Key Takeaways

- Indian Railways: With over 68,500 km of track, Indian Railways is the fourth-largest network globally, connecting remote areas and driving economic growth.

- Government’s Continued Investment: The Union Budget 2025-26 allocated ₹2.65 lakh crore to Indian Railways, maintaining focus on safety, introducing 200 new Vande Bharat trains, 100 Amrit Bharat trains, and enhancing passenger experience.

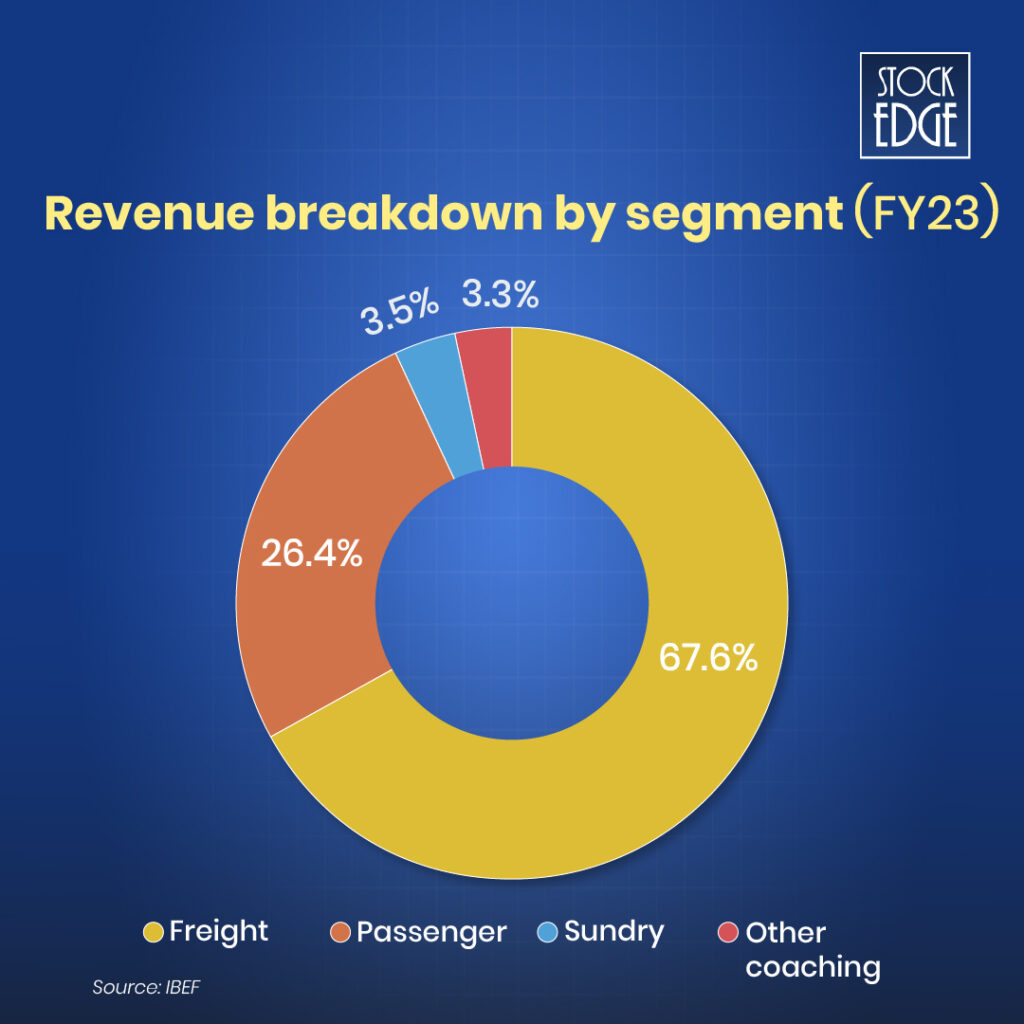

- Revenue Breakdown Highlights Freight Dominance: In FY23, freight contributed 67.6% to Indian Railways’ internal revenue, while passenger traffic accounted for 26.4%, indicating strong freight operations.

- Investment Perspective: Despite no increase in budget allocation, the government’s sustained capital expenditure and modernization efforts present long-term growth opportunities in the railway sector.

- Top Railway Stocks to Watch:

- Rail Vikas Nigam Ltd.

- Indian Railway Catering and Tourism Corporation Ltd.

- Container Corporation of India Ltd.

Table of Contents

The Indian Railways is considered the heart of India due to its unparalleled role in connecting the nation and driving economic growth. It has a vast network spanning over 68,500+ kilometres, and it links the remotest parts of the country, enabling trade and commerce. This immense infrastructure and economic significance also make railway stocks in India an attractive investment opportunity, especially ahead of the Union Budget 2025. The railway sector’s ongoing modernization and expansion by the government of India may benefit long term investors. This blog explores the investment opportunities in railway stocks.

Introduction

The Indian Railways is the fourth largest network in the world, after the US, Russia and China. It is growing at a healthy rate, and in the next five years, the Indian railway market is expected to be the third largest, accounting for 10% of the global market. Railway stocks in India skyrocketed in 2023 due to the expectation of high infrastructure spending by the Government of India. However, the capex has slowed down due to general elections and project delays.

However, the Union Budget 2025 allocation for Indian Railways for FY 2025-26 stands at ₹2.65 lakh crore, the same as last year’s allocation. Despite, unchanged allocation towards railways it indicated that overall push for inflow of Capex is being maintained to a focus on safety, 200 new Vande Bharat trains, 100 Amrit Bharat trains, 50 Namo Bharat rapid rail & 17,500 general non AC coaches to revolutionize travel experience for masses in next 2 to 3 years.

Railway Sector: Market Overview

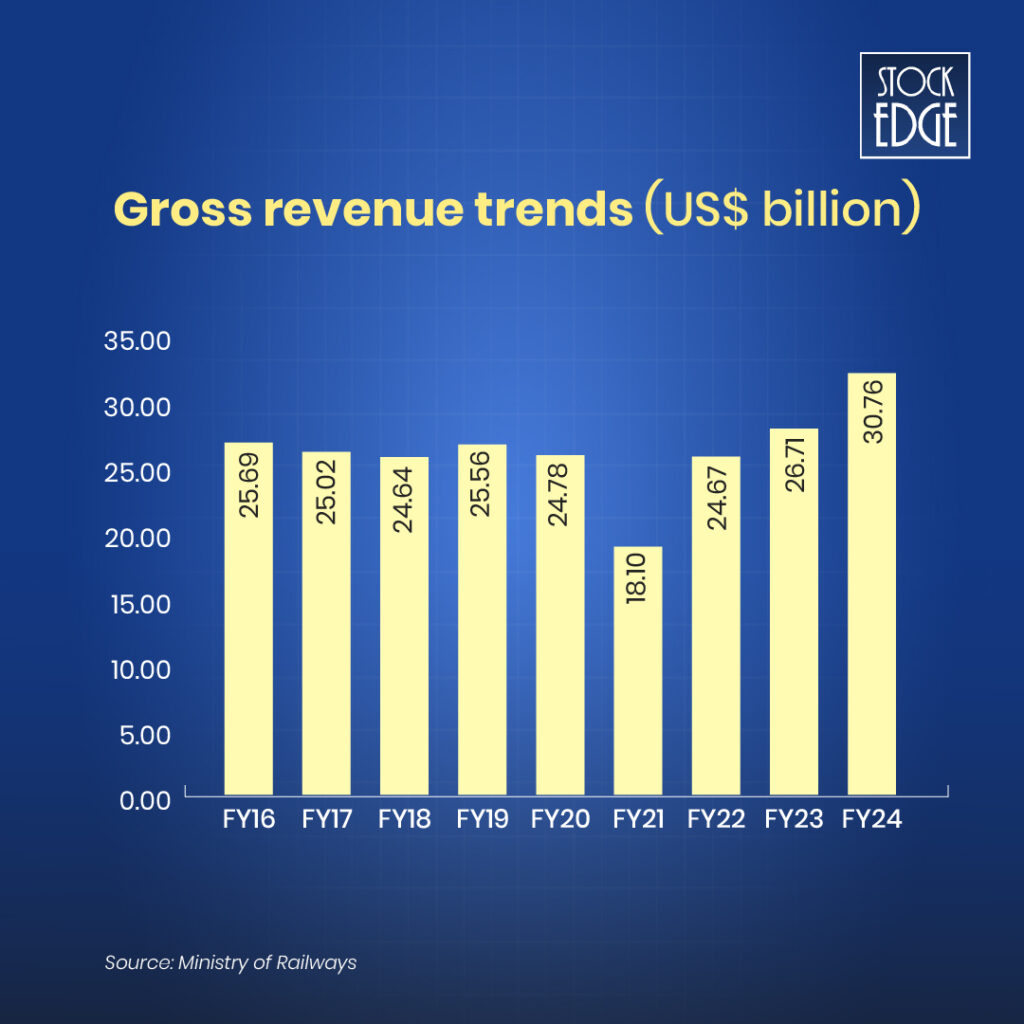

The Indian Railways completed a total revenue of ₹2.56 lakh crore (US$ 30.76 billion) by the end of FY24.

The Indian railways has two major segments which are Passenger and Freight. In FY23, Indian railways earned 67.6% of its internal revenue from freight and 26.4% from passenger traffic. The remaining was earned from other miscellaneous sources such as parcel service, coaching receipts, and sale of platform tickets.

The Indian railway sector offers a diverse range of investing opportunities in several railway stocks in India. The revenue wise revenue breakdown of the Indian railways provide an insight in identifying investing opportunities in the railway stocks in India.

So, now that you are familiar with the overall sector and convinced of the long term growth of the industry, StockEdge has a dedicated investment theme on railway stocks in India.

Investment Theme: Railways India’s Heart

The Indian Railways is undergoing significant modernization and expansion, presenting a promising investment opportunity in railway stocks. The government of India is prioritizing infrastructure development of Indian railways, including high-speed rail corridors, station upgrades, and improved freight capacity. In addition, as per the IBEF report, Indian Railways plans to market semi-high-speed ‘Vande Bharat’ trains by 2025-26, aiming to cover 10-12 lakh kilometers on 75 trains in three years. Indian Railways will target European, South American, and East Asian markets to export ‘Made in India’ trains. Moreover, government policies promoting Foreign Direct Investment (FDI) and public-private partnerships have attracted both domestic and international investors to rail projects.

As the railway network grows to become the third largest globally in the coming years, increased freight traffic and enhanced passenger experiences are expected to boost profitability. For investors, railway stocks in India represent a long-term growth opportunity driven by government support, modernization, and rising demand for efficient transportation solutions.

Best Railway Stocks in India

Due to the vast network of Indian railways, several companies in India are somehow connected to the huge network of railways. There are a vast number of stocks listed in the Indian markets that are directly or indirectly linked to revenue generation from the Indian railway sector.

For instance, the Indian Railways is developing technology to convert 15,000 kilometres of network into automatic signalling and 37,000 km to be fitted with ‘KAVACH’, the domestically developed Train Collision Avoidance System.

So, there is a probability that companies that develop these train collision avoidance systems could be an investing opportunity in the long run as the Indian railways are making significant developments in this space. There is one such company engaged in developing new generation train control and signalling systems under the KAVACH project of the Indian Railways, which is Quadrant Future Tek Ltd. You can view the company financials from StockEdge to make an informed decision about your investment.

Now that you have an understanding of the rationale behind stock identification, here are a few railway stocks from the investment idea on StockEdge which you may refer to for your investing portfolio.

1. Rail Vikas Nigam Ltd.

The company operates in-line infra for Rail and metro. RVNL was incorporated as a 100% owned PSU of the Ministry of Railways (MoR) with the twin objectives of raising extra-budgetary resources and implementation of projects relating to creation and augmentation of capacity of rail infrastructure. Thus, a positive impact can be expected as the overall railway infrastructure sector grows over the long term.

2. Indian Railway Catering And Tourism Corporation Ltd.

A Central Public Sector Enterprise (CPSE) wholly owned by the Government of India and under the administrative control of the Ministry of Railways, the company is the only entity authorized by Indian Railways to provide catering services to railways, online railway tickets and packaged drinking water at railway stations and trains in India. Its segments include Catering and Hospitality, Internet Ticketing, Travel and Tourism, and Packaged Drinking Water (Rail Neer).

So, as the passenger traffic of the Indian railway grows with the modernization of internet connectivity, online ticketing services are poised to grow and can have a positive impact on IRCTC stock in the coming years.

We have also published an edge report on the company simplifying its financials and future prospects in the long term. The research report is based on 6 parameters such as growth, profitability, efficiency, solvency, valuation and quality, derived through descriptive and detailed study by our team of analysts. Read the edge report on Indian Railway Catering And Tourism Corporation Ltd.

3. Container Corporation Of India Ltd.

As discussed earlier, the majority of revenue earned by the Indian railways is through freight, which accounts for 67% of the revenue in FY23, and the Indian railways provide dedicated container wagons to CONCOR for moving containers. The company derives ~80% of its revenues from the transportation of containers through railways. Thus, it is expected to have a positive impact on the stock in the long run as India’s logistics market grows and the railway network expands.

We have also published an edge report on the company simplifying its financials and future prospects in the long term. The research report is based on 6 parameters such as growth, profitability, efficiency, solvency, valuation and quality derived through descriptive and detailed study by our team of analysts. Read the edge report on Container Corporation Of India Ltd.

In addition to these three railway stocks in India, we have other railway stocks listed under the investment theme of Railways India’s Heart.

The Bottom Line

Hence, investing in railway stocks can be a lucrative long-term opportunity, driven by the Indian Railways’ ongoing modernization, expanding infrastructure, and increased freight and passenger capacities. Government support, investor-friendly policies, and growing demand for efficient transportation, railway stocks are well-positioned to benefit from the sector’s transformation, making railway stocks in India an attractive choice for future wealth creation.

Happy Investing!

Is it Worth Buying Railway Stocks ahead of Union Budget 2025?

As per the report by Business Today, the domestic brokerage expects the total railways capex to exceed ₹3 lakh crore, compared with ₹2.65 lakh crore for FY24. It is expecting a substantial boost in FY26 with a projected 15 to 20% increase in capital expenditure. Hence there is a probability for revival of railway stocks in India.

What is the highest revenue generating segment of Indian railways?

The Indian railways has two major segments which are Passenger and Freight. In FY23, Indian railways earned 67.6% of its internal revenue from freight and 26.4% from passenger traffic.