Table of Contents

SME stocks can be an emerging investing opportunity for many investors. They are basically, Small and Medium Enterprises which are publicly listed providing access to capital and future financing opportunities. In this blog, we will be taking you through a journey of the world of SME stocks which may become an excellent investment opportunity for your portfolio.

Back in 2012, the National Stock Exchange and the Bombay Stock Exchange started a separate platform to list small and medium enterprises publicly. This has provided a large number of small and medium companies in India to list their company with the exchange that helped them to raise funds to grow their business and get recognition in the market.

“NSE EMERGE” and “BSE SME” are two platforms that offer emerging businesses a new and viable option for raising equity capital from a diversified set of investors.

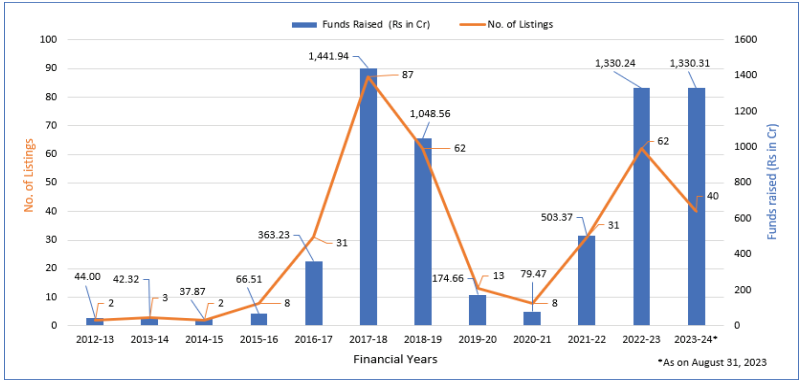

As of 31st Aug 2023, a total of 349 companies got listed on the NSE Emerge platform and total fund raised was ₹6462 crores. If you look closely at the graph, NSE Emerge started to take off and flourished in 2017-2018. However Covid-19 disrupted the growth but now it has again started to pick-up momentum, as every 8 out of 10 IPOs are from the SME zone.

Before we dig deep into the insights of SME stocks, let’s have a clear understanding of SME stocks and how different they are from regular stocks which are listed on the stock exchanges.

What are SME Stocks?

SME stocks in India refer to shares of small and medium size companies listed on the SME platforms, such as the BSE SME and NSE Emerge. They allow these companies to raise capital, enhance visibility, and improve liquidity while offering investors an opportunity to invest in emerging businesses with high growth potential. However, they often carry higher risks due to factors like limited financial history, smaller scale of operations, and potentially higher volatility.

How are SME stocks different from regular stocks?

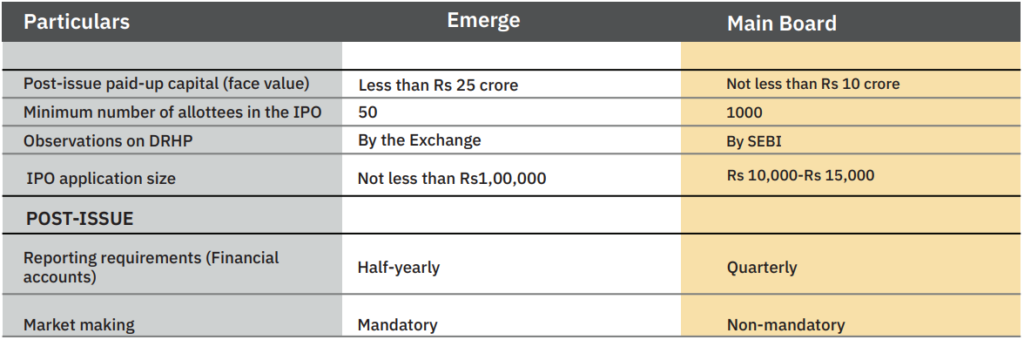

Here are a few key differences between SME stocks and regular stocks that are listed at the NSE and BSE:

- Listing Requirements: SME platforms have more lenient listing requirements compared to the main exchanges. While regular stocks must meet stringent criteria in terms of market capitalization, profitability, and public shareholding, SME stocks can be listed with lower thresholds, making it easier for smaller companies to access the capital markets.

Here is a quick snapshot of the differences between SME IPOs and mainboard IPOs in the stock market:

- Disclosure Norms: The regulatory and disclosure requirements for SME stocks are generally less rigorous. This reduces the compliance burden on SMEs, although it also means less information may be available to investors compared to larger, regularly listed companies. For instance, SME stocks can announce their financial results half-yearly, whereas quarterly results need to be published, which are not SMEs.

- Liquidity: SME stocks tend to have lower liquidity than regular stocks. This is because they are less well known, and their shares are traded less frequently, which can lead to higher volatility and wider bid-ask spreads.

- Risk and Return Profile: Typically, investing in SME stocks is even riskier for many reasons. First, due to their size, companies have a higher risk of bankruptcy. However, this higher risk comes with the promise of higher returns. If they succeed, small companies can grow faster than their larger counterparts.

- Investor Base: SME stocks often attract a different type of investor compared to regular stocks. Investors in SME stocks are typically more risk-tolerant and may be looking for high-growth opportunities, whereas investors in regular stocks may prefer more stable and well-established companies.

Overall, while SME stocks provide opportunities for investment in emerging businesses with significant growth potential, they also come with higher risks and different trading dynamics compared to regular stocks.

Now that you have a fair understanding of SME stocks and how they differ from regular stocks which are traded on NSE and BSE. It is time to focus on the return generated by these SME stocks or how well they perform over the long term.

How are SME stocks performing?

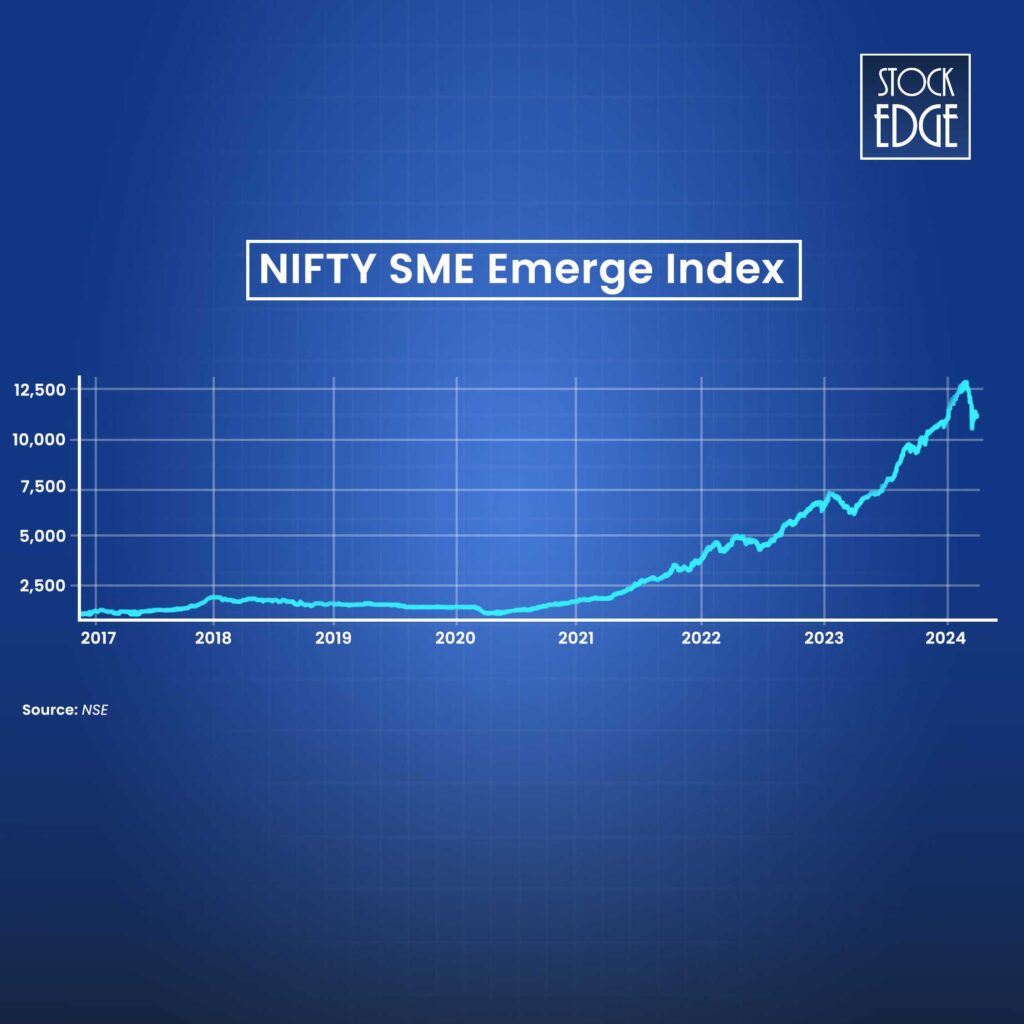

Currently there are 300+ listed SME stocks under the NSE Emerge platform. Each has performed differently over the years. So, it would be difficult for anyone to accurately gauge the performance of all SME stocks. Hence the national stock exchange has launched an SME index in 2016, which is the Nifty SME Emerge Index. It reflects the performance of SME stocks that are listed on NSE EMERGE platform.

Nifty SME Emerge Index consists of 245 SME stocks and their weights are based on free float market capitalization. Since the inception of the index in December 2016, it has given a price return of 38.79% and a staggering 79.15% in the last 1 year as of 31st March 2024.

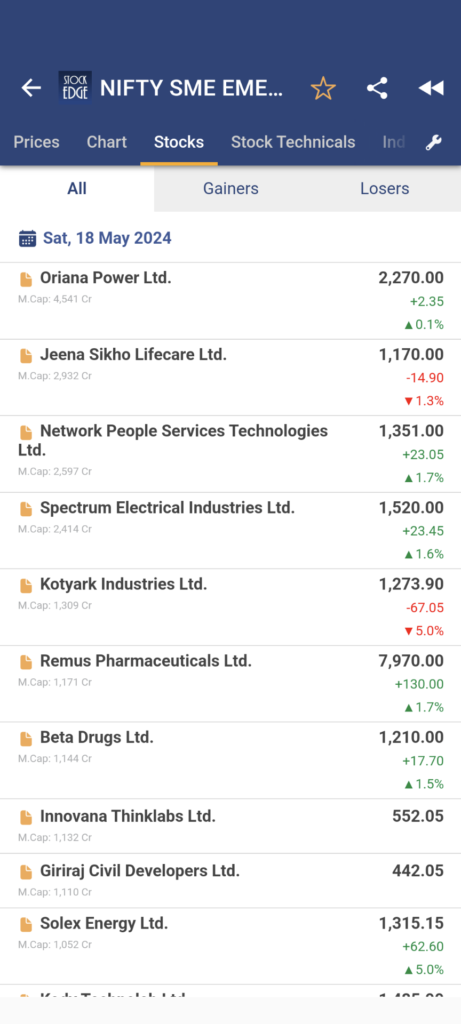

List of Stocks under Nifty SME Emerge Index

You can view the list of 245 stocks that are listed under the Nifty SME Emerge index with StockEdge app:

As you can see from the above screenshot, you can not only view the list of stocks but also the top gainer and losers of the index, along with its price return and closing price of the SME stock.

So, now that you have the entire list of stocks under the Nifty SME Emerge index. Should you start investing in SME stocks considering its booming price return in the past few years? Before coming to the conclusion of investing or not, let’s first find out the different ways to invest in SME stocks.

How to invest in SME stocks?

There are majorly two ways that you can invest in SME stocks in India, which are:

SME IPOs

Investing in SME IPOs can be very attractive in terms of listing gains. This is very similar to investing in a main board IPO, where allotment of shares is subjected to the subscription of the SME IPO. However there is a small difference between a subscription of SME IPO and main board IPO. The application size for SME IPOs cannot be less than 1 lakh, which is substantially higher than main board IPOs where the application size is less than equal to ₹15000. Here, the risk gets higher as the investment for 1 application is much higher. But as risk and reward goes hand in hand.

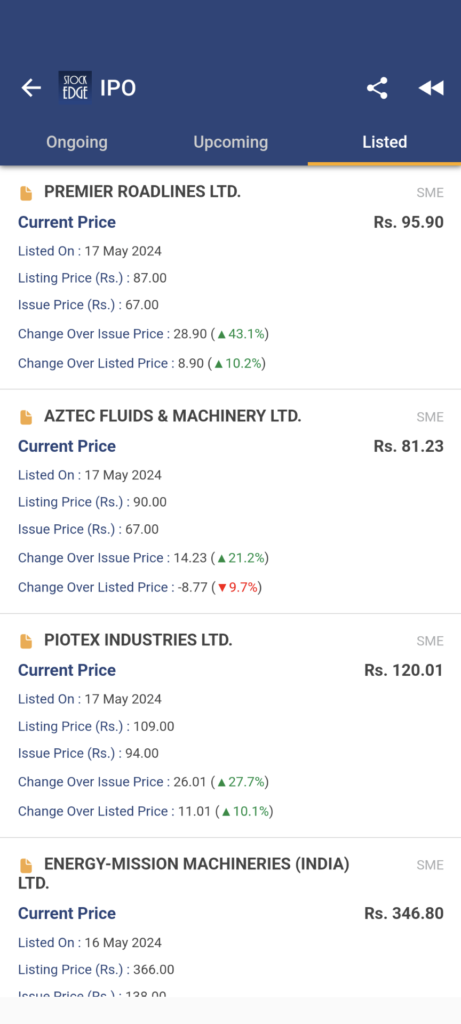

Here is a list of SME stocks that were recently listed on the SME exchange. You can view their listing gains or losses from its issue price as well as the listing price:

Other than this, the IPO section of StockEdge, also shows the ongoing IPOs and upcoming IPOs. The SME IPOs are tagged separately to differentiate it from the main board IPOs.

So, is it worth investing in SME IPOs?

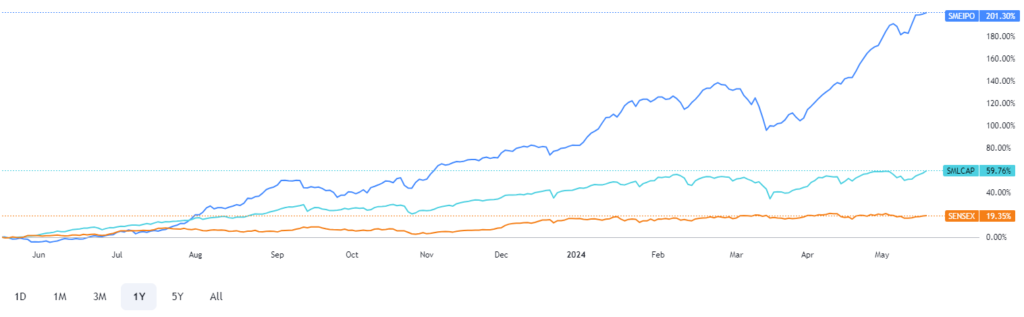

For your reference here is a price chart of BSE Small & Medium Enterprise IPO index in comparison to BSE Smallcap index and BSE Sensex. The return of the BSE SME IPO index has surpassed the other two indices by a huge margin in the past 1 year.

BSE Small & Medium Enterprise IPO index Vs BSE Small Cap Index Vs BSE Sensex

Yes, if you have the risk appetite to invest in SME IPOs, then surely it may be highly rewarding. But always read the company’s financial objective of IPOs from DRHP to get an idea about the company financials, management to get an idea about the future prospect of the company before subscribing to any SME IPO.

Directly Invest or Trade in SME Stocks

Before you invest directly in SME stocks, it is important to keep in mind that you can buy or sell SME stocks only in a particular quantity, also known as a Lot. Each SME stock has a particular lot size. Think of it as trading in futures of a stock, in which you can trade stock futures in a particular lot. Hence, the risk is higher in both. The only difference is that in the case of SME stock, you are buying or selling the underlying asset and not the contract, which is the case for stock futures.

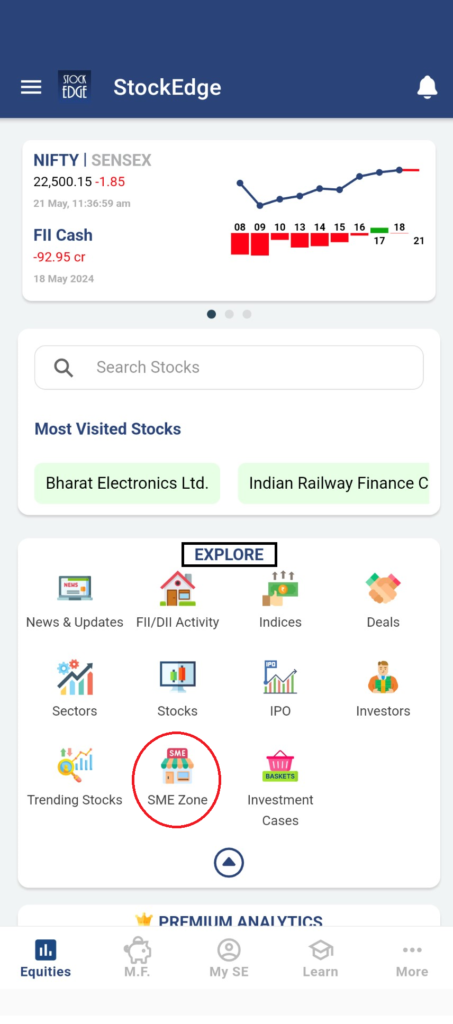

So, now that you have made up your mind to invest or trade in SME stocks. It is time to analyze or identify stocks that can be a good investment. Here, our very own StockEdge app can be your best partner. We have a dedicated feature called the SME Zone. You will find it under the Explore tab, as shown in the image below:

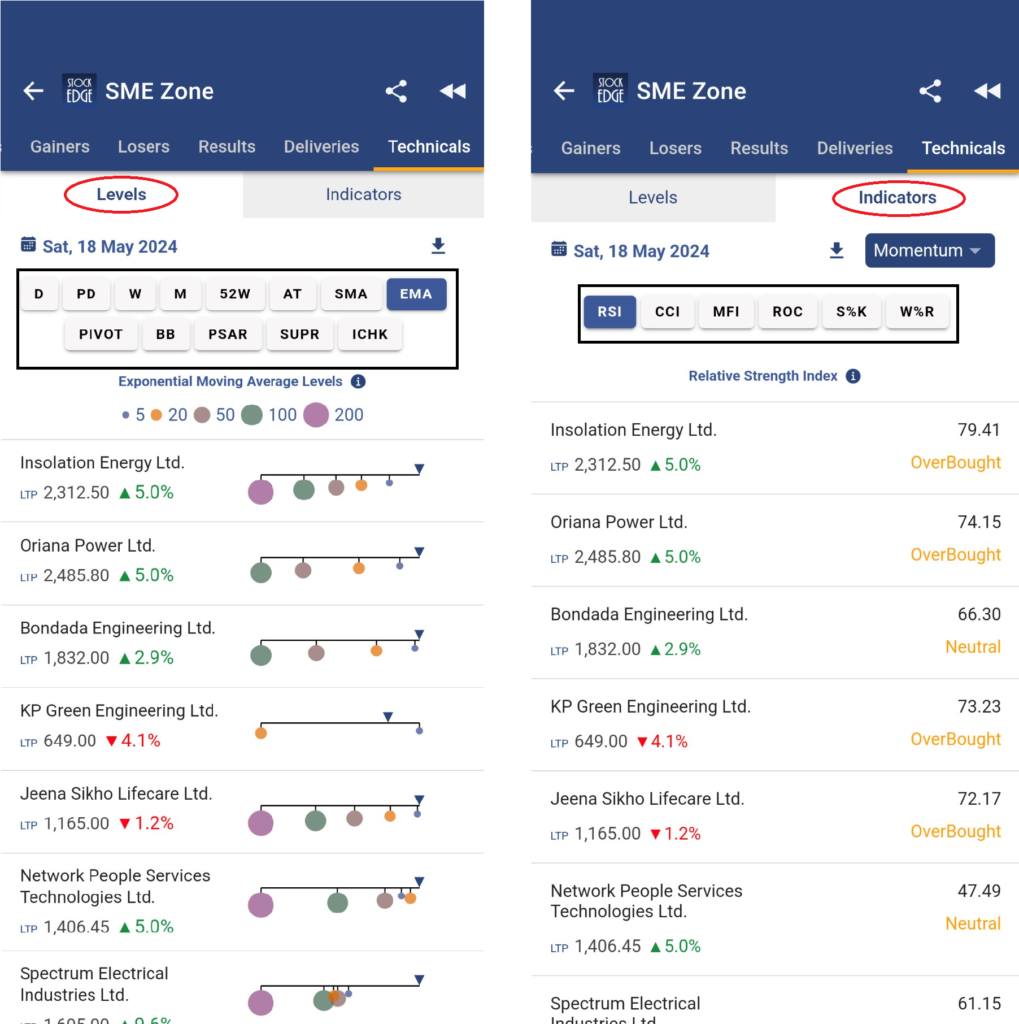

SME zone offers the list of stocks that are listed in the SME segment. All the stocks are sorted by Market Capitalization in descending order. It provides you with a whole host of details about the SME stocks such as top gainers and losers for the day along with its price return in different time horizons. The best part is that it shows the live data.The rates shown here are updated every 1 minute for NSE and every 5 minutes for BSE. Hence, this is extremely helpful for traders in the segment. Additionally, you can also view the delivery data of SME stocks at the end of day which adds more conviction while taking positional trades.

Moreover, you can individually each stock based on technical levels and indicators directly from the StockEdge app:

To learn more about technical peer analysis using StockEdge, read: A Comprehensive Guide to Technical Peer Analysis

But, what about long term investors? If you are one of them who wants to invest in growing companies then SME stocks could add shine to your portfolio. However, before making an investment decision you must analyze the fundamentals of the company. Yes, it is a time taking and tedious to do but StockEdege can help you to filter strong stocks based on their earnings. How let’s find out?

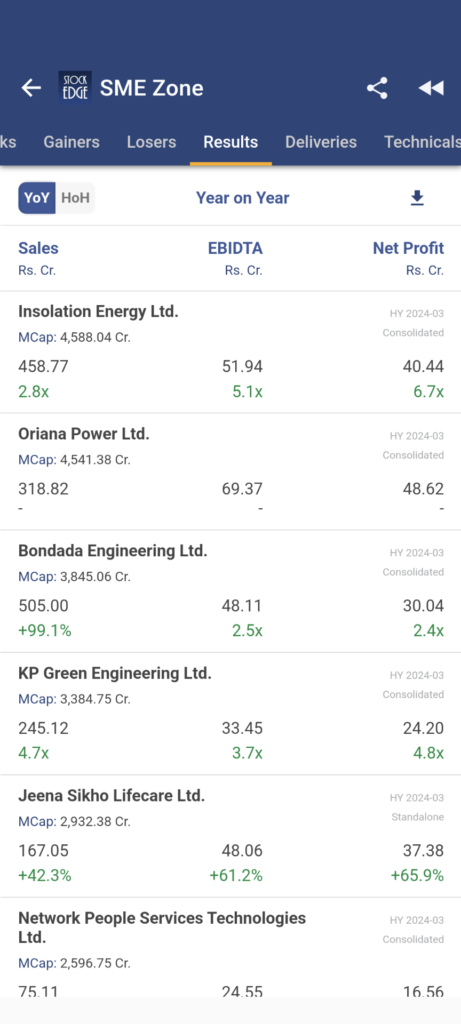

SME Zone has a particular result tab where you can find information about earrings of all the SME stocks listed in the market. You can easily figure out growth in a company’s both top line and bottom line growth with Sales, EBITDA, & Net profit. As per regulatory requirements, these small and medium enterprises are required to publish their results half-yearly instead of quarterly. Therefore, you can view the result based on YoY as well as HoH (Half-yearly on Half-yearly).

So, spot the strong stocks based on its strong earnings using StockEdge and analyze the company’s financials and study the management before making an investment decision.

The Bottom Line

SME stocks can be risky and equally rewarding at the same time. Investing in a portion of your portfolio in SME stocks can impact the returns of your overall portfolio. These small and medium enterprises are highly growing companies, and investing in a few strong companies can turn out to be good investments in the long run. However, investing in SME stocks requires high capital in comparison to investing in regular stocks, and there is a limitation of buying these SME stocks in a particular lot size, which could affect the overall risk for your portfolio. Therefore, keeping a strict drawdown based on your risk appetite is essential before investing in SME stocks.

What is SME Exchange?

An exchange specifically designed for trading small and medium-sized business (SMEs) that typically struggle to get listed on the major exchanges is known as the SME

Exchange.

How is the SME Platform going to help smaller firms?

SMEs can get access to capital for future financing of their activities and will have recognition in the market being a listed entity.

Whether the investors are protected under Investors Protection Fund (IPF) on the SME Platform?

Yes, the provisions of the IPF for the main board apply to SME Platform also.