Key Takeaways

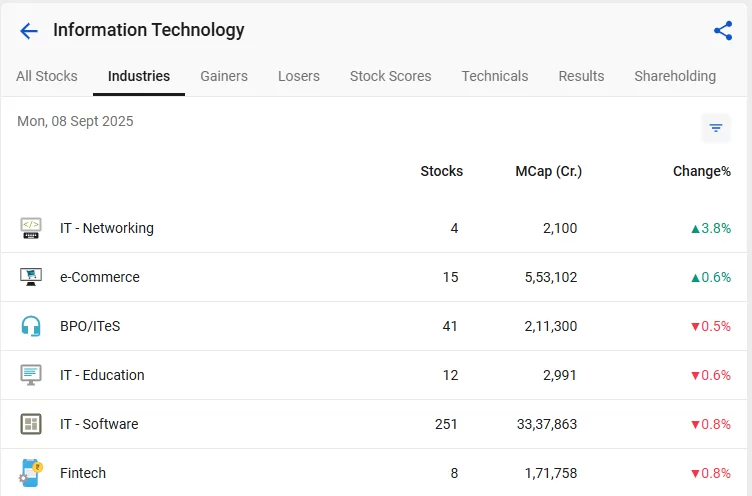

- Diverse IT Landscape: The Indian IT sector covers software, BPO, fintech, edtech, networking, and e-commerce, making it a core driver of the economy.

- Growth Drivers: Global demand, digital transformation, government policies, and adoption of AI, cloud, and emerging tech are fueling strong growth.

- Risks to Watch: Heavy dependence on global markets, currency fluctuations, visa restrictions, and automation pressures can impact IT stock performance.

- Top IT Stocks 2025: Infosys, Tech Mahindra, and Coforge stand out with strong deal pipelines, resilient financials, and focus on digital innovation.

- Investor Checklist: Key factors to assess include revenue mix, financial strength, attrition, order book, global exposure, valuations, and leadership quality.

Table of Contents

There is no doubt that the IT sector acts more like a Bollywood movie. In the first half of every blockbuster, the hero faces endless struggles before the big turnaround. Similarly, the Indian IT stocks also struggle due to the global slowdown, rising automation pressure, and the dramatic impact of Trump Tariffs.

But just like the turning point in a strong script, the second half for Indian IT looks far more promising. The industry is actively focusing on AI, cloud, and digital transformation, with Generative AI emerging as a key driver of growth. And these changes are opening up new revenue opportunities and enabling IT companies to go beyond traditional outsourcing approaches. In this blog, we will explore the possibilities and challenges of IT stocks and understand the financials and future outlook of IT stocks.

What are IT Stocks?

IT stocks are shares of companies in the information technology sector, which include firms that offer services like software development, consulting, digital transformation, cloud solutions, and business process outsourcing.

In India, the IT sectors are divided into six categories.

- IT – Networking: Companies that focus on building and managing networking solutions, connectivity infrastructure, and communication systems. Companies include D-Link (India) Ltd., Smartlink Holdings Ltd., Rox Hi-Tech Ltd., and Takyon Networks Ltd.

- E-Commerce: Digital-first businesses that operate online marketplaces, retail platforms, and technology-driven commerce ecosystems. Companies include Eternal Ltd, Swiggy Ltd, FSN E-Commerce Ventures Ltd., and many others.

- BPO/ITeS: Business Process Outsourcing and IT-enabled services companies, which handle processes like customer support, back-office operations, and outsourcing of business functions for global clients. Companies include Info Edge (India) Ltd., Affle 3i Ltd.,

- IT – Education: Firms leveraging technology to deliver learning solutions, digital classrooms, and edtech platforms. Companies include NIIT Ltd., Aptech Ltd., and many more.

- IT – Software: The largest category, which includes India’s well-known IT majors like TCS, Infosys, and Wipro. These companies develop software, offer consulting services, and provide digital transformation and IT solutions to global clients. Companies include Tata Consultancy Services Ltd., Infosys Ltd., HCL Technologies Ltd., and many more.

- Fintech: Technology-driven companies in the financial sector, providing solutions in digital payments, online lending, wealth management platforms, and other financial services innovations. Companies include PB Fintech Ltd., One97 Communications Ltd., and many more.

Key Factors Driving Growth in the Indian IT Sector

The Indian IT sector has transformed from being just an outsourcing hub into a global powerhouse of innovation and digital solutions. Let’s check out the key drivers of the Indian IT sector:

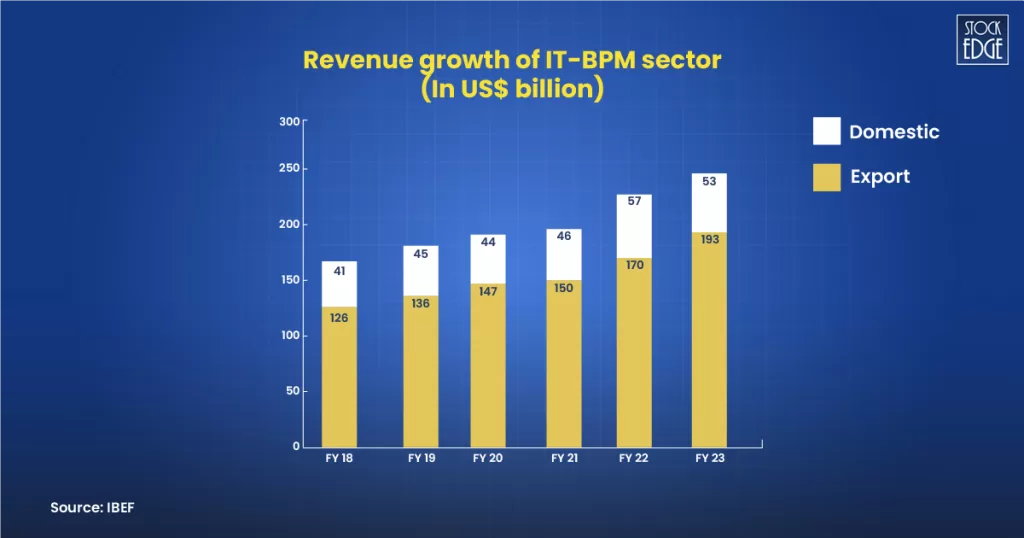

Strong Global Demand

According to NASSCOM, Indian IT exports have crossed $190 billion in FY24, making India the go-to destination for IT services. And they expected to gain a significant share of the global market, with the country’s investment projected to reach US$5 billion annually by 2025. It reflects consistent global demand for outsourcing, consulting, and IT services.

Digital Transformation Across Industries

Around 60-70% of global enterprises are investing in digital transformation, providing Indian IT firms a huge pipeline of projects. HCL Technologies implemented cloud and automation solutions for manufacturing and healthcare clients, while Tech Mahindra assisted telecom firms in rolling out 5G services across multiple regions. These cross-sector projects diversify revenue sources and mitigate dependency on a single industry.

Government Support & Policies

The Indian government’s initiatives such as Digital India, Startup India, and PLI schemes encourage domestic innovation and global competitiveness. SEZ benefits and export-friendly policies have bolstered IT exports. For instance, IT exports in FY24 grew by 12% YoY, reaching $190+ billion, demonstrating policy-driven sector growth.

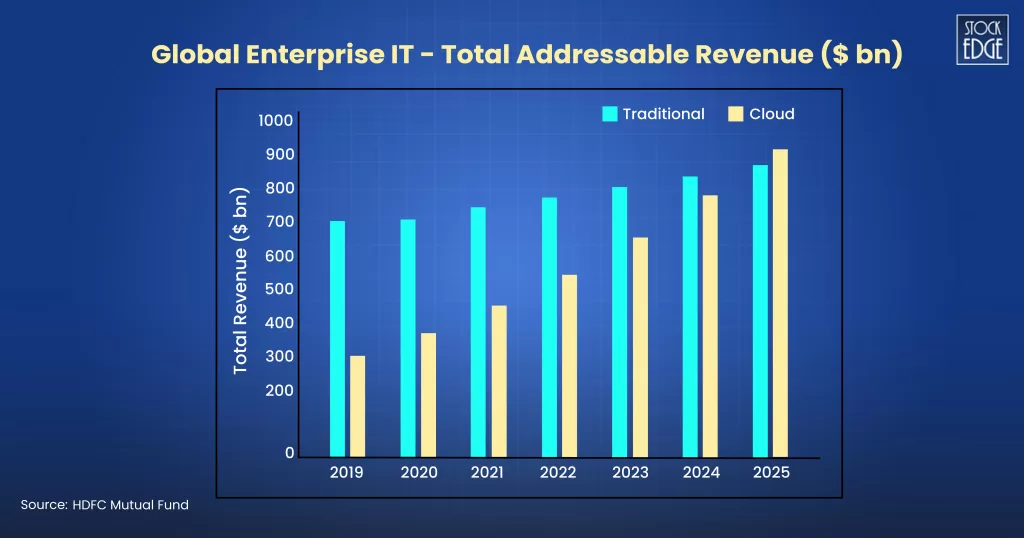

Rapid Adoption of Emerging Technologies

Indian IT companies are investing in cloud, AI, IoT, cybersecurity, and blockchain. TCS, for example, collaborates with Google Cloud and AWS to support enterprise cloud adoption. Infosys invested over ₹4,000 crore in AI and automation platforms in FY23–24. These initiatives drive high-margin, future-ready services and strengthen global competitiveness.

Also Read: AI Stocks in India: Future Prospects and Analysis

Risks to Watch

While the Indian IT sector continues to grow, investors and businesses should be aware of certain risks that could impact performance. Leading companies like TCS, Infosys, Wipro, HCL Technologies, and Tech Mahindra face challenges that can affect revenue, profitability, and global competitiveness.

Dependence on Global Markets

Around 81% of Indian IT revenues come from overseas clients, primarily in the US and Europe (IBEF 2024). This makes Indian IT firms vulnerable to economic slowdowns, currency fluctuations, and regulatory changes abroad.

Currency Fluctuations

Since most revenues are in USD or Euro, INR appreciation can reduce profit margins when earnings are converted back to rupees. For instance, a 5% INR strengthening against USD could lower reported revenue in rupee terms by a similar margin, affecting profitability for firms like Infosys and TCS, which derive the majority of income in foreign currency.

Trump-era Policies & Visa Restrictions

Policies introduced during Donald Trump’s presidency, especially changes to H-1B visa regulations, created hurdles for Indian IT companies employing US-based talent. Even though these policies are evolving, similar restrictive immigration or work visa regulations could limit onsite staffing flexibility, increase costs, and affect service delivery. Companies like Infosys and TCS, which rely heavily on skilled Indian professionals in the US, remain sensitive to such policies.

Technological Disruption

Rapid adoption of automation, AI, and low-code/no-code platforms can reduce dependency on traditional IT services. If Indian IT firms fail to innovate or upgrade skills, they risk losing market share to agile competitors or in-house IT teams at client organizations.

How to Identify the Best IT Stocks in India?

When investing in IT stocks in India, it’s not enough to simply look at market leaders or brand names. The sector is dynamic, globally connected, and highly sensitive to both macroeconomic and technological shifts. Here are the key factors you should carefully evaluate before picking the best IT stocks for your portfolio:

Revenue Mix and Client Dependency

The first thing to examine is how diversified the company’s revenue base is across geographies and industries. Most Indian IT companies derive 60–80% of their revenues from overseas clients, particularly in the United States and Europe. If a company relies too heavily on a single region or client, it increases the risk of sudden revenue decline in case of slowdown or contract loss.

Financial Strength and Margins

Financial health is one of the strongest indicators of a good IT stock. Key metrics to focus on include operating margins, net profit margins, and revenue growth. Top-tier IT companies typically maintain operating margins in the range of 23–25% and net profit margins above 15%, which signals efficiency in execution and cost control. Consistent revenue growth of 10–15% annually is healthy for large-cap IT companies, while mid-cap IT firms may deliver even faster growth of 18–20%. Strong financial performance ensures that the company can withstand downturns and invest in emerging opportunities.

Attrition and Employee Utilization Rates

Since IT services are people-driven businesses, employee-related metrics are critical. High attrition rates, meaning a large percentage of employees leaving the company, can drive up costs due to hiring and training replacements. An attrition rate above 20% can hurt profitability and delivery timelines. Utilization rate, which measures how effectively a company deploys its workforce, is also important. Companies that manage to control attrition while keeping utilization high usually perform better in the long run.

Order Book and Deal Pipeline

Another major factor to assess is the company’s order book, particularly its total contract value (TCV) of deal wins. A robust deal pipeline indicates healthy future revenue visibility. Large-cap IT firms often announce quarterly deal wins running into billions of dollars, reflecting their ability to secure long-term contracts.

Global Macroeconomic Exposure

Indian IT companies are highly sensitive to global economic conditions, especially in the US and Europe. Investors should pay attention to global interest rates, corporate spending trends, and currency fluctuations, particularly INR/USD movements. A strong dollar typically benefits Indian IT exporters since they earn revenues in foreign currency but pay expenses in rupees. However, economic slowdowns in major client regions can reduce IT spending, directly impacting revenues. Understanding these linkages helps investors anticipate the sector’s cyclical risks.

Valuation Metrics

Even the best IT stock may not be a good investment if it is overpriced. Valuation ratios such as the Price-to-Earnings (P/E) ratio, Price-to-Earnings-Growth (PEG) ratio, and Return on Equity (ROE) should be analyzed. A P/E ratio in line with or below the industry average (usually 20–30x for large IT companies) is attractive, while a PEG ratio below 1 indicates the stock is reasonably valued relative to growth. Consistent ROE or ROCE above 20% also reflects strong capital efficiency. Comparing valuations across peers helps avoid overpaying during bull markets.

Management Quality and Track Record

The long-term success of an IT company depends heavily on its leadership team and corporate governance standards. A stable leadership that articulates a clear vision for growth, invests in innovation, and maintains transparency in operations is crucial. Companies with a track record of weathering downturns, adapting to technological shifts, and maintaining ethical practices are safer long-term bets.

What are the Top 3 IT Stocks in India 2025?

Infosys Ltd.

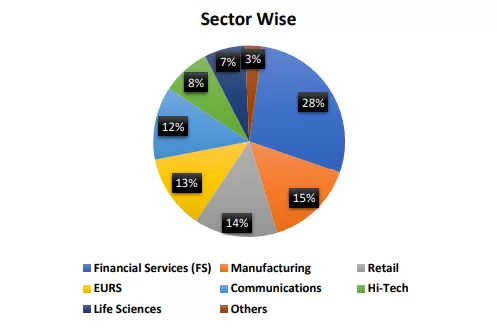

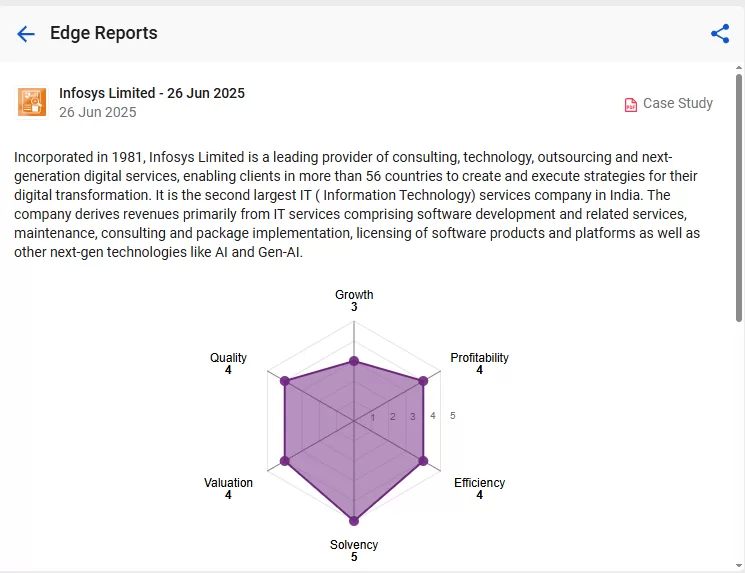

Infosys Limited is a leading provider of consulting, technology, outsourcing, and next-generation digital services, enabling clients in more than 56 countries to create and execute strategies for their digital transformation. It is the second-largest listed IT (Information Technology) services company in India. The company derives revenue from IT services comprising software development & related services, maintenance, consulting & package implementation, licensing of software products and platforms. The services are primarily classified as Core Services and Digital Services.

Financial Performance

Despite an uncertain & challenging macro environment, the company witnessed robust performance with broad-based growth across verticals & geographies, aided by an AI-led (artificial intelligence) uptick. In Q1 FY26, it closed 28 large deals with a total contract value (TCV) of $3.8 billion, of which 55% were net new deals. The TCV during Q4 FY25 was $2.6 billion. During the quarter, the operating margin contracted 30 bps YoY and 20 bps QoQ. The QoQ decline was due to a 100 bps impact from compensation rises and higher variable pay, partly offset by other salary-related items, 30 bps from currency movement, and 20 bps from sales investment in brand building and growth.

Why it Stand Out?

The company had guided for an organic revenue growth of 0%-3% for FY26 in constant currency (cc) terms, but has since upgraded this to 1%-3%. Further, they maintained operating margin guidance to be in the range of 20%-22%. The management remains optimistic about the deal pipeline and upcoming deal closures. In the medium term, they aim to improve margins through lower subcontractor costs, higher realisation, better utilisation, and enhanced cost efficiency. For more information on the future outlook, read our edge report.

Tech Mahindra Ltd.

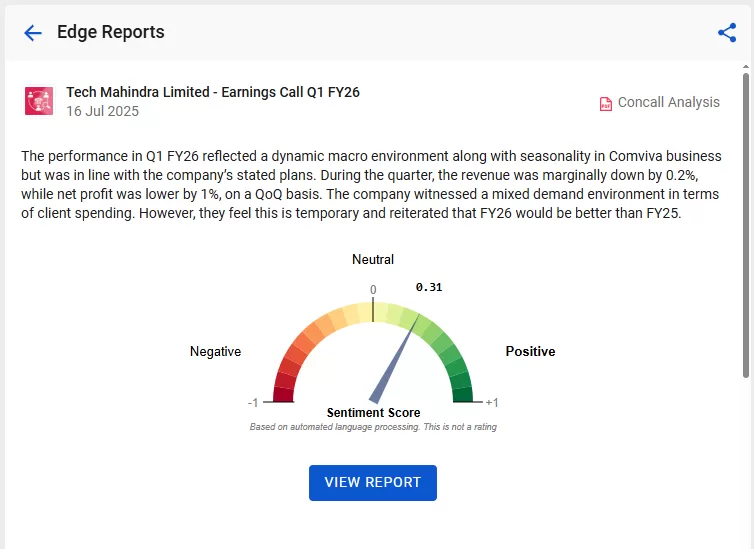

Tech Mahindra is an IT-led company that provides innovative, customer-focused digital solutions, helping enterprises, associates, and society grow. It leverages next-gen technologies like 5G, blockchain, quantum computing, cybersecurity, and AI to drive digital transformation worldwide. The company’s revenue mainly comes from IT and IT-enabled services across industries and regions.

Financial Performance

During the quarter, the revenue was marginally down by 0.2%, while net profit was lower by 1%, on a QoQ basis. The company witnessed a mixed demand environment in terms of client spending. However, they feel this is temporary and reiterated that FY26 would be better than FY25. During the quarter, the total contract value (TCV) of net new deals were $809 million, up by ~1% QoQ and by ~52% YoY.

Why it Stand Out?

The company observes mixed demand in client spending. However, they believe this is temporary and reaffirm that FY26 will outperform FY25, supported by steady deal pipeline growth, higher deal-to-revenue conversion, and internal efforts. Performance is expected to improve gradually from Q2 FY26 onwards and be better in H2 FY26. For more details, read our edge report.

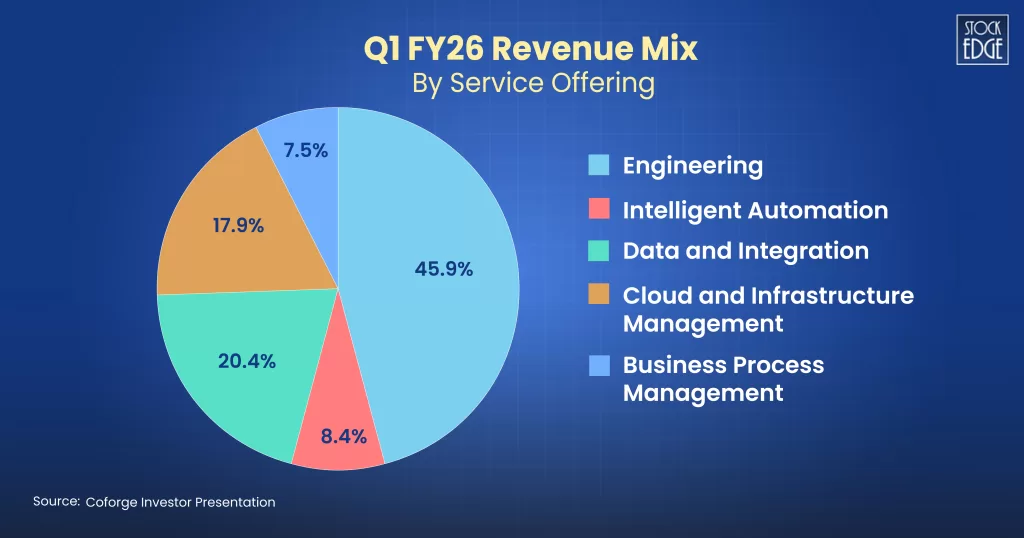

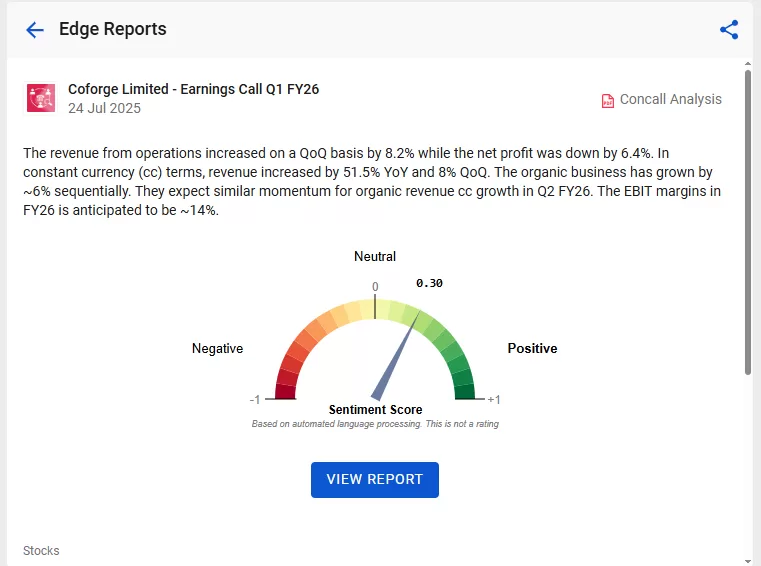

Coforge

Coforge is a global provider of digital services and business solutions, specializing in specific industry verticals with deep domain expertise. The company offers services globally, directly and via its subsidiaries and international branches. It emphasizes product engineering and utilizes Cloud, Data, Integration, and Automation technologies to transform client businesses into intelligent, high-growth enterprises. Its proprietary platforms support vital business processes across its key verticals.

Currently, the firm operates in 21 countries with 26 delivery centres in nine nations. It boasts world-class development centres located in New Delhi, Kolkata, Mumbai, Bangalore, Atlanta, London, and Singapore.

Financial Performance

During Q1 FY25, revenue (consolidated) increased by 1.6% quarter-on-quarter (QoQ) and by 7.8% year-on-year (YoY) in constant currency terms. Revenue for the quarter was recorded at ₹2,401 crore and $291.4 million, representing an increase of 1.8% in ₹ terms and 1.6% in $ terms on QoQ basis. In the quarter ended 30th June 2024, PAT (consolidated) was ₹133 crore, a decline of approximately 39% QoQ. However, normalized PAT (consolidated), excluding one-off items for the quarter, was ₹229 crore, showing a 28.2% increase YoY.

Why it Stand Out?

The company aims to become a net cash entity by the end of FY25. Management expects Cigniti’s business to gain more momentum in the upcoming quarters. Additionally, management guided that operating margins will be about 50 basis points higher by the end of H1 FY25 compared to the previous year. To know more in detail, read our edge report.

Bottomline

Large-cap players, such as TCS, Infosys, and HCL Tech, possess the scale, financial strength, and global client base to withstand policy shocks and capitalise on these opportunities. Earlier, most IT companies were signing a lot of smaller deals, which kept the pipeline ticking but didn’t move the needle much in terms of revenue visibility. This time, however, the momentum has shifted towards larger-sized contracts in the $10–50 million range.

Frequently Asked Questions (FAQs)

How do global factors impact IT stocks?

Indian IT companies are heavily influenced by the global market. That’s because a large chunk of their revenue, which is around 80-85% comes from the clients. So, when there’s an economic slowdown in the US or a rate hike by the Fed, it usually shows up in the order books of Indian IT firms. Even during the dot-com bubble era, India’s IT sector, heavily reliant on the US market, experienced a decline in revenue and job growth following the burst of the bubble. And we also saw this in 2023–24, when global uncertainty made clients cautious about spending on new tech projects.

What is the future of IT Stocks?

If we look ahead, IT stocks in India still have a promising future, though the way they grow is evolving. Earlier, outsourcing and back-office work drove most of the revenues. Now, the real growth is coming from digital transformation, things like cloud computing, AI, machine learning, and cybersecurity.

Why Invest in IT Stocks in India?

IT stocks have earned a reputation for being both stable and rewarding. Even during times of global uncertainty, companies like TCS, Infosys, and HCL Tech managed to protect their margins and keep paying steady dividends. In the June quarter, India’s top IT companies together bagged deal wins worth $21 billion, which is a healthy 17% jump from $18 billion in the same quarter last year. What makes this interesting is the kind of deals driving the growth.

How to analyze the financial performance of an IT company before investing?

When analyzing an IT company, look beyond headline revenue. Understand its roots, long-term client relationships, recurring revenues, margins, cash flows, and return ratios, indicating stability and resilience. The wings symbolize growth, innovation, and opportunity capture, seen in their pipeline, high-growth areas like AI, cloud, cybersecurity, and the ability to secure major contracts.