Key Takeaways

- India VIX: India VIX measures expected volatility in the market over the next 30 days. It tells you how much the market might move, not which way.

- Extreme VIX levels Signal: A VIX reading below 15 suggests calm markets, while levels above 20 indicate heightened fear and uncertainty. Recognizing these levels helps investors adjust risk exposure.

- Smart Strategies on VIX:

- When VIX is high, traders may consider reducing open positions or applying tighter stop-losses. Option sellers might benefit from strategies like short strangles or bear call spreads.

- When VIX is low, traders can consider broader stop-losses and prepare for potential sharp moves.

- VIX Plus Technical Analysis: Using VIX trends along with chart patterns allows for more precise and confident decision-making, especially during periods of market volatility.

- Your Trading Edge with VIX: India VIX acts as a risk barometer. When used smartly, it helps you time trades better, manage stress during market swings, and refine your strategy for long-term success.

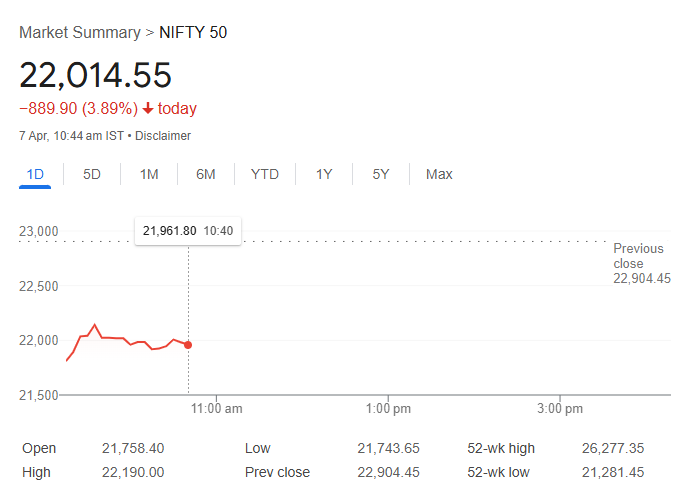

A ‘Black Monday’ for the financial market.

On Monday, the 7th of April, 2025, the Indian financial markets witnessed the first biggest decline in Nifty 50 for the financial year 2025-2026. Is it a Black Monday for the Indian stock market? For starters, the term ‘Black Monday’ was first coined on October 19, 1987, in the US, when the Dow Jones Industrial Average (DJIA) plummeted by 22.6% in just one day.

In recent times, 7th April 2025 the Indian stock market witnessed one the biggest drop of nearly 1000+ points in the benchmark index Nifty 50. However, there is one such index that shows early signs of such high market volatility. Yes! That is NSE INDIA VIX.

Here is a demonstration:

As you see, the INDIA VIX jumped by more than 50%+ in early trades where the Nifty 50 hitting nearly 1000+ drop near the day low.

So, what is India Vix?

Imagine you are on a rollercoaster. Before the big drop, your heartbeat races not because you are falling, but because you expect to. That expectation of a jolt? That’s what the India VIX captures; the market’s emotional heartbeat about future volatility.

NSE INDIA VIX: Overview

India Vix is a volatility index managed by the National Stock Exchange (NSE). Hence the name “NSE INDIA VIX”. The volatility of the market is computed using the bid/ask quotes of the out-of-the-money (OTM) for near and next-month NIFTY option contracts to depict the expected market volatility over the next 30 days.

Table of Contents

To simply put, higher the NSE India VIX values, the higher the expected volatility and vice-versa.

Here is a chart explaining the concept-

History of the Volatility Index

The first volatility index introduced by the Chicago Board of Options Exchange (CBOE) was the first to introduce the volatility index for the US markets in 1993 based on S&P 100 Index option prices. But in 2003, the methodology was revised and the new volatility index was based on S&P 500 Index options.

Key Factors affecting the NSE India VIX

Vix, popularly known as the Fear Index, has some key factors affecting it.

- Uncertainty

It is generally seen, whenever there is uncertainty in the market India VIX tends to rise and vice versa. That means crashes in the benchmark index Nifty 50 usually spike option premiums, raising the NSE India VIX.

- Global Macro Factors

Sometimes geopolitical tensions like the tariff war by the US, Fed announcements on interest rates, or any global financial crises like the recession of 2008 and covid 19, can ripple into Indian markets, raising NSE India VIX.

- Domestic Macro Factors

Some domestic events like the Union Budget, RBI monetary policy meeting, election results, or corporate earnings may often lead to market speculation and hedging, raising volatility thereby increasing the NSE India VIX.

How do you plan trades tracking NSE India VIX?

If Nifty 50 is the benchmark for the Indian stock market, then NSE India VIX is the mood of the market! This means that India VIX only predicts high or low volatility in the market.

Tracking the India VIX is like reading the mood of the market so you can tune your strategy to match the mood of the market. India VIX is like a compass that guides you during high volatility.

1. Understand High VIX- Low VIX

When India’s VIX is below 15, it is usually considered a low VIX, where trades or market participants expect stability. On the other hand, when India’s VIX is above 20 or more, it generally indicates a high VIX where traders expect fear and uncertainty in the market. Conversely, a rising VIX generally indicates high volatility, and traders usually expect a market fall! When the VIX falls, it generally indicates less volatility, and traders usually expect a rise in the market.

2. High Volatility – An opportunity for some!

When there is high volatility in the market, India VIX spikes and there is a rise in option premiums which get expensive. In such a scenario option sellers have a greater opportunity as they are selling options at higher prices and if they are confident about the direction of the market or expect a range bound, then option strategies like short strangles, iron condors, bear call spreads are great in such a scenario.

In contrast, when there is a continuous rise in VIX, it may explode. Traders may buy options that are fairly priced, and as volatility spikes, option premiums rise, which may benefit the option buyers.

3. Trend in VIX

A trend where both VIX and benchmark index Nifty 50 is rising is usually a sign of warning as fear is building up! Traders must be cautious in such a scenario. But a trend where both VIX and Nifty 50 is falling, is generally a sign for market cool-off after a high volatility and traders expect the price to settle.

4. Position Sizing by tracking India VIX

When volatility rises in the market, the first and foremost thing to do by the market participants is risk management by doing position sizing. A wise strategy during a high VIX environment is to reduce your open positions, as markets can sweep your gains out even if you’re right during high volatility. Using tiger stop losses may save your capital somewhat. However, during low VIX, when markets are stable, you may keep a wider stop loss but with caution, as a reversal in trend can occur anytime, especially when you do not expect the most. So, it is advisable to create a hedge for your position in the market to minimize the risk.

5. Combine VIX

A powerful combination in trading is when you combine your technical analysis to interpret the trend and structure your trades by closely tracking the NSE India VIX.

For example, you see a sharp rise in VIX as the markets drastically fall. Using technical analysis, you expect the market to remain bearish in the near term. So, how do you create a strategy? At this point, when VIX is high, you are aware that option premiums are high, and selling options can be beneficial at this point. Now, when you expect a bearish move along with high option premiums, ideally, a bear call spread could be deployed to gain from such a market scenario.

The Bottom Line: Trade Smarter!

India VIX is more than a number; it’s a read on the market’s mood, a silent signal about what’s brewing beneath the charts. So do use it to size your positions wisely, choose the right option strategies, and anticipate periods of market turbulence or calm. Do pair it with technical analysis or event calendars for sharper trade setups. But don’t treat it like a crystal ball for market direction.

VIX tells you how much markets might move, not which way. Don’t ignore it if you are especially trading options. It is the engine behind your premiums. And above all, don’t overtrade in high-VIX environments thinking big moves mean easy profits. It is because when volatility is king, whipsaws come free. Use India VIX as your market mood map: it won’t tell you where to go, but it will warn you how wild the ride might be.

Happy Trading!