Table of Contents

In the dynamic world of stock investing, two prominent strategies have garnered significant attention: value investing and momentum investing. Both methodologies have their own set of principles, adherents, and success stories. However, the debate over which is superior continues to divide investors and analysts alike.

So, which is the most suitable strategy for you? In this blog, we delve into the nuances of value investing and momentum investing, exploring each of them individually and knowing their merits and limitations while implementing a particular style of investing.

What is Value Investing?

Value investing, popularized by legendary investors like Benjamin Graham and Warren Buffett, revolves around the concept of buying undervalued stocks. The philosophy is rooted in the belief that the market occasionally mispriced securities, creating opportunities for astute investors to capitalize on discrepancies between a company’s intrinsic value and its market price.

In simpler terms, they’re like finding a bargain—a stock you can buy for less than what it’s actually worth.

So, how do you calculate a stock’s true value of the intrinsic value? Well, there are multiple ways to do so. The most popular one is the DCF or Discounted Cash Flow model. To know how to calculate the intrinsic value of the stock, you can read the blog on the Calculation of Intrinsic Value.

However, that’s not just it; value investors use fundamental analysis, wherein various financial metrics such as price-to-earnings ratio (P/E), price-to-book ratio (P/B), and dividend yield are scrutinized to assess a stock’s intrinsic value. Additionally, qualitative factors such as industry dynamics, competitive positioning, and management quality are also taken into consideration.

Out of several financial metrics, price to earnings ratio or commonly known as PE ratio is a simple way to find out whether a company is undervalued or overvalued?

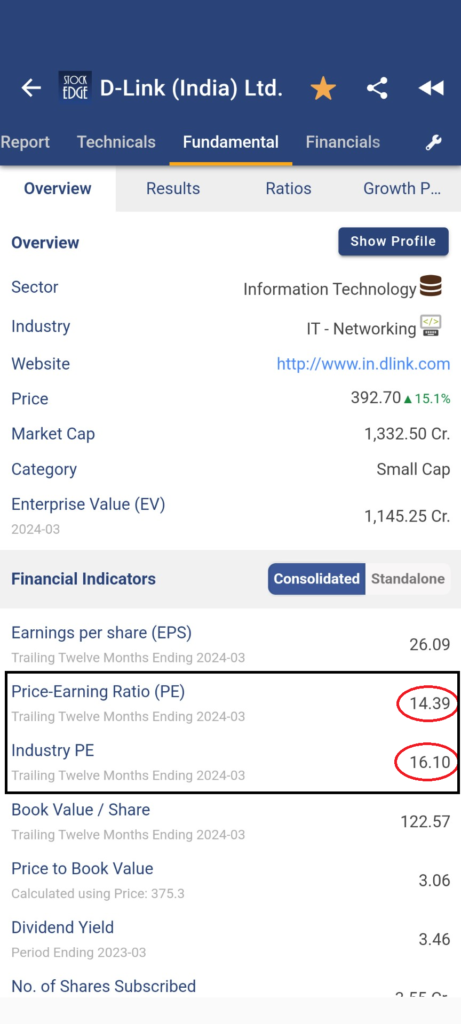

Here is an example:

In the above image, as you can see, StockEdge is a powerful tool through which you get an entire overview of the stock’s fundamentals at a glimpse. D-Link Ltd., which is a small-cap IT-networking company, has a trailing twelve-month PE of 14.39 whereas its industry PE stands at 16.10. Hence, it is considered an undervalued stock.

However, before investing in such an undervalued stock, it is important to find out the reason behind its undervaluation compared to that of its peers. Here are a few simple reasons why a company’s price-to-earnings (P/E) ratio might be lower than the industry average:

- Lower Growth Expectations: If investors believe that the company’s growth prospects are lower compared to other companies in the industry, they may assign a lower valuation to its earnings, resulting in a lower P/E ratio. This could be due to factors such as slower revenue growth, market saturation, or industry-specific challenges.

- Higher Risk Perception: If investors perceive the company to be riskier than its industry peers, they may demand a higher rate of return, leading to a lower valuation and a lower P/E ratio. Factors contributing to higher risk perception could include poor financial performance, management issues, regulatory concerns, or exposure to volatile markets.

Therefore, it is important for an investor to do a 360-degree analysis of a company before considering that it has good undervalued stock.

Identifying Undervalued Stocks

Let’s have a look at how the guru of value investing which is Mr. Warren Buffett, analyzes stocks for himself:

Identifying undervalued stocks like Warren Buffett involves a combination of financial analysis, qualitative assessment, and a long-term perspective. Buffett famously looks for companies with strong competitive advantages, known as “economic moats,” and buys them when they are trading below their intrinsic value. Here are some steps you can take to identify undervalued stocks:

- Understand the Business: Buffett emphasizes the importance of understanding the business you’re investing in. Look for companies with straightforward and predictable business models, strong brands, and durable competitive advantages.

- Assess Financial Metrics: Analyze key financial metrics such as earnings growth, return on equity (ROE), and debt levels. Buffett prefers companies with consistent earnings growth, high ROE, and manageable debt.

- Calculate Intrinsic Value: Use valuation techniques like discounted cash flow (DCF) analysis or relative valuation (comparing the stock’s price-to-earnings ratio, price-to-book ratio, etc., to industry peers) to estimate the stock’s intrinsic value.

- Margin of Safety: Buffett emphasizes the importance of buying stocks with a margin of safety, meaning they are priced significantly below their intrinsic value to protect against potential downside risk.

- Long-Term Perspective: Buffett is known for his long-term investing approach. Look for companies with sustainable competitive advantages rather than short-term market trends.

- Ignore Market Noise: Buffett advises investors to ignore short-term fluctuations in stock price and focus on the fundamentals of the business.

- Patience and Discipline: Buffett’s success is also attributed to his patience and discipline. Be prepared to wait for the right opportunities and avoid succumbing to market speculation or FOMO (fear of missing out).

By following these principles and conducting thorough research, investors can identify undervalued stocks that have the potential for long-term growth, similar to Warren Buffett’s approach.

However, value investing is not without its challenges; identifying undervalued stocks requires meticulous research and patience. Furthermore, value traps—stocks that appear cheap but fail to appreciate in value—pose a significant risk to investors.

What is Momentum Investing?

Contrary to value investing, momentum investing focuses on capitalizing on trends in stock price movements. This strategy operates on the premise that stocks that have performed well in the past are most likely to continue their upward trajectory, while those that have underperformed are likely to continue their descent.

In recent times, momentum investing has gained traction, particularly among short-term traders and speculators. The prevalence of volatility and market sentiment makes momentum strategies appealing to those looking to exploit short-term price movements for profit.

But what exactly are momentum stocks?

Criteria for Momentum Stocks

Momentum stocks typically include:

- Price Performance: Momentum stocks exhibit strong upward price momentum, often characterized by a series of consecutive price increases over a defined period, such as weeks or months.

- Relative Strength: Momentum stocks outperform their peers or benchmark indices over the same period, demonstrating superior relative strength in price performance.

- Trend Confirmation: Momentum traders often look for confirmation of the prevailing trend through technical indicators like moving averages or chart patterns.

- Fundamental Catalysts: While momentum trading primarily focuses on price action, some investors also consider fundamental catalysts such as earnings surprises, product launches, or positive news events that can sustain or amplify the momentum.

- Risk Management: Successful momentum trading strategies incorporate robust risk management techniques to mitigate potential losses, including setting stop-loss orders, adhering to position sizing rules, and maintaining disciplined entry and exit criteria.

One of the key indicators used in momentum investing is price momentum, which measures the rate of change in a stock’s price over a specified period. Stocks exhibiting strong price momentum are often favored by momentum investors, who seek to ride the wave of positive sentiment and capitalize on upward momentum.

Let’s see an example of momentum investing by looking at the fundamentals of Zomato Ltd.

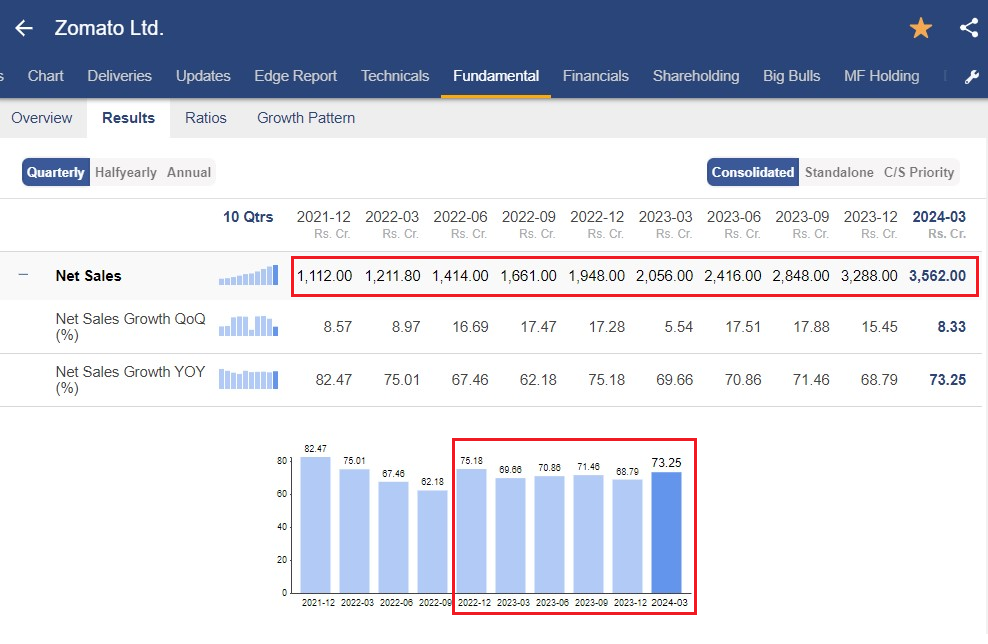

First and foremost let’s check at the company’s revenue which is important for any company you analyze based on its fundamentals.

As you can see, Zomato’s net sales have been growing consistently over the past 10 quarters, but it has really shown its strong sales growth from Q2 FY23 because previous quarters have witnessed declining sales growth YoY.

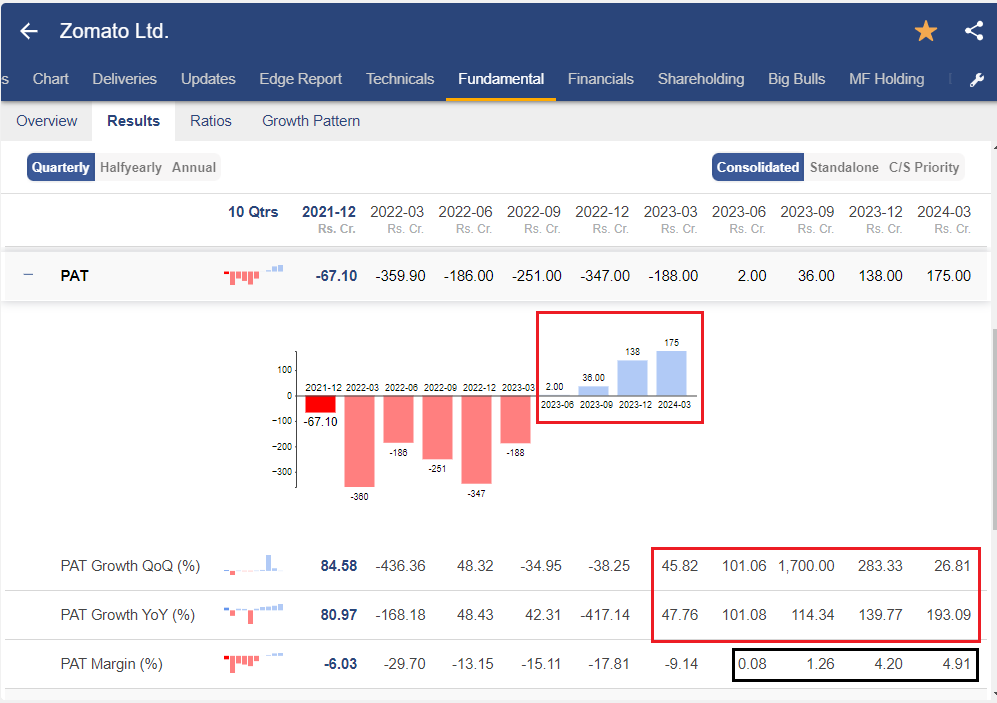

Additionally, Zomato posted its first-ever profit in Q4 FY23, which triggered a ray of hope for the company’s bright future. Also, for the last four consecutive quarters the company has not only made profit also its PAT surged from 2 crs in FY23 to 175 cr in FY24.

The Company’s PAT has also been growing consistently for the last four quarters, indicating strong financial performance. Now if we see the stock price performance of Zomato, you can see the stock has surged nearly 200% since its first ever profit in Q4 of FY23.

As you can see from the weekly chart of Zomato, since the relative strength of the stock turned positive, the stock has seen strong price action momentum. The relative strength turned positive, which means that the stock has started to outperform the Indian benchmark index – Nifty 50, which typically exhibits strong momentum in stock price.

However, momentum investing is not devoid of risks. The reliance on short-term price movements makes momentum strategies susceptible to market volatility and sudden reversals. Additionally, the tendency for stocks to exhibit mean reversion over the long term can undermine the efficacy of momentum strategies.

Difference between Value Investing and Momentum Investing

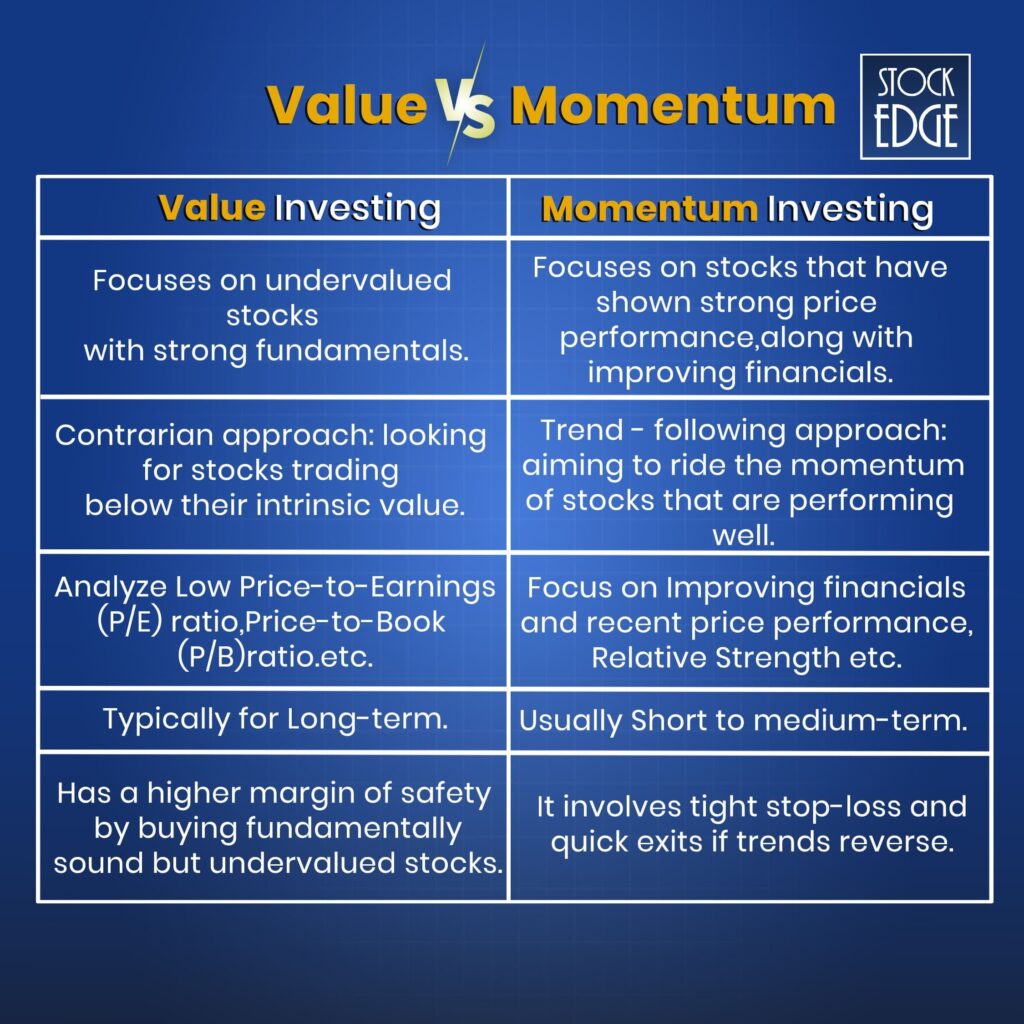

- Investment Style: Value investing focuses on undervalued stocks with strong fundamentals which have a potential in the long-term, whereas momentum investing focuses on stocks that have shown strong price performance, along with improving financials and is expected to continue in the trend in the short to medium term.

- Approach: Value investors a contrarian approach, looking for stocks trading below their intrinsic value due to market pessimism or temporary setbacks. But a momentum investor follows price trends, aiming to ride the momentum of stocks that are performing well.

- Key Metrics: Value investors look for low Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, etc. whereas momentum investors look for Improving financials and recent price performance, Relative Strength Index (RSI), Moving Averages, Price trends, etc.

- Investment Horizon: Value investing is typically for long-term, focusing on potential growth and having margin of safety. But momentum investing is for short to medium-term, aiming to capture short-term price movements.

- Risk Management: Value Investing emphasizes downside protection by buying fundamentally sound but undervalued stocks. However, momentum investing involves tight stop-loss orders and quick exits if trends reverse.

Here is a quick summary on the difference between Value and Momentum Investing:

Here is an detailed explanation of Value Vs Momentum investing along with a case study, which you can watch:

Here are 7 profitable momentum investing strategies that you can learn!

Now that you have a complete understanding of both value and momentum investing, you must be wondering which investment strategy is best for you?

Value Vs Momentum: Which is better?

Unfortunately, there is no right and wrong answer to it. That’s because it basically depends upon your investing style and risk tolerance level. Each investment strategy has its own pros and cons. It is important that you weigh your options based on your investment behavior and risk appetite.

When weighing the merits of value investing and momentum investing in the Indian stock market, several factors come into play:

1. Market Dynamics: The Indian stock market is characterized by volatility, regulatory changes, and macroeconomic factors that influence investor sentiment. Both value and momentum strategies must adapt to these dynamics to thrive.

2. Risk Appetite: Value investing is often associated with a long-term outlook and a focus on intrinsic value, making it suitable for conservative investors with a low tolerance for risk. In contrast, momentum investing appeals to more aggressive investors willing to embrace short-term volatility for potentially higher returns.

3. Information Availability: The availability of timely and accurate information is critical for both value and momentum strategies. In the Indian context, where corporate governance standards vary, and information asymmetry is prevalent, investors must exercise caution and conduct thorough due diligence.

4. Behavioral Biases: Investor behavior plays a crucial role in shaping market dynamics. While value investors may capitalize on market inefficiencies driven by fear and pessimism, momentum investors may exploit the herd mentality and greed-driven rallies.

5. Regulatory Environment: Regulatory changes and policy reforms can significantly impact the Indian stock market, influencing the efficacy of both value and momentum strategies. Investors must stay abreast of regulatory developments and adapt their strategies accordingly.

The Bottom Line

In conclusion, the debate between value investing and momentum investing is not a binary one. Both strategies have their strengths and weaknesses, and their suitability depends on various factors, including investor preferences, market conditions, and risk appetite. Despite these differences, even a value investor can do momentum investing. Value investing is an evergreen strategy that requires patience in the long term. However, momentum investing can give you handsome returns in the short to medium time horizon following price action moves along an improving financial performance of the company.

Whether you choose to embrace the timeless wisdom of value investing or ride the wave of momentum, both can be done in combination which may align your short term as well as long term investment objectives and philosophy in the ever-evolving landscape of the Indian stock market.

Irrespective you are a swing trader or momentum investor, here are Top 7 Innovations by StockEdge for Swing Traders and Momentum Investors!

Happy Investing!