Table of Contents

Key Takeaways

- Strong Brand Portfolio: Nestlé India boasts iconic brands like Maggi, Nescafé, KitKat, and Milkmaid, making it a household name across the country.

- Impressive Financials: Nestlé India showcases strong capital efficiency, low debt, and a premium market valuation driven by brand strength.

- Robust Management and Ownership: Led by Chairman and MD Suresh Narayanan, whose tenure was extended for five years in June. Nestlé S.A. holds a 62.76% stake, ensuring strong parent company support.

- Growth Potential in FMCG Sector: With India’s packaged food market valued at $100 billion, there’s significant room for growth, especially as the country transitions from unorganized to organized sectors.

- Stock Split and Accessibility: In January 2024, Nestlé India underwent its first-ever stock split in a 1:10 ratio, making shares more accessible to retail investors.

Do you love eating Maggi? You must be wondering what kind of a silly question this is: who doesn’t love Maggi? In 1983, Maggi, 2 minutes instant noodles, was introduced in India, and with the passing of time, it has now become a sentimental connection with people across generations in India. The company that introduced Maggi to India is Nestlé, a global leader in the Fast-Moving Consumer Goods (FMCG) sector, which is a Swiss multinational company with a rich history dating back to 1866.

Its presence in the FMCG space spans various categories, including milk products and nutrition, beverages, cooked food and cooking aids, chocolates, and confectionery, as well as across geographies, including India.

The company was established in India in 1959, and Nestle India stock was listed in 1969 on the Bombay Stock Exchange (BSE). The share price of a company climbed from a few hundred rupees a share to ₹27000/share. Recently, Nestle India stock had its first-ever stock split in a 1:10 ratio.

So, is it still worth investing in Nestle India stock post-stock split? Let’s find out.

Company Overview

Nestle India, currently headquartered in Gurgaon and its parent company Nestle S.A. of Switzerland, owns a 62.76% stake in the company. It is one of the world’s largest food and beverage players. It is one of the world’s largest food and beverage players often featuring as top gainers in the market.

A few of its prominent brands are Nescafe, Nestlè Everyday, Ceregrow, Nangrow, Maggi, Kitkat, Milkybar, Milkmaid, Milo, Nestea, Munch, Bar one, Polo, Nestle Milk and many more. Which one is your favorite?

Additionally, it is important to note the company follows the period of 1st January to 31st December as its financial year for the preparation of its financial statements.

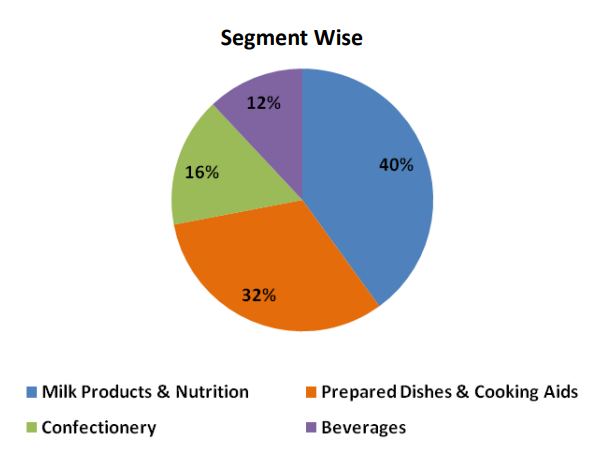

The revenue mix of Nestle India for different product categories based on CY22 is shown below:

The company has a pan India presence with nine manufacturing facilities, four branch offices.

FMCG – Sectoral Outlook

The total Food & Beverages market size in India is valued at USD 800 bn. Of this, the packaged food market size is USD 100 bn, and the branded packaged market size is USD 40 bn. Hence, it has a vast scope for expansion. As of today, India is way behind in the packaged food industry, below China at 4.2x and other southeastern Asian countries like the Philippines at 3.3x, which suggests ample headroom for growth in the segment.

The transition from an unorganized to an organized segment in the sector is likely to continue in the coming years in India. Consumer trends and increasing salience towards the adoption of brands in small towns and villages have propelled the growth of FMCG companies.

Financial Highlights

Analyzing financial statements such as income statements, balance sheets, and cash flow statements helps investors assess the company’s ability to generate returns, manage debt, and sustain growth, enabling informed and prudent investment choices.

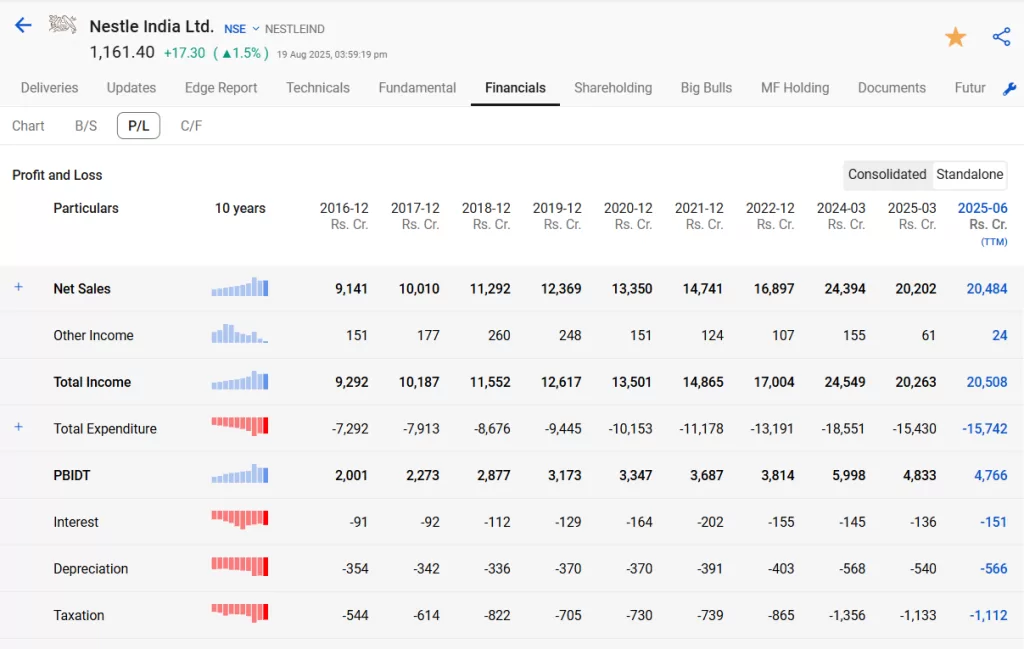

Income statement of Nestle India Ltd.

The income statement, commonly known as the profit and loss statement, gives you an understanding of its financial performance, such as its sales growth, profitability, etc.

At StockEdge, we have organized the income statement in a way that will help you analyze it with ease rather than going through the conventional way of downloading the documents from the stock exchanges, which could be time-consuming and tiresome to many.

In the above image, you can see the annual income statement of Nestle India stock. Every detail is in front of your eyes, starting from the top-line sales figures to the bottom-line Net profit of the company.

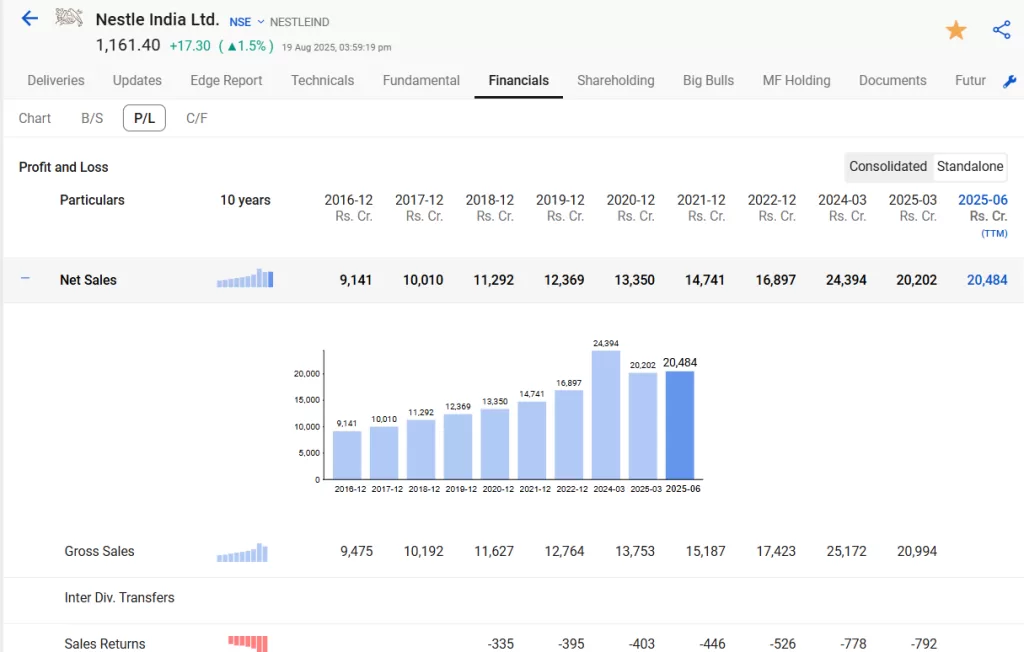

Sales Growth

In FY25, net sales were ₹20,400cr. Growth was broad-based and aided by pricing, volume, and product mix.

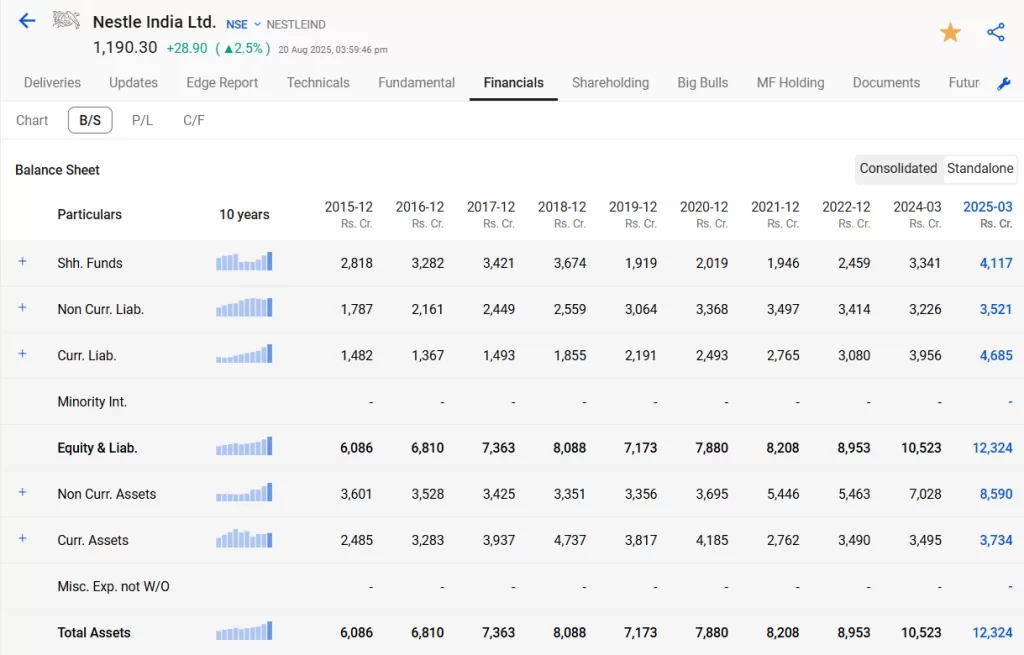

Balance Sheet of Nestle India Ltd.

The balance sheet follows the accounting equation: Assets = Liabilities + Equity. It provides a company’s financial position, stability, and overall health.

In the above image, you can see the balance sheet of Nestle India Ltd. It provides an overview of the financial position as on date. What are the assets and liabilities of the company? Liabilities of a company can be both short term and long term.

Nestle India continues to have a negligible amount of debt on its balance sheet for a very long time.

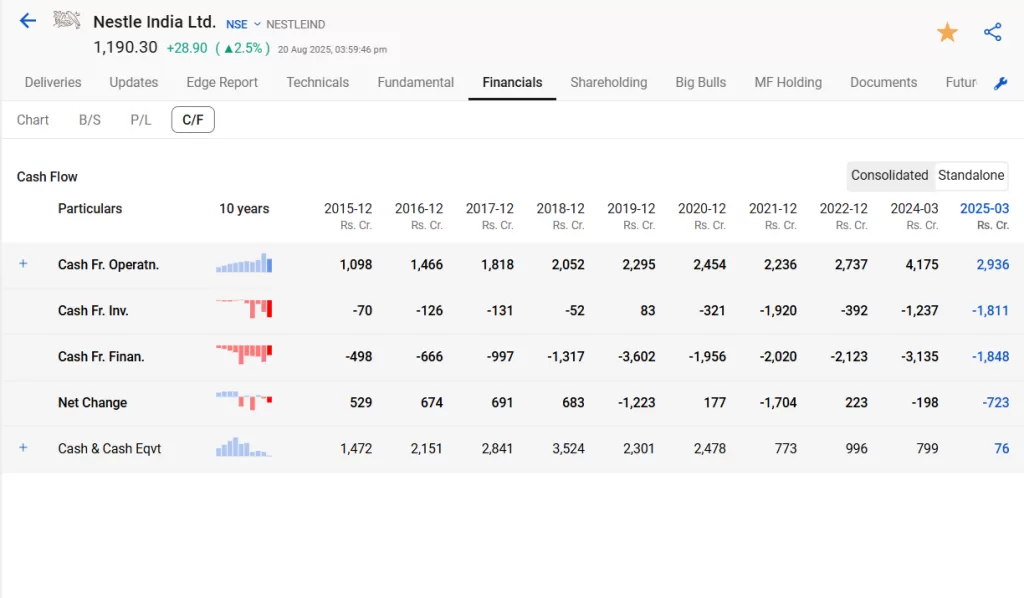

Cash Flow Statement of Nestle India Ltd.

A cash flow statement provides a summary of how a company generates and uses cash over a specific period of time. It has three different sections:

- Operating cash flow statement

- Financing cash flow statement

- Investing cash flow statement

Out of these the most important one being the cash flow from operations as it provides you with an understanding of how the company generated cash from its core business operations. A positive cash flow from operation signifies that the company has generated higher cash revenue than its expenditure.

In CY22, Nestle India reported a cash flow from operations amounting to ₹2,926 crore. This improvement can be attributed to enhanced operating profit and effective working capital adjustments.

In investing activities, there was a significant decrease in cash outflow, amounting to ₹1811 crore, as opposed to the previous year’s outflow of ₹1237 crore. This is due to a decrease in substantial investments made by the company in the prior year.

Overall, the company’s cash flow dynamics in FY25 reflect a positive trend in operating performance.

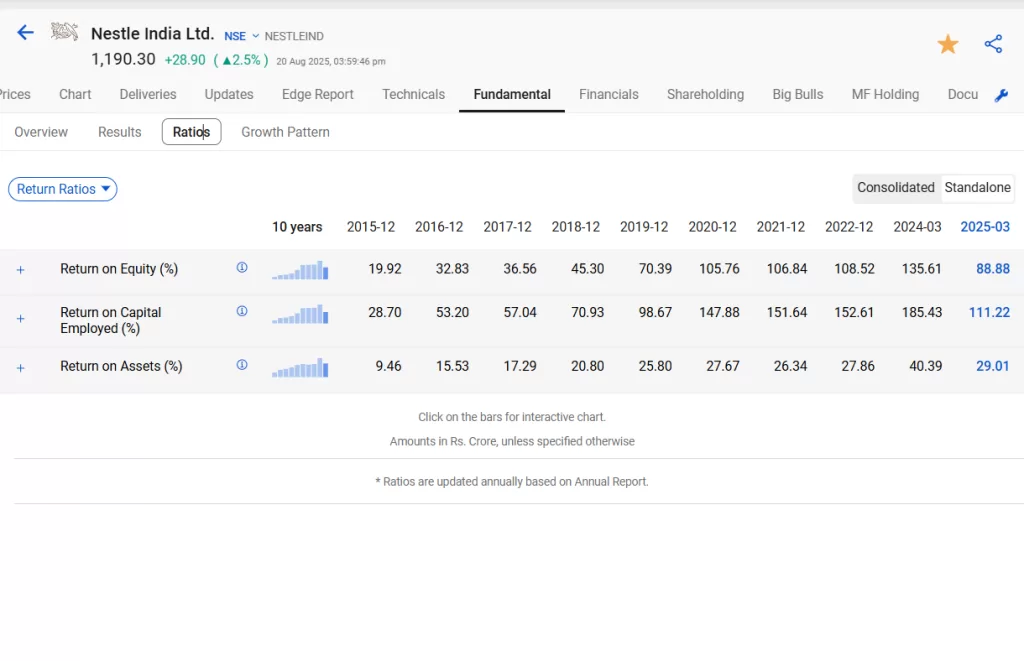

Ratio Analysis of Nestle India Stock

Ratio analysis of a company involves evaluating a company’s financial performance by examining certain ratios which are derived from its financial statements. It makes easy comparing the financial performance to its industry benchmarks or competitors.

Ratio has different classifications like profitability ratios, solvency ratios, return ratios and more as you can see in the image below, you can analyze all such ratios directly from StockEdge.

Here are the return ratios of the Nestle India stock, starting with the two most important ratios which are ROE and ROCE.

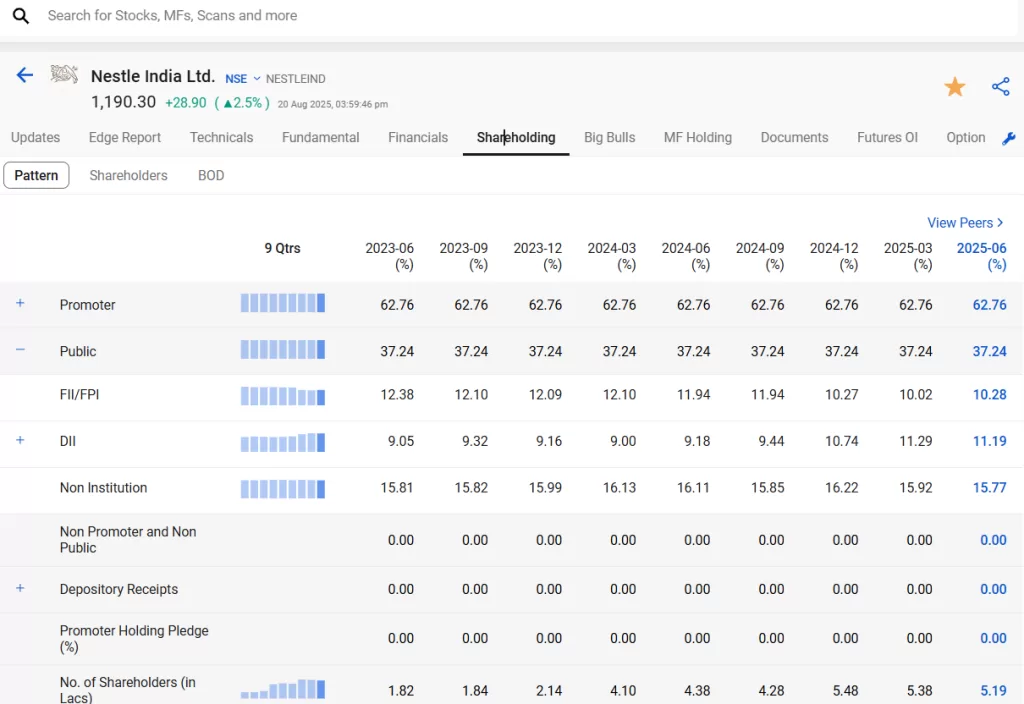

Management Quality & Shareholding Pattern

Suresh Narayanan, the company’s chairman and managing director, was given a five-year extension to his contract in June. The management’s main focus remains on expanding market penetration and attaining volume growth, especially in its core product line.

Coming to the shareholding pattern of Nestle India stock, you can check it from the StockEdge App itself.

Nestle India’s ownership structure has proven stable, with the promoter keeping a steady 62.76% stake over an extended period of time.

Noteworthy adjustments in investor positions have been observed, as the FII (Foreign Institutional Investor) stake saw increase to 10.28%/.

These alterations reflect an evolving investor interest in Nestle India stock, with FIIs and DIIs making strategic adjustments to their holdings. In contrast, the promoter’s stake remains unwavering, underscoring a consistent and steadfast commitment to the company.

Future Outlook of Nestle India Stock

Nestle India’s achievements are rooted in a strong amalgamation of elements, encompassing a formidable brand presence, a varied product lineup, an expansive distribution network, and the utilization of exclusive technology from its parent corporation. This is further supported by substantial research and development capabilities.

The company is strategically leveraging these strengths to enhance its presence in the e-commerce landscape, with a particular emphasis on hyperlocal (quick commerce) channels.

Nestle India’s strategic focus remains on core categories such as milk & nutrition, chocolates & confectionery, and coffee & beverages, aiming to capitalize on growth and expansion opportunities within these segments. Key brands like Nescafé, Kitkat, Everyday, Maggi noodles, and Masala-AeMagic continue to play a pivotal role as significant growth drivers.

The company is actively pursuing rural expansion, with rural sales presently contributing around 20%-25% to overall domestic sales. Nestle India plans to intensify its efforts in rural areas, emphasizing capacity expansion and introducing new products to cater to the unique needs and preferences of the rural consumer base. This holistic approach highlights Nestle India’s dedication to ongoing growth, continuous innovation, and an expanded footprint in the market.

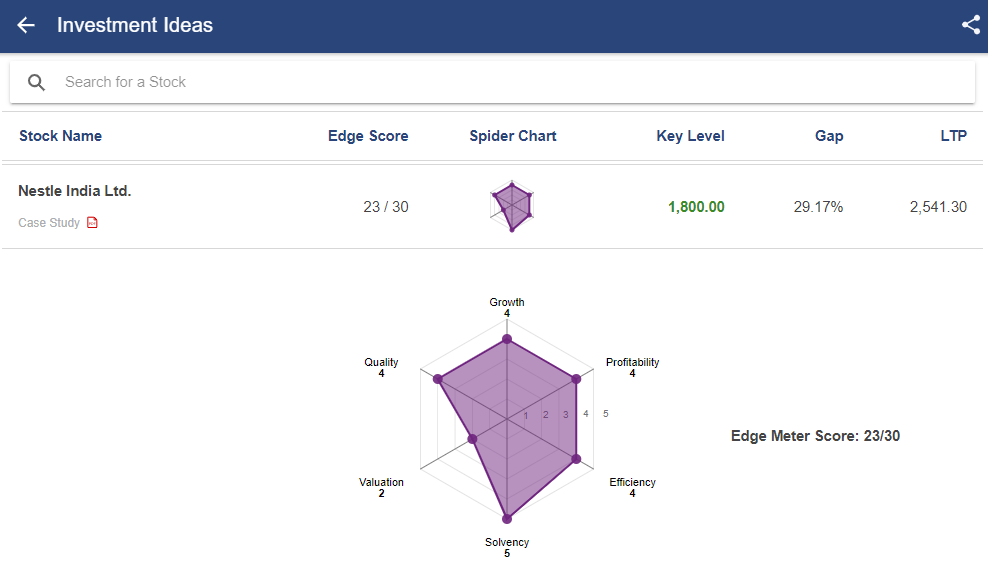

Case Study on Nestle India Stock

We have a case study report prepared by our team of analysts. This fundamental report on Nestle India stock provides you with a detailed analysis of the company as well as how it stands among its competitors.

As you can see, Nestle India stock has rating based on 6 parameters:

- Growth

- Quality

- Profitability

- Efficiency

- Solvency

- Valuation

Based on the above parameters, Nestle India stock scored 23/30. Read the case study report on Nestle India stock.

Conclusion

In conclusion, Nestle India emerges as a compelling investment opportunity for several reasons. The company’s steadfast focus on core categories, bolstered by a strong brand presence and diversified product mix, positions it well for sustained growth. Utilizing the exclusive technology from its parent company and having strong research and development capabilities further strengthens Nestle India’s competitive advantage. The strategic emphasis on expanding e-commerce channels, particularly in the quick commerce segment, aligns with evolving consumer trends.

Additionally, the company’s commitment to rural expansion, new product launches, and continuous innovation underscores its proactive approach to tapping into diverse market segments. With a proven track record, consistent financial performance, and a visionary growth strategy, Nestle India presents itself as an attractive prospect for investors seeking a reliable and resilient investment in the FMCG sector.

Apart from Nestle India stock, there are other stocks which are part of the Nifty 50 index. Read this blog All About NIFTY50, Components of NIFTY50, and How to Invest in it.

Happy Investing!

Which company introduced Maggie in India?

Nestle India introduced the iconic 2 minute instant noodles in India.

When did Nestle established in India?

Nestlé, a global leader in the Fast-Moving Consumer Goods (FMCG) sector, is a Swiss multinational company that established itself in India in the year 1959.

When was Nestle India stock listed in the stock exchanges?

Nestle India stock was listed in 1969 on the Bombay Stock Exchange (BSE).