Table of Contents

Bharti Airtel share is making new life highs. As of 21st March 2024, the share price of Airtel has reached ₹1242/share. Bharti Airtel shares have performed very well in the past couple of years. In the last year, Bharti Airtel shares gave a 62% return, which is nearly double that of the Indian benchmark index Nifty 50, which gave a return of nearly 30% last year. Of course, the Indian markets are in a continuous bull run. Hence, the majority of stocks have shown staggering returns over the past few years.

Can Bharti Airtel share continue to outperform? To know what lies ahead for the stock, you need to conduct a thorough analysis of its financials. In today’s blog, we will do exactly that with the help of StockEdge.

Before we get to know the company overview, let’s look at India’s overall telecom industry.

The Indian telecom industry has huge potential for growth in the coming years.

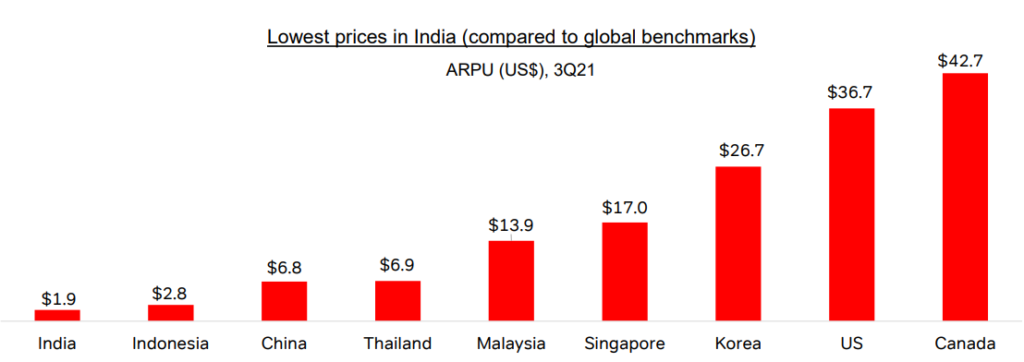

Since the entry of Jio into the market, data consumption in India has surged dramatically. However, the Average Revenue Per User (ARPU) hasn’t seen a corresponding increase due to fierce competition. In India, the ARPU stands at just USD 2, notably lower than the USD 6.6 in China. Additionally, 4G/5G penetration remains relatively low compared to developed nations but is expected to improve in the coming years.

Here is a comparison of the average ARPU of the telecom industry across different countries.

As you can see, there is potential for growth in ARPU and for a telecom company, an increase in ARPU directly reflects the revenue generated by each customer on average. ARPU acts as a key performance metric to measure the financial health and potential for growth of telecom companies. So, what is the ARPU for Bharti Airtel? Is it growing or not? Let’s take a deep dive into the company’s financials.

Company Overview

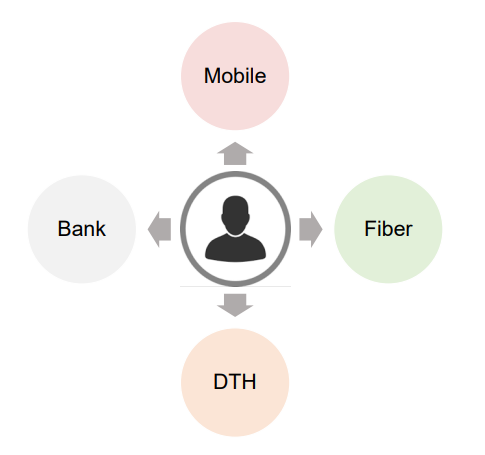

Bharti Airtel Limited is a telecommunications company operating in 18 countries across Asia and Africa. The company has more than 400 million customers across its various business segments. The company ranks amongst the top 3 telecom service providers worldwide in terms of subscribers. Bharti Airtel provides telecom services under wireless and fixed line technology, national and international long-distance connectivity and Digital TV, and complete integrated telecom solutions to enterprise customers.

Bharti Airtel has four major business segments:

Revenue Mix of Bharti Airtel

As of FY 23, geographical revenue breakup stands at India and South Asia, contributing to -70% and Africa -30 %. Out of which, revenue breakup for the India and South Asia region: Mobile Business-77%, Airtel Business-19%, Homes Services-4%, Digital TV Services-3%.

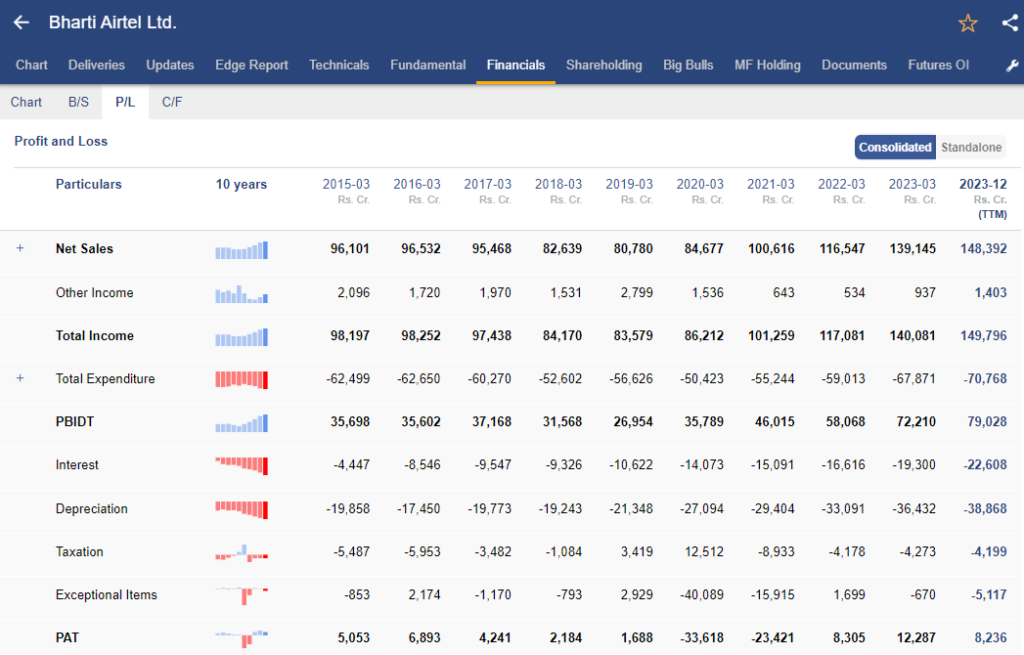

Financial Highlights of Bharti Airtel

As of FY 23, the geographical revenue breakdown is as follows: South Asia, contributing to -70%, and Africa -30 %. Out of which, revenue breakup for the India and South Asia region: Mobile Business-77%, Airtel Business-19%, Homes Services-4%, Digital TV Services-3%.

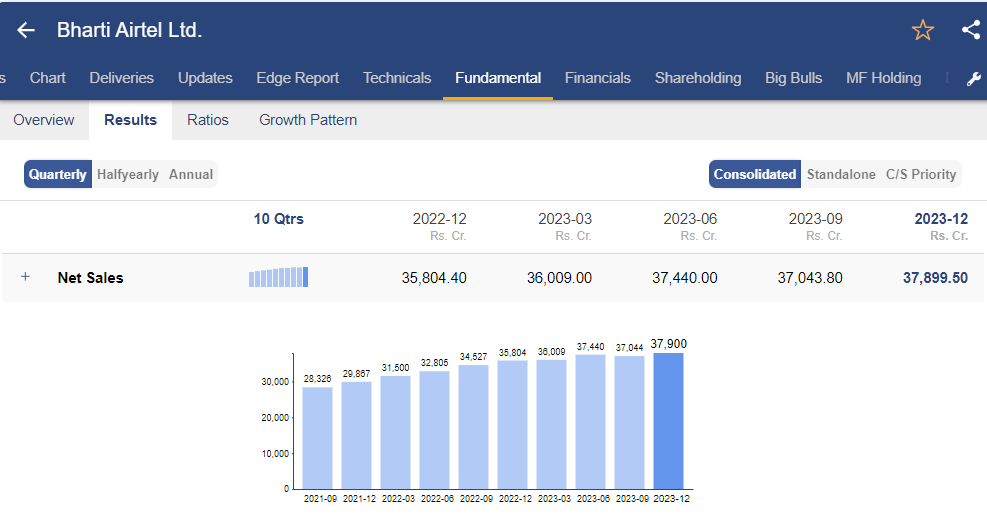

As you can see, StockEdge offers you a visual bar graph of each segment of the income statement so that it becomes easier to interpret the complex financials for any company.

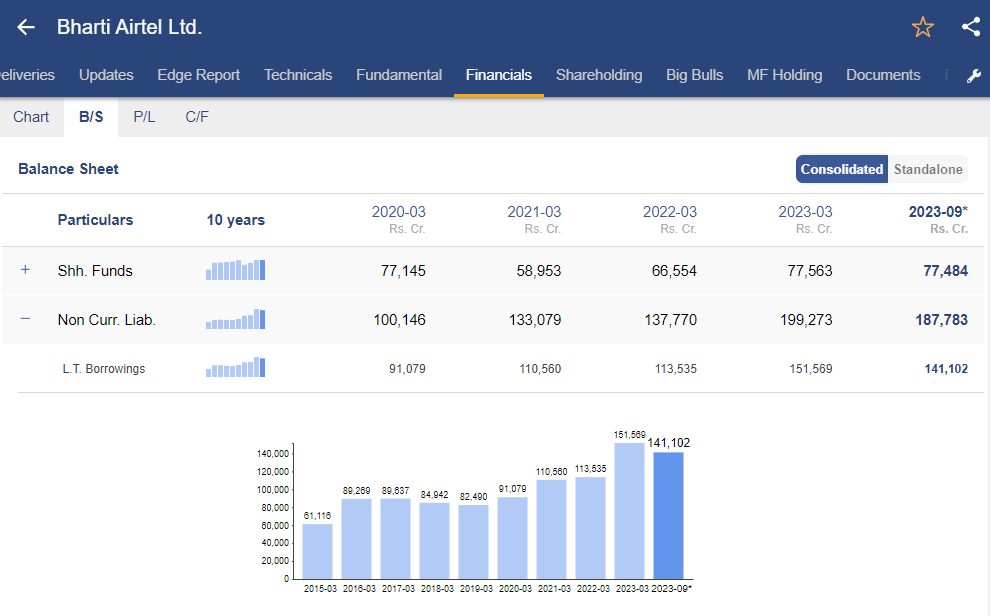

Debt, which is a balance sheet item, is still very high, and interest costs remained elevated during the year.

As you can see, the long term borrowings under the Non current liabilities on the balance sheet of Bharti Airtel remained elevated.

The consolidated mobile data traffic grew by 21.5% YoY, reaching 14,030 PBs. Revenue from India increased by 12.2% YoY, amounting to ₹25,250 crore. In Africa, revenue (in constant currency) rose by 18.6% YoY, with an EBITDA margin of 49.2%. The company’s mobile services revenues in India grew by 11.5% YoY, driven by improved realization and strong 4G customer additions. The average revenue per user (ARPU) increased to ₹193 in Q4 FY23. The average data usage per data customer stood at 20.3 GB/month.

During Q1 FY24, the company reported 14.1% YoY revenue growth, primarily driven by robust results in its India business. While the net profit declined by 38.4%, it was affected by a foreign exchange loss due to changes in the Nigerian Foreign Exchange Market. During Q2 FY24, the company reported an increase of 7.3% YoY. Despite a dip in net profit by 29.7%, amounting to ₹2,093.2 crores, the company demonstrated strength amid evolving market dynamics.

The growth was attributed to a robust portfolio performance, evidenced by a diverse business mix with Africa contributing 28%, India Mobility at 57%, and India Non-Mobile at approximately 15%.

In Q3 FY24, Company’s revenue increased by 5.9% YoY to ₹37,899.5 Cr and a 10.1% YoY growth was reported in Net Profit to ₹2,876.4 crore. You can check the quarterly results of the company from StockEdge itself, as you can see the quarterly net sales of bharti airtel can be viewed in a bar graph for easier comparison from previous quarters.

This growth trajectory is indicative of Airtel’s robust business model and its capacity to navigate the complexities of the telecom market. Despite these positive outcomes, the company faced challenges, including a foreign exchange loss of ₹130 crore due to currency devaluations in Africa.

The company’s EBITDA stood at ₹20,044 crore, up by 7.8% YoY, with margins expanding by 120 basis points to 53.9%. This margin expansion can be attributed to operational leverage and cost efficiencies across the board.

Airtel’s strategic initiatives in India, such as strengthening its 4G/5G customer base and focusing on ARPU improvement, have been pivotal. The customer base in India grew to approximately 34.6 crore, with a significant portion being high-quality 4G/5G users, underscoring the company’s focus on premiumization and quality customer acquisition.

SWOT analysis of Bharti Airtel share

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strength

The company is operating in an oligopoly market of telecommunication business in India. It has the highest ARPU (Average Revenue per Customer) in the telecom industry in India, followed by Jio and Vodafone. According to recent data, it has the second highest market share in the customer base, followed by Jio. It has quite an impressive 4G subscriber base, which is anticipated to grow in upcoming years in terms of 5G subscribers. It has been diversifying its operations in non-mobile business by venturing into DTH, OTT, Airtel Home and Airtel Business.

Weakness

As Jio started capturing the market, Airtel had to lose some of the subscribers, owing to higher tariff charges of Airtel, this risk might prevail. Airtel faces hurdles such as currency fluctuation risks, as seen with foreign exchange loss, and the challenge of maintaining profitability and market share in a highly competitive environment. The discontinuation of the entry-level broadband plan, which led to a moderation in net customer additions, highlights the delicate balance between market expansion and profitability.

Opportunities

As the current situation of Vodafone is not very good, it has been witnessing high attrition rate, this can be a good opportunity for the other players, Airtel & Jio. If Airtel can come up with better customer experience, the base will keep expanding.

Looking ahead, Bharti Airtel plans to leverage 5G technology to accelerate postpaid business growth. The company has created 5G experience zones in its retail stores nationwide, showcasing the power of 5G to consumers. Currently, 5G Plus service is available in around 3,000 cities and towns, with plans for further expansion towards nationwide coverage. Airtel aims to achieve a long-term ARPU of ₹300 and anticipates a capex range of ₹28,000-₹31,000 crores for FY24, focusing on 5G, data centers, and broadband rollouts.

Airtel also partnered with India Post Payments Bank (IPPB) to launch WhatsApp Banking Services for IPPB customers. Bharti Airtel expects its capital expenditure (capex) for FY24 to be at similar levels as FY23. The company aims to allocate capital strategically to maintain competitive growth in the market and reduce its leverage on the balance sheet.

Airtel’s capex investment of ₹9,274 crore during the quarter is a clear indicator of its commitment to expanding and enhancing its network infrastructure, including the rollout of 5G services, broadband expansion, and data centers. This investment is expected to continue, with a projected capex of ₹28,000-₹31,000 crore for FY24, aimed at supporting the ongoing 5G rollout, among other initiatives.

The company’s future outlook remains optimistic, with an emphasis on further 5G deployment, broadband expansion, and digital transformation. The acquisition of Beetel Teletech and its stakes in Dixon Electro Appliances Private Limited are strategic moves to bolster Airtel’s position in the telecom product ecosystem, aligning with the ‘Make in India’ initiative and enhancing its distribution and service capabilities.

Threat

The major threat is from the toughest competitor, Jio, as their tariff rates are lower, and the latter is a part of the Reliance group. Companies are susceptible to technological advancements, revolutions, and regulatory issues.

The Bottom Line

Bharti Airtel is reinforcing its position as a leading player in the Nifty 50 index, with strong subscriber base growth across all segments this quarter and a positive management outlook on upcoming opportunities, indicating robust future performance for the company. Over the next 2-3 years, the company will prioritize significant capital expenditure for investments in 5G technology and expanding its customer base in rural areas. However, implementing tariff hikes might prove challenging due to stiff competition from Jio, potentially impacting both the top and bottom lines. Despite these challenges, profit booking may occur in the short term. Nevertheless, we view this as an opportunity for long-term investment, and we remain optimistic about the company’s prospects.

For more such investing ideas, read stock insights section of our blog.

Happy Investing!