Table of Contents

Rakesh Jhunjhunwala: The Big Bull of the Indian stock market was a trader and investor. His decision-making ability, judgment ability, and vision helped him become a billionaire in the stock market. His interest in financial stocks made him enthusiastic about leading the stock market successfully in spite of tough competition.

Early Life of Rakesh Jhunjhunwala

Family Background

India’s Rakesh Jhunjhunwala was born on July 5, 1960, into a middle-class family. Rakesh was raised in a strict environment because his father was an income tax officer. He showed an early interest in the stock market despite experiencing financial difficulties.

Education and Initial Interests

He graduated with a degree in commerce from the University of Mumbai, and his family values education. His perseverance and strategic aptitude are evident in his rise from a modest investor to one of India’s most prominent and successful stock market investors. His family history emphasizes the value of tenacity and financial knowledge.

Journey into the Stock Market

First Steps into the Stock Market World

The Big Bull began his career in the stock market during his time in college. “Rakesh Jhunjhunwala success story” is noticed by the intricacies of the market when he started investing his savings. In spite of his early setbacks, he persisted and took lessons from them, setting the groundwork for his incredible journey to become a renowned Indian stock market investor.

Early Investments and Returns

Taking advantage of new prospects, he strategically invested in companies like Tata Tea, currently TATA Consumer Products and Sesa Goa in the early 1980s. “Rakesh Jhunjhunwala investment” is observed in its risk-taking prowess and perceptive market observations that produced significant profits. Jhunjhunwala’s remarkable career as a prosperous and well-known investor in the Indian stock market began with these initial investments.

Major Investments and Their Outcomes

Among the companies in which Rakesh Jhunjhunwala has made significant investments are Titan Company, Lupin, CRISIL, and Praj Industries. Titan Company was a trailblazer in the Indian jewellery sector, and its investment yielded impressive returns because of its rapid expansion. In a similar vein, his early support of the massive pharmaceutical company Lupin produced notable results, which is noticed in “Rakesh Jhunjhunwala portfolio“. The credit rating service CRISIL turned out to be another profitable venture. His varied portfolio and long-term outlook have solidified his position as one of India’s most successful investors, even though not all of his endeavours were immediately profitable. He has inspired others with his strategic insight and aptitude for spotting good market possibilities.

Get the list of stocks in Rakesh Jhunjhunwala’s portfolio and other ace investors in the stock market from the Investor Portfolio Section of StockEdge.

Later Successes

Rakesh Jhunjhunwala’s capacity for adaptation and seizing new opportunities is what led to his eventual success in the stock market. As his understanding of investing increased, he placed successful wagers on businesses like Voltas, Titan, and Aptech and generated sizable profits. His image as a financial maestro was cemented by his methodical approach and keen understanding of the market. Some of the recent changes in his portfolio can be easily identified from the Key Changes section in StockEdge.

Death

The ‘Big Bull’ of Dalal Street, ace investor Rakesh Jhunjhunwala, died at the age of 62 after a heart arrest. This comes as a shock to the entire stock market community. According to accounts, he had a number of health issues relating to his kidneys, diabetes, and heart.

Analysis of Rakesh Jhunjhunwala’s Portfolio

Overview of Portfolio Holdings

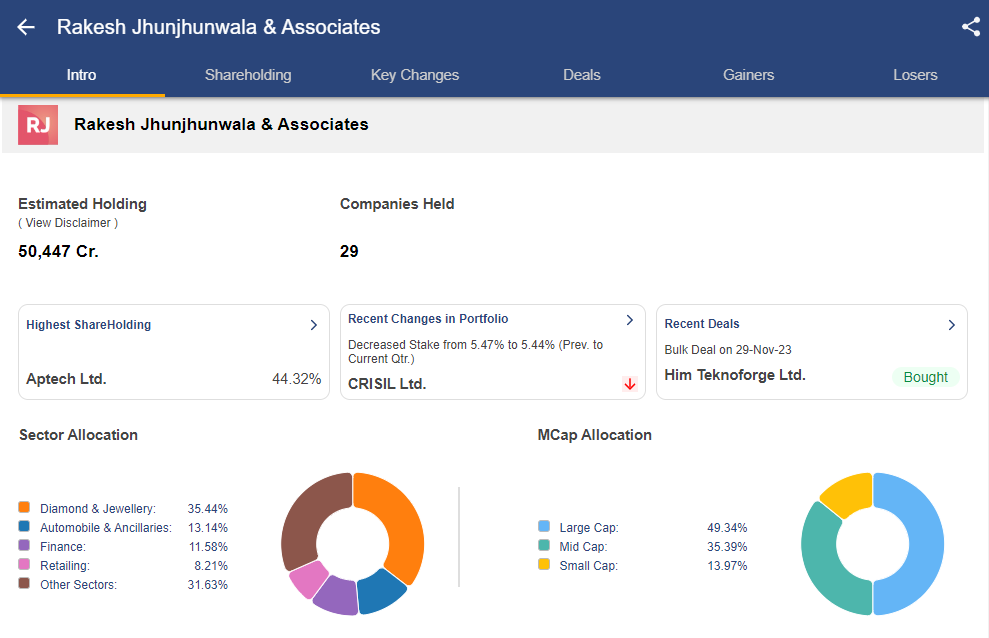

StockEdge provided you with a detailed overview of Mr. Rakesh Jhunjhunwala & Associates portfolio of stocks. You can view the estimated holdings along with the number of stocks held by him. It also shows the sector allocation and market cap allocation of stocks in his portfolio.

“Rakesh Jhunjhunwala investment” acumen is demonstrated by the diversity of his portfolio as of December 31, 2023, which consists of 20 stocks with a combined market value of an astounding Rs. 41,775.7 Cr. Based on publicly available company shareholding data, this financial master strategically moves throughout the stock market, holding positions in multiple industries. One of India’s most well-known stock market whizzes, Jhunjhunwala, controls his investments with transparency and accuracy, as demonstrated by the painstaking filing of shareholding data with exchanges. This provides investors and enthusiasts with an intriguing look into the wealth-generating process.

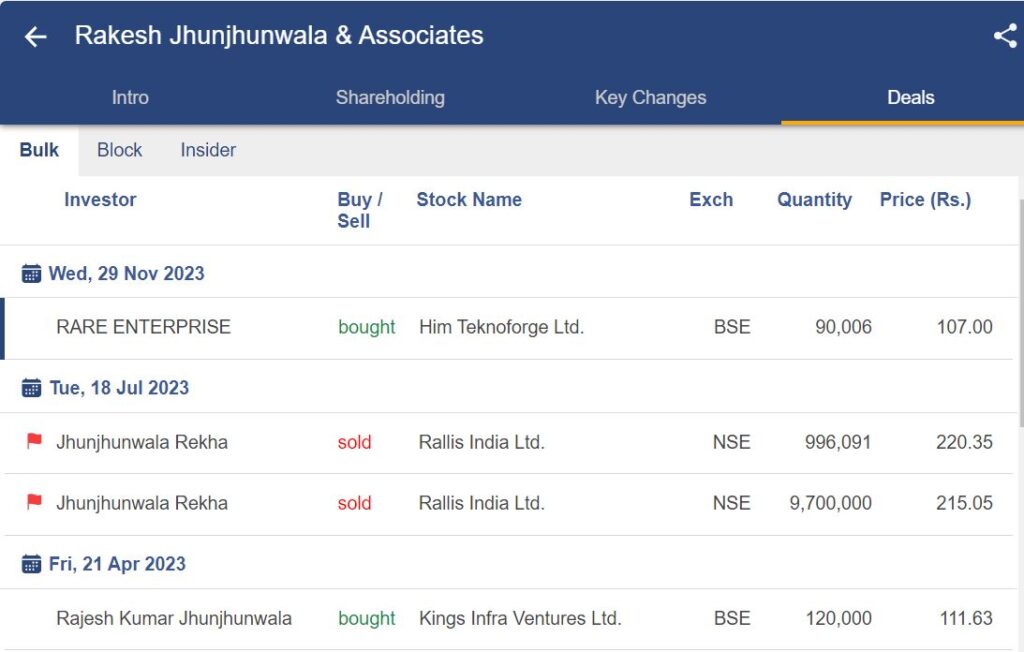

Additionally, one can track the daily stock deals by RARE Enterprise, which is basically RAkesh & REkha (his wife). Stock dealings like block deals, bulk deals, or any insider can be tracked from the deals section of StockEdge.

Key Changes and Trends in Portfolio

“Rakesh Jhunjhunwala portfolio” has historically concentrated on his investment strategy in industries such as banking, financial services, and pharmaceuticals. He typically maintains long-term roles in businesses with solid foundations. His opinions on the market and economic trends are frequently reflected in changes to his portfolio.

He has demonstrated an interest in startups and developing industries like technology as he had invested in Nazra Technologies Ltd. and still holds 8.99% shares. Rakesh Jhunjhunwala’s investment selections are subject to change, dependent on market dynamics and economic situations. With StockEdge, you can easily find out if there is a holding of a big bull investor in any stock.

Rakesh Jhunjhunwala’s Investment Style

Value Investing Approach

Value investing components are combined with an emphasis on long-term growth in the “investment of Rakesh Jhunjhunwala”. He finds cheap equities with solid fundamentals, focusing on businesses with long-term development potential. Before making investments, he conducts a detailed analysis of financial statements, managerial calibre, and market trends, which is considered “Rakesh Jhunjhunwala best investment”.

He patiently waits for profits to show up but also adjusts to shifting market conditions. His meticulous strategy, which reflects a dedication to value investing concepts, entails sticking to quality securities through market volatility. The secret to “Rakesh Jhunjhunwala recent investment” is a well-rounded approach that blends values-based ideas with an awareness of how dynamic the market is.

Long-Term Investments

The Big Bull was well known for his long-term investment strategy, which is a testament to his conviction and patience. He usually holds onto his investments for long stretches of time and invests in businesses with solid fundamentals and room to develop. He can ride out market swings and profit from the compounding effect thanks to this method.

Jhunjhunwala frequently stresses the value of careful investigation, solid business plans, and reliable management, which has been observed in “Rakesh Jhunjhunwala net worth”. He hopes to gain from the steady expansion of fundamentally sound businesses by keeping an eye on the long run, demonstrating a dedication to long-term wealth development as opposed to transient market volatility. This strategy is consistent with the long-term investing tenets of patience and strategy.

Diversification

One of the main tactics in his investing approach is diversification. Despite being well-known for his concentrated wagers on particular firms, he keeps a balanced portfolio that spans multiple industries. This strategy lessens the risks connected to a particular stock or industry.

Jhunjhunwala distributes his money wisely in order to spread risks and take advantage of new chances. He can manage market volatility and strike a balance between possible gains and losses thanks to diversification. By holding a variety of equities, he hopes to develop a more stable and durable investing portfolio, displaying a careful and balanced approach that blends specific bets with broader diversification for long-term success.

Diversification is the key to a prosperous financial future, read this blog on Portfolio Diversification: The Powerful Strategy for Safeguarding Your Financial Future

Learnings from Rakesh Jhunjhunwala’s Success

Importance of Research and Analysis

The accomplishments of Rakesh Jhunjhunwala highlight how crucial thorough investigation and analysis are in the field of investing. His long-term success in the stock market can be largely attributed to his rigorous analysis of financials, market trends, and managerial calibre. This highlights the crucial role that careful due diligence plays in helping investors make well-informed selections.

Patience and Persistence

His achievements teach us important lessons about the benefits of perseverance and patience in investing. His capacity to withstand market swings, hang onto investments for the long haul, and grow from failures emphasizes the need for tenacity and a solid strategy in attaining long-term success in the fast-paced world of finance.

Courage to Face Volatility

Additionally, the need for bravery in the face of market instability is a must. He highlights the significance of bravery in attaining long-term success in the stock market by remaining resilient in the face of adversity and proving that handling swings with poise and conviction may result in significant profits.

Impact on Indian Stock Market

Influence on Retail Investors

The Indian stock market has been greatly impacted by Jhunjhunwala’s success, which has motivated and impacted regular investors in the form of “Rakesh Jhunjhunwala best investment”. His experience might be seen as a lighthouse for novice investors, demonstrating the possibility of building wealth through methodical approaches and inspiring others to get involved and educated in the exciting world of stock investing.

“Rakesh Jhunjhunwala invested stocks” create a long-term impact on the Indian stock market.

Boost to Indian Economy

The prosperity of “Rakesh Jhunjhunwala investment journey” has bolstered the Indian stock market and the country’s economy. His well-thought-out investments and market sway garner interest and confidence in investors, which in turn may stimulate more market involvement and capital inflows and ultimately boost economic growth. Get more insights on the investment of Rakesh Jhunjhunwala on StockEdge.

Conclusion

Rakesh Jhunjhunwala’s impressive track record speaks volumes about his keen investment sense, which combines a methodical approach, long-term perspective, and a sensible balance of concentrated bets and portfolio diversification. His rise from a little investor to a market legend is a testament to his capacity for opportunity detection, flexibility, and long-term financial success.

How much money did Rakesh Jhunjhunwala start with?

Rakesh Jhunjhunwala began investing in the stock market with about INR 5,000 (Indian Rupees).

Are there any potential risks or downsides to following in Rakesh Jhunjhunwala’s footsteps?

Individual investors may run risks when trying to emulate Rakesh Jhunjhunwala’s investment technique because different people have different risk tolerances and market conditions might affect concentrated bets and market timing.

What are some of the investment strategies employed by Rakesh Jhunjhunwala?

Rakesh Jhunjhunwala focuses on fundamentally sound businesses while adjusting to market conditions. He does this by combining value investing principles, a long-term outlook, and strategic diversification.

What were the key factors that contributed to Rakesh Jhunjhunwala’s success?

The factors behind Rakesh Jhunjhunwala’s success are his keen market insights, methodical approach to investing, capacity to spot cheap stocks with room to develop, long-term outlook, and thoughtful portfolio diversification.