Table of Contents

Warren Buffet first used the term “Moat” in a 1995 letter to shareholders.

“We try to invest in businesses with economic moats that are deep and wide and in management that understands the importance of widening those moats.”

Now, what does the term “economic moat” mean? How can we identify these? How can understanding this help us investors? And finally, do they still work?

Let’s understand this entire chain of concepts in this blog.

Table of Contents

What is an Economic Moat?

Moats are, according to the dictionary, “a long, wide hole that is dug all the way around a place such as a castle and usually filled with water to make it more difficult to attack.”

But how do you relate this to investing? Hmm. Let’s make it simpler step by step.

Defining Moats

As we already know, the term “Economic Moat” was coined in the investment universe for the first time by Warren Buffet. What does he mean by this, though? Does it mean that companies should dig up around their premises and fill it with water in order to save it from enemies? Well, Yes and No. No, as Warren was not talking in the literal sense of creating a Moat but was indicating creating an abstract intangible economic moat around the business to protect it from its enemies, i.e., its competitors. In simple terms, economic moats are the competitive advantages that companies need to build over time in order to protect its profitability over the long term. Now, let us dive deep into how these economic moats are used in investing.

Importance of Economic Moats in Investing

Is it really that important for companies to have an economic moat? Well, read this tweet from legendry founder, Elon Musk.

Sounds fun, right? Two billionaires with different ideologies regarding Moat. But first, let’s understand the context of Elon Musk’s tweet. This tweet from 2018 was after Tesla’s earnings call, where Buffet supporters repeatedly asked Musk about the Moat that Tesla possesses, which can ensure its longevity. To this, Elon replied, “Moats are useless”. Here, he positioned his company, Tesla, as a disrupter that, due to its pace of innovation, was able to break the moat of century-old car makers like Ford and General Motors.

To this, Warren Buffet replied simply, “Stay away from See’s Candy.” You see, Buffet, through Berkshire, holds a majority stake in candy manufacturer See’s Candy. According to Buffet, this company has a moat as its brand is widely accepted, and people are ready to pay increased prices for its products year on year, expanding its profit margins.

Was Elon able to break the moat of Candy manufacturer Sees? Well, not yet. This proves that Economic Moats in Sees of “Pricing Power” are working well, and it’s difficult to break it with mere spending venture capital money. Late Charlie Munger once said, “If you give me $100 billion and ask me to break the monopoly of Sees or Coca-Cola, I would rather return the money to you!”

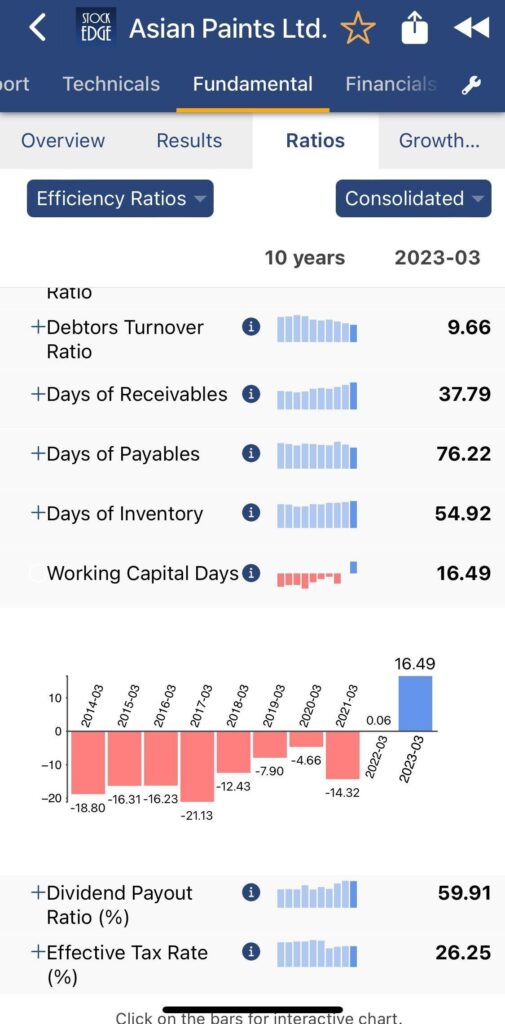

Another interesting example from the Indian markets is Asian Paints. Asian Paints, due to its longevity in the Indian paints industry and immense distributor network, is known for its inventory management.

For most of the last decade, Asian Paints operated at a negative working capital cycle, which means that its suppliers and distributors funded its day-to-day operations by providing it with money and raw materials in advance. This is an example of an “economic moat,” and hence, we can see how difficult it has been for not only the older paint companies like Berger Paints but also newer ones like Jindal Paints to beat it meaningfully.

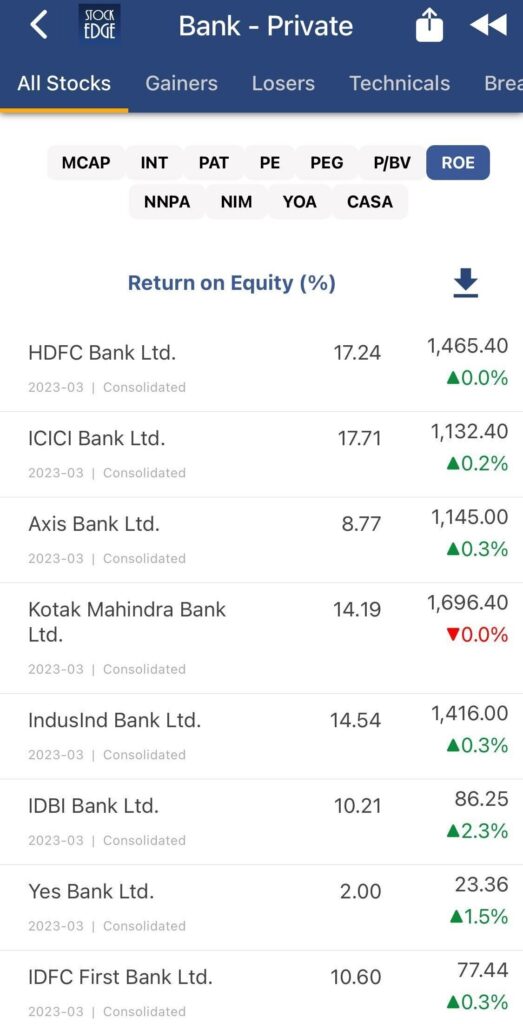

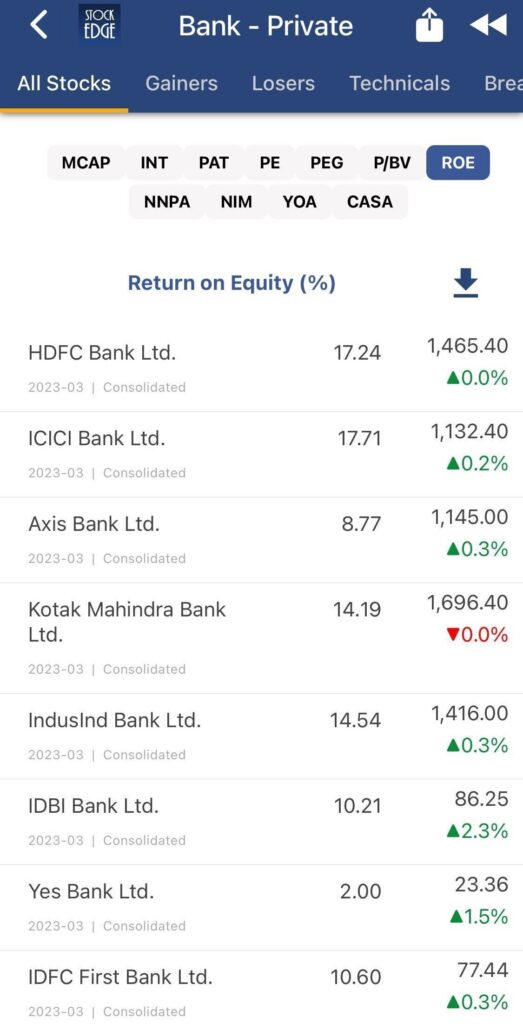

Another example of the economic moat is HDFC Bank. HDFC Bank, after its merger with the housing finance arm, HDFC Limited has a branch network of 8000 branches and added 725 branches over the last 1 year. This is the total size of IDFC First Bank. This means that HDFC Bank is effectively adding one IDFC First Bank every year! This is the economic moat of HDFC Bank, which helps it to generate above-average Return on Equity (ROE) and trade at a higher valuation in comparison to peers.

How Does a Company Create an Economic Moat?

Similar to the medieval fortifications that served as their model, economic moats come in various forms and dimensions. While an organization may discover its economic moat after the fact, many well-known moat types are deliberate attempts to keep market share and stave off competitors.

There are various moats; let us discuss some of them in detail.

How do you identify economic moats in a company and examples?

1. Intangible Assets (Example, Brands)

Brand is the most common form of economic moat for a company. Think of the last time you went to buy noodles. Chances are 99% you ended up buying Nestle’s Maggi. Similar brand recalls are

| Tomato Ketchup | Kissan – HUL |

| Aata | Aashirwaad – ITC |

| Baby Food | Cerelac – Nestle |

| Toothpaste | Colgate – Colgate Pamolive |

| Messaging | Whatsapp – Meta |

| Adhesive | Fevicol – Pedelite |

| Butter | Amul Butter – Amul |

And many more…

Brands are intangible assets, so their value cannot be measured. However, they contribute significantly to a company’s profitability, and companies spend a lot of money creating or acquiring them.

Look at the recent takeover of Capital Foods (Ching’s brand) by Tata Consumer Products for 5,100 crores.

Capital Foods’ annual turnover was just 770 cr for FY24, so why did Tata Consumer pay a hefty sum of 5,100 cr, or seven times the revenues? The answer is brand. Ching’s market has a 30% share, and the segment is expected to expand rapidly over the next few years. Hence, Tata saw value in this. Brands contribute to a company’s goodwill and, hence, drive its valuation.

Similarly, other intangibles, like patents, also provide a strong economic moat. Patents are in high demand in the pharmaceutical industry. They ensure that the company has an exclusive right to develop and sell the product. In India, Sun Pharma has the highest number of patents, which boosts its profitability.

2. High Switching Cost

Some companies produce products that are essential for the consumers, for example, accounting software Tally. Chartered Accountants and companies have been using this software for so long that now it is difficult for them to adapt to another accounting software just for the sake of lower prices. The data is also not transferable to other software easily, strengthening Tally’s economic moat. Unfortunately, Tally is not listed.

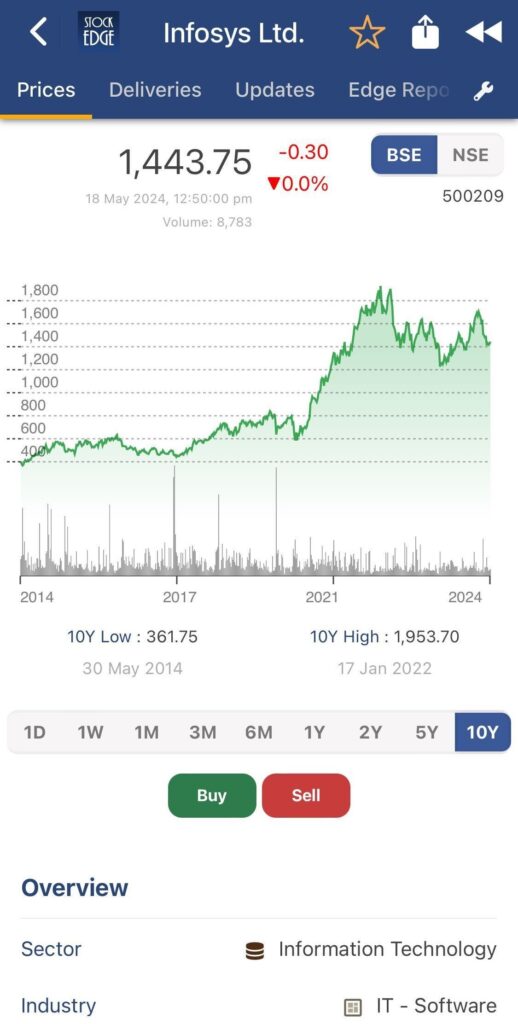

In the Indian stock markets, Infosys is one such company that owns a very common banking software, Finacle. This is widely used by Indian banks, and due to its complexity and data privacy, it is difficult to replicate. Hence it creates an Economic Moat. These types of economic moats help a company generate long term wealth. Look at the price chart of Infosys on the StockEdge app.

3. Network Effects

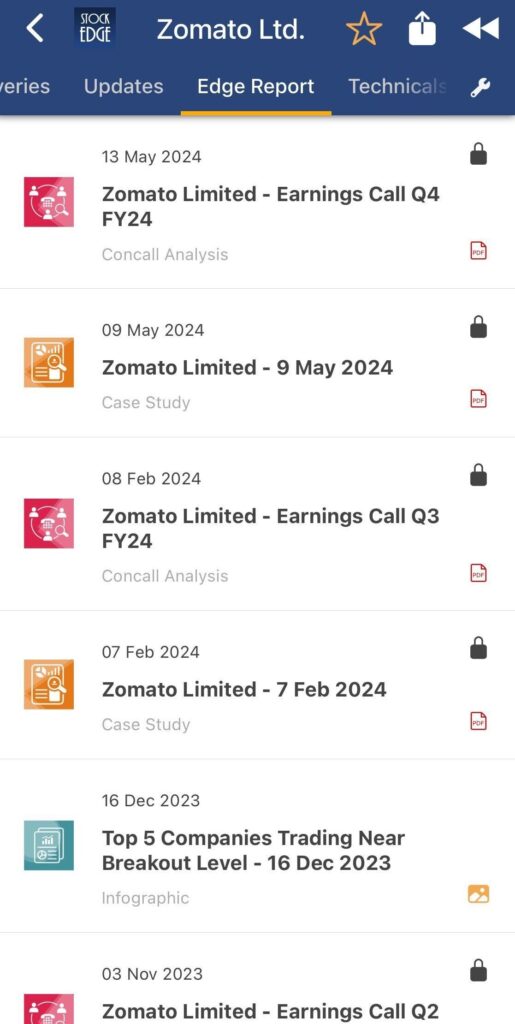

In simple terms, it means creating an ecosystem around the product that makes it difficult for the suppliers and customers to switch. An evident example of network effect in Indian stock markets is Zomato. Due to its large network of partner restaurants and delivery agents, customers choose Zomato to order the food. Similarly, as food and more customers are ordering food from Zomato, new restaurants feel the need to partner with them in order to boost their sales. Now, the cost to onboard new customers/ restaurant partners decreases with scale and at the same time, due to its monopoly/ duopoly, Zomato is able to charge higher margins. The value cost analysis for Zomato looks like below:

A deeper analysis of Zomato’s business model can be done by reading its investor con-calls. You may try StockEdge’s ready con-call summary for Zomato.

4. Low-Cost Production

Warren Buffet is a big fan of low-cost producers and thinks that low cost in itself is an economic moat. He propagates that in commodity businesses, i.e., businesses in which there is little or no differentiation in the products that they offer, for example, Iron and Steel, Telecom, Insurance, Banking, etc., a company that is the lowest cost producer takes up the maximum market share.

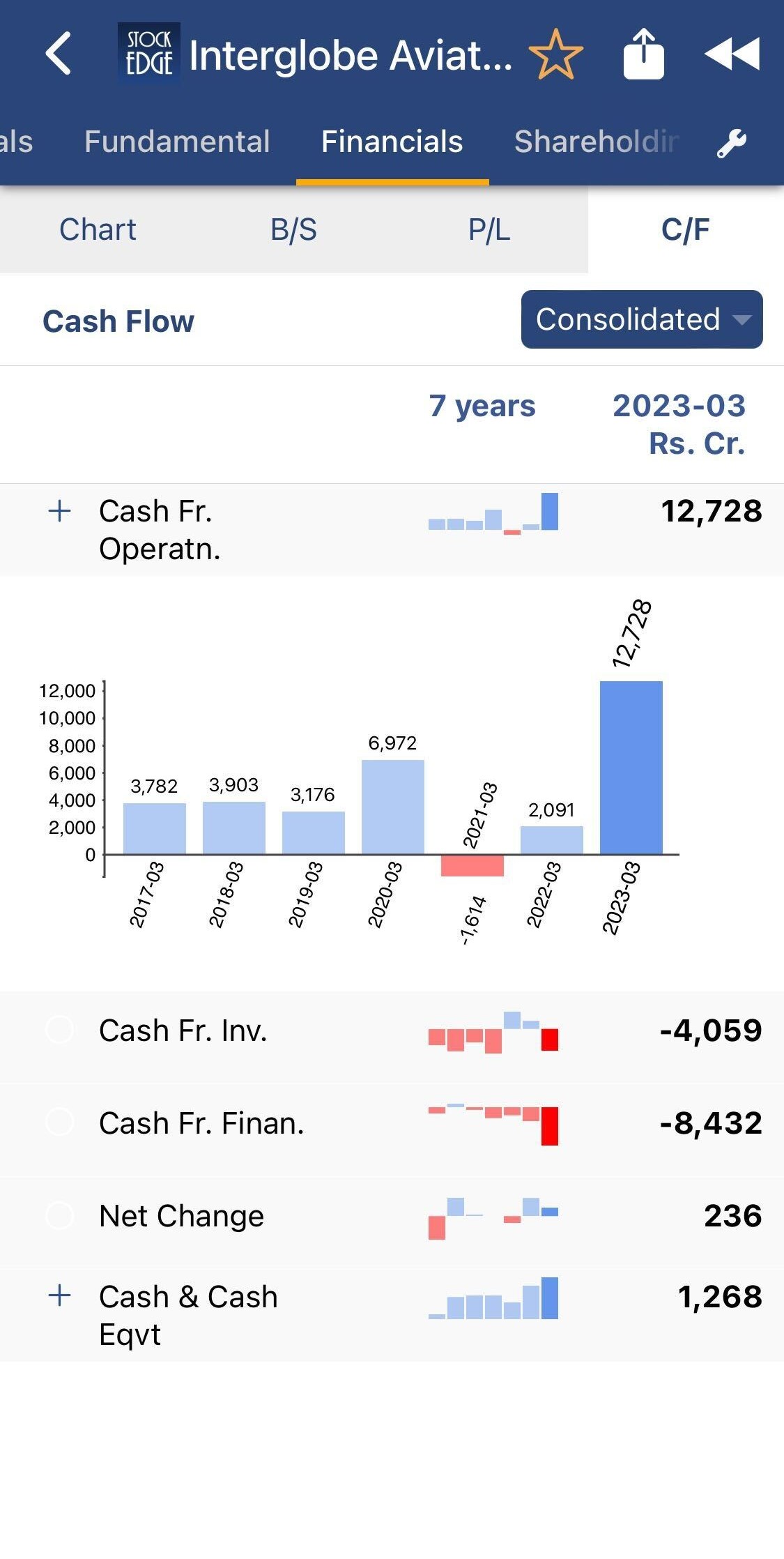

In the Indian stock market, Interglobe Aviation (Indigo) is a very encouraging example. Indigo, today, is the world’s lowest-cost airline (ex-fuel cost). The company, through various cost-cutting measures, has survived competitive times and today has a 60%+ market share and is generating huge cash flows. See here:

5. Regulatory Advantage

Some companies have a regulatory advantage, which allows them to gather more market share and higher profitability. Take, for example, the credit rating business. In India, there are just three listed credit rating agencies: Crisil, ICRA, and Care Ratings. The credit rating license is difficult to procure, and hence, it provides a regulatory advantage to the companies that possess it. They are also able to maintain healthy margins due to this.

Another example of an economic moat due to regulatory advantage is CDSL. Depositories are intermediaries in the financial markets responsible to keep the stocks on behalf of investors. Only two companies, namely, NSDL and CDSL, have the license, and hence, they are able to reap healthy margins.

What are the advantages of having an economic moat in a company?

The one and only advantage of having an economic moat is to make a company profitable over the long term. This makes it desirable among the investors. But how does it do it? Let’s find out.

- Moats help a company survive over longer periods of time.

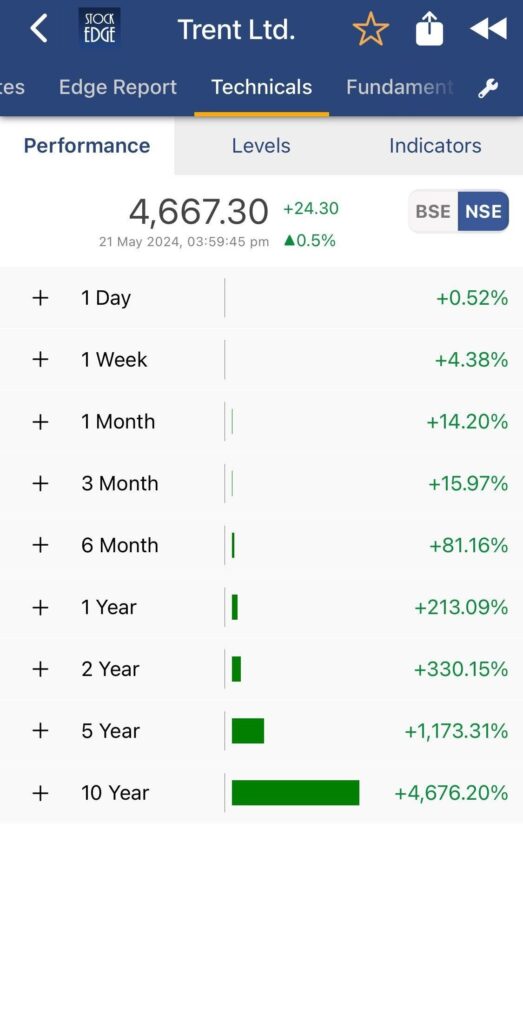

An economic moat like brand keeps the company alive (profitable) for extended periods of time. Think about it, would you invest in any shops at your nearest Fashion Street. I will certainly not do that since all the shops there are common and sell items that can be easily replicated and finally, have no competitive advantage. On the other hand, big branded showroom retailer Trent (owns Zudio, Westside, etc.) has been able to survive many ups and downs in the economic activities and has given handsome returns to the shareholders.

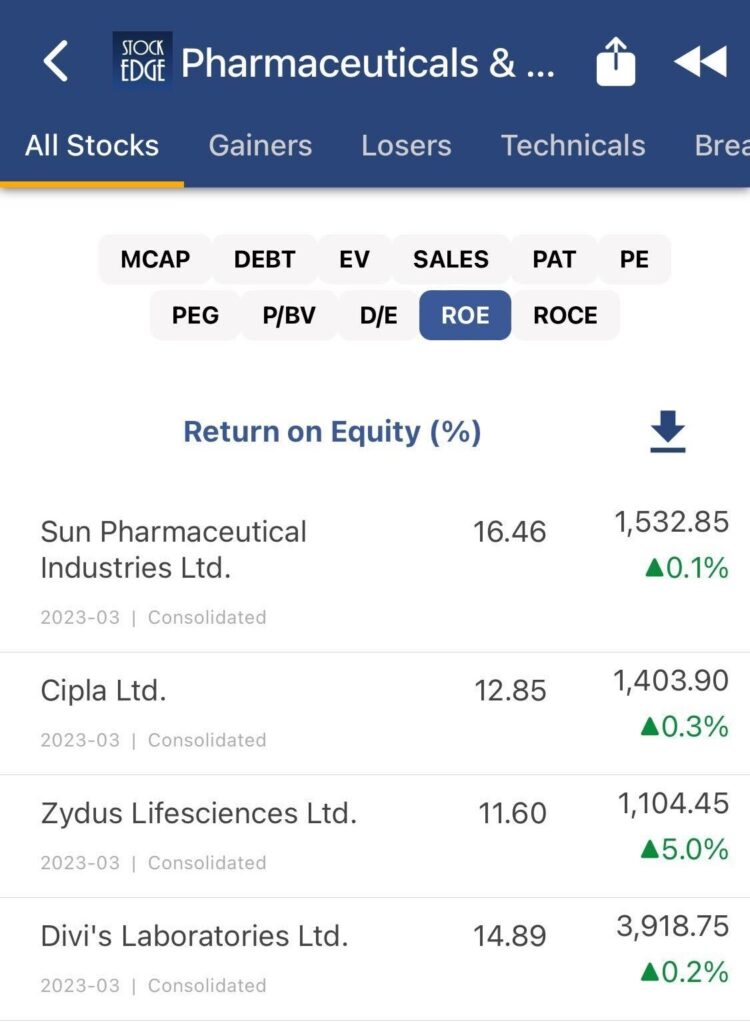

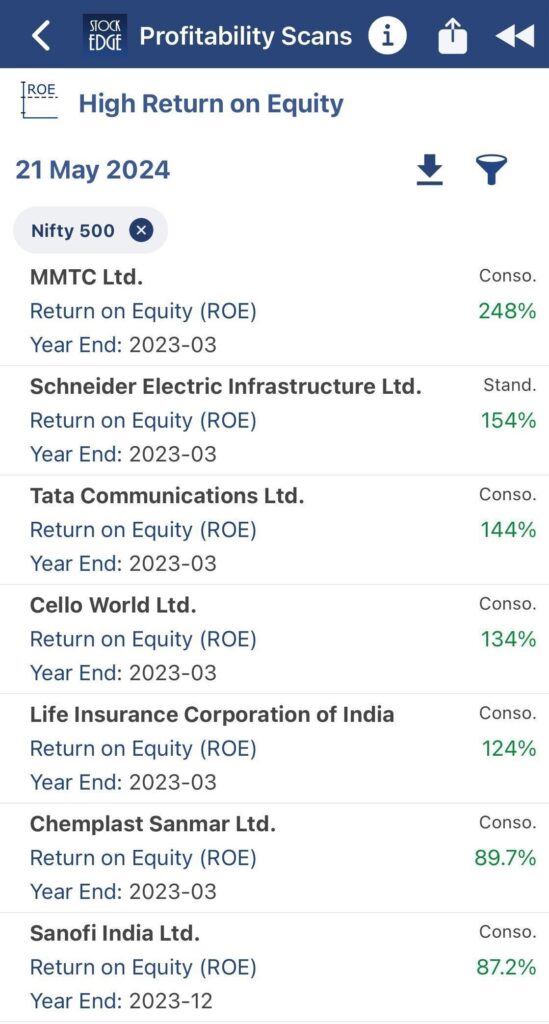

Moats help companies earn above average return on equity (ROE) over extended periods of time.

A business’ ultimate goal is to earn an ROE greater than the cost of capital. The average cost of capital in India stands at about 12%. Therefore, any company that is able to earn a ROE higher than 12% over the long term, is poised to hold some kind of deep or narrow moat.

Here, each of these companies will have some or the other kind of moat. For instance, look at Life Insurance Corporation – being a government owned entity in the insurance business is a big positive since it builds trust among the public for its survival. Hence the promoter brand is a moat for this company.

Next Tata Communication due to its large optic fibre network, has a deep economic moat of high switching cost. Companies using Tata Comms services will need to face heavy cost in terms of setting up the optic fiber infrastructure again.

MMTC, which owns and operates gold mines, has an economic moat due to the rights to use the mine and location advantage. This helps it to generate high ROE.

- Companies with wide economic moats are able to generate higher margins than competition.

Look at the margins of paint companies:

Source: screener.in

Without any doubt, Asian Paints stand at the very top. What are the reasons for this? Well, this was only possible due to the deep economic moat of the company of brand, low-cost production and network effects.

- An established brand helps the company to charge a premium vs its competitors.

- Low-Cost production helps the company to maintain margins and eliminate competition by engaging in price wars.

- Network effects help the company to keep its products popular among its distributors. Since the company is able to provide better incentives to the distributors, they prefer to sell only Asian Paints products. This motivates even the painters to buy only Asian Paints products, due to easy availability of Asian Paint products.

- Moats also help consumers avail lower prices for goods/services.

Certain types of moats exist, such as low-cost producers, who provide goods to consumers at a lower cost and gain market share.

Interglobe Aviation (Indigo) has consistently done this. The airline has been able to bring down its cost significantly over the years, thereby maintaining its fare range and benefiting customers. This, in turn, has led them to gain market share in the Indian aviation sector.

Factors to Consider for Identifying Economic Moats

Moat for a company can be identified in both qualitative and quantitative measures. However, both go hand-in-hand, i.e. what qualifies as economic moats via qualitative analysis, will have some quantitative (measurable) unit reflecting the same. Let us witness that via the table below:

| S.no | Qualitative Factor | Corresponding Quantitative Factor | Comments |

| 1. | Brands | Higher Gross Margin | Gross margin will truly represent the pricing power of the company. |

| 2. | High switching cost | Companies that are low-cost producers will have a higher EBITDA margin than the competition. Their market share will also be higher since they should be able to offer the same product at a lower price point. | Network effect leads to the company attaining economies of scale. This leads to higher EBIT or operating profit. |

| 3. | Network Effect | Higher operating profit | Repeat customers, higher revenue growth. |

| 4. | Low-Cost Production | Higher EBITDA margin + Consistent market share gain | Companies that are low-cost producers will have a higher EBITDA margin than the competition. Their market share will also be higher since they should be able to offer the same product at the lower price point. |

The ultimate effect of all this will be reflected in the company’s ROE. For a company that possesses any kind of economic moat, the long-term average ROE should be greater than 12%.

Investment Strategies Using Moat

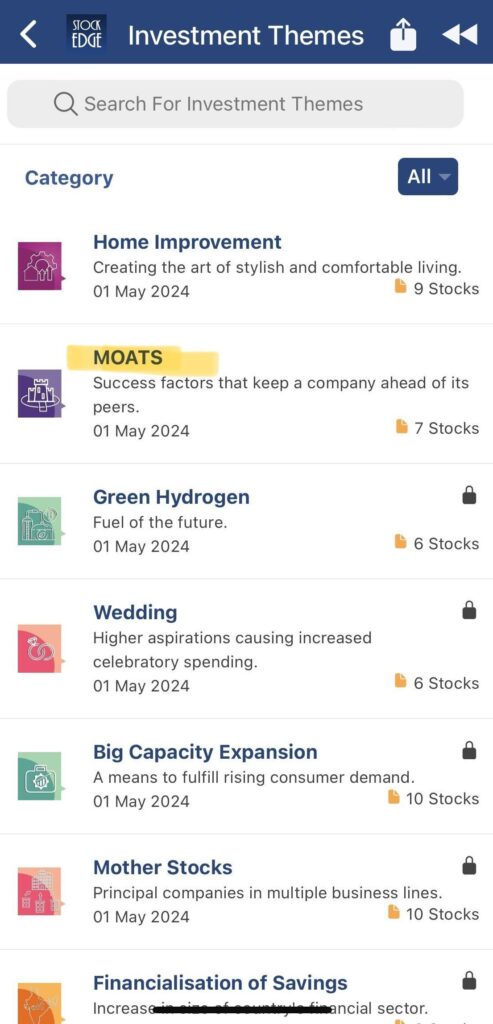

StockEdge has a prebuilt investment theme called “Moats”, which identifies stocks via a few predetermined matrices and can be used to filter stocks possessing higher economic moats. Find it here:

Case Study

1. Nestle India – Brands

Nestle India is a subsidiary of Swiss dairy company Nestle SA. Nestle in India manufactures various brands, including Maggi (instant Noodles), Cerelac (Baby Food), Munch (Chocolates), and Nescafe (Coffee).

Nestle is known for its brands, and hence, that is its economic moat.

Nestle is renowned for its brands. Remember when Maggi got banned in 2017 by FSSAI? Well, Nestle did suffer short term hiccups, however, it was ultimately able to bounce back. Look at Nestle’s gross margins.

The company has been able to maintain its gross profit margin in the range of 65-70% over the last 10 years, which is way higher than the average gross profit margin of FMCG companies.

These brands have also helped in increasing the sales over the last 10-years.

Source: Nestle India Investor Presentation

2. HDFC Bank – Low-Cost Producer

HDFC Bank is the largest private sector bank in India, and now, with the merger with the housing finance company HDFC Ltd., it’s become even bigger. HDFCB has been known for its lower deposit costs (a raw material for any bank) and, hence, is able to maintain a very low cost-to-income ratio.

This has led it to gain market share.

3. Asian Paints – Network Effect

Paints is a low margin product with little product differentiation. Then, how did Asian Paints become the largest paint company in India. The answer lies in the way Asian Paints has expanded its distribution network.

This is how Asian Paints has sustained its leadership over the years.

The Bottom Line

Looking at all the companies discussed in this blog, it seems that Elon was wrong in his hypothesis that with technology, you can destroy economic moats. It surely takes a lot of understanding of the company’s business model to prove its moat; however, if it proves to be a deep moat, empirically, it’s seen that those companies have made investors a lot of money! Hence, the bottom line is to try to find companies that have strong and deep moats, however, at reasonable valuations!