Table of Contents

“Khayal Apka” used to be the memorable slogan of India’s second largest private sector bank, ICICI Bank. But some years back, trust was shaken when the former CEO, Chanda Kochhar, faced accusations of fraud in 2018. It took Sandeep Bakshi, the new CEO, a lot of work through marketing campaigns and actions to rebuild trust in the bank among investors and depositors.

In the current high-interest rate era, many of us are fascinated by investing our hard-earned money in FDs. However, history has proven that over the market cycles, equities have outperformed FDs by a very large margin. So, why not delve deep into the financials of ICICI Bank stock to analyze whether we will be able to beat not only the FD return but also outperform the market benchmark, i.e. Nifty 50, over the long-term horizon?

Additionally, ICICI Bank’s stock is part of the Nifty 50 index. Click to find out the list of stocks that are part of Nifty 50 and how to invest in it.

In today’s blog, we are going to analyze the company’s current financial position to find out if it is still a good stock or the turnaround is already priced in.

Company Overview

ICICI Bank, the country’s second-largest private bank, has a wide network of branches and ATMs. It serves both business and retail customers, offering a wide range of services. The bank’s subsidiaries, including ICICI Pru Life Insurance, ICICI Lombard, ICICI Securities, ICICI Pru AMC, and ICICI Home Finance, are leaders in their industries. While ICICI Bank operates internationally through subsidiaries in the UK and Canada, its impact on the overall company is limited.

In terms of performance and growth, ICICI Bank has outperformed its competitors in recent quarters. It has a strong liability profile, high capitalization levels, a robust provisioning coverage ratio, and a significant contingency buffer, which supports its earnings trajectory.

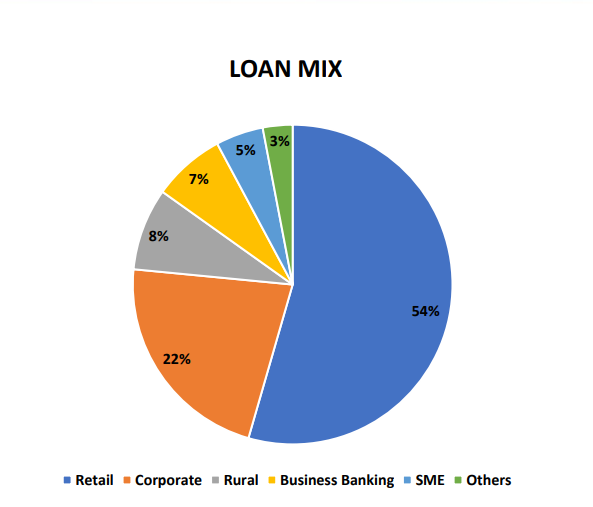

The bank’s loan book is largely composed of retail loans, which are considered safer and more likely to be repaid on time. Retail loans account for 54% of the total loans outstanding, with corporate, rural, business banking, SME, and other segments making up the rest. Here is the loan mix of ICICI Bank:

Sectoral Outlook- Banking

India now has a lower credit-to-GDP ratio than other BRICS countries, as well as Western countries, at roughly 55%. However, with 67% of the population being of working age, the country’s favourable demographics suggest significant potential for long-term and sustainable credit growth. Recent industry data and discussions with management indicate an expansion in the working capital requirement for loan demand. This expansion has led to strong corporate growth for ICICI Bank over the past few quarters. According to the Reserve Bank of India (RBI), bank credit increased by 20% year over year. This growth trend has been on the rise as the effects of the second wave of the pandemic subside.

Furthermore, both the government and the private sector are showing increasing requirements for capital expenditure (CAPEX). The Union budget announced a more than 30% increase in CAPEX outlays, which is expected to boost corporate credit demand further.

Now, let’s continue ICICI Bank stock analysis by reviewing the bank’s fundamentals based on growth, profitability, efficiency, solvency and valuation.

Growth of ICICI Bank

Credit Growth

Loans can be considered the revenue drivers for a bank, just like sales are for a manufacturing company. So, the higher the loan growth, the better it is, since it is going to generate more sales for the company. ICICI Bank has been able to grow its loan book by 14.8% CAGR over the last 5 years. In Q3 FY24, the bank’s advances grew 18.5% YoY and 3.9% QoQ to 11.5 lakh crore. The business banking showed higher growth, while the retail loan book also grew satisfactorily at 21.40% as personal loans and credit card business continued to grow.

As you can see, with the help of StockEdge you can analyze how ICICI Bank has managed to grow its loan book over the years.

Deposit Growth

In the latest quarter of Q3 FY 24, deposits have jumped by 18.7% YoY to ₹13.3 lakh crore. Overall, CASA growth for the quarter ending December 2023 was 39.4%.

NII Growth

To find out the Net Interest Income (NII) of any bank. You need to calculate the difference between the interest income on loans and the interest cost on deposits or bonds it has issued. For simplicity, you can consider it as the gross profit of a manufacturing company. NII growth the bank has been at 22% CAGR for FY18-23. The Q3 FY24 NII growth was 15.1% YoY driven by healthy loan growth.

PAT

Profit after tax grew at a healthy 36.3% CAGR for the last 5 years. A heavy charge on the bank’s profit and loss account is on account of provision for bad debts. These are determined by the bank’s management using a combination of prudence and regulatory obligations to account for potential loan losses down the road. ICICI Bank’s Q3 FY24 profit by 25.4% YoY.

Profitability of ICICI Bank

NIM

Net Interest Margin can be compared to the gross margin of a manufacturing company. Triggers for improvement in NIMs are higher interest yields on the advances or lower cost of funds. For Q3 2024, Net interest margin (NIM) was down by 22 bps YoY and 10 bps QoQ to 4.43; this was mainly due to the higher cost of deposits, especially from the corporate deposits segment.

Using StockEdge, you can easily get the overall NIMs trend of ICICI Bank.

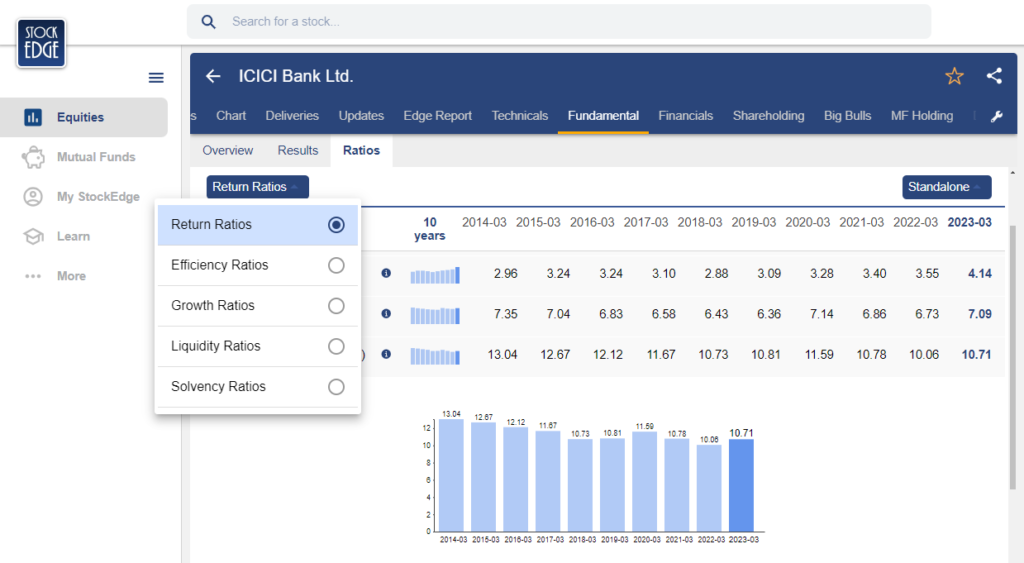

Yield on Advances

On average, ICICI Bank charges its customers an interest rate of 10.71% on loans. While some may think a high yield on loans is positive, it can actually signal higher credit risk. However, for ICICI Bank, the yield on loans has been decreasing steadily from 13.04% in 2014 to 10.71% in 2023. This decline is attributed to the bank’s shift towards more secured loans, which is seen as a positive trend for asset quality.

Efficiency

ICICI Bank stock analysis is incomplete without looking at the efficiency ratios. A bank’s valuation is heavily dependent on how efficient it is. Apart from efficiency ratios, using StockEdge you can do a ratio analysis of any stock. Here is a glimpse of the number of ratios which you can analyse.

Cost to Income Ratio

The cost to income ratio for ICICI Bank increased 233 bps YoY but was down 35 bps QoQ to 40.6% for the Q3 FY24. However, its comparable peers mostly have a Cost to income ratio over 40%.

Credit Cost

Credit cost is the ratio of provisions/loans. For FY22, the credit cost has reached near the 1% mark and has fallen to ~0.8% in FY23. In Q2 FY24, credit cost further improved to ~0.21% as stress on the book continued to subside. Also, for H1 FY24, credit cost declined to 0.35% versus 0.62% YoY. However, provisions were up 80% QoQ, mainly due to AIF (alternate investment fund) investment-related provisions worth ₹627 crore in Q3 FY24. But it is expected that the credit cost on an overall basis will be around 50 bps going ahead.

Gross NPA & Net NPA (Non Performing Assets)

Strong underwriting practices and choosy lending to risky corporates, especially in long-term project loans, have helped the bank to have a strong GNPA ratio. Gross Non-performing assets for ICICI Bank stood at 2.55% in Q2 FY 24, which further declined in Q3 FY 24 to 2.37%

Net NPA is gross NPA after deduction of the provisions made; for ICICI Bank, the Net NPA stood at 0.47% in Q3 FY 24.

Liquidity & Solvency of ICICI Bank

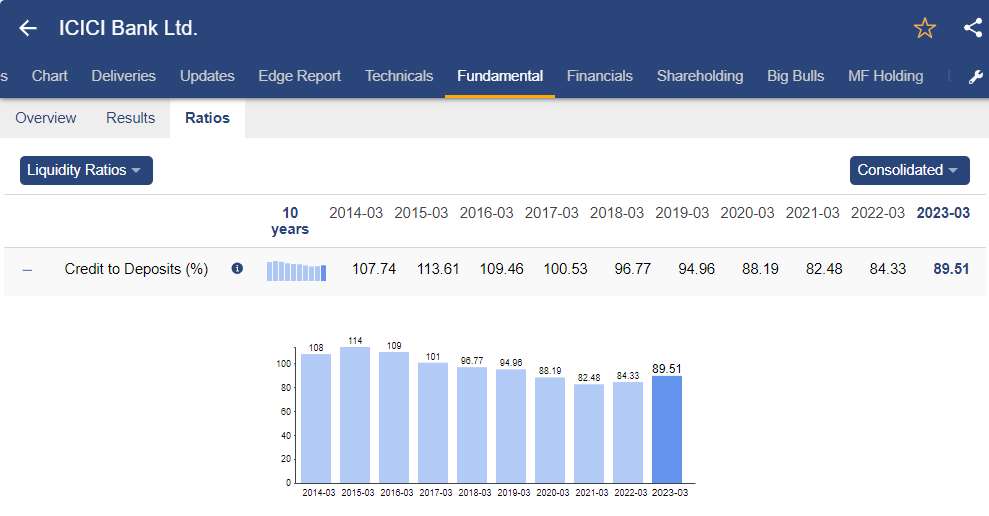

Credit – Deposits Ratio

A higher ratio suggests that more money is being borrowed to fund loans or credit, whilst a smaller ratio shows that there are few credit opportunities, meaning money is being invested in G-Sec or other assets. ICICI Bank’s ratio generally remains around 80%. This ratio has jumped to 89.51%, as you can see from the image below.

Bank’s liquidity is of utmost importance. ICICI Bank Stock analysis has become easy using StockEdge.

CASA Ratio

In the past quarters, the CASA ratio has been declining across the Industry as well due to the shift of deposits from savings to fixed books as interest rates increased. In the current quarter of Q3 FY 24, on an Average basis, the CASA ratio declined from 44.6% a year ago to 39.4%.

Capital Adequacy

Banks are required to hold adequate equity to back the loans provided. ICICI Bank has always kept sufficient and way above regulatory requirements.

Valuation

The final step in the ICICI Bank stock analysis is finding whether the current valuation is sensible or not.

Price to Equity Ratio

ICICI Bank stock PE ratio stands at 17.12 on a TTM basis, compared to the industry average PE of 17.94. It indicates that ICICI Bank’s valuation is in line with the industry average.

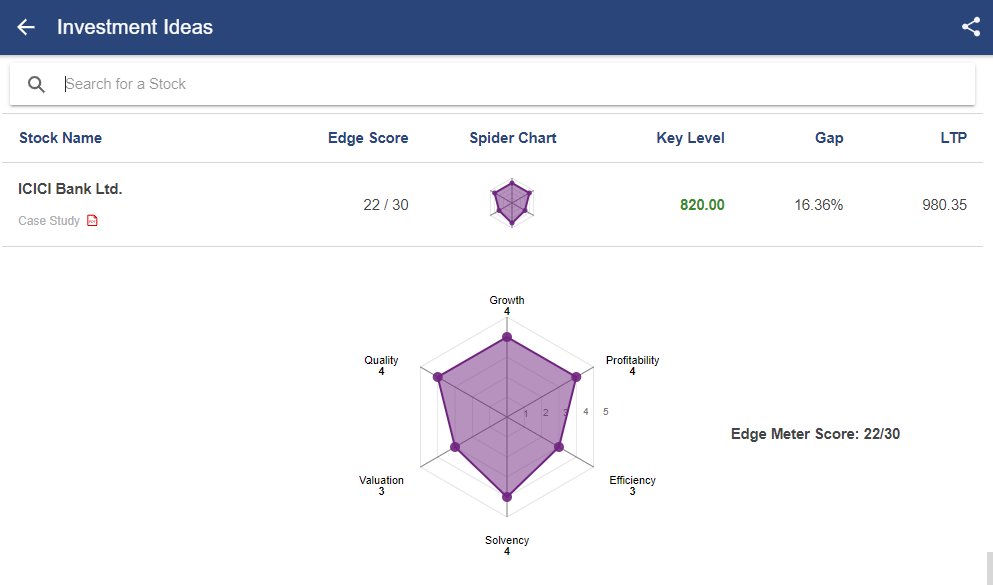

Case Study on ICICI Bank stock

Our group of analysts has compiled a case study report on ICICI Bank Stock. This report presents a detailed fundamental analysis of ICICI Bank Stock, in addition to a comparison of its position with respect to its competitors.

As you can see, ICICI Bank Stock have rating based on 6 parameters:

- Growth

- Quality

- Profitability

- Efficiency

- Solvency

- Valuation

Based on the above parameters, ICICI Bank Stock scored 22/30. Read the case study report here.

Management Quality & Shareholding Pattern

Mr. Sandeep Bakhshi is the Managing Director and CEO of ICICI Bank from October 15, 2018. He was the Bank’s Chief Operating Officer (COO) and a full-time director before being named MD & CEO.

After working for the ICICI Group for 32 years, Mr. Bakhshi has managed a variety of responsibilities at ICICI Bank, ICICI Limited, ICICI Lombard General Insurance, and ICICI Prudential Life Insurance.

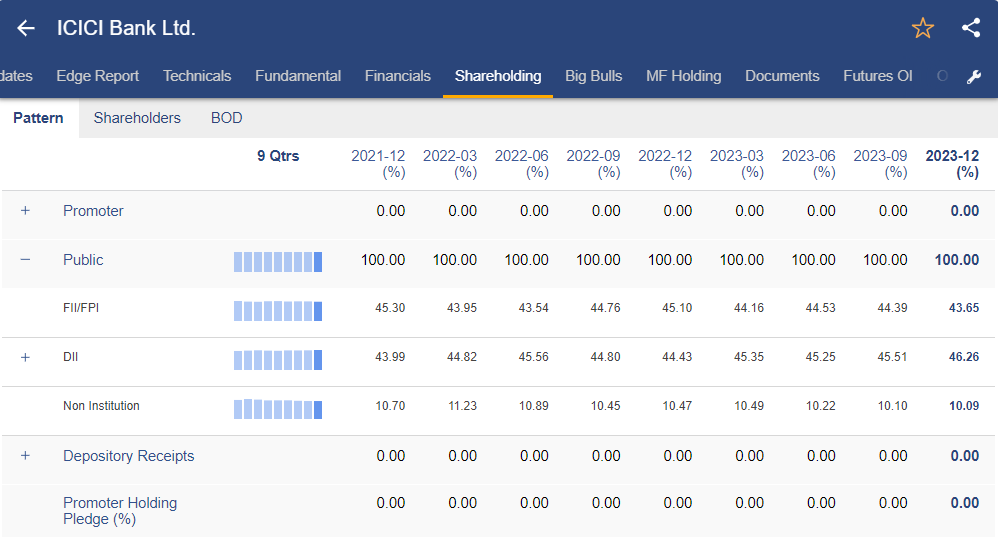

You can view the shareholding pattern of ICICI Bank stock in StockEdge

Future Outlook Of ICICI Bank Stock

- Asset quality has improved on a continuous basis.

- Loan book quality is improving, and the stress is expected to improve further. A close watch towards the unsecured book is required.

- The focus of the management towards the mid-corporate loan book is expected to increase.

- NIMs are expected to moderate as the cost of funding goes up.

- Branch and employee addition would continue.

- Return ratios are expected to improve further.

Conclusion

In order for India to reach its target of a $5 trillion GDP by 2027–2028, the financial sector needs to outperform. ICICI Bank, ranked as the 4th largest private sector bank in the country, stands in a strong position to capture market share amidst the growing demand for credit in the upcoming years. The recent turnaround story in ICICI Bank stock indicates a sharp recovery in its financials, with potential for further enhancement. Therefore, this validates the higher valuation of the stock compared to its peers in the private sector banking industry.

Happy Investing!