Table of Contents

As one of the leading technology-enabled healthcare solutions providers, Inventurus Knowledge Solutions (IKS) offers a unique blend of clinical expertise and advanced technology. With its innovative solutions for healthcare organizations, particularly in the U.S. market, this IPO promises to be a significant event for investors.

In this blog, you will dive deep into the details of the Inventurus Knowledge Solutions IPO, the company’s objectives, its financial performance, and how it stacks up against peers.

Inventurus Knowledge Solutions IPO is open for subscription from (12th Dec 2024) today onwards!

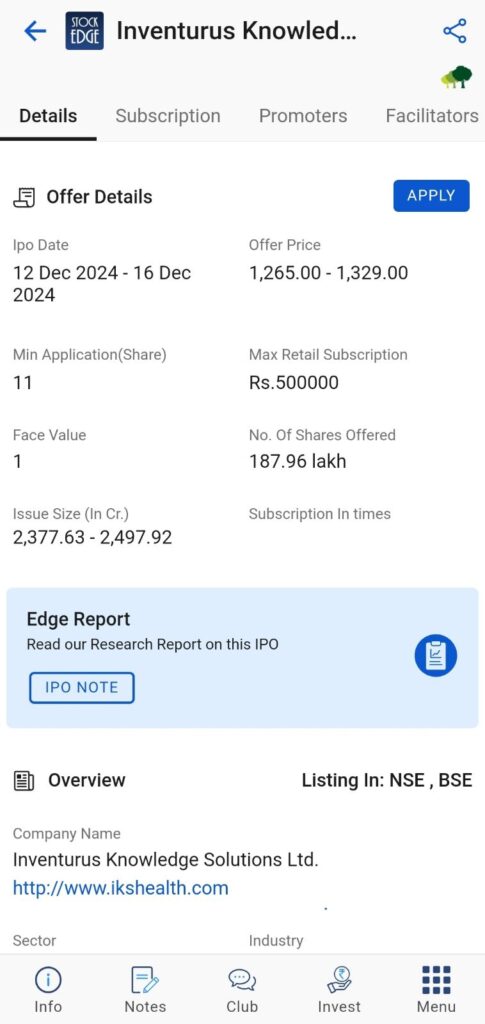

Inventurus Knowledge Solutions IPO Details:

- IPO Open Date 12th December 2024, Thursday

- IPO Close Date 17th December 2024, Tuesday

- Price Band ₹1265 to ₹1329 per share

- Lot Size 11 shares

- Face Value ₹1 per share

- Issue Size at upper price band ₹2498 crore (Offer for Sale ₹2498 crore)

- Listing exchanges NSE, BSE

- Cut-off time for UPI mandate confirmation by 5 PM on December 17, 2024

The tentative timeline for the IPO is as follows:

- Basis of Allotment 17th December 2024, Tuesday

- Initiation of Refunds (if not allotted) 18th December 2024, Wednesday

- Credit of Shares to Demat (if gets allotments of shares) 18th December 2024, Wednesday

- Listing Date 19th December 2024, Thursday

About the Company

Inventurus Knowledge Solutions (IKS) was founded in 2006 and has grown into a leading provider of technology-enabled healthcare solutions. Headquartered in Mumbai, the company focuses primarily on the US healthcare market, which contributed approximately 98% of its revenue in FY24. With a client base of 778 healthcare organizations, including health systems, academic medical centres, multi-speciality medical groups, and ancillary healthcare providers, IKS offers a comprehensive suite of solutions that help streamline administrative, clinical, and operational tasks for healthcare providers.

The company’s service offerings are powered by proprietary platforms tailored to address various challenges in the healthcare ecosystem. Key products include:

- IKS EVE: Manages front-end patient flow activities such as scheduling, insurance verification, and prior authorization.

- Optimix: Optimizes payouts from insurance companies and patients, minimizing billing and claim processing costs.

- IKS Stacks: Enables seamless electronic health record management by indexing and abstracting critical data points.

- IKS AssuRx: Standardizes prescription renewal requests, reducing administrative burdens on physicians.

- IKS Scribble: A virtual scribe solution that enhances clinical documentation efficiency.

With its recent acquisition of Aquity Holdings, a leader in clinical documentation and medical coding, IKS has expanded its capabilities and market presence. This strategic move allows the company to cross-sell services to Aquity’s 804 existing customers, creating a larger market opportunity.

As the healthcare sector continues to embrace outsourcing and technology-driven solutions, IKS is uniquely positioned to capitalize on these trends, offering healthcare organizations the tools to focus on core patient care while achieving operational excellence.

Sector Outlook in India

The healthcare technology sector, particularly in the US, is experiencing rapid growth, driven by the increasing demand for efficiency, cost reduction, and improved patient outcomes. The US healthcare expenditure is projected to rise from USD 4,799 billion in 2023 to USD 6,216 billion by 2028, reflecting a compound annual growth rate (CAGR) of 5.3%. This growth is fueled by an aging population, the prevalence of chronic diseases, and the growing need for technology-driven solutions to address these challenges.

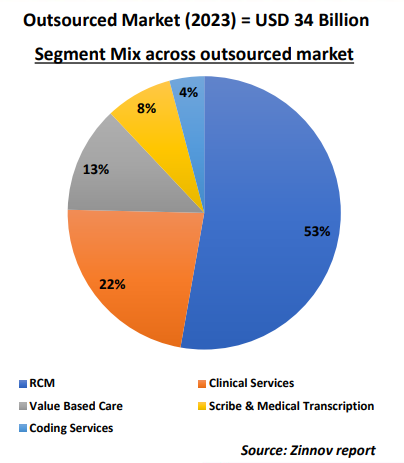

The provider enablement technology solutions market in the US, valued at USD 222 billion in 2023, is expected to expand to USD 323 billion by 2028 at a CAGR of 7.8%. Within this market, outsourced services have emerged as a crucial segment, with a current valuation of USD 34 billion and an impressive growth rate of 11.7% CAGR. This trend highlights healthcare organizations’ increasing reliance on third-party providers for critical workflows such as billing, revenue cycle management (RCM), patient engagement, and clinical documentation.

Key segments driving this outsourced market include:

- Revenue Cycle Management (RCM): The largest sub-segment, accounting for 18% of the total outsourced market, ensures smooth financial operations and revenue flow.

- Clinical Services: With a penetration of 11%, this segment supports clinical decision-making and is growing at a CAGR of 10%.

- Value-Based Care: Capturing 13% of the market, it focuses on improving care quality and is also growing at a 10% CAGR.

- Medical Scribing and Transcription Services: Comprising 27% of its market, this space is witnessing significant adoption.

- Coding Services: With the highest penetration of 29%, accurate coding is essential for billing compliance and financial accuracy.

As healthcare organizations increasingly outsource these critical services to focus on patient care, companies like Inventurus Knowledge Solutions (IKS) are well-positioned to benefit from this expanding market. IKS’s advanced platforms and diversified service offerings cater to these growing demands, ensuring it remains a vital player in the healthcare technology sector.

Financial Performance

Inventurus Knowledge Solutions (IKS) demonstrates its robust growth and operational efficiency in the competitive healthcare solutions market. Over the past three years, IKS has shown a remarkable increase in its revenue, climbing from ₹764 crore in FY22 to ₹1,818 crore in FY24, representing a compound annual growth rate (CAGR) of 27.8%. The EBITDA margin, although slightly declining from 38.9% in FY22 to 28.6% in FY24 due to increased operational expenses and investments in technology, remains strong. Net profit has also risen consistently, from ₹233 crore in FY22 to ₹370 crore in FY24, reflecting the company’s sound financial management and ability to scale operations.

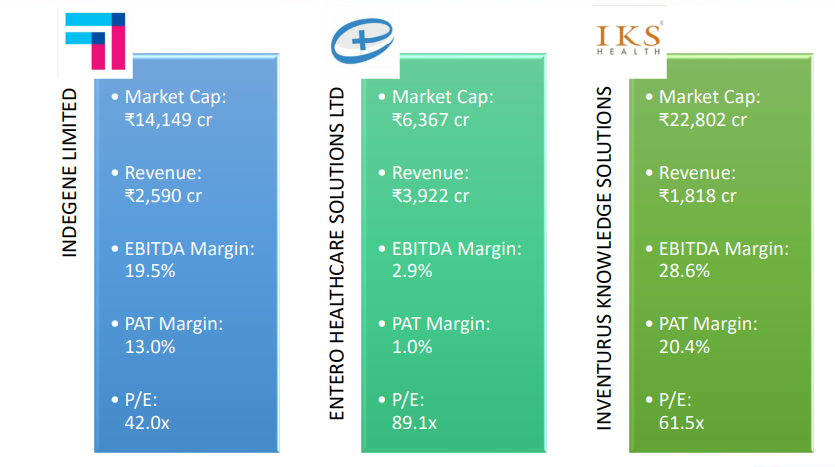

In terms of peer comparison, IKS outshines many competitors like Indegene Ltd. and Entero Healthcare Solutions Ltd. in the healthcare technology space. For instance, its EBITDA margin of 28.6% is significantly higher than Entero Healthcare Solutions’ 2.9%, showcasing its operational excellence. Similarly, IKS’s net profit margin of 20.4% surpasses that of peers like Indegene Limited, which reports a margin of 13.0%. Despite its relatively higher price-to-earnings (P/E) ratio of 61.5x, IKS offers investors a compelling case with its sector-leading profitability and a diversified portfolio of healthcare solutions. With a market cap of ₹22,802 crore, IKS is well-positioned as a formidable player in the healthcare technology space, bridging the gap between technology and patient care with unmatched efficiency.

Read our blog to know Top 3 Healthcare Stocks in India.

Objectives of the Issue

The Inventurus Knowledge Solutions IPO is entirely an offer for sale (OFS), amounting to ₹2,498 crore, with no fresh issue of shares. The primary objective is to provide an exit route for the existing shareholders, including promoters and investors, while listing the company’s equity shares on the stock exchanges. Post-IPO, the promoters’ stake will reduce to 66% from 70%, enhancing liquidity and market participation.

Risk Factors

While the Inventurus Knowledge Solutions IPO appears promising, investors should consider the following risks:

- Geographical Concentration: With 98% of revenue from the U.S., the company faces significant regional dependency.

- Regulatory Challenges: Operating in a highly regulated industry adds compliance-related risks.

- High Attrition: A 44.5% attrition rate in FY24 could impact operational efficiency.

Investors should carefully evaluate these risks before subscribing to the Inventurus Knowledge Solutions IPO.

Should you subscribe to Inventurus Knowledge Solutions IPO?

Inventurus Knowledge Solutions enables its clients to deliver the chores of healthcare across administrative, clinical, and operational burdens and enables clinicians to focus on their core purpose. The company operates in the highly competitive and regulated healthcare IT industry, primarily catering to the US market, which poses a concentration risk. However, its diversified offerings, coupled with the continued trend of outsourcing services by US-based firms, serve as key growth drivers.

Before investing in the Inventurus Knowledge Solutions IPO, it’s essential to weigh the potential risks and rewards. This blog offers a comprehensive review of the key benefits and possible challenges of participating in this IPO.

StockEdge’s expert panel has rated the Inventurus Knowledge Solutions Limited IPO as “Average”, reflecting a cautious but balanced outlook. To provide more clarity, we’ve prepared an Inventurus Knowledge Solutions IPO Note, which offers a detailed analysis of the company’s financial position and a SWOT assessment, giving you a deeper understanding of its growth prospects.

Explore StockEdge’s dedicated IPO section under the Explore tab, where you can track upcoming, ongoing, and recently listed IPOs.

Join the StockEdge Club, where our team of research analysts will assist you with queries related to investments, trading, and IPOs.

Happy investing!