Key Takeaways

- New GST Rules: GST 2.0 brings a fresh reform focusing on structural changes, rate rationalisation, and ease of living. The aim is to make the system simpler and more growth-oriented.

- Revised Tax Slabs: The earlier 12% and 28% slabs are removed, creating a cleaner structure of 0%, 5%, 18%, and 40% for luxury or sin goods. This reduces complexity and disputes.

- Sectoral Impact: Key industries like automobiles, FMCG, cement, consumer durables, apparel, real estate, and e-commerce stand to benefit, with reduced tax burdens driving stronger demand.

- Consumer Benefits: Essentials, packaged food, clothing, footwear, and appliances get cheaper under lower GST rates, directly reducing household expenses and boosting consumption.

- Boost for MSMEs & Startups: Small businesses and startups gain from easier compliance, quicker input tax credits, and reduced working capital pressure, making them more competitive.

Table of Contents

The Goods and Services Tax (GST) was hailed as India’s biggest tax reform when it was first introduced in 2017, unifying multiple indirect taxes under one system. Over the years, it has brought greater transparency, reduced tax cascading, and simplified compliance for businesses and individuals alike. But as the economy evolved, so did the need for a more streamlined structure, which has now led to the introduction of the new GST rules in 2025.

In 2025, the government is rolling out GST 2.0 – a landmark reform that promises to make taxation fairer, simpler, and more growth-oriented. Announced on the 79th Independence Day by Prime Minister Narendra Modi, the new GST framework is built on three pillars: structural reforms, rate rationalisation, and ease of living. From lowering the tax burden on the middle class to giving MSMEs a competitive edge, the new system is designed to fuel consumption, support manufacturing, and strengthen India’s journey towards becoming a $5 trillion economy.

But what exactly is changing? How will the new tax slabs impact industries such as automobiles, FMCG, cement, consumer durables, and MSMEs? And most importantly, who stands to gain the most from this reform? Let’s decode GST 2.0 in detail.

What Are the New GST Rules of 2025?

On the 79th Independence Day, Prime Minister Shri Narendra Modi highlighted how Goods and Services Tax (GST), first implemented in 2017, has transformed India’s tax structure and benefited the nation. Now, in 2025, the government is moving towards the next generation of GST reforms aimed at providing relief to the common man, farmers, middle class, and MSMEs.

The new reforms are built on three core pillars:

- Structural Reforms

- Rate Rationalisation

- Ease of Living

These reforms are designed to simplify compliance, boost consumption, encourage domestic manufacturing, and strengthen India’s economic growth story.

Updated GST Tax Slabs

The updated GST tax slabs under the proposed GST 2.0 are designed to simplify the structure by reducing the number of rates. Here’s the updated GST Tax Slabs:

- 0% – Essentials like food grains, healthcare, and education.

- 5% – Merit goods and services, including many items moving down from the current 12% slab.

- 18% – Standard rate for most goods and services, also absorbing several items earlier taxed at 28%.

- 40% – Limited to sin and luxury goods such as tobacco, pan masala, and possibly high-end cars.

- Special rates retained – 0.25% on certain diamonds and precious stones, and 3% on gold and jewellery.

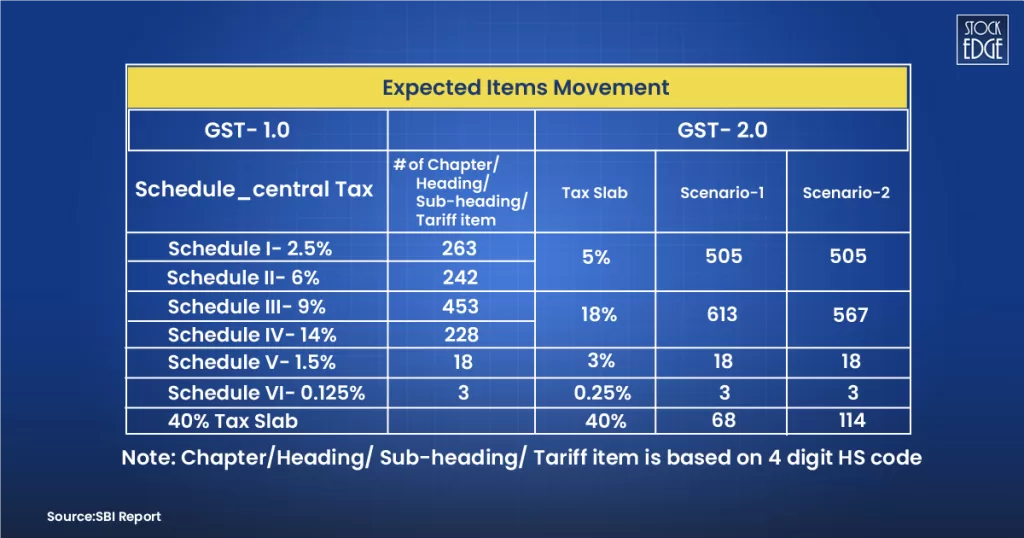

This shift removes the 12% and 28% slabs, creating a simpler three-tier system of 0%, 5%, and 18%, with a narrow 40% category for exceptions. According to the SBI report, they expect the movement of items under the following two scenarios.

- Scenario 1: Assume a 30:70 movement of 28% slab share across 40% and 18% slab

- Scenario 2: Assume a 50:50 movement of 28% slab share across 40% and 18% slab

Sector-Wise Impact of New GST Rules

Auto Sector

The automobile sector stands to be one of the biggest gainers from the proposed GST rate cuts. Two-wheelers with engines below 350cc and passenger vehicles with engines under 1.2L may see their GST reduced from 28% to 18%, directly making entry-level vehicles more affordable. Tractors, crucial for the rural economy, are also likely to see GST reduced from 12% to 5%, easing farmer costs and spurring rural demand. The move could drive both rural and urban sales, offering relief to companies such as Hero MotoCorp, Bajaj Auto, Maruti Suzuki, and Mahindra & Mahindra.

FMCG Packaged Food

The FMCG sector is expected to benefit strongly, with packaged food, dairy products, juices, and coconut water moving from the 12% slab to just 5%. This will not only enhance affordability for consumers but also expand demand in price-sensitive rural markets. Major beneficiaries include Britannia, Nestlé, Heritage Foods, Dodla Dairy, Tata Consumer Products, Parag Milk Foods, Bikaji, and Gopal Snacks, all of whom can expect higher volume growth.

Cement

The cement industry, which currently faces one of the highest GST rates at 28%, may see a reduction to 18%. This could lower cement prices by ₹30–₹40 per bag. Although demand for cement is relatively inelastic, companies may use this reduction to absorb input cost pressures or selectively pass on benefits to customers. Key players like UltraTech Cement, Shree Cement, ACC, and Dalmia Bharat are positioned to gain, especially given the government’s infrastructure push.

Consumer Durables

In the consumer durables sector, high-ticket items such as air conditioners, dishwashers, and televisions above 32 inches are likely to witness GST cuts from 28% to 18%. This reduction could revive discretionary spending and accelerate festive season demand. Beneficiaries include Voltas, Blue Star, Havells, Amber Enterprises, Dixon Technologies, and PG Electroplast, which could see improved sales momentum and stronger margins.

Apparel & Footwear

For garments priced above ₹1,000 and footwear in the ₹1,000–₹5,000 range, GST rates are proposed to fall from 12% to 5%. This will make branded apparel and footwear more affordable, spurring demand across urban and semi-urban markets. Fashion retailers like Trent, Vedant Fashions, and Sai Silk stand to benefit, while footwear leaders like Bata India, Relaxo Footwear, and Campus Activewear could see stronger volume growth and improved retail footfalls.

Services Sector

The services sector may experience mixed outcomes under the new GST regime. While certain services could benefit from rationalized tax structures, others like premium hospitality, insurance, and telecom may not see significant relief if they remain in higher brackets. On the positive side, uniformity in compliance and potential reductions for smaller ticket-size services may drive higher consumer spending in travel, logistics, and entertainment.

E-commerce & Digital Services

E-commerce platforms and digital service providers are likely to gain from clarity in tax slabs and possible rationalization of GST rates on digital goods and services. Lower GST on consumer-facing items (electronics, packaged food, and apparel) directly boosts online sales volumes. Furthermore, startups in digital content, online education, and cloud services may benefit from reduced compliance costs and more efficient input tax credits.

Real Estate Sectors

While automobiles gain directly from tax cuts on vehicles, the real estate sector could also benefit indirectly. Lower cement and steel prices due to GST cuts will reduce construction costs, supporting the government’s housing and infrastructure development plans. Affordable housing projects may see improved viability, while real estate companies could leverage lower input costs to attract homebuyers.

MSMEs & Startups

MSMEs and startups stand to benefit significantly as GST simplification reduces compliance burdens and working capital blockages. Many MSMEs face cash flow challenges due to inverted duty structures, which the new reforms aim to address. With lower tax rates on raw materials and finished goods, small businesses can become more competitive and expand market reach. Startups in consumer goods, logistics, and technology will particularly gain from reduced operating costs and higher demand driven by consumption.

Conclusion

The GST Reform 2025 marks a bold step towards creating a simpler, fairer, and more efficient tax system for India. By reducing the number of slabs, cutting rates for essential goods and mass-consumption items, and easing compliance for small businesses, the government is striking a balance between boosting demand and maintaining revenue.

For consumers, this means lower prices on everyday essentials and discretionary products. For businesses, it unlocks opportunities to grow with reduced tax burdens and fewer disputes around inverted duty structures. And for the economy, it sets the stage for stronger consumption-led growth, higher competitiveness in manufacturing, and renewed investor confidence.

In short, GST 2.0 is more than just a tax reform – it is an economic reset that could reshape India’s growth story in the years to come. The GST Council, led by the finance minister and including state finance ministers, will gather by October 2025 to implement these changes. GST 2.0 will be expected and rolled out by Diwali of 2025.

Also Read: Geopolitical Risks for the Stock Market

Frequently Asked Questions (FAQs)

What is GST 2.0?

During the 79th Independence Day Speech, Hon’ble Prime Minister Narendra Modi announced a major reform in GST, known as GST 2.0, with a focus on rate rationalisation. The government plans to cut the current four-slab GST system (5%, 12%, 18%, 28%) down to a simplified structure of just two main slabs: 5% and 18%, reserving a special 40% slab for luxury and ‘sin’ goods.

Will a GST rate cut lead to a loss in government revenue?

According to an SBI Research report, the proposed GST 2.0 reforms are expected to bring a positive overall effect on the Indian economy, even though there might be some revenue loss. The report suggests an average annual revenue decrease of about Rs 85,000 crore due to these reforms, with the estimate for FY26 around Rs 45,000 crore.

Which sectors will gain the most from the revised tax slabs?

Sectors that are expected to gain the most from the revised GST slabs are consumer goods, automobiles (especially non-luxury vehicles), and MSME-driven industries. These sectors stand to benefit as many items currently taxed at 12% or 28% are likely to shift into the lower 5% or 18% brackets, making products more affordable and boosting demand.

What are ‘sin goods’ and why are they taxed at 40%?

Sin goods are items considered harmful to health or society, such as tobacco and pan masala. They are taxed at higher rates both to discourage consumption and to maintain government revenue.

Will jewellery and precious stones be affected by this change?

Under GST 2.0, jewellery and precious stones are expected to remain largely unchanged. Gold will still attract a 3% GST, while some diamonds and precious stones will continue to be taxed at 0.25%.