Key Takeaways

- Auto Stocks: Auto stocks are companies involved in manufacturing passenger cars, commercial vehicles, two-wheelers, three-wheelers etc.

- Resilient Amid Global Slowdown: Analysts favour Eicher, TVS, Maruti and M&M as India’s auto safe-haven amid worldwide auto volume declines thanks to strong domestic demand and consistent product momentum.

- Why Invest: The automobile sector of India presents strong long-term growth potential, which is backed by supportive government policies, rising Foreign Direct Investment (FDI), and technological advancements, especially the EV revolution.

- Top Picks:

- Maruti Suzuki India Ltd.

- TVS Motor Company Ltd.

- Mahindra & Mahindra Ltd.

In the early 2000s, “Roti – Kapda – Makan” was the basic necessity of every man. But times have changed now, and buying a car or a bike for daily transportation has become a necessity, too. Therefore, there is a huge demand for automobiles in India, and the demand is expected to rise exponentially with the rise in aspirations of young Indians.

Hence, companies manufacturing passenger cars, two-wheelers and auto-ancillary or spare parts may expect huge demands for their products in the coming years. Thus, automobile stocks may become a good long-term investment opportunity for investors.

What are Auto Stocks?

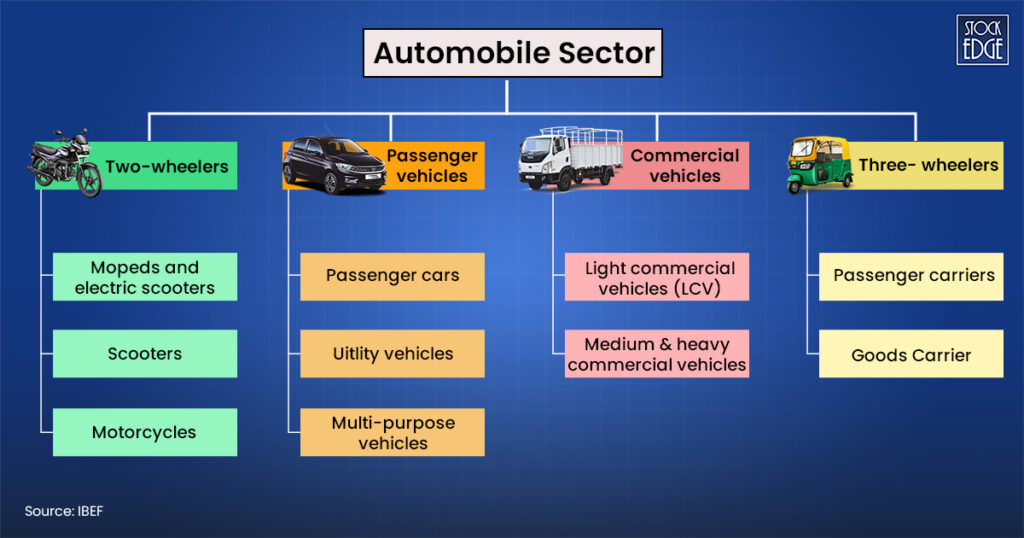

Auto stocks are companies involved in manufacturing passenger cars, commercial vehicles, two-wheelers, three-wheelers etc. In addition, companies manufacturing and distributing spare parts and other ancillary products like tyres, electronics and other auto equipment are also considered automobile stocks. But why should you be investing in automobile stocks? Are they performing well in the stock market?

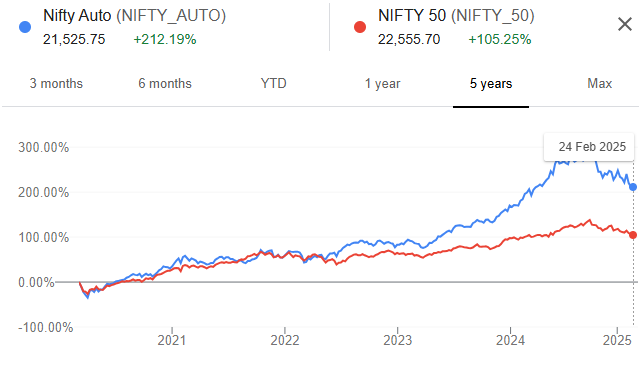

To gauge the performance of the auto sector stocks, you may view the Nifty Auto Index. This was designed to track the performance of the Indian automobiles sector.

As you see, the auto index gained approx. 212% in the past 5 years compared to the Indian benchmark index Nifty 50 which gained 105%. So, it is clear that the auto industry stocks have been outperforming in the last 5 years.

Sector Overview: Automobile & Auto Ancillary

Today, India is the third largest automobile industry in the world, as the total passenger vehicle sales crossed 3,56,752 units in Sep 2024. Moreover, the sector’s share of the national GDP increased from 2.77% in 1992–1993 to around 7.1% presently. That is quite a significant jump for a developing country like India. Overall, India has a strong domestic and export market for automobiles. However, the automobile industry in India is highly diversified and fragmented. So, to give you a clear structure of the sector. Here is a complete breakdown:

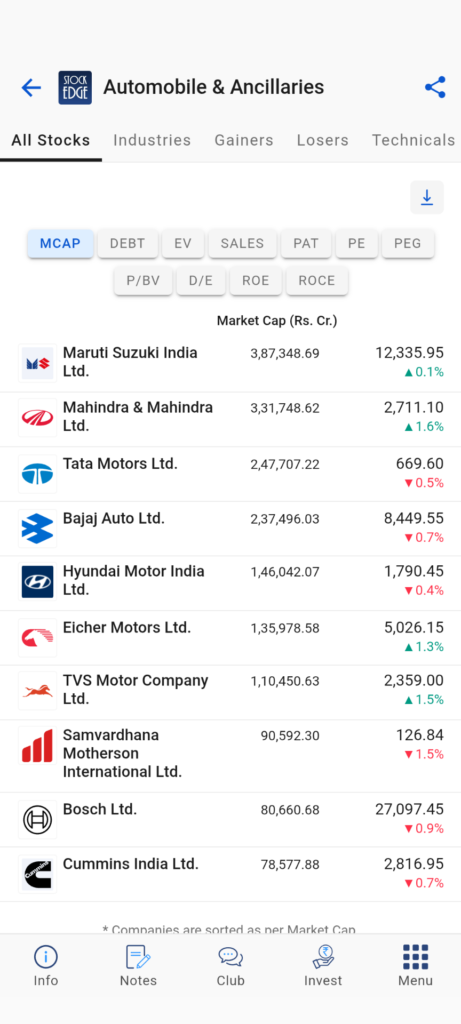

Now, you may ask, which automobile stocks are in each segment? To make it simple, StockEdge has divided the entire automobile and ancillaries sector into 16 industries consisting of 233 auto stocks. (as of Feb 2025). You may find the list of all the automobile stocks in India from the StockEdge app.

You have the list of all automobile stocks listed in the Indian stock market. But how do you identify which auto stocks to invest in? The article explores some investing opportunities in auto industry stocks.

Key Factors: Why invest in Automobile Stocks?

The automobile sector of India presents strong long-term growth potential, which is backed by supportive government policies, rising Foreign Direct Investment (FDI), and technological advancements, especially the EV revolution. Here are some factors listed:

1. Emerging Opportunities

Did you know that in India, there are only 24 per 1000 individuals who own a car? This, compared to the global average of 314, suggests there is immense potential for growth for the Indian automobile sector and auto ancillary industries. It is expected that the automobile and auto ancillary industry is projected to reach $300 billion by 2026.

2. Boosting Investments

Both foreign and domestic players are heavily investing in India’s automobile market. Automobile stocks or automobile manufacturers like Hyundai plans to invest $3.85 billion in EV expansion, while Tata Motors is allocating $1.08 billion for a new vehicle manufacturing facility in Tamil Nadu. Maruti Suzuki is making a $5.5 billion investment to double its production capacity.

3. Upsurge in EVs

Electric mobility has become a game-changer in the automobile industry. EVs are rapidly gaining popularity; EV sales in FY24 reached 16.77 lakh units, with a CAGR of 36% expected until 2026, as per the IBEF report. Some welcoming policies like the Battery Swapping Initiative are being introduced to enhance charging convenience and further boost EV adoption by Indians.

4. Cost Advantageous

Due to lower labour costs and technological advancement, India offers a 10-15% cost advantage compared to markets in Europe and Latin America, making it a favourable hub for automobile manufacturing. This also encourages automobile manufacturers to export. In FY24, exports stood at 4.5 million units and a target of a 5x increase by 2026. The country is already the largest global producer of electric two-wheelers and three-wheelers (E2W & E3W), further strengthening its export potential.

5. Ease of Financing

The rising middle class with high disposable income demands the convenience of a car, bike, or any personal mode of transportation, along with easy financing, which is fueling the sales of automobiles in India. Moreover, auto manufacturers are starting their own financing subsidiaries or partnering with banks to provide flexible financing options, making car ownership more accessible.

Now that you have an understanding of growing potential in the auto industry, here are few investment opportunities in automobile stocks.

Best Automobile Stocks for 2025

1. Maruti Suzuki India Ltd.

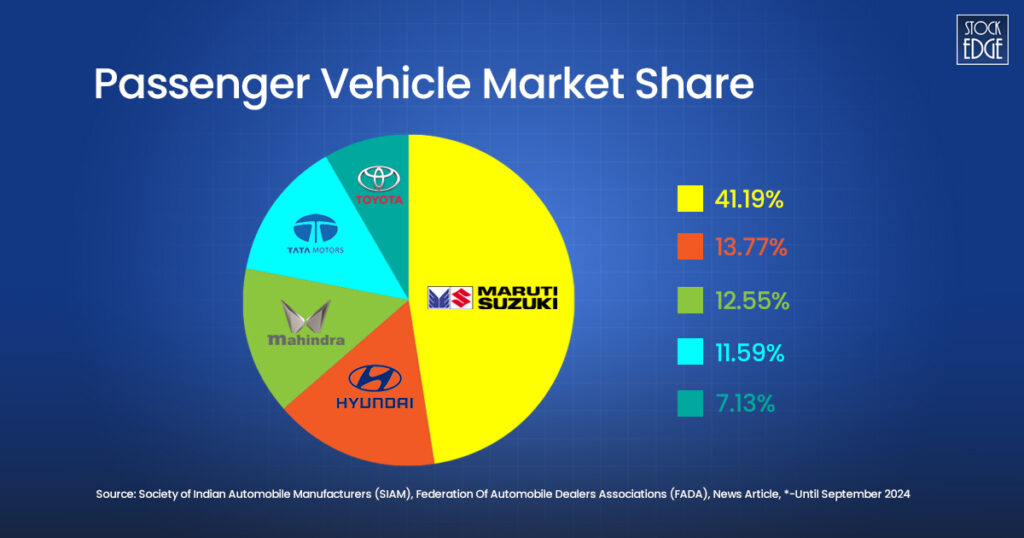

Who can forget the iconic Maruti 800, which revolutionized the Indian automobile industry back in the 1980s-1990s? Today, the company has more than 40% of the market share in Indian passenger cars. Maruti Suzuki is a joint venture between India’s Maruti Udyog Limited. & Suzuki Motor Corporation of Japan. The company has become a home-grown automaker in India and holds the largest market share among other Indian and foreign players in the automobile passenger car segment.

As per the financial highlights, in FY24, the net sales of the company stood at ₹1,41,858 cr and increased by 19% YoY. The EBITDA increased by 42% in FY24, but EBITDA margins have been expanding from 7% in FY21 to 13% in FY24, largely due to operating leverage benefits, lower ad & promotion spending, and softening of raw material costs. Similarly, PAT margins expanded from just 6% in FY21 to 9% in FY24. The company’s working capital cycle continues to remain strong over the years. The company remained debt-free with only ₹33 cr in short-term borrowings and no long-term borrowings as of 31st March 2024.

StockEdge offers a 360 analysis of the company by studying several parameters like growth, profitability, efficiency, solvency, valuation and quality of management to derive an edge score of 21/30. The detailed case study of Maruti Suzuki India Ltd. provides logical guidance to make an investment decision.

2. Mahindra & Mahindra Ltd.

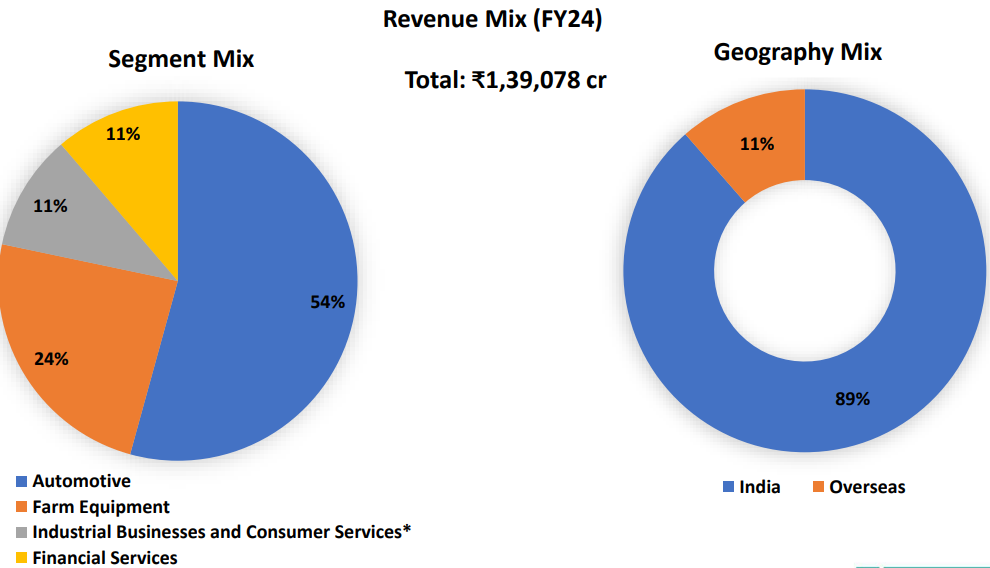

This automobile stock is the flagship company of the Mahindra group. The company is uniquely different from other auto-makers in India due to its diversified segments. It holds an 11-12% market share in the passenger vehicle segment manufacturing and selling only SUVs in India, whereas it has a market leadership with a 41% market share in the tractor segment in FY24, as per a report by the Federation of Automobile Dealers Associations of India (FADA). Alongside, M&M is increasing its product portfolio in the passenger vehicles segment by launching newer EV models for both domestic and international markets. In addition, the company is involved in farm equipment manufacturing, industrial businesses, consumer services, and financial services. It operates both domestically and overseas. Here is a segment-wise revenue mix for FY 24.

As per the financial highlights, in FY 24, the net sales increased by 14.5 % YoY, backed by healthy volume growth and average realisation across segments. The company’s EBITDA margins remained stable, ranging from 16-18% from FY 21 to FY 24. The company maintains its working capital cycle efficiently. In FY 24, trade receivables days declined mainly on account of better collection efforts. The consolidated debt/equity ratio in FY24 is 1.6x. Despite this, the ROCE is healthy at 14.9% in FY 24 as the company has been extensively spending towards new launches, technologies and dealership expansion in the country. For further details on a company’s financial performance to make an informed investment decision, you may view the case study of Mahindra & Mahindra Ltd.

3. TVS Motor Company Ltd.

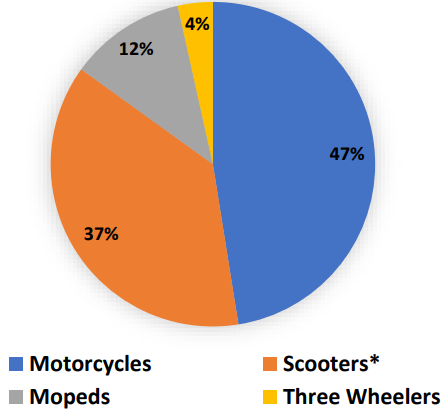

The company is a leading two-wheeler & three-wheeler manufacturer in India. TVS Motor is also the largest exporter in India, exporting to several countries. Its strength lies in its extensive research and development, resulting in products that are industry-leading in terms of innovation. That’s why the company also makes two-wheelers for German manufacturer BMW for the domestic market as well as other nations for export. The company mainly manufactures motorcycles, scooters, EVs, mopeds, and three-wheelers. In the last financial year of 2024, the company sold 41.9 lakh units. A sales mix of the product portfolio as of FY 24.

Source: Edge report by StockEdge

As per financial highlights, the net sales for FY 24 at ₹39,145 cr and increased by 22.4% YoY. The EBITDA margins have been expanding from 11.52% in FY21 to 14.16% in FY24 due to softening of raw material costs, better product mix and cost control measures. Similarly, PAT margins also increased at a healthy rate from 3.17% in FY 21 to 4.67% in FY 24. The debt to equity ratio is at 3.7x as of FY 24, but the company is efficiently managing its overall capital as the ROCE of the company increased on a YoY basis on account of a substantial rise in PBIT. Moreover, the company has sufficient resources to meet its interest obligations. For further details on a company’s financial performance to make an informed investment decision, you may view the case study of TVS Motor Company Limited.

3. Apollo Tyres Ltd.

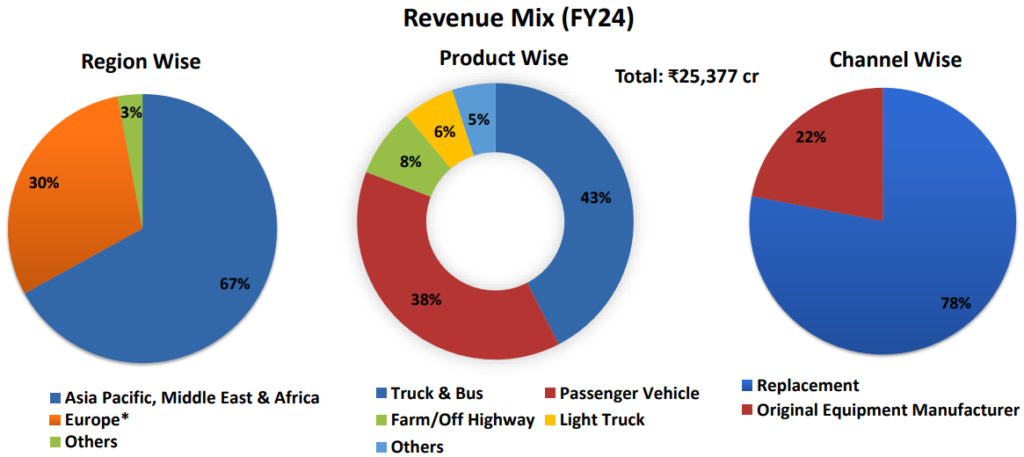

This is one of the auto ancillary stocks that is involved in the manufacturing, distribution, and selling of tyres for all segments, including truck and bus, light trucks, passenger vehicles, two-wheelers, and off-highway. It acquired Netherlands-based Vredestein BV, a producer of high-end passenger cars and specialty tyres with an extensive European distribution network. The company has OEM partnerships with Volvo, Audi, Bentley, Mercedes Benz, M&M, Hyundai, Volkswagen, Toyota, etc. It has seven manufacturing locations across India and Europe, with a production capacity of 6,82,366 MT as of FY 24. Here is a brief overview of the revenue mix for the company:

As per financial highlights, in FY 24, the net sales at ₹25,378 cr increased by just 3.3 % YoY. The sales growth in India was majorly led by exports, whereas the replacement segment and OEM category remained subdued. However, the company expects strong growth in European markets and Indian markets. The EBITDA margins expanded to 17.5 % on account of the softening of raw material costs, the better product mix, and cost control measures. The PAT margins also increased by 3x from 2.01% in FY 21 to 6.78% in FY 24. The company’s debt-to-equity ratio stands at 0.28x in FY 24. It has significantly reduced its debt by ₹1,600 cr on a YoY basis. For further details on a company’s financial performance to make an informed investment decision, you may view the case study of Apollo Tyres Limited.

5. Endurance Technologies Ltd.

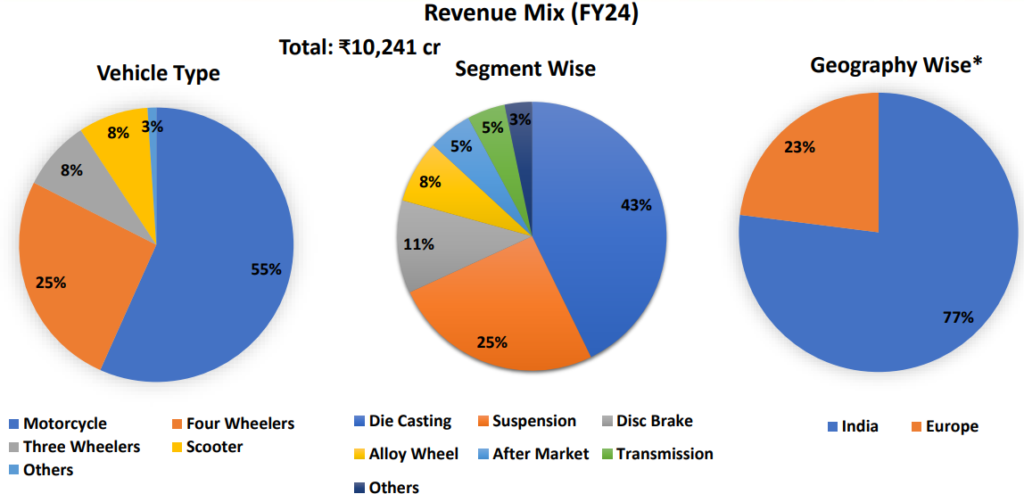

This is also one of the auto ancillary stocks, which is a leading global automotive components manufacturer with a diversified product base, including aluminium die castings, transmissions, braking systems and suspension products. It is majorly a leading two-wheeler and three-wheeler auto component manufacturer. In addition, the company has an electric vehicles segment, where it is focused on the supply of products for EV two-wheelers and three-wheelers for value addition. Here is a complete overview of the revenue mix in FY 24:

As per financial highlights, in FY 24, the net sales reached ₹10,241 cr and increased by 16% YoY, backed by the increase in domestic operations and 14 % growth in overseas operations; the company’s expansion was fuelled by strong industry volume growth in the two-wheeler and three-wheeler segments. The EBITDA margin is at 13%, which is an increase of 120 bps YoY, and the PAT margin is at 6.6%, an increase of 119 bps YoY. Also, the company has significantly reduced its debt over the years as the debt-to-equity ratio has decreased from 0.68x in FY 15 to just 0.11x in FY 24. The company’s current valuations also seem to be on par with the industry average. The PE ratio of Endurance Technologies Ltd. on a TTM basis is 31.97, compared to an industry average PE of 30.27. For further details on a company’s financial performance to make an informed investment decision, you may view the case study of Endurance Technologies Limited.

In addition to analyzing the fundamentals of the automobile stocks, you may track the month on month sales data provided by the company to get a detailed understanding of their short term financial performance. To know more you may read : Analysis of Auto Sales Data in India

The Bottom Line

Investing in Indian automobile stocks presents an investing opportunity due to the sector’s strong growth trajectory, supportive government policies, and rising consumer demand. The auto industry is projected to reach $300 billion by 2026; with increasing vehicle penetration and a booming electric vehicle market, the potential for long-term returns could be significant. Some Government initiatives like PLI, FAME-II, and PM E-DRIVE are accelerating innovation and manufacturing, while major automakers are making multi-billion-dollar investments to expand production.

Additionally, India’s cost advantage, robust export market, and emerging technologies in EVs and autonomous vehicles further enhance the sector’s attractiveness. Moreover, with a mix of established leaders and high-growth emerging segments, automobile stocks offer a diverse and resilient investment option for long-term wealth creation.

Which automobile share is best to buy?

Auto shares are companies involved in manufacturing passenger cars, commercial vehicles, two-wheelers, three-wheelers etc. Some best automobile shares in India are Maruti Suzuki, Mahindra & Mahindra, TVS Motors, etc.

What is the best auto parts stock to buy?

Auto parts stock basically stocks from the auto ancillary industry manufacturing spare parts or additional parts to produce automobiles. Some best auto parts stocks could be Apollo Tyres, Endurance Technologies, etc.

Are automobile stocks a good investment?

Automobile stocks have outperformed the market in the last 5 years, and with strong growth trajectory, supportive government policies, and rising consumer demand may turn out to be a good investment opportunity in the long term.