Table of Contents

“Insurance is the only product that both buyer and seller hope is never actually used” – Anonymous.

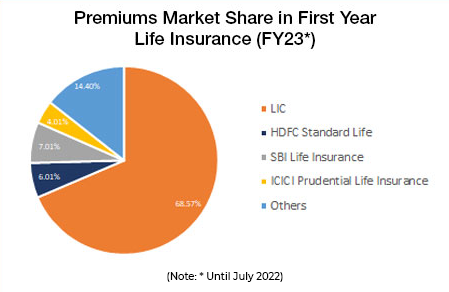

Isn’t it true for the overall insurance business? That’s why many experts consider insurance businesses to be the safest business. As of March 2024, India has 53 insurance companies, out of which 24 are life insurers and 29 are non-life insurers. In life insurance, the company that we have all known since childhood has gained the top spot in terms of market share: Life Insurance Corporation of India (LIC) is the sole public sector company.

As per FY23 data published by IBEF, based on first year life insurance premium collected, HDFC Life Insurance tops the private insurer list after LIC. So should you invest in HDFC Life Insurance share?

HDFC Life Insurance shares, listed at the National Stock Exchanges (NSE) on 17th Nov 2017 and in the past 1 year time, it has given nearly 35% return as of 19th March 2024. It is also a part of India’s benchmark index Nifty 50.

So, whether investing in HDFC life insurance shares can turn out to be a good investment for your portfolio? In this blog, let’s analyze HDFC life insurance shares fundamentally to understand its position in the current market scenario.

Company Overview

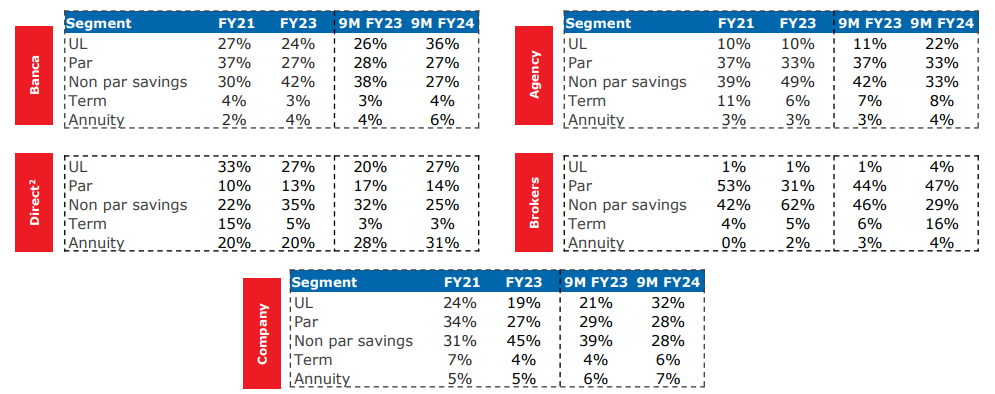

Established in 2000, HDFC Life Insurance Company Ltd. is a leading life insurance company in India, offering a wide range of insurance products that meet various customer insurance needs such as protection, pension, savings, investment, and annuity. HDFC Life has a diversified distribution mix for its products. Here is a brief overview of how each distribution channels is growing in different segments.

Financial Highlights of HDFC Life Insurance shares

HDFC Life Insurance reported a 21.5% YoY growth in Net Premium Income for FY23, making it a key stock to watch within the Nifty 50 index due to its strong performance in the insurance sector. Therefore, it is essential to keep track of its growth. Using the StockEdge app, you can check the quarterly net sales growth, which is basically the net premium received of HDFC life insurance.

In the above image you can see the quarterly net sales growth of HDFC Life Insurance. In Q3 FY24, net premium received increased by 6% YoY. However, the net profit showed significant growth, reaching ₹367.5 crores, a notable 16.3% YoY increase. In case you want to view the annual net profit of HDFC life insurance, head on to StockEdge.

Overall, the financial highlights reveal a positive trend for HDFC Life Insurance shares in the market.

There are few key metrics such as Value of New Business (VNB) standing at ₹2,267 crores for the first nine months of FY24, whereas the New business premium (NBP) was up 20.4% YoY during the same period. VNB margin increased by 20 bps YoY to 27.6% driven by better protection mix. Company witnessed a sharp rise during the year.

Despite recent changes announced in the Union Budget, insurance buyers need to pay tax on insurance proceeds if the premium paid surpasses 5 lakhs. That was initially seen as unfavorable for the insurance sector, HDFC Life Insurance shares demonstrated resilience.

However, the quarter faced certain challenges, primarily stemming from sluggishness in business involving premiums above ₹5 lakh. Renewal premium experienced healthy growth of 16.8% YoY, but first-year premium and single premium saw declines of 1.7% and 4.6%, respectively, on a YoY basis. The company’s expense of management ratio increased by 10 basis points YoY, although it decreased by 20 basis points sequentially to 19.4% in Q3 FY24. Net commissions surged by 79.7% YoY to ₹1,246 crores, while the net profit for the quarter increased by 15.8% YoY to ₹365 crores.

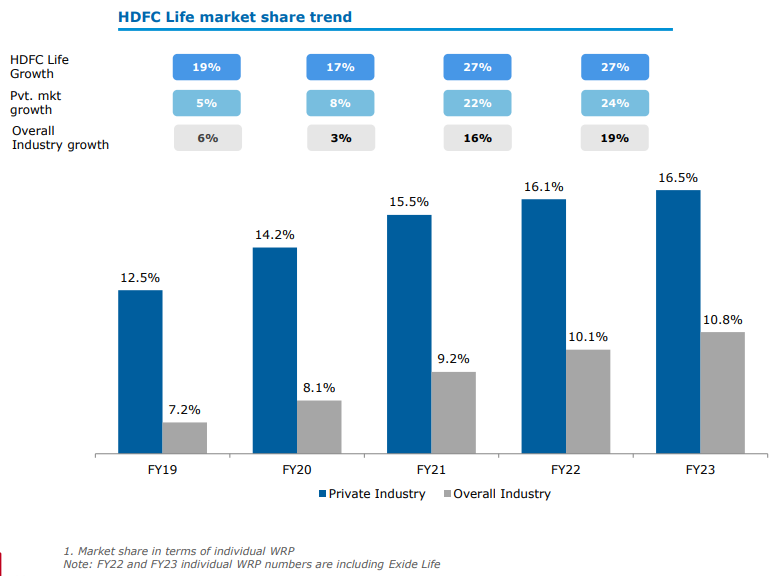

Despite these challenges, HDFC Life showcased positive operational developments. Individual Weighted Received Premium (WRP) saw a growth of 6% YoY for the first nine months of FY24, with a private market share of 15%. But what’s WRP?

Weighted received premium (WRP) – The sum of first year premium received during the year and 10% of single premiums including top-up premiums.

Additionally, retail protection demonstrated a substantial 36% YoY growth, and the credit protection business increased by 21% YoY. The company witnessed a 9% YoY growth in the number of policies, surpassing industry growth. Business growth from tier-2 and tier-3 locations was healthy at 14% YoY.

HDFC Life Insurance maintained a balanced product mix, with 24% coming from non-participating savings, 27% from ULIPs, 24% from participating policies, and the rest from protection and annuity business. The company added over 50,000 agents during the first nine months of FY24, and bancassurance continued to dominate the channel mix at 64%.

Hence, with strong growth and stability, the market share of HDFC life Insurance among the private insurers has been growing at a significant rate, outperforming both private market growth and overall industry growth.

You can see the growth in the trend of market share for HDFC life Insurance.

SWOT analysis of HDFC Life Insurance share

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strength

The company benefits from common branding with HDFC, which is India’s largest housing finance company with a strong retail presence, solid brand image, established franchise, and large customer base. It had a diversified distribution mix with nearly 300 partners and over 1.8 lakh agents as of 31st March 2023, further supplemented by ~500 branches spread across India. HDFC Life holds the number two position on Annual Premium Equivalent (APE) and one on New Business Premium (NBP) basis.

Weakness

Higher growth in Ulip could lower the margin. Also, the insurance sector in India is heavily regulated by IDRA, and its reforms are influenced by the Government. For instance, this year, the Union Budget announced that insurance buyers have to pay tax on insurance proceeds if the premium paid surpasses 5 lakhs. Such hurdles from the regulators or other government bodies could impact not only HDFC life Insurance shares but the insurance industry as well.

Opportunity

The company remains confident regarding growth prospects of protection business over the medium to long term in India and would continue to scale the business in a calibrated manner. The company’s main objective is to widen its customer base through a bancassurance channel after tying up with Bandhan Bank, IDFC First Bank, ICICI Securities, Yes Bank, etc. Digital would be a key lever for growth for the company, going forward. Management expects retail protection trends to remain strong.

HDFC Life has acquired a 100% stake in Exide Life Insurance from Exide Industries. This acquisition is expected to boost the growth of HDFC Life’s Agency business and enhance other distribution channels such as Broker, Direct, and Co-operative Banks. It aims to establish a solid presence in southern India, particularly in Tier-II and Tier-III cities. Additionally, customers can benefit from an expanded product range, a broader distribution network, and increased service points as a result of this move.

The company introduced two new products in the protection category: HDFC Life Sanchay Legacy and Click 2 Protect Elite. Sanchay Legacy is an industry-first whole life, return of premium protection plan with an increasing life cover, catering to middle-aged and older customer segments. The other product, C2P Elite, targets a more affluent customer category.

Threat

Intense competition from other life insurance players. As the Government revised the income tax slabs during the Union Budget 2023, a majority of taxpayers won’t be requiring the tax saving policies which they used as a measure for tax rebate. Thus, taxpayer may move away from tax saving policies and schemes with higher premiums and the insurance companies will feel the pressure.

The Bottom Line

HDFC Life Insurance is a market leader amongst private insurers in terms of new business premiums and the value of new business margins. The company is reaping the rewards of its expanded nationwide presence, boasting a broad outreach with branches and additional distribution channels through numerous new alliances and partnerships. The company expects continued growth from the new business segment and an increase in new business margins. HDFC Life anticipates double-digit premium growth in the next quarter, with a focus on expanding its presence in tier-2 and tier-3 cities through the addition of 75 more branches.

The company aims to boost its protection business, expecting it to outpace overall company growth in the next 2-3 years. The insurer also has plans to grow its embedded value by over 17% in the coming years. Despite facing challenges, HDFC Life appears well-positioned for future growth, leveraging its product mix, distribution channels, and strategic expansion initiatives.