Table of Contents

Markets are uncertain amid the ongoing geopolitical tensions around the world. In such a volatile market where there is no clear direction, what to do in such a confusing market scenario? In this blog, we will be exploring different wealth protection strategies and navigate you through the ups and downs of the stock market. Stock markets have cycles, when the market turns bearish, you need to focus on bearish strategies along with deploying wealth protection strategies to keep your capital and profits safe and secure.

The recent war between Iran & Israel has impacted our Indian markets negatively and escalated the ongoing confusing price moves in the benchmark indices like Nifty 50, Nifty Bank, etc.

Events like war, political tensions, and disputes at the borders of countries have generally impacted the stock market negatively. Due to such incidents, retail participants in the market are affected the most and lose their wealth. That’s why implementing wealth protection strategies is essential in such circumstances. Let’s understand this volatile market with the ongoing wars around the globe, which are creating geopolitical tensions and putting pressure on the stock market.

Impact of War on the Stock market

Here are a few historical events where the market triggers huge selling pressure in times of war.

1. Russia -Ukraine War started on February 24, 2022.

As you can see, the Indian benchmark index Nifty 50 tanked nearly 5% and follow up selling was witnessed for next few months and the index declined another 8-9%.

Two years have passed since Russia’s unprovoked full-scale invasion of Ukraine on February 24, 2022. The military stalemate between Ukraine and Russia appears to be continuing without any end in sight.

2. Israel-Hamas War

It began on October 7, 2023, when Hamas launched a land, sea, and air assault on Israel from the Gaza Strip. On the very next day, Israel declared a state of war, and the Israel Defense Forces (IDF) conducted air strikes on the Gaza Strip, followed weeks later by the incursion of ground troops and armored vehicles.

As you can see, within the next two weeks, the Nifty 50 again declined by nearly 5% and dropped 1000 points.

3. The Iran-Israel War

The latest addition to the already ongoing geopolitical tensions is the Iran-Israel war, which started on 13th April 2024 when Iran launched attacks on Israel soil with 170 drones, 120 ballistic missiles, and 30 cruise missiles. During this period from 12th April to 19th April 2024, Nifty 50 lost almost 1000 points, making a low of 21777.

As you can see, during this period from 12th April to 19th April 2024, Nifty 50 lost almost 1000 points making a low of 21777.

All these events have one thing in common, that is it destroys investor’s wealth, especially the retail participants in the market who go clueless during such times of uncertainty and volatile market.

Therefore, in this blog, we will discuss three wealth protection strategies that you can use during times of uncertainty in the stock market or when markets are in free fall.

3 Wealth Protection Strategies

Strategy 1: Keep Cash

“Cash is King”, we all know. During hard times, there is only cash which may protect us from catastrophic events in our lives. So, when there is high uncertainty in the stock market, you can keep cash for better times.

However, in such cases, there is a problem of erosion of wealth, which simply means if you keep cash in your locker with the passing of time, it will lose in value because of inflation. Even if you keep it in your savings bank account, it may lose its wealth because of low-interest rates on savings accounts. So, what are your options?

So, for the common man, the most easy way to park your savings is in a Fixed Deposit. At the current high-interest rates scenario, it can be a good option for you. However, fixed deposits have a shortcoming in that you have a lock-in period, meaning early withdrawal may attract a penalty.

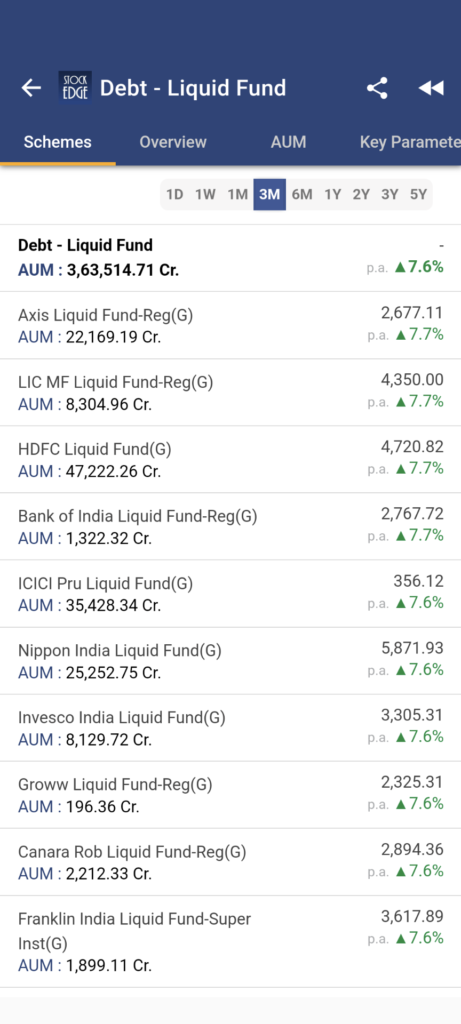

The next best option is to park your money in liquid funds. These are debt funds which invest in money market instruments like treasury bills for 91 days. The best part is they are open ended schemes which you can invest or withdraw anytime.

Here is a list of all liquid funds available for you to invest, and the average return generated by liquid funds over the last 6 months is approximately 7.6%.

Strategy 2: Index ETFs

During times of uncertainty when the moves in market indices are almost unpredictable, it is better to avoid directional trades or avoid trading in indices if you fear a highly volatile market. However for an investor it is essential to protect its wealth with proper risk management and focus on creating wealth in the long term.

Creating long term wealth is not that complex. Start investing in Nifty Bees or ETFs of Nifty 50 because despite the short fall in the benchmark index, Nifty 50 has continued to grow in the long term.

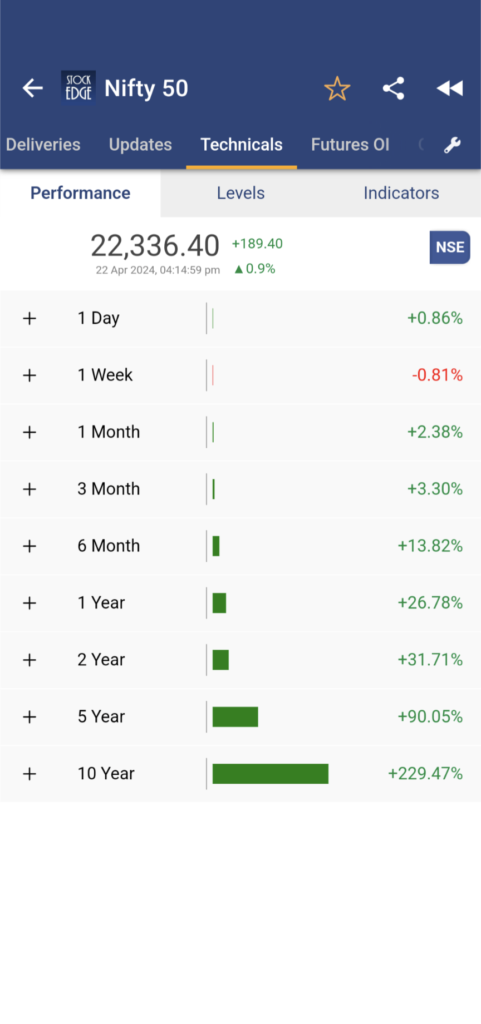

The technical performance of Nifty over the years will surely give you the confidence to invest or accumulate Nifty Bees for the long term. As of 22nd April 2024, the equity benchmark index Nifty 50 has increased by 13.82%, 26.78%, 90.05% and 229.47% in absolute terms for the last 6 months to 10 years, respectively.

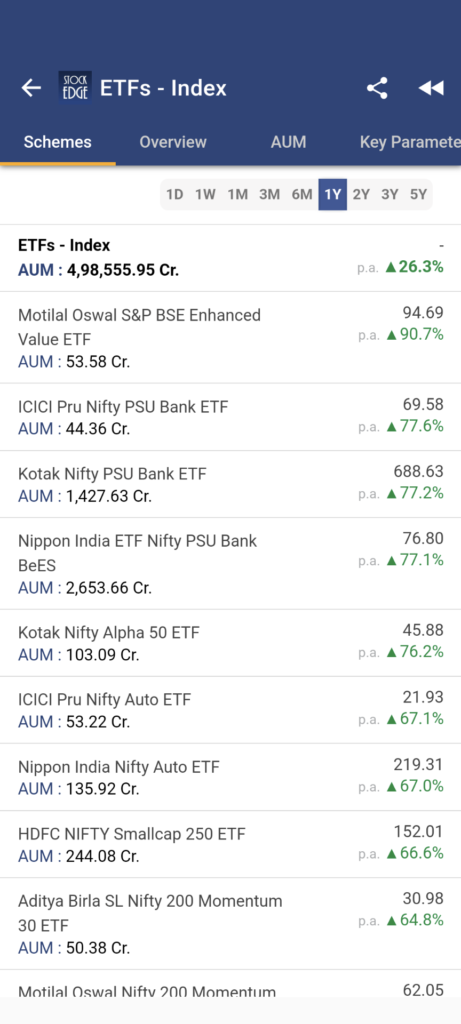

Here is a list of all index ETFs to choose from:

Strategy 3: Stocks for SIP

The last strategy is for those who are in FOMO, as they might lose opportunities to invest in the stock market. Markets are lucrative, but one must be disciplined when investing. Therefore during times of uncertainty, you can start SIP (Systematic Invest Plan) in quality large cap stocks which may reap good returns over the long term. That’s peaceful investing.

At StockEdge, we have an Investment theme called “Mother Stocks”. These stocks refer to principal companies operating in a particular line of business but have other subsidiaries which may or may not be in the same line of business but are performing well.

But what’s the objective behind investing in such Mother stock?

As discussed earlier there are few times in the market where there is uncertainty and high volatility. During such a market scenario, investing in mid and small cap stocks directly can be risky especially for the retail market participants. However investing indirectly through mother stocks gives you a certain cushion of safety that ultimately acts as a peaceful mode of investing in the market.

You can get the detailed thesis and logic behind investing in Mother stocks in the following YouTube video:

Here are 10 stocks which we have categorized as mother stocks:

- Reliance Industries Ltd.

- HDFC Bank Ltd.

- ICICI Bank Ltd.

- State Bank of India

- ITC Ltd.

- Larsen & Toubro Ltd.

- Kotak Mahindra Bank Ltd.

- Bajaj Finserv Ltd.

- Grasim Ltd.

- InfoEdge Ltd.

From the above list of stocks, 4 out of 10 stocks have a detailed case study report, which you can refer to for your investing decision. Click on the stock name to get the case study report: HDFC Bank Ltd, ICICI Bank Ltd, Larsen & Toubro Ltd, and InfoEdge Ltd.

Please note, that there may be other stocks which may have direct or indirect implication on theme. Additionally, the watchlist of stocks can be modified, removed or added. Therefore keep following the Investment theme of Mother stocks to stay up to date.

Bonus Strategy

Here is a bonus tip for you. Despite all your efforts in making investments, it is essential that you protect your portfolio in volatile markets. So, how to protect your portfolio? You need to create a hedge.

“A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment”. – Wikipedia

The best way to hedge your portfolio of stocks is to invest in the precious metal Gold. Why? Here are a few points to consider.

- Diversification: Gold often moves independently of stocks and bonds, offering diversification benefits that can help mitigate overall portfolio risk.

- Inflation Hedge: Historically, gold has preserved its value over time, making it a popular choice for investors seeking protection against inflation eroding the value of their portfolio.

- Safe Haven: During times of economic uncertainty or geopolitical instability, gold tends to retain its value or even appreciate, serving as a safe haven asset for investors seeking refuge from market volatility.

- Store of Value: Gold is seen as a store of value, with its intrinsic worth recognized globally, making it a reliable asset to hold in times of economic turmoil or currency devaluation.

- Portfolio Insurance: Incorporating gold into a long-term stock portfolio can act as insurance against systemic risks and market downturns, providing stability and preserving wealth over the long term.

Additionally, silver, which is also a precious metal, is currently expressing strong price momentum. Both gold and silver can be a good hedge against your portfolio.

To learn more about investing in Gold and Silver, you can read the following two blogs:

Investment in Gold: Discover ways to shine your portfolio brighter!

Invest in Silver to Diversify Your Portfolio Beyond Gold

The Bottom Line

We can conclude that in the current market scenario, there is no clear trend. The majority of market participants are facing a dilemma of whether to stay put or exit the volatile market for the time being. We hope this blog is able to help you give direction in your investment journey and the three wealth protection strategies will guide you through the market volatility.