Key Takeaways

- Stock Performance: Dr. Reddy’s share surged by 37% over the past year, and has delivered nearly 120% returns over the last 5 years, showcasing strong growth potential.

- Business Model: The company’s portfolio includes over 400 generic drugs, APIs, biosimilars, and differentiated formulations. The Global Generics segment contributes over 80% to total revenue.

- Global Presence: Dr. Reddy’s has a significant international footprint, with 46% of its revenue coming from North America, 18% from Emerging Markets, and 16% from India.

- Strong Financials: The company has achieved a 12% CAGR in revenue and a 39% CAGR in net profit over the last 5 years. In Q3 FY24, revenue grew by 6.6% YoY, and net profit increased by 11% YoY.

- SWOT Analysis:

- Strengths: Diverse product portfolio and strong global presence.

- Weaknesses: Exposure to price erosion in generic markets.

- Opportunities: Expansion in biosimilars and emerging markets.

- Threats: Regulatory challenges and intense competition.

Table of Contents

In the last 5 years, Dr Reddy’s share has surged by 50% as of July 2025, which is phenomenal for any stock, especially in the pharmaceutical industry. That’s because the healthcare or pharmaceutical business is generally resilient to any significant economic downturns. The overall sector remains stable, providing a healthy return to its shareholders.

However, industry dynamics have changed since the COVID-19 pandemic, with people now being more conscious of their health, which has driven overall growth for the entire industry.

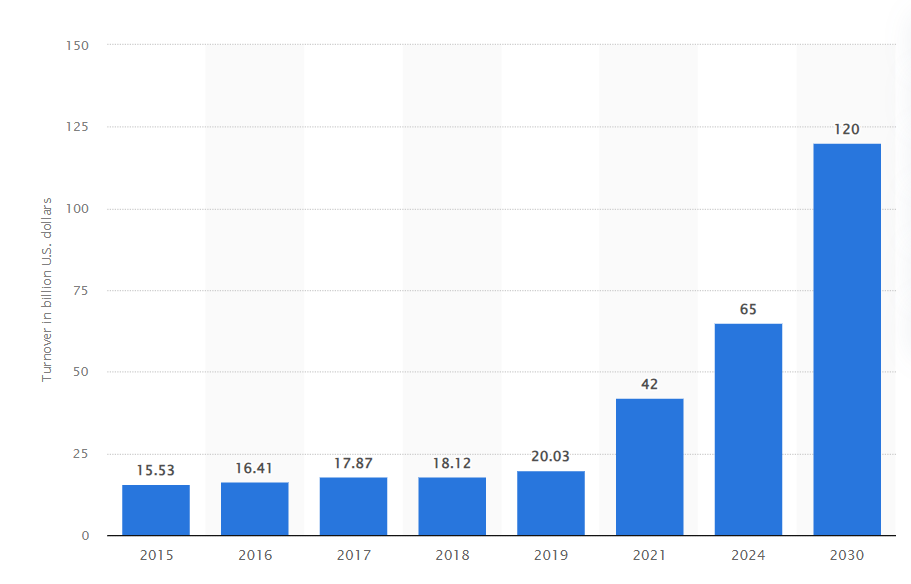

Here is a glimpse of the annual turnover of the Indian pharmaceutical market from 2015 to 2021, with expected growth till 2030 (USD billion)

Dr Reddy’s Laboratories Ltd. is a pharmaceutical company headquartered in Hyderabad, India. Established in 1986, it has become a renowned name in the healthcare sector, dedicated to serving millions of patients with high-quality, affordable, and innovative medicines.

In this blog, you can get the answer to this question and decide for yourself is this a good investment opportunity in the long run or not.

Company Overview

Dr Reddy’s portfolio includes pharmaceutical generics, APIs, custom pharmaceutical services, biosimilar and differentiated formulations. Company has Global Generics, Pharmaceutical Services & Active Ingredients (PSAI) and Proprietary Products & Others. Global Generic contributes to more than 80% of Total Revenue. It is the main business of the company wherein it offers 400+ high-quality generic drugs.

In June 2020, the company completed the acquisition of selected divisions of Wockhardt Ltd branded generics business in India, Nepal, Sri Lanka, Bhutan and Maldives. The company has a global presence, with more than 30% of Revenue coming from the USA.

Segment Breakup

During the quarter Q3 FY24, the revenue contribution across geographies were: North America 46%, Emerging Markets 18%, India 16%, PSAI (pharmaceutical services and active ingredients) 11%, Europe 7% and others 2%.

Financial Highlights

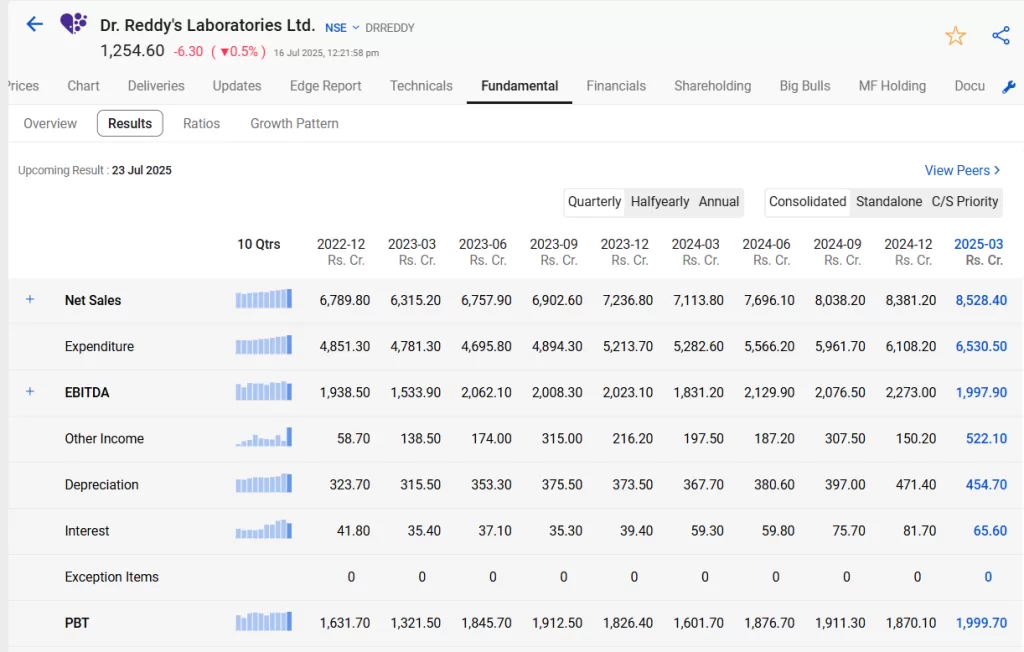

Using StockEdge, you can view the trend of net sales growth of Dr Reddy’s with the help of bar charts as shown in the below image.

Dr. Reddy’s Laboratories Ltd. reported a robust performance for the March 2025 quarter with its highest-ever net sales of ₹8,528.40 crore, marking a 1.8% increase from the previous quarter. However, the company faced a sharp 6.9% rise in expenditure to ₹6,530.50 crore, which led to a decline in EBITDA to ₹1,997.90 crore from ₹2,273 crore, indicating pressure on operating margins.

A major highlight was the surge in other income to ₹522.10 crore, up from ₹150.20 crore, which significantly supported the bottom line. Despite higher costs, the company posted a 6.9% sequential growth in Profit Before Tax at ₹1,999.70 crore, aided by improved treasury income and a decline in interest expenses to ₹65.60 crore. While revenue momentum remains strong, sustaining profitability will depend on managing input costs and maintaining operational efficiency in the upcoming quarters.

SWOT Analysis of Dr Reddy’s Share

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses,

opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions

Strength

The company has geographically diversified revenue segments. The product portfolio includes branded formulations, biosimilars, API, and OTC, which contribute to the core business. The global generic business contributes more than 80% towards the revenue. It is backward integrated in the APIs to the extent of 50%. Gross Profit margin improved on account of favorable product mix owing to price erosion on the baseline. The company continued to invest in R&D of new products in its biosimilars and generics businesses.

Additionally, during this quarter of Q3 FY24, the company acquired MenoLabs branded portfolio of women’s health-focused supplements in the U.S.

Weakness

The larger portion of revenue depends on international markets; thus, the company is vulnerable to foreign exchange fluctuations. The decline in Pharmaceutical Services and Active Ingredients was mainly due to price erosion in some of its products.

Opportunity

The company has made strategic moves, including new product launches and strengthening its portfolio through acquisitions and divestments. The management’s focus on R&D investments indicates a commitment to developing a robust pipeline of new products, both in small molecules and biosimilars. This emphasis on innovation and expansion is aimed at improving the affordability and accessibility of medicines for patients globally. It expects a 25% EBITDA margin going forward. They aim to launch approximately 25-30 new products across key markets in the next three years, emphasizing their commitment to continued growth and innovation.

Threat

Any regulatory and product litigation delays will be key risks to the stock.

The Bottom Line

Dr. Reddy’s Laboratories, a prominent player in the Nifty 50, stands out for its strong geographical diversification and a robust product pipeline. The company’s strategic focus on complex and differentiated formulations, backed by substantial R&D investments, positions it ahead in the competitive pharmaceutical market. But the regulatory issues arising out of litigation will keep affecting the business until resolved. However, new launches will provide good traction going ahead. Dr Reddy’s targets to launch ~25-30 new products across its key markets in FY25 and FY26. Additionally, it aims to launch six new biosimilar products, with the timeline (by FY30) contingent upon the necessary approvals. However, the first product may be launched by CY27.