Table of Contents

Key Takeaways

- Company Overview: JSW Steel is India’s largest private-sector steel producer, with a consolidated installed crude steel capacity of 29.7 million tonnes per annum (MTPA).

- Financial Performance: The company has demonstrated strong financials, with consistent growth in sales, EBITDA, and profit after tax (PAT).

- Management Quality: JSW Steel’s management is known for its strategic vision and execution capabilities, contributing to the company’s robust performance.

- Sector Outlook: The iron and steel sector in India is poised for growth, driven by infrastructure development and increasing demand.

- Investment Considerations: Investors should consider factors such as market conditions, commodity prices, and global economic trends when evaluating JSW Steel as an investment.

Iron and Steel have been the backbone of the Indian economy for more than a century. It has not only helped the Indian economy to stabilize after independence but also contributed to India making its mark on the global platform. Today, India is one of the largest producers of steel in the world.

Those planning to build a diversified portfolio cannot ignore the iron and steel sector. One of the most noteworthy stocks in this sector is JSW Steel, one of India’s largest private sector companies and a significant contributor to India’s “Make In India” initiative. In terms of market capitalization, it is the largest company in the iron and steel sector in India. Two of its most important competitors are Tata Steel Ltd. and Steel Authority of India Ltd (SAIL).

With a quarterly revenue of 1,018 Crore (Q3, 2023), JSW Steel is the first company in India to produce 1 crore tonnes of steel per annum. It is also the first company in India to use the Corex technology for hot metal production and successfully use this technology to produce “green steel”. Headquartered in Mumbai, JSW Steel possesses diversified manufacturing facilities across various regions in India as well as in the USA and Italy. JSW is the part of many indices which includes Nifty 50, Nifty 500 and Nifty 200. As of March 2025, JSW Steel’s share price has reflected significant investor interest within its 52-week high low range

Company Overview

The history of JSW Steel dates back to 1982 when the Jindal Group acquired Piramal Steel Limited and renamed it Jindal Iron and Steel Company (JISCO). In 1994, Jindal Vijaynagar Steel Limited (JVSL) was set up with a 10,000-acre plant in Karnataka. JVSL floated its IPO in BSE and NSE in 1995. In 2005, JISCO and JVSL merged to form JSW Steel Limited.

Since then, JSW Steel has merged and acquired several companies in India and abroad. Currently, JSW Steel has a consolidated installed crude steel capacity of 29.7 MTPA (million tonnes per annum) and a domestic downstream flat products capacity of 13.5 MTPA. It manufactures a variety of steel products as well as hot-rolled oils, cold-rolled coils, galvanised products, colour-coated products and Avante Steel Doors. JSW also produced oxygen, hydrogen and nitrogen.

For ensuring raw material security, the company has a total of 13 iron ore mines as well as a coal block in India. It also has a coking coal mine in the USA and a coal mining concession in Mozambique, Africa.

Revenue Mix of JSW Steel

In the steel segment, the company’s product portfolio includes long, flat and semi-finished products. Long products include bars and rods, steel structural and railway materials which are used in the construction, general engineering and energy sectors. Flat products include hot rolled, cold rolled and coated products such as galvanised plain/galvanised corrugated (GP/GC) sheets, HR coils/sheets, CR sheets/coils, pipes, electrical steel sheets, tin plates and plates. Semi-finished products include square billets, blooms, beam blanks, slabs and rounds that are used to hot-roll sections, flat products and pipes.

While the majority of the company’s revenue comes from steel products, value-added products such as colour-coated galvanised products, iron ore, etc. also contribute to the balance sheet as can be seen below:

Sector Outlook – Iron and Steel

Before digging deeper into the company’s financials, let us take a broad look at India’s iron and steel sector. With an anticipated steel consumption of 230 million tonnes by FY 2031, India’s iron and steel sector is going through a phase of consolidation of companies. This has encouraged investments from companies operating in other sectors as well as global players.

In addition, the government has launched various initiatives over the last few years to drive the growth of the sector. The National Steel Policy 2017 is one such noteworthy initiative which was implemented to encourage the industry to reach global landmarks and push the country’s steel production capacity to 300 MTPA by 2030. In 2021, the Production Linked Incentive scheme was approved by the Union Cabinet for speciality steel with an expectation of attracting investment worth ₹400 billion into the sector.

The proposal of Indian railways to spend ₹2 lakh crore a year till FY24 to upgrade its infrastructure is another great opportunity for the sector. The opening of the mining sector and investments in the infrastructure sector are expected to drive growth in capital goods which consumes around 15% of the domestic steel produced.

Moreover, under the Housing for All by 2022 scheme, 10 to 12 million houses and 29.5 million rural units are planned to be constructed which is expected to generate a potential steel demand of 50 – 60 MT.

Furthermore, it is part of the Nifty 50, India’s benchmark index.

Financial Highlights

The financials of a company are the true picture of how the company is performing. Analysis of the various financial statements of a company is crucial to understanding whether the stock is worth investing or not. Hence, let us delve deeper and get a clearer picture.

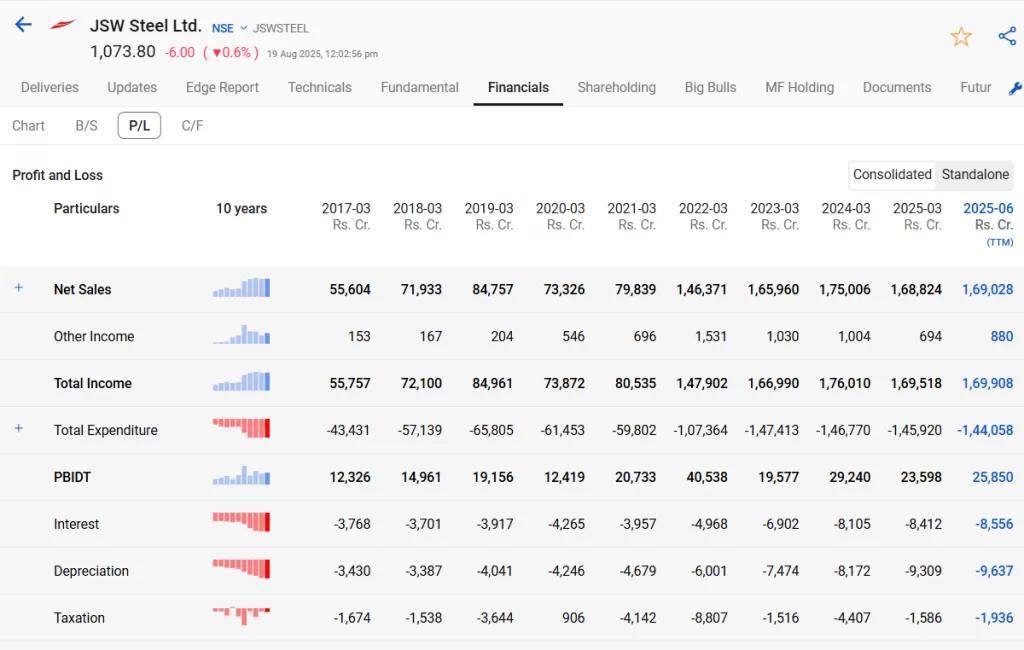

Income Statement of JSW Steel Ltd.

The income statement, also known as the profit and loss statement, provides a clear understanding of the company’s financial performance such as sales growth, profitability and others. However, reading an income statement can be tedious, especially for someone from a non-financial background.

At StockEdge, we have organized the income statement to help you analyze it with ease rather than going through the conventional and time-consuming way of downloading the documents from the stock exchanges.

The above image shows the annual income statement of JSW Steel Ltd. It consolidates all the important information from the company’s income statement from the top-line sales figures to the bottom-line net profit of the company.

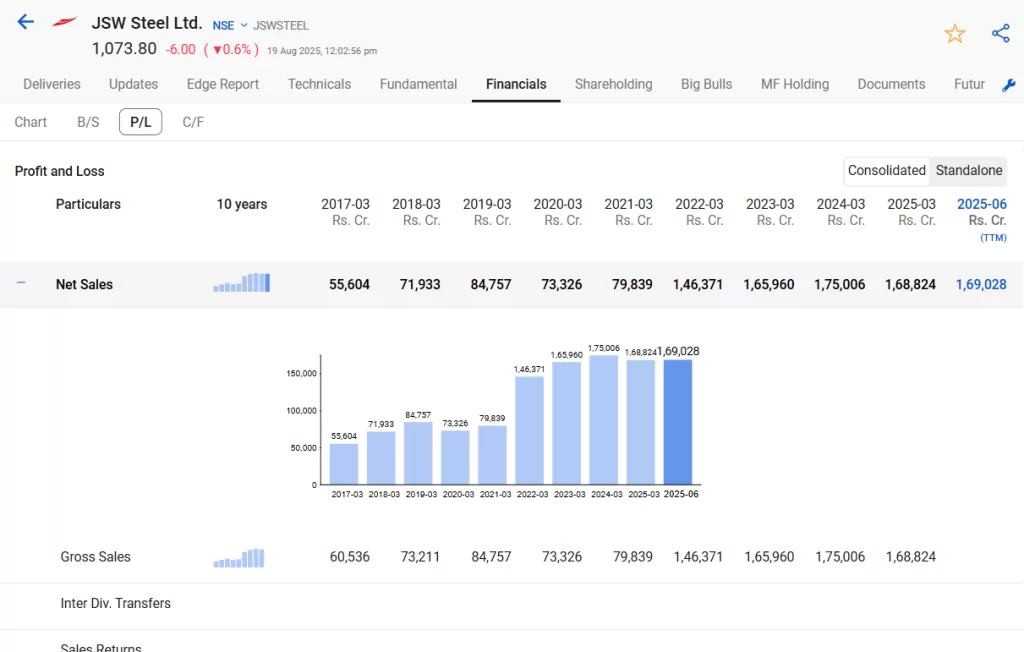

Sales Growth

The company has shown a consistent rise in sales over the last few years. In FY26, the company reported total sales of ₹169028 Crores. The increase was driven by higher volume (19.7 MT in FY23 vs 16.5 MT in FY25) as steel prices remained moderate during this period. It also has registered a 5-year CAGR of 17.8%.

PAT Growth

The company reported a profit of ₹5232 Crores in FY 26. This profit included an extraordinary gain of ₹591 Crores earned from the sale of a wholly owned subsidiary and the claim on de-allocating coal mines by a subsidiary. However, during this period, the company also witnessed a rise in finance costs and depreciation.

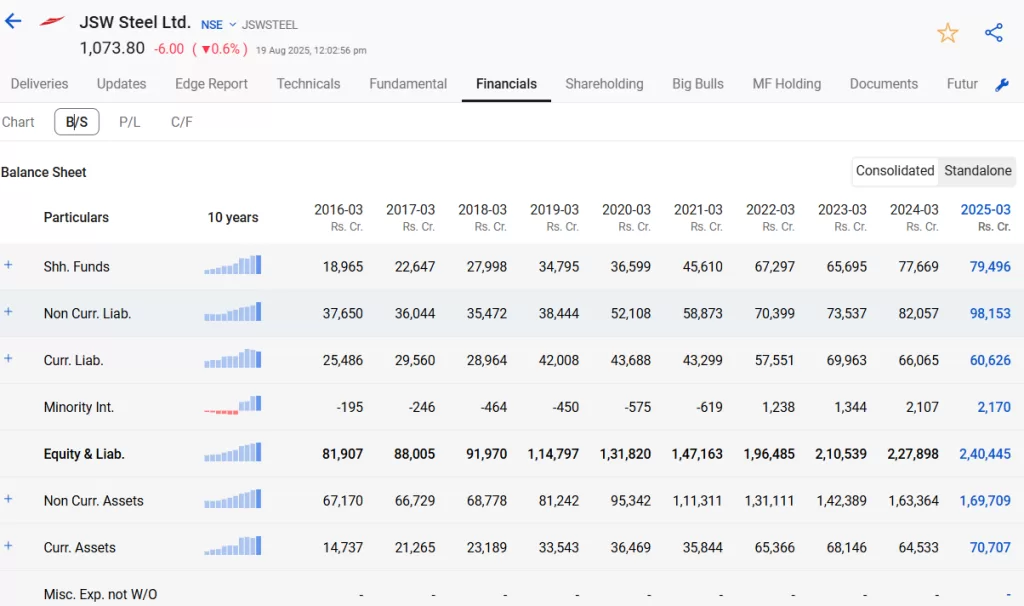

Balance Sheet of JSW Steel Ltd.

Another important financial statement of a company is its balance sheet which provides a clear understanding of the company’s financial situation, overall financial health and stability.

The balance sheet follows the accounting equation Assets = Liabilities + Equity. Here’s a snapshot of the balance sheet of JSW Steel Ltd.

Two of the most crucial components of a balance sheet are assets and liabilities. Assets are items that a company holds that have monetary value such as inventory, equipment, plants, etc. Liabilities, on the other hand, are things that the company owes to others, such as accounts payable, mortgages, etc. Liabilities can be long-term and short-term.

From the above image, we can see that in FY26, JSW Steel Ltd. had a long-term liability of ₹60,600 Crores as compared to long-term assets of ₹70,700 Crores.

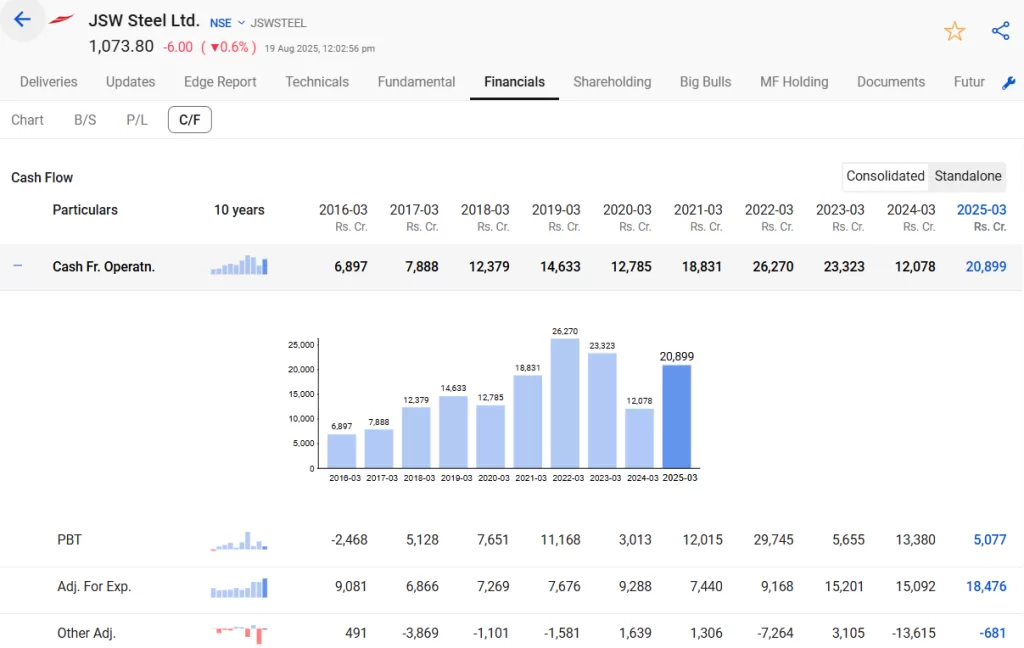

Cash Flow Statement of JSW Steel Ltd.

A cash flow statement is a summary of how a company generates and uses cash over a specific period. Out of its three sections operating cash flow, financing cash flow statement and investing cash flow statement, the first one is the most important as it provides a clear understanding of how much cash is generated from the company’s operations.

In FY26, the company generated a total cash flow of ₹20,899 Crores. The cash outflow from investing activities was ₹10,711 Crores, primarily due to the purchase of capital assets.

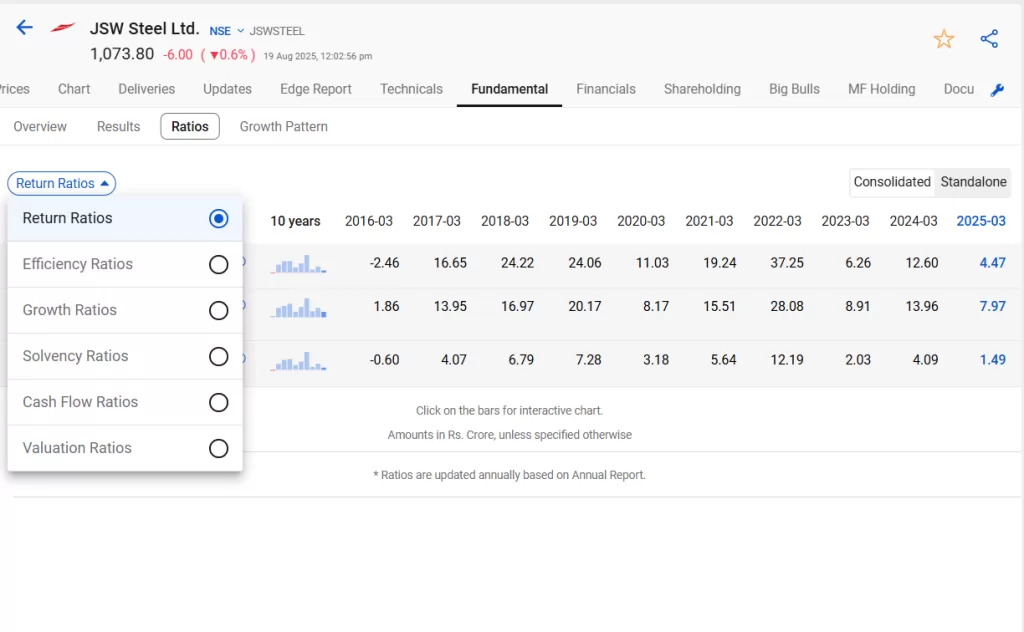

Ratio Analysis of JSW Steel Ltd.

Ratio analysis is an important tool in understanding the company’s financial performance vis-à-vis its competitors or benchmarks. It is done by deriving certain ratios from the company’s financial statements.

Thanks to StockEdge, you don’t have to calculate the ratios yourself. The app provides a detailed ratio analysis of all parameters related to a company.

The image above provides the ratio analysis screen of JSW Steel Ltd. on StockEdge App.

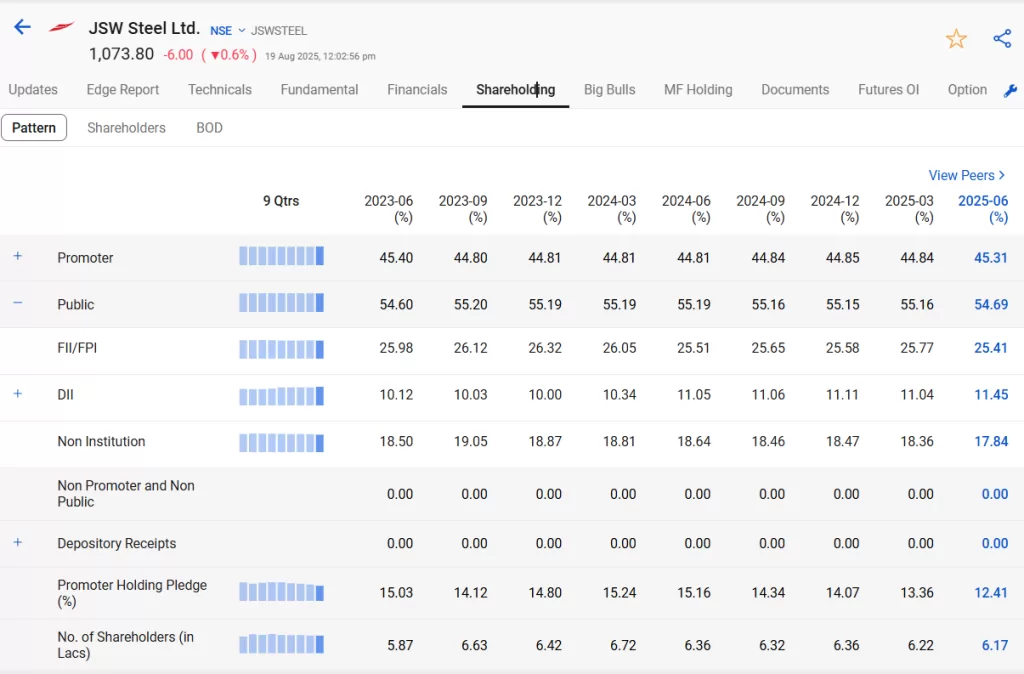

Management Quality and Shareholding Pattern

Mr Sajjan Jindal, chairman and MD of JSW Group of companies serves as the Vice Chairman of the World Steel Association. He is also the former Vice President and Chairman of the Ferrous Division of the Indian Institute of Metals.

A primary focus of the management is strategic growth by expanding its installed capacity through organic and inorganic routes. Another priority is backward integration and securing raw material security through captive mines, long-term contracts and ensuring an efficient supply chain.

You can easily check the shareholding pattern of JSW Steel from the StockEdge App.

Future Outlook of JSW Steel Ltd.

The company plans to increase its domestic crude steel production capacity to 37MT by 2025. It plans to do this by increasing the installed capacity at the Vijaynagar plant by 7.5MTPA and the BPSL plant by 1.5MTPA.

At present civil works are progressing well for the 5MTPA brownfield expansion at Vijaynagar. The project is expected to be completed by the end of FY24.

Phase-I expansion of the BPSL plant has been completed and long lead items for phase-II have been ordered. The phase-II expansion is expected to be completed by FY24.

The company also plans to commission a 0.12 MTPA colour coating line in Jammu and Kashmir in FY24 and is in the process of establishing an 8 MTPA pellet plant at Jatadhar port. This will help it export pellets as well as meet pellet demands for future expansions at different sites.

On the raw material side, the management plans to ramp up its captive iron ore mining capacity and meet 50% of its ore requirement captively.

With its aggressive growth roadmap and consistently strong financials, JSW Steel frequently appears among the top gainers NSE list, earning a place among the top gainers in the Indian steel sector.

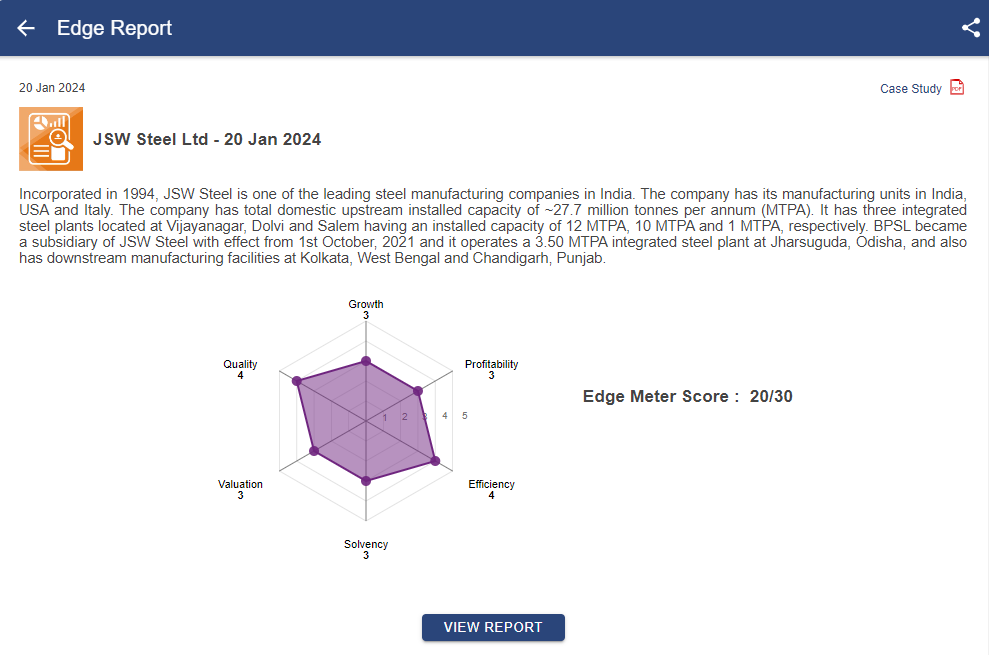

Case Study of JSW Steel Ltd.

Want to know what the analysts think about this stock? Head on to the investment ideas on the StockEdge App to access the case study prepared by our team of expert analysts. It shows a detailed analysis of the company and where it stands among its competitors. Also, recent price movements such as the 52 week high low, all time high low levels, and more.

The Edge Meter grades the company on various parameters and provides an overall score of the company. JSW Steel Ltd. has received 3 to 4 in almost all parameters, earning a total score of 20 out of 30. Read the entire case study report of JSW Steel stock.

Read next stock analysis blog; Cracking the Code: Apollo Hospitals Stock Analysis Decoded

Conclusion: A Final Word

JSW Steel Ltd. has provided a positive outlook for 2024, positioning itself as a key player in the Nifty 50 index with strong growth prospects. The fact that the company is looking at both improving its output as well as ensuring raw material security speaks volumes of the management’s resolve to drive growth.

Historically, the company has grown through expansion and acquisition. One of the priorities of the management remains looking for domestic and international acquisition opportunities to support their growth plans.

Head on to the StockEdge App today to find a detailed analysis of JSW Steel as well as other stocks that you are considering. Making informed decisions is the first step to being a smart trader.

Happy Investing!

What is the 52-week high of JSW Steel?

As of 19th August 2025, the 52-week high of JSW Steel is ₹1008

Is JSW Steel bigger than Tata Steel?

Yes, in terms of market capitalization JSW Steel Ltd. is bigger than Tata Steel Ltd. and frequently appears in the list of top gainers in the sector.