Table of Contents

Key Takeaways

- Monopoly Stocks: Monopoly stocks are shares of companies that dominate their respective markets with minimal competition. These companies often control pricing and supply, providing stable returns and long-term growth potential.

- Investment in Monopoly Stocks: Stable returns, long-term growth, resistance in downturns.

- Best Monopoly Stocks: Assess the company’s share and dominance in its sector. Evaluate opportunities for expansion and innovation. Review profitability, debt levels, and cash flow. Consider companies with consistent and attractive dividends.

- Top Picks:

- Indian Railway Catering and Tourism Corporation Ltd.

- Multi Commodity Exchange of India Ltd.

- Coal India Ltd.

- Computer Age Management Services Ltd.

Imagine you and your family want to take a train trip to Kashmir.

What’s the first thing you would do? You’d check if train tickets are available, right? And where would you check that?

IRCTC!

No other website or place allows you to book train tickets in India, so anyone who wants to travel by train has to go through IRCTC. Because IRCTC is the only platform for booking train tickets, it has control over the entire process of setting prices, deciding how tickets are booked, and when bookings open.

This makes IRCTC a monopoly in train ticket booking, as it’s the sole option for train travellers in India. A monopoly is a type of business in which a company controls the market for a particular product or service.

Monopoly stocks in India can be an attractive option when you are looking for reliable and potentially lucrative investment opportunities. In this blog, you will explore what monopoly stocks are and how you can benefit from investing in them. You will also learn about the best monopoly stocks in India to keep an eye out for in the future.

What Are Monopoly Stocks?

Monopoly stocks refer to shares of companies that hold a dominant market position within their respective industries. These companies often have little to no competition, allowing them to control pricing and supply.

Actually, the word “monopoly” comes from the Greek words “monos” (meaning “single”) and “polein” (meaning “to sell”). It refers to a situation where only one company dominates and controls the entire market for a product or service.

To identify potential monopoly stocks in India, consider the following key characteristics:

- Large Market Share: A company that controls a significant portion of its market, often over 50%, is likely a monopoly.

- Barriers to Entry: Monopoly stocks require high capital, government licenses, permits, exclusive rights, and unique or patented technology. This provides a significant competitive advantage.

- Strong Brand Recognition: Monopoly stocks should have a well-known and trusted brand, which can create customer loyalty and deter competition.

- Economic Moat: Monopoly stocks must be better than their competitors. Cost advantages, network effects, or intellectual property can achieve this.

Here are the top 7 stocks with economic Moats!

In India, it’s rare for a company to achieve 100% control. Government regulations, potential competition and advancements in technology and production processes can disrupt established monopolies and create new opportunities for competitors.

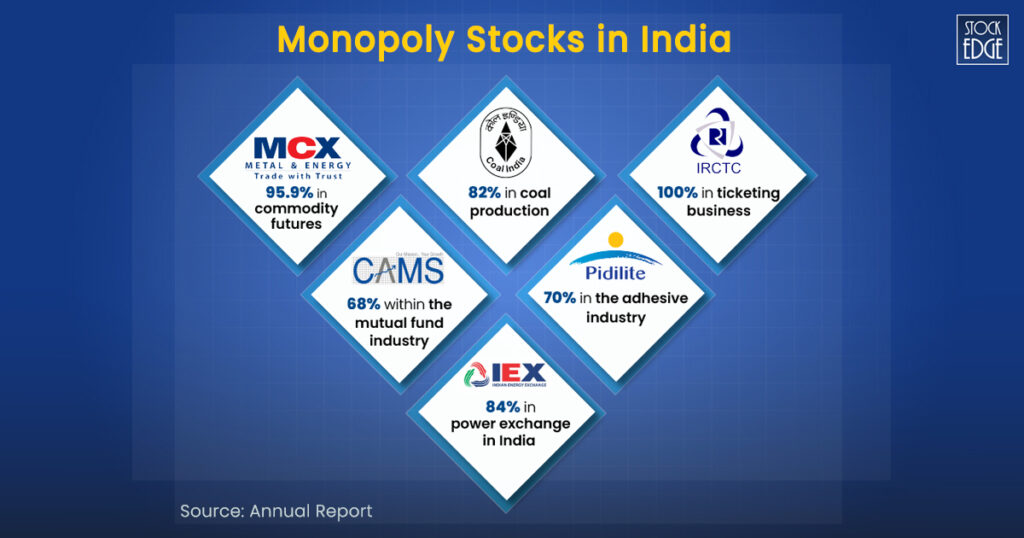

IRCTC is the best example of understanding the monopoly market. However, various near-monopoly companies also dominate their respective markets. Here is the list of monopoly stocks in India.

But as an investor, why would you have to invest in Monopoly stocks?

Key Benefits of Investing in Monopoly Stocks

Did you know that Warren Buffett made most of his money by investing in monopoly stocks?

He is particularly drawn to consumer monopolies, businesses with specific products or services that are hard to replicate.

Investing in monopoly stocks might be a prudent choice because these companies control their markets and provide distinct advantages. Let’s check out the key benefits of investing in monopoly stocks:

Stable Returns

Investing in monopoly stocks has the potential for stable returns, as they face limited competition. This allows them to maintain steady pricing and enjoy consistent demand for their products or services. As a result, these companies often generate reliable revenue, which translates into stable returns for investors over the long term.

Let’s look at the diagram below. This chart shows the performance of four monopoly stocks against the benchmark Nifty 50 index over five years. As of October 23, Indian Railway Catering and Tourism Corporation Ltd, Computer Age Management Services Ltd., and Indian Energy Exchange Ltd. outperformed the Nifty 50.

Long-Term Growth

Since monopoly companies dominate their industries, they tend to have the financial muscle to invest in innovation and expansion, which makes them well-positioned for long-term growth, especially in growing economies like India. As they continue to expand, both locally and globally, their stock value can increase, providing investors with the opportunity to enhance capital appreciation over time by investing in stocks near all time highs that reflect growth potential.

Resistance in Downturns

Monopoly companies are often more resilient during economic downturns. Their strong market position helps them tackle downturns. Consumers tend to stick with essential products and services even in tough economic times, allowing these companies to maintain profitability. This resistance makes monopoly stocks a safer investment during uncertain economic periods.

IRCTC is one of the best examples of this circumstance. During the lockdown, IRCTC experienced a significant surge in its share price due to the increased reliance on online services during the pandemic, as people were unable to travel to physical ticket booking counters.

Now, let’s look at the best monopoly stocks in India.

Top Monopoly Stocks in India to Watch

To understand why monopoly stocks are so valuable, let’s explore some of the top monopoly stocks in India. These companies dominate their respective industries and offer unique opportunities for growth and stability.

Indian Railway Catering and Tourism Corporation Ltd

IRCTC is a central public sector entity entirely owned by the Government of India and managed by the Ministry of Railways. It is the only firm authorised by Indian Railways to provide food services, online tickets, and packaged drinking water at stations and trains throughout India. IRCTC has been a Integral part of NIFTY 500 Index.

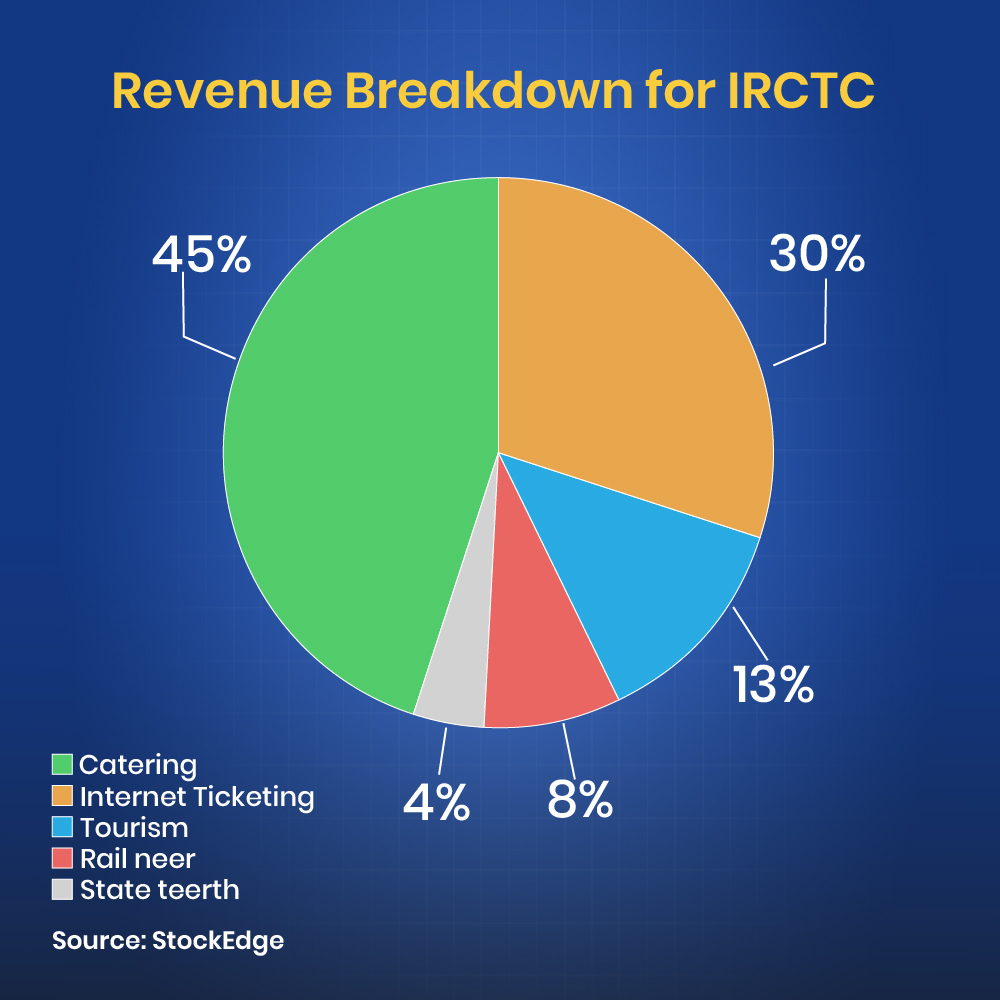

IRCTC’s business is divided into four main segments:

- Internet ticketing

- Catering and hospitality

- Tourism & Train operations and

- Packaged drinking water (Rail Neer).

You can check out the revenue breakdown for IRCTC.

They also diversified into other businesses such as e-catering, executive lounges and budget hotels, which are in line with its objective to build a ‘one-stop solution’ for its customers.

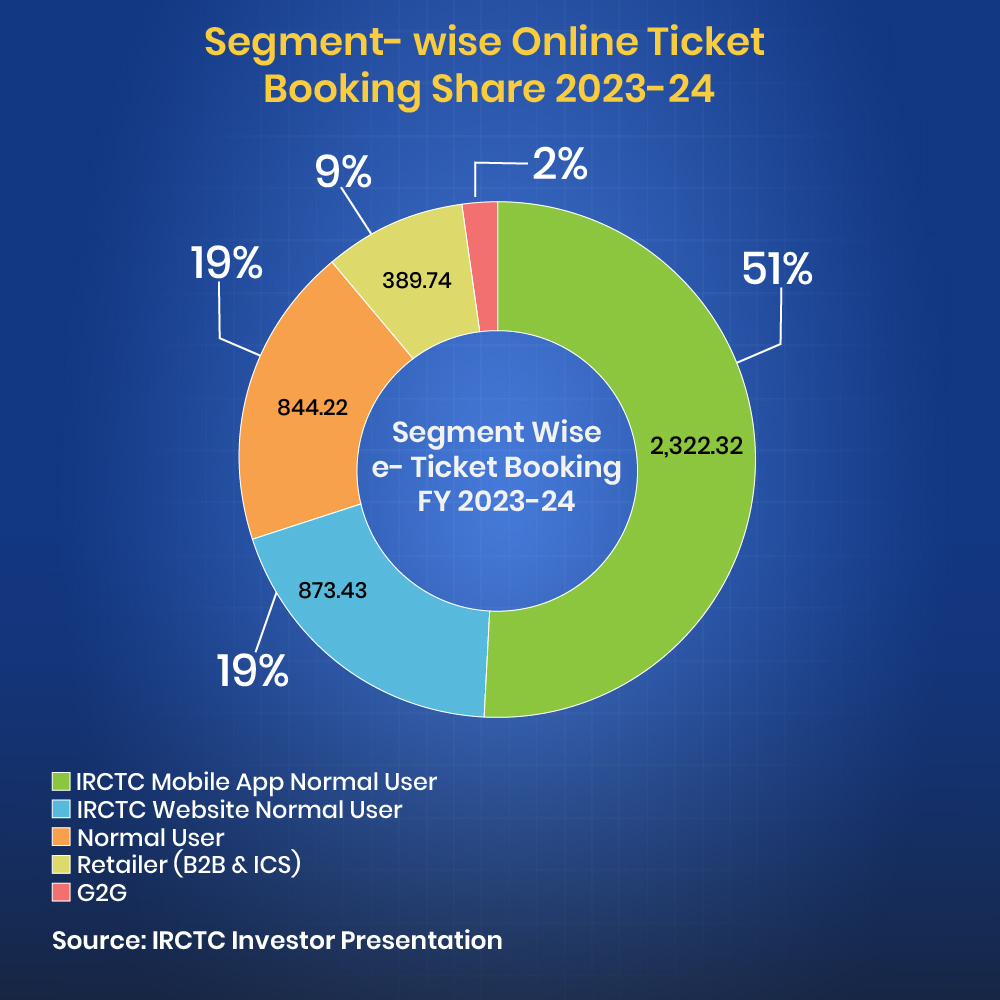

IRCTC has a 100% market share in the ticketing business. In FY24, the IRCTC mobile app emerged as the primary channel for online ticket bookings, accounting for a substantial 51% of the total volume. Traditional channels such as retailers (B2B & ICS) and B2C normal users continue to play a role in online ticket booking, contributing 9% and 19%, respectively. It indicates a diverse customer base for IRCTC’s online ticketing services. During Q2FY25, internet ticketing EBIT margin stood at 82.4%.

You can check out the Edge report

Multi Commodity Exchange of India Ltd

Multi Commodity Exchange of India Limited (MCX) operates as a recognised stock exchange under the Indian Securities and Exchange Board of India (SEBI). Since its inception in November 2003, MCX has become one of the world’s leading commodity futures exchanges. MCX has entered into strategic alliances with leading international exchanges such as CME Group, London Metal Exchange (LME), Dalian Commodity Exchange (DCE), Taiwan Futures Exchange (TAIFEX) and Zhengzhou Commodity Exchange (ZCE).

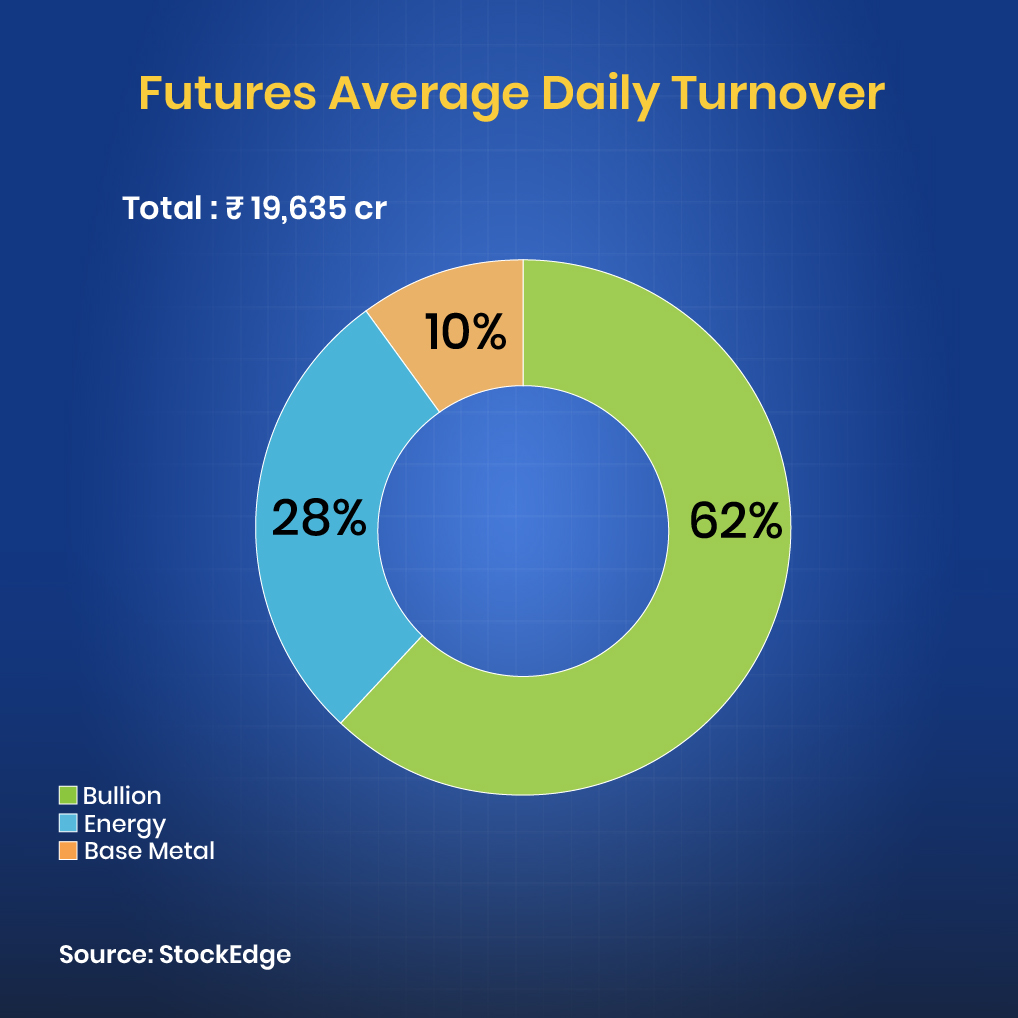

MCX is India’s leading commodity derivatives exchange, with a market share of 95.9% in commodity futures contracts traded in FY24.

Average daily turnover (ADT) of commodity futures contracts traded on the exchange increased by 44% to ₹26,941 crore in Q2 FY25 from ₹18,763 crore in Q2 FY24. On the other hand, the average daily turnover of options (notional) increased to ₹1,93,309 crore in Q2 FY25 from ₹85,873 crore during Q2FY24.

To know more about the company, you can visit Concall Analysis.

Coal India Ltd

Coal India Ltd. is the largest coal producer in the world. In India, where 57% of primary commercial energy is dependent on coal, CIL alone meets 40% of primary commercial energy requirements. It has an 82% market share in coal production.

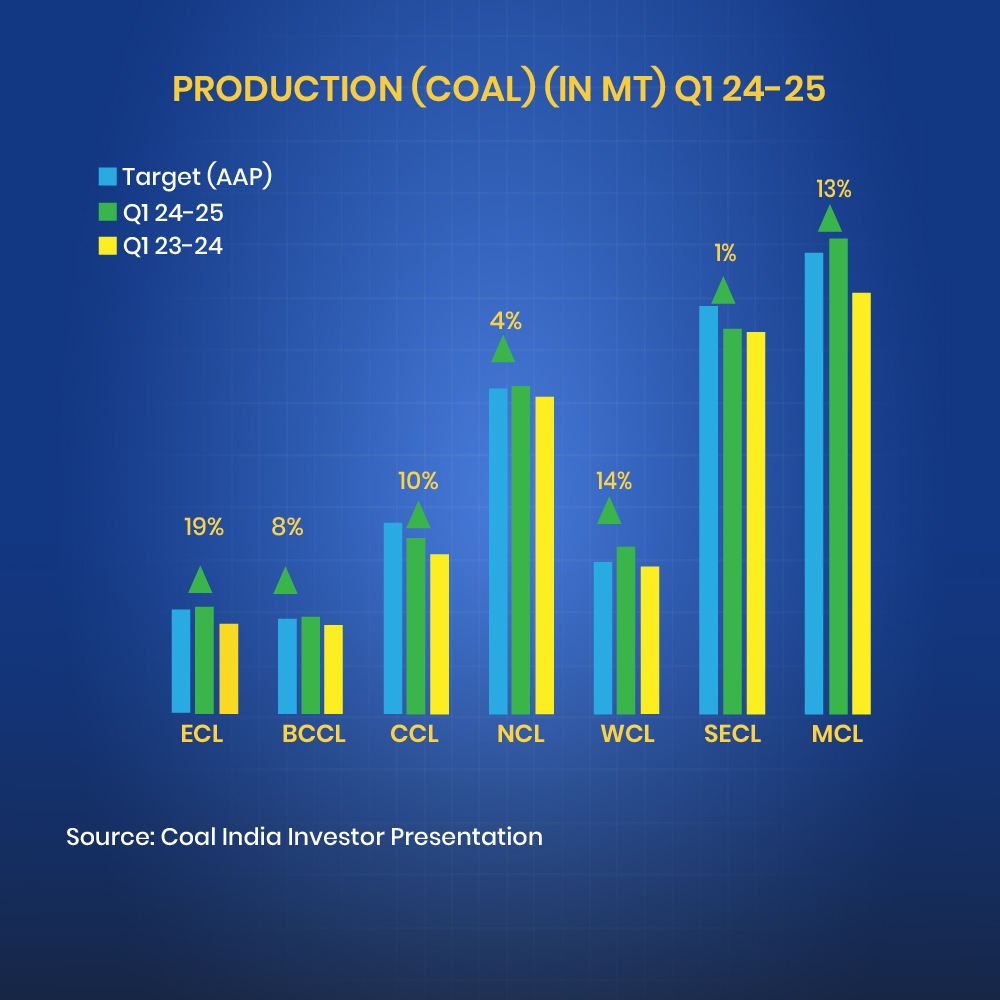

In Q1FY25, Coal India Limited (CIL) increased its coal production by 8%, producing 189.3 million tonnes (MT) of coal. They reported a 4% increase in consolidated net profit. To learn more, read our blog: Which Mining Stocks in India Are Dominating the Stock Market?

To explore more about the company’s fundamentals, check out StockEdge.

Computer Age Management Services Ltd.

Computer Age Management Services Limited (CAMS) was established in 1988 and has been providing technology-driven financial infrastructure and services to mutual funds and other financial organizations for more than 25 years. As the market-leading Registrar and Transfer Agency (RTA) for the Indian Mutual Fund industry, CAMS serves about 67.4% of the average assets under management (AUM) as of June 30, 2024.

They also offer technology-driven service solutions to alternative investment funds and insurance companies. In addition to being a B2B service partner, they provide customers with a range of touchpoints, including a pan-India network of service centres, a white-label call center, an online mobile app, and a chatbot.

To learn more about the company, you can visit Concall Analysis.

How to Choose the Best Monopoly Stocks

Investing in monopoly stocks requires a thoughtful approach. While these stocks offer stability and growth potential, it’s crucial to select the right companies. Here are key factors to consider while selecting the best monopoly stocks in India:

Market Position

Before investing, it’s essential to analyze the company’s market position. Look for companies that dominate their industry, have a strong brand, and a significant share of the market. This ensures that the company can maintain its competitive edge and continue to generate steady profits. These companies usually possess intangible assets such as strong brand recognition, customer loyalty, or intellectual property, which provide them a significant edge over their competitors.

Growth Potential

Growth potential is another crucial factor when selecting monopoly stocks. Research the company’s plans for expansion, both in terms of geographical reach and product or service offerings. Companies that continuously innovate and expand are more likely to deliver higher returns in the long run.

Financial Health

Reviewing a company’s financial health is essential before investing. Check for stable revenue growth, manageable debt levels, and healthy profit margins. A financially sound company is more likely to withstand market fluctuations and offer consistent returns to investors.

Dividend Payout

Some monopoly stocks also offer attractive dividend payouts, which can be an excellent source of passive income for investors. Companies with a strong monopoly often generate high profits, allowing them to pay out a portion of these profits as dividends to shareholders.

The Bottomline

Investing in monopoly stocks can be a solid strategy for those looking to secure stable returns, long-term growth, and protection during economic downturns. Companies that dominate their industries, such as IRCTC, Coal India, and MCX, offer investors unique opportunities for growth and resilience.

FAQ’s

What should I consider before investing in monopoly stocks?

Before investing, you should evaluate the company’s market dominance, growth potential, financial stability, and dividend payout history. Understanding the industry trends and any regulatory impacts is also essential.

Why should I invest in monopoly stocks?

Due to their dominant market positions, monopoly stocks offer stable returns, long-term growth potential, and some protection during economic downturns.

Are monopoly stocks safe during economic downturns?

Yes, monopoly companies tend to be more resilient during economic downturns because they face less competition and often provide essential goods or services that consumers continue to need.

What are the risks involved in investing in monopoly stocks?

The primary risk comes from regulatory changes. Governments may introduce laws to break up monopolies or introduce competition. Additionally, any disruption in the industry could impact the company’s market dominance.

How does government regulation affect monopoly stocks?

Government regulation of monopolies can significantly impact the valuation and operation of monopoly stocks. The government regulates monopolies to promote competition, prevent unfair practices, and protect consumers. Some ways the government regulates monopolies include:

- Antitrust laws: Discourage monopolistic operations and ensure an open market

- Legislation and court cases: Regulate monopolistic businesses

- Preventing new competitors: Prevent competing firms from entering an industry that is thought to be a natural monopoly

Government regulations can have a significant impact on monopoly stocks, especially in sectors like energy, defence, and utilities, where policies directly influence pricing and operations.

Do monopoly stocks offer good dividends?

Yes, many monopoly stocks offer good dividends. They often have stable earnings and strong cash flows, which can make them attractive to investors seeking consistent dividend payments. Because they have less competition, which can lead to higher profit margins and more predictable revenue streams. However, it’s important to note that not all monopoly stocks pay dividends, and dividend policies can vary. Some companies may choose to reinvest their profits in growth or other initiatives instead of paying dividends. Coal India Ltd., Multi Commodity Exchange Of India Ltd., and Indian Railway Catering And Tourism Corporation Ltd. are some of the best monopoly stocks in India that pay high dividends.

Happy Investing!

Read More: 5 Best FMCG Stocks with High-Potential: A Must-Add for Your Portfolio