Table of Contents

Did you know India is the largest manufacturer of general medicines in the world?

Indian pharmaceutical companies supply 50% of the global demand for vaccines, 40% of generic medicines demand in the US and 25% of all medication in the UK.

Hence, the pharmaceutical sector should be looked at, if you’re aiming to build a strong and diversified portfolio. In this company overview, we will cover one of India’s prominent pharma giants – Divi’s Laboratories Limited.

With a portfolio of over 160 products (as of 31st March 2023) across diverse therapeutic areas, Divi’s Laboratories has made its mark as a supplier to several world’s leading pharma companies. It manufactures around 30 generic APIs (active pharma ingredients), out of which it is the world leader in 10. It is the world’s leading manufacturer of many of the top global pharma companies.

Divi’s Laboratories Ltd – An Overview

Established in 1990 as Divi’s Research Centre, the company started its journey by developing commercial processes for manufacturing APIs and intermediates. In 1994, the company was renamed Divi’s Laboratories Limited indicating its intention to enter the API and intermediates manufacturing industry.

The first manufacturing facility was set up in Choutuppal, Telangana in 1995. A DC-SEZ unit was set up in the same location during FY20. Its second export-oriented manufacturing unit commenced operation in 2003 in Chippada near Vishakhapatnam. The company also has an SEZ unit which started commercial operations in 2006. In 2010, a research centre was set up in Hyderabad.

Divi’s Laboratories Stock floated its IPO on 17th February 2003. Today the company has a presence in over 100 counties.

The product portfolio of Divi’s Laboratories comprises two broad categories – Generic APIs and custom synthesis of APIs, intermediates and speciality ingredients. Their product portfolio includes a diverse range of APIs used in diverse therapeutic areas such as anti-inflammatory, anti-cancer, cardiovascular and central nervous system drugs. It has 26 CoSs (certificates of suitability) filed with EDQM, 40 DMFs (drug master files) with USFDA, 26 DMFs with Health Canada and 7 DMFs with PMDA, Japan and several filings at various other agencies. Divi’s Laboratories has filed for a total of 41 patents for generic products.

Apart from its presence in India, Divi’s Laboratories has two wholly owned subsidiaries – Divi’s Laboratories (USA) Inc. in the USA and Divi’s Laboratories Europe AG in Switzerland. These units are engaged in marketing/distribution of nutraceutical products thereby providing a greater reach to customers within these regions. The nutraceutical facility is an integrated facility for the production of active ingredients and finished forms of carotenoids. It supplies carotenoids to major food, dietary supplement and feed manufacturers around the world. Additionally, it does custom synthesis as in contract manufacturing of API and intermediates for global innovators.

Furthermore, it is included in the Nifty 50, India’s primary benchmark index. For further insights into Nifty 50 stocks, you can explore articles such as “All About NIFTY50,” “Components of NIFTY50,” and “How to Invest in it.“

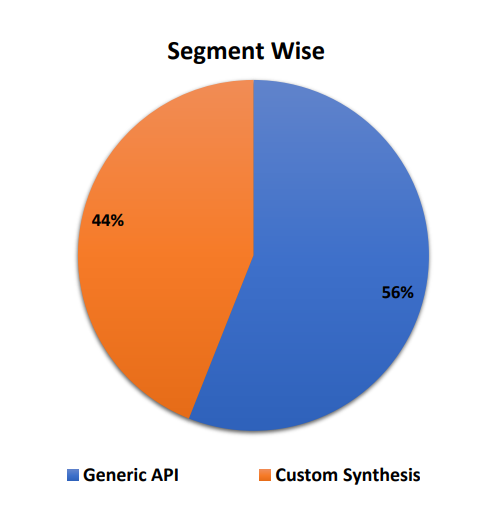

Revenue Mix

The two primary categories in the company’s product portfolio are generic API and Custom Synthesis. The image below reflects the revenue distribution across these two product categories. While Generic APIs contribute 56% of the company’s revenue, Custom Synthesis contributes 44%.

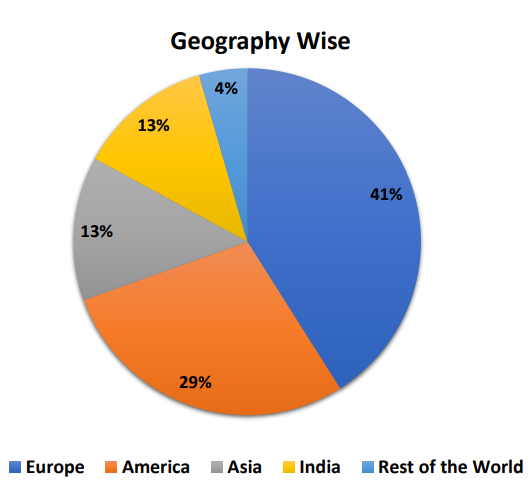

The revenue contributors based on geography are:

Europe is the largest contributor to total revenue for the company followed by the US. Domestic sales contribute only 13% of revenue to the company.

Sector Outlook – Pharmaceutical

Before deep diving into the financials of Divi’s Laboratories, let us understand what lies ahead for the pharmaceutical Industry.

The outlook remains positive as expired patents pave the way for increased demand for generic drugs. In a report published in January 2023, the IMF expected the global medicine market to reach USD 1.9 trillion by 2027 with a projected CAGR of 3%-6%.

IQVIA, a Fortune 500 company dedicated to health information technology and clinical research, expects the growth to be primarily fuelled by oncology, immunology, anti-diabetics and obesity drugs. Oncology is expected to lead the way with a 10-year CAGR of 15.3%. It is anticipated to grow by 13%-16% CAGR, reaching USD370 billion by 2027. This growth will be supported by the launch of innovative cancer treatments.

Another driving factor for growth will be the rising prevalence of chronic diseases which will boost the growth in the small molecule drug discovery market. Innovations in the space of small molecules are expected, especially in the fields of oncology and neurology.

There will also be a loss of exclusivity (LOE), according to IQVIA. This will have a significant impact as the US alone is expected to face LOE of USD 141 billion by 2027, as compared to USD 49 billion in the last 5 years. Small molecule expiries will lead to a decrease in brand spending by USD 98 billion by 2027 which accounts for more than double the impact of the preceding five years including the impact of high-profile products in the anticoagulants therapy area. The impact of LOE in the five largest European markets (Germany, France, Italy, Spain, and the UK) are expected to triple over the next five years.

But what about regions other than the US and Europe? Significant volume growth in medicine consumption is expected in markets such as Latin America, Africa-Middle East and Asia-Pacific including India.

The pharma industry of India is currently valued at USD 50 billion. India is a major exporter of pharmaceuticals serving over 200 countries. It supplies over 50% of Africa’s generic medicine requirement as well as 40% of generic demand in the US and 25% of all medicines in the UK.

Financial Highlights

Understanding the fundamentals is key to deciding whether you should invest in Divis Laboratories Stock or not. Taking a look at the three pillars of a company’s financials – income statement, balance sheet and cash flow statement can provide you with a wide range of information.

Income Statement

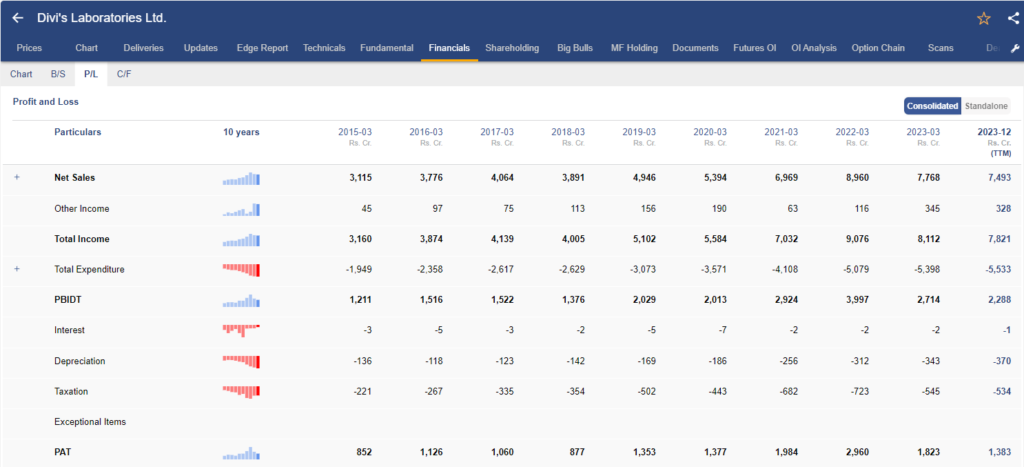

The profit or loss or the income statement provides an understanding of the income aspects of a company such as sales, profitability and others.

However, it can be difficult to interpret for a person from a non-finance background. Hence, on the StockEdge App, we have organised income statements of companies in an easy-to-understand manner to help you perform your analysis quickly.

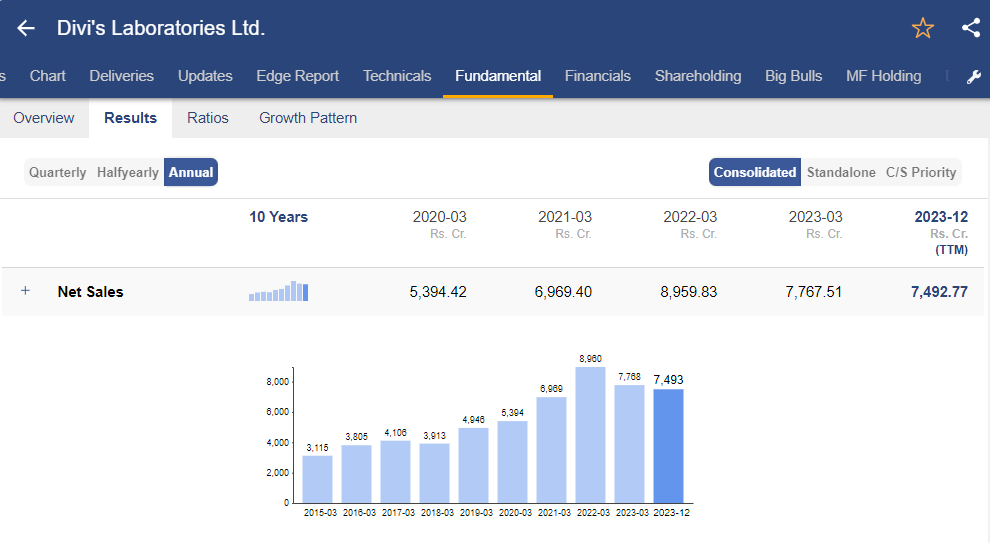

The above image shows the income statement of Divi’s Laboratories. It showcases all the details – from topline to bottom line.

Sales Growth

In FY23, the company demonstrated a net sales decline of 13.3% YoY, with total net sales of ₹7,768 Crores. The company had received an order for anti-covid during FY22 that led to a strong rise in sales. Revenue from nutraceuticals was ₹650 cr. Exports to Europe & North America accounted for 70% of total sales.

EBITDA Growth

In FY23, the company’s EBITDA stood at ₹2,368 Crores, a de-growth of 29% YoY. This decline was mainly due to the high cost of inventory, pricing pressure towards certain generic products, rise in raw material, power and fuel and shipment costs until Q3 FY23. All of these, however, improved from Q4 FY23 onwards. Net material consumption increased during the year due to a significant change in the product mix.

PAT Growth

The company registered a PAT decline of 38.4% YoY to ₹1,823 Crores in FY23. The company registered a standalone forex gain of ₹134 Crores in FY23. The effective tax rate in FY23 stood at 23%. However, as the tax benefits pertaining to SEZ will phase out soon, the company is expecting the tax rate to rise to 25% – 27% in the coming years.

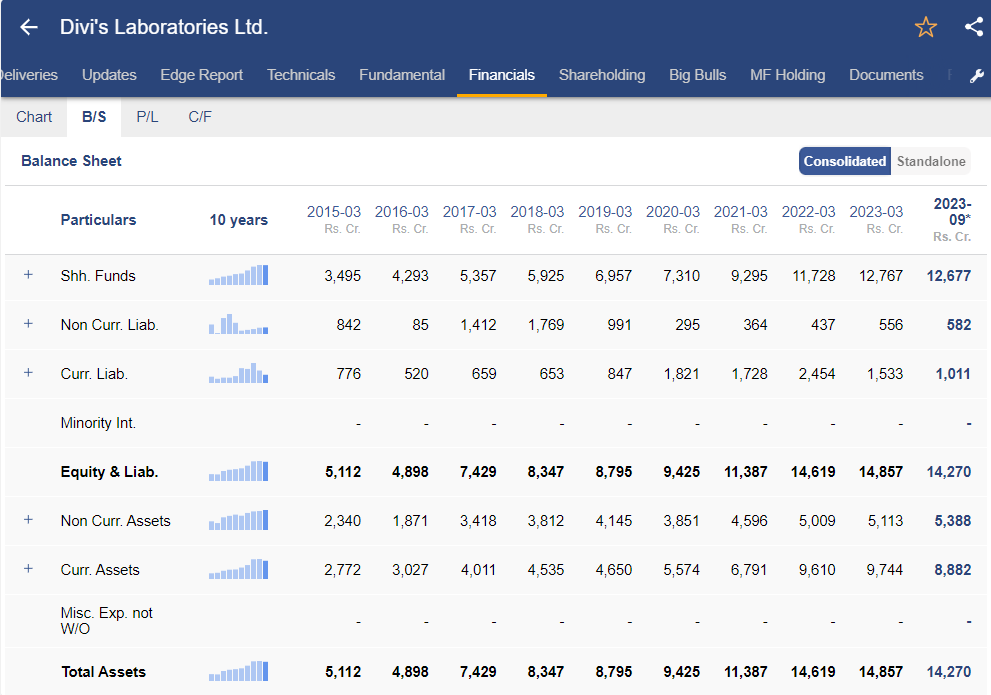

Balance Sheet

A very important indicator of a company’s financial health, the balance sheet is another document that is crucial to fundamental analysis.

Let us take a look at the balance sheet of Divi’s Laboratories:

The two most important components of a balance sheet are assets (materials held by the company which have monetary value such as inventory, equipment, plants, etc.) and liabilities (things that the company owes to others such as debt, mortgage, etc.). Both can be long-term and short-term.

During FY23, Divi’s Laboratories had long-term liabilities worth ₹556 Crores and long-term assets worth ₹5,113 Crores, while short-term liabilities were worth ₹1,533 Crores and short-term liabilities were worth ₹9,744 Crores.

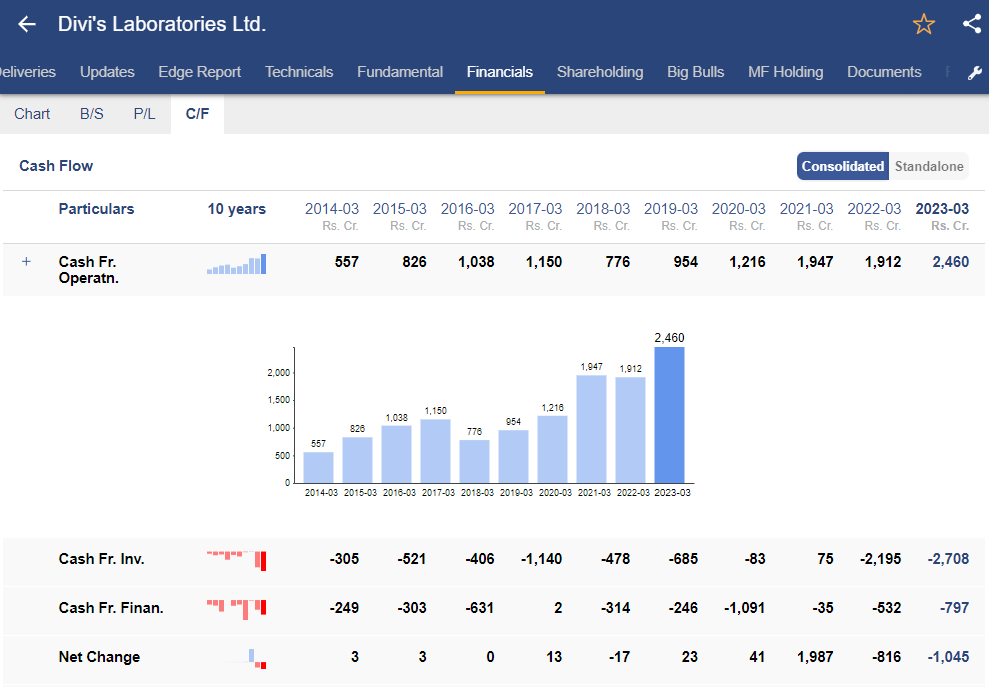

Cash Flow Statement

The cash flow statement of a company provides a summary of the generation and usage of cash by the company over a specific period. It consists of three main segments – operating cash flow, financing cash flow and investing cash flow. Out of these, operating cash flow is the most important as it shows how the company generated cash from its core business operations.

The cash flow statement of Divi’s Laboratories Ltd. shows that in FY23, the total cash flow generated from operations was ₹2,460 Crores. Major non-operating adjustments in the cash flow statement included depreciation & amortization expenses and interest income from financial assets at amortized cost. Operating adjustments were pertaining to working capital.

The company also reported a cash outflow from investing activities of ₹2,708 Crores in FY23. This was mainly related to net deposits and payments due to the purchase of property, plant and equipment. The ₹797 Crores cash outflow from financing activities in FY23 was due to the payment of dividends.

Financial Highlights for Q3 FY24

So how is FY 24 going so far? Here are some of the things to note from the last available quarterly report of Q3 FY24:

- Revenue from operations in Q3 FY24 was ₹1,855 Crores, a growth of 8.6% YoY. Total revenue earned for the first 9 months of FY24 is ₹5,542 Crores.

- The company reported a net profit of ₹358 Crores for Q3 FY24, a YoY growth of 17%. Total profit earned during the first 9 months of FY24 is ₹1,062 Crores.

- Raw material consumption for Q3 FY24 was 39% of the total sales, due to the favourable product mix and softening of raw material prices.

- The company reported a forex gain of ₹18 Crores in Q3 FY24 compared to ₹47 Crores in Q3 FY24. The total forex gain for the 9 months of Fy24 was ₹32 Crores.

- The company reported capital assets worth ₹77 Crores for Q3 FY24 and ₹202 Crores for the 9 months of FY24.

- As of 31st December 2023, cash on books was ₹3,913 Crores, receivables were ₹1,792 Crores and inventories were ₹3,201 Crores, respectively.

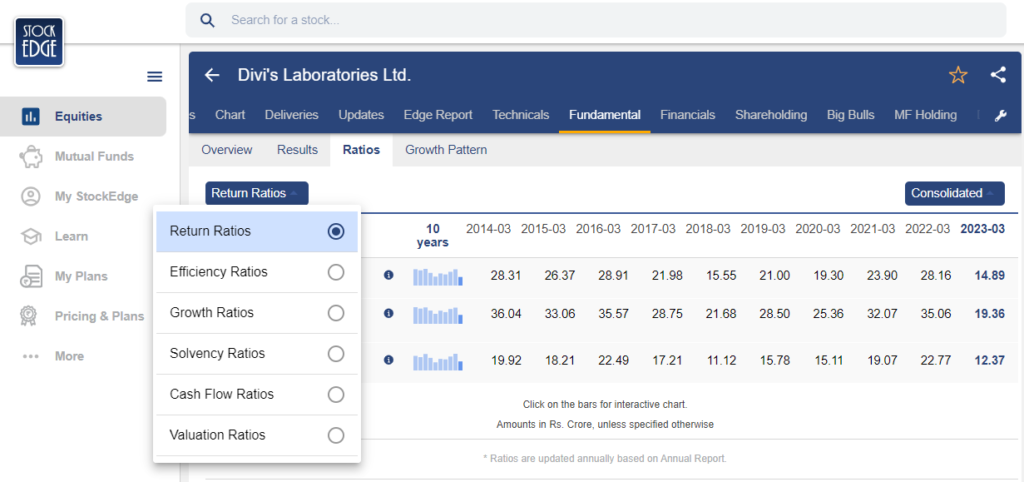

Ratio Analysis of Divi’s Laboratories

Another important way to understand the financials of a company is by evaluating various financial ratios. It enables us to compare the financial performance of a company to industry benchmarks and competitors.

You can evaluate various kinds of financial ratios. Thanks to the StockEdge App, you don’t have to calculate these ratios yourself, they are readily available on the app. You can access a range of ratios on the app, as shown in the image below:

Let’s take a look at a few important ratios of Divi’s Laboratories Ltd:

Return on Equity (ROE)

ROE is a profitability metric which gauges a company’s capacity to produce net income relative to the shareholders’ equity. In FY23, the ROE of the company declined to 15%. This decline was due to the substantial reduction in net profit.

Return on Capital Employed (ROCE)

ROCE measures how efficiently the company is utilising its total capital, including debt and equity. In FY23, Divi’s Laboratories ROCE declined to 19% due to a decrease in PBIT. The capital employed increased on a YoY basis on the back of the rise in total assets.

Debt to Equity Ratio (D/E Ratio)

The D/E ratio reflects the extent to which the company’s operations are being financed by debt. Divi’s Laboratories does not have any debt on its books.

Price to Earning Ratio (PE Ratio)

An important aspect to consider while investing in stocks, the PE Ratio measures the company’s share price relative to its EPS. As of 3rd March 2024, the TTM PE Ratio of Divi’s Laboratories is 67.12.

Management Quality & Shareholding Pattern

A company’s management is key to shaping the future of the company as it makes decisions related to various aspects of the company including financial performance, risk management and creating value for shareholders.

The management of Divi’s Laboratories is committed to working towards optimising production and upgrading its capacities to stay competitive and remain compliant with regulation. It aims to increase business opportunities in the coming years.

In the last few years, the company has taken various initiatives such as backward integrations and debottlenecking to enhance the efficiency of different aspects. The management intends to apply green chemistry tools to reduce the consumption of raw materials, conserve energy, enhance efficiency and reduce wastage.

As of Q3 FY24, 51.93% of the company is owned by promoters, while 48.08% of the company is held by the public, including 14.85% by FIIs and FPIs. DIIs own 21.89% of the company as well. The top public shareholders are SBI Mutual Fund, LIC of India, Axis Mutual Fund Trustee and Govt Pension Fund Global.

Future Outlook of Divi’s Laboratories

The future looks strong for Divi’s Laboratories. The iodine-based contrast media is catering to two products – Iopamidol for the generic market and Iohexol. It is also targeting other iodine-based compounds. It is in the final stages of completing processes in the gadolinium compounds and is waiting for approval to start commercialisation.

On the capex side, the unit III 200-acre Phase I construction project is progressing well. This greenfield project will free up facilities in units I and II for new opportunities in custom synthesis and generic products. The production is planned to commence by the end of Q1 FY25.

The company aims to be the leading supplier of peptides, dipeptides and tripeptides in the coming years. The company has the capability to be a major provider of amino acids required for pharmaceuticals. The company already had production capacities for this in Unit I and Unit II.

Case Study of Divi’s Laboratories

If you are keen to know what the experts have to say about Divi’s Laboratories, head to the StockEdge App and access Investment Ideas. You will find a quick snapshot of what our expert team of analysts think about the company:

Efficiency, solvency, valuation, quality and growth. Divi’s Laboratories has received 24 out of 30 on these six parameters.

A Final Word

Overall, pharmaceuticals and drugs are a competitive industry that has seen a robust increase over the last few years. Divi’s Laboratories is a leader in generic APIs owing to its exports to the US and Europe.

Over the last two years, the company’s has achieve scale through its investments in capacity expansion, debottlenecking, and backward integration strength. The company places importance leveraging its expertise and strengths in chemistry by building strong customer relationships supported by cost competitive and fast delivery structure.

The investment in the generic segment is expected to rise mainly due to the present market dynamics around the use of medicines, the adoption of newer treatments, the impact of patent expiries and new generic competition, which will all contribute to the market growth for the next five years.

How much is Divi company worth?

As of 5th March 2024, the market capitalisation of Divi’s Laboratories is ₹94, 184.27 Crores.

Who is the CEO of Divis?

Kiran S. Divi is presently the Director on the Board & Chief Executive Officer of Divi’s Laboratories Ltd.

What is the history of Divi Laboratories?

Established in 1990 under the name Divi’s Research Centre, the company embarked on its journey by developing commercial processes for manufacturing APIs and intermediates. Renamed Divi’s Laboratories Limited in 1994, it signalled its entry into the API and intermediates manufacturing sector.

The inaugural manufacturing facility was established in Choutuppal, Telangana, in 1995, followed by the setup of a DC-SEZ unit at the same location during FY20. In 2003, its second export-oriented manufacturing unit commenced operations in Chippada near Vishakhapatnam. Additionally, the company operates an SEZ unit that began commercial operations in 2006.

In 2010, a research centre was established in Hyderabad.

On February 17, 2003, the company went public with its IPO. Presently, it boasts a global presence spanning over 100 countrie