Key Takeaways

- Union Budget 2025: The budget focuses on main growth engines, investment, and boosting exports. It aims for a fiscal deficit of ~4.4% of GDP and supports India’s goal of becoming a $6.3 trillion economy by 2029-30.

- Budget Highlights: Major allocations include ₹2.66 lakh crore for farmers via new schemes like Dhan‑Dhaanya Krishi Yojana, expanded MSME thresholds, export-promotion infrastructure, and global capability centre frameworks to enable tier‑2 city growth.

- Top Sectors: The sectors that stood out after the budget were agriculture, power & renewable energy, tourism & hospitality, consumption & FMCG, and shipping & logistics.

- Overall Outlook: With strong policy backing and high capital spending, the budget offers compelling investment opportunities in rural and infrastructure-led sectors. Investors should monitor sector rotations, inflation pressures, and implementation efficiency going into 2025.

“Jai Jawan, Jai Kisan”—The Heart of Union Budget 2025

The Union Budget 2025 puts national security and rural development at the forefront, staying true to the spirit of “Jai Jawan, Jai Kisan.” With a record ₹4,91,732 crore dedicated to defence and ₹2,66,817 crore to empower farmers and rural communities, the budget aims to build a stronger, safer, and more self-reliant India.

The last year of budget 2024, after the general elections, had provided the road map to ‘Viksit Bharat’ But the current Union Budget 2025 has established the driving engines of development to accomplish “Viksit Bharat.’

Our Finance Minister (FM) Nirmala Sitaraman, expressed the aspiration of ‘Viksit Bharat‘ to accelerate growth of the country’s GDP, enhance spending power of the rising middle class and increase private sector investments.

As per the Economic Survey, India’s economy is projected to grow at 6.4% in FY25, with a steady trajectory supported by strong agricultural sector as well as the service sector performance. The International Monetary Fund (IMF) projected India to become a USD 5 trillion economy by 2027-28 and reach a size of USD 6.307 trillion by 2029-30. But, India needs to grow by 8% over the next decade or two to achieve the vision of Viksit Bharat, a developed nation, by 2047 as the country will celebrate 100 years of Independence.

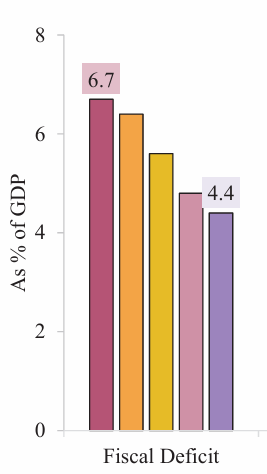

Additionally, the country’s fiscal deficit is on a downward trajectory. The budget estimates indicate the fiscal deficit for 2025-26 could be 4.4% of GDP, compared to previous year revised estimates for FY 2023-24 at 5.8% of GDP followed by FY 2024-25 budget estimates at 5.1% of GDP.

Also, to reduce the Current Account Deficit (CAD), the budget 2025 includes measures to improve exports, attract Foreign Direct Investment (FDI), and reduce import dependency, all of which can help narrow the CAD in the long term.

Additionally, the union budget 2025 focuses on generating employment, developing skills among the youth of our country, and supporting the MSMEs (Micro, Small & Medium Enterprises) and the middle class by increasing the taxable income limit to 12 lakhs. So, practically a person earning 12 lakhs p.a. would be paying no tax. This can boost consumption as more individuals will have greater disposable income to spend which may raise the country’s GDP.

Nevertheless, there have been major positive announcements in some sectors of the economy. Therefore, this particular blog will provide you with the top five sectors or industries that could benefit from the government’s union budget. But, before delving into the top sectors, here is a brief overview of the Union Budget 2025.

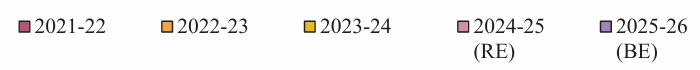

The image below will allow you to gain an understanding of the income and expenditure of the Indian government.

Overview: Union Budget 2025

The theme for the Union Budget 2025 focuses on four major priorities to drive the growth of the country. They are as follows:

- As India as you know is land of agriculture, the first and foremost initiative is to focus on agriculture and rural development.

- Next are the Micro, Small, and Medium Enterprises (MSMEs) of the country which generates 62% of India’s employment.

- Investments in the economy, innovation and people of the country.

- Lastly, development in business exports is needed to promote indigenous industries globally.

Budget Highlights

The Union Budget 2025 drives India’s economic transformation with four key engines—Agriculture, MSMEs, Investment, and Exports.

- 1st Engine: Agriculture: The objective is to strengthen the backbone of India as the union budget 2025 prioritizes agriculture with the Prime Minister Dhan-Dhaanya Krishi Yojana, covering 100 districts to boost productivity, crop diversification, and irrigation. Along with a Rural Prosperity and Resilience Programme to create jobs in rural areas through skilling, technology, and investment.

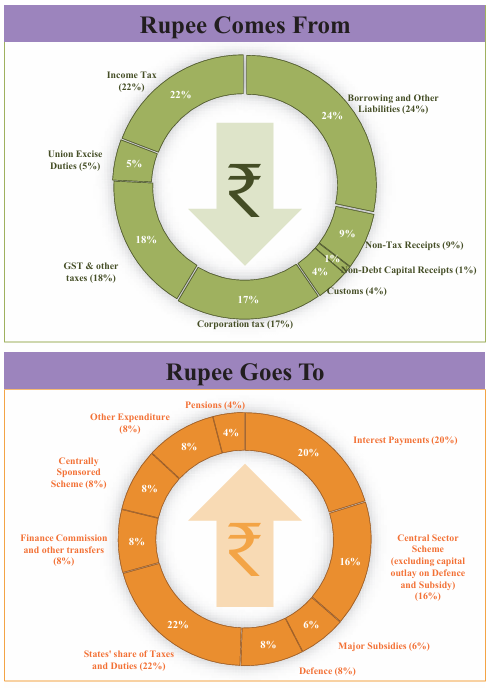

- 2nd Engine: MSMEs: The micro, small, and medium enterprises (MSMEs) of India are ready to drive the country’s economic advances and become the powerhouse of growth.MSMEs, which contribute 45% of India’s exports, receive a major push with enhanced credit access. The budget doubles the investment and turnover limits for MSMEs, enabling them to scale up efficiently. Here is the new classification for MSMEs in India:

- 3rd Engine: Investment: Investment in people, infrastructure, and innovation is a core budget priority. The government will establish 50,000 Atal Tinkering Labs in schools, provide broadband connectivity to rural health centers and schools, and launch five National Skilling Centers of Excellence. A ₹500 crore AI Centre of Excellence will drive research in education and automation. For economic expansion, ₹1.5 lakh crore is allocated for 50-year interest-free loans to states, alongside a ₹10 lakh crore Asset Monetization Plan for infrastructure. Additionally, the Urban Challenge Fund (₹1 lakh crore) will promote sustainable urban growth. Innovation will be supported with ₹20,000 crore for private sector-led R&D, a National Geospatial Mission, and the Gyan Bharatam Mission, which will document and digitize over 1 crore manuscripts for knowledge preservation.

- 4th Engine: Exports: Exports remain a critical pillar of India’s growth, with the Export Promotion Mission helping MSMEs tap into global markets. The BharatTradeNet (BTN) platform will simplify trade documentation and financing, enhancing India’s export ecosystem. To integrate with global supply chains, the government will support domestic manufacturing of electronic equipment and Industry 4.0 technologies. A National Framework for Global Capability Centres (GCCs) will help emerging tier-2 cities become international business hubs. Additionally, air cargo infrastructure will be upgraded with new warehousing facilities, boosting exports of high-value perishable goods like horticulture produce.

A strategic focus on reforms, innovation, and global integration, this union budget 2025 lays the foundation for a stronger and more competitive India!

Top 5 Sectors post Union Budget 2025

1. Agriculture

The Union Budget 2025 has reinforced agriculture as a key growth driver with major initiatives aimed at productivity enhancement, rural employment, and financial inclusion for farmers.

The Prime Minister Dhan-Dhaanya Krishi Yojana will cover 100 agri-districts to boost crop diversification, irrigation, and post-harvest storage. Also, the National Mission on High Yielding Seeds and Cotton Productivity may strengthen the country’s self-sufficiency in critical crops.

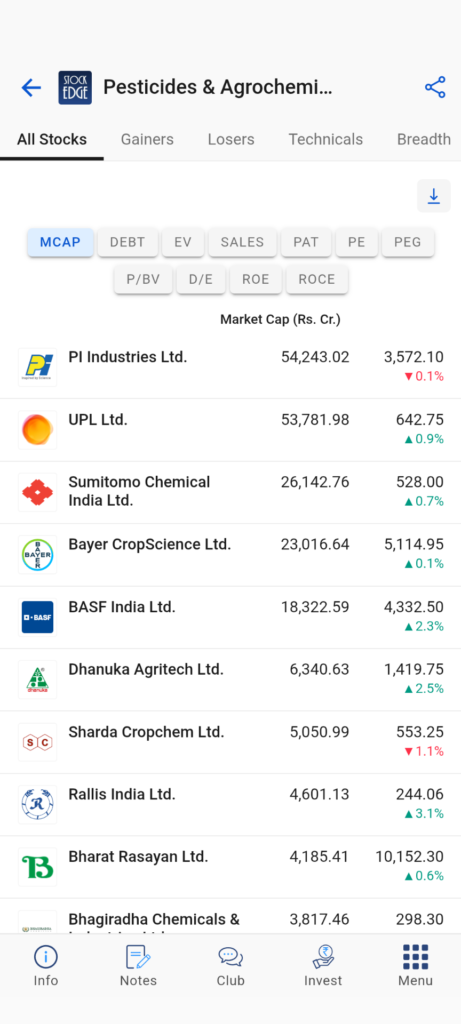

So, with increased budget allocation the development of rural infrastructure may drive demand for fertilizers, agrochemicals, and agri-equipment. Thus, agrichemical stocks like PI Industries, UPL Ltd. and others are leading producers of agrochemicals and specialty pesticides may benefit in the long term. Here is a complete list of Pesticides & Agrochemicals Stocks in India.

2. Power & Renewable Energy

The Union Budget 2025 places power and renewable energy at the core of India’s sustainability and energy plan for years ahead. The Nuclear Energy Mission aims to develop 100 GW of nuclear power by 2047, with ₹20,000 crore allocated for Small Modular Reactors (SMRs).

To boost solar energy, the government will support domestic manufacturing of solar PV cells and panels, reducing dependency on imports. So, stocks like Waaree Energies Ltd., which is one of the dominant manufacturers of solar panels and PV cells, can be beneficial in the long term. You can read one of the previous blogs to find out the top solar stocks in India you may invest in.

Moreover, electric vehicle (EV) battery production may get a major push under the Clean Tech Manufacturing program, which focuses on lithium-ion batteries, electrolyzers, and grid-scale storage solutions. Thus, stocks like Tata Power Company Ltd., which is into developing EV charging infrastructure, and battery storage facilities and battery manufacturing stocks like Exide Industries Ltd. and Amara Raja Energy & Mobility Ltd. are some of stocks to watch for in the upcoming years.

3. Tourism & Hospitality

India ranks among the leading countries for foreign tourism expenditure due to its diverse geography and the wide array of cultural experiences it offers. The Union Budget 2025 gives a significant boost to tourism and hospitality, recognizing it as a key driver of employment and economic growth. The government will develop the Top 50 tourist destinations in partnership with states. A special focus will be on spiritual tourism like the ‘Mahakumbh Mela 2025.‘

The budget also supports medical tourism under the Heal in India initiative, making it easier for foreign visitors to access India’s healthcare facilities. Also, to enhance regional connectivity, the UDAN scheme will be expanded to 120 new destinations, boosting air travel to remote and aspirational districts. Furthermore, MUDRA loans for homestays and incentives for hotels in tourist hubs will drive private sector investments.

With the new income tax rebate limit raised to ₹12 lakh per annum, the middle-class and upper-middle-class will have higher disposable income, leading to increased spending on travel and leisure. So, there are significant investment opportunities as the government’s push for regional connectivity and cultural tourism will further drive demand for hospitality services, tour operators, and travel technology platforms.

Thus, stocks like The Indian Hotels Company Ltd. (Taj Hotels), Lemon Tree Hotels Ltd., InterGlobe Aviation Ltd. (IndiGo Airlines), Le Travenues Technology Ltd. (IXIGO) and others are some stocks to watch in this sector.

To learn more about the growing investment opportunities in the tourism sector, you can read: Top 6 Tourism Stocks in India.

4. Consumption & FMCG Sector

The Union Budget 2025 is set to boost India’s consumption story, as rising disposable income and tax relief for the middle class will encourage higher spending on consumer goods, Fast Moving Consumer Goods (FMCG), and consumer durables. With the income tax rebate limit increased to ₹12 lakh per annum, households will have more purchasing power, leading to higher demand for essential goods, electronics, automobiles, and premium lifestyle products.

The impact of high disposable income may lead to more spending on premium and discretionary goods like electronics, appliances, and automobiles, higher demand for

FMCG products, including personal care, packaged food, and household essentials may also boost retail and e-commerce, as digital infrastructure and logistics improve.

Stocks like Hindustan Unilever (HUL) Ltd. who are leading in personal care, food, and home essentials, Titan Company Ltd. who is into jewelry, watches, and eyewear and stocks into passenger vehicles like Maruti Suzuki Ltd., Mahindra & Mahindra Ltd. along with two wheeler stocks like TVS Motor Company Ltd., Hero MotoCorp Ltd., etc. may benefit from rising disposable income.

Check out the investment theme of Booming Consumption to get the list of some of the best stocks you can invest in.

5. Shipping & Logistics

The Union Budget 2025 strengthens India’s maritime and logistics sector, aligning with the vision of self-reliance (Aatmanirbhar Bharat) and defence modernization. A ₹25,000 crore Maritime Development Fund has been announced to support long-term financing for ports, shipbuilding, and logistics infrastructure. The budget recognizes the strategic importance of naval power by incentivizing domestic shipbuilding for defence purposes. Ship manufacturing and naval defence projects may receive higher capital allocations, creating investment opportunities in defence-oriented shipyards.

Shipbuilding with the rise in defense contracts by government orders for naval vessels, and submarines could trigger a boost in the shipbuilding industry. Also, port infrastructure and cargo logistics with focus on supporting domestic and global trade routes via BharatTradeNet may turn out to be a good investing opportunity in the long term.

Therefore, stocks like Cochin Shipyard Ltd. which is into commercial vessel manufacturing, Mazagon Dock Shipbuilders Ltd. which is a key player in submarine and naval warship manufacturing, Adani Ports and Special Economic Zone Ltd. which is a major port operator and logistics service provider may be benefited in the long term.

The Bottom Line

The Union Budget 2025 lays a strong foundation for India’s economic transformation, focusing on growth, sustainability, and global competitiveness. With higher disposable incomes, strategic infrastructure investments, and sectoral incentives, the budget unlocks tremendous opportunities for businesses and investors alike. All these add up to a newer India with the potential to grow at an exponential rate. Therefore, invest in a highly growing sector of the Indian stock market with a greater focus on analyzing the financial performance of the companies in which you’re investing, which will help you to make better investment decisions.