Key Takeaways

- Broad market coverage: The Nifty 500 captures nearly 92% of India’s free-float market capitalization, offering exposure across large, mid and small caps for a true market picture.

- Diversified exposure reduces stock risk: With 500 stocks across sectors, the index lowers company-specific risk while capturing broader economic growth.

- Low-cost, passive access: Investing via Nifty 500 index funds or ETFs provides simple, transparent, and cost-effective market exposure without buying all 500 stocks.

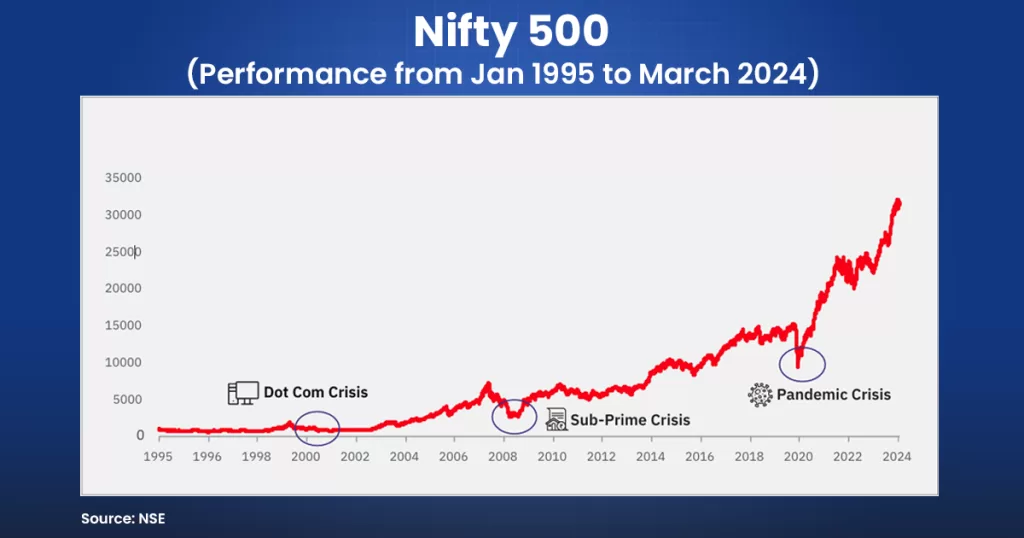

- Proven long-term performance: The Nifty 500 TR has delivered steady long-term returns (historical CAGR ~12.5% since inception), recovering from past market downturns.

- Ideal for SIPs and core portfolios: The index suits systematic investment plans and long-term investors seeking a low-effort, diversified core holding.

The Indian stock market has witnessed tremendous growth over the past few decades, with more investors seeking diversified, long-term opportunities beyond just a handful of blue-chip companies. While indices like the NIFTY 50 or NIFTY 100 capture the large-cap space, they don’t represent the entire market’s breadth. That’s where the Nifty 500 Index comes in.

Representing nearly the entire spectrum of India’s listed equity universe, it is the most comprehensive index on the National Stock Exchange (NSE). It captures companies across all sectors and market capitalizations: large, mid, and small caps, providing investors with a true picture of India’s economic and corporate growth story.

In this blog, we’ll break down what the NIFTY 500 is, how it’s constructed, why it matters for investors, and the smartest ways to invest in it through mutual funds or ETFs.

What is NIFTY 500?

The NIFTY 500 is a comprehensive stock market index in India that serves as the benchmark for the broadest segment of the Indian equity market.

It is managed by NSE Indices Limited, a subsidiary of the National Stock Exchange (NSE). It comprises the top 500 stocks based on market capitalisation from the eligible universe.

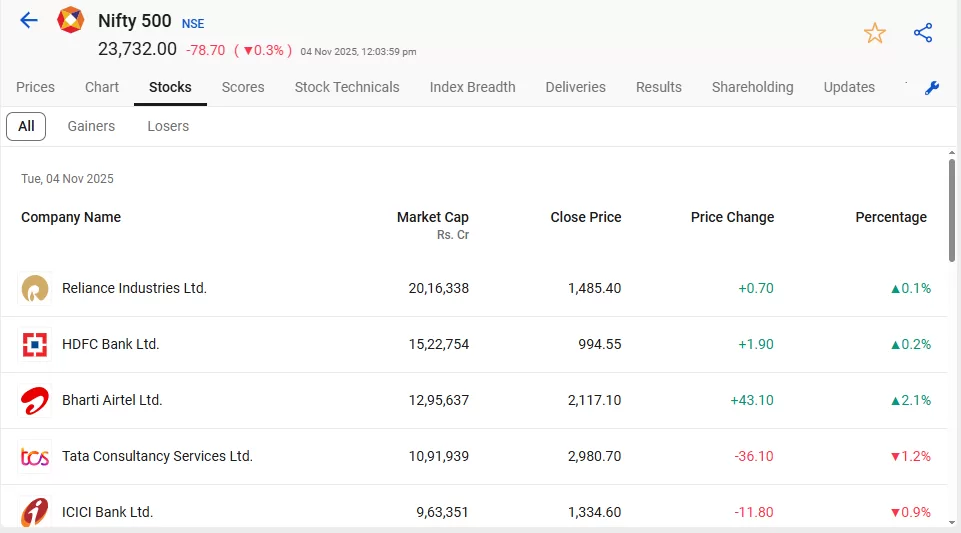

As of March 2025, the NIFTY 500 Index represents about 92.29% of the free float market capitalization of the stocks listed on the NSE. Here is the list of NIFTY 500 stocks:

Composition of NIFTY 500

The NIFTY 500 is designed to capture the performance of the entire Indian market, covering approximately 90-92% of the free-float market capitalization of all stocks listed on the NSE.

It is a multi-cap index because it includes companies across all market capitalization segments:

- Large Cap: (Approx. the top 100 companies)

- Mid Cap: (Approx. the next 150 companies)

- Small Cap: (Approx. the remaining 250 companies)

Sectoral Weightage

The index is highly diversified across sectors, though it is heavily dominated by the Financial Services sector, which includes Banks, NBFCs, and Insurance companies.

| Sector | Weight (%) |

| Financial Services | 31.11 |

| Information Technology | 7.81 |

| Oil, Gas & Consumable Fuels | 7.76 |

| Automobile and Auto Components | 7.08 |

| Fast Moving Consumer Goods (FMCG) | 6.37 |

| Capital Goods | 6.30 |

How is the NIFTY 500 Calculated?

The index’s weight is based on each stock’s free-float market capitalisation. The index has a base year of January 01, 1995, with a base value of 1000.

1. Eligible Universe

- The company must be domiciled in India.

- The stock must be listed and traded on the National Stock Exchange (NSE).

- Convertible stocks, bonds, warrants, preference shares, and stocks under BZ category are not eligible.

2. Investibility Criteria

- The Investible Weight Factor (IWF) should be at least 10%, or the 6-month average free-float market capitalization should be at least 25% of the 6-month average full market capitalization of the smallest stock in the index.

- The stock must have a minimum trading frequency of 90% during the previous six months.

- The average impact cost should be less than 1% during the previous six months.

- The company must have a minimum listing history of one month.

3. Stock Selection Criteria

- Companies should rank within the top 800 based on both:

- Six-month average daily turnover (ADT), and

- Six-month average full market capitalization.

- From this list, the top 500 stocks (based on six-month average full market capitalization) are selected for inclusion in the NIFTY 500 Index.

4. Index Review and Weighting Methodology

- The index is reviewed semi-annually, in March and September.

- The weight of each stock in the index is determined based on its free-float market capitalization.

How to Invest in NIFTY 500?

Investing directly in all 500 stocks of the NIFTY 500 index is practically difficult for an individual investor. You would need huge capital, a demat account, and constant monitoring of each company to maintain the correct index weight, which is both time-consuming and complicated.

A simpler and smarter way is to invest through NIFTY 500 index funds or exchange-traded funds (ETFs). In this method, funds replicate the composition and performance of the index, giving you instant diversification across sectors and market caps.

NIFTY 500 Index Funds (Mutual Funds)

This is the simplest and most common method, especially for those who prefer investing through a Systematic Investment Plan (SIP).

Under this scheme, the mutual fund holds the exact same 500 stocks in the same proportion as the NIFTY 500 index. It is passively managed.

You can invest via a Lump-Sum amount or set up a Systematic Investment Plan (SIP) with a minimum amount (often as low as ₹100 or ₹500).

NIFTY 500 Exchange Traded Funds (ETFs)

ETFs are similar like index funds but are traded on the stock exchange like shares. It is a basket of 500 index stocks packaged into a single security, listed and traded on the NSE/BSE.

Benefits of investing in NIFTY 500

Investing in the index, primarily through an index fund or Exchange Traded Fund (ETF), provides investors with broad, diversified, and cost-efficient exposure to the overall Indian equity market, making it an excellent core component for a long-term investment portfolio.

Here are the key benefits in detail:

1. Broadest Market Representation

The NIFTY 500 comprises the top 500 NSE companies by market cap and liquidity, covering 90-95% of NSE’s total market cap. It act as a broad indicator of the Indian economy. Investing in it means betting on the growth of most of the listed Indian market.

2. High Diversification Across Market Caps

The NIFTY 500 offers superior diversification compared to indices like the NIFTY 50 because it combines large-cap companies (the top 100, which includes all NIFTY 50 stocks), mid-cap companies (the next 150) and small-cap companies (the remaining 250).

While large-caps offer stability and reduce volatility, including mid- and small-caps offers greater growth potential during bullish market cycles.

3. Low-Cost Passive Investing

NIFTY 500 Index Funds and ETFs are passively managed, meaning the fund manager simply aims to replicate the index’s holdings and weights. So, it has a significantly lower Expense Ratio (the fee charged to manage the fund) compared to most actively managed mutual funds.

4. Simplicity and Transparency

Investing in a NIFTY 500 fund is simple and easy to understand. Since the fund tracks a rule-based index, you always know exactly which 500 stocks the fund holds, providing complete transparency and removing the reliance on a single fund manager’s skill or bias.

In summary, the NIFTY 500 is a powerful tool for any long-term investor seeking a low-cost, broadly diversified investment that captures the overall growth story of the Indian equity market.

NIFTY 500 – Stocks vs Mutual Funds

If you want to invest in the NIFTY 500, then there are two ways.

- Buying the stocks directly

- Investing through a NIFTY 500 mutual fund or index fund.

So, let’s check how these two ways of investing are different from each other.

| Feature | Direct Stock Investing | NIFTY 500 Mutual Funds/ETFs |

| Diversification | Difficult to replicate full index (500 stocks), prone to individual/company bias. | Broad-based, automatic diversification across sectors & caps. |

| Costs | High brokerage, transaction charges for 500 stocks; rebalancing is costly and complex. | Low expense ratio (0.2–0.5% for index funds/ETFs); SIP-friendly; lower trading costs. |

| Return Potential | Possible to beat index via active bets, but high risk of underperformance. | Index return minus expense ratio (past decade: ~14–16% CAGR). |

| Risk | High: Stock-specific risk, concentration, mistakes; can miss out high performers. | Lower: Index-level risk only, sector and stock exposure optimized, tracking error applies. |

| Time & Effort | Significant (research, monitoring, rebalancing 500 stocks). | Minimal; periodic review of fund performance, auto rebalance. |

| Portfolio Churn | Manual rebalancing is needed as the index changes semi-annually. | Portfolio managed by AMC, with automatic adjustment on index changes. |

| Minimum Investment | Large outlay needed for 500 shares (to match index weights). | Small capital as low as ₹100. |

Conclusion

The NIFTY 500 is one of the most comprehensive ways to invest in India’s growth story.

There have been several corrections and crashes throughout the NIFTY 500 index’s history, such as the Dot Com Crisis (2000), the Sub-prime Crisis (2008), and the COVID-19 Pandemic Crisis (2020). However, NIFTY 500 TR Index recovered from these periods of decline and as on October 31,2025, it has delivered a CAGR of 12.5% since its inception in 1995

Frequently Asked Questions (FAQs)

1. How is NIFTY 500 different from NIFTY 50?

NIFTY 50 includes only the top 50 large-cap companies, while NIFTY 500 covers 500 companies across large, mid, and small caps.

2. How often is the NIFTY 500 rebalanced?

NIFTY 500 rebalances like other equity indices. It is rebalanced twice a year, with the cut-off dates being January 31 and July 31.

3. Is NIFTY 500 good for SIPs?

NIFTY 500 provides broader diversification across various sectors and market capitalization. If you are a risk-averse investor, then the NIFTY 500 can be your watchlist. And you can start SIPs to build long-term wealth.

4. What are the eligibility criteria for a company to become part of the NIFTY 500?

To be part of the NIFTY 500, a company must rank within the top 800 by average daily turnover and market capitalization over the past six months. It should have traded on at least 90% of those days and have a minimum of one month of listing history. Companies are included if their market capitalization ranks within the top 350 or is at least 1.5 times that of the last constituent. Those falling below rank 800 are excluded during rebalancing.

5. What are the risks of investing in the NIFTY 500?

We have already heard or read, “Investment in the securities market is subject to market risks. Read all the related documents carefully before investing.” So, the NIFTY 500 also carries market risks like any equity investment. They also depend on economic cycles, global factors, market sentiment, and many other factors.