Table of Contents

Vishal Mega Mart IPO is more than just a new listing. It’s a glimpse into the future of India’s organized retail sector. With a well-rounded business model, strong revenue growth, and competitive market positioning, the company’s IPO is one to watch.

Let’s explore all key aspects of the Vishal Mega Mart IPO and why it could be a game-changer for your investment portfolio.

Vishal Mega Mart IPO is open for subscription from (11th Dec 2024) today onwards!

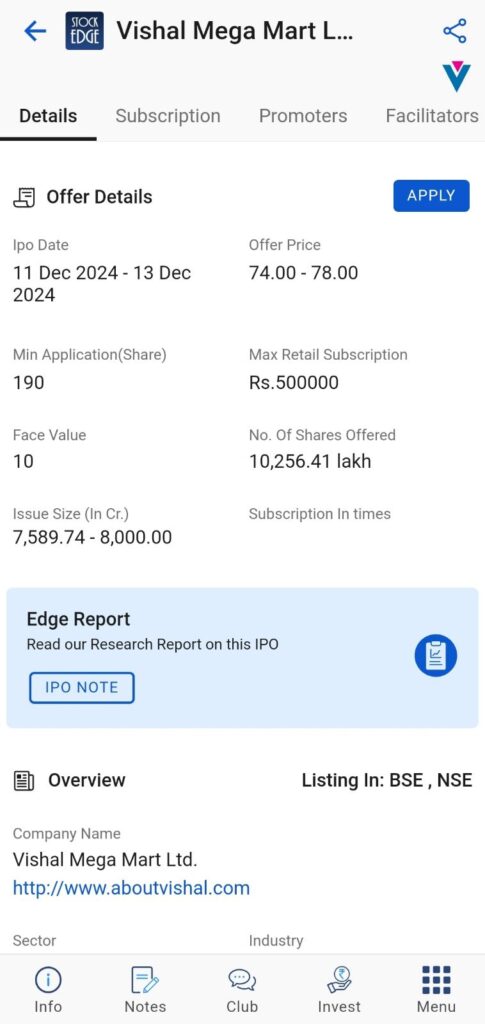

Vishal Mega Mart IPO Details:

- IPO Open Date 11th December 2024, Wednesday

- IPO Close Date 13th December 2024, Friday

- Price Band ₹74 to ₹78 per share

- Lot Size 190 shares

- Face Value ₹10 per share

- Issue Size at upper price band ₹8000 crore (Offer for Sale ₹8000 crore)

- Listing exchanges NSE, BSE

- Cut-off time for UPI mandate confirmation by 5 PM on December 13, 2024

The tentative timeline for the IPO is as follows:

- Basis of Allotment 16th December 2024, Monday

- Initiation of Refunds (if not allotted) 17th December 2024, Tuesday

- Credit of Shares to Demat (if gets allotments of shares) 17th December 2024, Tuesday

- Listing Date 18th December 2024, Wednesday

About the Company

Vishal Mega Mart Limited, incorporated in 2001, is a hypermarket chain that offers products across three major categories like: apparel, general merchandise and fast-moving consumer goods (FMCG). They own their brands and third-party brands to meet the everyday needs of consumers, offering a wide range of products. The company targets middle and lower-middle income people, operating through a pan India network of 645 stores across 33 tier-1 cities and 381 tier-2 cities and beyond as of 30th September 2024. To make the products more accessible, the company has enabled direct hyper-local delivery through its website and mobile app to its customers in close proximity to the stores. The company uses a hub and spoke strategy to acquire products and manage in-store inventories.

The company’s brand portfolio includes its brand products in the apparel category, general merchandise and FMCG category. In addition to creating its brands, the company continues adding additional products to its existing portfolio of brands. The own brands constituted ~72% towards the revenue from operations. Further, the sale of own brands grew at a CAGR of ~28% between FY22-FY24. As of date, the total number of brands they have stands at 26. Out of these categories, the FMCG category constitutes 8, followed by apparel five and general merchandise 4. The remaining comes from a mix of the categories mentioned. The company does not manufacture any products that are being sold across the stores; it relies entirely on third-party vendors for the manufacturing of its products under their brands.

Sector Outlook in India

India’s retail market has been growing much faster than the significant economies and is expected to sustain the same. The growing middle-income segment has been instrumental in driving this growth, as rising disposable incomes fuel greater demand for branded products, especially in tier-2 cities and beyond. This trend aligns with broader economic shifts, such as rapid urbanization and the rise of nuclear families, which have transformed consumption habits and broadened the consumer base.

India’s retail sector is becoming increasingly organized, with tier-2 cities leading the way. As disposable incomes rise and urbanization grows, unorganized retail is being replaced by organized offline stores and online platforms. These channels are expected to grow together, attracting new consumers and converting existing ones through improved service and efficiency.

The staples & FMCG category has witnessed rapid e-commerce adoption over the past 3-4 years, driven by consumer demand for convenience and value. Key factors include doorstep delivery, diverse product assortments, seamless payment options and attractive promotions. Further, the rise of dual-income households and nuclear families is reshaping habits, driving demand for convenient meal solutions, smaller packaging and diverse personal care products, from quick grooming essentials to specialized skincare.

To know more about the FMCG sector, read our blog 5 Best FMCG Stocks with High-Potential: A Must-Add for Your Portfolio.

Financial Performance

Vishal Mega Mart has seen consistent growth in revenue, EBITDA, and net profit, showcasing its operational efficiency and profitability. From FY22 to FY24, revenue grew from ₹5,589 crores to ₹8,912 crores, while EBITDA rose from ₹804 crores to ₹1,249 crores, and net profit increased from ₹203 crore to ₹462 crore. This consistent upward trend reflects the company’s robust business model and cost-efficiency measures.

When compared to industry competitors like Avenue Supermarts (DMart) and Trent Limited, Vishal Mega Mart’s valuations are relatively attractive. With a post-IPO market cap of ₹35,168 crore, the company holds a strong position in the retail sector. Its EBITDA margin of 14.0% is higher than DMart’s 8.1% but slightly lower than Trent’s 15.5%. The company’s P/E ratio of 76.1x places it in a competitive spot between DMart (92.4x) and Trent (135.1x). Vishal Mega Mart’s ability to generate higher revenue from its own brands (72% of total revenue) further strengthens its competitive position.

Objectives of the Issue

The primary objective of the Vishal Mega Mart IPO is to provide an opportunity for the existing shareholders, particularly Samayat Services LLP and Kedara Capital Fund II LLP, to divest their stakes in the company partially. This is a 100% Offer for Sale (OFS), which means no new shares are being issued, and the company will not receive any proceeds from the IPO. Instead, it provides liquidity to the existing shareholders and enhances the company’s market visibility and public profile. Additionally, the listing of shares on the stock exchange will offer investors a chance to be a part of Vishal Mega Mart’s growth journey as it continues its expansion in India’s retail sector.

Risk Factors

Like any investment, Vishal Mega Mart IPO comes with its own set of risks.

- Supply Chain Dependence: Reliance on third-party vendors for the production of its own-brand products exposes it to supply disruptions.

- Regional Concentration: A large portion of revenue (37%) comes from Uttar Pradesh, Karnataka, and Assam, increasing exposure to region-specific risks.

- Consumer Trends: The retail market is volatile, and failing to keep pace with changing consumer preferences could affect profitability.

Investors should carefully evaluate these risks before subscribing to the Vishal Mega Mart IPO.

Should you subscribe to Vishal Mega Mart IPO?

Investors seeking exposure to India’s booming retail sector may find Vishal Mega Mart’s IPO appealing. The company’s strong growth trajectory, market leadership in Tier-2/3 cities, and omni-channel strategy position it as a compelling investment opportunity.

As of 31st March 2024, the Northern region constituted ~43% (mainly contributed by Uttar Pradesh and Delhi), followed by the East, including the North-East region ~29% (the most significant contributor was Assam and West Bengal), South ~19% (Largely by Karnataka and Telangana) and the remaining were derived from the Western region (major contributor was Madhya Pradesh and Chhattisgarh). To improve accessibility and provide greater convenience for the customers, they have introduced direct hyper-local delivery through the Vishal Mega Mart website and mobile app for consumers located near their stores. As of 30th September 2024, their hyper-local delivery service had reached 6.77 million registered users and was operational in 600 stores across 391 cities.

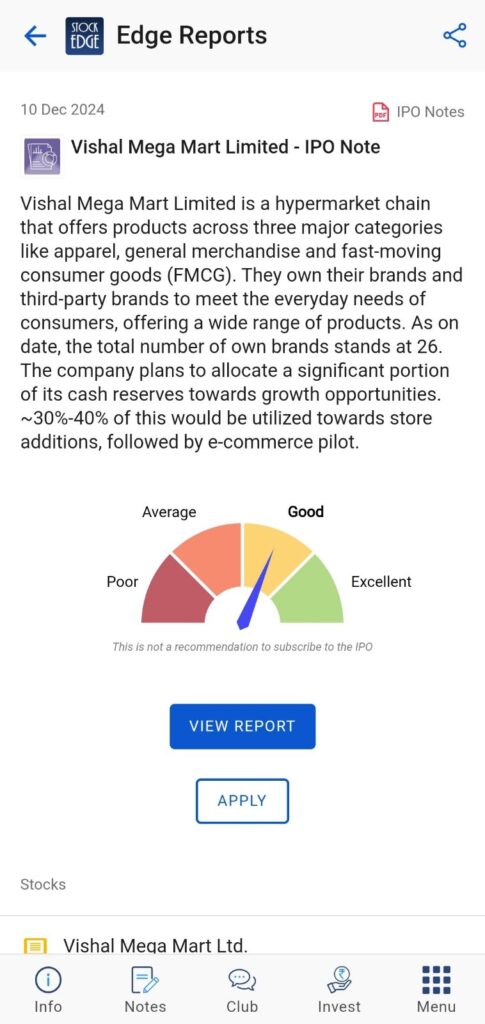

Before you invest in Vishal Mega Mart IPO, make sure you understand the potential risks and rewards. In this blog post, we have provided a full review of both the benefits and possible drawbacks of participating in the Vishal Mega Mart IPO. StockEdge’s panel of experts rated Vishal Mega Mart Limited’s IPO as Good. Furthermore, we’ve created a Vishal Mega Mart IPO Edge Report that delves deep into the company’s financial situation and SWOT analysis, providing you with a more in-depth understanding of the company’s prospects.

StockEdge has a different section on IPO under the Explore tab, where you can see the list of upcoming IPOs, ongoing and recently listed IPOs.

Join StockEdge Club, where our team of research analysts will be dedicated to solving your query related to investments, trading or IPOs.

Happy investing!