Table of Contents

Introduction

The investment landscape is an ever-evolving landscape with new strategies to cater to the needs of all types of investors. Systematic Plans have gained significant traction among investors in the last four to five years.

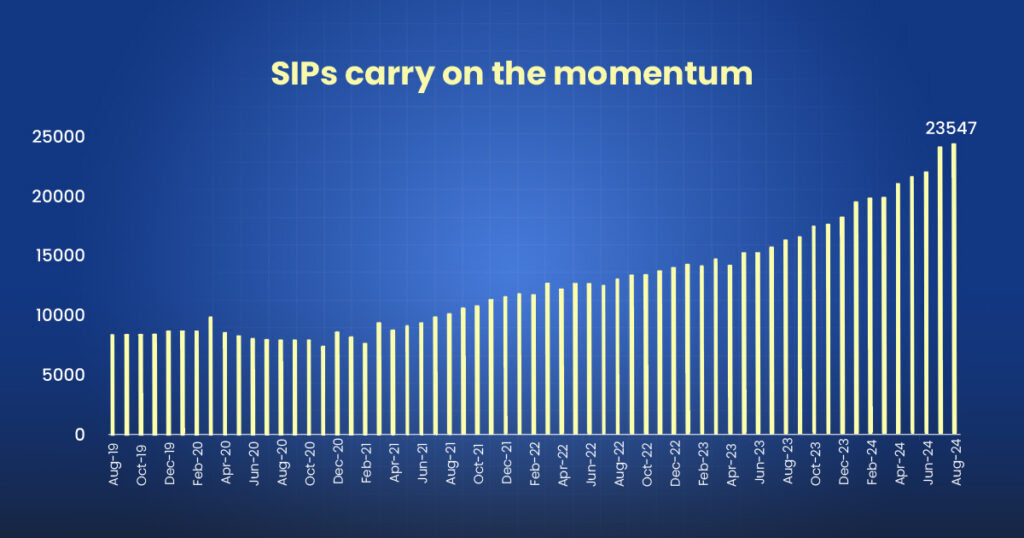

Contributions to SIPs reach an all-time high every month. From ₹9923 crore of SIP inflows in Aug ’21, the amount has surged to ₹23547 crore in just three years.

According to a report published by the Securities and Exchange Board of India (SEBI), SWPs have gained traction in recent years due to the increasing number of retirees and the need for a regular income source.

But what if we tell you that combining your SIP and SWP after you have accumulated a significant corpus can enhance your wealth?

Imagine planting a tree —nurturing it over the years, watching it grow, and one day, it bears fruit. SIP is similar to the seeds you plant, regularly sowing water and contributing to the growth of financial trees, but SWP is an act of enjoying ripe fruits without cutting trees. This magic combination not only helps your wealth to develop but also guarantees regular harvesting for the next few years.

In this blog, we’ll uncover how blending SIP and SWP creates a financial ecosystem where growth and sustenance coexist, giving you the best of both worlds.

What is SIP?

SIP, or a Systematic Investment Plan, is a method in which an investor invests a certain amount of money every month or quarter, with a long-term view of 15 to 20 years, to accumulate wealth and meet their financial goals.

A SIP can be beneficial in many ways. It not only provides rupee cost averaging by investing at regular intervals but also helps investors deal with market volatility and fluctuations.

SIPs make investors disciplined about investing while offering the flexibility to pause/ stop or redeem anytime as and when required by the investor.

What is SWP?

SWP works opposite to how a SIP works. SWP or Systematic Withdrawal Plans help investors to withdraw systematically by selecting a fixed withdrawal amount, frequency of withdrawals and the duration of the withdrawal.

Typically, SWPs are advantageous for investors close to retirement age who have a sizable corpus and are looking for regular income to meet their daily expenses. This enables them to stay invested in their remaining corpus, which can continue to grow further with time.

SWP is like receiving a monthly pension for a lifetime without completely exiting your investments.

The Magic Formula: Combining SIP and SWP

But what if you combined these two powerful tools? The SIP fuels your wealth accumulation engine, while the SWP ensures that you can enjoy the fruits of your hard work without disturbing your financial peace of mind. Together, they create the “magic formula”: a strategic blend that can help you accumulate wealth while making a smooth transition to a steady income stream.

In this blog post, we’ll explore how the fusion of SIP and SWP can turn your financial goals into reality, with practical examples and tips for keeping your portfolio in perfect harmony.

Benefits of the SIP-SWP Combination

The SIP-SWP combination works wonders for disciplined investors—SIP steadily fuels your investment, while SWP ensures smooth withdrawals without depleting your core wealth. Let’s understand the benefits of using this strategy in terms of risk management, regular income generation, and long-term wealth creation.

Risk management

SIP (Systematic Investment Plan) works by spreading your investments over time. It allows you to invest in fixed intervals, averaging the cost in rupees. Instead of investing in a lump sum and being exposed to sudden market changes, SIP helps you enter the market in smaller, regular amounts, which mitigates the impact of short-term market fluctuations.

A Systematic Withdrawal Plan (SWP) allows you to withdraw money from your investments in a planned and structured way. This reduces the risk of excessive withdrawals during market downturns and helps preserve the long-term value of your portfolio.

Regular income generation

The SIP-SWP combination is especially powerful for those seeking a regular flow of income without compromising long-term growth.

SIP allows for easy accumulation, thus growing your assets over time, while SWP allows you to withdraw fixed or flexible amounts periodically, providing a steady stream of income. This is best beneficial for retirees and first-time investors who want to ensure regular cash flow for expenses while continuing to invest the rest of their money.

Long-term wealth creation

The magic of the SIP-SWP combination lies in compounding and capital preservation. By compounding, we simply mean investing for longer durations, which multiplies your wealth exponentially.

SIP allows for long-term wealth accumulation through regular investments, irrespective of market conditions. Over time, the power of compounding works in your favour, especially if you invest in equity mutual funds and other growth-oriented assets.

SWP helps you withdraw funds systematically, leveraging your assets without depleting your investment core. This method is ideal for individuals looking to increase the value of their assets over time while still enjoying the benefits of investing (such as regular income).

How to implement the SIP-SWP Strategy

Implementing the SIP-SWP strategy can be a game changer for managing wealth, generating income, and minimizing risk. You can check on Top 10 Mutual funds to do SIP in 2024.

Here’s a practical guide on how to get started and key considerations for different life stages.

Steps to get started

- Set Clear Financial Goals:

Before you get started, it’s important to define your financial goals. These may include building wealth for retirement, funding a child’s education, or creating a passive income stream. This clarity helps you decide on the duration, amount and types of funds to invest through SIP and the payout amounts through SWP.

Example: If your goal is retirement planning, SIP can help you build a retirement corpus, and SWP can provide you with regular withdrawals to manage expenses post-retirement.

2. Start SIP in a Suitable Mutual Fund:

The first step is to begin your Systematic Investment Plan (SIP) in a mutual fund that aligns with your financial goals and risk tolerance. Equity mutual funds offer higher return potential and are ideal for long-term growth and wealth creation. On the other hand, Debt funds offer more stability and lower risk, making them suitable for risk-averse investors nearing retirement age.

Example: If you are in your late 20s or 30s, you are probably a working professional with a decent income. The key to successful planning is choosing a monthly SIP amount that fits your budget. Assuming Ram is 25 years old and is a working professional makes an investment of ₹ 15,000 per month via SIP for a long-term horizon of 20 years. Assuming an annual rate of return of 15% over 20 years, Ram would accumulate a total corpus of 2.27 crore.

3. Plan Your SWP (Systematic Withdrawal Plan):

Once you have built up a sufficient corpus through SIP, it’s time to implement your SWP strategy. The idea is to withdraw a pre-decided amount regularly while letting the rest of your investments continue growing.

Example: If Ram invests his entire corpus in a fund assuming 12% annual returns and starts a SWP with a withdrawal of 1.5 lakh per month. After 15 years, Ram will still have more than 4 crores of investment corpus left after consecutively withdrawing 2.7 crores (18 lakhs per year for 15 years). If you need ₹1.5 lakhs per month as a post-retirement income, you can set up an SWP to withdraw that amount while the rest of your corpus remains invested, growing through market gains or interest.

4. Monitor and Adjust

Like any financial plan, the SIP-SWP strategy requires periodic reviews. Monitor the performance of your investments and adjust the withdrawal amounts or the SIP contributions as needed.

If market conditions are unfavorable, you may consider temporarily reducing your SWP withdrawals. If you experience a salary increase, consider increasing your SIP contributions to boost your corpus.

5. StockEdge Pro Tip:

The SIP-SWP strategy works wonders if investors focus on a disciplined approach with long-term planning. One smart strategy is to set up a SWP plan with a yearly withdrawal percentage lower than the expected returns from the fund.

For Example, Ram expects an annual return of 12% on the corpus generated through SIPs, but withdrawals are 8% to 9%. This helps in higher capital appreciation, and Ram can withdraw the amount for a longer period.

Considerations for different life stages

a. Early Career (20s to 30s)

At this stage, you have the advantage of time. The goal should be to build wealth aggressively while you have a longer time horizon to take advantage of compounding. Setting a goal of saving at least 15-20% of your income through SIPs will help to build a significant corpus in the long run.

Focus on Equity SIPs: Given your risk tolerance, invest heavily in equity mutual funds or growth-oriented funds through SIPs.

b. Mid-Career (40s to 50s)

In your 40s and 50s, financial goals become more focused, whether it’s saving for children’s education, a home, or retirement. At this stage, you should consider balancing risk and growth.

Balanced SIP Approach: Continue SIPs in equity funds for growth but also start diversifying into Hybrid debt funds to reduce portfolio risk as you approach financial goals.

c. Pre-Retirement and Retirement (60+)

As you approach retirement, financial stability and regular income become the primary concerns. The focus shifts from growth to capital preservation and income generation.

SIP in Low-Risk Funds: Continue SIPs, but now prioritize low-risk debt funds or hybrid funds to safeguard your investments.

At this stage, SWP becomes crucial. Set up an SWP to withdraw a monthly income that will cover your expenses while keeping your capital invested to generate returns.

Conclusion

A SIP-SWP portfolio is a powerful strategy for risk management, regular income generation, and long-term wealth creation. It offers a balanced approach that suits both investors looking for growth and those who need secure income. To grow your wealth, make sure you choose the right investment product, the right amount, and for the long term.

The SIP-SWP strategy is a flexible and efficient financial approach that can be adapted to different stages of life, from early-stage investors to those approaching retirement age. Essentially, SIP helps you grow your wealth, while SWP ensures that you have a reliable source of income while keeping your investment portfolio intact.