Table of Contents

“Silver is the biggest bargain I have ever seen!” Quotes, Robert Kiyosaki, author of the famous book, The Rich Dad Poor Dad. In his own words, he has been recommending investing in silver for years now, and he is putting in money on silver. He calls himself a hard-core Silver (and gold) guy.

But why is Kiyosaki, the multi-billionaire investor, so bullish on silver? Does he want to save us from a global financial crisis? Is the industrial demand for silver going to increase many-fold in the future? Why silver- when you can invest in gold? Or is there any other reason for him to suggest we invest in silver? Well, read through the entire blog to get some mind-boggling facts about why it makes sense to invest in silver.

Gold vs Silver

Historical Returns

The following table shows the absolute returns of Silver and Gold as of 31 December 2023.

| 1Y | 3Y | 5Y | 10Y | |

| Silver | 7.23% | 9.29% | 275% | 767% |

| Gold | 14.9% | 26.0% | 279% | 790% |

It can be noticed from the above table that Silver has given at par returns with gold over the last 5- and 10-year periods. However, over the last one- and three-year periods, silver returns underperformed those of gold.

Which is More Volatile?

| Std Deviations | Gold | Silver |

| 3 Yr | 10.81% | 9.98% |

| 5 Yr | 12.55% | 19.90% |

| 10 Yr | 12.60% | 19.59% |

Standard deviation is a metric used to define the volatility of returns around the average. The more volatile the returns – arguably, riskier the asset class. As can be noted via the table above, silver is more volatile than gold in 5 year and 10 year periods, barring the 3 year period, when silver underperformed gold by a huge margin.

Why Invest in Silver?

Uses of Silver

Silver, unlike gold, has industrial usage apart from being a precious metal. Silver is a great conductor of heat and electricity. Some of the industries where silver is used are Solar panel manufacturing, EV, electronics manufacturing, semiconductors, cell phone manufacturing, microphone and many more.

But if someone remembers their primary school science lessons, isn’t gold a better conductor? It is. Actually, it’s superior to silver, copper and aluminium when it comes to conductivity. However, gold is expensive. That is why manufacturers prefer silver.

So, with the growing popularity of EVs, the demand for silver is also increasing. Silver is used in EV batteries and also in semiconductor chips. Both are essential for EVs.

Not only that, due to its antibacterial properties, silver is used in medicines, water filtration, wine manufacturing as well. Another interesting usage of silver is into missiles.

Factors affecting Silver Prices

As noted in the previous section, silver is both an industrial-metal and a precious metal. This gets silver into a very unique position.

- As an industrial metal, silver demand would increase when the industrial production of EVs, electronics, etc. are on a rise. And intuitively, we can guess that this will happen in an economic upcycle

- Similarly, as a precious metal, like gold, the demand for silver will increase when investors fear a recession.

Therefore, if you invest in silver, you can enjoy the economic upcycle while at the same time having downside protection during an economic crisis.

Return on Investment in Silver

The following table shows the absolute returns of Silver and Gold as of 31 December 2023.

| 1Y | 3Y | 5Y | 10Y | |

| Silver | 7.23% | 9.29% | 275% | 767% |

| Gold | 14.9% | 26.0% | 279% | 790% |

It can be noticed from the above table that silver has given at-par returns with gold over the last 5- and 10-year periods. However, over the last one- and three-year periods, silver returns underperformed those of gold. The reason for this is that silver is more volatile than gold. Gold, due to its limited availability, has a stable price movement, while silver, on the other hand, shows volatile price movements.

An interesting fact to note here is that since gold has no major industrial use, whatever gold is produced is either stored with the central banks or is kept as jewelry, and hence, its overall availability has remained stable over the years. While investing in precious materials like gold and silver, it’s worth noting that Swarovski crystals, known for their brilliance and craftsmanship, are primarily used in luxury and fashion, unlike silver, which has extensive industrial applications. However, when it comes to silver, due to its growing industrial, medical, and defense usage, everyday silver is depleting or becoming scarce.

Hence, with the growing demand and also its acceptance as an “Emerging Rare Asset” or precious metal comparable to gold, silver is expected to deliver better inflation-adjusted returns.

Demand & Supply of Silver

The global silver availability stands at 61,000 million ounces or 61 billion Oz (1 kg = 35 Oz), which is 19 times the availability of gold. For the year 2024, it is estimated that 1.02 billion Oz of Silver will be in supply – i.e. available for sale as per silverinstitue.org. USA, India and China are the biggest consumers of silver in the world, together consuming 48% of the world’s silver supply.

It’s interesting to know where we can get the silver from. Well, here is a list of the possible sources of silver supply.

- Mines: In 2024, silver mine production is expected to be 843 million Oz. Mexico is the largest producer of silver and is home to 5 out of 10 most important silver producing mines in the world. In India, Rajpura Dariba Mine in Rajasthan produces 941 thousand ounces of silver and is owned by Vedanta Ltd.

- Future exchanges: The New York Mercantile Exchange (NYME), the London Metal Exchange (LME), and the Chicago Board of Trade (CBOT) are the three primary global venues for silver trading. Traders can take physical delivery of silver contracts from these exchanges.

- Privately held Silver: It is estimated that 1,500 million Oz or 1.5 billion Oz is held by households in the form of jeweler, artifacts, coins, bars, etc. In the fiscal year 2020, Indians held about 1675 million oz of silver.

- Recycling: Scrap silver recycling generated through e-waste and other materials which contain silver has a market size of USD 14 billion as per Verified Market Reports. For the period 1990-2023, a gross 25,000 million Oz or 25 billion Oz of silver was recovered from scrap, which at today’s price stands at INR 55.4 lakh crores. Yeah! Scrap dealers do mint money.

The demand for silver is expected to rise to 1.20 billion ounces in 2024, as per silverinstitue.org. Now, compared to the 1.02 billion Oz of supply, it suggests that demand is going to be higher than supply and hence higher prices (Economics 101). You will be surprised to know that silver used in jewellery is just 3% of the total supply; the rest is used in industrial usages, as discussed in the earlier sections, like EVs, solar panels, defence equipment, medicines, etc.

Is it an Inflation Hedge?

Before reaching a conclusion, let’s first understand what makes an asset class an inflation hedge? An asset becomes an inflation hedge, when it is able to make up for the decreased purchasing power of money due to rising prices of goods and services.

Some consider stocks as an inflation hedge. The reason is companies that sell goods and services increase their selling prices with the rise in raw material prices due to inflation, therefore negating the impact of inflation. However, as we all know, stock prices, in the short term, are a reflection of many factors rather than just the profitability of the company, hence it won’t stand as a true inflation hedge.

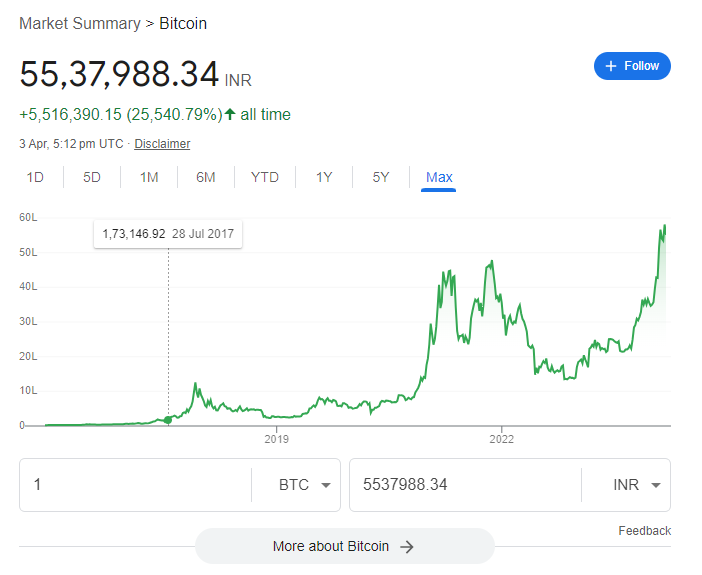

With the growing popularity of crypto, millennials are of the view that Bitcoin is a true inflation hedge. Well, look at this volatile price chart and decide for yourself if you feel safe investing in Bitcoin.

An actual inflation hedge will not only rise with inflation but also keep your money safe and sound.

Real, tangible assets that have limited availability, like real estate, gold and silver, are considered good inflation hedges as they generally do not lose value with inflation. Due to its illiquid nature, real estate is preferably ruled out. Left are the precious metals – gold and silver.

Look at this table.

| Year | YoY Inflation | Gold Return | Silver Return |

| 2023 | 5.93% | 14.9% | 7.23% |

| 2022 | 6.70% | 14.4% | 10.8% |

| 2021 | 5.10% | -4.09% | -8.0% |

| 2020 | 6.60% | 28.2% | 45.8% |

| 2019 | 3.70% | 24.6% | 20.3% |

| Total Return | 31.3% | 279% | 275% |

| Volatility | NA | 12.6% | 19.9% |

What do we see here? Well, first gold is an absolute inflation hedge as it has beaten inflation in 4 of the last 5 years as well as kept your money safe with very less volatility. Second, silver is inferior to gold in terms of inflation hedge, but not bad right? Over the last 5 years, silver has increased your money value by 275% against the depreciation of 31.3% via inflation.

Which is the Better Hedge for Portfolio – Silver or Gold?

Look at this chart:

Sensex has purely outperformed both Gold and Silver. Then why invest in silver or gold? Well, look at the highlighted portions. There surely seems to be a relationship. When the Sensex drops sharply, it is usually seen that gold and silver both rise, offsetting some of the losses for the portfolio. However, arguably, gold is a better hedge to the portfolio compared to silver, although it’s expensive! And both do a fairly good job of protecting the stock portfolio. Hence, it is suggested to invest in silver, at least a small portion of the portfolio, in order to safeguard the portfolio against sharp falls in equity markets.

If you are also looking ways to invest in Gold, can read this blog; Investment in Gold: Discover ways to shine your portfolio brighter!

How to Invest in Silver?

While investors desiring silver exposure can directly invest in it through physical silver, silver ETFs, or derivatives, there is also an indirect way to invest in silver, like buying listed companies that have exposure to it.

Silver Proxy Plays through Stock Market

Hindustan Zinc is the largest silver producer in India extracting an annual output of 750 tonnes – being 20% of its total revenues. It also produces other metals such as Zinc (60%), Lead (14%) and others.

Vedanta is a global mining company, mining metals such as Zinc (96%) and Silver (4%). In India, Rajpura Dariba Mine in Rajasthan produces 941 thousand ounces of silver and is owned by Vedanta.

Additionally, Jewellery Companies such as Titan Company Ltd, ThangaMayil Jewellery Ltd. and Goldiam International Ltd. can also be used as a proxy silver play.

Silver ETFs

Exchange Traded Funds (ETFs), in layman’s language, can be called a mutual fund that is traded on the stock exchange. ETFs were traditionally designed to give investors a cheaper option to passively invest in stock market indices. There are various ETFs that are launched by mutual fund companies tracking various benchmarks. However, with the growing popularity of ETFs, silver ETF was also launched in order to provide investors with a cheaper way to invest in silver. How do you ask?

Well, when you buy physical silver there are charges, taxes, storage charges, etc. which raise the cost of investment. However, in ETFs these costs are not present and just a marginal fee is charged by the mutual fund companies. Hence, Silver ETFs are a cheaper way to invest in silver.

While ETFs are mostly standardised and benchmark tracking instruments, some of the factors to look out for in the selection of ETFs are listed below:

- Expense ratio: Expense ratios are charged by the asset management companies (AMCs) for the service provided by them. These generally range in 0.20% to less than 1% for ETFs. Look for ETFs with lower expense ratios.

- Cash holding: While the ETFs are created in order to mimic the benchmark (Silver return in this case), however due to the practicality of deploying capital in physical silver, the AMCs may at times purchase silver derivatives or keep the undeployed capital as cash. This would make the return of ETFs different from Silver price returns. Hence look for ETFs with lower cash holding.

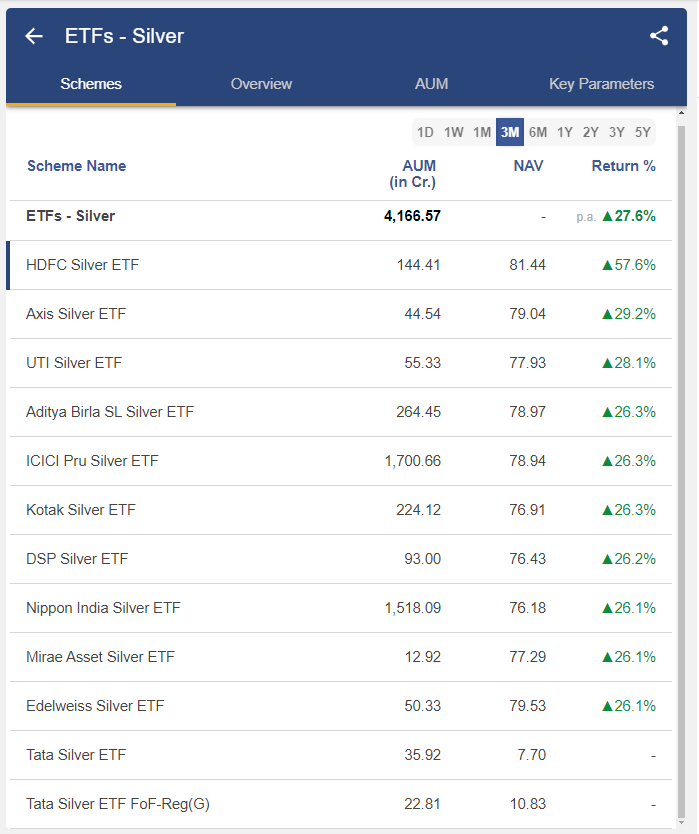

StockEdge provides a list of silver ETFs provided by various AMCs. Do check it out.

Top 3 Silver ETFs in India

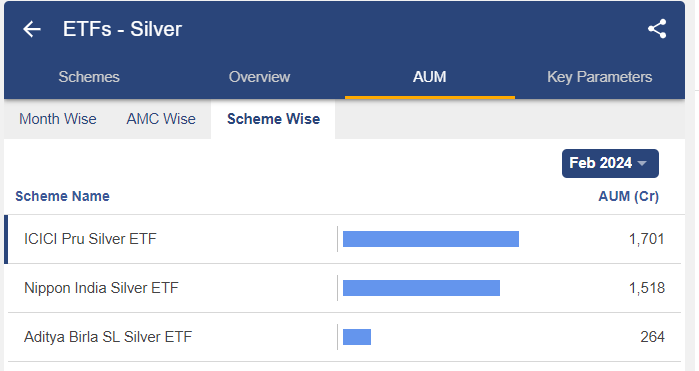

Scheme wise, the top three Silver ETFs according to AUM are:

- ICICI Prudential Silver ETF– The fund house launched the first Silver ETFs in India. The total AUM stands at 1701 crores as of 29 February 2024. The fund has given a return of 7.70% and 6.20% over one- and two-year periods respectively. The expense ratio is 0.40% and cash held in the scheme is 2.80%

- Nippon India Silver ETF– The total AUM stands at 1518 crores as of 29 February 2024. The fund has given a return of 7.60% and 6.80% over one- and two-year periods respectively. The expense ratio is 0.51% and cash held in the scheme is 2.80%.

- Aditya Birla SL Silver ETF– The total AUM stands at 264.5 crores as of 29 February 2024. The fund has given a return of 5.50% and 6.60% over one- and two-year periods respectively. The expense ratio is 0.37% and cash held in the scheme is 2.80%.

How to Trade in Silver?

The following methods are used to trade and invest in silver:

- Physical purchase: Silver, like gold, can be purchased in physical mode from jewellers.

- Future and Option market: Silver is traded actively on the commodity exchanges and can be bought and sold there. We can both speculate on commodity exchanges or be an actual buyer by taking delivery of silver on the expiry of future and option contracts from MCX.

- Silver ETF: As discussed above, silver can be purchased in the form of ETFs through stock exchanges, just like we purchase a share.

Conclusion

Can you now list the industries that demand silver? Well, I know the list is huge and longer than gold. That is why many investors, including award-winning book writer Robert Kiyosaki, are so bullish on silver. Silver has a double role: being used as an industrial metal and a precious metal. It can be allocated a special space in your portfolio, which is expected to perform both on the upside and downside. And as we know, the best of silver demand is yet to come as EVs and solar panels gain popularity. So, knowing all this, will you invest in silver?