Key Takeaways

- Industry Outlook: India’s insurance sector is at an inflexion point, supported by rising incomes, digitisation, and regulatory reforms.

- Growth Drivers: Demographics, expanding middle class, low insurance penetration, and increasing financial awareness are boosting demand.

- Investment Factors: Evaluate solvency ratio, premium growth, profitability metrics (VNB, combined ratio), persistency, and distribution strength.

- Risks: Interest rate moves, regulatory changes, distribution disruptions, and competitive pressure can impact insurers’ performance.

- Top Insurance Stocks:

- Life Insurance Corporation of India (LIC)

- SBI Life Insurance

- Star Health and Allied Insurance

In 2025, the Indian insurance sector is at a fascinating inflexion point. Rising incomes, digitisation, regulatory reforms, and increased financial awareness are creating multiple tailwinds.

But success in this space isn’t just about picking the biggest names. It requires a disciplined framework to analyze underwriting, capital, distribution, and interest rate exposure. In this blog, you’ll learn what insurance stocks are, why they matter, how to select the best ones, and the top three to watch in 2025, all with actionable, data-driven insights.

What Are Insurance Stocks?

First, let’s understand what insurance stocks are. Typically, we know that insurance stocks are companies that sell insurance to individuals or businesses to protect them from various risks. But unlike regular businesses that sell products once, insurance companies benefit from recurring revenue, high entry barriers, and heavy regulatory oversight.

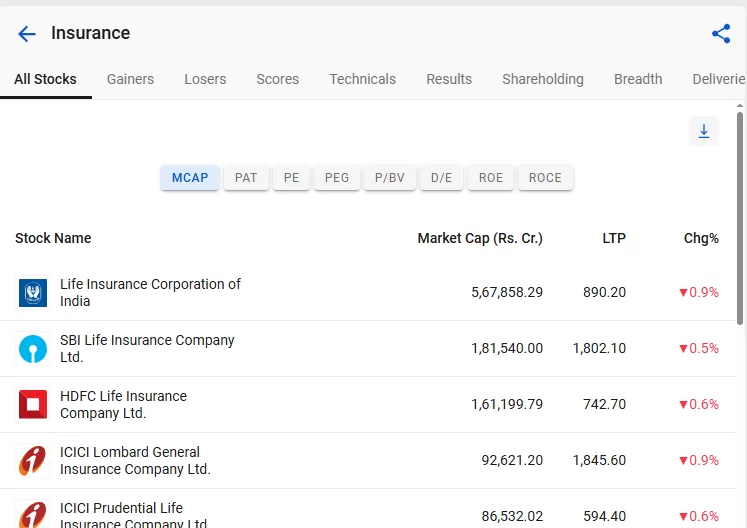

Click here to view on StockEdge

Types of Insurance Stocks

Insurance stocks can be broadly categorized based on the type of insurance they provide: Life Insurance and General (Non-Life) Insurance.

- Life Insurance Companies: They primarily offer long-term protection and savings products, including term plans, endowment policies, and pension plans. Notable listed companies include Life Insurance Corporation of India, HDFC Life Insurance Company Ltd., SBI Life Insurance Company Limited, and ICICI Prudential Life Insurance Company Ltd.

- General Insurance Companies: They provide short-term coverage for risks like health, motor, property, liability, and travel. Companies that are listed on the market are ICICI Lombard General Insurance Company Ltd., General Insurance Corporation of India, Go Digit General Insurance Ltd., The New India Assurance Company Ltd., Star Health and Allied Insurance Company Ltd. and Niva Bupa Health Insurance Company Ltd.

Future of Insurance Stocks

India is one of the fastest-growing insurance markets in the world. It is the 9th largest country globally in terms of life premium volume and is expected to be the 5th largest by 2032.

According to Swiss Re, while global life insurance premiums are expected to grow at around 3% annually through 2025-26, India’s market is projected to expand at a significantly higher rate of 6.9% between 2025 and 2029.

So, why should investors pay attention to insurance stocks? Let’s break it down:

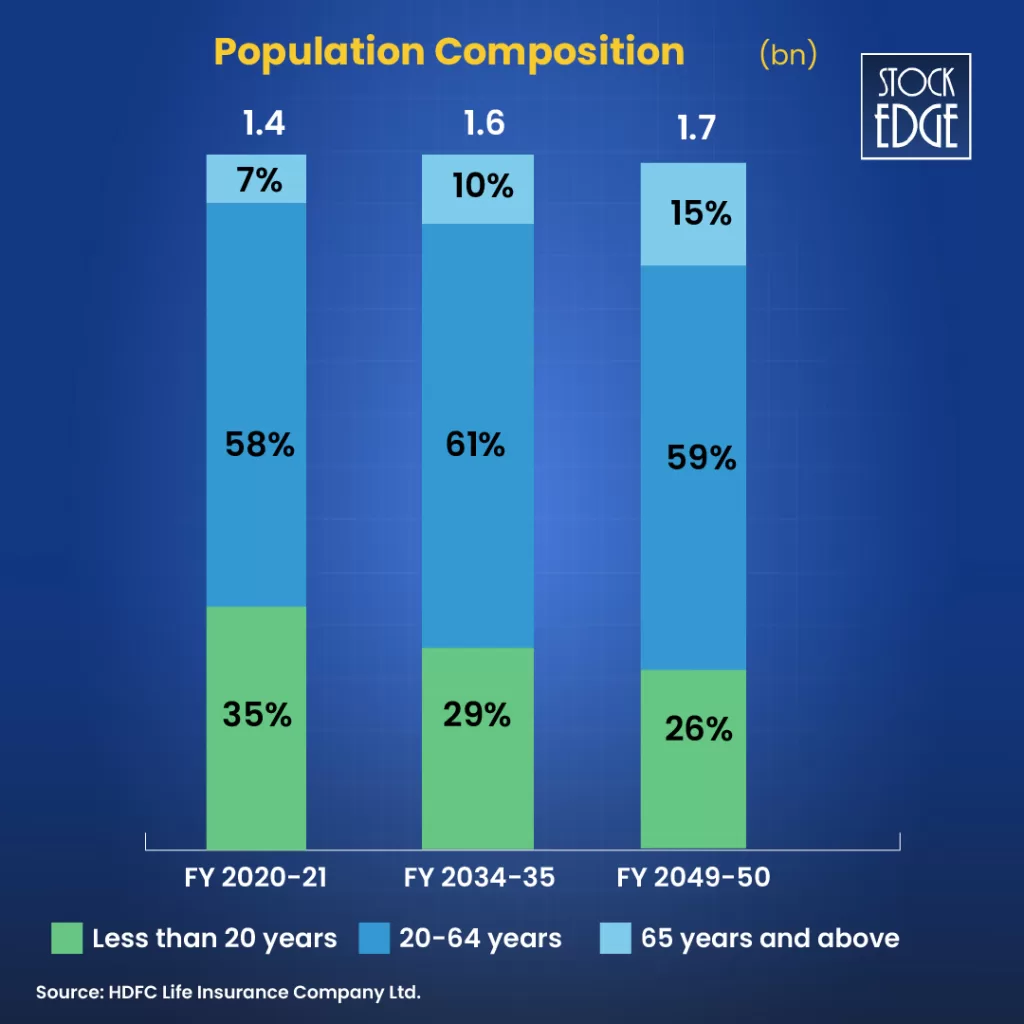

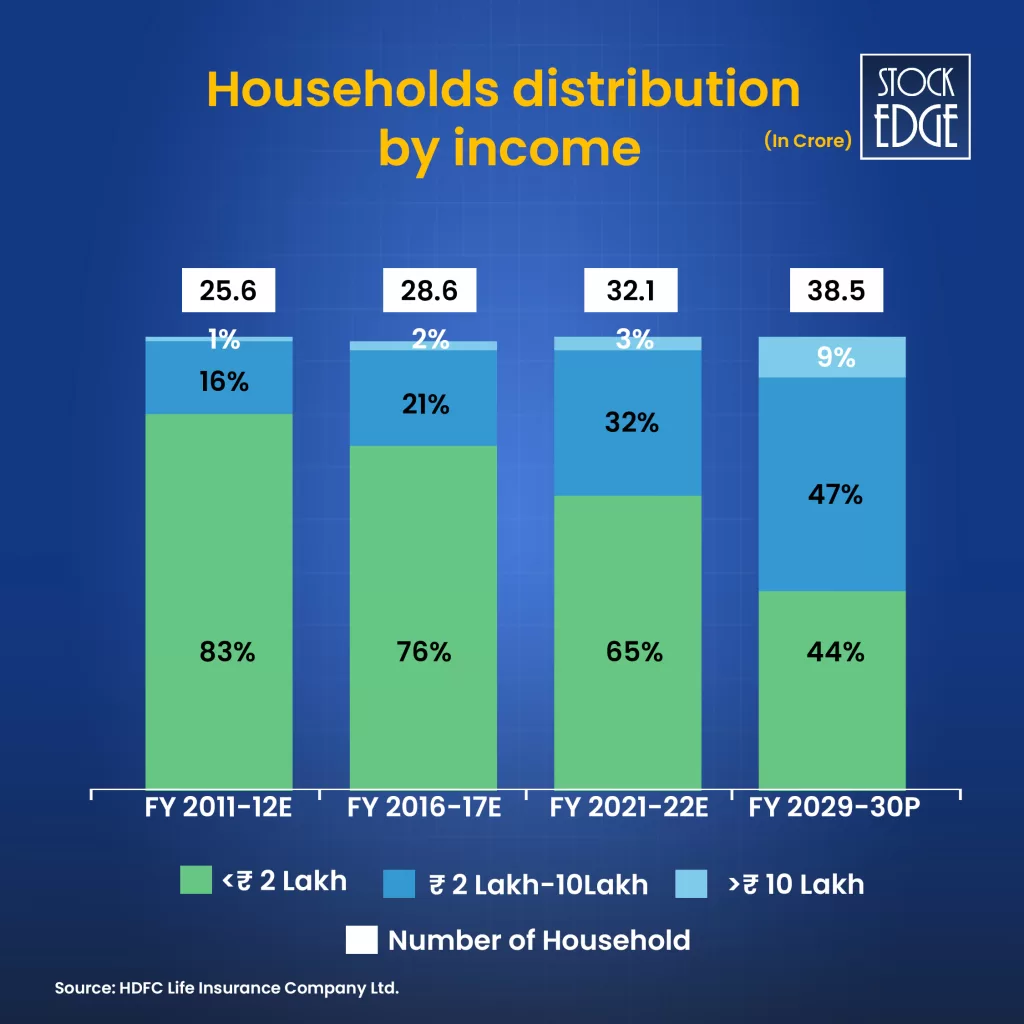

1. Demographics and Middle-Class Expansion

India is the world’s most populous country and also one of its youngest, with a median age of around 28 years. The working-age population (15–64 years) stands at approximately 97 crore individuals, or 68% of the population. About 25% of the incremental global workforce over the next decade is expected to come from India.

The rise of middle-income households is another important trend. Their share increased from 16% in FY 2011-12 to 32% in FY 2021-22, and is expected to reach 47% by FY 2029-30, expanding the base for life insurance adoption.

2. Low Insurance Penetration

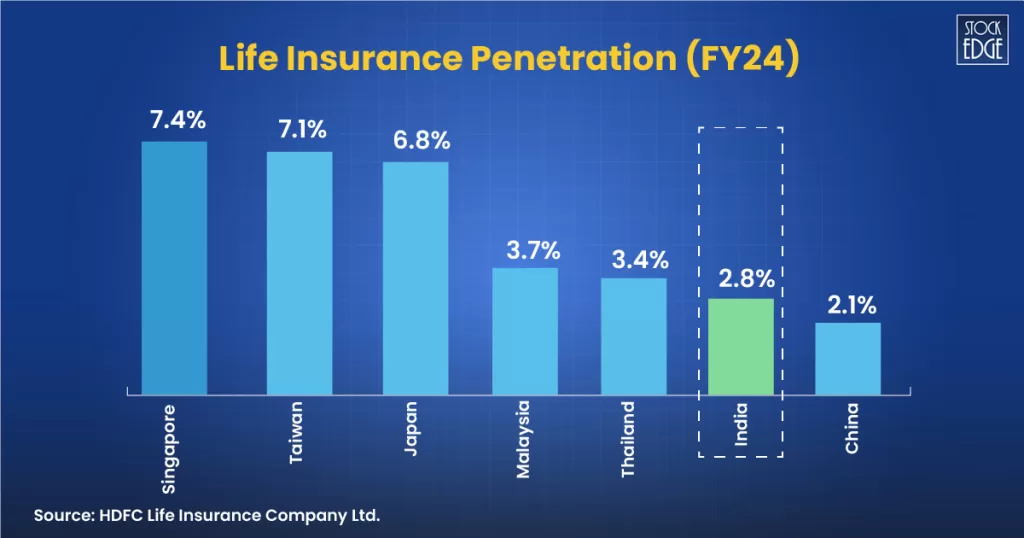

Despite this growth, India remains significantly underinsured. Life insurance penetration stands at just 2.8% of GDP, among the lowest in comparable markets, and the protection gap is one of the highest globally at 91%. This indicates substantial untapped potential, both in urban and rural areas.

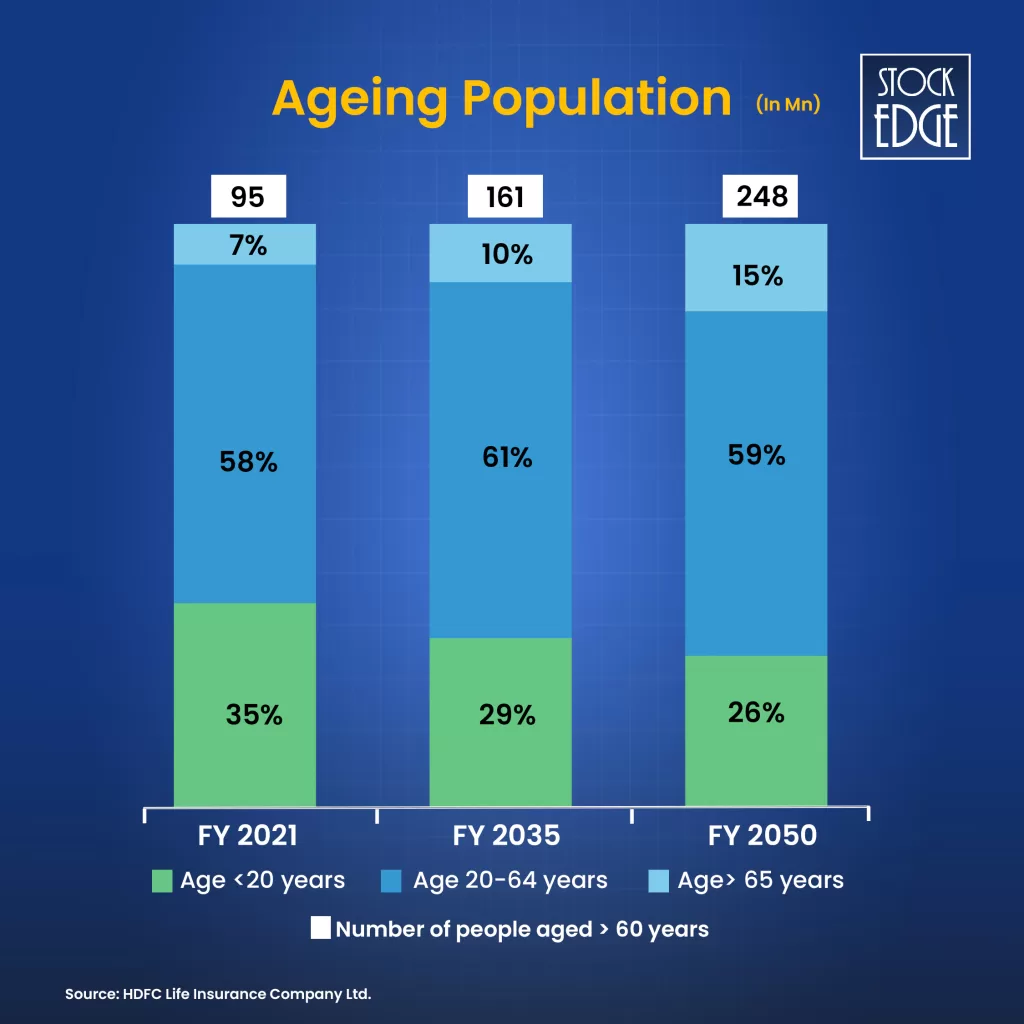

3. Increasing Life Expectancy and Retirement Needs

Life expectancy is rising, extending post-retirement periods to about 20 years. The elderly population will grow 2.5 times by 2050. With a pension market at around 9% of GDP, this offers insurers a big chance to provide long-term savings, income security, and annuities.

4. Financialisation of Savings

Rising disposable incomes and focus on financial planning boost household savings, with more funds going into financial instruments like life insurance. Government initiatives such as Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and the growth of small finance and payments banks improve financial inclusion, awareness, and access.

5. Digitisation and Technology Adoption

The sector is rapidly transforming as insurers use AI, machine learning, cloud computing, and data analytics to personalize services, manage risks, and scale efficiently. PolicyX.Com launched India’s first insurance price index.

Risks of Investing in Insurance Stocks

While insurance stocks offer strong growth potential, they are not without risks. Factors that can impact performance include:

- Market Fluctuations: Changes in interest rates, equity markets, or bond yields can affect an insurer’s investment income and overall profitability.

- Regulatory & Tax Changes: Updates in tax policies, solvency requirements, or insurance regulations may influence growth and returns.

- Distribution Challenges: Disruptions in relationships with key partners, such as banks, agents, or digital platforms can affect the ability to sell policies and reach new customers.

- Competitive Pressure: With more players entering the market, pricing pressures and the need for constant innovation can impact margins.

Investors need to be aware of these risks and evaluate a company’s risk management practices, financial resilience, and strategic positioning before investing.

Factors to Consider Before Investing in Insurance Stocks in India

Before putting your money into insurance stocks, it’s wise to evaluate these key factors:

1. Solvency Ratio

A company’s solvency ratio shows its ability to pay claims even during tough times. The IRDAI mandates a minimum of 150%, but a higher ratio indicates a stronger buffer. Investing in insurers with solid solvency ensures your money is with a financially stable company.

2. Premium Growth & Customer Retention

Check the growth in new business premiums and the proportion of renewal premiums. High renewal premiums indicate that the company is retaining its customers successfully, which is cheaper than acquiring new ones and reflects long-term trust.

3. Profitability

For life insurers, metrics like Value of New Business (VNB) and VNB margin show profitability from new policies. For general insurers, the combined ratio (less than 100% is ideal) indicates whether the company earns efficiently from premiums versus claims. Profitability trends help gauge business health over time.

4. Claims Settlement Record

A high claims settlement ratio builds confidence among policyholders. But don’t just look at percentages, consider the total number of claims handled. A larger, experienced insurer that reliably handles more claims can often be more trustworthy than a smaller company with a slightly higher ratio.

5. Persistency Ratio

The persistency ratio measures how many policyholders continue their policies over time. A higher ratio indicates loyal customers, consistent cash flow, and a company that successfully maintains long-term relationships with its clients.

6. Digital & Distribution Advantage

Insurers leveraging digital platforms, bancassurance, agents, and brokers efficiently have a competitive edge. Strong distribution networks combined with technology adoption allow the company to scale faster, reach untapped markets, and offer better customer experiences.

7. Regulatory Compliance

Insurance is a highly regulated sector in India. Ensure the company complies with IRDAI regulations, capital requirements, and disclosure norms. Non-compliance can lead to penalties or business restrictions.

Top 3 Insurance Stocks to Watch in 2025

Life Insurance Corporation of India

LIC is the second-largest public sector company in India by market capitalization and ranks as the fourth-largest insurer worldwide. The company offers participating and non-participating insurance products, such as unit-linked insurance, saving plans, term insurance, health insurance, and annuities & pension products.

Financials

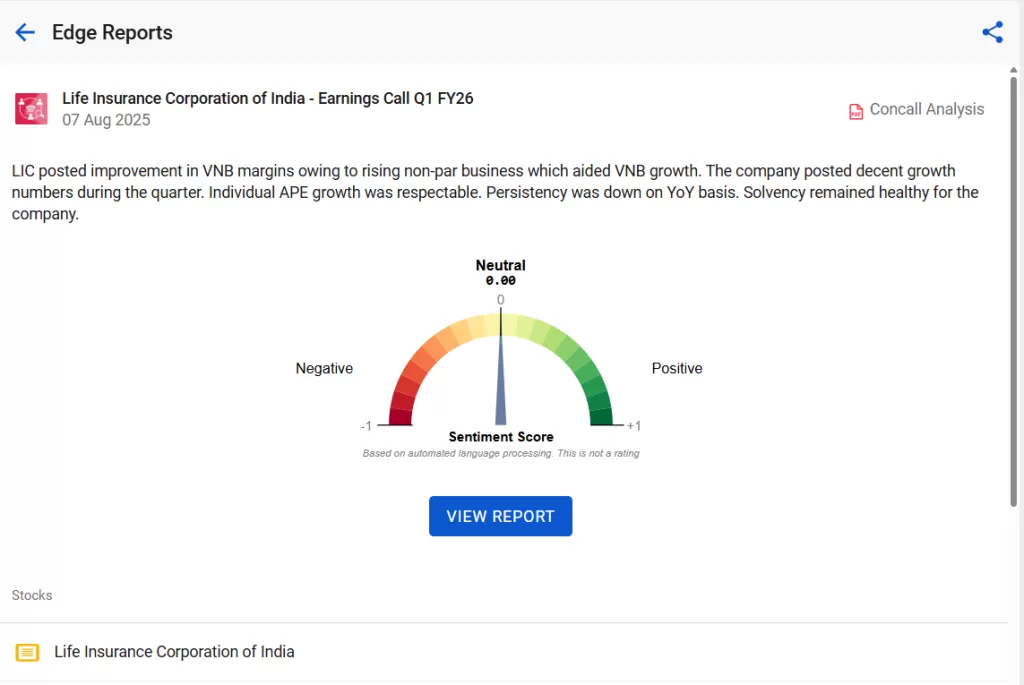

Total net premium income for Q1 FY26 increased by 4.8% year-over-year to ₹1.19 lakh crore. First-year premium remained flat at 0.7%, while renewal premiums rose by 6.1% YoY to ₹59,885 crore. The overall expense ratio decreased by 140 basis points YoY to 10.47%, and the company’s solvency ratio improved to 217% from 199% last year. Additionally, assets under management increased by 6.5% YoY to ₹57.05 lakh crore.

Why it Stands Out?

LIC is focusing on digital transformation and expanding product offerings. It has 14.86 lakh agents in India, with over 1 lakh trained last quarter, including 27,103 new agents. They are also increasing the share of non-par products in individual business.

For more insights about the business, take a look at our Edge Report!

SBI Life Insurance Company

SBI Life Insurance is a leading Indian private life insurer offering a wide range of protection, pension, savings, and health solutions for individuals and groups. Incorporated in October 2000, it is a joint venture between the State Bank of India (SBI) and was registered with the Insurance Regulatory and Development Authority of India (IRDAI) in March 2001. It offers a comprehensive portfolio of life insurance products, including traditional and unit-linked plans (ULIPs), child plans, pension plans, retirement solutions, and health plans.

Financials

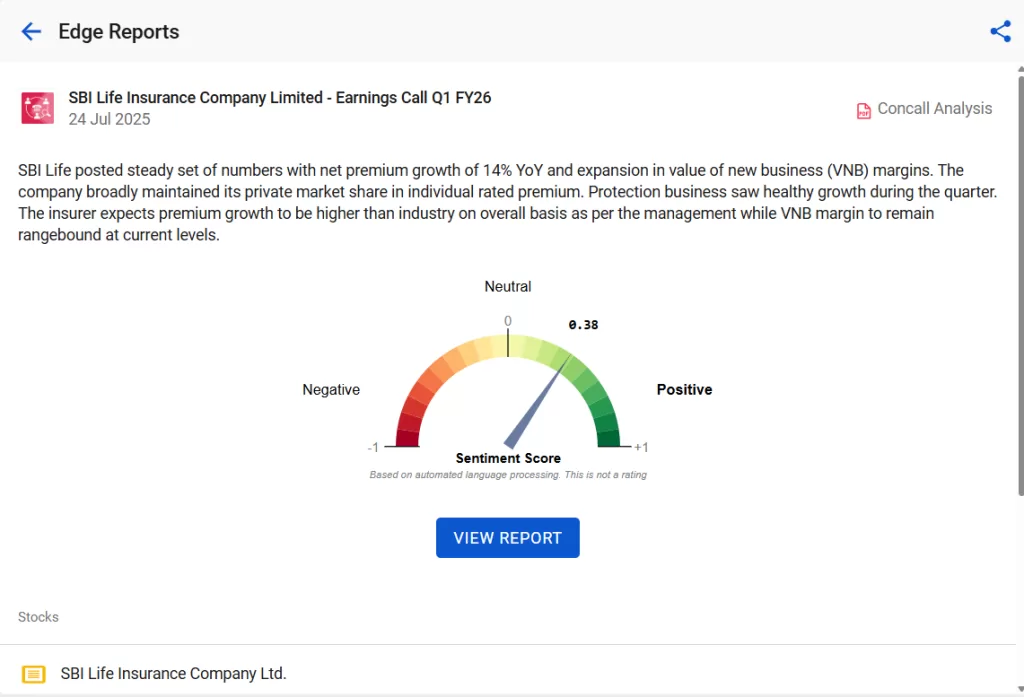

SBI Life reported stable results, with a 14% year-over-year increase in net premiums and improved VNB margins. The company largely retained its share in the private market for individual rated premiums. Its protection segment experienced robust growth in the quarter. Assets under management rose by 15% YoY to approximately ₹4.75 lakh crore, with a debt-equity ratio of 60:40. Around 94% of its debt investments are in AAA-rated or sovereign securities.

Why it Stands Out?

The management believes that the product mix will largely stay steady throughout this year. They anticipate that overall premium growth will be in the mid-teens range for FY26. Additionally, credit life business is expected to see growth of around 20% to 25% in FY26.

For more insights about the business, take a look at our Edge Report!

Star Health and Allied Insurance Company Ltd

Star Health & Allied Insurance Ltd (Star) is recognized as India’s pioneering Standalone Health Insurance provider and is the largest private health insurer in India, holding a market share of 32.59% in the retail health insurance sector during FY25.

As of March 31, 2025, Star Health boasts a comprehensive distribution network with 913 health insurance branches and more than 2,000 customer touchpoints across 25 states and 5 Union Territories in India.

Financials

Retail health Gross Written Premium grew by 18% in Q1FY26, mainly due to a 25% increase in new retail premiums and a renewal persistency rate of 98% on premiums and 85% on volumes. In July 2025, retail premium growth was 7.3% year-over-year.

Why it Stands Out?

Star Health showed strong growth in its main retail business in FY2025, with new retail Gross Written Premium (GWP) increasing by 24.7%. The company has taken strategic steps to improve operational efficiency and strengthen financial results. By realigning its group strategy and adopting stricter underwriting rules, it also aims to boost profitability and lower its loss ratio in the future.

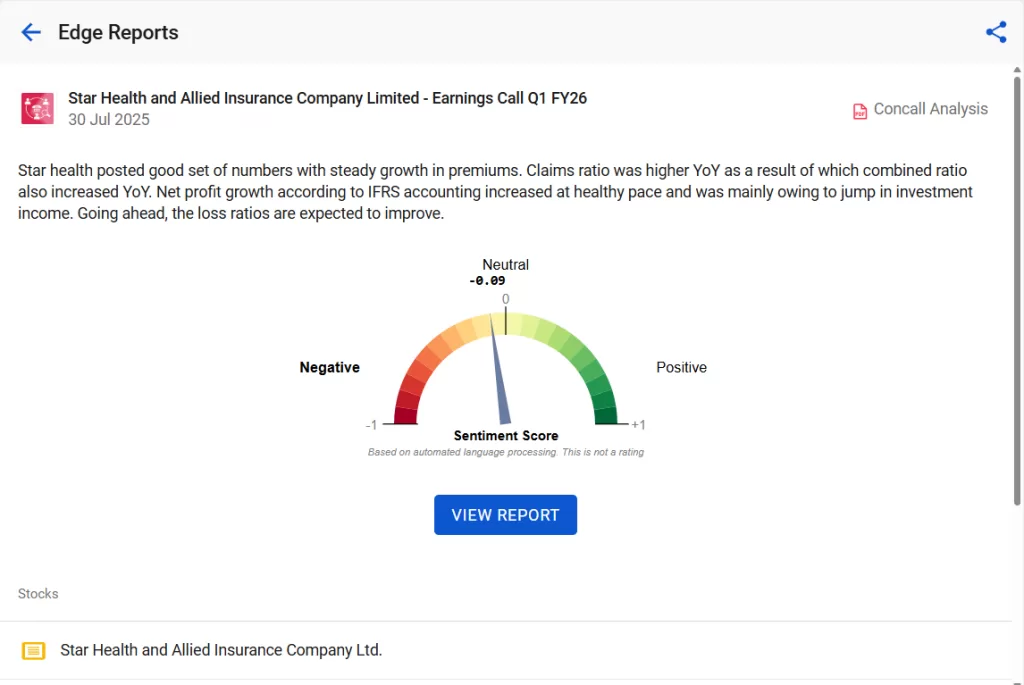

For more insights about the business, take a look at our Edge Report!

Conclusion

The Indian insurance sector presents a compelling story for investors in 2025. With rising incomes, increased financial awareness, and a young, growing population, the demand for insurance products is set to expand rapidly. Life and general insurers alike are benefiting from this structural tailwind, offering opportunities for both steady premium income and attractive investment returns.

To get more stock insights visit us here: StockEdge Blog

Frequently Asked Questions (FAQs)

Are insurance stocks a good investment?

Yes, insurance stocks can attract long-term investors due to recurring revenue, strong regulation, and benefits from India’s growing middle class and insurance penetration.

What’s the most underpriced insurance stock?

Valuation varies with market and fundamentals. To identify underpriced stocks, consider metrics like P/EV, profit growth, solvency, and persistency. Comparing multiple insurers is preferable to relying on one number.

How to choose the best insurance stocks in India?

Focus on solvency ratio, premium growth, claims settlement record, persistency ratio, profitability (VNB or combined ratio), and digital/distribution strength. Also, consider market position, regulatory compliance, and long-term growth prospects.

Why should you invest in insurance stocks?

India’s insurance sector is growing rapidly due to rising financial awareness, a young population, expanding middle class, and low penetration levels. Insurance companies offer long-term, recurring revenue streams, making them structurally resilient and a promising investment for patient investors.