements supertrend indicator may generate multiple false signals. Hence in a consolidating phase of a stock, you can avoid using the supertrend indicator as this technical indicator is considered for a trend analysis and its best works in trending markets.

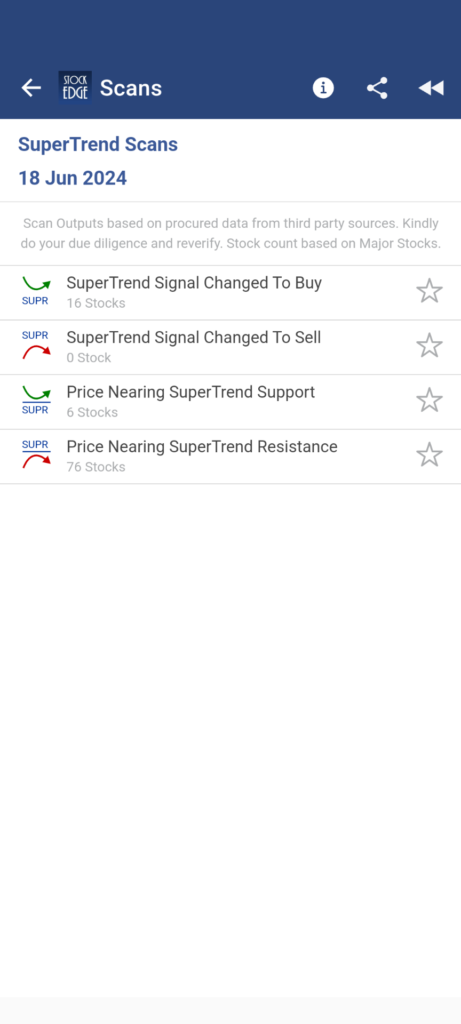

Now, to identify such stocks which are giving buy or sell signals based on the supertrend indicator, you can use StockEdge Scans. Simply go to technical scans to find supertrend scans.

All four supertrend scans can provide you with trading opportunities in stocks. It easily filters out from more than 6000 stocks listed in the market to give accurate trading signals, so that you can make informed decisions at the right time.

3. Parabolic SAR

Parabolic SAR is a versatile and straightforward technical indicator that can not only help you identify trends but also potential reversal points, set trailing stop losses, and make informed trading decisions. It determines the direction of a stock’s momentum to identify potential points of trend reversals. It is primarily used to set trailing stop losses and to decide entry and exit points for trades.

This technical indicator is plotted on a price chart as a series of dots, either above or below the price. When the price is in an uptrend, the dots are plotted below the price, and when the price is in a downtrend, the dots are plotted above the price.

Parabolic SAR Strategy

A Bullish Signal (Buy) is generated when the SAR dots move below the price, which indicates a potential uptrend. A Bearish Signal (Sell) is generated when the SAR dots move above the price; it indicates a potential downtrend.

Take a look at the example of Syngene International Ltd. This technical indicator has generated buy and sell signals on the daily price chart. As you can see, when the dots move below the price a buy signal is generated and a long entry can be created. The exit can be made when SAR dots move above the price or when the trend progresses, the dots move closer to the price, signaling potential reversal points when the price crosses the SAR dots.

Being a trend based technical indicator its limitation remains the same where in case of consolidating phases, the parabolic SAR tends to generate false signals and you can avoid using this or any other trend based technical indicator during such phases.

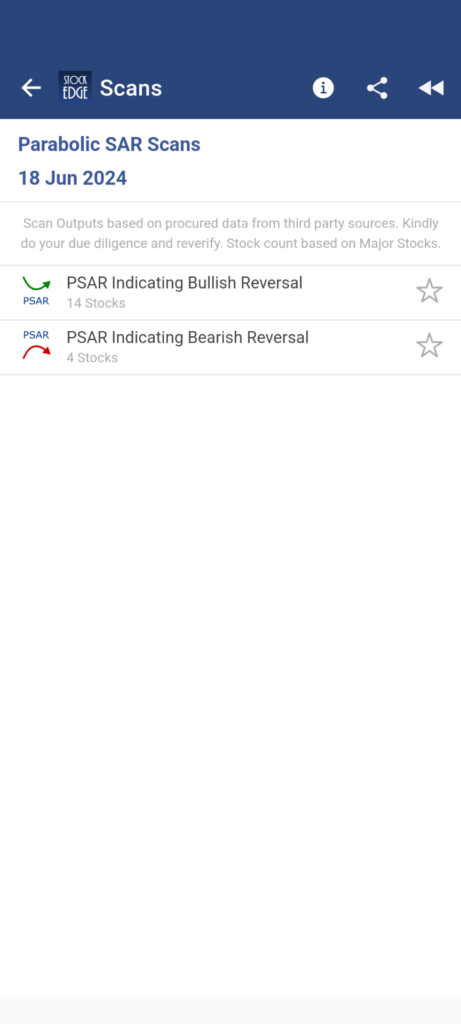

Again, to identify such potential trend reversal in stocks, you can use Parabolic SAR scans in StockEdge. It offers both bullish and beamish price reversals in daily and weekly charts.

If you are looking for trend reversal trades, Parabolic SAR is one of the best technical indicators for identifying potential trading opportunities.

Wondering how to scan or filter out stocks for trading? StockEdge has 300+ scans based on several technical and fundamental parameters. You can learn to optimize your stocks selections using StockEdge scans. Read the blog: Optimize Your Stock Selection: Leverage StockEdge Scans

Hopefully, these three technical indicators may turn out to be helpful in your trading journey. Moreover, you can also watch this YouTube video:

The Bottom Line

To sum it up, these three technical indicators are some of the most useful for trend analysis of a stock that provide timely buy or sell signals. However it is important to note that often these technical indicators are lagging compared to the price action of a stock. Hence, do not heavily rely on them, instead you must follow price action first and then use technical indicators for added conviction for your trades.

Happy trading!