Cryptocurrencies appeared just a couple of years ago and are better referred to as a new breed of digital or virtual currencies which have turned a whole new dime on how money is understood and applicable. If this is the first time you have learned about how these cryptocurrencies function, you might feel quite confused. This article will provide a short analysis of thе definition of cryptocurrencies and what they do as well as some important dеtails rеlеvant to thе application of thеsе cryptocurrеnciеs.

What is Cryptocurrency?

As simplified as possible, we can define cryptocurrency as money that can be used and stored on the internet, received, and sent to any number of people at any time. Unlike conventional cash which is managed by organizations and other financial institutions, cryptocurrencies are managed by networks that use the blockchain. The biggest player here is Bitcoin, one of the most traded cryptocurrencies; however, nonetheless, there are many more known altcoins like Ethereum, Litecoin, and Ripple among others.

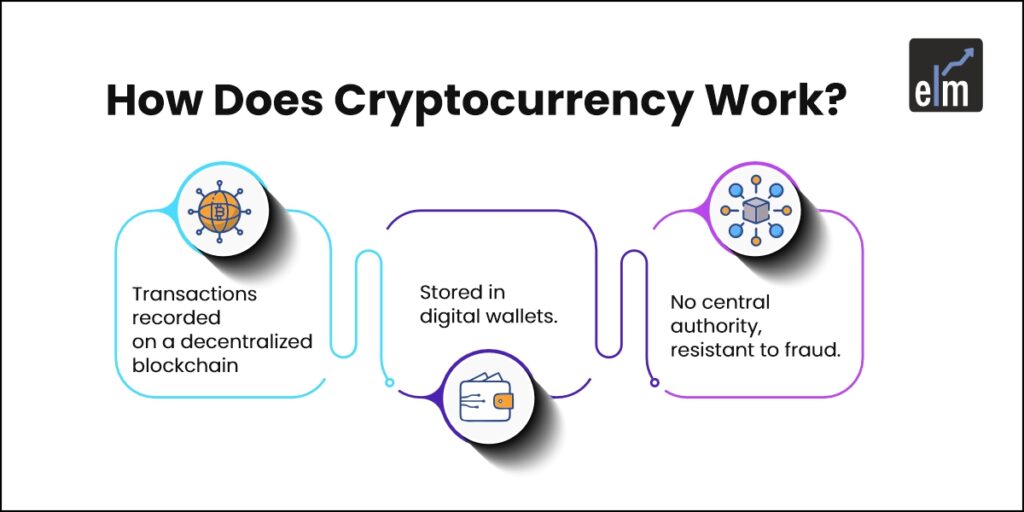

How Does Cryptocurrency Work?

The general idea of cryptocurrency comes from what is known as blockchain and which acts as a ledger that is responsible for keeping records of all the crypto transactions. These transactions are bundled in blocks and then recorded on the blockchain. This system is decentralized and meaning no organization owns it and it cannot be fraud or manipulated easily. Cryptocurrencies are stored in digital wallets and users can trade crypto directly with one another and leaving out the need for traditional banks. And this is why they are so convenient.

Why Invest in Cryptocurrency?

The first reason investors are drawn to cryptocurrencies is for the higher rates of return they provide. For example, Bitcoin, which began in 2009 has expanded in value tremendously from a fеw hundred dollars to a whopping $70,000. Cryptocurrencies are also private, cost-effective, and flexible in terms of cross-border transactions which is a plus for those willing to expand their buying portfolios. On the other hand, as the crypto market is known for being highly volatile, do read and research before you jump into it.

Crypto Trading

Crypto trading is getting more popular, as many people wish to earn money due to the volatility of the crypto world. It implies the use of special crypto trading platforms that provide people with the conditions to trade, monitor their market, and review the data. Although many trading platforms are regarded as the most user-friendly ones, including Binance, Coinbase, and Kraken, you need to understand that any trading always involves risks. Therefore, it would be a smart idea to start with a minimum investment. This is especially true for those people who are new to trading, so there is no need to risk everything.

Different Types of Cryptocurrencies

Bitcoin was the first digital currency while today there are thousands of these currencies and each one has its function. Some were designed for fast and inexpensive exchanges like Litecoin, and others support smart contracts like Ethereum. There are also stablecoins such as Tether which as the name suggests is anchored on traditional fiat currency such as the USD and provides a stable market rate in a very volatile environment.

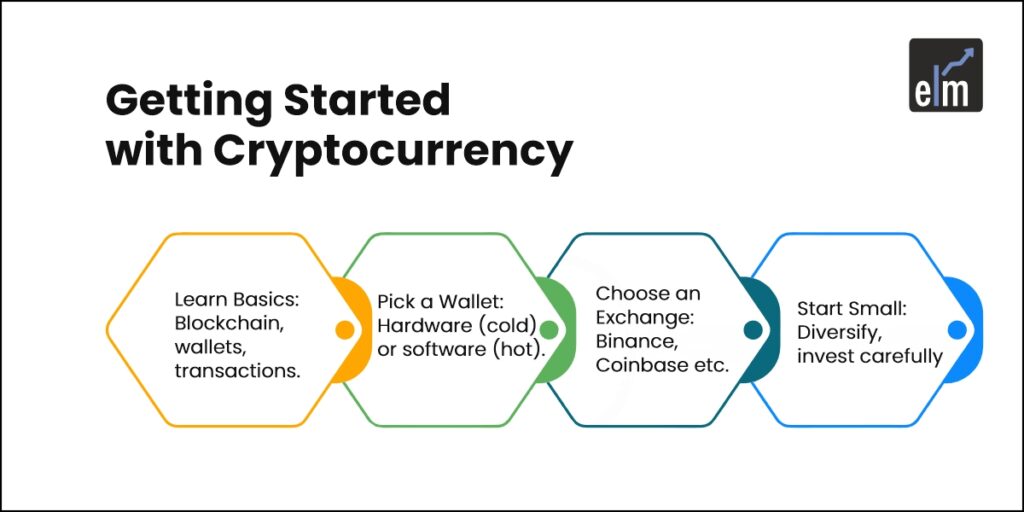

Getting Started with Cryptocurrency

#1 Learn the Basics: Before you decide to spend your well-earned money on crypto it is essential to familiarize yourself with all the types of cryptocurrencies and how each of them functions. Get to know some general facts about blockchain and wallets and the way that transactions happen.

#2 Pick a Crypto Wallet: Cryptocurrencies are digital assets that have to be stored in a wallet. There are two main types of wallets – a hardware wallet or a cold wallet which is a physical device like a flash drive and a software wallet or a hot wallet which is an application on your phone or computer. Both of these types have pros and cons and so it’s up to you which one you will choose.

#3 Choose a Crypto Exchange: If you’d like to trade cryptocurrency then you need to join an exchange platform that deals in digital currencies. It is essential to choose a site that offers many cryptocurrencies with a focus on protection measures.

#4 Begin with Small Investments: The cryptocurrency market can be very volatile. Whеn starting investing it is recommended to invest small amounts of money and gradually increase your investments. It is also a smart move to diversify your portfolio, meaning don’t invest all of your money in thе same cryptocurrency.

Final Wrap

Cryptocurrency is quite a new and innovative concept in financing. It has been embraced by investors worldwide because of high returns, a decentralized structure, and unique technologies. Whether you have decided to invest in it in the long perspective, master trading, or just have a taste of it, you should know the basics. Just always remember the crypto market is very volatile and be careful and think long-term.