Key Takeaways

- ICICI Bank Ltd: Fundamentals with strong loan/deposit growth, expanding NIMs, and best-in-class Net NPA (0.45%) position it as a long-term outperformer in the private banking space.

- Affle (India) Ltd: A differentiated ad-tech company with no direct listed Indian peers; strong growth in CPCU revenues and high margins make it a niche digital bet in emerging markets.

- JK Tyre & Industries Ltd: Margin expansion, premiumization strategy, and aggressive debt reduction (D/E from 2.96 to 1) offer valuation comfort and growth visibility in the auto ancillary sector.

- Adani Ports & SEZ Ltd: India’s largest private port operator with integrated logistics infrastructure; 28% YoY revenue growth and rising margins make it a strategic infrastructure play.

- Narayana Hrudayalaya Ltd: Cost-effective healthcare provider with consistent growth in ARPP and EBITDA; positioned to benefit from India’s expanding and ageing population.

Table of Contents

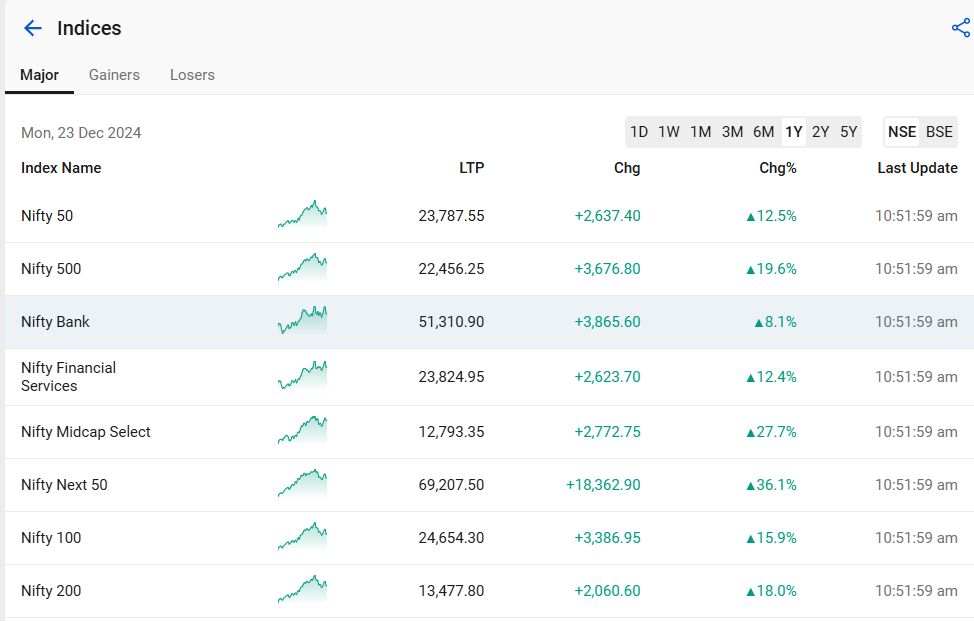

Let’s welcome 2025 and say goodbye to 2024. The year 2024 was indeed a great year for the Indian stock market, as major indices have soared to new highs. The BSE Sensex reached its all-time high (ATH) nearly to 86000. The benchmark index, Nifty 50, made its ATH at 26277 and Nifty Bank at 54467. But since then, the broader markets started to fade away some of their gains by the end of the year. Despite the market fall, major indices are still standing strong with significant gains that contributed to their return in the last 1 year.

In the above image, you can view the performance of major NSE indices in the last 1 year. Nevertheless, why is there a sudden fall in the Indian markets that everybody is curious about? Should you exit the market for a while? Or should you invest heavily, as the market has shown some correction? Can’t decide?

In this blog, you will get an overview of the Indian stock market and what to expect in 2025. Along with this, the blog will share the best stocks for 2025 that you may invest in the long term.

Overview of Indian stock market

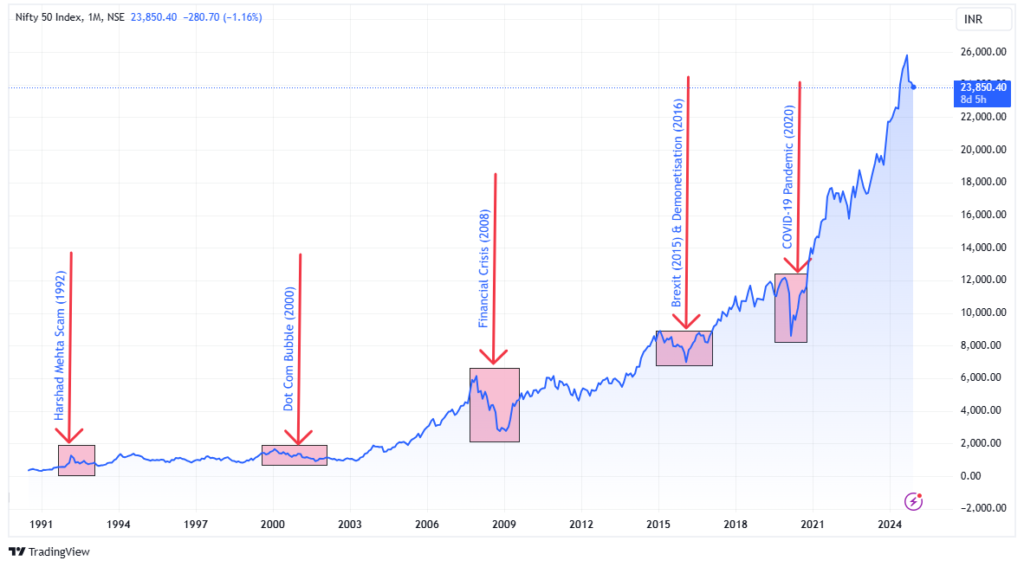

The Indian stock market has witnessed multiple corrections in the last two decades. Since the Covid-19 pandemic, the stock market has not seen any major decline for the last 4 years. It has steadily climbed in 2024 making new lifetime highs almost every month or so. Hence the year 2024 can be considered as one of the best periods for both traders and investors. As trades get numerous opportunities in trading stocks across multiple sectors as the broader markets were in continuous upticks, whereas investors saw their portfolio gain steadily rising.

But it seems like the tables have turned down as the markets continue to decline from his ATH zones. Should you be worried about it? Not really, as these are considered to be health corrections in the market. As you saw in the past two decades markets have corrected but then again it settles and rises for fresh highs. Every time there is fall, markets have regained eventually. So, over the long run there is a high probability that markets will settle and rise further. So, continue to invest in the market and select good stocks which have higher probability to sustain in the long term.

But, why is the Indian stock market lagging? Let’s find out!

Key Factors: Why are markets falling?

There are several reasons attached to the recent market fall. Some noteworthy reasons are mentioned below:

1. Strong Dollar ($)

The US dollar $ is the world’s primary reserve currency. It is considered the backbone of international trade and investment. It plays a crucial role in global stability and a safe haven during times of uncertainty and influences trade, inflation, and investments across the world.

Recently, the US Dollar Index touched 108, close to its two-year high, driven by rising US Treasury yields. Higher yields make US bonds more attractive to global investors, increasing demand for dollars to purchase these bonds.

As you can see, DXY & Nifty 50 have an inverse relationship. At current times, when DXY started to rise, the Indian benchmark index is sliding down.

In addition, the expectation of fewer Federal Reserve rate cuts in 2025 also supported the dollar. Fewer rate cuts signal tighter monetary policy, which supports the dollar’s value and reflects confidence in the US economy.

Tariff threats from President-elect Trump and the temporary avoidance of a government shutdown further supported the dollar by creating uncertainty around global trade, prompting investors to move away from riskier assets in favour of the safer US dollar and bonds.

Meanwhile, the Indian rupee fell to an all-time low of 85.13 per dollar. A weaker rupee makes India less attractive to foreign investors because converting their earnings back into their own currencies gives them lower returns. This leads to money leaving the Indian market, putting more pressure on the economy. Additionally, a weaker rupee makes imported goods more expensive, causing higher inflation.

2. Rise in US 10Y Bond Yields

The US 10-year yield is the return on a 10-year Treasury note and is considered a risk-free rate, making it a key benchmark for global markets. Currently at 7-month high, its rise makes bonds more attractive, drawing money away from riskier investments like stocks.

A higher yield increases borrowing costs for individuals and businesses. For example, when yields rise, interest rates on loans, such as mortgages, auto loans, and business loans, also go up, making it more expensive for people to buy homes or cars and for businesses to borrow money for expansion or operations, which can weaken economic growth.

3. FIIs/FPIs Outflow

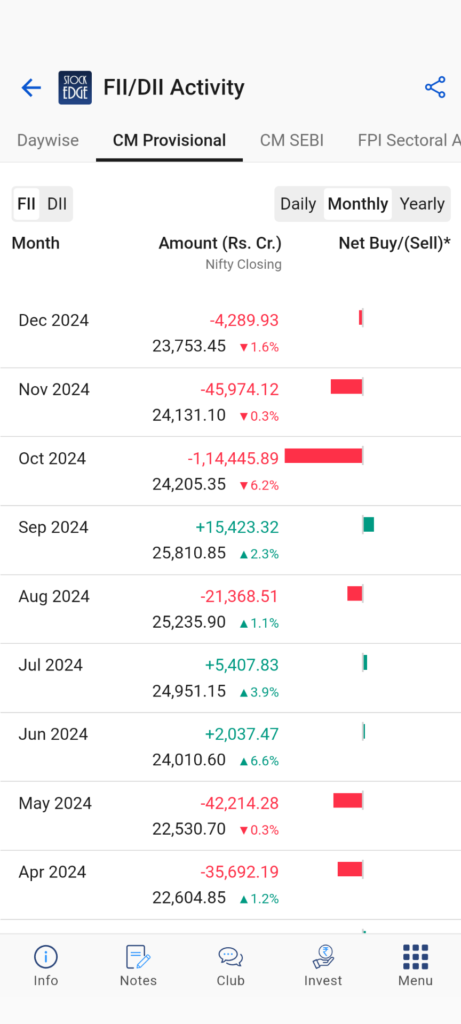

Foreign Institutional Investors (FIIs) or Foreign Portfolio Investors (FPIs) are constantly selling in the Indian stock market. The inflows from FIIs and FPIs are considered smart money in the Indian stock market. Whenever there is consistent cash inflow in the Indian equities, then the broader market performs very well and vice versa.

As you can see in the screenshot below, the FIIs have been net sellers in the Indian equity market in the last 3 months. Therefore, the markets are experiencing high volatility, uncertainty and overall bearish sentiment.

All these factors have combined to affect the Indian markets. So, what to expect in 2025? The year 2025 can be tough for the Indian stock market. The quarterly numbers for Q2 FY25 have failed to excite Dalal Street. In addition, poor corporate earnings in the last quarter have also put immense pressure on the markets. So, what now?

It is time to pick the best stocks for 2025. Due to such turmoil in the markets, a good company may underperform in the short term, but over a long time, because of their strong financials, they are most likely to overcome the short-term challenges. So, here are stocks for 2025 that have a higher probability of outperforming in the markets over the long term.

Best Stocks for 2025

1. ICICI Bank Ltd.

It is India’s second largest private sector bank. It caters to a wide range of banking and financial services across retail and corporate segments. ICICI Bank has several subsidiaries that are majorly market leaders in their respective industries. Notable among them are ICICI Prudential Life Insurance, ICICI Lombard, ICICI Securities, ICICI Prudential Asset Management, and ICICI Home Finance, all of which have demonstrated strong business performance and solid market positioning. While the bank also operates internationally through its subsidiaries in the UK and Canada, their overall contribution to the business remains relatively modest.

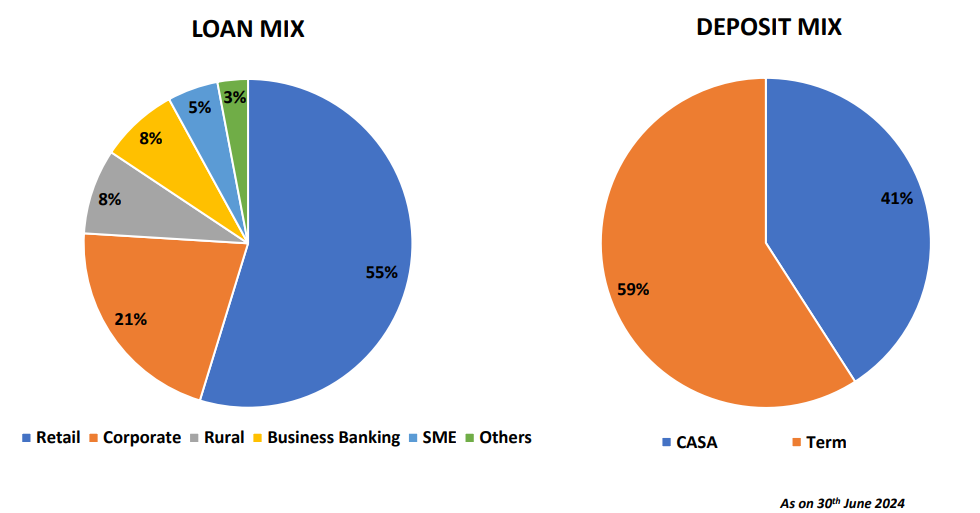

The loan book of the bank has increased by 15.1% CAGR in the past 5 years and deposits have grown at a healthy pace of 16.7% CAGR in the past 5 years. Here is the loan mix and deposit mix of the bank.

Next, a bank’s major focus is on growing its NII (Net Interest Income) and expanding its NIM (Net Interest Margin). ICICI Bank’s NII has been at 22.4% CAGR for FY19-FY24 and driven by steady margin expansion, where NIM for the bank has improved from 3% in FY21 to 4.58% in FY24.

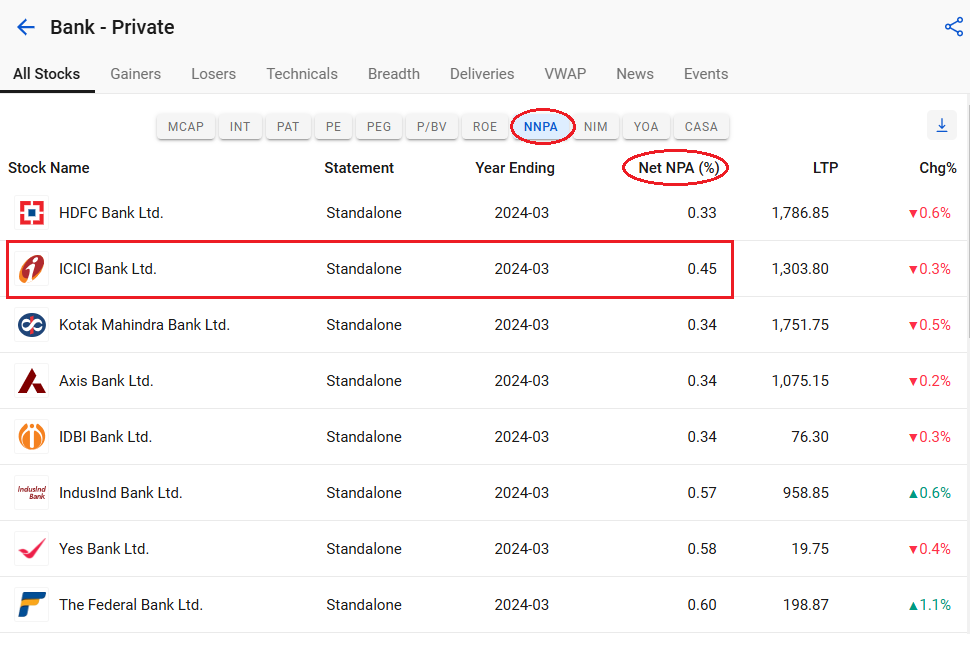

Apart from the NII and NIM of a bank, it is equally important to measure the NPA (non-performing asset) as it offers insights into the asset quality, helping identify potential risks. NPAs are basically loans or advances for which the borrower has stopped making interest or principal repayments. The RBI guidelines state that an asset is deemed non-performing if the interest or principal payment is overdue for 90 days or more.

Gross NPA and Net NPA are two essential metrics that are used to assess a bank’s asset quality. Gross NPA represents the total value of non-performing loans, while Net NPA considers provisions made against these loans. Gross NPA is an indicator of the overall asset quality of the bank, while Net NPA provides a more accurate measure of the bank’s financial health and the effectiveness of its risk management practices.

To know more detail on Gross NPA and Net NPA, here is a blog you can read: Navigating the NPA Landscape

For ICICI Bank, a strong underwriting practice, selective lending to risky corporates especially in long-term project loans has helped the bank to have a strong GNPA ratio. ICICI Bank has Net NPA of 0.45% as of 2024 down 6 bps YoY, and is amongst the best in the overall industry.

Overall, ICICI Bank is strategically positioned in the banking sector. Hence it can be one of the best performing stocks for 2025. For further analysis of the stock, make sure to read our edge report on ICICI Bank before making an investment decision.

2. Affle (India) Ltd.

Affle (India) Ltd is a global IT company with a unique distinction. Its proprietary consumer intelligence platform delivers consumer engagement, acquisitions and transactions through relevant mobile advertising. The platform aims to enhance returns on marketing investment through contextual mobile ads and reduce digital ad fraud. The company primarily operates in emerging markets like India, South East Asia, Middle East & Africa and LATAM.

This company provides mobile advertising solutions for businesses, including:

- Customer acquisition: Reaching new customers through targeted ads.

- Customer retention: Retargeting existing customers with relevant ads to complete purchases.

- O2O marketing: Driving online engagement to in-store visits.

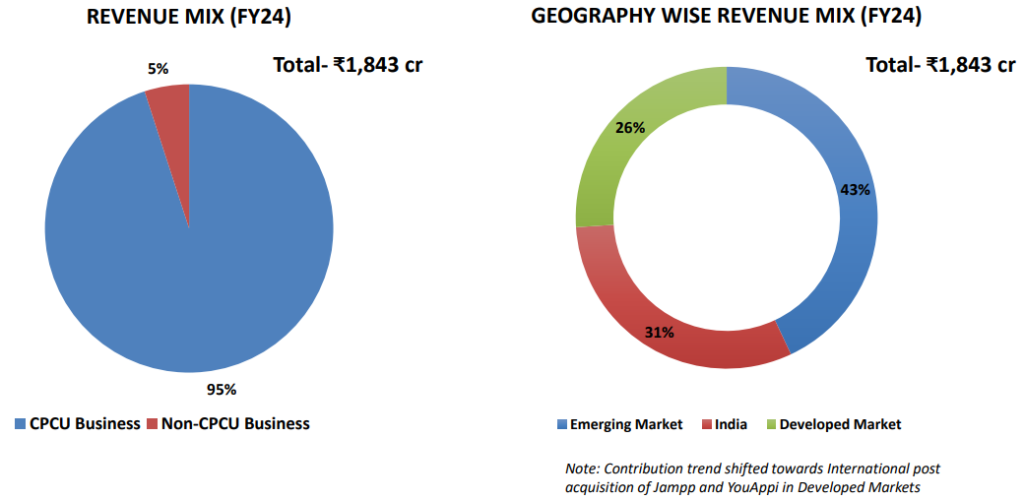

They serve a wide range of B2C companies across industries, including e-commerce, fintech, and more. Some of their clients include Apollo 24|7, Motilal Oswal, Swiggy, and Zepto. The company primarily earns revenues from its consumer platform on a Cost Per Converted User (CPCU). Additionally, it also earns revenue through awareness and engagement type advertising (Non-CPCU), which comprises cost per thousand impressions (CPM), cost per view (CPV) and cost per click (CPC) models.

Here is the revenue mix of Affle India in terms of business segment and geography.

In terms of financials, the company’s net sales witnessed a growth of 28.5 % YoY and stood at ₹1,843 cr during FY 24. The CPCU business saw a significant rise in the number of converted users. During FY24, the EBITDA stands at ₹360 cr, registering a growth of 24.7 % YoY. The data & inventory cost (~61 % of revenue) and employee costs (~13 % of revenue) increased significantly on a YoY basis. In FY24, Affle generated ₹262 cr of operating cash flows aided by healthy profits and working capital adjustments. As of 31st March 2024, the total debt of the company increased to ₹177 and the debt to equity ratio at 0.07 on a consolidated basis. However, on a standalone basis, the company remained debt-free.

The overall company fundamentals are strong. However, the global advertising technology market is highly competitive and is dominated by digital giants such as Google and Facebook. But Affle India is uniquely positioned in the overall value chain. There are no direct competitors of Affle in the Indian listed space and even in the unlisted space, making it one of the best stocks for 2025 that you may invest for the long term. For further analysis of the stock, make sure to read our edge report on Affle India before making an investment decision.

3. JK Tyre & Industries Ltd.

A leading tyre manufacturer in India and the flagship company of the JK group. The company offers a diverse product range, catering to segments including trucks, buses, light commercial vehicles (LCV), passenger cars (M&M, Hyundai India, Maruti Suzuki India, Force Motors, Tata Motors, etc), multi-utility vehicles (MUV), two-wheelers (Bajaj Auto, TVS Motor, Hero Moto Corp), and tractors. JK Tyre has a strong global presence, operating in around 100 countries with over 230 distributors worldwide.

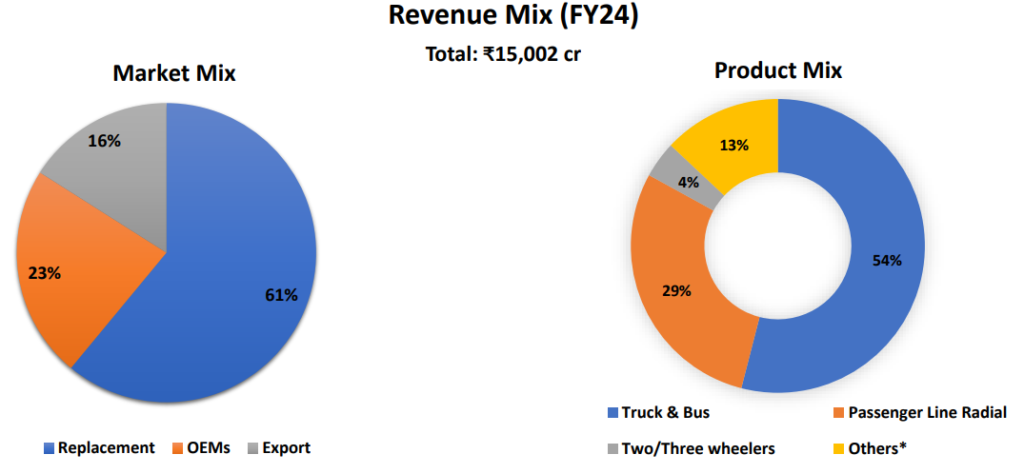

The company majorly earns revenue from the replacement of tyres, which accounts for 61% of the revenue. Here is a detailed breakdown of the revenue mix for FY24.

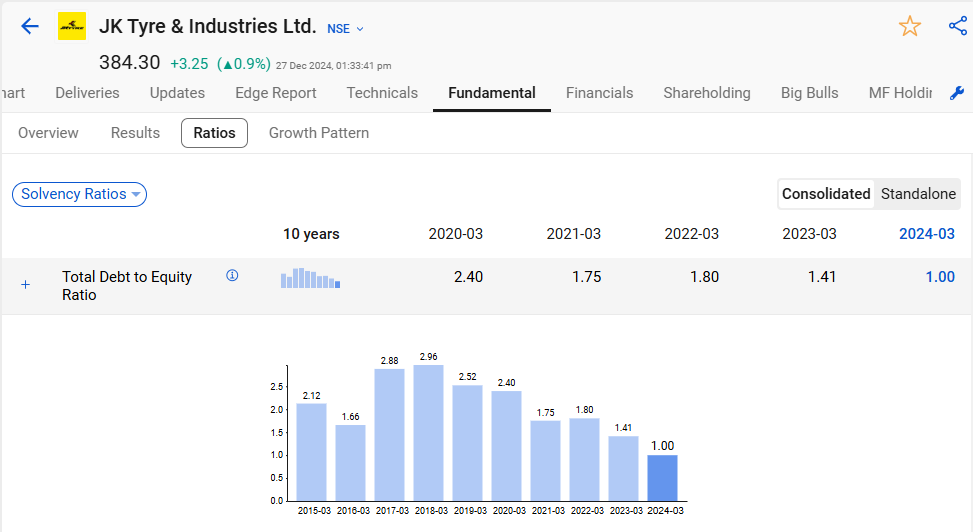

In terms of its financial performance, the net sales at ₹15,002 cr for FY24 showcased an increase of 2.4 % YoY. However, the EBITDA jumped by 60% YoY to ₹2,078 cr. The increase can be attributed to softening of raw material prices. Also, the EBITDA margins increased to 13.9%, and the increase in margins was owing to premiumization, softening of raw material cost, price hikes and cost control initiatives by the company. The contribution of premium tyres increased from 12% in FY19 to 25% in FY24 and is expected to improve to 30%-35% over the next two years. Moreover, the company is on a debt reduction journey. The debt-to-equity ratio of the company stands at 1, compared to a peak of 2.96 during FY18.

Also, the cash flow from operations increased to ₹1,614 cr, mostly owing to a rise in profit before tax and working capital adjustments during FY24. Overall, the company has strong fundamentals at lower valuations, with the PE (TTM) basis at 14.3 compared to an industry average PE of 26.68 as of Dec 2024.

JK Tyre holds a position in the top five tyre manufacturers in India based on revenue. It is recognized as a significant player in the truck and bus radial segment as well. Therefore, it can be one of the best stocks for 2025, which you may add to your diversified portfolio of stocks. For further analysis of the stock, make sure to read our edge report on JK Tyre & Industries Ltd. before making an investment decision.

4. Adani Ports and Special Economic Zone Ltd.

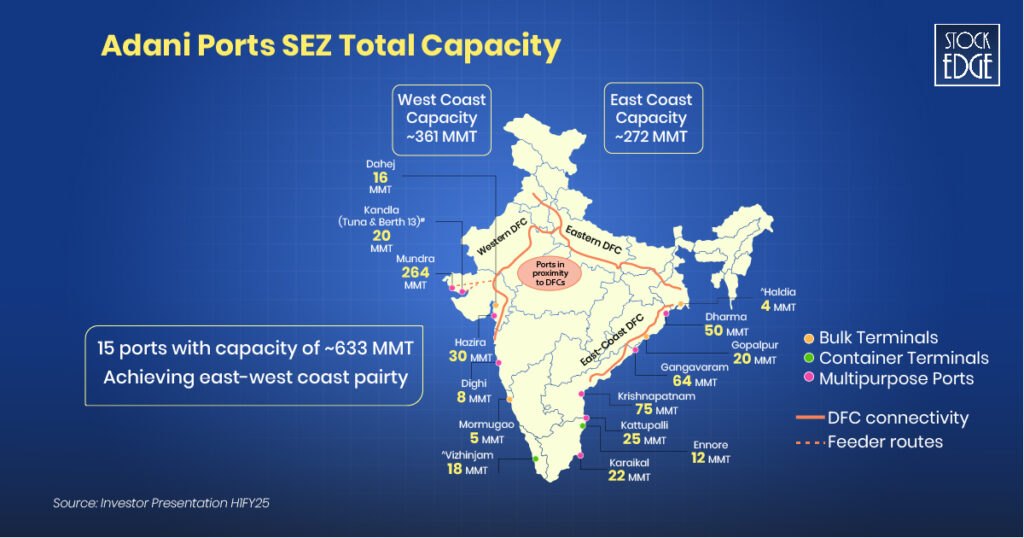

The company is the largest port developer and operator in the country, with 7 strategically located ports and terminals on the West coast and East coast of India combined, representing more than 26% of the country’s total port volumes. Apart from its port operations, through its subsidiary, Adani Logistics Ltd., APSEZ operates 127 trains, 12 MMLP (Multi Modal Logistics Park), 1.2 MMT (million metric tonnes) of Grain Silos, 2.4 mn sq. ft. of ware-housing and 690 km of rail tracks.

The company’s integrated services across three verticals:

- Ports

- Logistics

- SEZ (Special Economic Zones)

It has enabled it to forge alliances with leading Indian businesses, making APSEZ an undisputed leader in the Indian port sector. Here is the total capacity of Adani Ports across different geography of India.

In terms of financials, sales increased by 28% YoY to ₹26,711 cr, led by growth in ports (both domestic and international) and logistics businesses during FY24. In terms of various business segments, the port business (both domestic and international) EBITDA grew by 26% YoY because of an increase in cargo volume & operational efficiencies and the logistics business EBITDA grew by 11% YoY. The PAT margin expanded by 532 bps YoY to 30.9%. It is expected that an improvement in cargo volumes, an increase in operating efficiency, and capacity utilization in new ports will help increase earnings and improve profit margins. In FY24, the total debt stood at ₹46,279 cr. It includes long-term debt of ₹37,663 cr and short-term debt of ₹8,616 cr. The debt-to-equity ratio stood at 0.87x.

The company is continuously growing its market share in all of India’s cargo volume and container segments by improving its operation in existing ports and acquiring new ports. The bottom line is that the sector has a lot of potential and plays a crucial role in the country’s economic empowerment. The Indian ports and shipping industry plays a vital role in sustaining growth in the country’s trade and commerce, and APSEZ, being the largest private port company, has groundbreaking potential to become one of the best stocks for 2025. However, as always, dig deep into further analysis of the stock, and make sure to read our edge report on Adani Ports and Special Economic Zone Ltd. before making an investment decision.

5. Narayana Hrudayalaya Ltd.

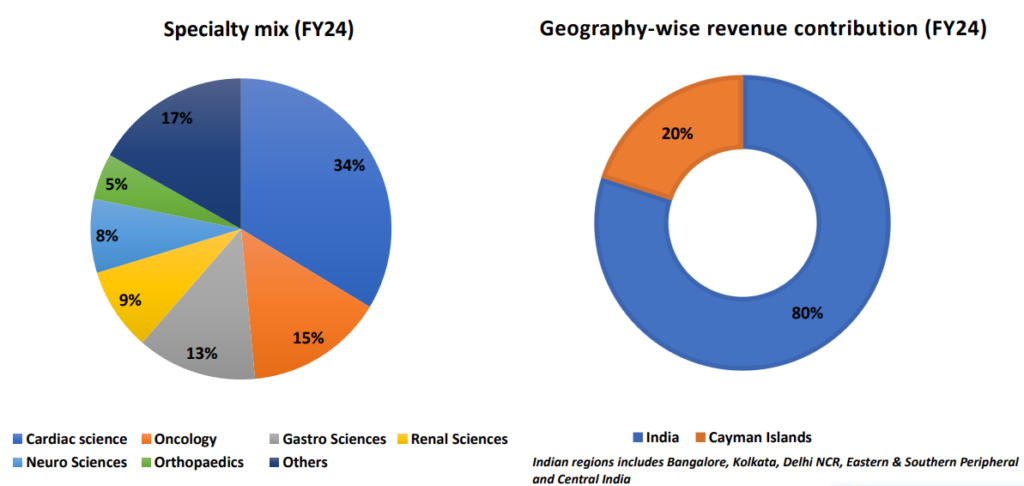

Narayana Hrudayalaya Limited is engaged in providing economical healthcare services in the country. It has a wide network of multispecialty and super-speciality hospitals in India, a strong presence in Karnataka and eastern India, and an emerging presence in western and central India. It offers a comprehensive range of healthcare services across different specialities, including cardiac sciences, gastro sciences, oncology, renal sciences, neurosciences and orthopaedics.

Here is the speciality mix and geography mix of the company:

In fiscal year 2024, revenues climbed by 11% from the previous year to ₹5,018 crores. This growth was driven by improvements in key performance indicators. Strong performance in flagship hospitals and other hospital units, as well as healthy growth in newer hospitals, all made an important contribution. The FY 24 EBITDA at ₹ 1,152 cr, clocking in a growth of 19% YoY. Also, the company observed a rise in the back improvement in the ARPP (average revenue per patient). In terms of liability, the debt-to-equity ratio stood at 0.50x, which has increased from the previous year. In recent times, a major increase in debt due to a rise in capex has largely been attributed to greenfield projects. Nevertheless, the company is well poised to meet its interest liabilities.

The company is strongly positioned in the healthcare industry. The expanding and ageing population, changing demographic trends, rising per capita income, and rising awareness of healthy lifestyle coupled with cost competitiveness are some of the factors that would be aiding the growth of the healthcare industry in India and may add the potential for growth in Narayana Hrudayalaya Limited as it is engaged in providing economical healthcare services. For further analysis on stock, make sure to read our edge report on Narayana Hrudayalaya Ltd. before making an investment decision.

Are you looking for more such investment opportunities?

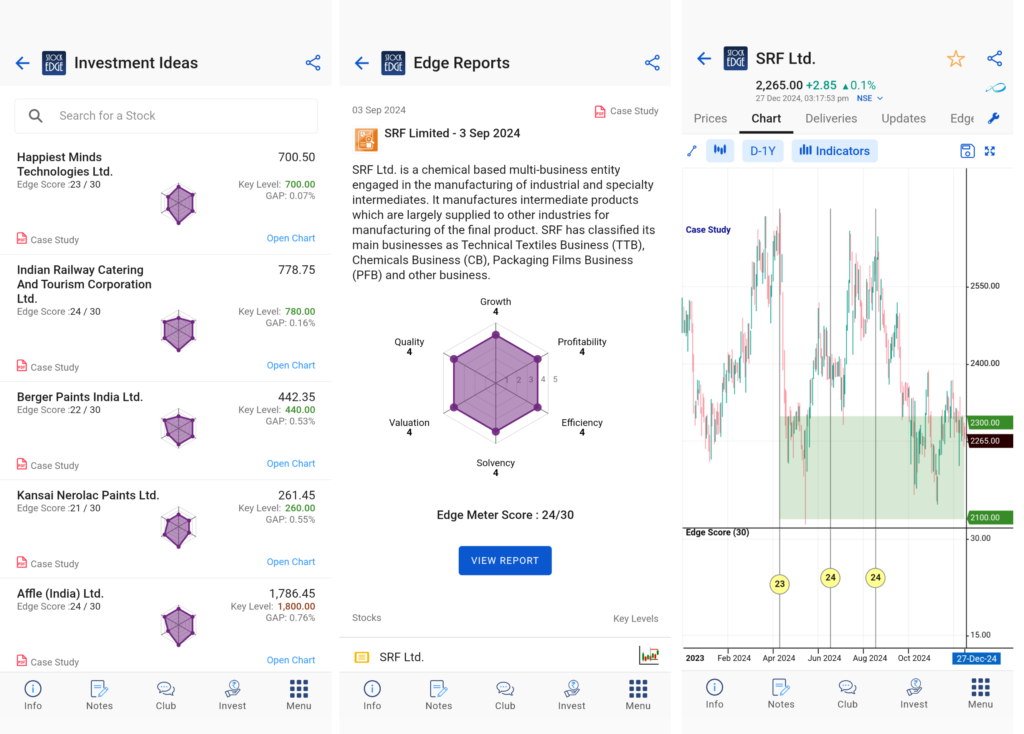

StockEdge: Investment Ideas

For more such investment ideas, head on to the StockEdge app. We have a list of curated investable stocks as per our internal assessment of company fundamentals, trading near key levels. We analyze a company on the basis of six parameters to provide a rating out of 30. The spider chart adjacent to Edge Score is a visualization of the same. Also, on the basis of our fundamental analysis, we provide key upside and downside levels. Green line/zone means the stock is available at a reasonable valuation as per the current fundamentals, and long-term investors can accumulate the stock herein. Brown line/zone means some supply may come at this level, but a move beyond the zone may trigger fresh momentum.

A word of caution that one must do their own research before investing in the markets. Our team of analysts have put in tremendous effort to publish each report, and it is done with absolute thoroughness with the sole aim of making every user financially literate. Also, the listed investment ideas get updated every quarter. So, look for the latest update on the report. In addition, we keep on adding coverage to new investment ideas or dropping old ones. So, keep following the investment ideas section of StockEdge for the latest investment ideas.

The Bottom Line

As we look ahead to 2025, the Indian stock market holds immense promise, bringing with it opportunities across diverse industries. The 5 stocks for 2025, each representing a unique sector, highlight the breadth of growth potential in India’s dynamic economy. While these stocks present compelling narratives, it’s crucial for you to align your choices with long-term goals, conduct thorough research, and stay vigilant to market shifts. The year 2025 could well be a landmark period for wealth creation, but success will favor the informed and the disciplined.

Happy Investing!