Table of Contents

Have you ever invested in Debt mutual funds ?

If not, then you’re missing out on a desirable option.

Debt funds are less volatile and, hence, less risky than equity funds. If you have been saving in traditional fixed-income products like Fixed Deposits, and looking for alternate asset offering steady returns with low volatility, debt mutual funds could be the best option.

But Why? Let us understand it below..

Global Markets macro data and the economic outlook look positive, with the US inflation rate dropping below 3% on an annual basis, which is in line with the US Fed target. In March 2024, the US Federal Reserve and Bank of England (BoE) announced keeping the repo rates unchanged at 5.25%, with the US Fed expressing hopes of three possible rate cuts in 2024.

RBI has kept the repo rate unchanged since April 2023, and it is anticipated that the interest rate cycle might be reduced in the next half of 2024.

The year 2024 will be the comeback year for the Indian debt market, as economic growth data, inflation dynamics, and flat repo rates are favouring debt markets globally. We discuss in depth later in the article how this global outlook will impact debt funds.

In India, the Central government has set its gross borrowings at Rs 14.13 trillion for FY25, which is 8% lower than the FY24 target. It will push down the 10-year benchmark bond yields, increase existing bond prices and enhance the returns of the fixed-income assets subject to mark-to-market.

Let us understand how this entire dynamic works . . .

What are Debt Mutual Funds? How do they work?

A debt fund invests in fixed-interest-generating securities such as corporate bonds, government securities, commercial paper, treasury bills, and other short duration money market instruments. The fundamental reason for investing in debt mutual funds is that they prioritize preserving capital and earning a steady interest income and capital appreciation. These are mainly for conservative investors. They are also known as “fixed-income” securities.

When companies or entities who issue debt instruments wants to raise funds, they will borrow from investors. In return, they promise a regular and fixed interest. This is how debt instruments work in simple terms.

The prices of such securities are directly affected by interest rate changes, as bond prices and interest rates are inversely proportional. When interest rates go down in the market, the prices of existing bonds tend to rise, and MFs need to mark their net asset value (NAV) to the market daily, and hence the MTM gains.

Debt funds invest in various securities based on their credit ratings. A higher rating assigned to a security implies that the fund is more likely to pay the interest on the debt security and pay back the principal upon maturity.

The fund manager of a debt fund ensures that he invests in top-rated credit instruments mainly in AA and above rated papers.

Types of Debt Mutual Funds

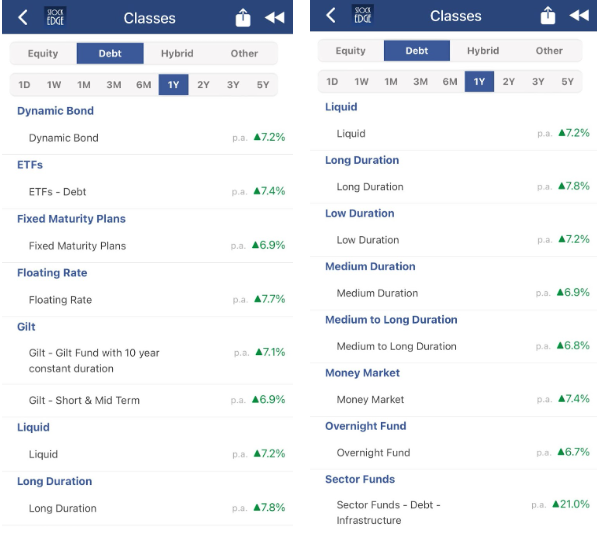

Types:

Many types of debt funds invest in debt securities with specific durations, for specific goals, or for a particular risk profile. There are 16 categories in Debt Mutual Funds, ranging from a one-day maturity to as long as 30 years.

These are liquid funds, short-term, ultrashort, medium-term, long-term, credit risk bond, dynamic bonds, gilt bonds and fixed maturity plans.

We will discuss the different types of debt mutual funds that can benefit from the reduction in interest rates. These are long-duration bonds with seven years and above maturity, Dynamic Bonds having dynamic maturity, and Gilt funds having longer maturity.

Long-duration Funds-

Long-duration funds invest in debt securities with portfolio maturity between 7 and 10 years. They are suitable for investors with a longer investment horizon.

Dynamic Bond Funds-

Dynamic bond funds invest in debt securities having different maturity periods raning from low duration to long duration. These are actively managed by the fund manager, and the portfolio are adjustable in nature according to the fund managers’ interest rate views based on his view of interest rate movement.

Gilt Funds-

The word Gilt refers to ‘Government Securities”. Government securities are issued by Central and state governments, these fund carry very low risk as it is backed by the Government of India. Gilt funds invests in such G-secs having both long-term and short-term maturities.

Understanding current Indian and Global market scenarios.

Potential for gaining extraordinary returns.

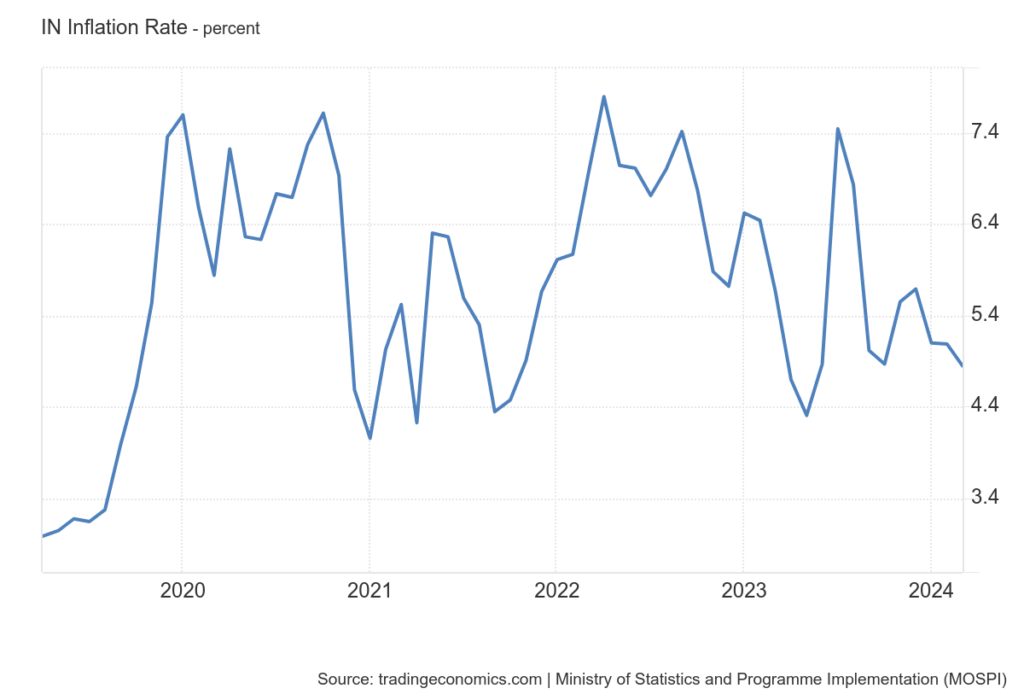

High Inflation, High Interest:

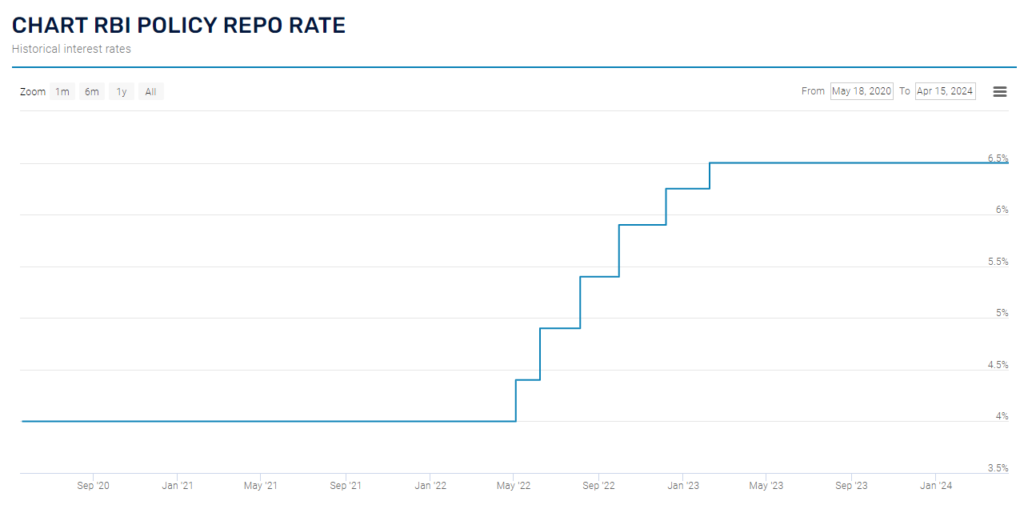

The past few years have witnessed high interest rates. RBI raised the repo rates to 6.5% in February 2023, and they have remained unchanged since then.

Many developed countries experienced a significant rise in Inflation, forcing their central banks to adopt inflation-led monetary policies. As a result, interest rates moved up globally.

In India, CPI inflation moderated to a three-month low of 5.1 per cent in January ‘24 due to a drop in prices of several items in the food basket. Previously, CPI-based Inflation came in at 5.69 per cent in Dec’23 and 6.52 per cent in Jan’23.

Anticipated Fall:

Interest rates are at a five-year high of 6.50%, and Inflation is also above the RBI’s tolerance band of 4%. The RBI has kept the repo rate unchanged since April 2023.

CRISIL expects the first interest rate cut in June 2024 as Inflation softened in January 2024, it is expected to decline further to 4.5% in FY25.

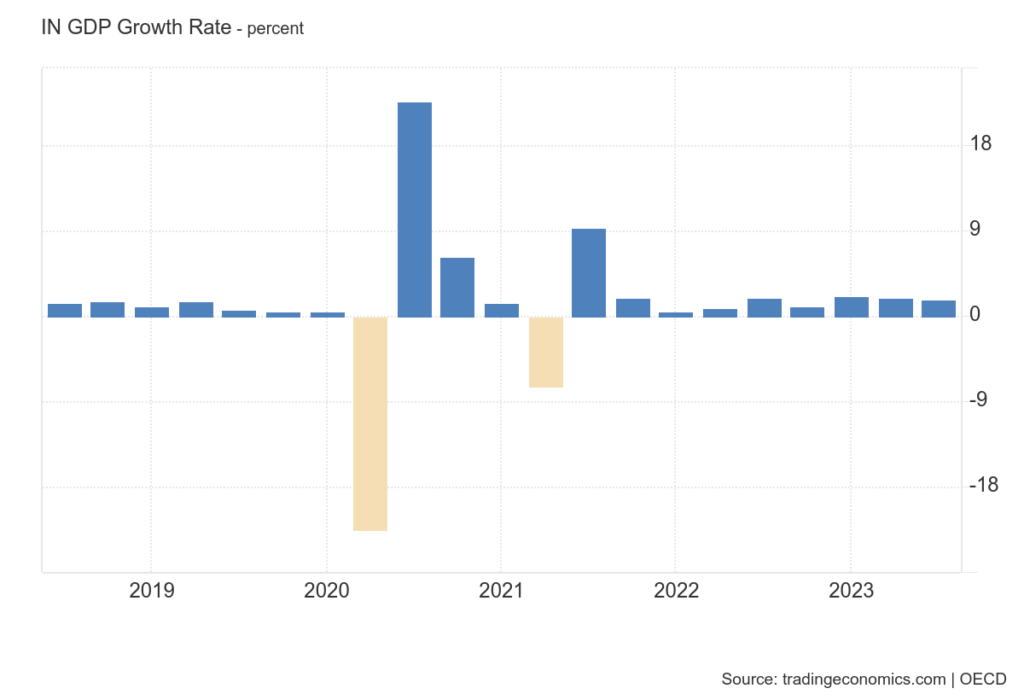

GDP growth:

CRISIL expects real GDP growth to be moderate to 6.8 per cent in fiscal 2025 from 7.61 per cent this fiscal year. High-interest rates and a lower fiscal impulse will impact domestic demand, leading to a decline in existing bond yields and a rise in bond prices. The rating agency expects the softening in Inflation to continue next fiscal year on the back of healthier agriculture output that impacts food inflation and flatter oil and commodity prices.

Impact on Debt Mutual Funds

As discussed earlier, bond prices are negatively correlated with interest rates. This means that when the interest rates go up, bond prices will go down, and when interest rates go down, bond prices go up. The maturity or term of a bond highly affects its yield. In most interest rate environments, the longer the term to maturity, the higher will be the yield.

When bond yields fall, prices rise in proportion to the time left to maturity. Therefore, long-term bond funds benefit the most. Long-duration debt funds are rightly placed to deliver double-digit returns in the coming years.

Wondering how?

Let us first understand the terms duration and modified duration with the help of an example.

Duration is a way of measuring the interest rate risk of a portfolio consisting of fixed-income securities. It shows how much changes in the instrument’s yield-to-maturity (YTM) will ultimately impact the bond’s price, since the interest rate is one of the key factors influencing a bond’s value.

Modified duration measures the price change of a bond in response to a 1% change in interest rates. It shows the percentage change in the bond’s price per basis point of interest rate.

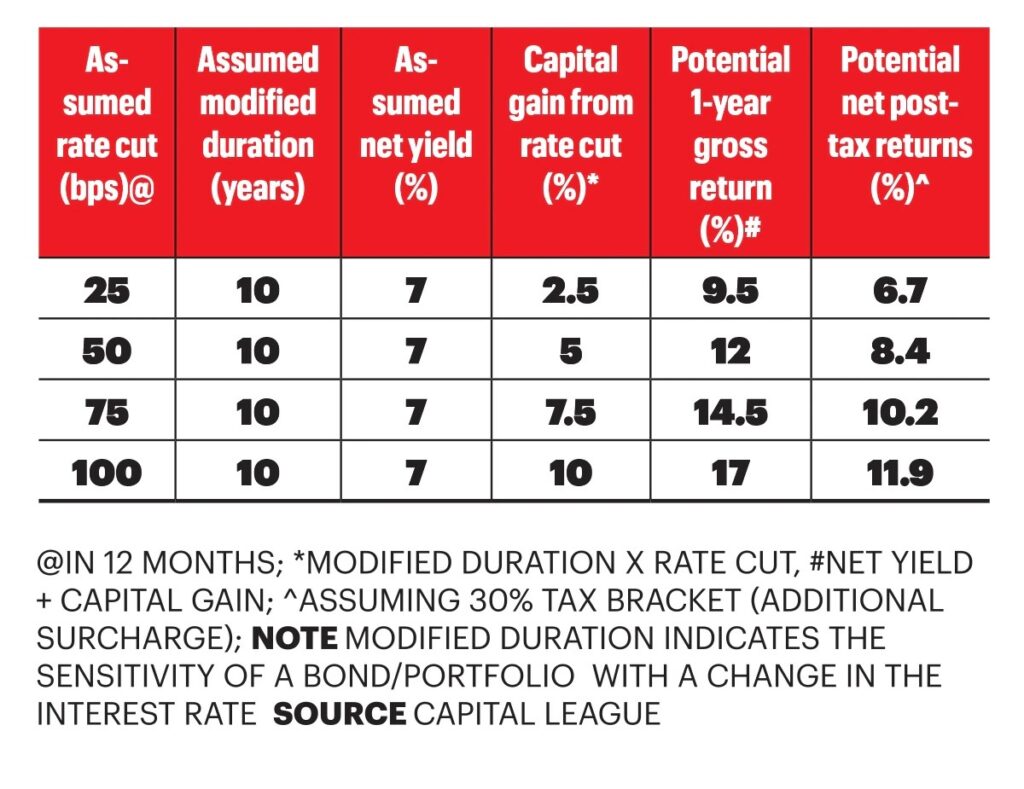

It is expected by the Reserve Bank of India (RBI) to reduce the repo rate by 75 bps from the later half of the year 2024. Currently, the 7.18 GS 2033 G-sec is trading around the levels of 7.15 per cent, which can fall by 100 bps and come down to 6.15 per cent.

Such a movement will increase the bond’s price, potentially generating additional capital gains for the investors.

For example:

A debt fund with a modified duration of eight years would be expected to experience a 6% gain in price for a 0.75% fall in interest rates.

Similarly, if a fund with a modified duration of ten years and 8% YTM experiences a 50-bps fall in a year, then the estimated return is expected to be near 13%. (8%+ (10*0.5))

(Formula for Calculation= Average YTM + Modified Duration X Change in Interest Rate)

From the above illustration, it is assumed if the modified duration across funds is 10 years and a minimum of 50 bps is reduced, it will generate an extra capital gain of 5% (modified duration x interest rate, 10*0.50=5%) in addition to the net yield of 7%. It is generating a total of 12% pre-tax returns. Similarly, if 75 bps is reduced, it will generate additional capital gain returns of 7.5% in addition to a net yield of 7%, generating a total of 14.5% pre-tax returns.

Factors to Consider Before Investing in Debt Fund:

Why is it a good time for Debt Mutual Funds?

The shift in interest rate cycle:

It is anticipated interest rate cuts may favour debt mutual funds which have longer duration. The US Fed, in its recent FOMC meeting held on 20th March 2024, kept the rates unchanged to 5.25-5.5% and gave hopes of three possible rate cuts in FY 24-25 after monitoring the inflation data. On 21st March, Bank of England (BoE) also kept the rate flat to 5.25%. All these factors indicate the possibility of a rate cut by RBI in the near future.

Risk-Return Balance:

Debt funds add value to an investors portfolio with their promise of reasonably better returns over bank deposits and liquidity too. Good debt funds have historically given better returns than bank FD. So aligning investment choices with risk profile, investing in safe debt funds over fixed returns of bank FD’s can provide superior returns.

Modified Duration Strategy:

Modified duration is a useful tool for investors to evaluate a bond’s interest rate sensitivity. It can help investors predict how the bond’s price will be affected by fluctuations in interest rates. Investing in long-term debt funds with modified durations ranging from 7 to 11 years is expected to gain from declining interest rates.

Bond Prices:

Interest rates are likely to fall, as we know if interest rate falls, bond prices are likely to go up. The expected fall in interest rates could appreciate capital gain in bond prices in addition to the yield to maturity.

The expected fall in interest rates can give a capital appreciation of 8-10% in addition to the yield to maturity. Generating a total of 12-18% of pre-tax returns.

Inclusion of Indian Bonds in Foreign market:

ICICI Direct estimates that JP Morgan’s Bond index inclusion could alone lead to FPI inflows of $25b billion or Rs 2 trillion in the Indian debt market, while FPI share in government borrowing may rise to 10-15 per cent in FY25, the highest since FY19.

Apart from JP Morgan’s GBI-EM-GD index, the Bloomberg Global Aggregate Index is also likely to include Indian bonds in its index with 0.6%-0.8% weight, with additional potential inflows of $15-20 billion.

Strategic Investments:

As we know, government securities are considered risk-free investments. Gilt Funds invest only in government securities having high-ratings assigned with very low credit risk. Since the government is the borrower, gilt funds are an ideal choice for risk-averse fixed-income investors.

Mutual funds with higher durations will benefit more. So, long-term debt funds and dynamic debt funds with increased duration in the portfolio are expected to benefit more from reducing interest rates.

Are Debt Mutual Funds better than Fixed Deposits(FDs)?

Amendment to Finance Bill 2023 removed the indexation benefit on debt mutual funds. They will now be taxed at investor’s slab rates. These changes will bring the taxation of debt mutual funds at par with fixed deposits. Earlier investing in debt mutual funds were taxed at 20% with indexation for LTCG with holding periods above 3 years, giving an advantage to the investors who fall in higher tax slab brackets.

Despite the recent amendments, there are still several compelling reasons why debt funds can be a great investment option over Fixed Deposits-

1. Actively Managed:

Bank FD’s have maturity ranging from 7 days to several years, yielding returns at a predetermined fixed interest rate annually, whereas debt mutual funds give the right to the fund managers to generate returns that surpass the benchmark index by rebalancing the portfolio.

2. Liquidity:

Regular FDs have fixed maturity periods giving less liquidity to investors. Early withdrawals from fixed deposits typically incur penalties, Debt funds have no exit loads after a certain period. Therefore debt mutual funds can be sold like any normal mutual fund and it offers high liquidity.

3. Returns:

Debt funds historically have delivered higher returns than fixed deposits.

Profits from Debt mutual funds are classified as capital gains, while fixed deposits are categorized as ‘income from other sources’. This means that in the event of losses with debt mutual funds, they can be carried forward and offset against gains.

4.Taxation:

Debt mutual funds are only subject to taxation at the time when the investments are sold . Therefore, it can help you in deferring taxes unlike Fixed Deposits where interest income was taxed at the individual’s applicable tax slab.

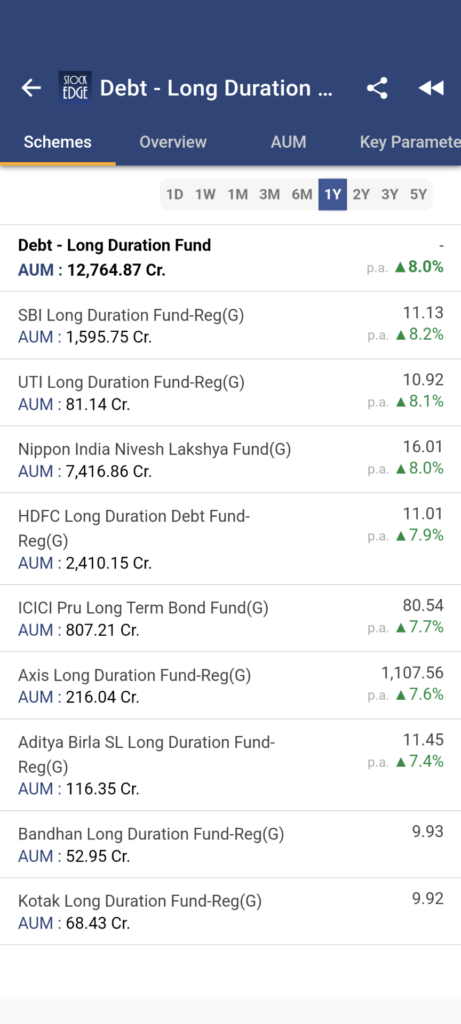

Top Schemes Which May Generate Good Returns:

Debt Mutual Fund schemes having longer duration to maturity with a modified duration of above eight years are going to benefit the most. Some of the debt mutual fund schemes that fulfills the selection criteria are:

HDFC Long Duration Fund- Direct- These long-duration debt funds are invested mainly in government bonds with maturity of seven years or more. It has a modified duration of 11.73 years and YTM of 7.24%.

Nippon Nivesh Lakshya Fund- Direct- This scheme is Long Duration debt funds with modified duration of 10.22 years and giving yield of 7.23%.

SBI Long Duration Fund—Direct—This scheme is a Long-Duration debt fund with a modified duration of 11.85 years and a yield of 7.23%.

Kotak Dynamic Bond Fund- Direct- This debt mutual fund scheme falls under Dynamic bond category with modified duration of 7.91 years and yield of 7.43%.

HDFC Long Duration Debt Fund—Direct—This scheme is a Long-Duration debt fund with a modified duration of 11.73 years and a yield of 7.24%.

UTI Long Duration Fund- Direct- This scheme is a duration debt funds with a modified duration of 9.13 years and giving a yield of 7.22%.

SBI Dynamic Bond Fund—Direct—This debt mutual fund scheme falls under the Dynamic bond category. Its modified duration is 8.34 years and its yield is 7.41%.

DSP Gilt Fund- Direct- This debt mutual fund scheme falls under the Gilt Funds category. They invest in securities issued by Central and State governments with a modified duration of 10.52 years and a yield of 7.27%.

Edelweiss Government Securities Fund- Direct- This debt mutual fund scheme falls under Gilt Funds category. They invest in securities issued by Central and State governments with a modified duration of 8.76 years and a yield of 7.21%.

Invesco India Gilt Fund- Direct- This debt mutual fund scheme falls under the Gilt Funds category. Fund has a modified duration of 10.19 years and yield-to-maturity of 7.25%.

Steps To Invest In Debt Mutual Funds

Investing in debt funds is relatively easy; there are two ways to invest in debt funds

- Directly through the mutual fund house

- Through a Mutual Fund Distributor/ Broker

Below are the steps mentioned :

1. Complete the KYC process by submitting all the relevant documents-

- ID Proof

- Address Proof

- PAN Card

2. Visit StockEdge and choose the best debt mutual fund that you’d like to invest in. StockEdge MF Analysis can be used to compare funds, check its performance, investment objective and other necessary details.

3. Decide whether you want to invest via Systematic Investment Plan (SIP) or Lumpsum

4. Decide on the amount that needs to be invested.

5. Register yourself on the mutual fund house website/ MFD broker

(keep the login credentials safe)

6. Invest via Net Banking.

Conclusion:

Many times, investing in debt funds seems to be complex for many retail investors. In case you don’t possess enough financial knowledge and are finding it too difficult to understand, then you can simply invest in Liquid funds, Ultra short duration funds which deliver a yield in between 6 to 7 percent, alternatively you can reach out to us if you want to understand it further. We offer handpicked funds from experts.

Join StockEdge Club today!

The debt market operates in cycles. There is an upcycle that comes after every downcycle. The 10-year G-Sec yield touched 7.6% during its upcycle, which began in June 2022. Movement in the downcycle has started since January 2024, which may last 12-15 months, pushing the yield down by 100 bps towards 6.25% levels.

Bond prices will rise, and in 2024, duration funds may yield annualized pre-tax returns of 12% to 16%.

Investors should consider government securities that primarily focus on long-dated Indian Government Bonds (IGBs)/State Development Loans (SDL) with an average maturity ranging from 10 to 20 years, depending on their individual risk appetite and investment horizon.

Therefore, it is essential to check the modified duration of a fund when investing in long-term debt funds, Dynamic bond funds and Long-term Gilt securities.

For those looking for long-term double digit returns, long duration funds should be an ideal choice. Some recommended debt mutual funds are HDFC Long Duration Debt Fund, Nippon India Nivesh Lakshya Fund and SBI Long Duration Fund.

However, investors need to keep in mind that for short-term needs, they can park their money in liquid funds, ultra-short-duration funds, or money market instruments.