Table of Contents

Last week, the India VIX rose by nearly 21%, indicating market volatility caused by mixed global cues and growing geopolitical tensions in the Middle East. As these tensions impact global markets, investors are increasingly feeling the pressure.

If you look at the domestic front, on October 1, 2024, the Securities and Exchange Board of India (SEBI) announced a six-step plan to reduce excessive speculation in index derivatives, which might result in a 30-40% decline in trading volumes.

In this situation where everything is chaotic, what will be the best sector to safeguard your investments?

FMCG is a potential sector that offers steady growth opportunities for investors. Today, India’s FMCG sector is the fourth-largest contributor to the economy, characterized by high-turnover consumer goods that move rapidly through production, distribution, and consumption cycles. This sector encompasses a wide range of essential products, including detergents, toiletries, tooth-cleaning items, cosmetics, and more, making it indispensable to everyday life.

Before moving ahead, let’s understand the sector.

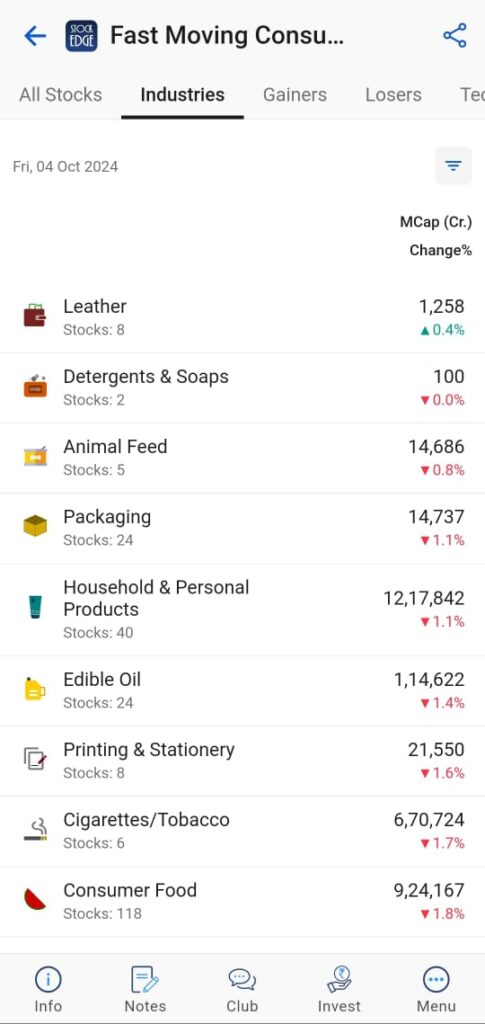

The FMCG sector of India is vast, and therefore, in StockEdge, we have identified nine significant sub-industries inside the FMCG sector of India.

The entire FMCG sector is divided into nine major industries. They are:

- Leather

- Detergents & Soap

- Edible Oil

- Consumer Food

- Packaging

- Cigarettes/Tobacco

- Household & Personal Product

- Printing & Stationery

- Animal Feed

In this blog, we will explore key growth drivers of FMCG stocks, how to analyze the best FMCG stocks and evaluate the financial performance of the top 5 FMCG stocks.

Let’s now move to understand why you should invest in the FMCG sector.

Why Invest in FMCG Stocks?

The FMCG products are always in demand and are considered essential household items. In India, investing in the best FMCG stocks has been a popular choice due to the sector’s consistent growth and the continuously rising consumer demand for these products.

Let’s look at key growth drivers of the FMCG sector stocks

Growing Demand

In 2022, the Indian food processing industry reached $307.2 billion and is expected to grow to $547.3 billion by 2028, with an average CAGR of 9.5% between 2023 and 2028. The FMCG market heavily relies on digital advertising to reach customers. According to the Densu-e4m Digital Advertising Report for 2024, digital media accounted for around 47% of overall FMCG ad spending in 2023.

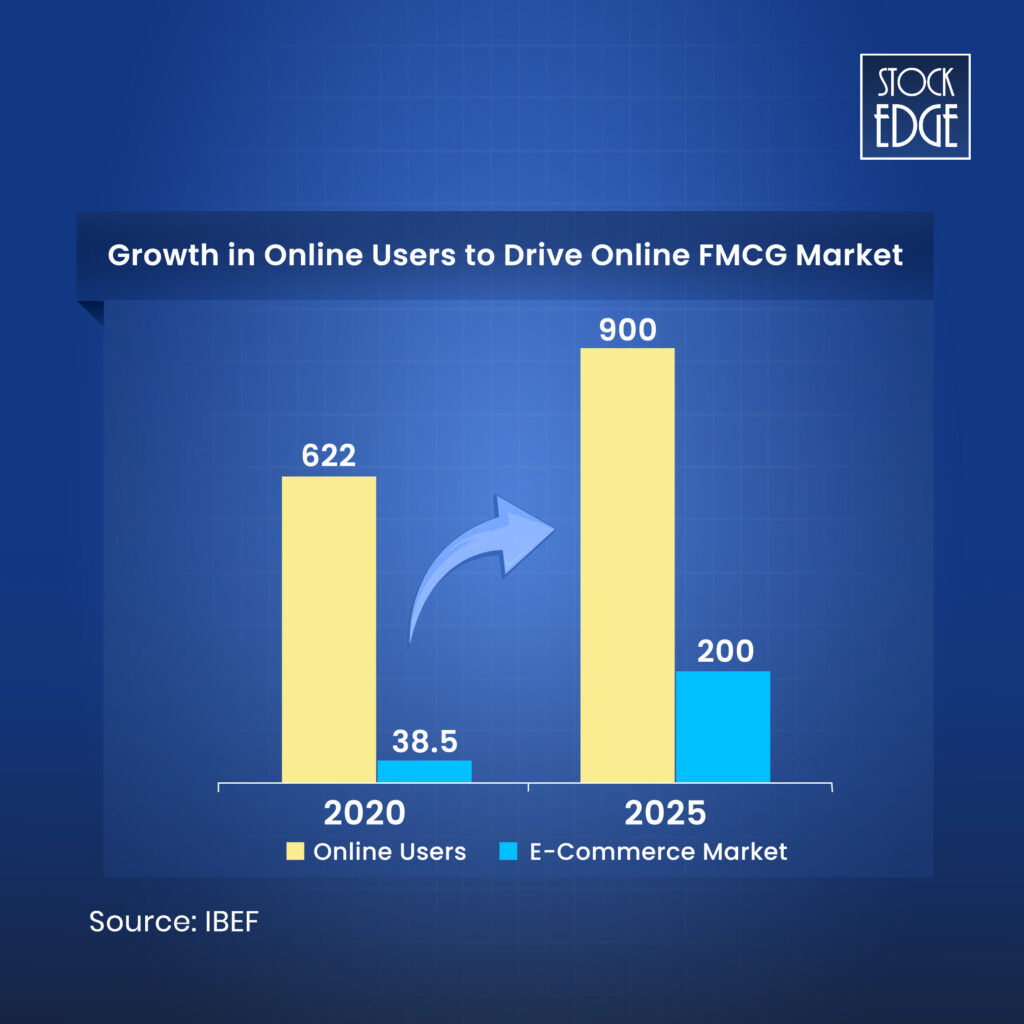

E-commerce

India’s online shopping market is growing very fast. According to the IBEF report, it is expected to reach $350 billion by 2030. In 2023, India had over 907 million internet users, representing over 64% of the entire population and driving e-commerce growth. Over the last five years, the market has seen rapid expansion driven by increased internet and smartphone usage, favorable policy reforms, and rising disposable incomes.

By 2030, the e-commerce segment is predicted to contribute 11% of total FMCG sales. In 2021, India ranked as the eighth-largest e-commerce market, generating $63 billion in revenue and contributing to global e-commerce growth with a 26% increase. Leading players in the FMCG sector, like Emami Ltd., expect to increase the combined contribution of its e-commerce and modern trade business to 25% in the next 3-4 years. This is further supported by the growing penetration of smartphones and internet access, particularly in rural areas, enhancing accessibility to e-commerce platforms.

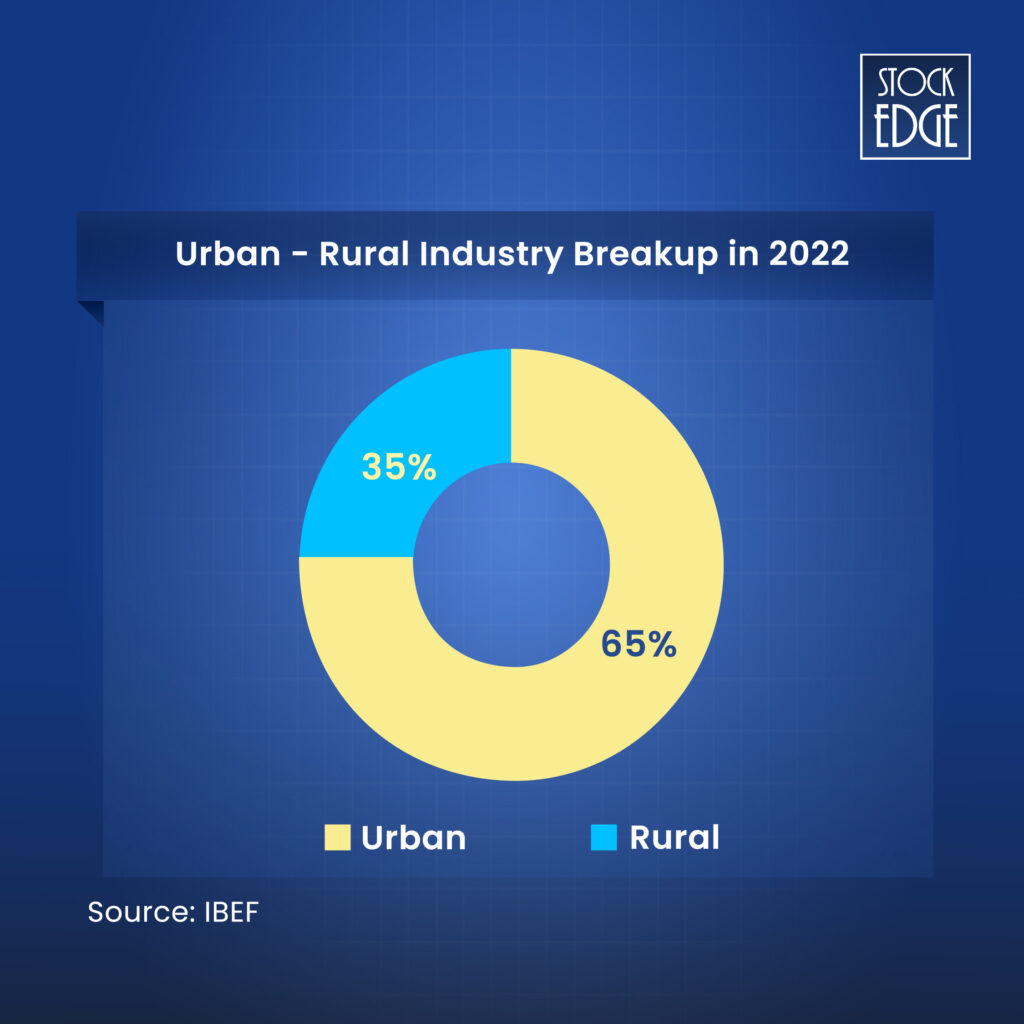

Strengthen Rural Network

The urban segment accounted for a revenue share of around 65% of the overall revenue generated by the FMCG sector in India in 2022. India’s villages contributed more than 35% to overall annual FMCG sales in 2022.

The total revenue of the FMCG market is predicted to surge at a CAGR of 27.9% between 2021 and 2027, reaching about $615.87 billion. This is because the rural population uses e-commerce and digital connectivity services due to the high penetration of smartphones, credit and debit cards, and online banking. Key players of FMCG companies like Dabur India Ltd., Marico Ltd., and Nestle India Ltd. expanded their outlets in rural areas of India.

Sustainability Practices

FMCG companies are looking to invest in energy-efficient plants to benefit society and lower costs in the long term. Companies are focusing on reducing environmental impact by adopting eco-friendly packaging, improving supply chain efficiency, and promoting sustainable sourcing of raw materials. For example, on World Environment Day 2023, ITC Ltd. reaffirmed its commitment to address the issue of plastic waste management through its multidimensional initiatives. Homegrown FMCG and ayurvedic products maker Dabur India Ltd. announced that it is a plastic waste positive by collecting, processing, and recycling more plastic waste than it sold in its product packaging in FY23.

Government Initiatives

To promote the FMCG sector in India, the government has approved 100% foreign direct investment (FDI) in the FMCG segment in single-brand retail and 51% FDI in multi-brand retail.

The Indian government is also supporting the food processing sector with tax benefits, including a 100% profit deduction for five years and a 25% deduction for the subsequent five years for new agro-processing industries. Additionally, the excise duty on dairy machinery has been waived, and the duty on flesh products, including meat, poultry, and fish products, has been reduced from 16% to 8%.

Factors to Consider When Investing in the Best FMCG Stocks

Now, let’s move on to understanding how to analyze the FMCG stock to pick the best FMCG stocks. It is important to evaluate several key factors to ensure you make an informed decision. These factors help gauge the company’s market position, financial health, and growth potential, allowing investors to choose stocks that can provide sustainable returns. Let’s look at some crucial aspects to consider:

Market Position and Brand Strength

Market Position and Brand Strength are crucial factors to consider when investing in FMCG (Fast-Moving Consumer Goods) stocks. Market share indicates a company’s relative size and position within a specific industry or market. A higher market share often indicates a dominant position in the industry, which can lead to economies of scale and pricing power. Even a strong brand can command premium pricing and attract loyal customers, even if competitors offer similar products at lower prices.

CRP, or Consumer Reach Points, measures a brand’s performance in a market.

Let’s look at the best FMCG stocks based on brand strength.

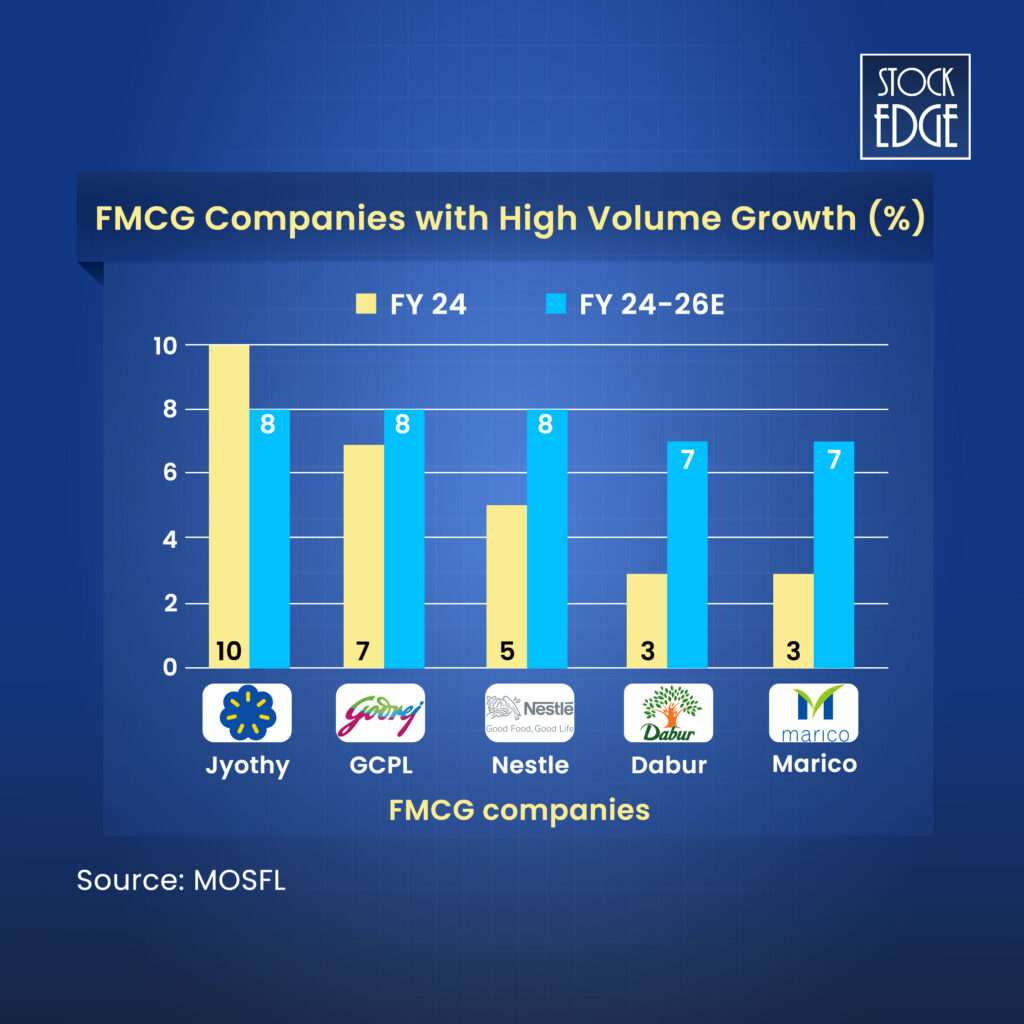

Volume Growth

Volume growth refers to an increase in the quantity or amount of goods or services sold or produced over a specific period. It’s a fundamental metric used to assess a company’s performance and growth potential. In the FMCG Sector, high volume growth % indicates strong demand and competitive pricing.

Here’s a look at the best FMCG stocks that showcase significant volume growth, indicating strong market demand and potential for sustained growth.

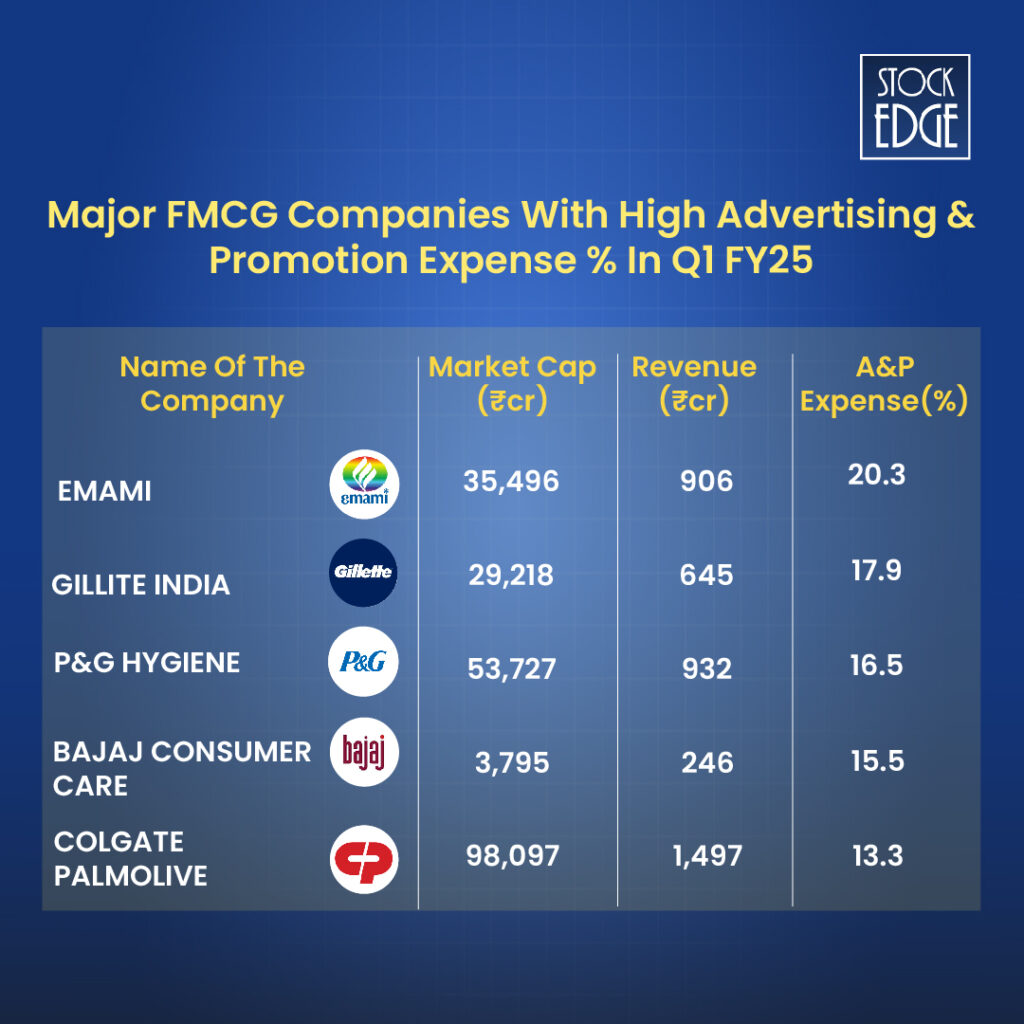

Advertisement spend

Advertisement expenses are significant in increasing the overall growth of companies in the FMCG sector. They help persuade a target market to purchase or consume a particular brand. During the quarter, a few companies increased their spending on advertising and promotion to enhance their sales and counter surging raw material costs. Usually, FMCG companies spend between 7% and 13% of their sales on advertisements, depending on their gross margins. Advertising is essential for brand building and new product launches.

Let’s explore the best FMCG stocks based on their advertising strategies and expenditures.

Operating margin

Operating margin is a crucial financial metric that measures a company’s profitability. It is measured by dividing the company’s operating income (revenue minus operating expenses) by its total revenue. A high operating margin reflects that a company is efficient in its operations and can generate profits even in challenging economic conditions. Let’s take a look at the best FMCG stocks based on robust operating margins, showcasing their operational efficiency and profitability potential.

Best FMCG Stocks to Consider for Your Portfolio

Now, let’s dive into the best FMCG stocks to consider for your portfolio. These companies demonstrate strong fundamentals, consistent demand for their products, and a solid track record of growth in the fast-moving consumer goods sector. Here’s a list of top-performing FMCG stocks that could offer promising opportunities for long-term investors.

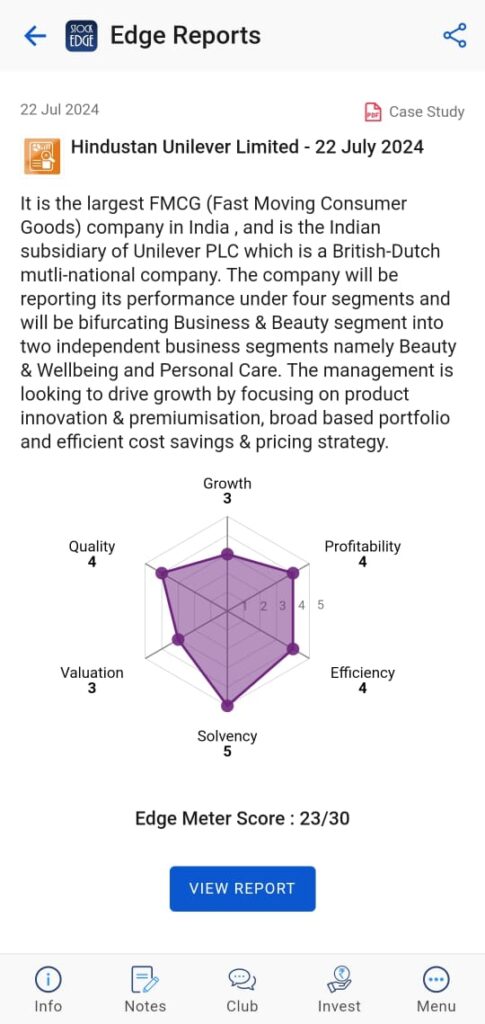

Hindustan Unilever Ltd.

The company operates in three large categories, with a presence in traditional and emerging segments. It is a market leader in ~90% of its businesses.

The company has a diverse product portfolio with over 50 brands across 16 distinct categories, including fabric solutions, home and hygiene, life essentials, skin cleansing, skincare, haircare, colour cosmetics, oral care, deodorants, tea, coffee, ice cream and frozen desserts, foods, and health food drinks (HFD).

In Q1 FY25, their net sales increased by 2% year-over-year, with 4% volume growth. Sales growth was seen across all segments.

To know more about the company financials, check out our Edge report.

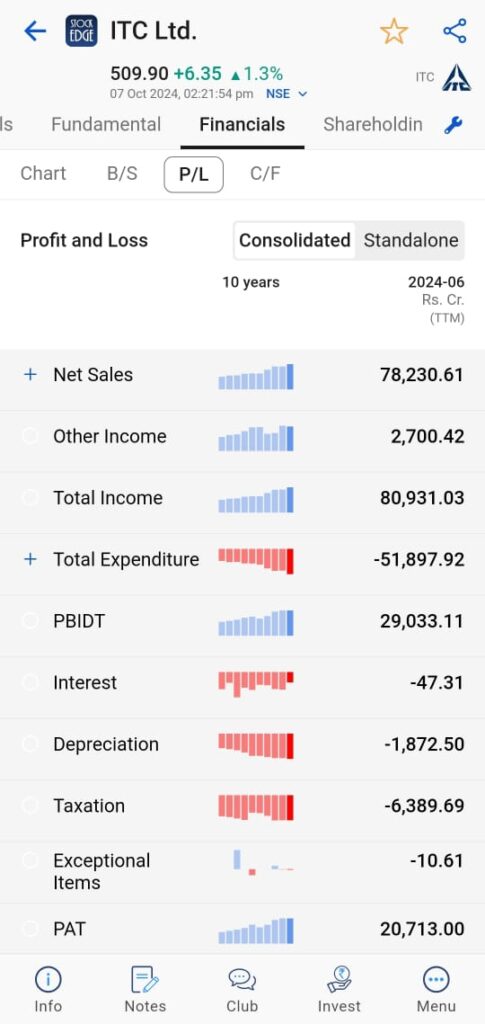

ITC Ltd

ITC currently operates in five business segments: FMCG Cigarettes, FMCG Others, Hotels, Paperboards, Paper and Packaging, and Agri-Business. ITC dominates the organized domestic cigarette business, with a market share of over 80%. Despite this vertical contributing only 40% to revenues, it is the company’s most profitable business, with an 81% contribution to PBIT.

In Q1 FY25, ITC reported consolidated revenue growth of 8% year-on-year (YoY), but increased commodity prices, weak demand, and rising competitive pressure slightly hurt its margins. Its EBIT margin stood at 8.7%. Read our blog to know how ITC is scaling up its FMCG Business.

Nestle India Ltd

Nestle India Limited is a subsidiary company of Nestle, a Swiss multinational. The company operates in the Food segment. It holds a 62% stake and is primarily involved in the Food business, which incorporates product groups.

The company has launched 130 new products in the last seven years, and many new projects are in the pipeline. Some of its recent launches include MAGGI Korean noodles, MAGGI Oats Noodles with Millet Magic, and GERBER Puffs.

In Q1FY25, they faced some short-term difficulties in the first quarter of 2025, but they have a strong plan to overcome these challenges and achieve long-term growth.

Nestle launched the NesMitra Retailer Self-Ordering Application in 2023, which emerged as a game-changer in rural and semi-urban (RUrban) markets. This mobile app enables retailers to conveniently place orders, enhancing engagement and overcoming logistical challenges in difficult-to-reach rural areas. With a rapidly growing user base of over 10,000 active users, NesMitra has streamlined ordering processes and is recognized within Nestlé’s global network for driving operational efficiency and speed. On the e-commerce front, Nestlé has witnessed significant growth, with the business contributing 6.8% to sales in the financial year ending March 31, 2024.

To explore more about the company’s fundamental performance, you can check out our Edge Report.

Britannia Industries Ltd.

Britannia is one of the leading players in the business segment, with a leading market share in the Indian biscuit segment, which also accounts for 90% of its revenue.

They are one of the major companies in the organized bread market, with an annual turnover of more than 1 lakh tons in volume and Rs. 450 crores in value.

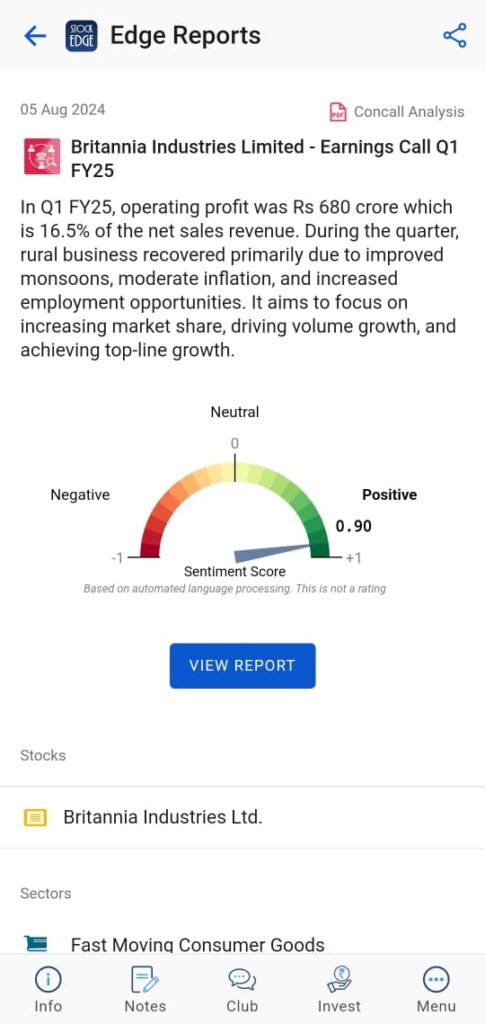

In Q1 FY25, Britannia Industries reported an operating profit of ₹680 crore, representing 16.5% of net sales revenue, with a ~10% YoY growth. The profit before tax (excluding exceptional items) was ₹706 crore, reflecting a ~13% YoY growth.

Going forward, management remains focused on upgrading technology to enhance productivity. It aims to increase market share, drive volume growth, and achieve top-line growth.

To know more about the company’s financial performance, check out our Concall Analysis.

Dabur India Ltd.

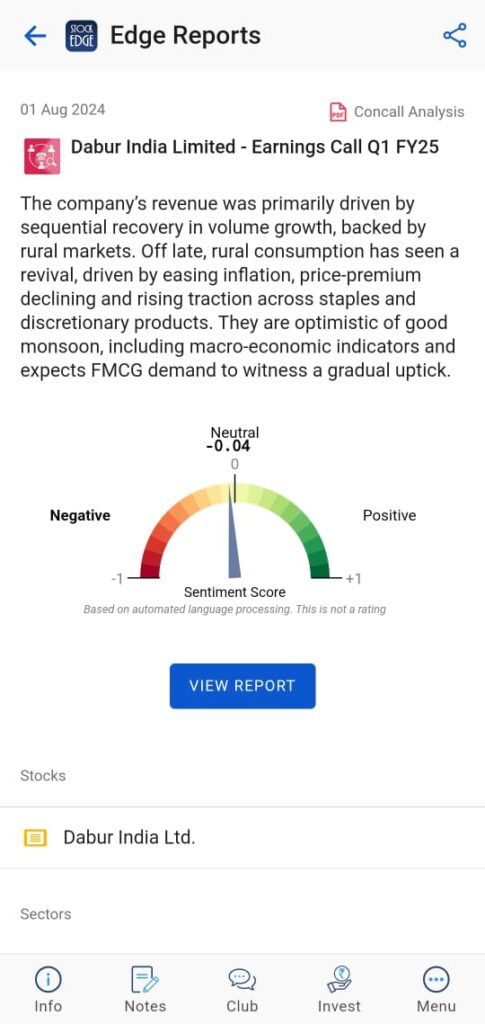

Dabur India Limited is India’s fourth largest FMCG company and the world’s largest Ayurvedic and Natural Health Care company, with a range of more than 250 herbal/Ayurvedic products. During FY22, the company incurred a Capital Expenditure of 374 Cr, and it has pledged an investment of 550 crore in Capex over the next five years. In Q1 FY25, sales contribution by verticals in the domestic FMCG business was: HPC (home & personal care) ~50%, healthcare ~26% and F&B (food & beverages) ~24%.

To know more about the company’s financial performance, check out our Concall Analysis.

The Bottomline

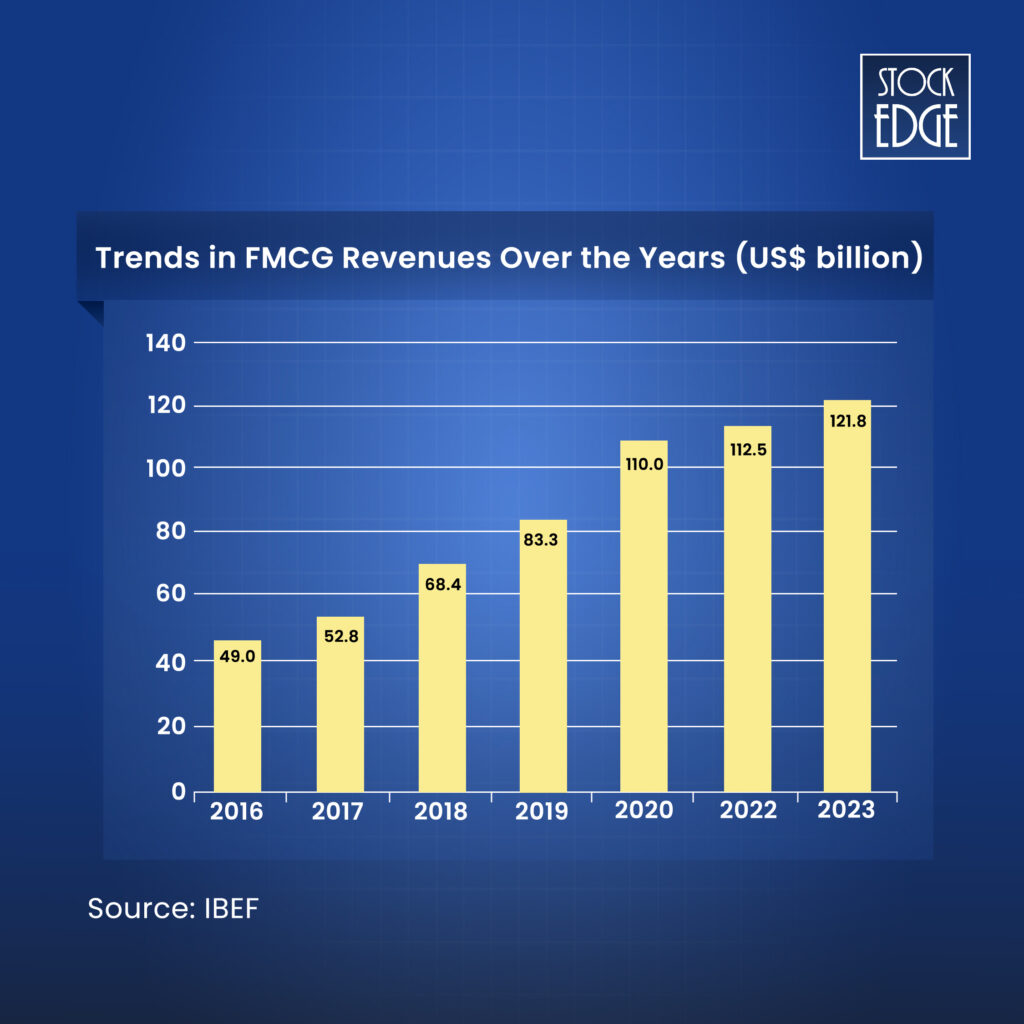

The FMCG market reached US$167 billion as of December 2023. Favorable government efforts and laws, a growing rural market and youth population, newly branded items, and the expansion of e-commerce platforms are all major growth factors for the sector. The food and beverage sector is a vital part of the FMCG market, accounting for around 3% of its GDP.

The Union government approved a new PLI scheme for the food processing industry, with a budget of Rs. 109 billion (US$1.46 billion). The incentive system will be in place for six years, until 2026 – 2027.

In conclusion, investing in the best FMCG stocks can offer promising opportunities for long-term growth driven by consistent demand, innovation, and enhanced supply chain efficiencies in India’s economy.

FAQ’s

What are FMCG stocks?

FMCG stands for Fast-Moving Consumer Goods. This is also known as consumer packaged goods. It means the goods/products that are sold quickly and are mostly priced at a relatively low cost. The Fast-Moving Consumer Goods (FMCG) category includes products used in daily life, such as soaps, toothpaste, cookies, beverages and many more. Examples of the best FMCG sector stocks are Hindustan Unilever Ltd., ITC Ltd., Varun Beverages Ltd. and many more. To get the FMCG stocks list with price, check out our StockEdge.

Is it good to invest in FMCG companies?

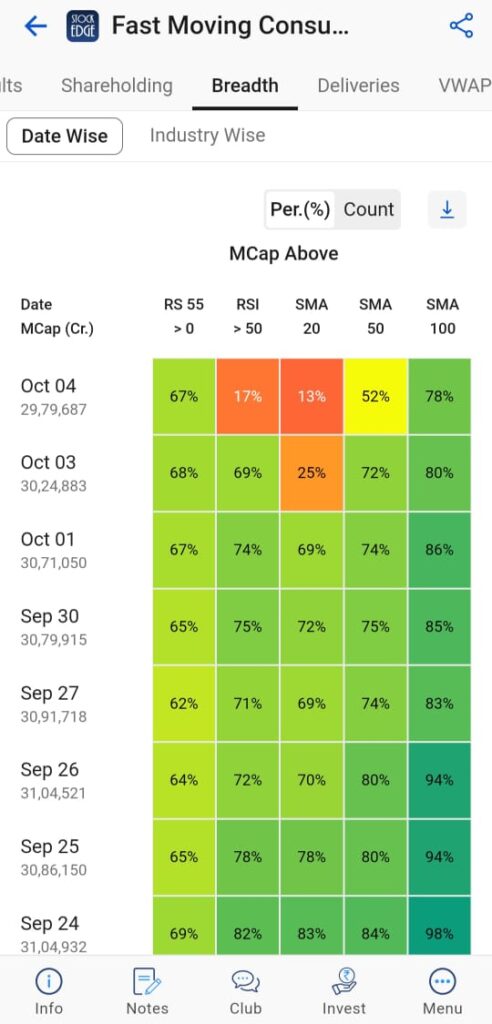

Currently, the Nifty FMCG sector is underperforming compared to the Nifty 50. To analyze whether it is a good time to invest, you can use the Sector Rotation Tool, which evaluates whether the sector is outperforming or underperforming. It analyzes three types of technical indicators: Relative Strength (RS), Relative Strength Index (RSI), and Simple Moving Averages (20, 50, and 100).

When the overall sentiment is bullish, the indicators show a green colour, whereas a bearish trend is derived with shades of red. In the image below, on 04th October, the sector was bearish, but the long trend was bullish.

Are FMCG stocks suitable for long-term investments?

Yes, FMCG (fast-moving consumer goods) stocks are considered defensive investments because they are less volatile than other sectors and tend to maintain stable demand regardless of economic conditions. By investing in the best FMCG stocks, you can reduce the overall risk of their portfolio.

Which FMCG companies offer the best dividend payouts?

Best FMCG stocks offering high and consistent dividend payouts include ITC Ltd., Hindustan Unilever Ltd., Colgate-Palmolive (India) Ltd., Marico Ltd., Britannia Industries Ltd. and many others. To explore which companies offer consistently high dividend payout ratios, you can check out Dividend Scans.

What role does sustainability play in FMCG companies?

The best FMCG stocks constantly invest in energy-efficient plants to benefit society and lower costs in the long term. Companies are focusing on reducing environmental impact by adopting eco-friendly packaging, improving supply chain efficiency, and promoting sustainable sourcing of raw materials.

Happy Investing!