Table of Contents

Initial Public Offering (IPOs) offer a gateway to exciting investment opportunities for investors. Majorly retail investors eagerly await upcoming IPOs in the market which have good potential to deliver quick listing gain, whereas some wait for upcoming IPOs to enter a stock at the IPO to tap into early-stage investments, often resulting in significant returns as the company expands and gains market traction over long term.

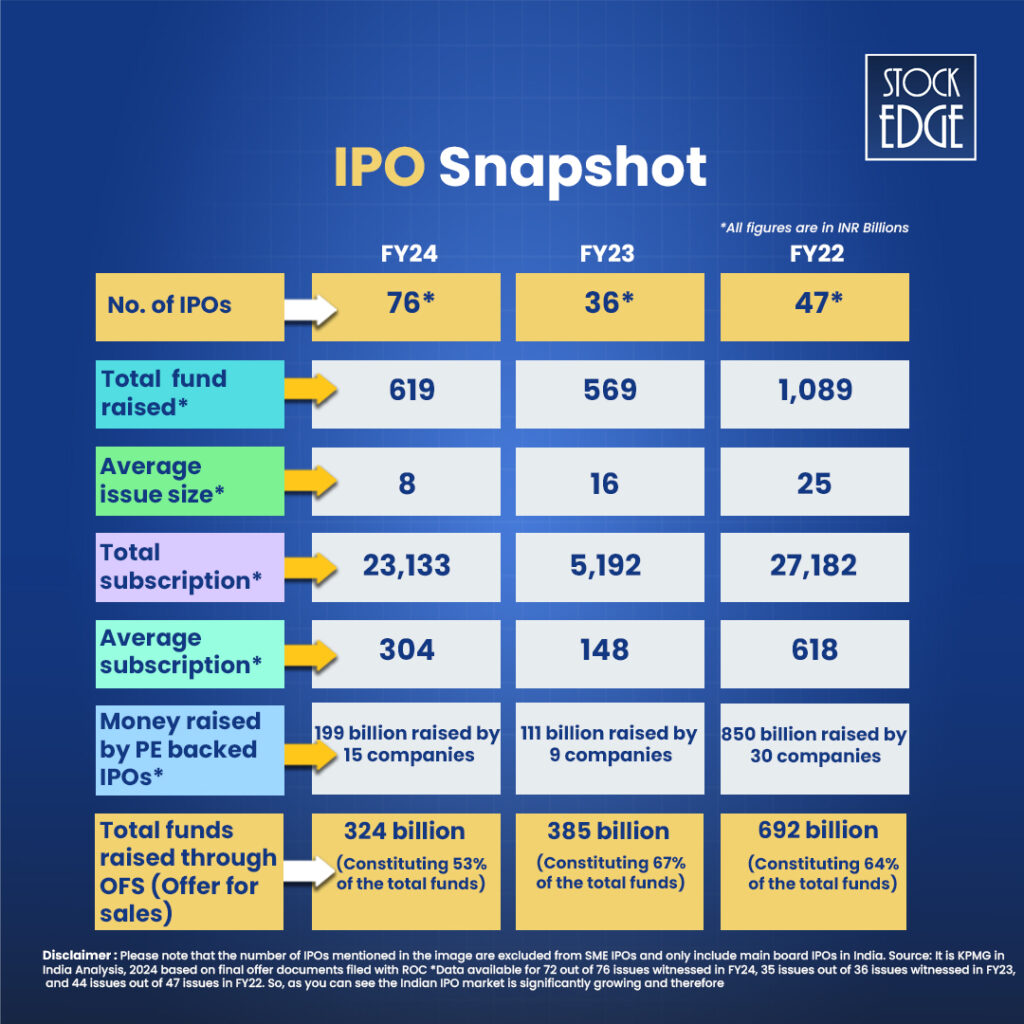

A KPMG report published in July 2024 suggests that “FY24 marked a significant uptick in mainboard IPOs, with 76 listings— the highest since FY17. This surge reflects a notable 111% increase from the 36 listings in FY23 and a substantial 62% rise from the 47 listings in FY22.”

So, as you can see the Indian IPO market is significantly growing and therefore upcoming IPOs in India can be an excellent opportunity for investors.

What are Upcoming IPOs?

The upcoming IPOs can become the future market leaders in the stock market. An IPO provides an opportunity to become a shareholder of the company, offering a chance to be part of the company’s growth from the nascent stage.

Here is an example of a highly successful IPO in the Indian stock market: DMart, owned by Avenue Supermarts. It was a hugely anticipated IPO because DMart had already built a strong reputation in the retail sector with its chain of supermarkets. The IPO was launched in March 2017 at a price of ₹299 per share.

The IPO was oversubscribed more than 100 times, showing high demand from both institutional and retail investors. Upon listing, DMart’s shares surged, opening at ₹604 per share—more than doubling the issue price. Investors who held on to their shares post-listing have seen tremendous growth, as DMart has continued to expand and perform well, making it one of the most valuable retail companies in India. As of Sep 2024, DMart was trading at ₹5484 per share.

This IPO serves as a great example of how investing in a company’s early stages through an IPO can yield significant returns, both in the short term (through listing gains) and in the long term (through the company’s consistent growth).

How to check for Upcoming IPOs?

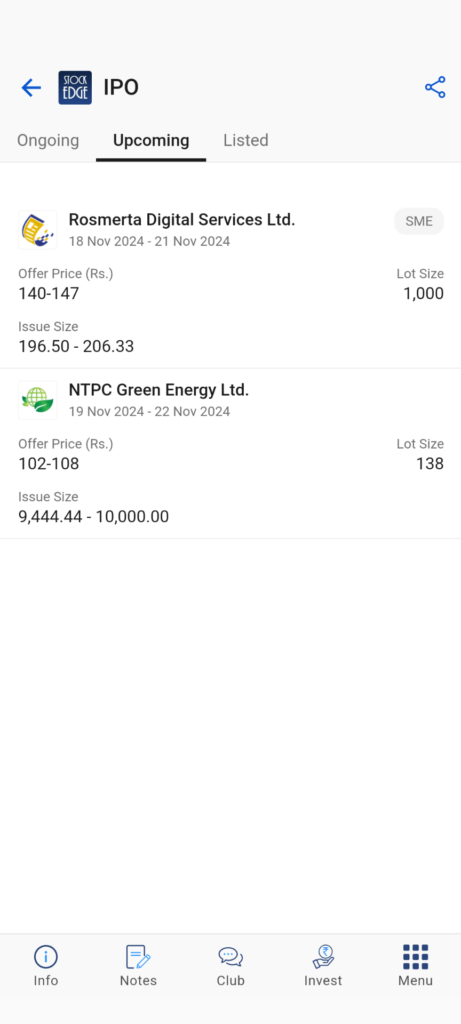

Using StockEdge, you can easily check for upcoming IPOs in the market.

One of the most recent upcoming IPO is for NTPC Green Energy Ltd. as you can see. Just at a glance you can view important information about the IPO like the issue size, price band for the IPO as well as the IPO’s open and close date within which you can apply for this upcoming IPO.

So, who can apply for an IPO? Let’s find out!

Who Can Invest in an IPO?

Every individual having a DeMAT account can apply for an IPO. What’s a Demat Account? How can you open one? Here is everything you need to know about the different categories of investors in an IPO.

There are broadly three categories of investors in an IPO and are eligible to apply in the upcoming IPOs in future.

- Retail Individual Investors (RII) – This is the most common category in an IPO where a minimum of 35% of the issue offer is reversed for retail investors and are eligible to subscribe to the IPO for a maximum of ₹2 lakhs.

- Non Institutional Investors or High Net Worth Individuals (NIIs/HNIs) – If an individual is applying for more than ₹2 lakhs, then they are categorized under HNIs or NIIs.

- Qualified Institutional Buyers (QIB) – Financial institutions like Banks, Mutual Funds, FPI or FIIs, who have the experience and expertise of the capital markets are considered as QIBs. A minimum of 50% of the issue offer is reversed for the QIBs.

Apart from QIBs, there are Anchor Investors, who are essentially QIBs making an application for an IPO for a value of ₹10 crores or more.

Other than these, in some upcoming IPOs there are reserved quotas for a set of individual investors. They are:

- IPO Employee Quota: The IPO prospectus document details the employee reservation quota and the discount (if any) offered to employees. Under the regulations, the employee reservation quota may not exceed 5% of the company’s post-issue paid-up capital.However, to avail the employee discount (if any), the investment amount should not exceed ₹2 lakhs.

- Eligible shareholders Quota: Some IPOs have a special reservation quota for eligible shareholders of the parent company. When a subsidiary of a listed company issues an IPO, it generally reserves some shares for shareholders of the parent company. This is known as shareholder quota in IPOs.

Process of Upcoming IPOs in India

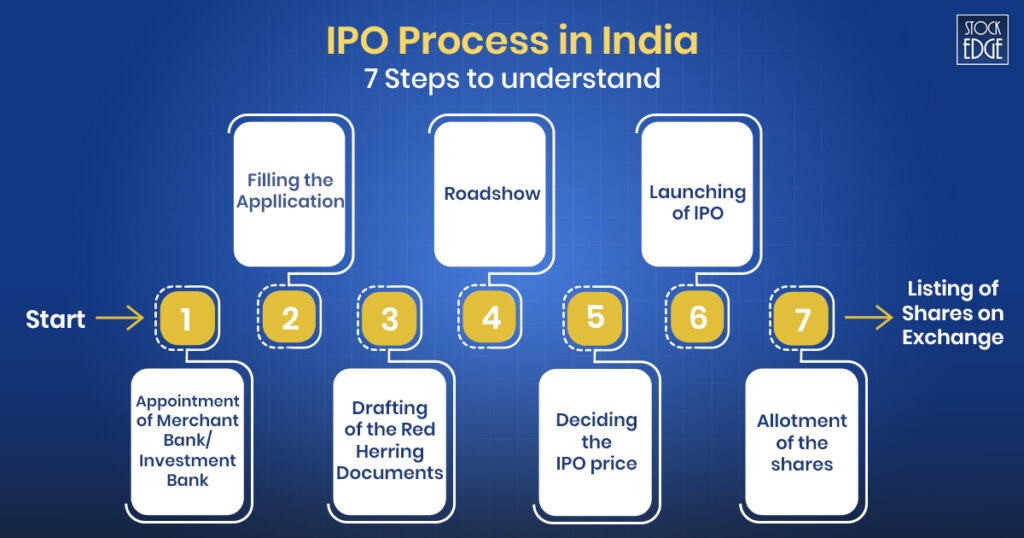

Here’s a breakdown of the IPO (Initial Public Offering) process in India:

- Appointment of Merchant Bank/ Investment Bank: The first and stage to launch an IPO is to find an investment bank or Merchant Banker that will help manage the entire IPO process from start to end. It acts as an underwriter, providing guidance on the IPO structure and handling legal and financial requirements.

- Filling the Application with SEBI: The company submits an IPO application to India’s regulator of capital markets, the Securities and Exchange Board (SEBI). It reviews the application to ensure it complies with legal and financial standards. Here, an application for the IPO can be either a fresh issue where news shares for the company are being issued or an Offer for sales where existing investors are selling their shares in the IPO.

- Drafting of the Red Herring Documents: A draft prospectus, known as the Red Herring Prospectus, is prepared. This document includes the company’s business overview, income statement, balance sheet, cash flow statement and objectives of the IPO, helping you make informed decisions before subscribing to the IPO.

- Roadshow: The company conducts advertisements, or “roadshows,” to promote its IPO. In roadshows various meetings with potential anchor investors or QIBs are being held, explaining the company’s strengths, and generating interest in the IPO offering among various market participants.

- Deciding the IPO Price: There are two ways to determine the price for an IPO price that is a fixed pricing method or book building. An IPO with a book building issue has a lower end of the price band, which is the floor price, and the upper-end price is called the ceiling price. However, real investors are only allowed to bid at a cut-off price, which is the ceiling price.

- Launching of IPO: The IPO is officially launched for subscription. Individual investors can start applying for the IPO from its opening date, and bids are collected till the IPO is closed for subscription.

- Allotment of the Shares: The shares are allotted to applicants based on outcome of the subscription. If IPO is underscribed then every investor receives share allotment. However in case of oversubscription then the registrar will conduct a lottery to allocate shares to the applicants.

Now, let’s dive into the top 5 upcoming IPOs in India. The list of upcoming IPOs can be companies that are about to be open for subscription or companies that have filled their DRHP to SEBI and may launch its IPO any time soon!

Best 5 Upcoming IPOs in India

- LG Electronics India Ltd. A subsidiary of South Korea’s LG Electronics, is planning to go public on the Indian stock market. The company has filed preliminary paperwork with SEBI for an Initial Public Offering (IPO), where the parent company will sell 15% of its stake, amounting to over ₹10.18 crore shares. This move follows Hyundai Motors India’s recent listing on the Indian stock exchange. The upcoming IPO is an Offer for Sale (OFS), meaning no new shares will be issued. The parent company, LG Electronics, will sell 15% of its stake, and all the proceeds from the IPO will go to them. The final price range for the IPO will be determined through a book-building process, considering market demand and other relevant factors. After the IPO, LG Electronics Inc.’s stake in LG Electronics India will decrease to 57.69%. LG Electronics India earned ₹64,087.97 crore in FY24. The launch of this IPO is not yet decided but you can read the DRHP of LG Electronics India Ltd. for more details.

- Navi Technologies Ltd. It is a technology-driven financial products and services company in India focusing majorly on three non-payments financial service offerings–lending, insurance and asset management. The issue size is ₹3350 Cr. and it is also a fresh issue. The launch of this IPO is not yet decided but you can read the DRHP of Navi Technologies Ltd for more details.

- Imagine Marketing Ltd. This company which is commonly known as Boat offers wired/wireless headphones and earphones, Bluetooth speakers and home theater systems and sound-bars & smartwatches & wired and wireless headsets, mouse and keyboards. The IPO is valued at over ₹2000 crore, with ₹1100 crore from an Offer for Sale by existing shareholders and a ₹900 crore fresh issue. The launch of this IPO is not yet decided but you can read the DRHP of Imagine Marketing Ltd for more details.

- HDB Financial Serviced Ltd. The banking industry mammoth HDFC Bank’s subsidiary arm HDB Financial Services is about to come up with an IPO of ₹12500 crore. The IPO will be a combination of both fresh issue and offer for sales (OFS); where the parent company HDFC Bank Ltd to off-load ₹10,000 crore via this IPO. The launch of this IPO is not yet decided but you can read the DRHP of HDB Financial Services Ltd. for more details

- Bharat FIH Ltd. It is one of the largest Electronic Manufacturing Services (EMS) providers in India and it is a subsidiary of FIH Mobiles and a Foxconn Technology Group company. The issue size is ₹5003.8 crores comprising both fresh issue and Offer for sale. The launch of this IPO is not yet decided but you can read the DRHP of Bharat FIH Ltd for more details.

We also share insightful content on some main board IPOs in India. You can read about Waaree Energies IPO: All You Need to Know! which was subscribed 76x and listed at a premium of nearly 60% above its issue price.

The Bottom Line

Please note that all the upcoming IPOs which are mentioned above have drafted its Red Herring Prospectus with the SEBI and are waiting for final approval to launch its IPO. The details are subject to change in the final draft and more information about the IPO such as the price band for an IPO and the opening date for subscription will be provided at a later date. So, to keep a track of all major upcoming IPOs, you can keep a track of ongoing IPOs and upcoming IPOs using StockEdge.

Wish you all the very best for applying in the upcoming IPOs! Although due to the high number of bids in a few IPOs, getting a successful allotment is challenging.