Key Takeaways

- PSU stocks are undergoing a significant resurgence, transforming from perceived slow-moving entities into dynamic players. This shift is fueled by strong government support, increased capital expenditure (capex), and improved operational efficiency.

- A primary attraction of PSUs is robust government backing, offering policy support and stability, especially valuable during economic challenges. Strategic government reforms and a substantial capex outlay (₹11.1 lakh crore in FY25) further enhance their competitiveness and growth potential.

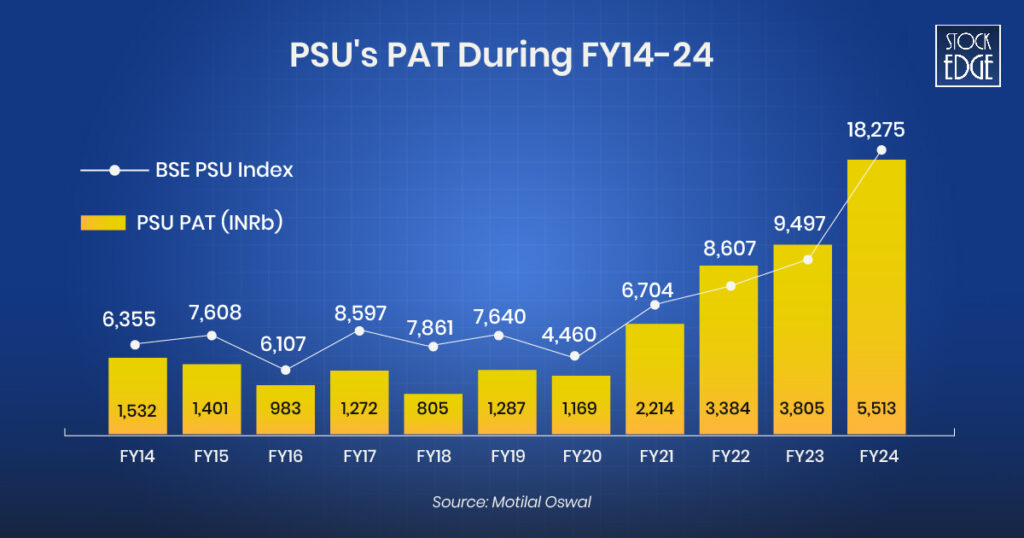

- PSUs appeal to investors through features like high dividend yields and dominant market positions ensuring earnings predictability. Their collective profits have seen significant growth, increasing roughly 4.3 times between FY19 and FY24.

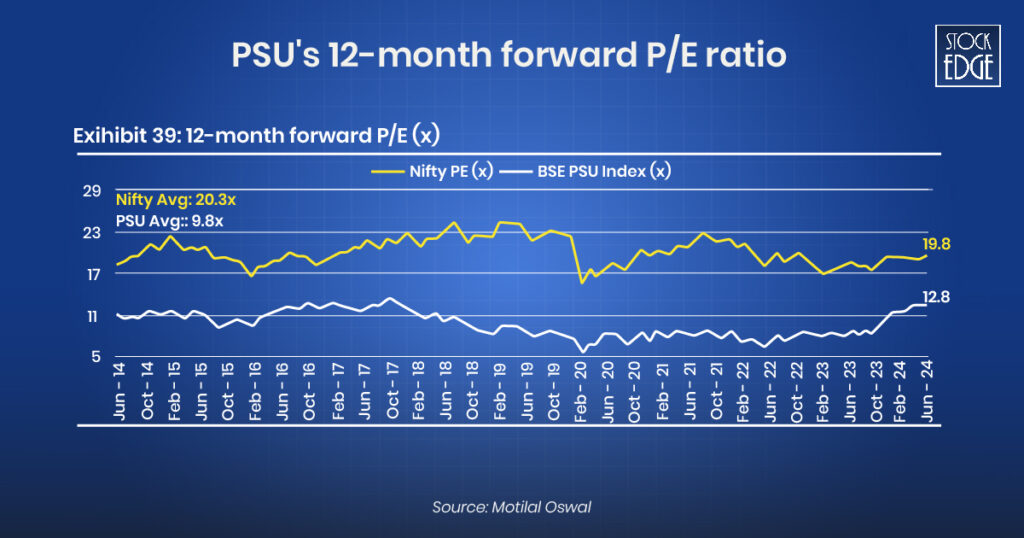

- While investor sentiment is improving and the gap is narrowing, many PSU stocks still trade at a noticeable valuation discount (lower P/E ratios) compared to private-sector companies despite their improved fundamentals.

- The sources highlight three specific top PSU stocks to watch: NTPC Ltd. (India’s leading power company focused on expansion and clean energy transition), State Bank of India (SBI) (the largest PSU bank with a strong market share and digital presence), and ONGC (India’s largest producer of crude oil and gas, crucial for energy security).

For many years, PSU stocks in India were often viewed as slow-moving, less innovative, and bureaucratic entities. They served national interests but rarely excited equity investors. However, this narrative is changing rapidly. In recent times, PSU stocks have delivered strong returns, driven by robust financial performance, increased operational efficiency, and favourable government policies.

The Union Government’s focus on infrastructure-driven growth, domestic defense production, and energy security has positioned PSUs strategically. Experienced investors are reassessing these firms, not only for their historically generous dividends but also for their prospects for long-term growth.

As we approach 2025, PSU stocks represent more than just stability; they embody resurgence, reform, and opportunity. In this blog, we will explore PSU stocks, their appeal, and the top PSU stocks in India.

Table of Contents

What are PSU stocks in India?

PSUS (Public Service Undertakings) are companies in which the government of India owns a majority stake (51% or more). They operate in various sectors, such as banking, energy, defence, infrastructure, and mining. PSUs can be central public sector enterprises (CPSEs), State-Level Public Enterprises (SLPEs), or joint ventures between the centre and states.

In simpler terms, PSU stocks represent government-owned companies listed on the stock exchanges, and investing in them means you are partly owning a company that is backed by the Indian government.

In StockEdge, you can find the list of PSU stocks in India under the Investor Portfolio.

Types of PSU in India Based on Their Level of Autonomy

To allow high-performing PSUs more autonomy and flexibility, the Government of India classifies them into three categories: Maharatna, Navratna, and Miniratna. This categorization is based on their performance, size, turnover, and global presence. These statuses give them varying degrees of financial and operational independence without constant government approval.

Maharatna PSUs:

Maharatna PSUs are the largest and most profitable, with global operations and an annual turnover of ₹25,000 crore or more. They can invest up to ₹5,000 crore without government approval. Notable Maharatna PSU stocks in India are ONGC, NTPC, Coal India, IOC, GAIL, SAIL, BHEL, Power Grid and many more.

B. Navratna PSUs

Navratna PSUs are mid-sized but consistently profitable companies allowed to invest up to ₹1,000 crore. Notable Navratna PSU stocks in India are Indian Railway Catering & Tourism Corporation Limited, BEL, National Aluminium Company Limited, Engineers India Limited and many more.

C. Miniratna PSUs

Miniratna PSUs are smaller, efficient, and financially sound companies, further divided into Category I (₹500 crore limit) and Category II (₹300 crore limit). Notable Navratna PSU stocks in India are Hindustan Copper Limited, KIOCL Limited and many more

What Makes PSUs Stocks Attractive?

Let’s explore why PSU stocks in India are more appealing.

Strong Government Backing

One of the most compelling aspects of investing in PSUs is the security that comes with majority government ownership. This backing ensures not only regulatory support but also policy continuity, which is crucial in sectors such as defence, power, and infrastructure that require long-term capital investments. During economic downturns or crises, government support can act as a stabilizing force, helping these companies withstand volatility better than their private-sector counterparts. Moreover, the strategic importance of these companies often ensures preferential treatment in terms of contracts, subsidies, or regulatory easing.

Increased Capex and Strategic Reforms

The Government of India has significantly increased its capital expenditure (capex) outlay, allocating ₹11.1 lakh crore in the FY25 Union Budget. This budgetary commitment focuses on infrastructure, renewable energy, and defence domains, dominated mainly by PSUs. At the same time, structural reforms are being rolled out to make PSUs more competitive and agile. These include asset monetization programs, the privatization of non-strategic PSUs, digitization efforts, and compliance simplification.

High Dividend Yields and Earnings Visibility

PSUs have long been known for their generous dividend payouts. With steady cash flows, PSUs like Coal India, NTPC, and PFC consistently offer high dividend yields, making them appealing for long-term investors.

Beyond dividends, these companies often enjoy dominant market positions, ensuring earnings visibility and predictability. Between FY19 and FY24, public sector companies (PSUs) in India saw their profits grow significantly by about 4.3 times.

Valuation Gap vs. Private Sector Peers

Despite improved fundamentals and performance, PSU stocks still trade at a notable discount compared to their private-sector counterparts. Over the past decade, PSU stocks have consistently traded at much lower price-to-earnings (P/E) ratios compared to the broader Nifty index, indicating that investors were less optimistic about their growth. While the Nifty’s average P/E during this period has been around 20.3 times, PSUs have averaged only 9.8 times. However, as of June 2024, the PSU P/E has risen to 12.8, showing a noticeable improvement in investor sentiment. This suggests that the market is beginning to recognize the improved performance and potential of PSU companies, narrowing the valuation gap with private sector peers.

Best PSU Stocks in India

Let’s now explore the leading PSU stocks in India

NTPC Ltd.

When we talk about the backbone of India’s energy infrastructure, NTPC stands tall as the country’s largest integrated power company. Since its inception in 1975, NTPC has been a key force in driving India’s economic progress, illuminating homes, industries, and lives across every corner of the nation.

Today, NTPC boasts an impressive installed capacity of 80,155 MW, contributing to nearly one-fourth (~25%) of India’s total power generation. The company has a presence in 97 locations across the country, underscoring its vast reach and critical role in energy accessibility.

But NTPC’s ambition doesn’t stop here. The company has set a bold target to scale its capacity to 130 GW by 2032, embracing a diverse mix of energy sources—coal, gas, hydro, nuclear, and renewables. This strategic fuel mix is central to NTPC’s commitment to reducing its carbon footprint while delivering affordable and reliable power.

Financials

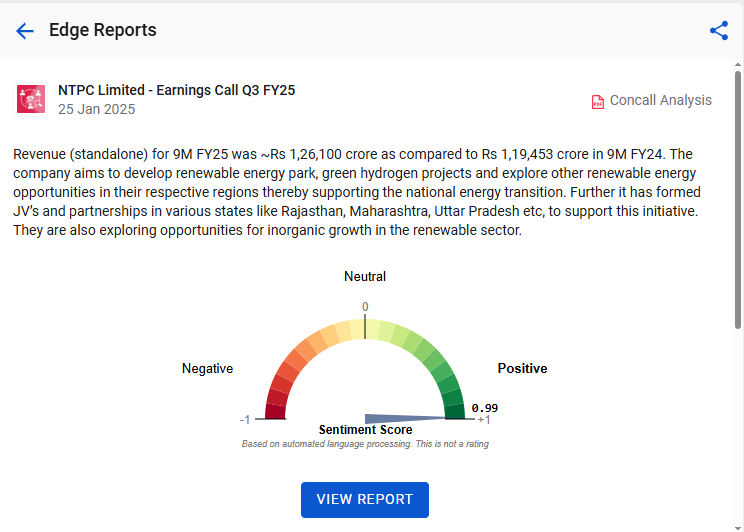

Financially, NTPC Group exhibited strong performance in Q3 and 9M FY25. In Q3 FY25, standalone revenue reached approximately ₹41,352 crore, marking a 4.8% increase YoY, while standalone PAT amounted to ₹4,711 crore, reflecting a growth of 3.1% YoY. For 9M FY25, the company’s standalone capex totalled ₹16,350 crore, up from ₹11,963 crore in 9M FY24. Additionally, consolidated capex during this timeframe was ₹31,333 crore, representing a YoY growth of about 45%. Their power stations achieved a PLF (plant load factor) of approximately 76.2% in 9M FY25, surpassing the ~67.2% PLF of coal stations across the rest of India. The company aims to significantly boost its capacity, investing around ₹1 lakh crore for an additional 8 GW of thermal capacity.

What makes it stand out?

NTPC distinguishes itself through its operational efficiency, ambitious capacity expansion plans, focus on clean energy transition, and strategic diversification. The company aims to develop renewable energy parks, green hydrogen projects, and explore other renewable energy opportunities in their respective regions, thereby supporting the national energy transition. Furthermore, it has formed JVs and partnerships in various states, such as Rajasthan, Maharashtra, and Uttar Pradesh, to support this initiative. The management indicated that an additional ~7.2 GW (gigawatts) of thermal capacity is under consideration for FY26 and FY27, and the company is targeting ~60 GW of renewable energy by 2032. To know more in details, read our blog: Sustainable Investments: Best Green Hydrogen Stocks for 2024.

To know more about their future outlook in detail, check out our Edge Reports.

SBI Bank Ltd.

State Bank of India is a Fortune 500 company. It is an Indian Multinational, Public Sector banking and financial services statutory body headquartered in Mumbai. As of FY24, the bank has a deposit market share of about 22.55% and a net advance share of 19.06% in India. The bank offers digital services via WhatsApp banking, digital loans, cross-selling products, and a payment ecosystem featuring QR codes, POS machines, and online credit facilities. Alternate channels like Internet, Mobile, UPI, and YONO account for 92% of its transactions, securing a 25.8% market share in UPI remittances

Financials

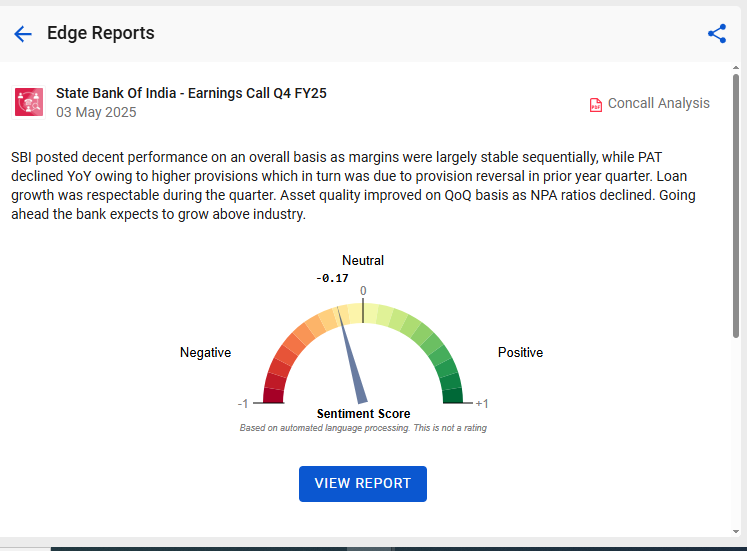

Net Interest Income (NII) for Q4FY25 rose by 2.7% YoY to INR 4,27,746 million, aligning with our forecasts. PPOP increased by 8.8% YoY to INR 3,12,860 million, exceeding our estimates by 16.2%, bolstered by nearly double QoQ growth in non-interest income. Net profit stood at INR 1,86,426 million, a decline of 9.9% YoY (+10.4% QoQ), impacted by a significant rise in provisions. In light of credit-related challenges, management remains dedicated to strategic execution, enhancing customer offerings, and advancing digital platforms. The company’s diversified business segments have mitigated certain pressures. We believe SBI is well-positioned for deposit-driven credit growth, supported by robust customer acquisition and enhanced brand visibility, despite ongoing concerns about shifting macroeconomic and geopolitical risks.

What makes it stand out?

SBI has passed an enabling resolution to raise up to ₹25,000 crore capital via QIB (qualified institutional buyers) or FPO (follow-on public offering) in FY26. Margins could have some pressure as interest rates decline. The bank intends to have ROE of 15% and ROA of above 1% mark going ahead.

To know more about their financials and future prospects, check out our Edge report.

Oil & Natural Gas Corporation Ltd.

ONGC is the largest crude oil and natural gas Company in India, contributing around 71 per cent to Indian domestic production. The company specialises in the exploration and production of crude oil and natural gas. It has joint ventures for oil fields in Vietnam, Norway, Egypt, Tunisia, Iran, and Australia. ONGC contributes to 70% of India’s crude oil and around 84% of its natural gas production.

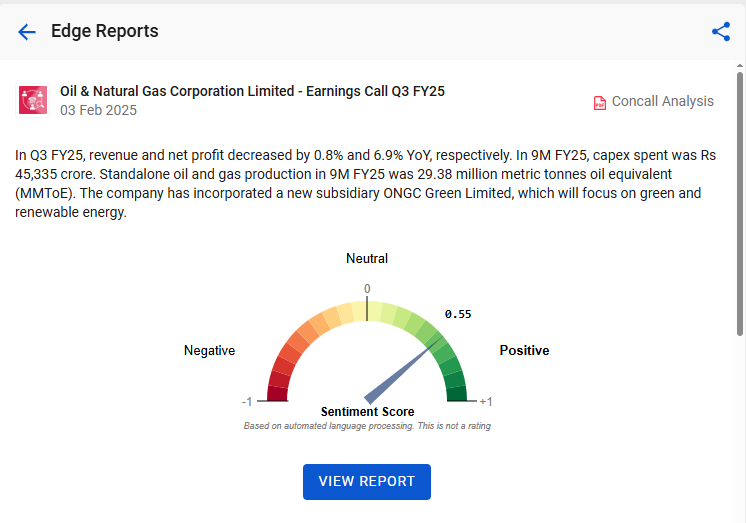

Financials

On a YoY basis, standalone revenue in Q3 FY25 saw a ~3% decline in revenue despite production increase due to lower realizations. During 9M FY25, consolidated EBITDA was ₹76,590 crore, de-grew by ~15% YoY. PAT in 9M FY25 was ₹29,472 crore as compared to ₹44,177 crore in 9M FY24. During 9M FY25, they drilled 353 development wells and 60 exploratory wells.

What makes it stand out?

On a yearly basis, management intends to drill approximately 500 wells in the current fiscal year. Through equity infusion, the company has successfully reduced the high-interest loans of OPaL (ONGC Petro additions Limited), which will assist in mitigating the interest burden in the future. The planned capex for FY26 is ₹36,920 crore. The company has established a new subsidiary, ONGC Green Limited, which will concentrate on green and renewable energy. Furthermore, the subsidiary has formed a partnership with NTPC Green Limited.

To know more about their financials and future prospects, check out our Edge report.

The Bottomline

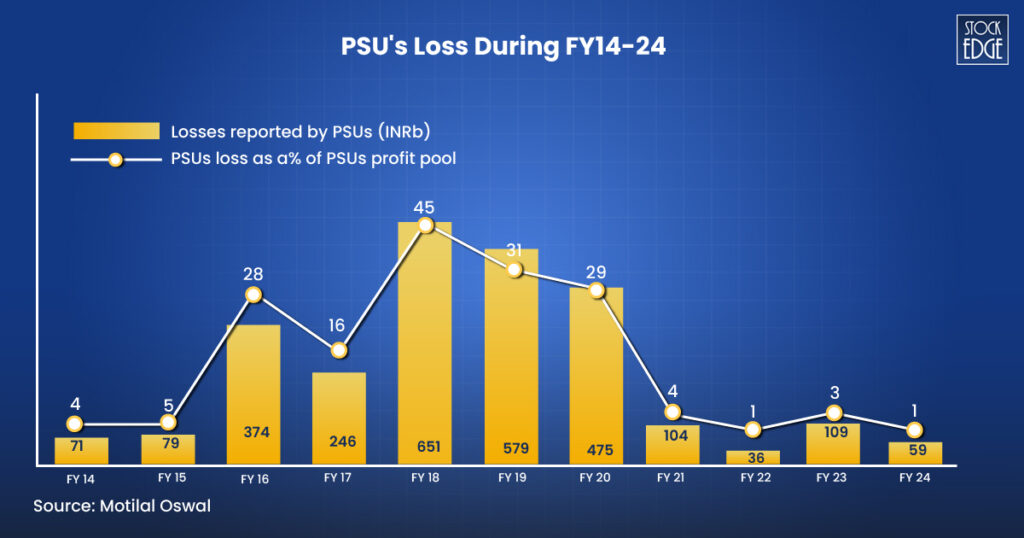

The profitability of PSUs is likely to improve significantly across domestic and global cyclicals, driven by a sharp turnaround in the fortunes of PSU Banks. Higher commodity prices over the last two years have strengthened the profit and loss statements and balance sheets of Metals and O&G PSUs. The government’s focus on localization, increased capex, and ‘Make-in-India’ initiatives in the defense sector has catalyzed the enhancement of Industrial PSUs’ fortunes. The quality of earnings has also improved dramatically, with loss-making PSUs, which once contributed 45% to the loss pool in FY18, now account for just 1%.

PSUs are no longer merely slow-moving government entities. With reforms, record profits, high dividends, and strategic roles in India’s growth, they are emerging as stable wealth creators.

Happy Investing!