Table of Contents

Are you also facing FOMO as the index is soaring and is trading near life highs? Nifty at around 22000 levels. The index has generated returns of over 20% since Nov 2023, and the mutual fund industry has seen a surge of new investors in the recent past , with the rising demat accounts and the market performance. Mutual funds also seems to be one of the most approachable and viable investment options to the new investors in the markets.

Mutual Funds give users the flexibility to invest in markets with a smaller capital base, and they can be easily linked to the broking account. Even with little knowledge about the markets, users have historically generated decent returns with Mutual fund investing.

Why do fund managers play an important role?

Mutual funds are professionally managed by experienced fund managers who diversify the portfolio and regularly monitor performance in different market scenarios. The fund manager, managing the mutual fund portfolio is often an experienced professional who manages the fund’s day-to-day and puts his investment strategy into action. A fund manager’s job is to make investment decisions and achieve the fund’s investment objectives. They analyze market trends, company financials, economic indicators and other relevant data to make informed investment decisions. The fund management can be done by one person or a team of people.

A mutual fund’s performance is mainly dependent on the skill and expertise of its fund manager. A successful mutual fund manager can outperform both its competitors and benchmark indices by showcasing its analytical skills backed by extensive research.

Mutual Funds can be categorized into Active or Passive Fund Management.

Passive fund managers aim to mirror the performance of a specific index by replicating its composition, trying to match its returns.

On the other hand, active fund managers actively select individual stocks with the goal of surpassing the market’s overall performance. Let us know some more differences between active and passive fund management.

Actively managed funds v/s Passively managed funds?

| ACTIVE MANAGER | PASSIVE MANAGER |

| Through intensive research, analysis and market forecasting, they build a portfolio consisting of stocks, bonds, gold, etc. and also determine the optimal allocation mix within the portfolio to achieve the desired investment objective. | Their main objective is to replicate the performance of a specific benchmark or index, aiming to match its performance rather than beat it. |

| Active Fund Managers charge higher management fees due to active management and research costs. | They charge lower fees as they replicate the Index’s performance, and no expertise is needed. |

| They take more risk and hence generate more returns. | They typically take less risk exposure. |

| They have the potential to outperform the market and generate alpha returns for the investor. | They replicate the index performance subject to tracking error and charge a fixed fee. |

When picking a mutual fund, it’s important to focus on the manager’s job. This article talks about why. Active fund managers are like the captains of ships, steering the fund’s direction. Not all managers can beat the market, so it’s crucial to look for ones who are really involved. Think of it like how good management is key to a company’s success—here, the fund manager is just as important for the mutual fund’s performance.

Factors to consider when selecting a mutual fund manager?

Fund Manager’s Qualification & Experience:

Understanding the educational background and previous work experience of fund managers before they join an Asset Management Company (AMC) is crucial. This helps investors feel more confident and it encourages them to remain invested in the scheme even in turbulent market conditions.

Track Record of Fund Manager:

Assessing the fund’s past performance is key. It shows how well the manager handled various market situations. Investors should check how consistently the manager performed and compare it with industry benchmarks and other similar funds.

Fees and Expenses:

Actively managed funds charge higher fees than passive fund managers because they have a dedicated team of research analysts. Investors should check the expense ratio and exit load of the desired fund. Lower fees can majorly impact long-term returns.

Communication and Transparency:

Fund managers share their strategies and approaches in the stock selection to align them with the investment objective and also communicate before making any changes in the portfolio. It’s important for investors to get regular updates and clear information about what the fund owns and its strategy to make smart investment decisions.

Investment Philosophy and Approach:

Even during tough times in the market, managers should stick to their method of picking stocks. If they stay true to their approach, they can achieve success over the long run.

Top 5 fund managers in INDIA 2024?

In FY-23 there were 428 fund managers in India which has increased to 473 in FY24, according to Morningstar’s data.

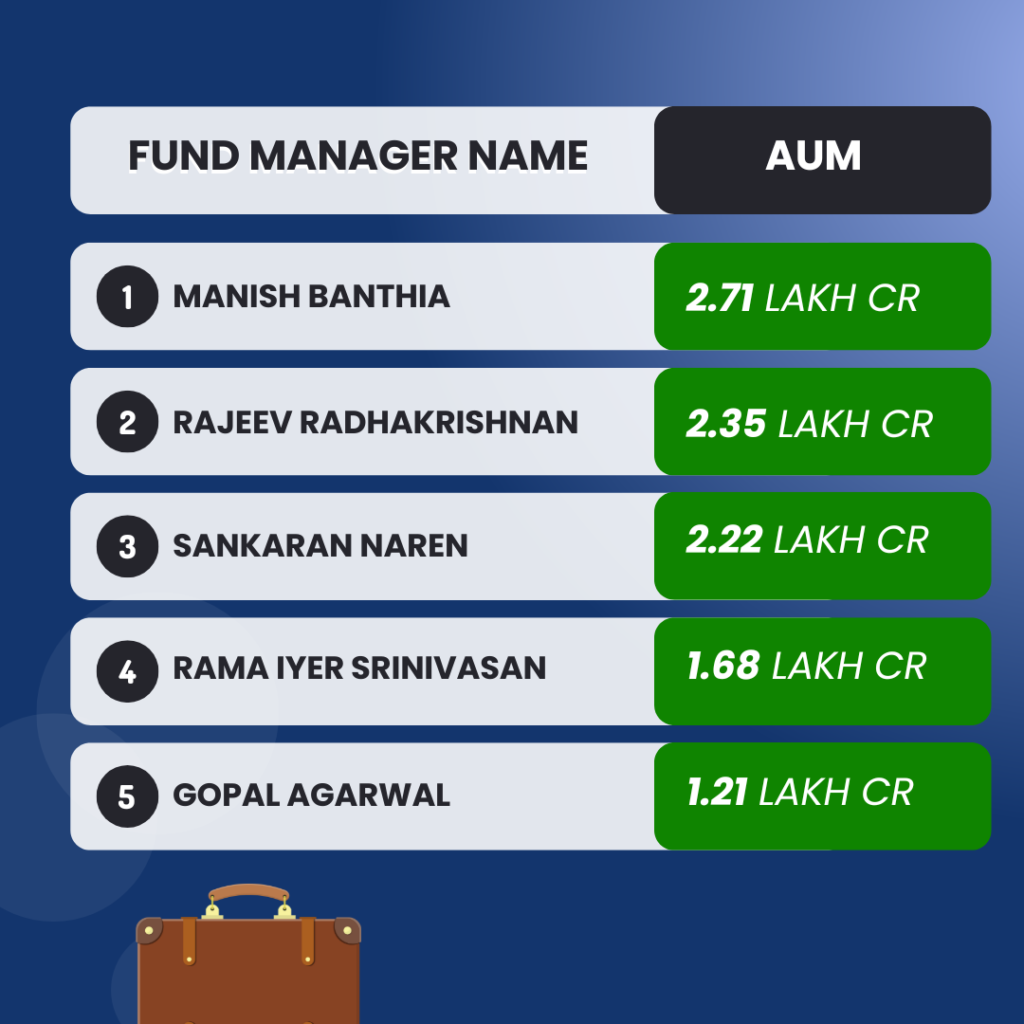

StockEdge selection criteria for top fund managers are based on the category of active fund management and maximum assets under management.

Out of 473 fund managers, top 5 fund managers based on Assets Under Management are:

Manish Banthia – CIO- Fixed Income in ICICI Prudential AMC.

Manish has been a fund manager of ICICI Prudential Asset Management Company since 2005. He is a qualified Chartered Accountant and has completed his Masters in Business Administration from the Indian Institute of Foreign Trade (IIFT) Delhi. He currently oversees the Fixed-Income division and plays key roles in fixed-income trading, credit analysis, and product development.

Prior to joining the ICICI AMC, he was associated with Aditya Birla Group. He specializes in portfolio management and credit research.

He manages a total AUM of 2.71 lakh crores, mainly in the Debt category of Mutual Funds. He currently manages 24 schemes, with the most number of schemes in the Debt Category.

Top Funds actively managed by Manish:

ICICI Prudential Equity & Debt Funds.

Rajeev Radhakrishnan is the head of fixed income at SBI AMC.

Rajeev has been with SBI Mutual Fund since 2008, and he has 24 years of experience in funds management. He is a B.Tech graduate and holds a Master’s degree in finance from Mumbai University. He is also a charter holder of the CFA Institute, USA.

Previously he was associated with UTI Asset Management Company Ltd. as Co – Fund Manager for seven years (June 2001-2008)

Rajeev joined SBI MF as a fixed-income portfolio manager in 2008 and is currently heading the Fixed-Income desk at the AMC. He manages 14 schemes, handling a total AUM of 2.35 lakh crores, mainly in the Debt and Hybrid Mutual Fund Categories.

Top Funds actively managed by Rajeev:

2. SBI Balance Advantage Fund3. SBI Liquid Fund.

Sankaran Naren– Equity Hybrid- ICICI Prudential AMC.

Sankaran Naren is a fund manager at ICICI Mutual Fund House. Mr. Naren is a B.Tech graduate from IIT Chennai and an MBA in Finance from IIM Kolkata.

He has experience in a variety of roles related to investment management and the financial services sector. Before joining ICICI Prudential AMC, he worked with HDFC Securities Ltd. and Yoha Securities. His opinions on markets and macroeconomic issues are discussed widely in local and international media.

He manages 13 schemes, mainly equity-oriented schemes, with a total of 2.22 lakh crore assets under management. Within the equity and equity-hybrid category, the top schemes.

Top Funds actively managed by Sankaren::

1. ICICI Prudential India Opportunities Fund

2. ICICI Balanced Advantage Fund3. ICICI Value Discovery Fund.

Rama Iyer Srinivasan– Head of Equity in SBI AMC.

Rama Iyer Srinivasan is a Fund manager of SBI Mutual Fund House. R. Srinivasan is an M.Com and Master of Financial Management.

Prior to joining SBI Mutual Fund, he worked with Principal AMC, Oppenheimer & Co, Indosuez WI Carr, and Motilal Oswal.

He manages a total AUM of 1.68 lakh crores and is currently managing 21 schemes in SBI AMC, with the highest AUM in the Equity & Hybrid category.

Top Funds actively managed by R.Srinivasan:

4. SBI Flexi Cap,5. SBI Multi Cap

Gopal Agarwal– Senior Fund Manager- Equity in HDFC AMC.

Gopal Agarwal is a fund manager of HDFC Mutual Fund House. Mr Agrawal is a B.E graduate with a master’s degree in business management.

He has 11 Years of experience in the Capital market. He has been with SBI AMC since November 2004. Prior to joining HDFC Mutual Fund, he worked with DSP Mutual Fund, Tata AMC, Mirae Asset Mutual Fund, SBI Mutual Fund, Kotak Securities, HDFC Securities, IDBI Capital, UTI Securities and IPCL.

He manages a total AUM of 1.21 lakh crores and is currently managing eight schemes in HDFC AMC.

Top Funds actively managed by Gopal:

1. HDFC Balanced Advantage Fund

CONCLUSION

In conclusion, Fund managers play a crucial role in the field of investments. They are professionals who have a deep understanding of financial markets and robust techniques for selecting stocks. They help achieve investors’ financial goals and meet fund objectives.

It is essential to understand that during market turmoil, fund managers safeguard investments and protect them from downfall through their tried-and-tested strategies and long expertise in the financial market.

Investors need not worry about their investments as fund managers follow a reliable and true strategy to generate superior returns. This strategy involves continuous rebalancing of the portfolio depending on market scenarios, analyzing quarterly earnings, and tracking the fund’s key management commentary to ensure the fund is aligned to meet its investment objectives.

StockEdge provides full insight of all the fund managers with a complete overview of the Fund managers background, Assets under Management, Name of the schemes and other relevant data to analyze.