- Why Union Budget 2026 is Important?

- Union Budget 2026 Overview

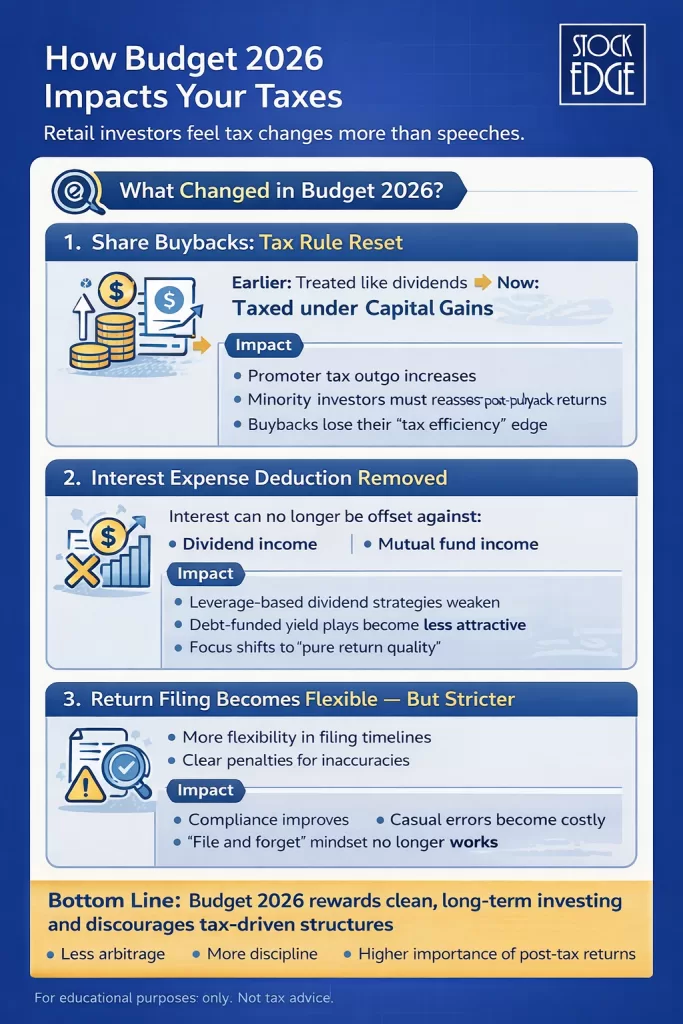

- How Budget 2026 Impacts Your Taxes Directly

- Security Transaction Tax Changes

- How the Stock Market Reacted to the Union Budget 2026

- Sector Impact of Union Budget 2026 – Winners and Watch Zones

- What Long Term Equity Investors Should Do After Budget 2026

- What Traders Should Change Post Budget 2026

- Common Budget Myths Investors Believe

- Your Action Checklist After Union Budget 2026

- Frequently Asked Questions (FAQs)

Every Union Budget brings its share of headlines, but this time, the Union Budget of 2026 carries some clear signals too.

As an investor in Indian markets, this budget affects you in three direct ways. Your taxes. Your transaction costs. Your sector opportunities. Many retail investors look at headline announcements and miss the real shifts happening underneath.

This blog breaks Union Budget 2026 into simple, actionable insights. No policy jargon. No politics. Only what matters for your portfolio and trades.

Why Union Budget 2026 is Important?

Union Budget 2026 comes at a time when Indian markets are already sensitive. Valuations remain elevated. Derivative volumes are high. Retail participation is at record levels. In this setup, even small policy changes change behaviour.

This budget focuses on fiscal discipline, manufacturing push, infrastructure spending, and financial market reforms. At the same time, it raises trading costs through Security Transaction Tax changes. This combination matters if you invest long-term or trade actively.

If you ignore these changes, your returns suffer quietly.

Union Budget 2026 Overview

Before going sector by sector, look at the big picture.

- Nominal GDP growth for FY27 is budgeted at around 10 percent.

- Real GDP growth expectation stays near the 7 percent zone.

- Fiscal deficit target for FY27 moves down to about 4.3 percent of GDP.

- Government capital expenditure for FY27 stands at ₹12.2 lakh crore, about 3.1 percent of GDP.

This signals continuity. The government continues to spend on infrastructure while keeping debt under control. Markets generally reward consistency over surprises.

How Budget 2026 Impacts Your Taxes Directly

Retail investors care about taxes more than speeches. Union Budget 2026 brings changes you should note carefully.

Capital gains on share buybacks now move under capital gains taxation instead of dividend treatment. For promoter shareholders, effective tax rates rise. Minority investors also need to reassess post-buyback returns.

Interest expense deduction against dividend and mutual fund income is removed from FY27 onward. If you used leverage for dividend strategies, this hits net returns.

Updated return rules become more flexible. Filing revised or updated returns gets a longer window, but with clear costs attached. Compliance improves, but casual mistakes get expensive.

The bottom line is that Budget 2026 rewards clean, long-term investing and discourages tax-driven structures.

You can track post-tax returns and corporate actions’ impact directly on the stocks you own or track here

Security Transaction Tax Changes

One of the biggest talking points of the Union Budget 2026 is the Security Transaction Tax.

STT on futures rises from 0.02 percent to 0.05 percent.

STT on options premium and option exercise rises to 0.15 percent.

For option sellers and high frequency traders, this is not small. Even a few basis points matter when turnover is high.

This means:

- Short term option strategies need tighter risk control.

- Low probability trades become less attractive.

- Overtrading hurts faster than before.

This move signals a clear intent. Markets should reduce excessive speculation. For retail traders, discipline matters more than ever.

Derivative analytics, open interest shifts, and volatility tracking help you adapt instead of guessing.

How the Stock Market Reacted to the Union Budget 2026

Budget day market reactions often confuse retail investors.

Markets sold off sharply during the special budget session. Traders reacted to higher STT and tax changes. FIIs and DIIs both sold on the day.

History shows a pattern. Budget day reactions rarely decide the full year trend. Earnings and liquidity do.

If you react emotionally on budget day, you often exit at the wrong time.

Study past budget day reactions versus six-month and one-year returns. Data keeps emotions out.

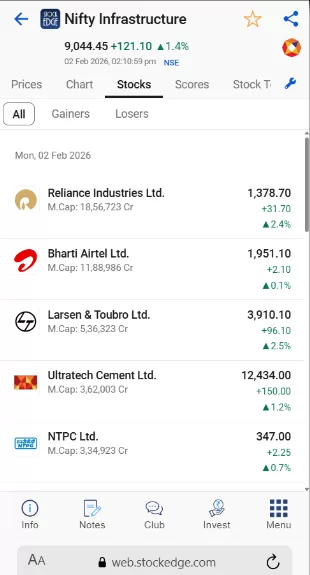

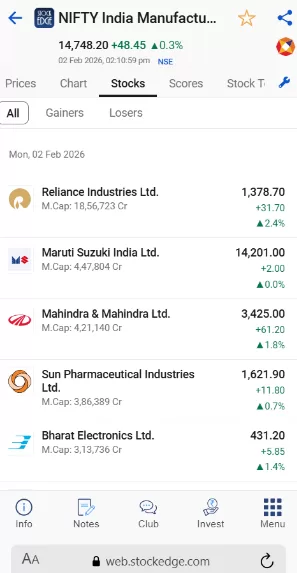

Sector Impact of Union Budget 2026 – Winners and Watch Zones

Infrastructure and Capital Goods

Government capex remains strong. Freight corridors, rail connectivity, urban infrastructure, and logistics get steady funding.

Capital goods companies with order visibility stand out. Execution matters more than announcements. Track order book growth and margin trends.

Manufacturing and Make in India Themes

Budget 2026 reinforces domestic manufacturing. Electronics components, semiconductors, chemicals, capital equipment, and rare earth supply chains receive policy support.

This benefits companies with balance sheet strength and technical capability. Weak players without execution struggle despite themes.

Filter quality stocks within manufacturing themes to simplify your analysis.

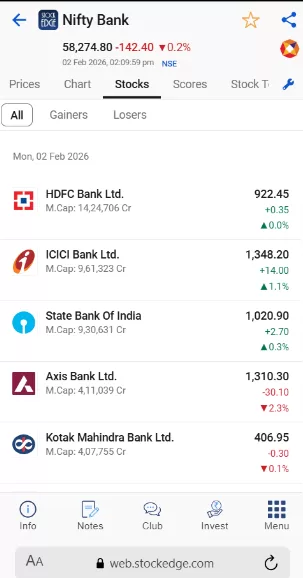

Banks and Financials

Banking sector reforms continue. A high level committee on banking signals long term structural improvements.

Credit growth remains healthy. Asset quality stays strong. PSU banks remain sensitive to bond yields and policy execution.

Do not chase momentum blindly. Track valuation versus return ratios.

Defence and Railways

Defence manufacturing and railways continue to get policy backing. Order flows remain strong.

Markets already price in optimism. Selectivity matters.

Track order inflows, execution timelines, and promoter activity.

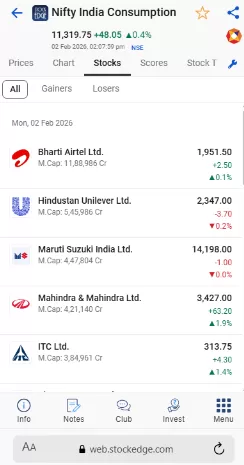

Consumption and Rural Themes

Budget support to agriculture, allied activities, and rural income continues. This helps FMCG, tractors, agri inputs, and rural focused lenders.

Recovery remains gradual. Avoid assuming instant demand revival.

Read this blog on StockEdge Sector Analytics to make your investing process easier and wiser.

What Long Term Equity Investors Should Do After Budget 2026

If you invest for three to five years, budget headlines should not shake you.

Focus on these actions:

- Review sector allocation.

- Check earnings visibility for budget linked themes.

- Avoid rotating portfolios based only on announcements.

- Track companies where policy support aligns with profit growth.

StockEdge portfolio tools help you monitor exposure and risk without emotional decisions.

What Traders Should Change Post Budget 2026

After the increase in the Security Transaction Tax (STT), you need to adapt to a new reality. It’s important to reduce overtrading and concentrate on higher conviction setups. Avoiding low-reward strategies becomes crucial, while closely monitoring market volatility helps in making better decisions. This disciplined approach will help navigate the changed trading landscape effectively.

Markets will still offer opportunities. Costs punish undisciplined behaviour.

Common Budget Myths Investors Believe

1. Budget decides market direction for the whole year – Wrong, earnings do.

2. Every announced sector rallies sustainably – Rarely true.

3. Higher taxes mean markets will crash – Not supported by data.

Your Action Checklist After Union Budget 2026

- Review the tax impact on your investing and trading style.

- Reassess option strategies after STT changes.

- Identify sectors with earnings plus policy tailwinds.

- Avoid impulsive budget day trades.

- Use data daily, not headlines.

StockEdge Can Become More Important to You After Budget Season

Budget creates direction. Markets reward execution. StockEdge helps you track sector trends, earnings data, derivative positioning, and institutional activity in one place. Retail investors who use data stay ahead of noise.

If you want to understand what really works after the Union Budget 2026, start tracking markets the right way.

Register on StockEdge.

Stay informed.

Stay disciplined.

Frequently Asked Questions (FAQs)

1. What are the major highlights of the Union Budget 2026?

Union Budget 2026 focuses on fiscal discipline, higher infrastructure spending, and continued support for manufacturing. Key changes include a higher Security Transaction Tax (STT) for derivatives, new tax treatment for share buybacks, removal of interest deduction against dividend income, and steady capital expenditure to boost long-term economic growth.

2. Which sectors are expected to benefit most from Union Budget 2026?

Sectors likely to gain from Budget 2026 include infrastructure, capital goods, manufacturing-linked industries, defence, railways, and rural consumption themes. Government capex and Make in India policies support companies with strong execution, order visibility, and earnings growth rather than pure thematic plays.

3. How will higher STT affect option traders and futures trading?

Higher STT increases trading costs in futures and options, making frequent and low-margin strategies less profitable. Option sellers and high-turnover traders will feel the biggest impact. Traders may need to reduce overtrading, focus on higher conviction setups, and manage risk more tightly to protect net returns.