Table of Contents

StockEdge, the popular stock market analysis app, has announced its latest release, Version 11.4, packed with powerful features designed to enhance your financial analysis experience. This release focuses on providing deeper insights into sectoral performance, stock growth trends, and high-fundamental stocks over the past decade. Let’s dive into the key highlights of this update:

Sector Analytics

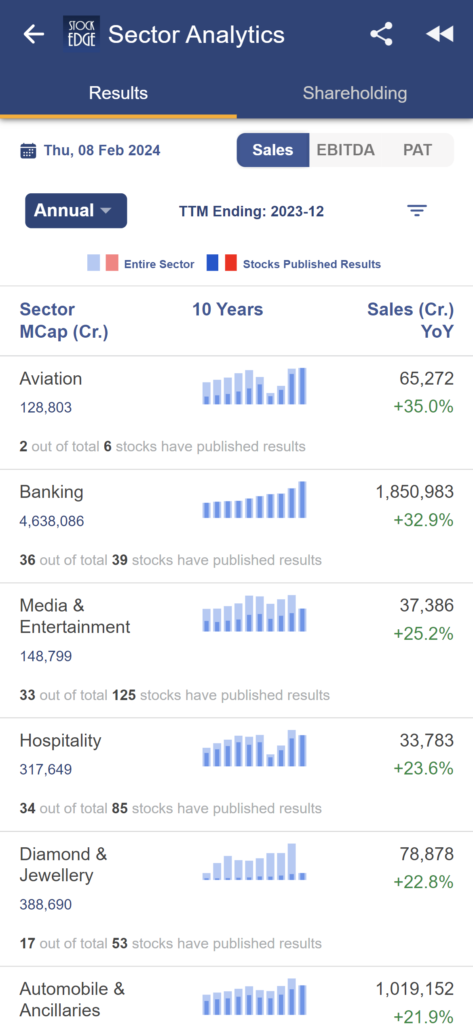

The Sector Analytics feature offers a comprehensive analysis of sectoral financial performance trends. It allows you to analyze key metrics such as Sales, EBITDA, and PAT, providing valuable insights into sectoral health and performance. Additionally, it includes the analysis of Sectoral Shareholding Pattern trends, highlighting the trend of shareholding among Promoters, FII, DII, and other stakeholders within sectors. This feature empowers you to make informed decisions by understanding sectoral dynamics better.

Performance Trend Analysis:

Investors can now analyze the financial performance trends of various sectors based on key metrics such as Sales, EBITDA, and PAT (Profit After Tax). This feature provides valuable insights into sectoral health and growth prospects.

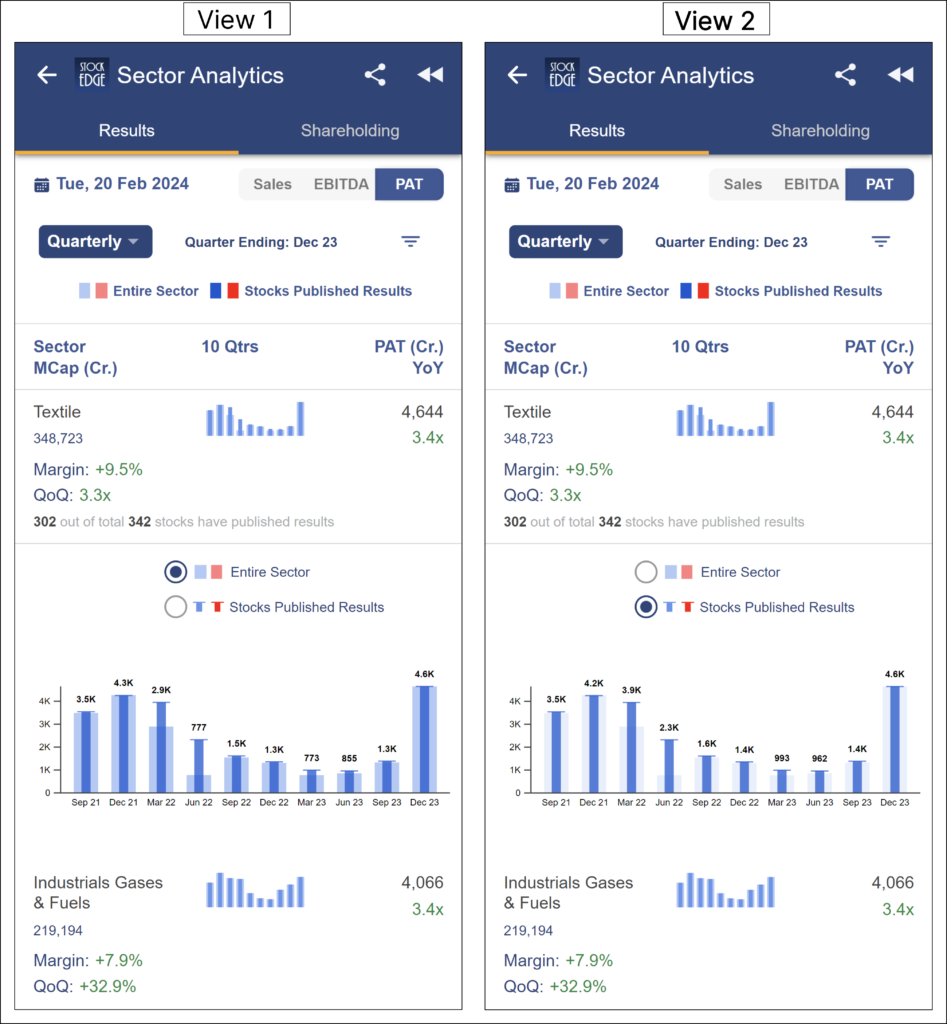

Visual Trend representation of Sectors: Investors can now analyse the trends of the overall sector as well as the current trend of the sector comprising stocks only that have reported their results or shareholding pattern in the current quarter, with the help of an interactive bar graph view:

The following graph provides with two views:

- When Entire Sector is selected (default) – Each bar represents a specific quarter or year-end which displays data of the entire sector including all stocks based on the current categorisation of stocks.

- When Stocks Published Results is selected – Each bar represents a specific quarter or year-end which displays data of the sector comprising of only those stocks that have released their results or shareholding pattern in the current quarter. For example – In the case of Textile sector mentioned below, when Stocks published results is selected, each bar represents the combined PAT values of only those 302 stocks out of 342 stocks that have reported their quarterly earnings in the December 2023 quarter.

Comparative Sector Analysis:

StockEdge enables users to compare the performance of different sectors based on available metrics and filter out the best-performing sectors with the help of growth and margin metrics, helping investors identify potential investment opportunities and make informed decisions.

Advanced Sorting Options: To give users a seamless experience, Stockedge has introduced smart sorting options in both sections of Sector Analytics: Results and Shareholding wherein each sector has customised sorting options based on importance and efficiency.

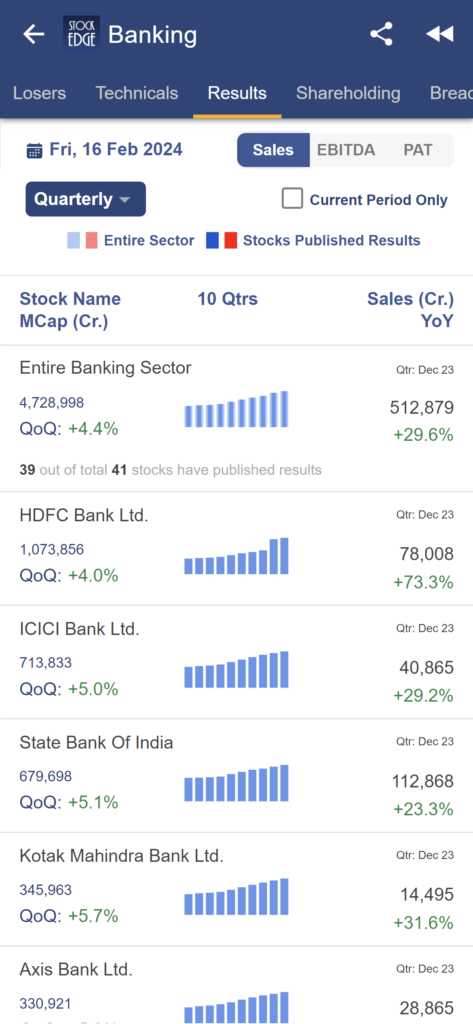

Stock Picking through Sector Analysis

Investors can click on the top sectors and find out the financial performance trend of the stocks of the respective sectors with key metrics enabling effective identification of outperforming strong stocks driving the sector.

Sectoral Shareholding Pattern Analysis

Promoters, FII, DII Trends: The new release includes an in-depth analysis of the shareholding patterns of Promoters, Foreign Institutional Investors (FII), Domestic Institutional Investors (DII), and others in various sectors. This feature helps investors gauge market sentiment and trends among different types of investors.

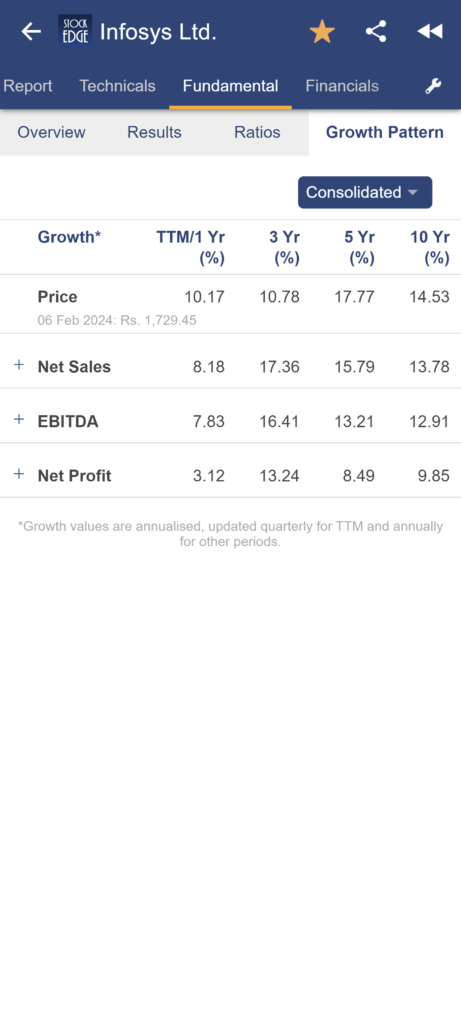

Growth Table – Stock CAGR Performance

The Growth Table feature enables you to track the annualised growth trends of individual stocks based on key fundamental parameters. You can analyze the Net Sales, EBITDA, and Net Profit growth rates, along with Price performance, over specific periods such as 1 year, 3 years, 5 years, and 10 years. This feature provides a comprehensive view of stock performance, helping you identify high-growth opportunities.

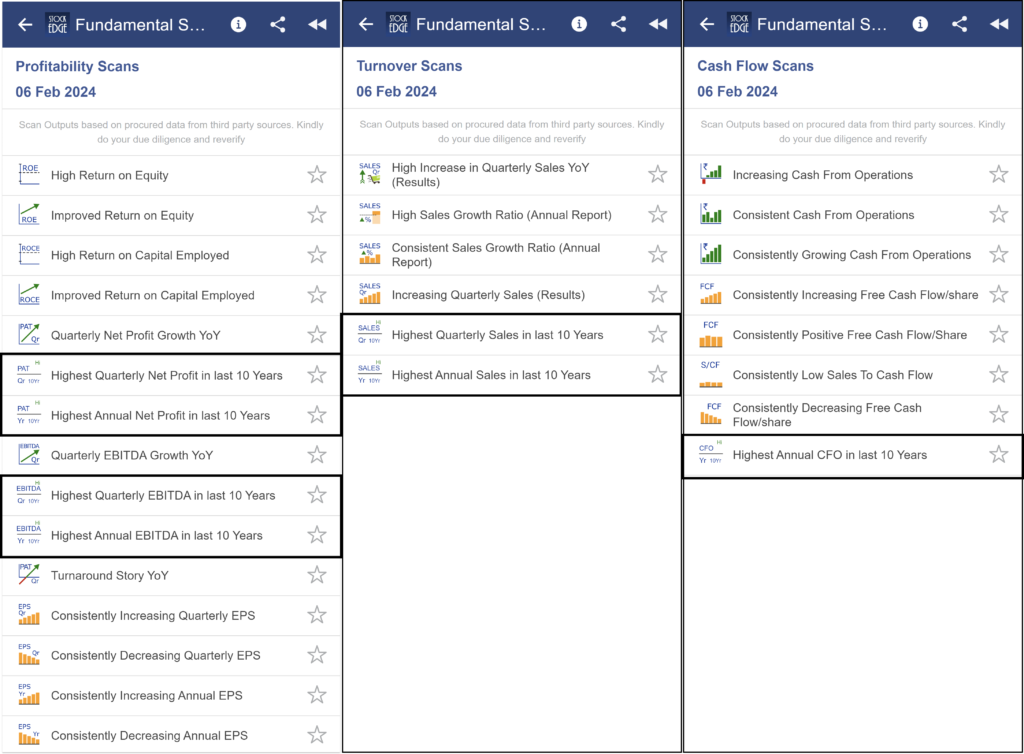

10-Year High Fundamental Scans

With the 10-Year High Fundamental Scans, you can now filter out stocks that have reported the highest Sales, EBITDA, Net Profit, and Cash Flow in quarterly and annual results over 10 years. This feature allows you to identify stocks with strong and consistent fundamental performance, providing a valuable resource for your investment research. Here is the list of the 7 new powerful fundamental scans:

1. Highest Quarterly Sales in last 10 years – Filtered list of stocks that have reported the highest sales in the current quarter in the last 10 years

2. Highest Annual Sales in last 10 years – Filtered list of stocks that have reported the highest sales in the latest annual results in the last 10 years

3. Highest Quarterly EBITDA in last 10 years – Filtered list of stocks that have reported the highest EBITDA in the current quarter in the last 10 years

4. Highest Annual EBITDA in last 10 years – Filtered list of stocks that have reported the highest EBITDA in the latest annual results in the last 10 years

5. Highest Quarterly Net Profit in last 10 years – Filtered list of stocks that have reported the highest Net Profit in the current quarter in the last 10 years

6. Highest Annual Net Profit in last 10 years – Filtered list of stocks that have reported the highest Net Profit in the latest annual results in the last 10 years

7. Highest Annual CFO in last 10 years – Filtered list of stocks that have reported the highest cashflow in the latest annual results in the last 10 years

StockEdge continues to be a go-to platform for stock market enthusiasts, offering comprehensive data and analysis tools to empower investors of all levels. With the release of Version 11.4, StockEdge further solidifies its position as a leading stock market analysis app, providing users with valuable insights and tools to navigate the complex investing world.

If you enjoy using StockEdge, don’t hold back from sharing the platform with your near and dear ones.

Check out StockEdge’s Premium Plans to get the most out of it. Also, watch this space for our midweek and weekend editions of ‘Stock Insights‘.

Stay tuned for more updates and insights from StockEdge as it continues to innovate and enhance its platform for the benefit of investors.

Happy Investing and Trading with StockEdge Version 11.4!

-The StockEdge Team