Table of Contents

If you are an investor, at some point in time, you must have heard of contra mutual funds. And if you don’t mind taking higher risks to enjoy better returns, then contra funds will surely intrigue you.

With their unique investment philosophy, contra funds provide a chance for investors to enjoy superior returns, albeit with higher risk. In this article, we will explore the what, why, and how of contra funds to help you assess whether contra funds are suitable for you.

What is the Contrarian Investing Strategy?

A contrarian investing strategy is an investing style that involves purposefully going against the market trend by buying when most of the other investors are selling and vice versa. Contra investing involves investing in stocks that are not favoured by most investors in the market. Stocks are chosen based on their intrinsic value and not on market sentiment.

Renowned investor Warren Buffet, CEO of Berkshire Hathaway, is famous for following a contra investment strategy.

Understanding Contra Mutual Funds

A mutual fund with a contrarian investing strategy at its core is known as a contra mutual fund, or simply a contra fund. The fund manager invests in stocks that have not been performing well recently, thus going against the market trend. They look for potential investment opportunities and focus on stocks that are undervalued.

Due to their inherent nature, contra-mutual funds pose a higher risk. Hence, fund managers diversify their portfolio to manage risk. Contra funds are excellent tools to identify hidden potentials in the market. They are ideal for long-term investors looking for higher returns by taking a considerable amount of risk.

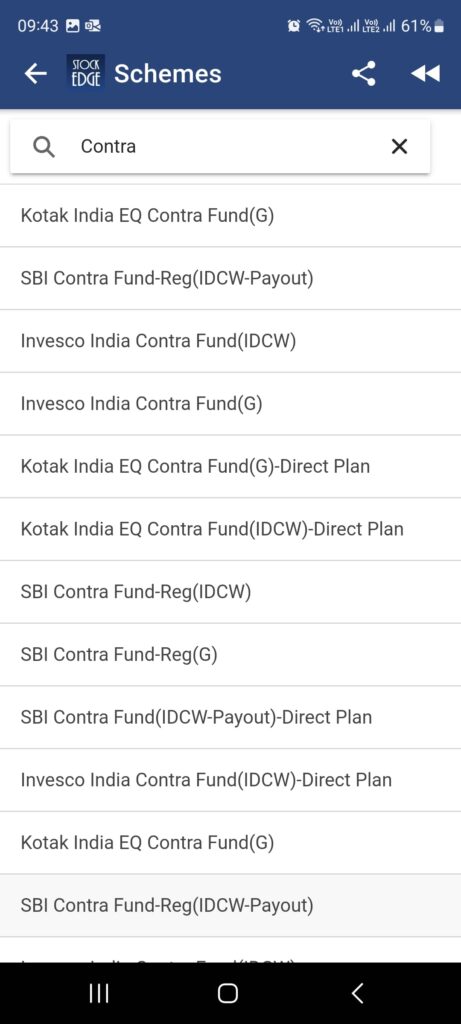

At present, India has three well-run contra funds delivering considerable results. A convenient way to explore the details of these contra funds is by downloading the StockEdge App, India’s favourite market tracking and analysis tool. You can access extensive details of all these contra funds from the app.

A screenshot of the StockEdge App showing the list of contra funds in India

Other than contra funds, we have curated a list of top 5 mutual funds you can invest in.

The Concept of Contra Mutual Funds

Now that you have a basic understanding of contra mutual funds meaning, let us take a deeper look at the concept of contra funds in mutual funds.

One of the inherent aspects of contrarian investing is focusing on stocks with distorted market prices, which includes both under-performance and over-performance. Contra investors believe that an unreasonably priced asset (whether too high or too low) ultimately normalizes after the triggers are mitigated.

A contra fund manager aims to purchase stocks trading at a lower price than their intrinsic value for a long time. This can be due to the lower performance of a certain market sector, unfavourable market conditions, or other market factors.

The fund manager invests in these stocks and holds on to them till their price increases due to higher demand. However, this may take a long time. Hence, if you take a look at the results of any of the contra funds available in India, you will find that the short-term results are relatively low, but the long-term results are significantly high.

A screenshot of the performance of Kotak India EQ Contra Fund from the StockEdge App

Features of Contra Funds

- Contra mutual funds follow the contrarian investing approach, investing in stocks that are trading at a lower price than their value, presenting significant investment opportunities.

- Contra mutual funds reduce risk by diversifying their holdings across different sectors and different companies.

- A contra fund manager makes investment decisions intending to generate high returns for the investors.

- Contra mutual funds benefit from market corrections.

- They aim for long-term growth, and hence, are not suitable for short-term investment.

Risk Tolerance and Contra Funds

One of the inherent aspects of the contrarian investment theme is the higher level of risk since the fund focuses not on the current favourite of the market but the underdog.

Contra funds are susceptible to market fluctuations, which can impact their returns in the short term. In general, market conditions may take a long time to improve. Hence, contra funds diversify their holdings by investing in different sectors and different companies in the same sector to reduce the overall risk of the portfolio.

Benefits of Investing in Contra Funds

- If executed well, a contrarian investment strategy can generate significant returns for investors. Of course, this involves high risk, but the returns may be worth the risk.

- Since fund managers invest in stocks generally not favoured by other investors, they can get good bargains on the stocks, purchasing them at a significantly lower rate.

- Most contrarian stocks are intrinsically good stocks, which are not reflected in the price during the time of investing. Hence, contra funds can invest in good-quality stocks at reasonable prices.

Investment Horizon for Contra Funds

Market conditions take time to improve. Since, as per the inherent structure, the fund manager has to wait for this improvement, contra funds have a longer time horizon than most of their counterparts. Hence, a minimum of 5 years of time horizon should be kept before investing in contra funds. Moreover, investors should not be worried about short-term fluctuations in the fund value because the inherent concept of contrarian investing is that the market corrects itself in the long run.

Who Should Invest in Contra Mutual Funds?

It is said, “Patience is a virtue”. In the investing world, this applies to contra-mutual funds. It is not meant for people looking to make money in the short term or play it safe.

Contra funds are ideal for investors who are ready to take considerable risk and keep an investment horizon of at least 5 years.

Key Factors to Consider Before Investing in Contra Mutual Funds

Here are some crucial factors that you should consider before investing in a contra fund:

1. High gestation period

Returns of contra funds may take a long time to materialize. Hence, contra mutual funds have high gestation periods, and investors are required to be patient during this time. Keeping a long-term horizon is crucial to providing time for the market to improve.

2. High risk

An inherent feature of contra funds is their high risk. As these funds focus on stocks of companies in challenging market conditions, they are susceptible to short-term market fluctuations, which can impact their returns. Hence, contra funds are suitable for investors who are not averse to risk exposure.

3. Fund manager

The decisions of the fund manager, from identifying potential investments to diversification, have a direct impact on the return and risk of the portfolio. Hence, contra fund managers must have specific experience in contrarian investing. As an investor, ensure to review the fund manager’s track record, investment strategies, and market exposure before investing.

4. Past Market Performance

Assessing past performance is essential while investing in any mutual funds, more so with contra funds since they entail a significant amount of risk. Start with the fund’s strategy and then check out the historical returns. Weigh the past returns vis-à-vis the market fluctuations to get a clearer picture. Consider the fund’s performance in different market conditions, such as bull and bear markets, as well as take a look at the fund’s risk management strategies.

A study of these details can provide you with insights into the fund’s investment approach and market performance. This can help you gain an understanding of the fund’s long-term potential.

One of the easiest ways to analyse all these aspects of contra funds in India is to use the StockEdge App. It lists extensive details of each contra fund, including historical movement of the NAV, detailed information about the fund (including risk rating, key parameters, and others), performance vis-à-vis related schemes, performance, holdings, AUM, fund managers, and financial ratios pertinent to the fund.

A screenshot of the info screen of the Invesco India Contra Fund on StockEdge

Best Contra Funds Available in India

India has three contra equity funds managed by three of the top fund houses. Here is a short contra fund review to help you gain an overview of these funds:

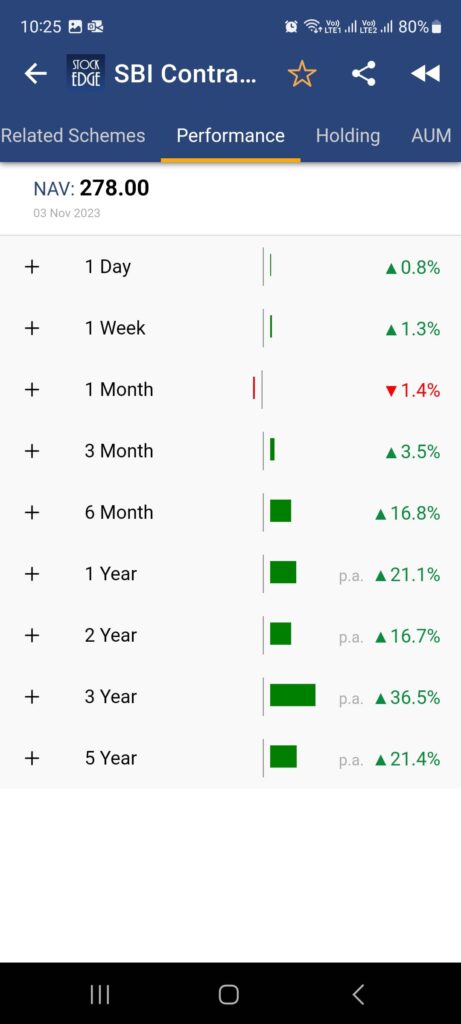

This is one of the top contra funds in India. Launched in 1999, this fund has delivered considerable results over the years. The portfolio of contra mutual fund SBI is composed of a mix of large and mid-cap stocks. Fund manager Dinesh Balachandran has been managing this fund since 2013. He uses both qualitative and quantitative analysis to identify potential investments. The minimum amount for lump sum investments is ₹5,000 while that for SIPs is ₹500.

A screenshot of the StockEdge App showing the performance of the SBI Contra Fund

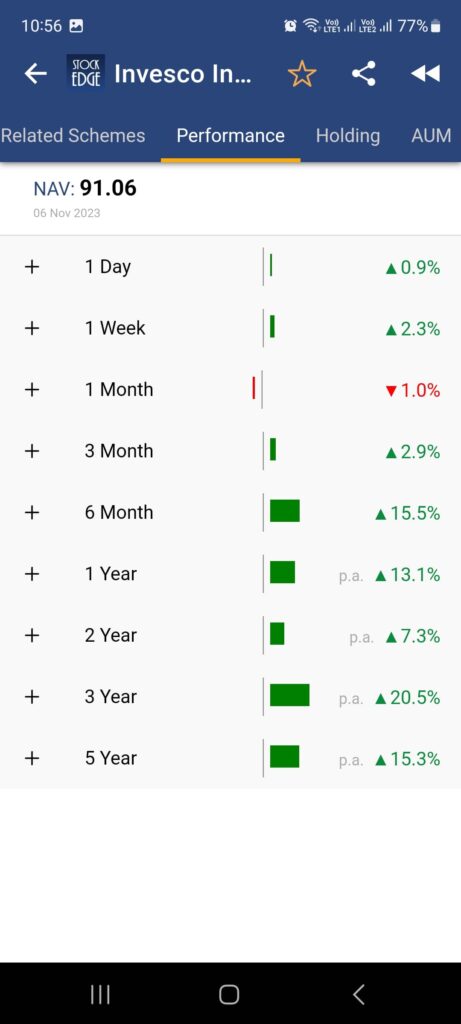

Launched in 2007, the Invesco India Contra Fund currently has an AUM of ₹ 11,453 Crore. The fund’s portfolio consists of stocks from a diverse range of sectors, including healthcare, technology, and finance. The fund’s holdings include prominent giants like Infosys Ltd., HDFC Bank, NTPC Ltd., Larsen & Toubro Ltd., and others. The minimum lump sum investment in this fund is ₹1,000, while SIP is ₹500.

A screenshot of the StockEdge App showing the performance of the Invesco India Contra Fund

Kotak India EQ Contra Fund is managed by fund manager Shibani Kurian. Launched in 2005, this contra fund has an AUM of ₹1860.92 crore at present. The fund’s portfolio is diversified, spreading across multiple sectors and market capitalizations. Some of the notable stocks in the portfolio include HDFC Bank Ltd., Infosys Ltd., Reliance Industries Ltd., NTPC Ltd., and others. The minimum investment for both lump sum and SIPs is ₹100.

A screenshot of the StockEdge App showing the performance of the Kotak India EQ Contra Fund

Q1: Is Contra Investing suitable for new investors?

Contra investing requires a deeper understanding of the market. Hence is generally not recommended for new investors. Mutual funds with less risk are more suitable for new investors. New investors are also recommended to consult an experienced financial advisor before making any investment decisions.

Q2: Is contrarian investing risky?

Contrarian investing can be considered risky since it involves going against popular market trends. It requires a lot of research and analysis. However, if done correctly, it can generate significant returns.

Q3: Is contrarian trading profitable?

Contrarian trading can be profitable under certain market conditions. Profitability is dependent on the fund manager’s ability to identify undervalued assets and predict market trends. Significant research, analyses, and experience are required to generate profit using contrarian trading.

Contra Mutual Funds: A Diversification Option

Contra mutual funds are a good investment option to consider if you are a risk-taker. They are all about betting on underperformers for the long term. A good contra fund can be a beneficial addition to your portfolio, enabling you to diversify it. If you are not risk-averse, consider allocating 10% of your portfolio to contra mutual funds while keeping an investment horizon of five years or more. They can significantly increase the overall return of your portfolio.